Autlan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autlan Bundle

Autlan's market position is defined by its unique strengths and emerging opportunities, but understanding its vulnerabilities and potential threats is crucial for any strategic move. Our comprehensive SWOT analysis dives deep into these factors, providing you with the clarity needed to navigate the competitive landscape effectively.

Want the full story behind Autlan's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Autlán's integrated business model, spanning manganese ore extraction, ferroalloy production, and electricity generation, offers remarkable control over its value chain. This vertical integration minimizes reliance on external suppliers, bolstering operational stability and cost management. For instance, in 2024, Autlán's ability to generate its own electricity through Autlán Energy significantly cushioned the impact of rising energy costs for its ferroalloy operations.

Autlán's strategic importance in the steel industry is undeniable. As a key producer of ferroalloys like ferromanganese and silicomanganese, the company provides vital components that improve steel's strength and resilience. The global steel market, expected to reach approximately $1.1 trillion by 2025, and Mexico's steel sector, which saw production around 18.5 million metric tons in 2023, demonstrate a robust and growing demand for Autlán's essential products.

Autlán's strategic ownership and operation of hydroelectric power plants are a significant strength, fostering energy self-sufficiency. This reduces their vulnerability to volatile energy market prices and guarantees a consistent power supply for their mining and processing activities.

This integrated approach to energy management not only stabilizes operational costs but also unlocks additional revenue. Autlán can capitalize on its hydropower assets by selling surplus electricity, a move increasingly attractive given the global shift towards renewable energy sources.

Established Market Position

Autlán holds a commanding presence as the largest producer of manganese ferroalloys across the Americas. This significant market share, combined with its status as the foremost producer of manganese ore in North and Central America, underscores its industry leadership.

Since its inception in 1953, Autlán has cultivated a reputation for reliability and delivering high-quality products, a testament to its enduring market position. This deep-rooted history translates into a distinct competitive advantage.

- Market Dominance: Largest producer of manganese ferroalloys in the Americas.

- Regional Leadership: Most important producer of manganese ore in North and Central America.

- Long-Standing Reputation: Established in 1953, demonstrating consistent quality and reliability.

- Competitive Edge: Benefits from established customer relationships and extensive industry knowledge.

Commitment to Sustainability

Autlán's dedication to sustainability is a significant strength, encompassing environmental responsibility and community involvement. For instance, the company has focused on reducing water usage, with efforts to improve recirculation processes contributing to more efficient operations. This commitment is not just about environmental stewardship; it also bolsters Autlán's brand image and appeals to a growing segment of investors prioritizing ESG (Environmental, Social, and Governance) factors.

The company's proactive approach to environmental management includes initiatives aimed at energy efficiency to lower greenhouse gas emissions. This focus can translate into cost savings through reduced energy consumption and potentially qualify Autlán for green financing opportunities. By integrating sustainable practices, Autlán positions itself favorably in an industry increasingly scrutinized for its environmental impact.

- Environmental Stewardship: Autlán actively pursues strategies to minimize its ecological footprint.

- Investor Appeal: Its sustainability focus attracts environmentally conscious investors, potentially lowering the cost of capital.

- Operational Efficiency: Efforts in water recirculation and energy efficiency can lead to direct cost reductions.

- Reputational Enhancement: A strong commitment to sustainability builds trust and improves brand perception.

Autlán's integrated business model, from mining to ferroalloy production and electricity generation, provides significant control over its operations and costs. This vertical integration, exemplified by its energy self-sufficiency through hydroelectric plants, insulates the company from market volatility and ensures a stable power supply for its core activities.

As the largest producer of manganese ferroalloys in the Americas and the leading manganese ore producer in North and Central America, Autlán holds a dominant market position. This leadership, coupled with a reputation for quality since 1953, provides a substantial competitive advantage and deepens established customer relationships.

