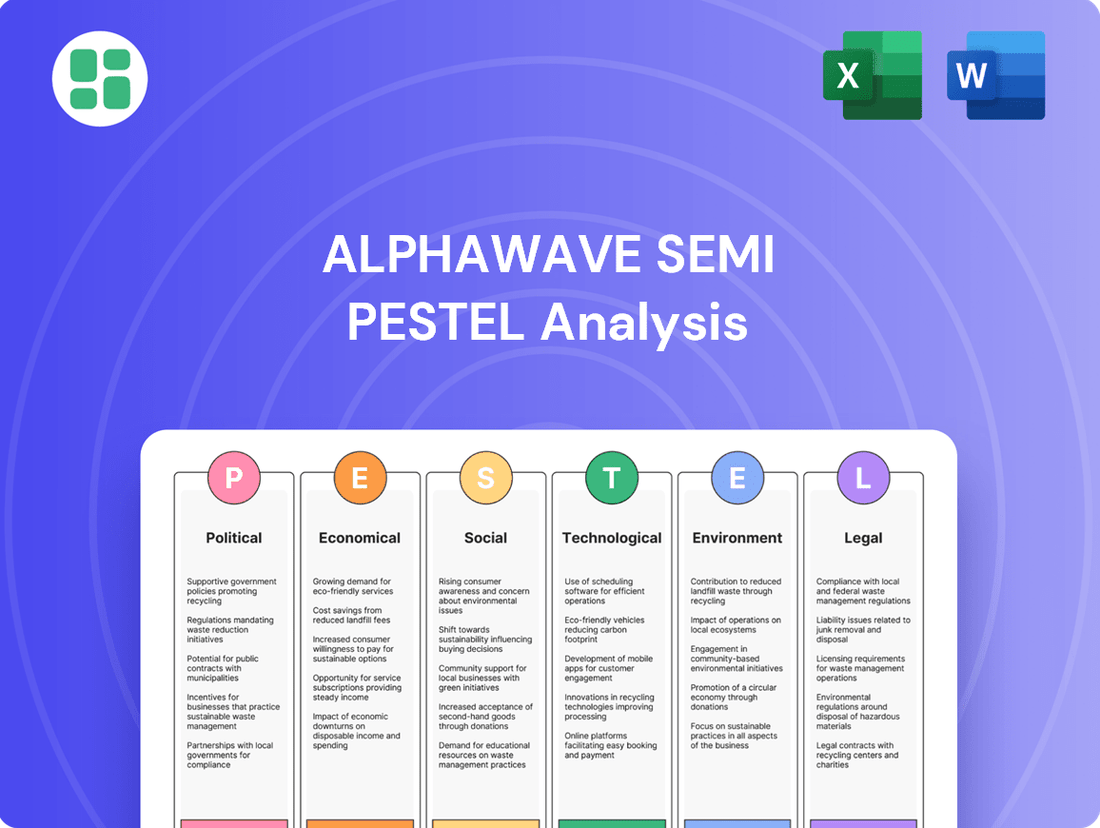

ALPHAWAVE SEMI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALPHAWAVE SEMI Bundle

Unlock the strategic advantage with our comprehensive PESTLE analysis for ALPHAWAVE SEMI. Understand the critical political, economic, social, technological, legal, and environmental factors shaping the semiconductor industry and impacting ALPHAWAVE SEMI's trajectory. Equip yourself with actionable intelligence to navigate market complexities and identify emerging opportunities. Purchase the full PESTLE analysis now for an in-depth understanding that will drive your strategic decisions.

Political factors

Government policies, like the U.S. CHIPS and Science Act, are crucial for Alphawave Semi. This act allocates over $70 billion to bolster the domestic semiconductor industry, offering incentives and grants for manufacturing and research.

These initiatives are designed to fortify national supply chains and decrease dependence on overseas production. Such policies can directly benefit Alphawave Semi, particularly if the company plans to expand its operations or R&D within the United States, tapping into these significant financial commitments aimed at advancing high-technology manufacturing.

Ongoing geopolitical tensions, especially between the U.S. and China, significantly shape the semiconductor landscape. These tensions manifest as tariffs, export controls, and limitations on technology sharing, directly affecting companies like Alphawave Semi. For instance, in 2023, the U.S. continued to implement export controls on advanced semiconductor technology to China, impacting global supply chains and market access for chip manufacturers.

Alphawave Semi, operating at the forefront of high-speed connectivity solutions, must meticulously manage these intricate trade dynamics. The push for 'tech decoupling' by nations like the U.S. aims to lessen dependence on Chinese IT supply chains, creating both challenges and opportunities for global semiconductor players. This strategic shift can influence investment decisions and R&D priorities for companies seeking to maintain resilience and competitive advantage.

