Ayala Corp PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ayala Corp Bundle

Ayala Corp operates within a dynamic landscape shaped by evolving political stability, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying opportunities. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights. Download the full version to gain a competitive edge and make informed decisions for your business.

Political factors

Ayala Corporation's extensive portfolio, especially in real estate and infrastructure, is deeply intertwined with the political landscape of the Philippines. Political stability is a cornerstone for attracting and retaining the significant, long-term capital required for projects like those in property development and utilities. A consistent policy framework minimizes the risks associated with regulatory shifts, which can significantly impact project timelines and profitability.

The current administration's approach to foreign investment and public-private partnerships (PPPs) directly shapes Ayala's strategic direction. For instance, the Philippine government's commitment to infrastructure development, evidenced by the "Build, Better, More" program, presents opportunities for Ayala's infrastructure arm, AC Infrastructure. The ease of doing business initiatives also play a vital role in streamlining approvals for Ayala Land's numerous property developments, fostering a more predictable operating environment.

The Philippine government's ambitious 'Build Better More' infrastructure program, with a projected budget of PHP 9.9 trillion (approximately USD 170 billion) for 2024-2026, directly fuels Ayala Corporation's core businesses. This massive investment in roads, bridges, and public transport enhances connectivity, creating significant opportunities for Ayala Land's property developments and improving the operational efficiency for ACEN in the energy sector.

These infrastructure upgrades are crucial for stimulating economic activity and demand in new growth corridors where Ayala Land is actively developing integrated communities. For instance, improved accessibility to previously underserved areas directly translates into increased property values and sales volume for the company.

Furthermore, the program's focus on logistics and transportation networks supports Ayala's strategic expansion in these areas, ensuring smoother supply chains and greater market reach for its various ventures. Continued government commitment to these projects is a vital component of Ayala's long-term growth strategy.

Ayala Corporation navigates a dynamic regulatory landscape in the Philippines, where changes in sectors like telecommunications, banking, and energy directly impact its diverse business units. For instance, the Department of Information and Communications Technology's push for greater competition in the telco space, where Globe Telecom is a major player, necessitates ongoing strategic adjustments.

Government initiatives aimed at improving the ease of doing business are crucial for Ayala's operational efficiency. The Philippine government's ongoing efforts, as reflected in its ranking improvement in the World Bank's Ease of Doing Business report (though the report was discontinued after 2020, the underlying reform momentum continues), signal a potentially more favorable environment for investment and expansion.

Policy shifts, such as potential adjustments to foreign ownership rules or specific industry regulations, demand constant vigilance and adaptation from Ayala. The conglomerate's ability to anticipate and respond to these policy evolutions, for example, in the renewable energy sector where the government is actively promoting green energy adoption, is key to maintaining its competitive edge and profitability.

Foreign Investment Policies

The Philippine government's stance on foreign investment significantly impacts Ayala Corporation's growth. In 2024, the Philippines continued to refine its policies to attract more Foreign Direct Investment (FDI), aiming to boost economic development. For instance, the CREATE (Corporate Recovery and Tax Incentives for Enterprises) Act, enacted in 2021 and still influential in 2024-2025, offers tax incentives to businesses, including those with foreign ownership, which can benefit Ayala's various ventures.

Favorable policies can unlock crucial capital for Ayala's expansion, particularly in its burgeoning sectors like renewable energy and digital infrastructure. The government's efforts to streamline business registration and improve the ease of doing business are designed to encourage foreign capital inflows. For example, the Philippine government has been actively promoting investment in key industries, with FDI inflows in the first quarter of 2024 reaching a notable increase compared to the previous year, signaling a more open environment.

- FDI Inflows: The Philippine government reported a significant uptick in FDI inflows in early 2024, driven by policy reforms and incentives.

- CREATE Act Impact: The CREATE Act continues to provide tax benefits, making the Philippines a more attractive destination for foreign investors and supporting Ayala's capital-intensive projects.

- Sectoral Focus: Government initiatives prioritize attracting FDI into strategic sectors such as renewable energy and digital transformation, aligning with Ayala's core business areas.

- Ease of Doing Business: Ongoing reforms aim to simplify regulatory processes, reducing barriers for foreign companies looking to invest and partner with Philippine conglomerates like Ayala.

Geopolitical Dynamics and Regional Alliances

The Philippines' active participation in regional blocs like ASEAN, coupled with its bilateral ties, shapes trade agreements and influences investor sentiment, directly impacting Ayala Corporation's extensive operations. For instance, the Philippines' commitment to free trade agreements within ASEAN can streamline import/export processes for Ayala's manufacturing arms.

Ayala's exposure to global markets, particularly through its telecommunications and infrastructure segments, makes it susceptible to shifts in regional economic stability. A slowdown in a key trading partner within Southeast Asia, for example, could dampen demand for Ayala's services or products. The country's stance on international disputes also plays a role in maintaining a stable investment climate.

