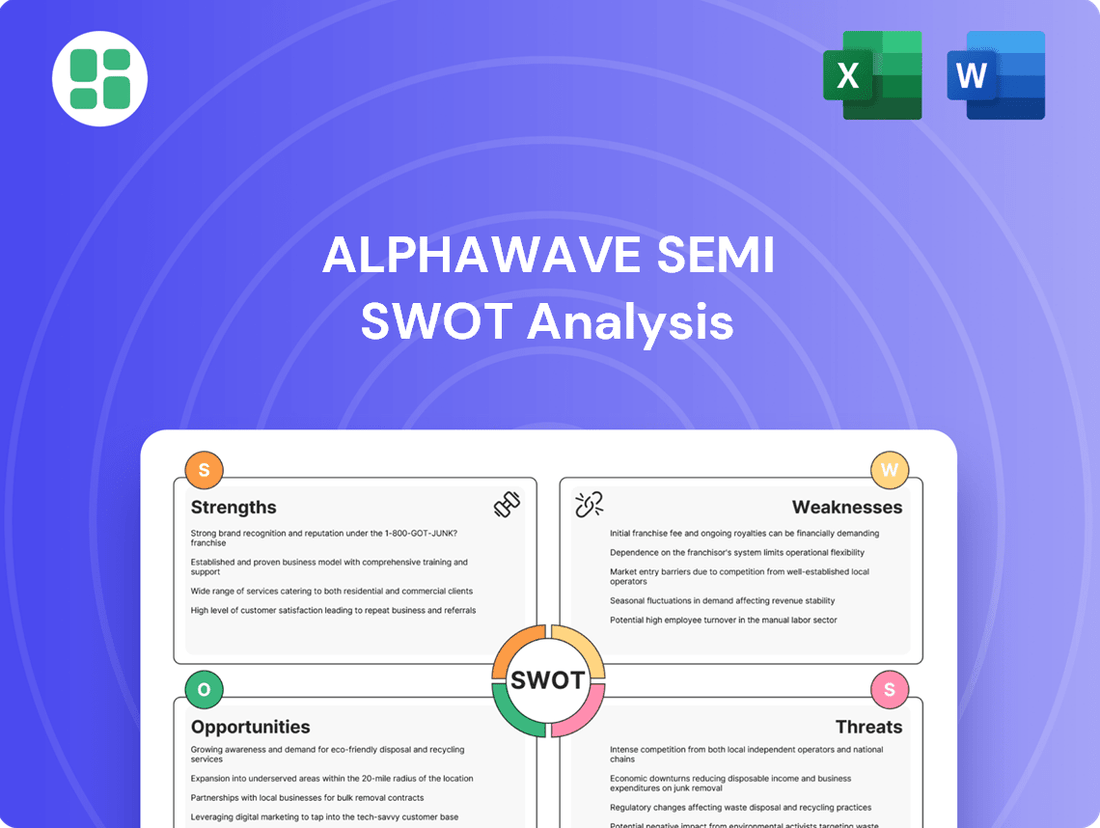

ALPHAWAVE SEMI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALPHAWAVE SEMI Bundle

ALPHAWAVE SEMI's innovative technology and strong market presence are key strengths, but potential supply chain disruptions and intense competition present significant challenges.

Want the full story behind ALPHAWAVE SEMI's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alphawave Semi stands out with its leading-edge technology in high-speed connectivity, providing essential silicon IP, SerDes, and innovative chiplet designs crucial for today's data infrastructure. The company has demonstrated its innovation by releasing industry-first products, such as its multi-protocol I/O chiplets and advanced 3nm IP specifically for AI and data center use cases.

Alphawave Semi is strategically positioned within high-growth markets like artificial intelligence, data centers, and 5G wireless infrastructure. Their technology is designed to tackle the critical bottleneck of data movement, facilitating quicker and more dependable data transfers in these booming sectors. This targeted approach allows them to leverage substantial industry growth trends.

Alphawave Semi's intellectual property (IP) portfolio is a significant strength, having expanded to over 240 silicon IPs by the close of 2024. This robust IP base is crucial for their continued innovation and market competitiveness.

The company's consistent success in securing new design wins with top-tier customers and major hyperscalers highlights the value and demand for their advanced technology solutions. These wins, such as those announced in late 2024 with leading semiconductor manufacturers, underscore strong customer confidence and market validation.

