ALPHAWAVE SEMI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALPHAWAVE SEMI Bundle

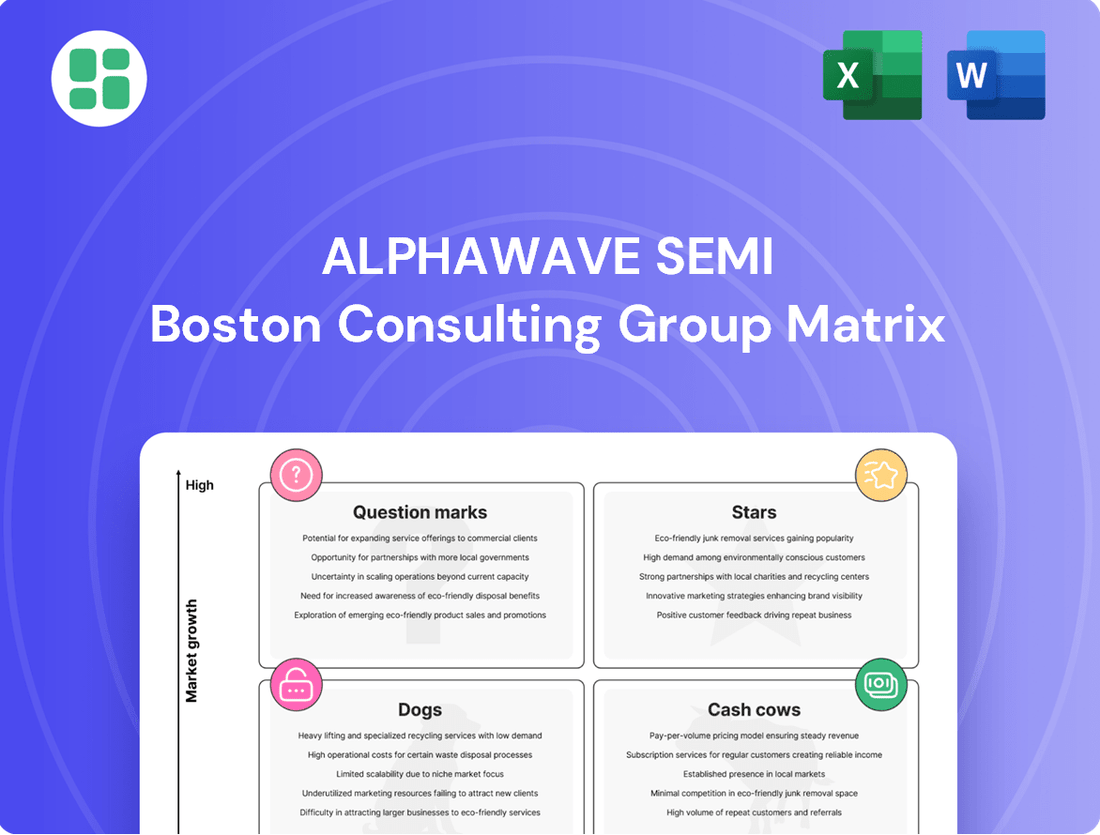

Curious about ALPHAWAVE SEMI's product portfolio and market standing? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full strategic advantage by purchasing the complete BCG Matrix report. Gain in-depth analysis, actionable insights, and a clear roadmap to optimize ALPHAWAVE SEMI's product investments and drive future growth.

Stars

Alphawave Semi's cutting-edge silicon IP and chiplets are designed for the demanding needs of AI accelerators, powering Large Language Models (LLMs) and high-performance computing (HPC). Their focus on advanced process nodes, including 3nm and 2nm, positions them at the forefront of innovation in these rapidly expanding sectors.

These offerings are crucial for markets experiencing explosive growth in demand for ultra-high-speed connectivity, such as AI and data centers. Alphawave Semi's impressive performance, highlighted by record bookings of US$515.5 million in 2024, with over 75% of those bookings coming from advanced nodes like 7nm and below, clearly demonstrates their strong market traction and leadership in these vital technology areas.

Alphawave Semi's 800G/1.6T connectivity solutions, featuring PAM4 and Coherent-lite DSPs, are crucial for overcoming data transfer bottlenecks in hyperscale data centers. This market is projected to surpass $4 billion by 2028, highlighting a significant growth opportunity.