- ASEAN Trade Facilitation: The Philippines' adherence to ASEAN trade agreements, aiming to reduce non-tariff barriers by 2025, can benefit Ayala's supply chain efficiency.

- Foreign Direct Investment (FDI) Trends: In 2023, the Philippines saw a notable increase in FDI, reaching $9.79 billion, signaling growing investor confidence potentially influenced by regional stability and government policies.

- Regional Connectivity Projects: Ayala's infrastructure ventures, such as those in power and transportation, are strategically positioned to benefit from increased regional connectivity initiatives, fostering economic growth across Southeast Asia.

- Geopolitical Risk Assessment: Ayala's risk management frameworks likely incorporate assessments of geopolitical tensions in the South China Sea, which could affect shipping routes and raw material costs for its diverse businesses.

Political stability and government policies significantly influence Ayala Corporation's operations, particularly in infrastructure and real estate. The Philippine government's 'Build Better More' program, with a projected PHP 9.9 trillion (approx. USD 170 billion) investment from 2024-2026, directly supports Ayala's infrastructure and property development arms by enhancing connectivity and creating demand in new growth areas.

Favorable foreign investment policies, including incentives from the CREATE Act, are crucial for attracting capital to Ayala's expansion plans, especially in renewable energy and digital infrastructure. The government's focus on improving the ease of doing business aims to streamline regulatory processes, reducing operational friction for Ayala's diverse ventures.

Ayala Corporation must continually adapt to evolving regulations across its key sectors, such as telecommunications and energy. The government's push for greater competition in telecommunications and its promotion of green energy adoption directly impact strategic adjustments for companies like Globe Telecom and ACEN.

Regional trade agreements and geopolitical stability are also key political factors affecting Ayala's international operations. The Philippines' participation in ASEAN and its bilateral ties can influence trade dynamics and investor sentiment, impacting Ayala's supply chains and market access.

| Political Factor | Impact on Ayala Corp | 2024/2025 Data/Trend |

| Infrastructure Spending | Drives demand for property and infrastructure projects. | PHP 9.9 trillion (USD 170B) 'Build Better More' program (2024-2026). |

| Foreign Investment Policy | Facilitates capital inflow for expansion. | CREATE Act incentives continue; FDI inflows showed a notable increase in Q1 2024. |

| Regulatory Environment | Requires adaptation in telecom, energy, and other sectors. | Ongoing reforms for ease of doing business; focus on telco competition and green energy. |

| Regional Trade & Geopolitics | Affects supply chains, market access, and investor sentiment. | ASEAN trade facilitation efforts aim to reduce barriers by 2025; geopolitical risks assessed. |

