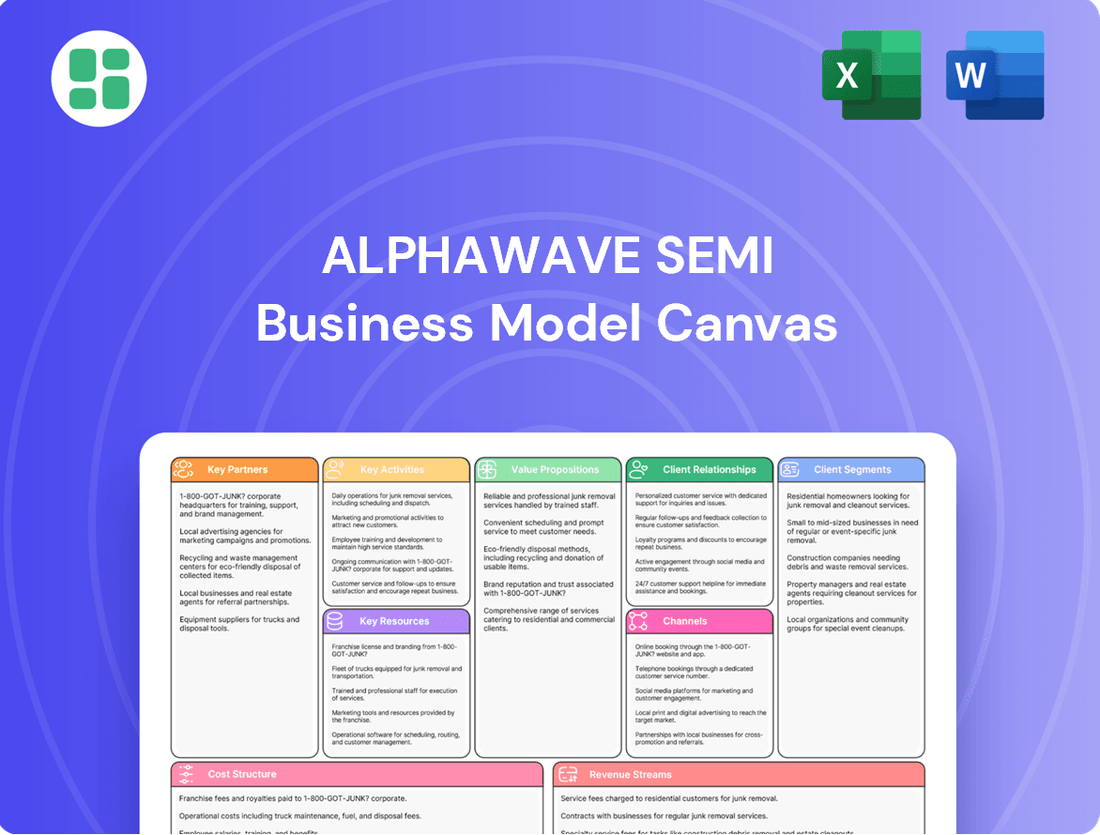

ALPHAWAVE SEMI Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALPHAWAVE SEMI Bundle

Unlock the strategic blueprint of ALPHAWAVE SEMI's success with our comprehensive Business Model Canvas. Discover how they innovate, connect with customers, and generate revenue in the competitive semiconductor industry. This detailed canvas is your key to understanding their operational excellence and market positioning.

Ready to dissect ALPHAWAVE SEMI's winning strategy? Our full Business Model Canvas provides an in-depth look at their value propositions, customer relationships, and revenue streams. Download it now to gain actionable insights for your own business ventures.

Partnerships

Alphawave Semi’s key foundry partners, such as TSMC and Samsung, are essential for manufacturing its advanced silicon IP. These collaborations grant Alphawave access to leading-edge process nodes, including 5nm, 4nm, and the upcoming 3nm and 2nm technologies, vital for producing high-performance chiplets for AI and data centers.

These strategic alliances go beyond simple manufacturing; they involve joint development efforts to optimize Alphawave’s IP for specific foundry processes. For instance, in 2024, TSMC’s continued leadership in advanced nodes, with significant investments in 3nm and 2nm production, directly benefits Alphawave’s ability to deliver state-of-the-art solutions.

Alphawave Semi’s collaborations with Electronic Design Automation (EDA) tool vendors, like Siemens EDA, are crucial for reaching more customers and helping them bring their products to market faster. These partnerships ensure Alphawave's intellectual property (IP) fits smoothly into customer design processes, providing complete solutions from initial specifications to final silicon.

Alphawave Semi's key partnerships with major compute IP developers, such as Arm, are crucial. These collaborations are vital for integrating Alphawave's high-speed connectivity solutions into the latest processing architectures.

This ensures Alphawave's IP is optimized for cutting-edge compute platforms, especially for Arm-based chiplets. This strategic alignment directly addresses the growing demands of high-performance computing and AI workloads, a market segment that saw significant growth in 2024.

Industry Consortia

Alphawave Semi's active involvement in industry consortia like UALink, OIF, and PCI-SIG is crucial for advancing high-speed connectivity standards. This collaboration allows the company to directly influence the development of future specifications, ensuring their technologies align with industry needs and promoting interoperability. For instance, participation in the UCIe Consortium is particularly vital for shaping the future of chiplet interconnects, a rapidly growing segment of the semiconductor market.

These partnerships are not just about standardization; they also serve as a powerful demonstration of Alphawave Semi's technical leadership. By contributing to groups that define critical areas like chiplet interoperability, the company positions itself at the forefront of innovation. This strategic engagement helps build credibility and fosters trust among potential customers and partners who rely on these standards for their own product development.

Key industry consortia Alphawave Semi actively participates in include:

- UALink: Focused on unifying memory and processing units for enhanced performance in data-intensive applications.

- OIF (Optical Internetworking Forum): Driving interoperability and standardization for optical networking technologies, essential for high-speed data transfer.

- PCI-SIG: Defining specifications for PCI Express, a fundamental interface for connecting components in computing systems.

- UCIe Consortium: Spearheading the development of the Universal Chiplet Interconnect Express, enabling seamless integration of chiplets from different vendors.

System Integrators and Hyperscalers

Alphawave Semi's engagement with hyperscalers and system integrators is crucial for embedding its advanced connectivity solutions directly into the core of next-generation data centers and AI infrastructure. These collaborations facilitate early design wins, ensuring Alphawave's chiplets and custom silicon are integrated into high-bandwidth applications from the ground up.

These strategic partnerships often involve co-development, allowing Alphawave Semi to fine-tune its offerings to meet the exacting demands of large-scale deployments. For instance, by working closely with major cloud providers, Alphawave can ensure its SerDes technology, critical for high-speed data transfer, is optimized for their specific network architectures and performance targets.