The company's strategic focus on these next-generation technologies, coupled with their 'industry-first' product introductions, firmly establishes them as a frontrunner. This early market penetration is vital in capturing share within this rapidly evolving and high-demand sector.

Alphawave Semi's Universal Chiplet Interconnect Express (UCIe) IP and chiplets are a significant strength, aligning perfectly with the growing demand for chiplet-based architectures in high-performance computing and AI. The company has demonstrated its prowess by delivering the first multi-protocol I/O chiplet and securing design wins that leverage UCIe, PCIe, 112G, and 224G IP, particularly for AI accelerators.

This technological leadership positions Alphawave Semi as a key enabler for the future of advanced computing, offering scalable and efficient solutions. The increasing adoption of chiplets, driven by the need for greater customization and performance, underscores the strategic importance of Alphawave Semi's UCIe offerings. For instance, the market for chiplet solutions is projected to grow substantially, with some estimates suggesting it could reach tens of billions of dollars by the end of the decade, highlighting the immense potential for companies like Alphawave Semi.

Partnerships with Leading Foundries and Ecosystems

Alphawave Semi's strategic alliances with industry leaders are a cornerstone of its Star position in the BCG Matrix. Collaborations with foundries like TSMC and Samsung, along with IP providers such as Arm, grant Alphawave access to cutting-edge manufacturing technologies and ensure its designs are compatible with the latest system architectures. For instance, in 2024, Alphawave announced expanded collaboration with TSMC for advanced process nodes, enabling higher performance and lower power consumption for its connectivity solutions.

Active participation in industry consortiums further strengthens Alphawave's market influence. By contributing to standards bodies like UALink and the Optical Internetworking Forum (OIF), the company ensures its intellectual property is integrated into the foundational technologies driving future connectivity. This proactive engagement in 2024 helped shape the development of next-generation interconnect standards, positioning Alphawave's offerings as essential components for emerging applications.

- Foundry Partnerships: Access to leading-edge process nodes (e.g., TSMC's 3nm, Samsung's 2nm) for advanced chip manufacturing.

- IP Ecosystem Integration: Collaboration with companies like Arm ensures seamless integration of Alphawave's connectivity IP into diverse processor designs.

- Industry Standards Development: Active roles in UALink and OIF in 2024 contributed to the definition of new high-speed interconnect specifications.

- Market Adoption: These partnerships facilitate the incorporation of Alphawave's solutions into high-volume products across data centers, AI, and automotive sectors.

Custom Silicon for AI and Data Centers

Alphawave Semi's custom silicon business, particularly for AI and data centers, is a clear Star. This segment is experiencing robust growth, driven by the increasing demand for specialized processing power. The company is strategically shifting towards higher-margin projects, utilizing its advanced intellectual property (IP) and chiplet technologies to create tailored solutions for leading customers.

The transition to advanced nodes is a key indicator of this segment's Star status. Alphawave is leveraging its expertise in high-speed connectivity and complex chip design to meet the stringent requirements of AI and data center applications. This focus on specialized hardware is crucial, as the market for AI accelerators and high-performance computing continues to expand rapidly.

- Growing Demand: The AI and data center markets are projected to see significant expansion, with global AI chip revenue expected to reach tens of billions of dollars in the coming years.

- Advanced Node Transition: Alphawave's involvement in advanced process nodes (e.g., 5nm and below) allows for greater power efficiency and performance, critical for AI workloads.

- Tier-One Customers: Securing engagements with major players in the tech industry validates the strength and competitiveness of Alphawave's custom silicon offerings.

- Higher Margins: The shift to bespoke solutions and the integration of proprietary IP enable higher profitability compared to standard chip manufacturing.

Alphawave Semi's custom silicon and connectivity solutions are positioned as Stars in the BCG Matrix due to their strong market leadership and high growth potential in the AI and data center sectors. Their focus on advanced technologies like UCIe and high-speed interconnects, coupled with strategic partnerships, fuels their expansion. The company's 2024 performance, with significant bookings from advanced nodes, underscores their Star status.

The custom silicon segment, driven by AI and data center demand, is a key Star. Alphawave's shift to higher-margin, specialized solutions utilizing advanced IP and chiplets is a testament to this. Their involvement in advanced process nodes (5nm and below) is critical for delivering the performance and efficiency required by these demanding workloads.