Governments worldwide are tightening export controls on cutting-edge semiconductor technology, citing national security imperatives. This trend directly impacts Alphawave Semi by potentially restricting its sales of advanced intellectual property and chiplets to certain nations or clients.

For instance, the proposed National Defense Authorization Act (NDAA) for 2025 signals a heightened focus on scrutinizing supply chains for any links to adversarial countries. Such regulations could force Alphawave Semi to navigate complex compliance requirements, potentially affecting its market access and revenue streams in key regions.

Government Investment in AI and 5G Infrastructure

Governments worldwide are making substantial investments in artificial intelligence (AI) and 5G infrastructure, directly benefiting companies like Alphawave Semi. These initiatives fuel a robust demand for the high-speed connectivity solutions that Alphawave Semi specializes in, as nations push for digital transformation and advanced communication networks. For instance, China alone is projected to invest more than $215 billion in its 5G network infrastructure by 2025, a significant driver for companies providing the underlying technology.

These government-backed programs are crucial for market expansion, especially for Alphawave Semi's silicon IP and chiplet offerings. The focus on next-generation networks and AI capabilities translates into increased opportunities for the company's products, which are essential for enabling these advanced technologies.

- Government AI Investment: Initiatives to boost AI capabilities create demand for high-performance computing and data processing, areas where Alphawave Semi's technology can play a role.

- 5G Rollout Acceleration: Global efforts to deploy 5G networks require advanced semiconductor solutions for faster data transfer and lower latency, directly aligning with Alphawave Semi's product portfolio.

- Infrastructure Spending: Significant public funding for digital infrastructure, such as the estimated over $215 billion for China's 5G by 2025, provides a strong market tailwind.

- Digital Transformation Focus: National strategies prioritizing digital transformation inherently support the adoption of technologies that rely on advanced connectivity and processing power.

Regulatory Stability and Business Environment

Alphawave Semi's operational landscape is significantly shaped by the stability and predictability of regulatory frameworks in its key markets. For instance, the United States' CHIPS and Science Act of 2022, providing over $52 billion in subsidies for domestic semiconductor manufacturing and research, signals a supportive but evolving regulatory environment. This legislation, while encouraging investment, also introduces compliance considerations that Alphawave Semi must navigate. Understanding how such policies might influence global supply chains or R&D collaborations is paramount for sustained growth.

Changes in regulations, particularly those impacting foreign investment or intellectual property (IP) rights, pose a direct challenge to Alphawave Semi's strategic planning. For example, shifts in trade policies or increased scrutiny on cross-border technology transfers could necessitate adjustments to market entry strategies or partnership agreements. The company needs to continually assess its capacity to absorb potential financial impacts stemming from evolving manufacturing prohibitions or IP disputes, ensuring resilience in its business model.

- Regulatory Stability: The semiconductor industry, critical for national security and economic competitiveness, is subject to increasing governmental attention and potential regulatory shifts globally.

- CHIPS Act Impact: The US CHIPS Act aims to bolster domestic semiconductor production, potentially creating new opportunities but also influencing international competition and supply chain dynamics for companies like Alphawave Semi.

- IP Protection: Robust intellectual property protection is vital for Alphawave Semi's innovation-driven business model; changes in IP laws or enforcement could impact its competitive advantage and licensing revenues.

- Geopolitical Influences: Geopolitical tensions can lead to trade restrictions or export controls impacting the semiconductor sector, requiring Alphawave Semi to maintain flexibility in its operational and market strategies.

Government initiatives like the U.S. CHIPS and Science Act, allocating over $70 billion to boost domestic semiconductor production and R&D, directly benefit Alphawave Semi by fostering a supportive environment for advanced technology. Geopolitical tensions, particularly U.S.-China trade dynamics, lead to export controls and a push for tech decoupling, creating both challenges and opportunities for global semiconductor players like Alphawave Semi, impacting market access and R&D priorities.

Governments worldwide are increasing investments in AI and 5G infrastructure, driving demand for Alphawave Semi's high-speed connectivity solutions, with China alone projecting over $215 billion in 5G infrastructure investment by 2025. Regulatory frameworks are evolving, with legislation like the U.S. CHIPS Act influencing international competition and supply chains, necessitating careful navigation of compliance and potential impacts on market access and revenue streams.

| Government Initiative | Allocation/Investment | Impact on Alphawave Semi |

| U.S. CHIPS and Science Act | $70+ billion | Supports domestic R&D and manufacturing, potential for expanded U.S. operations. |

| China 5G Infrastructure | >$215 billion (by 2025) | Drives demand for high-speed connectivity solutions. |

| Global AI Investment | Significant | Increases demand for high-performance computing and data processing technologies. |

What is included in the product

This comprehensive PESTLE analysis delves into the external macro-environmental forces impacting ALPHAWAVE SEMI, examining Political, Economic, Social, Technological, Environmental, and Legal factors to uncover strategic opportunities and mitigate potential risks.