What is included in the product

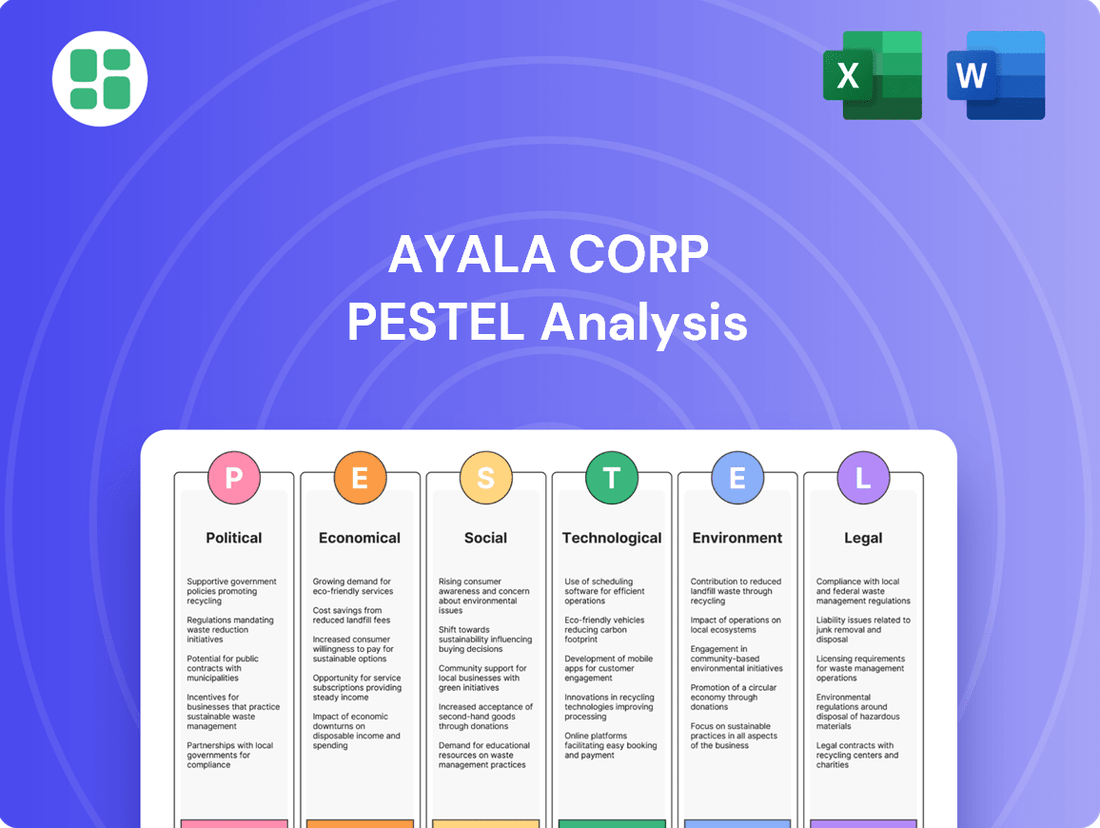

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ayala Corporation across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for Ayala Corp's diverse business portfolio.

A PESTLE analysis of Ayala Corp provides a clear, summarized version of external factors for easy referencing during strategic planning meetings, alleviating the pain of information overload.

By visually segmenting Ayala Corp's PESTLE analysis, stakeholders can quickly interpret key external influences, relieving the pain of complex data interpretation.

Economic factors

The Philippine economy's strength is a direct driver for Ayala Corporation, whose operations are intrinsically linked to national economic activity. The Philippines achieved a 5.7% GDP growth in 2024, with projections indicating continued robust expansion into 2025. This consistent economic momentum, fueled by strong domestic consumption and increasing investments, creates a favorable environment for Ayala's diverse business interests, including real estate development and financial services.

Inflation and interest rate trends are crucial for Ayala Corporation's diverse operations. For instance, BPI's profitability is directly tied to interest rate differentials, while Ayala Land's sales volume is sensitive to borrowing costs for homebuyers. In 2024, inflation remained within the Bangko Sentral ng Pilipinas (BSP) target, but potential increases in transport and utility costs presented a risk.

Looking ahead to 2025, a projected easing of inflation and possible interest rate cuts by the BSP could stimulate consumer spending and business investment, benefiting both BPI's loan growth and Ayala Land's property market. However, sustained high interest rates, even if easing slightly, could still challenge affordability, particularly in the middle-income housing sector.

Consumer spending is a major driver of the Philippine economy, directly impacting Ayala Corporation's diverse portfolio. Businesses like Ayala Land, with its residential and retail segments, and Globe Telecom, benefit significantly from robust household consumption. In the first quarter of 2024, the Philippine economy grew by 5.7%, with household consumption contributing substantially to this expansion.

The strength of consumer spending is bolstered by consistent remittances from Overseas Filipino Workers and a healthy labor market. This economic resilience provides a solid foundation for Ayala Land to pursue premium and upscale developments, as the higher-income demographic demonstrates sustained purchasing power, evidenced by continued demand in their luxury residential projects.

Real Estate Market Dynamics

The Philippine real estate sector, especially in Metro Manila, is seeing mixed signals. While some areas are booming, others, particularly certain condominium segments, are grappling with an oversupply issue. Despite these complexities, Ayala Land demonstrated resilience, reporting a rise in net income for 2024. This growth was largely attributed to robust demand for their high-end and horizontal developments, with a notable surge in interest for projects located outside the capital.

Looking ahead to 2025, the real estate market is anticipated to expand. Key drivers for this growth include ongoing urbanization trends, the expansion of e-commerce, a recovering tourism sector, and the evolving nature of work arrangements. These factors are expected to sustain demand, particularly for adaptable office spaces that can cater to new work models.

- Ayala Land's 2024 net income increased, showcasing strong performance in specific market segments.

- Oversupply is a concern in certain condominium markets, particularly within Metro Manila.

- Demand for horizontal projects and developments outside Metro Manila remains strong.

- Urbanization, e-commerce, tourism, and flexible work models are projected to fuel market growth in 2025.

Capital Expenditures and Investment Climate

Ayala Corporation is demonstrating strong confidence in the investment climate by planning significant capital expenditures. For 2025, the company has earmarked P230 billion to fuel growth across its diverse business segments.

This substantial investment is strategically directed towards key areas like renewable energy, real estate development, and the expansion of digital services. Ayala's robust balance sheet and favorable access to credit further underscore its optimistic outlook and capacity to execute these ambitious plans.

The company views 2025 as a pivotal year, aiming to achieve profitability for its emerging businesses. This aggressive investment strategy is designed to support this transition and capitalize on anticipated market opportunities.

- Capital Expenditure: P230 billion allocated for 2025.

- Key Investment Areas: Renewable energy, real estate, digital services.