Autlán's commitment to sustainability is a key strength, enhancing its brand image and attracting ESG-focused investors. Initiatives in water conservation and energy efficiency not only reduce environmental impact but also lead to operational cost savings and potential access to green financing.

| Metric | 2023/2024 Data | Significance |

|---|---|---|

| Manganese Ferroalloy Production (Americas) | Largest Producer | Market dominance and scale economies |

| Manganese Ore Production (North/Central America) | Foremost Producer | Regional supply chain control |

| Operational History | Established 1953 | Proven reliability and expertise |

| Energy Self-Sufficiency | Hydroelectric Power Generation | Cost stability and operational resilience |

What is included in the product

Analyzes Autlan’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities.

Weaknesses

Autlán's core operations are deeply tied to the volatile prices of manganese ore and ferroalloys. These commodity markets are known for their significant price swings, directly affecting Autlán's financial results.

Recent market conditions, including oversupply, have led to price downturns, underscoring the company's vulnerability. This inherent market risk creates unpredictability in revenue and profitability, making financial forecasting challenging.

Autlán's significant reliance on the steel industry, while a source of strength, also represents a key weakness. A slowdown in global steel demand directly translates to reduced sales for Autlán's ferroalloy products. For instance, while the Mexican steel market showed resilience in 2023, global economic uncertainties, as highlighted by IMF projections for slower global growth in 2024, can still dampen demand for steel and, consequently, Autlán's output.

This concentration makes Autlán particularly susceptible to the cyclical nature of the steel market. If major steel-producing regions experience downturns, Autlán's revenue streams are directly impacted. The company's performance is thus intrinsically linked to the health and demand patterns within the international steel sector, creating a vulnerability to external market shocks.

Autlán's financial performance shows a concerning trend of negative net income in recent periods. For instance, Q2 2025 reported a net loss of US$15.3 million, a stark contrast to the profit achieved in Q2 2024. This shift from profitability to losses, despite revenue growth, can be a significant red flag for investors assessing the company's long-term financial stability and operational efficiency.

Regulatory Uncertainty in Mexican Mining Sector

The Mexican mining sector is navigating a period of significant regulatory uncertainty. A notable aspect is the freeze on new mining concessions, which directly impacts the potential for future exploration and expansion within Mexico. This governmental policy, alongside delays in the issuance of necessary permits, creates an unpredictable operating environment for companies like Autlán. For instance, as of early 2024, the backlog of permit applications remained a concern for many operators.

Proposed amendments to the mining law further contribute to this unpredictability. While some degree of clarity is anticipated, these potential changes could fundamentally alter the operational landscape and investment attractiveness of the sector. This environment can hinder exploration efforts and the development of future projects, directly affecting Autlán's strategic planning and capital allocation within its primary operating region.

- Concession Freeze: A moratorium on new mining concessions limits future growth opportunities.

- Permit Delays: Extended timelines for permit approvals can stall exploration and development activities.

- Legislative Changes: Potential amendments to mining laws introduce uncertainty regarding operational frameworks and fiscal regimes.

- Impact on Autlán: These factors create an unpredictable operating environment for Autlán in its home country, potentially affecting project timelines and investment decisions.

Geographic Concentration in Mexico

Autlán's operational heart beats in Mexico, with its primary mining and ferroalloy production facilities concentrated there. This singular focus, despite international sales, means the company is particularly susceptible to the specific economic, political, and regulatory shifts within Mexico. Any instability or unfavorable policy changes in the country could have a magnified negative impact on Autlán's overall performance and bottom line.

This geographic concentration presents a significant vulnerability. For instance, while Autlán reported international sales, its 2023 annual report highlights that its Mexican operations are the bedrock of its revenue generation. Any disruption, from labor disputes to changes in mining laws, could severely hamper production and, consequently, its global reach.

- Geographic Reliance: Autlán's core assets are solely located in Mexico, creating a single point of operational and financial vulnerability.

- Country-Specific Risks: The company is directly exposed to the economic volatility, political uncertainties, and evolving regulatory landscape of Mexico.

- Disproportionate Impact: Adverse events within Mexico could significantly and disproportionately affect Autlán's production capacity and profitability compared to a more diversified company.

Autlán's profitability is heavily influenced by commodity price volatility, particularly for manganese ore and ferroalloys. Recent market conditions, including oversupply, have led to price downturns, impacting financial results. For example, the average manganese ore price saw a decline in early 2024 compared to the previous year, directly affecting Autlán's revenue potential.