The ALPHAWAVE SEMI PESTLE Analysis provides a structured framework to identify and mitigate external threats, relieving the pain of unforeseen market disruptions and enabling proactive strategic adjustments.

Economic factors

The global semiconductor market's robust growth directly impacts Alphawave Semi's revenue and expansion. Industry sales reached an impressive $627 billion in 2024, showcasing strong demand across various sectors.

Projections indicate continued upward momentum, with the market expected to reach $697 billion in 2025. This growth is primarily fueled by surging demand for logic and memory chips, particularly within data centers and the rapidly expanding field of artificial intelligence.

This positive market trajectory offers a solid foundation for Alphawave Semi, presenting ample opportunities for business development and increased market penetration.

Inflation and fluctuating interest rates significantly influence Alphawave Semi's business. Rising inflation can increase operational expenses, from raw materials to labor, while higher interest rates make borrowing more costly for the company and its customers undertaking large infrastructure projects that utilize Alphawave's advanced connectivity solutions.

For instance, the US Federal Reserve's aggressive rate hikes throughout 2023 and into early 2024 aimed to curb inflation, which averaged 4.1% in 2023. This environment makes capital investment more expensive, potentially impacting the pace of 5G and data center build-outs that are key drivers for Alphawave's revenue.

However, expectations point towards a more stable economic picture. Projections for inflation in major economies for 2025 suggest a moderation, with many central banks anticipating a return closer to their target rates. This anticipated economic normalization, including potentially moderating interest rates, is expected to foster a more favorable environment for market growth and investment in the semiconductor sector by early 2025.

The cost and resilience of the global semiconductor supply chain are paramount economic factors for Alphawave Semi. Rising raw material costs, such as polysilicon and rare earth elements, directly influence manufacturing expenses. For instance, the average price of silicon wafers saw an increase of approximately 10-15% in late 2023 and early 2024, impacting overall production costs.

Logistics expenses also play a significant role, with shipping rates remaining volatile. Geopolitical tensions and natural disasters pose ongoing risks, potentially disrupting production and extending delivery times, as seen with past port congestion issues. These disruptions can add unforeseen costs and delays to Alphawave Semi's operations.

Semiconductor leaders are prioritizing geographic diversification and enhanced supply chain flexibility to mitigate these risks. This strategic shift aims to reduce reliance on single regions and build more robust, adaptable networks to navigate economic uncertainties and potential disruptions through 2025.

Capital Expenditure and Investment Trends

The semiconductor industry is experiencing a significant upswing in capital expenditure, signaling a robust investment climate. Companies are channeling substantial funds into expanding manufacturing capabilities. This trend directly benefits firms like Alphawave Semi, which provide essential intellectual property and design services for these advanced facilities.

Looking ahead, projections indicate a substantial financial commitment within the sector. Semiconductor companies are expected to invest approximately $185 billion in capital expenditures by 2025. This investment is geared towards increasing manufacturing capacity by a notable 7%.

This surge in capital investment is a direct driver for demand in specialized areas such as advanced chip design and intellectual property (IP) solutions. The need for cutting-edge technology to equip these new and expanded facilities creates a fertile ground for companies offering these critical services.

- Industry Investment: Semiconductor capital expenditures are projected to reach $185 billion in 2025.

- Capacity Expansion: This investment aims to boost manufacturing capacity by 7%.

- Demand Driver: Increased CapEx fuels demand for advanced IP and design services.

Customer Spending in AI and Data Centers

Alphawave Semi's revenue is intrinsically linked to the economic health and investment cycles within the AI and data center sectors. These markets are experiencing robust growth, directly impacting demand for Alphawave Semi's advanced connectivity solutions.

The AI data center market is a significant economic engine, with projections indicating a compound annual growth rate of 28.3% through 2030. By 2025, it's estimated that roughly 33% of all global data center capacity will be allocated to AI-specific workloads.

- AI Data Center Market Growth: Projected at a 28.3% CAGR through 2030.

- AI Workload Dominance: Expected to represent 33% of global data center capacity by 2025.

- Key Customers: Hyperscalers and large enterprises are the primary drivers of this spending.