- Financial Strength: Healthy balance sheet and good credit access.

- Strategic Goal: Achieve profitability for newer ventures in 2025.

The Philippine economy's trajectory significantly impacts Ayala Corporation, with a 5.7% GDP growth in Q1 2024 and projections for continued expansion in 2025, driven by consumption and investment. Inflation remained within the BSP target in 2024, though potential cost increases pose risks. Easing inflation and possible rate cuts in 2025 could boost spending and investment.

| Economic Indicator | 2024 (Actual/Estimate) | 2025 (Projection) |

|---|---|---|

| GDP Growth | 5.7% (Q1 2024) | Continued robust expansion |

| Inflation | Within BSP target (potential risks) | Projected easing |

| Interest Rates | Influential on BPI & Ayala Land | Potential easing |

Preview Before You Purchase

Ayala Corp PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ayala Corporation delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its diverse business portfolio. Gain actionable insights into the strategic landscape shaping one of the Philippines' largest conglomerates.

Sociological factors

The Philippines is experiencing significant urbanization, with an estimated 57% of its population living in urban areas as of 2023, a figure projected to rise. This trend directly fuels demand for Ayala Land's integrated communities, housing projects, and commercial developments, as more people move to cities seeking opportunities.

Demographic shifts, characterized by a median age of 25.7 years in 2023 and a consistently growing population, present a robust and sustained market for Globe Telecom's services and AC Health's expanding healthcare network. This young demographic is tech-savvy and increasingly health-conscious, aligning with Ayala's core business segments.

Ayala Corporation's strategic focus on developing townships and economic hubs outside Metro Manila, such as in Cebu and Pampanga, directly addresses the decentralization of economic activity and population dispersal. This approach taps into the growing demand in emerging urban centers, anticipating future growth patterns.

Consumer preferences are increasingly leaning towards convenience, digital integration, and a commitment to sustainability. This shift directly impacts how companies like Ayala Corp strategize their offerings and operations.

The growing demand for digital financial services, robust e-commerce platforms, and adaptable work environments significantly influences BPI's digital banking initiatives, Globe Telecom's connectivity solutions, and Ayala Land's development of flexible office and retail spaces. For instance, Globe Telecom reported a 12% year-on-year increase in its digital channels' transaction volume in the first quarter of 2024, highlighting this trend.

Ayala Corp's strategic vision includes creating integrated communities that seamlessly blend residential living with commercial hubs, educational institutions, and leisure facilities. This approach directly addresses the modern consumer's desire for holistic living experiences, as seen in projects like Vertis North, which offers a mixed-use environment designed for convenience and lifestyle enhancement.

The increasing focus on health and wellness, amplified by recent global health concerns, creates substantial avenues for Ayala Corporation's healthcare arm, AC Health. This societal shift is driving demand for more accessible and high-quality medical services.

Ayala Corporation is actively investing in expanding its network of hospitals and multi-specialty clinics, directly responding to this burgeoning demand. This strategic expansion is a key component of their growth strategy.

This societal trend underpins AC Health's ambitious target to evolve into a USD2-billion healthcare enterprise by 2035, reflecting a strong alignment between consumer priorities and corporate objectives.

Digital Adoption and Connectivity Needs

Filipinos are increasingly embracing digital tools, which directly boosts demand for strong telecommunications services, a clear advantage for companies like Globe Telecom. This trend is evident as digital payments, for instance, saw a significant surge, with the Bangko Sentral ng Pilipinas reporting over 2.4 billion digital transactions in the first half of 2024, a substantial increase from previous periods.

While mobile network coverage is widespread, reaching an estimated 97% of the population by late 2024, many in remote areas still face connectivity gaps. Globe Telecom is actively addressing this by focusing on expanding its network into these underserved regions, aiming to bridge the digital divide.

This societal shift towards digitalization is also driving the adoption of innovative content and applications. We're seeing a growing interest in services powered by artificial intelligence and Web 3.0 technologies, indicating a future where connectivity fuels advanced digital experiences.

- Digital Payment Growth: Over 2.4 billion digital transactions were recorded in the first half of 2024, highlighting increased digital adoption.

- Network Expansion Focus: Globe Telecom is prioritizing network build-out in remote areas to address remaining connectivity gaps.

- Emerging Technology Adoption: The digital transformation is fostering demand for AI and Web 3.0 applications.

Social Responsibility and Community Engagement

Ayala Corporation deeply integrates social responsibility into its operations, aligning its business strategies with the developmental needs of the Philippines. This commitment is evident in its active contribution to achieving the UN Sustainable Development Goals. For instance, in 2023, Ayala Land's sustainability initiatives focused on affordable housing and community development, directly addressing SDG 11 (Sustainable Cities and Communities).