The company's significant dependence on the steel industry creates a vulnerability to demand slowdowns. Global economic uncertainties, projected by the IMF to moderate growth in 2024, could dampen steel demand, impacting Autlán's ferroalloy sales. This makes Autlán susceptible to the cyclical nature of the steel market, with downturns in major steel-producing regions directly affecting its revenue streams.

Autlán has experienced periods of negative net income, raising concerns about financial stability. For instance, Q2 2025 reported a net loss of US$15.3 million, a reversal from the profit in Q2 2024. This shift, despite revenue growth, highlights potential operational inefficiencies or market pressures that erode profitability.

Regulatory uncertainty in Mexico's mining sector, including a freeze on new concessions and permit delays, hinders future growth and creates an unpredictable operating environment. Potential amendments to mining laws further add to this unpredictability, impacting strategic planning and capital allocation. As of early 2024, a significant backlog of permit applications remained a concern for the industry.

Autlán's core operations are concentrated in Mexico, exposing it to country-specific economic, political, and regulatory risks. Any instability or unfavorable policy changes in Mexico could disproportionately affect its production capacity and profitability. For example, labor disputes or changes in mining laws could severely hamper production, impacting its global reach.

| Weakness | Description | Impact | Relevant Data/Context |

|---|---|---|---|

| Commodity Price Volatility | Reliance on fluctuating manganese ore and ferroalloy prices. | Unpredictable revenue and profitability. | Average manganese ore prices declined in early 2024 compared to 2023. |

| Steel Industry Dependence | High exposure to demand cycles within the global steel sector. | Reduced sales during steel market downturns. | IMF projects slower global growth for 2024, potentially impacting steel demand. |

| Profitability Concerns | Recent periods of net losses despite revenue growth. | Questions about financial stability and operational efficiency. | Q2 2025 net loss of US$15.3 million vs. Q2 2024 profit. |

| Mexican Regulatory Uncertainty | Concession freeze, permit delays, and potential mining law changes. | Hinders future growth, creates operational unpredictability. | Backlog of permit applications as of early 2024. |

| Geographic Concentration | Sole reliance on Mexican operations for core assets. | Exposed to country-specific economic and political risks. | 2023 annual report highlights Mexican operations as the bedrock of revenue. |