Alphawave's strategic alliances with foundries like TSMC and participation in industry standards bodies in 2024 further solidify their Star position. These collaborations ensure access to cutting-edge manufacturing and integration into foundational technologies, driving market adoption across key sectors.

The company's 800G/1.6T connectivity solutions are crucial for hyperscale data centers, a market projected to exceed $4 billion by 2028. This highlights a significant growth opportunity and reinforces Alphawave's Star status in this area.

| Segment | BCG Classification | Key Drivers | 2024 Performance Highlight | Future Outlook |

|---|---|---|---|---|

| Custom Silicon (AI/Data Centers) | Star | Growing AI/HPC demand, advanced node transition, tier-one customer wins | Secured design wins leveraging UCIe, PCIe, 112G, 224G IP for AI accelerators | High growth, higher margins, expansion in specialized hardware |

| Connectivity IP (High-Speed Interconnects) | Star | Demand for ultra-high-speed connectivity in AI/data centers, chiplet architecture adoption | Record bookings of US$515.5 million, >75% from advanced nodes (7nm and below) | Dominance in 800G/1.6T solutions, crucial for hyperscale data centers |

What is included in the product

The ALPHAWAVE SEMI BCG Matrix provides a strategic framework for analyzing a company's product portfolio based on market share and growth potential.

It offers clear insights into which business units to invest in, divest from, or maintain.

ALPHAWAVE SEMI BCG Matrix provides a clear, actionable visual of your portfolio's health.

It pinpoints underperforming assets, enabling targeted strategic adjustments.

Cash Cows

Alphawave Semi's established Multi-Standard SerDes (MSS) IP, particularly those deployed in stable networking and data center infrastructure, represent a significant Cash Cow. These mature, widely adopted designs continue to generate consistent licensing revenue, reflecting their proven reliability and broad market penetration.

Unlike newer, more R&D-intensive IP, these established MSS solutions likely require less ongoing investment relative to their market share, thereby contributing positively to profitability. For instance, the company's SerDes IP is a foundational element in many high-volume connectivity solutions, ensuring a steady stream of income even in less rapidly evolving market segments.

Legacy IP licensing agreements are Alphawave Semi's cash cows. These older, widely adopted licenses are in established markets, not hyper-growth ones, but they still contribute significantly to the company's revenue. Think of them as reliable income generators, even if they don't offer the same explosive growth as newer technologies.

Alphawave Semi's extensive portfolio, boasting over 240 silicon IPs, includes these mature licensing deals. While newer, advanced node deals might have higher margins, these legacy agreements provide a steady and predictable revenue stream. This stability is crucial for maintaining consistent financial performance.

Certain Ethernet and PCIe IP generations, like 100G Ethernet and PCIe Gen 4, are established as cash cows for AlphaWave Semi. These technologies are deeply embedded in the vast majority of current data center and enterprise networking hardware, ensuring a consistent demand. Their widespread adoption means they require minimal new investment in research and development, allowing AlphaWave Semi to capitalize on their existing market dominance and generate significant, stable profits.

Standard Connectivity Products (Initial Revenues)

Standard Connectivity Products, including PAM4 and Coherent-lite DSPs for 800G/1.6T, began generating revenue in 2024. These offerings are positioned to become cash cows as they mature and achieve broader market penetration within hyperscale data centers.

The strategic significance of these products in established hyperscale environments points towards a future of stable, high market share. This transition will occur once initial investments translate into consistent, predictable returns.

- Revenue Recognition: First revenues recorded in 2024 for PAM4 and Coherent-lite DSPs.

- Market Position: Strategic importance in established hyperscale data centers.

- Future Potential: Expected to evolve into cash cows with mature products and wider adoption.

- Financial Trajectory: Path to stable, high market share following initial investment returns.

Foundational IP for 5G Wireless Infrastructure

Foundational IP for 5G Wireless Infrastructure represents a stable cash cow for AlphaWave Semi. These intellectual property solutions cater to the more mature segments of 5G deployment, where the initial rapid expansion is giving way to sustained demand for robust connectivity.

While not seeing the hyper-growth associated with emerging technologies like AI, this segment generates consistent revenue. This stability stems from a substantial installed base and the continuous need for infrastructure upgrades and maintenance.