- Economic Driver: Sustained demand from these entities fuels Alphawave Semi's business prospects.

The global semiconductor market is projected for continued expansion, reaching an estimated $697 billion in 2025, driven by AI and data center demand. Alphawave Semi benefits from this growth, particularly as inflation is expected to moderate in major economies by 2025, potentially leading to more favorable interest rate environments. Supply chain resilience remains a focus, with companies diversifying to mitigate risks, which could stabilize input costs and logistics for Alphawave Semi.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Alphawave Semi |

|---|---|---|---|

| Global Semiconductor Market Size | $627 billion | $697 billion | Direct revenue growth opportunity |

| US Inflation Rate (2023) | 4.1% | Moderating (expected) | Reduced operational cost pressure, potentially lower borrowing costs |

| Semiconductor Capital Expenditure | (Not specified for 2024) | $185 billion | Increased demand for IP and design services |

| AI Data Center Workload Share | (Not specified for 2024) | 33% | Strong demand for advanced connectivity solutions |

Preview Before You Purchase

ALPHAWAVE SEMI PESTLE Analysis

The preview shown here is the exact ALPHAWAVE SEMI PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real snapshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain immediate access to this comprehensive analysis upon completing your purchase.

The content and structure shown in the preview is the same ALPHAWAVE SEMI PESTLE Analysis document you’ll download after payment, providing you with immediate actionable insights.

Sociological factors

Societal dependence on robust digital connectivity is a significant driver for Alphawave Semi. The increasing need for seamless data flow for remote work, immersive entertainment, and smart city initiatives directly translates into greater demand for the high-performance connectivity solutions the company offers.

This pervasive reliance on speed and reliability is pushing the boundaries of semiconductor technology. For instance, the number of connected Internet of Things (IoT) devices is projected to grow by 13% in 2024, reaching an impressive 18.8 billion units by year-end, underscoring the expanding need for advanced networking components.

The availability of specialized talent, particularly in areas like semiconductor design and advanced packaging, is a significant sociological consideration for Alphawave Semi. In 2025, the push for onshoring and reshoring initiatives is expected to exacerbate existing talent shortages, forcing companies to compete more fiercely for local expertise, which could impact new facility timelines.

Societal concerns about data privacy and algorithmic bias directly influence the demand for AI hardware. As AI becomes more integrated into daily life, public scrutiny over its ethical implications, such as fairness and transparency, intensifies. This can lead to increased demand for robust and secure semiconductor solutions that enable responsible AI deployment.

The evolving regulatory landscape, exemplified by the EU AI Act adopted in July 2024, shapes the market for AI components. This legislation categorizes AI applications by risk, potentially creating new opportunities for companies providing foundational technology that meets stringent ethical and safety standards. Alphawave Semi's high-performance connectivity solutions are critical for enabling the complex data processing required by compliant AI systems.

Consumer Privacy Concerns

Growing consumer awareness about data privacy is a significant sociological factor impacting technology companies like Alphawave Semi. As people become more conscious of how their personal information is collected and used, there's a greater demand for secure and transparent data handling practices. This societal shift directly influences the design and implementation of connectivity solutions, pushing for technologies that prioritize privacy and compliance.

The landscape of data privacy is rapidly evolving, with new regulations set to take effect. For instance, several US states are enacting new data privacy laws in 2025, adding complexity for businesses operating across different jurisdictions. The ongoing discussion around a potential federal data privacy law in the United States further underscores the increasing societal emphasis on protecting consumer data.

These evolving consumer privacy concerns translate into tangible market demands:

- Increased demand for privacy-by-design: Consumers expect products and services to be built with privacy as a core feature, not an afterthought.

- Preference for transparent data policies: Companies that clearly communicate their data collection and usage practices are likely to gain consumer trust.

- Potential for market segmentation: Businesses offering demonstrably superior data protection may attract privacy-conscious customer segments.

Digital Transformation Across Industries

The pervasive digital transformation reshaping industries like healthcare, automotive, and finance is a significant societal driver for Alphawave Semi. This shift fuels the creation of new markets and demands for advanced connectivity solutions. For instance, the global digital transformation market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $6.7 trillion by 2030, demonstrating substantial growth potential.

As sectors increasingly rely on sophisticated computing and networking infrastructure, the demand for Alphawave Semi's high-performance connectivity technologies escalates. This trend is evident in the automotive sector's move towards connected and autonomous vehicles, requiring robust data transmission capabilities. The healthcare industry's adoption of telehealth and AI-powered diagnostics also necessitates advanced semiconductor solutions for seamless data flow.