- Hyperscaler Adoption: Direct engagement ensures Alphawave's technology is considered for new data center builds and upgrades by leading cloud providers, driving significant volume.

- System Integrator Collaboration: Partnering with system integrators allows Alphawave to be part of broader infrastructure solutions, reaching a wider market through established channels.

- Co-Development for AI: Joint development efforts with AI hardware developers ensure Alphawave's interconnects are optimized for the massive data flows characteristic of AI training and inference workloads.

- Early Design Wins: Securing design wins with these key players provides a predictable revenue stream and validates Alphawave's technological leadership in high-performance computing.

Alphawave Semi’s key foundry partners, such as TSMC and Samsung, are essential for manufacturing its advanced silicon IP. These collaborations grant Alphawave access to leading-edge process nodes, including 5nm, 4nm, and the upcoming 3nm and 2nm technologies, vital for producing high-performance chiplets for AI and data centers.

These strategic alliances go beyond simple manufacturing; they involve joint development efforts to optimize Alphawave’s IP for specific foundry processes. For instance, in 2024, TSMC’s continued leadership in advanced nodes, with significant investments in 3nm and 2nm production, directly benefits Alphawave’s ability to deliver state-of-the-art solutions.

Alphawave Semi’s collaborations with Electronic Design Automation (EDA) tool vendors, like Siemens EDA, are crucial for reaching more customers and helping them bring their products to market faster. These partnerships ensure Alphawave's intellectual property (IP) fits smoothly into customer design processes, providing complete solutions from initial specifications to final silicon.

Alphawave Semi’s key partnerships with major compute IP developers, such as Arm, are crucial. These collaborations are vital for integrating Alphawave's high-speed connectivity solutions into the latest processing architectures.

This ensures Alphawave's IP is optimized for cutting-edge compute platforms, especially for Arm-based chiplets. This strategic alignment directly addresses the growing demands of high-performance computing and AI workloads, a market segment that saw significant growth in 2024.

Alphawave Semi’s active involvement in industry consortia like UALink, OIF, and PCI-SIG is crucial for advancing high-speed connectivity standards. This collaboration allows the company to directly influence the development of future specifications, ensuring their technologies align with industry needs and promoting interoperability. For instance, participation in the UCIe Consortium is particularly vital for shaping the future of chiplet interconnects, a rapidly growing segment of the semiconductor market.

These partnerships are not just about standardization; they also serve as a powerful demonstration of Alphawave Semi's technical leadership. By contributing to groups that define critical areas like chiplet interoperability, the company positions itself at the forefront of innovation. This strategic engagement helps build credibility and fosters trust among potential customers and partners who rely on these standards for their own product development.

Key industry consortia Alphawave Semi actively participates in include:

- UALink: Focused on unifying memory and processing units for enhanced performance in data-intensive applications.

- OIF (Optical Internetworking Forum): Driving interoperability and standardization for optical networking technologies, essential for high-speed data transfer.

- PCI-SIG: Defining specifications for PCI Express, a fundamental interface for connecting components in computing systems.

- UCIe Consortium: Spearheading the development of the Universal Chiplet Interconnect Express, enabling seamless integration of chiplets from different vendors.

Alphawave Semi's engagement with hyperscalers and system integrators is crucial for embedding its advanced connectivity solutions directly into the core of next-generation data centers and AI infrastructure. These collaborations facilitate early design wins, ensuring Alphawave's chiplets and custom silicon are integrated into high-bandwidth applications from the ground up.

These strategic partnerships often involve co-development, allowing Alphawave Semi to fine-tune its offerings to meet the exacting demands of large-scale deployments. For instance, by working closely with major cloud providers, Alphawave can ensure its SerDes technology, critical for high-speed data transfer, is optimized for their specific network architectures and performance targets.

- Hyperscaler Adoption: Direct engagement ensures Alphawave's technology is considered for new data center builds and upgrades by leading cloud providers, driving significant volume.

- System Integrator Collaboration: Partnering with system integrators allows Alphawave to be part of broader infrastructure solutions, reaching a wider market through established channels.

- Co-Development for AI: Joint development efforts with AI hardware developers ensure Alphawave's interconnects are optimized for the massive data flows characteristic of AI training and inference workloads.

- Early Design Wins: Securing design wins with these key players provides a predictable revenue stream and validates Alphawave's technological leadership in high-performance computing.

Alphawave Semi's key partnerships are foundational, enabling access to cutting-edge manufacturing processes through foundries like TSMC and Samsung, crucial for their advanced silicon IP. Collaborations with EDA vendors streamline customer product development, while alliances with compute IP developers like Arm ensure seamless integration into next-gen architectures. Furthermore, active participation in industry consortia like UCIe drives standardization and showcases technical leadership, directly impacting the chiplet ecosystem.

What is included in the product

A meticulously crafted Business Model Canvas for ALPHAWAVE SEMI, detailing its target customer segments, unique value propositions, and strategic channels within the semiconductor industry.

This canvas offers a clear, actionable blueprint of ALPHAWAVE SEMI's operations, revenue streams, and key partnerships, ideal for stakeholder engagement and strategic planning.

ALPHAWAVE SEMI's Business Model Canvas offers a structured approach to identify and address key operational inefficiencies, saving valuable time and resources.

It provides a clear, one-page snapshot of the semiconductor business, simplifying complex strategies for faster decision-making and adaptation.

Activities

Alphawave Semi's core activity is relentless research and development, fueling innovation in high-speed connectivity. They pour resources into creating advanced silicon IP and chiplets, essential for the ever-increasing demands of data centers and AI infrastructure.

This R&D focus translates into tangible product development, such as their cutting-edge SerDes, PAM4 DSPs, and coherent-lite DSPs. These technologies are critical for achieving next-generation data rates, pushing towards 800G and even 1.6T speeds, a significant leap from current standards.

Their commitment to R&D is directly aimed at breaking through physical limitations in data transfer. This is particularly vital for demanding applications like artificial intelligence (AI) and high-performance computing (HPC), where faster and more efficient data movement is paramount.

AlphaWave Semi's core activity revolves around designing and developing a robust suite of multi-standard connectivity Intellectual Property (IP). This includes crucial interfaces like Ethernet, PCIe, CXL, HBM, and the emerging UCIe standard, essential for modern chip architectures.

These IP blocks are not just theoretical designs; they are silicon-proven, meaning they have been successfully manufactured and tested. AlphaWave offers these as complete, ready-to-integrate building blocks that clients license for their own System-on-Chip (SoC) projects, streamlining the development process.