Same Document Delivered

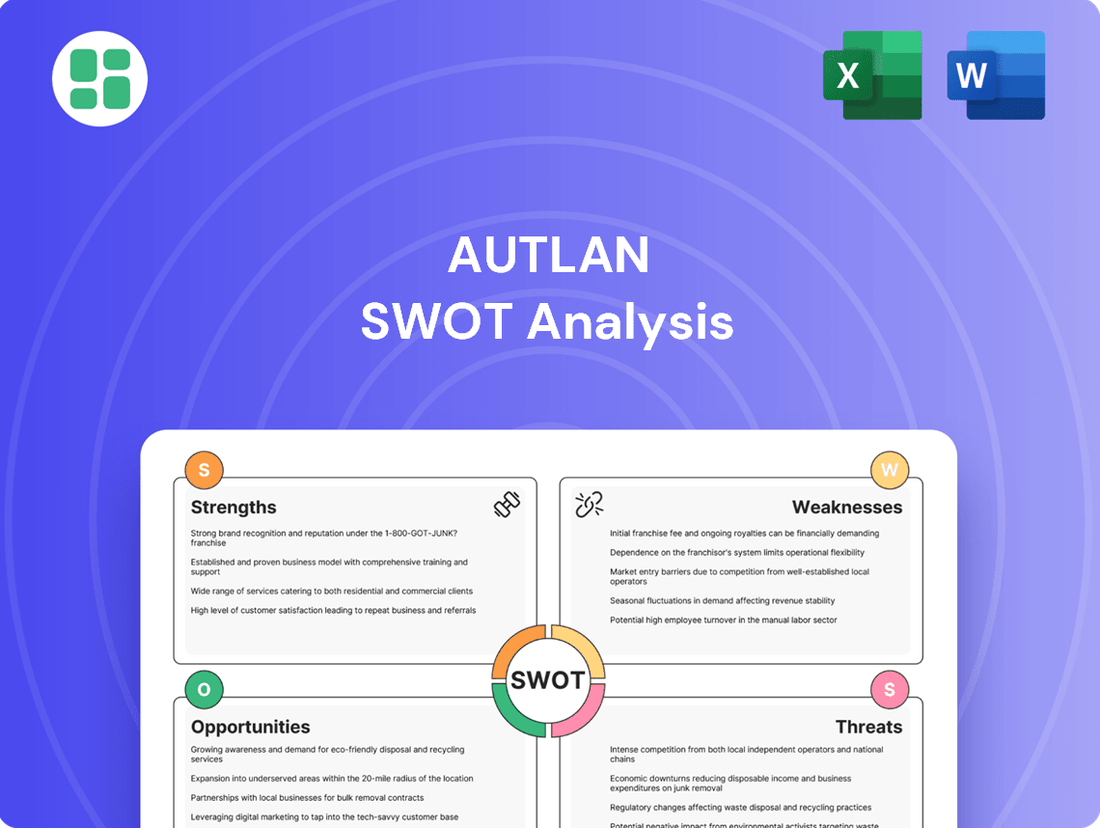

Autlan SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown of Autlan's Strengths, Weaknesses, Opportunities, and Threats is yours to use immediately after checkout. You're getting a genuine look at the complete, ready-to-deploy analysis.

Opportunities

The electric vehicle (EV) market's rapid expansion is fueling a substantial rise in demand for manganese. Specifically, manganese-rich lithium-ion battery chemistries like LMFP are gaining traction, creating a compelling opportunity for Autlán to diversify its revenue streams away from the traditional steel sector.

This shift signifies a chance for Autlán to tap into high-growth markets by focusing on the production of high-purity manganese essential for these advanced battery technologies. Global EV sales are projected to reach over 30 million units annually by 2025, underscoring the immense market potential.

The global ferroalloys market is anticipated to experience robust expansion, fueled by rising steel demand, especially in developing nations, and growth in the automotive and construction industries. For instance, the global steel production is expected to reach 2.3 billion tonnes by 2025, a significant increase from previous years.

Autlán, a key player in ferroalloy production, is strategically positioned to leverage this market growth. The company's established presence and production capabilities allow it to benefit from increasing demand for its products.

Further enhancing its market position, Autlán could consider strategic investments aimed at increasing production capacity or pioneering new product innovations. Such moves would solidify its competitive edge and potentially capture a larger share of the expanding market.

Mexico's steel market is poised for expansion, fueled by a strong manufacturing base, significant infrastructure investments, and the booming automotive sector, particularly with the rise of electric vehicle (EV) production. This growth is projected to reach approximately 4.5% in 2024, according to industry forecasts.

The ongoing nearshoring phenomenon is a significant tailwind, driving demand for domestically produced steel and ferroalloys within North America, directly benefiting companies like Autlán. This regional focus helps mitigate the impact of volatility in global steel markets.

Leveraging Hydroelectric Capacity for Renewable Energy Market

Autlán's existing hydroelectric capacity offers a significant opportunity to capitalize on the growing renewable energy market. By expanding its hydroelectric operations or investing in other renewable sources, the company can bolster its energy independence and tap into new revenue streams through energy sales. This strategic move directly supports global decarbonization efforts and enhances Autlán's environmental, social, and governance (ESG) credentials.

For instance, in 2023, renewable energy sources accounted for approximately 29% of Mexico's total electricity generation, a figure expected to rise. Autlán's commitment to expanding its renewable portfolio, particularly through its hydroelectric assets, positions it favorably to capture market share in this expanding sector. This expansion could also lead to a reduction in energy costs for its own operations, further improving profitability.

- Expand Hydroelectric Output: Invest in upgrades or new capacity for existing hydroelectric plants to increase generation.

- Diversify Renewable Portfolio: Explore investments in other renewable technologies like solar or wind to complement hydroelectric power.