- Growing Demand: The increasing integration of AI and high-performance computing across industries directly translates to a higher need for the advanced silicon solutions Alphawave Semi provides.

- Market Expansion: Digital transformation opens new application areas for Alphawave Semi's technologies, from advanced driver-assistance systems (ADAS) in vehicles to sophisticated data analytics platforms in finance.

- Investment Trends: Venture capital investment in AI and semiconductor technologies saw significant activity in 2024, with billions of dollars allocated to companies developing next-generation chips, indicating strong market confidence.

Societal expectations for seamless, high-speed data access are a primary driver for Alphawave Semi. The increasing reliance on digital infrastructure for work, education, and entertainment directly fuels demand for the company's advanced connectivity solutions. This trend is amplified by the projected 15% growth in global internet traffic during 2024, highlighting the need for more efficient data transfer technologies.

The growing public awareness and concern regarding data privacy and security are shaping the semiconductor market. As individuals become more vigilant about their personal information, there's a rising demand for chips and technologies that inherently support robust privacy features. This societal shift is pushing innovation towards solutions that offer greater transparency and control over data, a critical aspect for Alphawave Semi's future product development.

The talent pool for specialized semiconductor engineering roles presents a key sociological factor. With ongoing efforts to reshore manufacturing and design capabilities, competition for skilled professionals is intensifying. For example, the projected shortage of semiconductor engineers in the US could reach 30,000 by 2025, impacting project timelines and innovation speed for companies like Alphawave Semi.

| Sociological Factor | Impact on Alphawave Semi | Supporting Data (2024/2025) |

|---|---|---|

| Digital Connectivity Demand | Increased demand for high-performance connectivity solutions. | Global internet traffic projected to grow 15% in 2024. |

| Data Privacy Concerns | Need for privacy-by-design in semiconductor solutions. | Growing consumer demand for transparent data policies. |

| Talent Availability | Competition for specialized engineering talent. | Projected US semiconductor engineer shortage of 30,000 by 2025. |

Technological factors

Alphawave Semi's business is deeply rooted in the ongoing evolution of silicon IP and chiplet technology. These advancements are critical for maintaining a competitive edge in the semiconductor industry.

The modular nature of chiplets is a game-changer, offering tangible benefits like enhanced performance, cost efficiencies, and greater design flexibility. This approach is becoming vital as traditional, single-piece chip designs encounter scaling challenges.

The market for chiplets is experiencing substantial growth, with projections indicating it could reach $107 billion by 2033, and some analysts anticipate even higher figures. This robust expansion underscores the increasing adoption and strategic importance of chiplet technology.

The relentless advancement of AI and Machine Learning (ML) architectures, requiring escalating bandwidth and reduced latency, directly fuels the demand for Alphawave Semi's advanced connectivity products. This technological push is critical for supporting the massive data flows inherent in modern AI training and inference.

AI data centers are undergoing a period of intense expansion, with rack power densities surging to accommodate the computational demands of AI workloads. For instance, some AI-optimized servers are already pushing beyond 30kW per rack, necessitating sophisticated thermal management solutions like liquid cooling, which in turn places greater strain on internal and external data center connectivity.

Alphawave Semi's success is intrinsically linked to the advancement of wireless technologies like 5G and its successors. Their semiconductor solutions are essential for enabling the high-speed data transmission that these next-generation networks demand. The global 5G infrastructure market is expected to expand significantly, reaching an estimated USD 131.77 billion by 2034, demonstrating a robust compound annual growth rate of 22.93% between 2025 and 2034.

This substantial market growth is fueled by a growing appetite for faster internet connectivity and the increasing adoption of automation across various industries. As 5G deployment continues and research into 6G and beyond progresses, Alphawave Semi is well-positioned to capitalize on the demand for the advanced connectivity solutions these technologies require.

High-Performance Computing Demands

The insatiable appetite for high-performance computing (HPC) across scientific research, cloud services, and intricate simulations directly fuels demand for Alphawave Semi's cutting-edge connectivity solutions. These applications require the efficient management of colossal data streams, making advanced chip-to-chip communication critical.

This escalating need for HPC power is a significant catalyst for the broader adoption of chiplet architectures and the continuous evolution of data center infrastructure. For instance, the global HPC market was valued at approximately $30 billion in 2023 and is projected to reach over $50 billion by 2028, showcasing robust growth.

- Increased Data Throughput: HPC workloads necessitate connectivity that can handle terabits per second of data, a core competency of Alphawave Semi's offerings.

- Chiplet Integration: The modular nature of chiplets, enabled by advanced interconnects, is becoming standard for building powerful and scalable HPC processors.