- Consistent Revenue Stream: The mature 5G infrastructure market offers predictable income due to ongoing demand.

- Large Installed Base: A significant number of deployed 5G networks require continuous support and upgrades.

- Stable Demand: Unlike rapidly evolving fields, the need for reliable 5G connectivity is a long-term, stable requirement.

Alphawave Semi's established Multi-Standard SerDes (MSS) IP, particularly those deployed in stable networking and data center infrastructure, represent a significant Cash Cow. These mature, widely adopted designs continue to generate consistent licensing revenue, reflecting their proven reliability and broad market penetration.

Legacy IP licensing agreements are Alphawave Semi's cash cows. These older, widely adopted licenses are in established markets, not hyper-growth ones, but they still contribute significantly to the company's revenue, providing a steady and predictable revenue stream crucial for financial stability.

Certain Ethernet and PCIe IP generations, like 100G Ethernet and PCIe Gen 4, are established as cash cows. These technologies are deeply embedded in current data center and enterprise networking hardware, ensuring consistent demand and minimal new R&D investment, allowing Alphawave Semi to capitalize on market dominance.

Foundational IP for 5G Wireless Infrastructure also serves as a stable cash cow, catering to mature deployment segments and generating consistent revenue due to a substantial installed base and ongoing demand for upgrades.

| Product Category | Key IP Examples | Market Maturity | Revenue Contribution | Strategic Role |

|---|---|---|---|---|

| Multi-Standard SerDes (MSS) | Established SerDes IP | Mature, Widely Adopted | Consistent Licensing Revenue | Foundational for Connectivity |

| Legacy IP Licensing | Older, Broadly Licensed IP | Established Markets | Significant Revenue Contribution | Stable Income Generator |

| Ethernet & PCIe | 100G Ethernet, PCIe Gen 4 | Deeply Embedded | Steady Profits | Market Dominance Capitalization |

| 5G Wireless Infrastructure | Foundational 5G IP | Mature Segments | Predictable Income | Sustained Demand Support |

What You See Is What You Get

ALPHAWAVE SEMI BCG Matrix

The ALPHAWAVE SEMI BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready strategic tool. You can confidently expect the same professional design and comprehensive data presented here to be delivered directly to you, ready for immediate implementation in your business planning and decision-making processes. This ensures you get exactly what you need to effectively analyze your product portfolio and identify strategic growth opportunities without any further editing or adjustments.

Dogs

AlphaWave Semi has strategically de-prioritized its China-related business, marking it as a 'Dog' within its BCG Matrix. This decision is underscored by the cessation of revenue recognition from the WiseWave contract, signaling a clear pivot away from this segment.

This legacy business, though it previously generated revenue, is now being phased out. Factors such as evolving market dynamics, potential margin pressures, and geopolitical considerations likely contributed to this strategic shift, positioning it for divestiture or significant downsizing.

Older, lower-margin custom silicon engagements are considered '' in the BCG Matrix. These legacy projects, often on older process nodes and not catering to high-growth areas like AI or data centers, represent a declining business segment for Alphawave Semi. For instance, in Q4 2023, the company noted a strategic shift away from lower-margin custom silicon, focusing instead on new, higher-margin opportunities.

Underperforming Acquired Product Lines represent those acquisitions that haven't met expectations, struggling to gain market share or integrate smoothly. These can drain valuable resources, acting as cash drains rather than growth drivers.

For instance, if a company acquired a niche software product in 2023 for $50 million and its revenue in 2024 only reached $2 million with a negative EBITDA of $3 million, it would likely fall into this category. Such products demand a critical look for potential divestment or significant restructuring.

Non-core IP without Clear Market Demand

Non-core IP without clear market demand represents portions of Alphawave Semi's substantial IP portfolio, which exceeds 240 silicon IPs, that don't directly support its strategic focus on AI, data centers, or next-generation connectivity. These assets have demonstrated limited market traction, suggesting they are unlikely to capture significant market share or drive substantial growth.

These IPs would be categorized as Dogs within the BCG matrix. While they might be retained for potential future, albeit unlikely, opportunities or as part of a broader portfolio, they would receive minimal investment. This approach conserves resources for more promising ventures, aligning with a strategy of focusing on high-growth areas.