The company's sustainability blueprint, which prioritizes access, inclusivity, productivity, competitiveness, and responsible growth, serves as a roadmap for its social impact endeavors. This strategic approach not only fosters positive community development but also strengthens Ayala Corporation's reputation. In 2024, their continued focus on inclusive business models is expected to further enhance stakeholder relationships and brand loyalty.

- Commitment to Filipino Development: Ayala Corporation's business units actively support national development goals, contributing to sectors like infrastructure, housing, and telecommunications.

- UN Sustainable Development Goals Alignment: The corporation prioritizes projects that directly address SDGs, aiming for measurable social and environmental impact.

- Sustainability Blueprint: This framework guides efforts in ensuring access and inclusivity, enhancing productivity, fostering competitiveness, and promoting responsible growth across all ventures.

- Enhanced Reputation and Stakeholder Relations: A strong emphasis on social impact and community engagement bolsters Ayala Corporation's standing with the public, government, and investors.

The Philippines' young and growing population, with a median age of 25.7 in 2023, fuels demand for Globe Telecom's services and AC Health's offerings. This demographic is tech-savvy and increasingly health-conscious, aligning perfectly with Ayala's core business areas.

Urbanization continues to rise, with over half the population in cities by 2023, driving demand for Ayala Land's integrated communities and commercial spaces. This trend supports strategic developments in emerging urban centers like Cebu and Pampanga.

A strong societal embrace of digital tools, evidenced by over 2.4 billion digital transactions in the first half of 2024, benefits Globe Telecom. Efforts to bridge connectivity gaps in remote areas are ongoing, with network expansion a key focus.

Ayala Corporation's commitment to social responsibility and UN Sustainable Development Goals is evident in projects like those by Ayala Land, which focused on affordable housing and community development in 2023. This aligns business strategy with societal needs.

| Sociological Factor | Impact on Ayala Corp | Supporting Data/Examples |

|---|---|---|

| Demographics | Young, growing population drives demand for telecom and healthcare services. | Median age 25.7 in 2023; Growing population supports Globe & AC Health. |

| Urbanization | Increased demand for housing, commercial, and integrated developments. | 57% urban population in 2023; Ayala Land's township developments in Cebu, Pampanga. |

| Digital Adoption | Boosts demand for digital services and connectivity solutions. | 2.4 billion+ digital transactions (H1 2024); Globe's network expansion in underserved areas. |

| Social Responsibility & SDGs | Enhances reputation and stakeholder relations through aligned initiatives. | Ayala Land's 2023 focus on affordable housing (SDG 11); Sustainability blueprint guiding impact. |

Technological factors

Ayala Corporation is actively investing in digital transformation and innovation to bolster its diverse business segments. For instance, in 2023, Globe Telecom, a key Ayala subsidiary, reported a 14% increase in its data revenue, driven by the growing demand for digital services and enhanced customer experiences. This focus on technology is crucial for maintaining competitiveness across banking, real estate, and telecommunications.

The company's commitment to leveraging new technologies is evident in its efforts to streamline operations and develop novel digital products. Ayala Land, another major subsidiary, is integrating smart city technologies into its developments, aiming to improve urban living and operational efficiency. This strategic adoption of digital tools is a cornerstone of Ayala's strategy to drive growth and adapt to evolving market demands through 2025.

Globe Telecom, a key Ayala Corporation subsidiary, is significantly boosting its telecommunications capabilities. In 2024, Globe committed P48 billion to capital expenditures, primarily for network upgrades and expansion, including its 5G rollout. This strategic investment aims to improve mobile data speeds and reliability, crucial for supporting the increasing digital consumption by its over 100 million subscribers.

The company's drive to expand network accessibility, especially in previously underserved regions, is a major technological factor. By extending 5G coverage and enhancing its fiber-to-the-home network, Globe ensures more Filipinos can tap into advanced digital services. This focus on accessibility is vital for enabling customer adoption of emerging technologies such as artificial intelligence applications and the evolving Web 3.0 ecosystem.

The rapid growth of fintech and digital banking is a significant technological factor influencing Ayala Corporation, particularly its banking arm, BPI. BPI is actively investing in technology to stay ahead, focusing on improving its online and mobile banking services and bolstering cybersecurity defenses. The bank is also exploring innovative digital payment solutions to meet evolving customer demands.

BPI's strategic investments in digital transformation are paying off, as evidenced by its robust performance in 2024. This adaptability to the fintech landscape is crucial for maintaining its competitive position in the financial sector.

Proptech and Smart City Development

Ayala Land is actively integrating property technology, or proptech, into its projects. This means embedding smart solutions within their communities and commercial spaces. For instance, they are implementing smart building management systems and utilizing the Internet of Things (IoT) for various services. Digital platforms are also key for managing properties and facilitating sales, streamlining operations and enhancing customer experience.