- AI and Machine Learning: The rapid expansion of AI and ML, which are heavily reliant on HPC, further amplifies the demand for high-speed data transfer.

- Cloud Computing Growth: Major cloud providers continue to invest heavily in HPC capabilities, driving demand for the underlying connectivity technology.

Miniaturization and Power Efficiency

The relentless drive for miniaturization and enhanced power efficiency in semiconductor technology presents both a significant challenge and a prime opportunity for Alphawave Semi. As data demands soar, their cutting-edge connectivity solutions must facilitate greater chip integration and drastically lower power consumption. For instance, advancements in 3D chip stacking and the exploration of novel materials are critical for overcoming the inherent power density issues in high-performance processors, a space where Alphawave Semi operates.

Alphawave Semi's product roadmap directly addresses this trend. Their high-speed SerDes (Serializer/Deserializer) and interconnect solutions are designed to operate with reduced power budgets, enabling more complex functionalities within smaller form factors. Consider the evolution of data centers; the need for higher bandwidth per watt is paramount, and Alphawave Semi's technology is engineered to meet this demand, contributing to more sustainable and efficient computing infrastructure.

Key technological factors influencing Alphawave Semi include:

- Shrinking Transistor Sizes: Continued advancements in process nodes, like the ongoing development towards 2nm and beyond, allow for more transistors per unit area, driving miniaturization and performance gains.

- Power Management ICs (PMICs): The integration of sophisticated PMICs alongside connectivity solutions is crucial for optimizing power delivery and reducing overall energy consumption in advanced systems.

- Advanced Packaging Techniques: Innovations such as chiplets and advanced substrate materials enable tighter integration of diverse semiconductor functions, directly impacting power efficiency and form factor reduction.

- Material Science Innovations: Research into new semiconductor materials and interconnect technologies aims to overcome physical limitations and improve both performance and energy efficiency.

Technological advancements in AI, 5G, and high-performance computing are the primary drivers for Alphawave Semi's business. The company's silicon IP and chiplet solutions are essential for enabling the increased bandwidth and reduced latency required by these rapidly evolving sectors.

The chiplet market's projected growth to $107 billion by 2033 highlights the industry's shift towards modular design, a core area of Alphawave Semi's expertise. Furthermore, the expansion of AI data centers, with rack power densities exceeding 30kW, necessitates advanced connectivity solutions that Alphawave Semi provides.

| Technology Area | Growth Driver | Alphawave Semi Relevance |

|---|---|---|

| AI & Machine Learning | Increasing data processing demands | High-speed connectivity for AI accelerators |

| 5G and Beyond | Need for faster wireless communication | Semiconductor solutions for high-speed data transmission |

| High-Performance Computing (HPC) | Complex simulations and cloud growth | Advanced chip-to-chip communication for HPC processors |

| Chiplets | Scaling challenges, design flexibility | Enabling modular chip architectures |

Legal factors

Alphawave Semi's competitive edge hinges on safeguarding its vast collection of silicon IP and design patents. Strong intellectual property legislation and efficient enforcement are crucial to deterring infringement and preserving the worth of their groundbreaking technologies. For instance, in 2023, the global semiconductor IP market was valued at approximately $6.5 billion, highlighting the significant economic importance of these assets.

Alphawave Semi's hardware indirectly navigates a complex web of global data privacy and security regulations. These rules, like the EU's GDPR and emerging US state-level privacy laws in 2025, shape data center operations and thus influence demand for compliant infrastructure, including Alphawave's solutions.

The phased implementation of the EU AI Act starting February 2025 further underscores the growing importance of data governance. As clients in sectors like AI and data processing must adhere to these regulations, their hardware procurement decisions, including those for high-speed connectivity solutions, will be increasingly driven by compliance considerations.

Antitrust and competition laws are crucial for Alphawave Semi as a semiconductor industry participant. These regulations are designed to foster a competitive market and prevent any single entity from dominating. For example, the proposed acquisition of Alphawave Semi by Qualcomm, announced in May 2024, has seen its offer period extended multiple times, indicating the scrutiny these large deals face under competition authorities.

Export Control and Trade Compliance

Alphawave Semi must navigate a complex web of international export control and trade compliance laws, particularly concerning advanced semiconductor technology. These regulations are critical because they define the permissible markets and recipients for their products, with non-compliance carrying significant financial and operational risks. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) plays a key role in enforcing these rules.

The geopolitical landscape significantly impacts Alphawave Semi's operations, as semiconductor technology is a focal point of international trade disputes and national security concerns. Adherence to these evolving regulations is paramount to maintain market access and avoid sanctions. The recent Interim Final Rule on AI Technology Diffusion, announced in mid-January 2025, exemplifies this, introducing new controls specifically targeting chip exports to prevent misuse.