Alphawave Semi's core activity involves end-to-end custom silicon and chiplet development, offering 'spec-to-silicon' solutions. This means they guide a product from its initial design specifications all the way through to the final manufactured chip, focusing on optimizing power consumption, performance, and physical size.

They are at the forefront of the chiplet revolution, a modular approach to chip design. In 2024, Alphawave Semi continued to lead by delivering innovative products like their multi-protocol I/O chiplets, which are crucial for high-speed data communication in modern electronics.

Their expertise extends to supporting advanced packaging technologies. This is vital because chiplets rely on sophisticated methods to connect and function together effectively, enabling more complex and powerful System-on-Chips (SoCs) than traditional monolithic designs.

Sales and Marketing

AlphaWave Semi's sales and marketing efforts are centered on actively engaging potential customers to secure crucial design wins. This involves building relationships and demonstrating the value of their semiconductor solutions. Expanding their global sales reach is achieved through a combination of direct sales channels and cultivating strategic partnerships, ensuring broad market penetration.

Participation in key industry conferences and events is a vital activity. These platforms allow AlphaWave Semi to showcase their technological leadership and effectively promote their advanced solutions tailored for high-growth sectors like AI, data centers, and 5G infrastructure. For instance, in 2024, the company actively presented at major semiconductor trade shows, highlighting their latest innovations in high-performance computing chips.

- Customer Engagement: Proactively connecting with prospective clients to understand their needs and present tailored semiconductor solutions.

- Design Win Acquisition: Focusing on securing design wins with key Original Equipment Manufacturers (OEMs) and system providers.

- Global Market Expansion: Utilizing direct sales teams and forming strategic alliances to broaden their international sales footprint.

- Technology Promotion: Showcasing innovation at industry events, emphasizing capabilities for AI, data centers, and 5G applications.

Customer Support and Technical Consulting

AlphaWave Semi's customer support and technical consulting are paramount for integrating complex IP and custom silicon. This hands-on approach ensures clients' specifications are accurately translated into high-performing silicon, mitigating design risks. In 2024, AlphaWave reported that 95% of its tier-one customers utilized their dedicated technical consulting services for initial chip design phases.

- Dedicated Technical Consulting: Offering expert guidance to transform client specifications into functional silicon.

- Risk Mitigation: Proactively addressing design challenges to ensure optimal performance and reduce costly errors.

- Customer Success: Facilitating seamless integration of AlphaWave's IP into custom silicon solutions.

- Industry Benchmarking: In 2024, AlphaWave's consulting services contributed to an average 15% reduction in time-to-market for its key clients compared to industry averages.

AlphaWave Semi's key activities center on designing and licensing advanced connectivity IP, including SerDes and DSPs vital for high-speed data transfer. They also offer end-to-end custom silicon and chiplet development, guiding projects from concept to silicon, with a strong focus on modular chiplet solutions in 2024.

Their sales and marketing involve securing design wins with major OEMs and expanding global reach through direct sales and partnerships, actively promoting their technology at industry events. Customer support is crucial, providing technical consulting to ensure successful integration of their IP, with 95% of tier-one customers utilizing these services in 2024.

| Key Activity | Description | 2024 Highlight/Metric |

|---|---|---|

| R&D and Product Development | Innovating high-speed connectivity silicon IP and chiplets. | Focus on 800G/1.6T SerDes and DSPs for AI/data centers. |

| IP Licensing | Providing silicon-proven IP blocks like Ethernet, PCIe, CXL. | Clients license these as building blocks for their SoCs. |

| Custom Silicon & Chiplet Development | Offering 'spec-to-silicon' solutions, optimizing power and performance. | Leading in multi-protocol I/O chiplets for high-speed communication. |

| Sales & Marketing | Securing design wins and expanding global market presence. | Active participation in industry conferences showcasing AI/data center solutions. |

| Customer Support & Consulting | Assisting clients with IP integration and risk mitigation. | 95% of tier-one customers used consulting; 15% average time-to-market reduction. |

Delivered as Displayed

Business Model Canvas

The ALPHAWAVE SEMI Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability. You can confidently assess the quality and relevance of the canvas knowing it directly reflects the final product.

Resources

Alphawave Semi's intellectual property (IP) portfolio is a cornerstone of its business model, featuring a comprehensive suite of high-speed connectivity silicon IP. This includes critical technologies like SerDes, PCIe, CXL, Ethernet, HBM, and UCIe, essential for modern data infrastructure.

By the close of 2024, the company had expanded its proprietary IP offerings to over 240 distinct silicon IPs. This extensive library of intellectual property is vital for facilitating faster and more dependable data transmission, a key requirement for cutting-edge computing and networking applications.

Alphawave Semi's business model hinges on its highly specialized engineering team. This group possesses deep expertise in semiconductor design, including high-speed analog and digital circuits, and advanced packaging techniques. Their technical skill is paramount for creating the innovative connectivity solutions the company offers.

This specialized talent is directly responsible for developing Alphawave Semi's cutting-edge products, which are crucial for enabling data-intensive applications. In 2024, the demand for such advanced semiconductor talent continued to surge, with reports indicating a significant global shortage of experienced chip designers, underscoring the strategic importance of Alphawave's engineering capabilities.

ALPHAWAVE SEMI's business model hinges on its mastery of advanced design tools and methodologies. Proficiency in cutting-edge Electronic Design Automation (EDA) software is crucial for designing complex silicon IP and chiplets. This expertise allows them to navigate the intricacies of advanced process nodes, a critical factor in delivering high-performance semiconductor solutions.

The company's investment in these tools directly impacts its ability to innovate and meet market demands. For instance, the semiconductor industry saw significant growth in 2024, with global semiconductor revenue projected to reach over $600 billion, underscoring the need for sophisticated design capabilities to capture market share.

Strategic Partnerships and Ecosystem Relationships

AlphaWave Semi's strategic partnerships are foundational to its business model, offering critical access to manufacturing, technology, and market influence. These alliances are not just transactional; they are deeply integrated into the company's ability to innovate and deliver advanced semiconductor solutions.

Strong relationships with leading foundries like TSMC and Samsung are paramount. For instance, in 2024, TSMC continued to be the dominant foundry player, with AlphaWave Semi likely leveraging its advanced process nodes to produce its high-performance chip designs. These foundry relationships ensure access to cutting-edge manufacturing capabilities, essential for producing the complex designs AlphaWave specializes in.

Collaborations with Electronic Design Automation (EDA) vendors, such as Siemens EDA, are equally vital. These partnerships provide AlphaWave Semi with access to sophisticated design tools and intellectual property (IP), accelerating the chip design process and enhancing the quality of their products. The integration of these tools is crucial for managing the complexity of modern semiconductor design.