The company’s commitment to green-certified buildings and sustainable development further underscores this technological push. Ayala Land aims to incorporate advanced environmental technologies to reduce their ecological footprint. This approach aligns with the growing global demand for eco-friendly and technologically advanced living and working environments.

In 2023, Ayala Land reported a net income of PHP 21.3 billion, reflecting continued growth. Their focus on integrated developments, powered by proptech, positions them to capitalize on the evolving real estate landscape. This strategic direction is crucial as smart city initiatives gain momentum, driving demand for connected and sustainable urban living.

- Smart Building Systems: Ayala Land incorporates automated controls for lighting, climate, and security in its developments.

- IoT Integration: Devices and sensors are used for energy monitoring, waste management, and resident services.

- Digital Platforms: Online portals and apps facilitate property management, leasing, and sales transactions.

- Sustainability Tech: Features like solar panels, rainwater harvesting, and energy-efficient materials are standard.

Emerging Technologies (AI, EVs, Logistics Tech)

Ayala Corporation is strategically investing in transformative technologies, notably through its AC Mobility and AC Logistics subsidiaries. AC Mobility, focused on electric vehicles (EVs), is positioning itself to capture growth in the sustainable transportation sector. For instance, in 2024, the Philippine government continued to promote EV adoption, with targets for increased EV sales and charging infrastructure development, creating a favorable market for Ayala's initiatives.

AC Logistics is leveraging advancements in logistics technology to enhance supply chain efficiency, a critical factor for businesses in the current economic climate. This includes exploring automation and data analytics to optimize warehousing and delivery operations. By 2025, the logistics industry is expected to see continued integration of AI for route optimization and inventory management, areas where AC Logistics is actively developing capabilities.

- AC Mobility's EV push aligns with global trends: By 2024, EV sales worldwide were projected to surpass 15 million units, indicating a significant market opportunity.

- AC Logistics benefits from digitalization: The adoption of digital technologies in logistics is forecast to increase efficiency by up to 20% by 2025, according to industry reports.

- AI integration in supply chains: AI applications in logistics are expected to grow substantially, with an estimated market size of over $20 billion by 2026, offering significant operational improvements.

Ayala Corporation's technological strategy centers on digital transformation across its diverse holdings. Globe Telecom's substantial 2024 capital expenditure of P48 billion for network upgrades, including its 5G rollout, underscores this commitment to enhancing digital connectivity for its over 100 million subscribers.

Ayala Land is integrating proptech, such as smart building management systems and IoT, into its developments to improve efficiency and customer experience, aligning with the growing demand for sustainable and connected urban living.

The company's subsidiaries, AC Mobility and AC Logistics, are capitalizing on technological advancements in electric vehicles and logistics automation, respectively, positioning themselves for growth in these evolving sectors. By 2025, AI integration in logistics is expected to offer significant operational improvements, a trend AC Logistics is actively pursuing.

Legal factors

Ayala Corporation operates within a complex web of regulations across its diverse sectors, from banking to energy. For instance, the Bangko Sentral ng Pilipinas (BSP) sets stringent capital adequacy ratios for its banking arm, Bank of the Philippine Islands (BPI), which maintained a Common Equity Tier 1 (CET1) ratio of 15.3% as of December 31, 2023, well above the regulatory minimum.

Navigating these varied legal landscapes, including property laws for Ayala Land and telecommunications regulations for Globe Telecom, is critical. Non-compliance can lead to significant fines and reputational damage, impacting investor confidence and operational continuity. Ayala's robust governance frameworks are designed to proactively manage these legal obligations.

Ayala Corporation must strictly adhere to Philippine labor laws, which govern minimum wage, working conditions, and employee benefits. For instance, the current minimum wage in Metro Manila, as of early 2024, is PHP 610 per day for non-agricultural workers, a figure that impacts the operational costs for Ayala's extensive employee base across its various subsidiaries.

Any shifts in these labor policies, such as potential increases in mandated benefits or stricter enforcement of working hour regulations, could directly influence Ayala's human resource strategies and overall expenditure. Furthermore, increased engagement or demands from labor unions, which represent a significant portion of the Philippine workforce, can also introduce complexities and potential cost escalations.

Ayala's proactive stance on fostering a people-first culture and upholding responsible business practices serves as a key strategy to navigate these legal and regulatory landscapes. This approach aims to build strong employee relations and preemptively address potential labor disputes, thereby mitigating risks associated with employment regulations.

Strict environmental regulations, especially concerning land use, waste management, and emissions, significantly influence Ayala Land's property developments and ACEN's renewable energy ventures. These rules often mandate detailed environmental impact assessments and specific mitigation measures, adding to project timelines and costs.