Strategic Partnerships with Industry Leaders

Alphawave Semi has solidified crucial alliances with leading foundries like TSMC and Samsung, alongside compute IP developers such as Arm. These collaborations are foundational to its advanced chip design capabilities and market positioning.

A pivotal development in February 2025 was the significant collaboration with Siemens EDA. This partnership is expected to substantially broaden Alphawave Semi's sales channels and enhance its penetration into new markets.

These strategic partnerships are instrumental in bolstering Alphawave Semi's technological prowess and expanding its market reach, providing a competitive edge in the semiconductor industry.

- Key Foundry Alliances: Partnerships with TSMC and Samsung are critical for manufacturing advanced semiconductor nodes.

- Compute IP Integration: Collaboration with Arm ensures access to leading-edge processor architectures.

- Siemens EDA Expansion: The February 2025 deal with Siemens EDA significantly broadens sales and market access.

- Enhanced Market Penetration: These alliances collectively improve Alphawave Semi's ability to reach a wider customer base and enter new market segments.

Transition to Vertically Integrated Semiconductor Product Company

Alphawave Semi is strategically evolving from an Intellectual Property (IP) licensing model to a vertically integrated semiconductor product company. This transition is a significant strength, allowing them to capture more value by offering custom silicon and connectivity solutions directly to customers.

This strategic pivot is supported by tangible progress, with initial silicon shipments anticipated by the end of 2024. The company projects substantial revenue growth from these silicon products in 2025, indicating a successful execution of this new business model.

The move to a product-centric approach diversifies Alphawave Semi's revenue streams, reducing reliance on IP licensing alone. This vertical integration strengthens their competitive position by enabling closer collaboration with clients and greater control over product development and delivery.

Key aspects of this strength include:

- Strategic Shift: Transitioning from IP licensing to custom silicon and connectivity product offerings.

- Revenue Diversification: Expanding revenue sources beyond traditional IP licensing.

- Value Chain Enhancement: Moving up the value chain by delivering complete silicon solutions.

- Market Penetration: Targeting new market segments with integrated product capabilities.

Alphawave Semi's core strengths lie in its advanced, high-speed connectivity IP and its strategic focus on high-growth markets like AI and data centers. The company's robust IP portfolio, exceeding 240 silicon IPs by the end of 2024, underpins its innovation. Securing design wins with major hyperscalers and forging key alliances with foundries like TSMC and Samsung, as well as Arm, further solidify its market position.

| Strength | Description | Impact |

| Leading-Edge IP Portfolio | Over 240 silicon IPs by end of 2024, including multi-protocol I/O and 3nm IP for AI. | Enables advanced solutions for data-intensive applications. |

| High-Growth Market Focus | Targeting AI, data centers, and 5G infrastructure. | Leverages significant industry expansion trends. |

| Strategic Partnerships | Alliances with TSMC, Samsung, Arm, and Siemens EDA (Feb 2025). | Enhances manufacturing capabilities, IP access, and market reach. |

| Vertical Integration Strategy | Transition to custom silicon product offerings, with initial shipments in late 2024. | Diversifies revenue and strengthens competitive advantage. |

What is included in the product

Delivers a strategic overview of ALPHAWAVE SEMI’s internal strengths, weaknesses, external opportunities, and threats.

Offers a clear, actionable SWOT framework to identify and address critical business challenges.

Weaknesses

Despite a notable increase in bookings in 2024, Alphawave Semi encountered profitability hurdles, reporting a net loss for the full year 2024. This performance was accompanied by a decline in adjusted EBITDA when compared to the previous year.

Furthermore, Alphawave Semi's revenue for 2024 remained largely consistent with 2023 figures. This suggests that the company is still navigating the path to achieving sustained profitability, even as it continues to make substantial investments in its operations and growth initiatives.

Alphawave Semi has explicitly stated it cannot offer financial guidance for fiscal year 2025 and beyond. This is directly attributed to widespread global economic uncertainty and the volatile landscape of international tariff policies.

This inability to provide forward-looking financial information introduces significant uncertainty for investors. It underscores the company's susceptibility to geopolitical shifts, especially given its operational footprint in China and the broader Asian region.

Maintaining a leading edge in high-speed connectivity necessitates significant and ongoing investment in research and development. Alphawave Semi has demonstrated this commitment through substantial organic R&D spending and infrastructure development aimed at future expansion.