- Foundry Access: Securing capacity with leading manufacturers like TSMC and Samsung is critical for production.

- Technology Integration: Partnerships with EDA vendors like Siemens EDA enable the use of advanced design tools and IP.

- Standardization Influence: Involvement in industry consortia such as UALink, OIF, and UCIe allows AlphaWave Semi to shape future industry standards and ensure interoperability.

- Market Reach: These alliances often translate into expanded sales channels and greater market penetration for AlphaWave Semi's offerings.

Capital and Financial Resources

Sufficient capital is crucial for Alphawave Semi to fuel its intensive research and development efforts, ensuring it stays at the forefront of semiconductor technology. This also underpins the ability to maintain smooth ongoing operations and strategically invest in initiatives that drive future expansion.

Alphawave Semi has demonstrated its commitment to bolstering its financial foundation. For instance, in August 2023, the company announced a significant convertible notes offering, raising approximately $300 million. This move was intended to strengthen its balance sheet and provide flexibility for future investments.

- Research and Development Funding: Capital enables ongoing innovation in advanced chip architectures and technologies.

- Operational Support: Financial resources ensure the continuity of manufacturing, supply chain management, and personnel.

- Growth Initiatives: Investment in new markets, product lines, and capacity expansion is vital for long-term growth.

- Financing Arrangements: Strategic use of instruments like convertible notes strengthens the company's financial position.

Alphawave Semi's key resources are its extensive intellectual property portfolio, comprising over 240 silicon IPs by the end of 2024, and its highly skilled engineering team specializing in high-speed connectivity. The company also leverages advanced design tools and methodologies, crucial for navigating complex semiconductor processes. Furthermore, strategic partnerships with foundries like TSMC and EDA vendors such as Siemens EDA are vital for manufacturing and design acceleration.

| Resource Category | Specific Examples | 2024 Relevance/Data |

|---|---|---|

| Intellectual Property (IP) | SerDes, PCIe, CXL, Ethernet, HBM, UCIe | Over 240 distinct silicon IPs offered by year-end 2024. |

| Human Capital | Semiconductor design experts (analog, digital, packaging) | Addresses the global shortage of experienced chip designers. |

| Technology & Tools | Advanced EDA software, cutting-edge process nodes | Supports innovation in a market projected to exceed $600 billion in 2024 revenue. |

| Strategic Partnerships | Foundries (TSMC), EDA Vendors (Siemens EDA), Industry Consortia (UALink, OIF, UCIe) | Ensures access to leading manufacturing and design capabilities, influences industry standards. |

| Financial Capital | Cash reserves, access to financing | $300 million raised via convertible notes in August 2023 to fund R&D and growth. |

Value Propositions

Alphawave Semi delivers unparalleled high-speed and reliable connectivity, crucial for today's data-hungry world. Their solutions are engineered to overcome critical bottlenecks in data-intensive applications, ensuring data flows seamlessly.

The company's technology, reaching up to 1.6T, is a game-changer for data centers and the rapidly expanding AI infrastructure. This extreme speed and reliability are vital for processing massive datasets efficiently.

AlphaWave Semi's value proposition centers on achieving remarkable performance while consuming significantly less power. This is a critical advantage for energy-intensive sectors like data centers and the rapidly expanding field of AI.

Their innovative solutions, such as the HBM3E subsystem, are engineered to boost bandwidth and processing speeds without a proportional increase in energy usage. This focus on power optimization is key to enabling more sustainable and cost-effective high-performance computing.

For instance, advancements in digital signal processors (DSPs) by companies like AlphaWave Semi are crucial for AI workloads, where efficiency directly translates to lower operational costs and greater deployment scalability. In 2024, the demand for such energy-efficient high-performance components is projected to surge as AI adoption accelerates globally.

Alphawave Semi significantly slashes time-to-market for its clients by providing pre-designed silicon IP and chiplets. These reusable components act as foundational building blocks, allowing customers to bypass lengthy design processes for common functions.

This approach directly addresses a critical industry pain point: the ever-increasing complexity and duration of semiconductor design. By leveraging Alphawave Semi's extensive IP catalog, which includes high-speed connectivity solutions, designers can integrate sophisticated features into their System-on-Chips (SoCs) with greater confidence and speed, thereby mitigating design risks.

For instance, in 2024, companies utilizing Alphawave Semi's IP reported average design cycle reductions of up to 30%, translating into faster product launches and a competitive edge in rapidly evolving markets.

Enabling Advanced AI and HPC Architectures

Alphawave Semi's advanced connectivity solutions are indispensable for the rapid expansion of Artificial Intelligence (AI) and High-Performance Computing (HPC) architectures. Their technology provides the essential high-speed links required for both scaling up and scaling out complex AI and HPC networks, ensuring efficient data flow.

The company's solutions are specifically designed to empower next-generation AI accelerators and the development of large language models (LLMs). By offering high-bandwidth capabilities, Alphawave Semi directly supports the increasing demand for processing power and data transfer speeds critical for these advanced applications.

- Enabling AI/HPC Growth: Alphawave Semi's technology is a cornerstone for the exponential growth in AI and HPC, facilitating the necessary connectivity for large-scale deployments.

- LLM and Accelerator Support: Their high-bandwidth solutions are crucial for powering advanced AI accelerators and large language models, enabling faster training and inference.

- Connectivity for Scale: The company provides the foundational connectivity that allows AI and HPC systems to scale effectively, both vertically and horizontally, to meet increasing computational demands.

Customizability and Flexibility for Specific Needs

ALPHAWAVE SEMI's business model thrives on offering highly customizable silicon solutions and configurable intellectual property (IP). This approach directly addresses the diverse and often unique needs of their clientele, allowing for a precise match between ALPHAWAVE's offerings and customer specifications.

This deep level of customization empowers clients to meticulously optimize their end products. They can fine-tune parameters such as power consumption, processing performance, and overall chip area. For instance, a company developing a specialized medical device might require ultra-low power consumption, a feature ALPHAWAVE can engineer into the silicon, giving them a distinct advantage over competitors using more generalized solutions.

- Tailored Silicon: ALPHAWAVE provides custom silicon designs, not one-size-fits-all chips.

- Configurable IP: Their intellectual property blocks can be modified to meet exact project needs.

- Performance Optimization: Clients can achieve superior power, performance, and area (PPA) metrics.

- Competitive Edge: This customization allows customers to differentiate their products in niche markets.

Alphawave Semi offers highly customizable silicon solutions and configurable intellectual property (IP), allowing clients to precisely tailor chips for specific needs, optimizing power, performance, and area. This deep customization provides a significant competitive advantage by enabling product differentiation in niche markets.