Ayala Corporation is actively pursuing its commitment to achieving net-zero greenhouse gas emissions by 2050. This proactive stance involves adherence to internationally recognized reporting standards such as the GHG Protocol and the Task Force on Climate-related Financial Disclosures (TCFD), showcasing a dedication to robust environmental stewardship and compliance with evolving legal frameworks.

Competition Laws and Anti-Trust Policies

Ayala Corporation, as a major conglomerate in the Philippines, navigates a landscape shaped by robust competition laws and anti-trust policies. These regulations are crucial for fostering a level playing field and preventing monopolistic practices across its diverse business segments, including telecommunications, banking, infrastructure, and real estate. For instance, the Philippine Competition Commission (PCC) actively scrutinizes mergers and acquisitions to ensure they do not stifle competition. In 2023, the PCC reviewed numerous transactions, reflecting the ongoing enforcement of these vital market safeguards.

Compliance with these legal frameworks directly impacts Ayala’s strategic decisions regarding expansion and market positioning. Any significant merger or acquisition, such as potential consolidation within its digital services or energy ventures, requires thorough review and approval from regulatory bodies like the PCC. Failure to adhere to these regulations can result in substantial penalties and hinder growth opportunities, underscoring the importance of proactive legal diligence in its business operations.

- Regulatory Scrutiny: Ayala Corporation must ensure all mergers, acquisitions, and market practices align with Philippine competition laws to avoid legal repercussions.

- Market Fairness: Anti-trust policies aim to prevent monopolies and promote fair competition, influencing Ayala's expansion strategies and market share growth.

- PCC Oversight: The Philippine Competition Commission plays a key role in reviewing transactions, with a significant number of cases processed annually, demonstrating active enforcement.

- Strategic Impact: Non-compliance can lead to penalties and impede business development, making adherence to competition laws a critical factor in Ayala's long-term success.

Data Privacy and Cybersecurity Laws

Ayala Corporation's extensive operations in banking through BPI and telecommunications via Globe Telecom place it squarely under the purview of stringent data privacy and cybersecurity laws. The Data Privacy Act of 2012 in the Philippines, for instance, mandates robust protection of personal information, impacting how these subsidiaries handle customer data. Failure to comply can result in significant penalties and reputational damage.

Ensuring the security of digital platforms is a critical legal obligation for Ayala Corporation, especially given the increasing sophistication of cyber threats. BPI, as a major financial institution, actively invests in and implements advanced cybersecurity measures and consumer protection initiatives. This proactive stance is essential to safeguard customer assets and maintain trust in an evolving digital landscape.

Globe Telecom, in its role as a telecommunications provider, also faces substantial legal requirements related to data privacy and network security. The company must adhere to regulations designed to protect subscriber information and ensure the integrity of its network infrastructure against breaches and malicious attacks. These legal frameworks are constantly evolving to keep pace with technological advancements and emerging risks.

- Data Privacy Act of 2012: Governs the processing of personal information in the Philippines, directly affecting BPI and Globe Telecom's data handling practices.

- Cybersecurity Regulations: Mandate the implementation of security measures to protect digital assets and customer data from cyber threats.

- Consumer Protection: Legal frameworks require financial institutions like BPI to implement measures that protect consumers from fraud and unauthorized transactions.

- Network Security: Telecommunications companies like Globe Telecom are legally obligated to maintain the security and integrity of their network infrastructure.

Ayala Corporation must navigate a complex legal environment, particularly concerning competition and anti-trust laws enforced by the Philippine Competition Commission (PCC). The PCC actively reviews transactions to prevent monopolistic practices across Ayala's diverse sectors, processing numerous cases annually to ensure market fairness. Compliance is crucial, as non-adherence can lead to significant penalties and impede strategic growth initiatives.

Environmental factors

The Philippines' susceptibility to climate change and extreme weather events poses significant risks to Ayala Corporation's diverse operations, especially in real estate and infrastructure development. Typhoon season, for instance, can lead to costly damages and project delays. In 2023, the Philippines experienced several major typhoons, including Typhoon Egay, which caused widespread damage and economic losses estimated in the billions of pesos, directly impacting infrastructure and property.

Ayala Corporation is actively addressing these environmental challenges, demonstrating a commitment to sustainability by aiming for net-zero greenhouse gas emissions by 2050. This forward-looking strategy is crucial for long-term resilience. The company's investments in renewable energy and sustainable building practices are key components of this commitment, aiming to mitigate its carbon footprint and adapt to a changing climate.

Integrating climate-related considerations into its strategic business decisions is paramount for Ayala to safeguard its assets and ensure business continuity. This proactive approach involves risk assessments for climate-induced disruptions, such as sea-level rise and increased frequency of extreme weather, allowing for the implementation of adaptive measures in project planning and existing asset management.