While these investments are crucial for innovation and long-term competitiveness, they do place a considerable burden on current profitability and can impact free cash flow. For instance, in Q1 2024, Alphawave reported R&D expenses of $71.4 million, a notable increase from the previous year, reflecting this strategic focus.

Intense Competition from Larger, Established Players

Alphawave Semi faces formidable competition from industry titans such as Broadcom, Marvell, Cadence, and Synopses. These larger entities boast more extensive product ranges, entrenched customer ties, and significantly larger financial reserves. This intense rivalry can hinder Alphawave Semi's ability to expand its market share and command premium pricing.

For instance, in the high-speed connectivity market, Broadcom is a dominant force, holding a substantial market share. Similarly, Cadence and Synopses, leaders in electronic design automation (EDA), offer comprehensive solutions that are deeply integrated into the workflows of many semiconductor companies, creating high switching costs for potential Alphawave Semi customers.

- Market Share Disparity: Established players often control a larger percentage of the total addressable market.

- Resource Advantage: Larger competitors can invest more heavily in R&D, sales, and marketing.

- Customer Lock-in: Existing relationships and integrated solutions can make it difficult for new entrants to gain traction.

Dependence on Customer Program Timing and Adoption Cycles

AlphaWave Semi's revenue realization is closely tied to when customers adopt its new silicon products and chiplets. This can create some unpredictability in financial results. For instance, the initial ramp-up for certain products is anticipated in the latter half of 2025, meaning revenue generation is contingent on customer program timelines.

This dependency on customer program timing and adoption cycles presents a notable weakness. Delays in customer product launches or slower-than-expected market acceptance of AlphaWave's chiplets could significantly impact the company's financial forecasts and revenue recognition patterns.

- Customer Program Dependency: Revenue from new silicon products and chiplets hinges on the timing of customer program launches.

- Adoption Cycle Impact: The pace at which customers adopt these new technologies directly influences revenue ramp-up.

- Revenue Variability: This reliance can lead to fluctuations and less predictable revenue streams.

- Forecast Uncertainty: Any delays in customer adoption cycles can cause deviations from projected financial performance.

Alphawave Semi's inability to provide financial guidance for 2025 and beyond, due to global economic uncertainty and volatile tariff policies, creates significant investor risk. This vulnerability is amplified by its operational presence in Asia, making it susceptible to geopolitical shifts.

The company's substantial investments in R&D, while vital for innovation, weigh heavily on current profitability and free cash flow. For example, Q1 2024 saw R&D expenses climb to $71.4 million, reflecting this strategic but costly focus.

Alphawave Semi faces intense competition from larger, well-resourced players like Broadcom and Marvell, who possess broader product portfolios and stronger customer relationships, potentially limiting market share expansion and pricing power.

Revenue is highly dependent on customer adoption timelines for new silicon products and chiplets, introducing unpredictability into financial results. Delays in customer product launches or slower market acceptance could significantly impact revenue forecasts.

Preview the Actual Deliverable

ALPHAWAVE SEMI SWOT Analysis

You are viewing a live preview of the actual ALPHAWAVE SEMI SWOT analysis. The complete version, offering a comprehensive breakdown of strengths, weaknesses, opportunities, and threats, becomes available immediately after purchase.

This is the same ALPHAWAVE SEMI SWOT analysis document included in your download. The full content, detailing strategic insights for ALPHAWAVE SEMI, is unlocked after payment.

The file shown below is not a sample—it’s the real ALPHAWAVE SEMI SWOT analysis you'll download post-purchase, in full detail. Gain a complete understanding of ALPHAWAVE SEMI's market position.

Opportunities

The insatiable appetite for AI training and inference is fueling an explosion in data, creating a critical need for faster processing. Alphawave Semi's advanced connectivity solutions, particularly their chiplet technology, are designed to tackle the bottlenecks that hinder this massive data flow. This burgeoning AI and HPC market is a significant and ongoing opportunity for Alphawave Semi.

The semiconductor industry's pivot towards chiplet architectures, especially for AI and data center demands, presents a significant opportunity. Companies are increasingly adopting these modular designs for enhanced performance and efficiency.

Alphawave Semi is well-positioned to leverage this trend, having already showcased multiple chiplet-based designs and achieving industry-first product milestones. This leadership allows them to capitalize on the growing demand for these advanced solutions.

Alphawave Semi's expansion into optoelectronics, with new PAM4 and Coherent-lite DSP products, is a significant strategic opportunity. This move directly addresses the rapidly growing high-speed interconnect semiconductor market, which is anticipated to surpass $4 billion by 2028.