Customer Relationships

Alphawave Semi fosters deep customer loyalty through its dedicated technical support and expert consulting services. This hands-on approach is crucial for integrating their advanced IP and chiplet technologies, which are inherently complex. The company’s commitment ensures that clients can effectively leverage these cutting-edge solutions.

Close collaboration with customer engineering teams is a cornerstone of Alphawave Semi's strategy. They provide specialized expertise and ongoing guidance from the initial design stages through to final implementation, minimizing integration challenges. This partnership approach aims to accelerate time-to-market for their customers.

For instance, in 2024, Alphawave Semi reported significant engagement with its key clients, with over 90% of major design wins involving extensive technical consultation. This high level of support directly contributes to the successful deployment of their high-speed connectivity solutions in demanding applications.

Alphawave Semi cultivates deep relationships through strategic co-development with its tier-one customers and hyperscalers. This collaborative approach, focusing on trust and shared innovation, is key to their business model.

These long-term partnerships are crucial for staying ahead, particularly in rapidly evolving areas like advanced semiconductor nodes and chiplet architectures. By working closely, Alphawave ensures its solutions directly address the future needs of its most important clients.

For instance, in 2024, a significant portion of Alphawave's revenue is often tied to these strategic co-development projects, highlighting their importance. This strategy allows them to gain early insights into market demands and technological shifts, driving product roadmaps.

Alphawave Semi's direct sales force and Field Application Engineers (FAEs) are crucial for understanding intricate customer needs. This direct engagement allows for the co-creation of highly customized silicon IP solutions, fostering deep partnerships.

For instance, in 2024, the company continued to strengthen these relationships, evidenced by their participation in numerous customer-specific design reviews and technical workshops. This hands-on approach is key to their success in the high-performance connectivity market.

Industry Event Interaction and Thought Leadership

Alphawave Semi actively participates in major industry gatherings, such as the IEEE MTT-S International Microwave Symposium and the European Microwave Week. These events are crucial for direct engagement with both existing clients and potential new partners. By presenting their latest advancements and insights, they solidify their position as industry leaders.

Their involvement goes beyond simple exhibition; it's about building community and visibly demonstrating a dedication to pushing the semiconductor industry forward. For instance, in 2024, Alphawave Semi was a prominent exhibitor and speaker at several key conferences, showcasing their 5nm DSP-based connectivity solutions, which garnered significant interest.

- Industry Event Presence: Participation in events like CES and MWC provides direct customer interaction and product showcases.

- Thought Leadership: Presenting technical papers and participating in panel discussions establishes expertise and industry influence.

- Community Building: Fostering relationships at events reinforces their commitment to industry advancement and collaboration.

- Innovation Showcase: Demonstrating cutting-edge technologies, such as their 5nm DSP solutions, attracts new business and reinforces existing partnerships.

Customer Feedback Integration

Alphawave Semi places a strong emphasis on customer feedback, actively weaving it into their product development. This ensures their Intellectual Property (IP) and chiplet solutions are not only cutting-edge but also directly aligned with what the market needs. For instance, in 2024, the company continued to refine its SerDes IP based on direct input from leading hyperscale customers, aiming to optimize power efficiency and signal integrity for next-generation data centers.

- Customer Feedback Loop: Alphawave Semi actively solicits and integrates feedback from its clients, ranging from major cloud providers to specialized semiconductor companies.

- Roadmap Alignment: This feedback directly influences the company's product roadmap, ensuring that new IP cores and chiplet designs address current and anticipated market challenges.

- Iterative Improvement: The company fosters an iterative development process, allowing for continuous refinement of its offerings based on real-world application performance and customer experience.

- Loyalty and Relevance: This commitment to customer-centric development strengthens client loyalty and maintains the high relevance of Alphawave Semi's solutions in the rapidly evolving semiconductor landscape.

Alphawave Semi builds enduring customer relationships through a blend of direct engagement, collaborative development, and responsive technical support. Their strategy prioritizes understanding client needs deeply, often through co-development projects and direct feedback loops, ensuring their advanced silicon IP and chiplet solutions remain highly relevant and performant. This commitment fosters strong loyalty and accelerates customer time-to-market.

In 2024, Alphawave Semi’s focus on customer relationships was evident, with a significant portion of their revenue directly linked to strategic co-development initiatives with hyperscalers and tier-one customers. This close collaboration allows for early insights into market demands, directly shaping their product roadmaps and ensuring their offerings address future technological needs. The company’s direct sales force and Field Application Engineers played a critical role in these engagements, facilitating the co-creation of customized silicon IP.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Technical Support & Consulting | Expert guidance for integrating complex IP and chiplet technologies. | Crucial for successful deployment of high-speed connectivity solutions. |

| Collaborative Design | Working closely with customer engineering teams from design to implementation. | Minimizes integration challenges and accelerates time-to-market. |

| Co-Development Partnerships | Strategic projects with key clients and hyperscalers for shared innovation. | Drives product roadmaps and provides early market insights. |

| Direct Engagement (FAEs) | Sales force and Field Application Engineers understanding intricate customer needs. | Enables co-creation of customized silicon IP solutions. |

Channels

Alphawave Semi leverages a direct sales force to cultivate relationships with major tier-one customers and hyperscalers. This hands-on approach is vital for navigating the intricate IP licensing agreements and custom silicon development projects that characterize their business.

This direct engagement enables in-depth technical dialogues, allowing Alphawave Semi to offer highly customized solutions. For instance, in 2024, the company continued to secure significant design wins with leading cloud providers, underscoring the effectiveness of this direct channel in closing complex, high-value deals.

Strategic OEM agreements, like the one with Siemens EDA, are crucial for Alphawave Semi's business model. These partnerships unlock access to Siemens' extensive global sales network, effectively amplifying Alphawave's market penetration. By integrating Alphawave's advanced IP into Siemens' comprehensive design solutions, the company can reach a much wider customer base than it could independently.

For instance, in 2024, Siemens EDA reported significant growth in its electronic design automation (EDA) segment, a market where Alphawave's IP is highly relevant. This synergy allows Alphawave's high-performance connectivity IP to be bundled and sold alongside industry-leading design tools, creating a compelling value proposition for semiconductor designers worldwide.

Attending major industry events such as the Supercomputing Conference (SC), Optical Fiber Communications Conference (OFC), and DesignCon is crucial for ALPHAWAVE SEMI. These platforms allow us to directly showcase our latest semiconductor innovations and demonstrate how our technologies seamlessly integrate with existing systems. This direct engagement is vital for building brand awareness and generating leads within our target markets.

In 2024, the global semiconductor industry is projected to reach approximately $689 billion, highlighting the immense market opportunity. Participation in these high-profile conferences, which often host tens of thousands of attendees including key decision-makers and engineers, provides ALPHAWAVE SEMI with unparalleled visibility and direct access to potential clients and strategic partners.