- Low Market Demand: IPs not aligning with AI, data centers, or next-gen connectivity.

- Minimal Investment: Resources are not allocated to develop or promote these IPs.

- Portfolio Maintenance: IPs are kept but without significant strategic or financial backing.

- Strategic Focus: Resources are prioritized for core, high-potential IP areas.

Products affected by rapidly changing standards

Certain older products or intellectual property (IP) within the semiconductor industry are particularly vulnerable to the rapid evolution of connectivity standards. For instance, components designed for 100 Gigabit Ethernet (100G) are rapidly being superseded by demand for 800 Gigabit Ethernet (800G) and even 1.6 Terabit Ethernet (1.6T) solutions. Similarly, older Peripheral Component Interconnect Express (PCIe) generations are giving way to newer, faster versions.

Products that haven't secured new design wins in these rapidly advancing segments face a significant risk of becoming obsolete. This situation is akin to placing these offerings in the 'Dog' quadrant of the BCG Matrix. The demand for these older technologies is declining, and their market share is shrinking as the industry aggressively adopts newer, higher-speed alternatives. For example, in 2024, the market for 100G optical transceivers, while still present, is seeing its growth significantly outpaced by the burgeoning 400G and 800G markets.

- Obsolescence Risk: Products tied to older connectivity standards like 100G Ethernet or earlier PCIe generations face a high risk of becoming obsolete.

- Declining Demand: As the industry transitions to 800G/1.6T Ethernet and newer PCIe versions, demand for older technologies naturally decreases.

- Loss of Market Share: Companies with a significant portion of their portfolio in these older, un-upgraded segments will likely see their market share erode.

- Need for R&D Investment: To avoid this 'Dog' classification, continuous investment in research and development to align with emerging standards is crucial.

Dogs represent business segments with low market share and low growth potential. For AlphaWave Semi, this includes legacy custom silicon projects on older process nodes and non-core intellectual property that doesn't align with their strategic focus on AI and data centers. These areas consume resources without contributing significantly to growth, making them candidates for divestiture or minimal investment.

Older products, such as those designed for 100 Gigabit Ethernet, are increasingly becoming Dogs as the industry rapidly adopts faster standards like 800 Gigabit Ethernet. Companies heavily reliant on these older technologies risk obsolescence and declining market share. For instance, while 100G transceiver markets still exist in 2024, their growth is dwarfed by the 400G and 800G segments.

Underperforming acquired product lines also fall into the Dog category. These are acquisitions that fail to gain traction, becoming a drain on resources rather than a growth driver. A hypothetical example from 2024 might be a $50 million software acquisition generating only $2 million in revenue with a negative EBITDA of $3 million.

AlphaWave Semi's strategic decision to de-prioritize its China-related business, including the cessation of revenue from the WiseWave contract, clearly marks this segment as a Dog. This move reflects an assessment of evolving market dynamics and potential margin pressures, positioning the business for a potential exit.

Question Marks

Alphawave Semi is making significant strategic investments in emerging optical I/O and Co-Packaged Optics (CPO) solutions, as evidenced by their prominent presence at OFC 2025. These advancements are foundational for the next generation of AI infrastructure and data centers, a sector experiencing rapid expansion.

While the market for these optical technologies is poised for substantial growth, their current market share and broad adoption are still in nascent stages. This necessitates continued, substantial investment from companies like Alphawave Semi to fully unlock their potential and establish market leadership.

The new Arm Neoverse CSS-based compute chiplets are firmly in the Question Mark category of the BCG Matrix. These chiplets, leveraging the Arm Neoverse N3 Compute SubSystem, are designed to tap into the burgeoning AI and High-Performance Computing (HPC) sectors, a significant growth area. This represents a strategic pivot for Arm, moving more decisively into custom silicon solutions.

Despite the promising target market, the actual market penetration and revenue generation from these chiplets are currently minimal. Significant investment is necessary to establish market share and validate the technology's commercial success. For instance, the AI chip market alone was projected to reach over $100 billion by 2026, highlighting the potential but also the competitive landscape Arm aims to enter.

AlphaWave Semi's IP for 2nm process nodes, particularly those taped out in early 2025, signifies a substantial R&D commitment to the forefront of semiconductor technology. This investment targets next-generation applications poised for future growth, though their market penetration and revenue generation are still in nascent stages, necessitating ongoing financial support.