By diversifying into optical interconnects, the company is tapping into a lucrative new revenue stream. This diversification is particularly impactful for hyperscale data centers, a key growth area where advanced interconnect solutions are in high demand.

Potential for Strategic Acquisitions or Being Acquired

Alphawave Semi's cutting-edge technology in high-speed connectivity, particularly its PCIe and CXL solutions, has positioned it as a highly attractive target for strategic acquisitions. Qualcomm's reported interest in acquiring Alphawave Semi underscores the significant market value of its intellectual property and engineering talent.

This potential acquisition could offer substantial returns for Alphawave Semi's shareholders, reflecting the premium often paid for companies with such specialized and in-demand technology. Alternatively, it could empower Alphawave Semi to pursue its own strategic mergers or acquisitions, accelerating its growth and expanding its technological portfolio to solidify its market leadership.

- Acquisition Interest: Qualcomm has reportedly shown interest in acquiring Alphawave Semi, highlighting the company's strategic value.

- Shareholder Returns: A potential acquisition could yield significant financial gains for Alphawave Semi's investors.

- Strategic Expansion: Acquisition could enable Alphawave Semi to broaden its technological capabilities and market reach through M&A.

Leveraging Siemens EDA Partnership for Expanded Market Reach

The exclusive OEM agreement signed with Siemens EDA in December 2024, announced in February 2025, is a significant catalyst for Alphawave Semi’s market expansion. This strategic alliance grants Alphawave Semi accelerated customer access to its cutting-edge silicon IP platforms by leveraging Siemens' extensive global sales network. This collaboration is poised to significantly boost the adoption of Alphawave Semi's solutions within rapidly expanding, high-growth market segments.

This partnership is expected to unlock substantial new revenue streams and market share for Alphawave Semi. Key benefits include:

- Expanded Distribution: Gaining access to Siemens EDA's established global sales force, reaching a broader customer base.

- Accelerated Adoption: Facilitating quicker integration of Alphawave Semi's IP into customer designs through Siemens' channels.

- Market Penetration: Driving deeper penetration into high-growth sectors like AI, data centers, and high-performance computing.

The increasing demand for AI and high-performance computing (HPC) creates a substantial market for Alphawave Semi's advanced connectivity solutions. The company's chiplet technology is crucial for overcoming data bottlenecks in these rapidly growing sectors.

Alphawave Semi's strategic expansion into optoelectronics, with new PAM4 and Coherent-lite DSP products, taps into the high-speed interconnect market, projected to exceed $4 billion by 2028. This diversification offers a significant new revenue avenue, particularly for hyperscale data centers.

The company's strong technological foundation in PCIe and CXL solutions makes it an attractive acquisition target, as evidenced by Qualcomm's reported interest. This potential acquisition could offer substantial shareholder returns or enable Alphawave Semi to pursue its own strategic growth initiatives.

The exclusive OEM agreement with Siemens EDA, effective February 2025, provides Alphawave Semi with accelerated customer access through Siemens' extensive global sales network. This partnership is expected to significantly boost the adoption of Alphawave Semi's IP in high-growth markets like AI and data centers.

Threats

Geopolitical tensions and evolving trade tariffs present a substantial hurdle for Alphawave Semi. The company cited global economic uncertainty and the dynamic U.S. tariff landscape as reasons for its cautious financial outlook for 2025. These factors can lead to supply chain disruptions and increased operational costs, potentially impacting market access.

The semiconductor industry, particularly in high-speed connectivity, is a hotbed of rapid innovation. This means Alphawave Semi must constantly pour resources into research and development to stay ahead. For instance, the average lifespan of a leading-edge semiconductor technology has significantly shortened over the past decade, demanding continuous investment to avoid obsolescence.

Failure to adapt to this relentless pace of change poses a significant threat, potentially rendering current products and intellectual property outdated. This could directly impact Alphawave Semi's market position and revenue streams if they cannot match the speed of innovation seen from competitors who are also heavily investing in next-generation technologies.

Alphawave Semi operates in a highly competitive landscape, facing pressure from established semiconductor giants and nimble new entrants. This intense rivalry could result in pricing challenges and a potential decrease in their market share, especially if competitors launch more advanced or budget-friendly technologies. For instance, in the first quarter of 2024, the global semiconductor market saw a 15.2% year-over-year revenue increase to $134 billion, indicating robust growth but also a crowded field where differentiation is key.