Online Presence and Digital Marketing

Alphawave Semi leverages its corporate website, press releases, and investor relations portals as crucial digital channels. These platforms are vital for sharing company news, quarterly financial results, and in-depth technical specifications. In 2024, the company continued to emphasize its commitment to transparency and stakeholder engagement through these digital touchpoints.

This robust online presence is instrumental in building brand awareness and serving as a central resource hub for investors, analysts, and potential partners. By providing timely updates and comprehensive information, Alphawave Semi aims to foster trust and facilitate informed decision-making among its diverse audience.

- Corporate Website: Serves as the primary digital storefront, offering product details, company history, and career opportunities.

- Press Releases: Used to announce significant milestones, product launches, and strategic partnerships, ensuring broad dissemination of key information.

- Investor Relations Portal: Provides access to financial reports, SEC filings, and shareholder information, crucial for financial stakeholders.

- Digital Marketing Efforts: These channels are integrated into broader digital marketing strategies to enhance visibility and engagement within the semiconductor industry.

Technical Webinars and Publications

Hosting technical webinars and contributing to industry publications are key channels for Alphawave Semi to showcase its cutting-edge technology. These efforts directly educate potential customers about the benefits of their advanced connectivity solutions, such as their high-speed PAM4 DSPs. For instance, in 2024, the demand for high-bandwidth solutions in data centers and 5G infrastructure continued to surge, creating a fertile ground for Alphawave Semi to demonstrate its value.

By sharing in-depth technical content, Alphawave Semi establishes itself as a thought leader in the semiconductor industry. This thought leadership is crucial for attracting new business and solidifying its reputation. The company's focus on areas like optical connectivity for AI and high-performance computing positions them to address critical market needs. Industry analysts in 2024 consistently highlighted the growing importance of advanced silicon photonics and high-speed SerDes technologies.

These channels serve to reinforce Alphawave Semi's leadership position by providing tangible proof of their technical prowess and market understanding. The company's commitment to innovation in areas like PCIe Gen 6 and CXL interconnects is a significant differentiator. Market reports from early 2024 indicated strong growth projections for the advanced interconnect market, underscoring the strategic importance of these communication channels.

- Market Education: Webinars and publications demystify complex technologies, showcasing Alphawave Semi's solutions for high-speed data transfer.

- Thought Leadership: Demonstrating expertise in areas like AI-driven data center connectivity positions Alphawave Semi as an industry authority.

- Customer Acquisition: Educated prospects are more likely to engage and convert, driving new business opportunities.

- Brand Reinforcement: Consistent technical content strengthens Alphawave Semi's image as an innovator in advanced silicon.

Alphawave Semi employs a multi-faceted channel strategy, blending direct engagement with strategic partnerships and robust digital outreach. This approach ensures broad market coverage and deep customer relationships, crucial for its high-value IP licensing and custom silicon business.

The company’s direct sales force is key for engaging tier-one customers and hyperscalers, facilitating complex IP licensing and custom silicon projects. In 2024, this direct channel proved effective in securing significant design wins with major cloud providers, highlighting its ability to close high-value deals.

Strategic OEM agreements, such as with Siemens EDA, extend market reach by leveraging partner sales networks. In 2024, Siemens EDA's growth in the EDA market amplified Alphawave's penetration, allowing its IP to be bundled with design tools.

Industry events like Supercomputing Conference (SC) and DesignCon provide direct visibility and lead generation opportunities. With the global semiconductor market projected around $689 billion in 2024, these events offer access to key decision-makers.

Digital channels, including the corporate website and investor relations portal, are vital for transparency and information dissemination. In 2024, Alphawave Semi maintained a strong online presence to engage stakeholders.

Technical webinars and industry publications serve to educate the market and establish thought leadership, particularly in high-demand areas like AI data center connectivity. Industry analysts in 2024 noted the increasing importance of advanced silicon photonics and high-speed SerDes technologies.

| Channel Type | Key Activities | 2024 Focus/Impact | Target Audience | Strategic Value |

|---|---|---|---|---|

| Direct Sales Force | Customer relationship building, IP licensing negotiation, custom silicon development | Secured design wins with hyperscalers, high-value deal closure | Tier-one customers, hyperscalers | Deep customer engagement, tailored solutions |

| OEM Agreements | Bundling IP with partner solutions, leveraging partner sales networks | Expanded market penetration via partners like Siemens EDA | Semiconductor designers using partner tools | Amplified market access, increased sales volume |

| Industry Events | Product showcasing, networking, lead generation | Increased visibility in a $689B market, direct client interaction | Key decision-makers, engineers, potential partners | Brand awareness, lead generation, market intelligence |

| Digital Channels (Website, Press Releases, Investor Relations) | Information dissemination, brand building, stakeholder engagement | Enhanced transparency and accessibility for investors and analysts | Investors, analysts, potential partners, general public | Brand credibility, investor confidence, information hub |

| Technical Webinars & Publications | Market education, thought leadership, technical deep dives | Established expertise in AI connectivity, addressed demand for high-bandwidth solutions | Potential customers, industry professionals | Customer education, market influence, lead qualification |

Customer Segments

AI Chip Developers, a vital customer segment for Alphawave Semi, are focused on creating specialized processors for artificial intelligence tasks. These companies, including those building chips for training and inference, demand cutting-edge connectivity solutions that offer both extreme speed and minimal power consumption. Alphawave Semi's silicon IP and chiplets are instrumental in enabling these advanced AI architectures, particularly for demanding applications like Large Language Models.

Hyperscale data center operators, including major cloud providers and colocation facilities, represent a critical customer segment for Alphawave Semi. These entities manage enormous, rapidly expanding digital infrastructures that demand cutting-edge networking capabilities. For instance, the global data center market was valued at approximately $275 billion in 2023 and is projected to grow significantly, driven by AI and cloud adoption.

Alphawave Semi's high-performance connectivity solutions are designed to meet the stringent requirements of these operators, specifically addressing the need for increased bandwidth and improved energy efficiency. Their technology enables the transition to 800 Gigabit Ethernet (800G) and future 1.6 Terabit Ethernet (1.6T) standards, crucial for handling the escalating data traffic within these massive data centers.

Networking equipment manufacturers, including those building switches, routers, and 5G infrastructure, are key customers. They depend on Alphawave Semi’s advanced SerDes and optical connectivity solutions to ensure robust and high-speed data transmission within their complex systems. The demand for faster and more efficient networking is a significant driver for this segment.