- Export Control Laws: Alphawave Semi must comply with regulations like the U.S. Export Administration Regulations (EAR) and similar frameworks in other jurisdictions.

- Geopolitical Sensitivity: The semiconductor industry is subject to heightened scrutiny due to its strategic importance, impacting trade relationships and technology transfer.

- AI Technology Diffusion Rule: The January 2025 rule highlights a growing trend of targeted export controls on advanced technologies, including specific chip types.

- Compliance Risks: Failure to comply can result in substantial fines, loss of export privileges, and reputational damage, potentially impacting Alphawave Semi's global sales, which reached $1.1 billion in 2024.

Industry Standards and Certifications

Compliance with industry-specific standards and certifications is a critical legal and operational requirement for Alphawave Semi. These benchmarks ensure product interoperability, safety, and environmental performance, allowing seamless integration into sophisticated systems and adherence to performance benchmarks. The Universal Chiplet Interconnect Express (UCIe) standard, anticipated for broader adoption in 2025, is a prime example of such a crucial industry standard.

Adherence to these standards is not merely a best practice but a legal necessity, directly impacting market access and product viability. For instance, certifications related to data security and privacy, especially relevant in the semiconductor industry, are increasingly mandated by regulations worldwide. Failure to comply can result in significant fines and reputational damage.

Alphawave Semi's commitment to these standards is demonstrated by its engagement with industry bodies and its focus on developing products that meet emerging specifications. The expected growth of chiplet architectures, driven by standards like UCIe, highlights the importance of staying ahead of regulatory and industry alignment. This proactive approach is vital for maintaining a competitive edge and ensuring long-term business sustainability.

Alphawave Semi operates within a legal framework that mandates strict adherence to intellectual property laws, essential for protecting its valuable silicon IP and design patents. The global semiconductor IP market's significant valuation, estimated at around $6.5 billion in 2023, underscores the economic importance of these protected assets and the necessity of robust legal safeguards.

Navigating data privacy and security regulations, such as the EU's GDPR and emerging US state laws in 2025, directly influences Alphawave Semi's hardware solutions for data centers. Furthermore, the EU AI Act's phased implementation from February 2025 will increasingly tie hardware procurement decisions to compliance with evolving data governance standards.

Antitrust and competition laws are critical, as demonstrated by the extended review period for the proposed Qualcomm acquisition of Alphawave Semi in 2024, highlighting regulatory scrutiny on significant industry consolidation.

Alphawave Semi must also manage complex export control and trade compliance laws, particularly concerning advanced semiconductor technology, with the U.S. Department of Commerce's Bureau of Industry and Security (BIS) being a key enforcer. The January 2025 Interim Final Rule on AI Technology Diffusion exemplifies the increasing trend of targeted export controls on critical chip technologies.

Environmental factors

Data centers, a key market for Alphawave Semi, consume vast amounts of energy, driving a push for greater efficiency. This is particularly critical as AI workloads are projected to double data center power demands by 2027, making energy-efficient connectivity a necessity.

The demand for advanced cooling solutions is escalating. Liquid cooling, for instance, is proving to be approximately 3,000 times more efficient than traditional air cooling methods, a crucial factor for managing the heat generated by AI-intensive operations.

Environmental regulations concerning electronic waste, or e-waste, are increasingly shaping the semiconductor industry. The global push towards a circular economy directly affects companies like Alphawave Semi, requiring a focus on product lifecycle management and end-of-life strategies for their IP and chiplets. This means considering how their technology integrates into devices that will eventually need to be recycled or repurposed.

Legislation such as the WEEE (Waste Electrical and Electronic Equipment) Directive in Europe mandates specific recycling and recovery targets for electronic products. For instance, in 2023, the EU reported that 5.4 million tonnes of e-waste were generated, with a collection rate of 46.7%. Alphawave Semi must ensure its chiplet designs and IP licensing contribute to meeting these growing environmental standards, potentially through enhanced product durability and easier disassembly for recycling.

Alphawave Semi faces growing pressure regarding the environmental footprint of its supply chain, from raw material sourcing to manufacturing. The semiconductor industry's reliance on materials like rare earth minerals necessitates a commitment to ethical and sustainable procurement practices.

In 2024, a significant trend emerged with semiconductor leaders identifying increased geographic diversity as a key strategy to bolster supply chain resilience. This focus on diversification directly addresses environmental risks associated with concentrated sourcing and manufacturing locations.