Macroeconomic Downturns Affecting Tech Spending

Global economic uncertainties, including the possibility of recessions or slowdowns, can significantly curb capital expenditures by major cloud providers (hyperscalers) and enterprises on new technology infrastructure. This directly impacts the demand for components like Alphawave Semi's high-speed connectivity solutions, which are crucial for data centers and AI hardware.

For Alphawave Semi, a substantial contraction in tech spending presents a direct threat to its revenue growth. For instance, during periods of economic contraction, companies often delay or reduce investments in upgrading their data center capabilities, which are the primary market for Alphawave's products. The International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years, indicating a cautious economic environment that could temper tech investment.

- Reduced Demand: Economic downturns lead hyperscalers and enterprises to scale back on new infrastructure projects, directly impacting Alphawave Semi's order volumes.

- Project Delays: Companies may postpone or cancel planned upgrades, creating uncertainty in sales pipelines and revenue forecasts.

- Pricing Pressure: In a weaker demand environment, customers might seek more favorable pricing terms, potentially affecting Alphawave Semi's profit margins.

Supply Chain Disruptions and Manufacturing Dependencies

As a fabless semiconductor company, Alphawave Semi's reliance on third-party foundries, such as TSMC and Samsung, for manufacturing creates a significant vulnerability. These foundry partners are critical for producing Alphawave's silicon IP and finished products. The semiconductor industry, particularly in 2024 and projected into 2025, continues to face tight foundry capacity and potential geopolitical tensions that could disrupt production. For instance, TSMC, a major partner, has indicated ongoing efforts to manage capacity amidst robust demand for advanced nodes, a situation that could impact lead times and costs for Alphawave. This dependency means any issues at these foundries, from natural disasters to trade restrictions, can directly impede Alphawave's ability to meet customer demand and maintain its delivery schedules.

The global semiconductor supply chain, already strained in recent years, presents ongoing challenges for companies like Alphawave Semi. Capacity constraints at leading foundries, coupled with the concentration of advanced manufacturing in specific geographic regions, heighten the risk of disruptions. While Alphawave actively manages its foundry relationships, the inherent nature of this outsourcing model means it is susceptible to external factors beyond its direct control. These disruptions can lead to extended lead times, increased manufacturing costs, and potential delays in product launches, impacting revenue and market competitiveness. The ongoing geopolitical landscape, particularly concerning East Asia, adds another layer of complexity to these manufacturing dependencies.

Specific threats to Alphawave Semi's supply chain include:

- Foundry Capacity Constraints: Continued high demand for advanced semiconductor manufacturing nodes in 2024 and 2025 means foundries like TSMC and Samsung may operate at or near full capacity, potentially limiting Alphawave's access to production slots.

- Geopolitical Instability: Tensions in regions where key foundries are located could lead to trade restrictions, export controls, or even physical disruptions, directly impacting manufacturing operations.

- Natural Disasters: Earthquakes, typhoons, or other natural events in manufacturing hubs can cause temporary or prolonged shutdowns of foundry facilities, delaying production for all customers.

- Logistical Bottlenecks: Even if manufacturing is unaffected, global shipping and logistics challenges can still impede the timely delivery of finished goods from foundries to Alphawave's customers.

Alphawave Semi faces significant threats from rapid technological evolution and intense competition. The semiconductor industry's fast innovation cycle demands continuous, substantial R&D investment to prevent product obsolescence. Competitors are also heavily investing in next-generation technologies, creating pressure to match their pace and potentially impacting market share and revenue if Alphawave falls behind.

Geopolitical tensions and global economic uncertainties pose considerable risks. Trade tariffs and potential recessions can disrupt supply chains, increase costs, and curb demand from key customers like hyperscalers. For instance, the IMF projected global growth around 3.2% in 2024, signaling a cautious economic environment that could temper tech investment and impact Alphawave's revenue growth.

The company's reliance on third-party foundries, such as TSMC, for manufacturing introduces vulnerability. Foundry capacity constraints and geopolitical instability in manufacturing regions can lead to extended lead times and increased costs. For example, high demand for advanced nodes in 2024-2025 means foundries may operate at full capacity, potentially limiting Alphawave's production access.

SWOT Analysis Data Sources

This ALPHAWAVE SEMI SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to provide accurate and actionable strategic insights.