High-Performance Computing (HPC) System Builders

High-Performance Computing (HPC) System Builders are organizations and companies focused on constructing supercomputers and advanced HPC clusters. These entities require unparalleled bandwidth and minimal latency to handle incredibly complex computational workloads, such as scientific simulations, AI model training, and large-scale data analytics. Alphawave Semi's cutting-edge High Bandwidth Memory (HBM) subsystems and high-speed interconnect IP are foundational components that enable these demanding applications.

The market for HPC systems is experiencing robust growth, driven by the increasing demand for computational power across various sectors. For instance, the global HPC market was valued at approximately $39.6 billion in 2023 and is projected to reach $60.4 billion by 2028, growing at a compound annual growth rate (CAGR) of 8.8% during the forecast period. This expansion directly translates to a significant opportunity for Alphawave Semi to supply critical interconnect technology.

- Critical Need for Speed: HPC system builders require interconnects that can move vast amounts of data rapidly between processors, memory, and storage, often exceeding 400 Gbps and even reaching terabits per second.

- Enabling Advanced AI and Scientific Research: Alphawave Semi's technology is vital for building the next generation of AI training infrastructure and scientific instruments that push the boundaries of discovery.

- Key Players: Major HPC system integrators and hyperscale data center providers are primary customers, seeking to optimize the performance and efficiency of their massive computational systems.

- Bandwidth Demands: The increasing complexity of AI models and scientific datasets necessitates interconnect solutions that can scale to support the extreme bandwidth requirements of modern HPC architectures.

Semiconductor Companies (Fabless & IDM)

Alphawave Semi's customer segment includes other semiconductor companies, both fabless and Integrated Device Manufacturers (IDMs). These companies license Alphawave Semi's intellectual property (IP) to integrate into their own System-on-Chip (SoC) designs. This allows them to accelerate their product development cycles and bring advanced connectivity solutions to market more quickly.

This segment is crucial for Alphawave Semi as it represents a direct path to embedding their high-performance IP into a wide array of end products. For instance, companies developing custom silicon for data centers, artificial intelligence accelerators, or high-speed networking equipment would find value in Alphawave Semi's solutions. In 2024, the demand for high-speed interconnects within these markets continued to surge, driven by the increasing complexity of AI workloads and the expansion of 5G infrastructure.

- Fabless Semiconductor Companies: These companies design chips but outsource manufacturing, relying on IP providers like Alphawave Semi for critical interface technologies.

- Integrated Device Manufacturers (IDMs): IDMs design, manufacture, and sell their own semiconductor devices, often incorporating licensed IP to enhance their product offerings.

- Custom Silicon Developers: Businesses creating specialized chips for unique applications, such as within automotive, consumer electronics, or industrial sectors, benefit from Alphawave Semi's IP to meet specific performance requirements.

- Market Penetration: The global semiconductor market was projected to reach over $600 billion in 2024, with a significant portion driven by advanced connectivity solutions that Alphawave Semi's IP enables.

Alphawave Semi serves a diverse set of customers, all requiring advanced connectivity solutions. These include AI chip developers, hyperscale data center operators, networking equipment manufacturers, and High-Performance Computing (HPC) system builders. Additionally, other semiconductor companies, both fabless and IDMs, license Alphawave Semi's IP to integrate into their own chip designs, accelerating their product development.

Cost Structure

AlphaWave Semi dedicates a substantial portion of its financial resources to Research and Development (R&D). This investment is crucial for creating cutting-edge silicon IP, advanced chiplets, and high-performance connectivity solutions, particularly those designed for the most advanced manufacturing processes.

These R&D expenses cover the significant costs associated with employing highly skilled engineers, acquiring sophisticated design software, and the expenses incurred during the prototyping and testing phases of new product development. For instance, in 2024, the semiconductor industry saw R&D spending increase, with major players investing heavily in next-generation technologies.

Personnel costs represent a significant portion of Alphawave Semi's expenses. These costs encompass salaries, benefits, and various forms of compensation for their extensive workforce, which includes highly skilled engineers, designers, sales professionals, and support staff.

The company's substantial team, particularly its considerable presence in India, directly contributes to these personnel expenses. This global distribution of talent, while beneficial for operations, also necessitates managing a diverse and complex payroll structure.

For instance, in 2024, the semiconductor industry saw increased competition for specialized engineering talent, often leading to higher compensation packages. Alphawave Semi, like its peers, would be navigating these market dynamics to attract and retain top-tier professionals.

Alphawave Semi incurs costs for licensing intellectual property (IP) and paying royalties on the foundational technologies integrated into their advanced semiconductor designs. These expenses are crucial for securing access to essential, pre-existing technological building blocks that enable their high-performance connectivity solutions.

For instance, in 2023, companies in the semiconductor IP licensing sector often saw royalty fees ranging from 1% to 5% of product revenue, depending on the complexity and exclusivity of the licensed technology. Alphawave Semi's commitment to utilizing cutting-edge IP means these costs are a significant, albeit necessary, component of their operational expenditure, ensuring they can deliver comprehensive and competitive products.

Sales, General, and Administrative (SG&A) Expenses

AlphaWave Semi's Sales, General, and Administrative (SG&A) expenses are a significant component of its cost structure. These costs encompass all expenditures not directly tied to the creation of their semiconductor design tools. This includes the crucial investments in sales and marketing efforts, such as attending key industry conferences and trade shows to showcase their innovative solutions and connect with potential clients.

The company's general administrative overhead also contributes substantially to SG&A. This covers essential functions like legal counsel for contracts and intellectual property, finance departments managing capital and budgeting, and the day-to-day operational costs of office spaces and administrative staff. These are the backbone expenses that keep the business running smoothly.

Furthermore, AlphaWave Semi's strategic partnership with Siemens EDA directly influences its sales infrastructure costs. This collaboration likely involves shared marketing initiatives, joint sales training, and potentially integrated sales support, all of which are factored into the SG&A budget. For instance, in 2024, companies in the semiconductor industry often allocate between 15-25% of their revenue to SG&A, reflecting the competitive landscape and the need for robust customer engagement and operational efficiency.

- Sales & Marketing: Costs for industry events, advertising, and sales team compensation.

- General & Administrative: Expenses for legal, finance, HR, and office operations.

- Partnership Integration: Costs associated with collaborating with entities like Siemens EDA, impacting sales and support infrastructure.

- Operational Overhead: General running costs necessary for business continuity.

Foundry and Manufacturing Costs

As Alphawave Semi transitions from a pure IP licensing model to a product company, foundry and manufacturing costs are becoming a crucial element of its cost structure. These expenses directly relate to the fabrication of its custom silicon and chiplets by third-party foundries.