Ayala Corporation has set a significant goal to achieve Net Zero Greenhouse Gas (GHG) Emissions by 2050, demonstrating a strong commitment to global climate action. This initiative is backed by rigorous efforts to enhance GHG accounting and validation, with a particular emphasis on reducing Scope 1 and 2 emissions in line with Science Based Targets initiative (SBTi) recommendations.

Furthering this commitment, Ayala Land is targeting Zero Waste to Landfill by 2030, a crucial step in operationalizing sustainability across its businesses. These targets reflect a strategic approach to environmental stewardship and long-term value creation.

Ayala Corporation is making significant strides in resource efficiency, with a strong emphasis on adopting renewable energy sources across its various businesses. This strategic shift is driven by a commitment to sustainability and operational resilience.

ACEN, Ayala's dedicated renewable energy platform, is a key player in this transition. The company has ambitious targets, aiming for 20 gigawatts of renewable capacity by 2030. This expansion is crucial for powering Ayala's diverse operations and contributing to a greener energy mix.

In 2024, ACEN's efforts are already showing results, with a notable increase in the proportion of renewable energy powering Ayala Land's commercial properties. This move not only slashes the carbon footprint of these developments but also enhances their long-term operational stability by reducing reliance on volatile fossil fuel markets.

Waste Management and Circular Economy Initiatives

Ayala Land is actively pursuing waste management and circular economy initiatives, a key environmental consideration. The company has set an ambitious target of achieving Zero Waste to Landfill by 2030. To support this, pilot programs are underway for the diversion of plastics, food waste, and residual waste from landfills, showcasing a tangible commitment to reducing environmental impact.

These efforts directly align with circular economy principles, aiming to transform waste into resources and minimize the footprint of Ayala Land's construction and operational activities. This proactive approach to environmental stewardship not only addresses regulatory pressures but also enhances the company's reputation and long-term sustainability.

- Zero Waste to Landfill Target: Ayala Land aims for this by 2030.

- Pilot Programs: Focusing on plastics, food waste, and residual waste diversion.

- Circular Economy Alignment: Practices designed to minimize environmental impact.

Biodiversity and Land Use Management

Ayala Land, a key subsidiary of Ayala Corporation, manages extensive land holdings for its real estate projects, making responsible land use and biodiversity conservation critical. The company is actively developing private forest carbon projects, aiming to offset its carbon emissions. In 2023, Ayala Land reported a 12% increase in its green building certifications, reflecting a commitment to minimizing its ecological footprint through sustainable master planning.

Their efforts extend to their supply chain, where they collaborate with partners to reduce overall emissions. Ayala Corporation's broader sustainability agenda, which includes biodiversity, saw a 15% improvement in its environmental performance metrics in 2024 compared to the previous year.

- Land Use Responsibility: Ayala Land's vast real estate portfolio necessitates careful management to preserve natural habitats and minimize environmental impact.

- Carbon Offsetting Initiatives: The company is investing in private forest carbon projects as a strategy to mitigate its greenhouse gas emissions.

- Supply Chain Engagement: Ayala Corporation actively works with its suppliers to implement emission reduction strategies throughout its value chain.

- Green Building Standards: Sustainable master planning and the development of green-certified buildings are core components of Ayala Land's approach to reducing its ecological footprint.

Ayala Corporation faces significant environmental risks due to the Philippines' vulnerability to climate change, impacting its real estate and infrastructure sectors. The company is proactively addressing this by targeting Net Zero GHG Emissions by 2050 and aiming for Zero Waste to Landfill by 2030 through various pilot programs and circular economy initiatives.

Ayala's renewable energy arm, ACEN, is central to this strategy, with a goal of 20 GW of renewable capacity by 2030, powering its operations with cleaner energy. In 2024, ACEN reported a notable increase in renewable energy powering Ayala Land's commercial properties, enhancing operational stability and reducing carbon footprints.

Responsible land use and biodiversity conservation are key for Ayala Land, with a 12% increase in green building certifications in 2023. The company is also investing in private forest carbon projects and has seen a 15% improvement in its environmental performance metrics in 2024, demonstrating a commitment to sustainability across its value chain.

| Environmental Initiative | Target Year | Progress/Status | Key Metric |

| Net Zero GHG Emissions | 2050 | Ongoing | Scope 1 & 2 emission reduction |

| Zero Waste to Landfill | 2030 | Pilot programs underway | Waste diversion from landfills |

| Renewable Energy Capacity (ACEN) | 2030 | Target: 20 GW | Gigawatts of renewable capacity |

| Green Building Certifications (Ayala Land) | Ongoing | 12% increase in 2023 | Percentage increase in certifications |

| Environmental Performance Improvement | 2024 | 15% improvement | Overall environmental metrics |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ayala Corporation is built on comprehensive data from reputable sources, including official government publications, global financial institutions like the World Bank and IMF, and leading market research firms. This ensures that each factor, from political stability to technological advancements, is grounded in current and credible information.