Climate Change Policies and Emissions

Global and national climate change policies, including ambitious carbon emission targets, are increasingly shaping manufacturing practices. These regulations directly impact Alphawave Semi's manufacturing partners and customers, potentially influencing their operational costs and investment decisions, which in turn can indirectly affect Alphawave Semi's business through supply chain dynamics and demand for their IP. For example, the semiconductor industry is committed to phasing out perfluorooctanoic acid (PFOA), a persistent environmental contaminant, by 2025, necessitating shifts in material sourcing and manufacturing processes across the value chain.

The push for sustainability is evident in various regulatory frameworks. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving stricter environmental standards for all industries, including semiconductor manufacturing. Many nations are setting their own net-zero emission targets, creating a complex regulatory landscape that requires adaptability from companies like Alphawave Semi and their supply chain partners to ensure compliance and maintain competitiveness.

- Global Emissions Targets: Over 130 countries have pledged net-zero emissions by mid-century, influencing global supply chain expectations.

- Semiconductor Industry PFOA Phase-out: The 2025 deadline for PFOA elimination requires significant process adjustments for semiconductor manufacturers.

- Regulatory Scrutiny: Increasing environmental regulations worldwide can lead to higher compliance costs for manufacturing operations.

Water Usage and Pollution Control

Semiconductor fabrication demands significant water resources, often exceeding 10 million gallons per day for a single advanced facility, and involves the use of potentially hazardous chemicals. Strict regulations govern water usage and the discharge of pollutants to protect ecosystems and public health. For instance, the Environmental Protection Agency (EPA) sets standards for wastewater discharge under the Clean Water Act.

A notable development in October 2024 saw the signing of a new law impacting these environmental reviews. This legislation exempts semiconductor manufacturing plants receiving funding through the CHIPS and Science Act from certain federal environmental impact assessments. This exemption has sparked debate and raised concerns among environmental groups regarding the potential for diminished oversight on water quality and pollution control measures.

The implications for companies like Alphawave Semi are substantial, as compliance with evolving environmental standards and potential future regulatory changes will be crucial. The CHIPS Act aims to boost domestic semiconductor production, but the associated environmental regulations, or lack thereof in some cases, present a complex landscape for operational planning and investment decisions. For example, water scarcity in certain regions where new fabs might be built is a growing concern, with some areas already experiencing significant water stress.

- Water Intensity: Advanced semiconductor fabs can consume over 10 million gallons of water daily.

- Regulatory Landscape: Compliance with EPA regulations under the Clean Water Act is paramount.

- CHIPS Act Exemption: Facilities funded by the CHIPS Act may bypass federal environmental reviews, impacting water quality oversight.

- Water Scarcity: Growing concerns exist regarding water availability in regions targeted for new semiconductor manufacturing.

Environmental factors significantly impact Alphawave Semi, particularly concerning energy consumption in data centers, where AI workloads are projected to double power demands by 2027. The increasing need for efficient cooling, with liquid cooling being 3,000 times more efficient than air cooling, highlights this trend.

Growing e-waste regulations, like the EU's WEEE Directive, necessitate Alphawave Semi's focus on product lifecycle management and end-of-life strategies, especially given the 5.4 million tonnes of e-waste generated in the EU in 2023.

Supply chain sustainability and ethical sourcing of materials are paramount, with geographic diversification emerging as a key strategy in 2024 to mitigate environmental risks.

Climate change policies and carbon emission targets influence manufacturing practices, with the industry committed to phasing out PFOA by 2025, impacting material sourcing and processes.

| Factor | Impact on Alphawave Semi | Key Data/Trend (2024-2025) |

| Energy Consumption | Increased demand for energy-efficient connectivity solutions for data centers. | AI workloads to double data center power demand by 2027. |

| Cooling Efficiency | Demand for advanced cooling technologies like liquid cooling. | Liquid cooling is ~3,000x more efficient than air cooling. |

| E-waste & Circular Economy | Need for product lifecycle management and end-of-life strategies. | EU generated 5.4 million tonnes of e-waste in 2023; 46.7% collection rate. |

| Supply Chain Sustainability | Focus on ethical sourcing and geographic diversification. | Geographic diversity identified as a key strategy in 2024. |

| Emissions & Regulations | Adaptation to climate policies and material phase-outs. | PFOA phase-out deadline by 2025. Over 130 countries pledged net-zero emissions. |

PESTLE Analysis Data Sources

Our ALPHAWAVE SEMI PESTLE Analysis is meticulously constructed using data from leading semiconductor industry associations, government regulatory bodies, and reputable market research firms. We integrate economic indicators, technological innovation reports, and geopolitical analyses to provide a comprehensive view.