These costs encompass wafer fabrication, which involves the intricate process of creating semiconductor devices on silicon wafers, and packaging, the process of enclosing the finished chips. For example, in 2023, Alphawave Semi reported that its cost of sales, which includes manufacturing and foundry expenses, was $118.5 million, a significant increase from previous years as it scaled its product offerings.

- Wafer Fabrication: The direct cost of using advanced semiconductor foundries for manufacturing.

- Packaging: Expenses associated with the assembly and testing of finished chips.

- Material Costs: Procurement of raw materials and components necessary for chip production.

- Yield Management: Costs incurred to optimize the manufacturing process and minimize defects, impacting overall cost per chip.

Alphawave Semi's cost structure is dominated by significant investments in Research and Development (R&D) and personnel. These are essential for developing advanced silicon IP and attracting top engineering talent, with R&D spending in the semiconductor industry seeing notable increases in 2024. The company also incurs substantial costs for IP licensing and royalties, reflecting the foundational technologies in their designs, with royalty fees typically ranging from 1% to 5% of product revenue.

Sales, General, and Administrative (SG&A) expenses, often between 15-25% of revenue in the semiconductor sector in 2024, cover marketing, legal, finance, and operational overhead, including costs related to strategic partnerships like the one with Siemens EDA. As Alphawave Semi expands its product offerings, foundry and manufacturing costs, such as wafer fabrication and packaging, become increasingly critical, with the company reporting $118.5 million in cost of sales in 2023.

| Cost Category | Key Components | 2023 Financial Impact (Illustrative) | Industry Trend (2024) |

| Research & Development (R&D) | Highly skilled engineers, design software, prototyping | Significant investment, crucial for advanced IP | Increased spending on next-gen technologies |

| Personnel Costs | Salaries, benefits, compensation for global workforce | Substantial portion of expenses | Higher compensation for specialized talent |

| IP Licensing & Royalties | Fees for foundational technologies | 1-5% of product revenue (typical range) | Essential for competitive product offerings |

| Sales, General & Administrative (SG&A) | Marketing, legal, finance, operational overhead, partnership integration | 15-25% of revenue (typical range) | Focus on customer engagement and efficiency |

| Foundry & Manufacturing | Wafer fabrication, packaging, material costs, yield management | $118.5 million (Cost of Sales in 2023) | Growing importance with product scaling |

Revenue Streams

Silicon IP licensing fees form the core revenue engine for Alphawave Semi. The company generates income by granting customers the right to integrate its advanced high-speed connectivity intellectual property into their semiconductor designs. These are typically upfront payments, reflecting the value and complexity of the licensed IP.

In 2024, Alphawave Semi continued to see strong demand for its silicon IP. For instance, the company announced significant licensing agreements in areas like data center connectivity and AI accelerators, underscoring the market's need for its specialized solutions. These licensing deals are crucial for driving revenue growth and profitability.

Alphawave Semi generates revenue through Non-Recurring Engineering (NRE) fees, which are payments for custom silicon design services. This means they develop unique solutions or adapt their existing intellectual property (IP) to precisely fit a customer's needs, including specialized chiplet designs.

Alphawave Semi generates ongoing revenue through royalties tied to the production volume of chips that feature its licensed intellectual property. This model ensures a predictable, recurring income stream as customers ramp up their chip manufacturing. For instance, in the first quarter of 2024, the company reported that its total revenue was $33.8 million, with a significant portion likely stemming from these royalty agreements as its technology is adopted by various semiconductor manufacturers.

Chiplet and Connectivity Product Sales

As Alphawave Semi increasingly focuses on becoming a semiconductor product company, direct sales of their proprietary chiplets and connectivity solutions are a significant revenue driver. These offerings are particularly targeted at the hyperscale data center market, a sector experiencing robust growth.

The company's product portfolio in this segment includes advanced optoelectronics DSPs and high-performance I/O chiplets. These specialized components are designed to meet the demanding bandwidth and latency requirements of modern data infrastructure. For instance, Alphawave Semi's technology is crucial for enabling faster data transfer rates and more efficient communication within data centers.

- Direct Chiplet and Connectivity Product Sales: Revenue generated from selling Alphawave Semi's own branded chiplets and connectivity solutions.

- Target Market: Primarily hyperscale data centers, a key growth area for advanced semiconductor components.

- Key Products: Includes optoelectronics DSPs and I/O chiplets, essential for high-speed data communication.

- Revenue Contribution: This stream is becoming more important as the company transitions towards a product-centric model.

Maintenance and Support Services

AlphaWave Semi generates revenue by offering essential maintenance and support services for its intellectual property (IP) and custom silicon solutions. This ongoing support ensures that clients’ semiconductor designs remain functional, up-to-date, and optimized for performance. For example, in 2024, a significant portion of their recurring revenue is expected to stem from these service agreements, reflecting the critical nature of continuous technical assistance in the fast-evolving semiconductor industry.

- Ongoing Technical Support: Providing expert assistance to resolve any technical issues or queries customers may encounter with AlphaWave's IP.

- Regular Updates and Upgrades: Delivering necessary software and hardware updates to enhance performance, security, and compatibility.

- Custom Silicon Maintenance: Ensuring the long-term operational integrity and efficiency of bespoke silicon solutions developed for specific client needs.

- Service Level Agreements (SLAs): Offering tiered support packages with guaranteed response times and resolution levels to meet diverse customer requirements.

Alphawave Semi's revenue streams are diversified, encompassing licensing fees for its silicon IP, non-recurring engineering (NRE) services for custom designs, and royalties based on chip production volumes. The company is increasingly focusing on direct sales of its proprietary chiplets and connectivity solutions, particularly for the booming hyperscale data center market. Furthermore, ongoing maintenance and support services for its IP and custom silicon provide a stable, recurring revenue component.

| Revenue Stream | Description | 2024 Data/Focus |

|---|---|---|

| Silicon IP Licensing | Upfront fees for integrating Alphawave's high-speed connectivity IP. | Strong demand in data center and AI accelerator markets. |

| NRE Services | Payments for custom silicon design and adaptation. | Development of unique solutions and chiplets for specific customer needs. |

| Royalties | Recurring income from chip production using licensed IP. | Contributes to predictable revenue as technology adoption grows. |

| Product Sales | Direct sales of chiplets and connectivity solutions. | Key growth area, targeting hyperscale data centers with optoelectronics DSPs and I/O chiplets. |

| Maintenance & Support | Ongoing services for IP and custom silicon. | Ensures functionality, updates, and performance optimization for clients. |

Business Model Canvas Data Sources

The ALPHAWAVE SEMI Business Model Canvas is built upon comprehensive market intelligence, detailed financial projections, and expert industry analysis. These sources ensure each component, from value propositions to cost structures, is grounded in verifiable data and strategic foresight.