Specific New Connectivity Products (Post-2024 Launch)

New connectivity products launched by AlphaWave Semi in late 2024 or early 2025, beyond their initial PAM4/Coherent-lite DSPs, are positioned in the Question Mark quadrant of the BCG matrix. These offerings are targeting rapidly expanding markets, such as advanced Wi-Fi standards and next-generation optical interconnects, which are projected to see significant growth through 2025 and beyond.

These products require significant investment in sales and marketing to gain traction. For instance, the global AI chip market, a key driver for advanced connectivity, was estimated to reach over $50 billion in 2024, indicating the high-growth potential but also the intense competition these new AlphaWave Semi products will face.

- Targeting High-Growth Markets: AlphaWave Semi's new connectivity products are entering sectors like 5G Advanced and Wi-Fi 7, which are experiencing substantial adoption. The Wi-Fi 7 market alone is anticipated to grow from approximately $1.5 billion in 2024 to over $5 billion by 2028.

- Need for Market Penetration: Securing design wins in these competitive spaces is critical. Companies in this segment often need to demonstrate superior performance and cost-effectiveness to displace established players.

- Investment in Sales and Marketing: To achieve rapid market share growth, AlphaWave Semi will need to allocate considerable resources to build brand awareness and establish strong relationships with key customers in the consumer electronics and enterprise networking sectors.

- Potential for High Returns: Despite the investment required, successful penetration of these dynamic markets could lead to significant revenue streams and a strong competitive position in future connectivity standards.

Solutions for Autonomous Vehicles Market

Alphawave Semi's intellectual property (IP) tailored for the autonomous vehicles (AV) sector positions it within a high-growth market, yet it likely falls into the Question Mark category of the BCG matrix. This segment demands highly specialized, low-latency, and robust connectivity solutions, areas where Alphawave's expertise is relevant.

The AV market is experiencing rapid expansion, with projections indicating significant growth. For instance, the global autonomous vehicle market was valued at approximately USD 24.1 billion in 2023 and is anticipated to reach USD 110.6 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 24.1% during the forecast period. This substantial market potential highlights the opportunity for Alphawave.

- High-Growth Potential: The autonomous vehicle market is a rapidly expanding sector, presenting substantial revenue opportunities.

- Specialized IP: Alphawave Semi offers IP crucial for the demanding connectivity needs of AVs, such as low-latency and resilient data transfer.

- Market Uncertainty: Despite the growth, Alphawave's current market share and the exact timeline for widespread adoption of its specific solutions in this evolving industry remain uncertain.

- Strategic Investment: Significant investment is required to solidify Alphawave's position and capitalize on the AV market's potential, managing the inherent risks of a nascent technology.

Question Marks represent business ventures or products with low market share in high-growth industries. These require substantial investment to gain traction and establish a competitive foothold.

Alphawave Semi's new Arm Neoverse CSS-based compute chiplets and advanced connectivity products for 5G Advanced and Wi-Fi 7 are prime examples. While targeting rapidly expanding markets, their current market penetration is minimal, necessitating significant sales, marketing, and R&D investment.

Similarly, their IP for autonomous vehicles, though targeting a high-growth sector with a projected market value of USD 110.6 billion by 2030, faces market uncertainty and requires strategic investment to secure design wins and achieve widespread adoption.

The success of these Question Marks hinges on effectively converting potential into market share through focused investment and strategic execution. Failure to do so could result in these ventures becoming cash drains without significant returns.

| Product/IP Area | Market Growth | Current Market Share | Investment Need | Potential Outcome |

| Arm Neoverse CSS Chiplets | High (AI/HPC) | Low | High (R&D, Sales) | Market Leader or Divestment |

| Advanced Connectivity (Wi-Fi 7) | High (expected to exceed $5B by 2028) | Low | High (Sales, Marketing) | Significant Revenue or Stagnation |

| Autonomous Vehicle IP | High (24.1% CAGR to 2030) | Low | High (Specialized R&D, Market Entry) | Key AV Supplier or Niche Player |

BCG Matrix Data Sources

ALPHAWAVE SEMI's BCG Matrix is built on comprehensive industry data, including financial reports, market share analysis, and technology trend forecasts, ensuring robust strategic insights.