- Energy Sales Agreements: Secure long-term power purchase agreements with industrial clients or the national grid for surplus energy.

- Enhance ESG Profile: Clearly communicate the benefits of increased renewable energy generation to investors and stakeholders, improving the company's ESG rating.

Technological Advancements in Mining and Processing

Technological advancements present a significant opportunity for Autlán. Innovations in mining and processing can directly translate to improved operational efficiency and reduced costs. For instance, the adoption of advanced sensor technologies and automated extraction methods could streamline operations, potentially lowering the cost per ton of manganese produced.

Autlán can strategically invest in modernizing its facilities and adopting new extraction or ferroalloy production techniques. This could involve exploring novel refining and purification processes to enhance the quality and yield of its products. The global mining technology market is projected for substantial growth, with estimates suggesting it could reach over $30 billion by 2028, indicating a fertile ground for such investments.

- Enhanced Efficiency: Implementing AI-driven predictive maintenance on mining equipment can reduce downtime, a key factor in operational costs.

- Resource Recovery: New beneficiation techniques could increase the percentage of valuable minerals extracted from ore bodies, boosting overall output.

- Cost Reduction: Automation in processing plants can lead to lower labor requirements and more consistent product quality, driving down per-unit costs.

- Market Competitiveness: Adopting cutting-edge purification methods can allow Autlán to produce higher-grade ferroalloys, commanding premium prices in the market.

Autlán's strategic positioning in the burgeoning electric vehicle (EV) market presents a significant opportunity by catering to the increasing demand for high-purity manganese in advanced battery chemistries like LMFP. With global EV sales projected to surpass 30 million units annually by 2025, this expansion offers a clear pathway for revenue diversification beyond traditional steel markets.

The company is well-placed to capitalize on the robust growth of the global ferroalloys market, driven by rising steel demand in developing economies and expansion in the automotive and construction sectors, with global steel production expected to reach 2.3 billion tonnes by 2025.

Leveraging its existing hydroelectric capacity, Autlán can tap into the expanding renewable energy market, aiming to increase energy independence and generate new revenue streams through energy sales, aligning with global decarbonization trends and enhancing its ESG profile. Mexico's renewable energy share in total electricity generation was around 29% in 2023, a figure anticipated to grow.

Technological advancements in mining and processing offer a chance to boost operational efficiency and reduce costs, with the global mining technology market projected to exceed $30 billion by 2028, creating a favorable environment for investments in automation and advanced extraction methods.

Threats

Despite expectations for market expansion, the global manganese and ferroalloy sectors face persistent price volatility. This instability stems from a combination of oversupply, geopolitical tensions, and shifts in demand from major consumers such as China. For instance, during 2023, ferroalloy prices experienced significant swings, with some key grades seeing double-digit percentage changes within a single quarter.

This inherent price fluctuation directly affects Autlán's financial performance, creating uncertainty in revenue streams and profit margins. The challenge lies in forecasting earnings when the cost of essential inputs and the selling price of its products can change dramatically, impacting the predictability of financial planning and investment decisions.

The global ferroalloys market is highly competitive, featuring many significant international corporations. Autlán operates within this landscape, facing considerable pressure from these larger entities, which can manifest as downward pressure on pricing and a potential reduction in market share.

Furthermore, the industry is characterized by ongoing consolidation through mergers and acquisitions. This trend presents a significant threat, particularly to smaller or more regionally focused companies like Autlán, as larger, combined entities can leverage greater economies of scale and market influence.

Autlan faces a significant threat from increasingly stringent environmental regulations in Mexico. There's a growing possibility of new rules that could restrict or even ban certain mining practices, such as open-pit mining, which is crucial for many operations. This heightened scrutiny, driven by public and governmental concerns over environmental impact, could directly increase operational expenses and limit future growth.

Global Economic Slowdowns Affecting Steel Demand

A slowdown in the global economy, especially in key steel-consuming regions like China and Europe, poses a significant threat to Autlán. For instance, the IMF projected global growth to moderate to 2.9% in 2024, down from 3.2% in 2023, indicating a cooling economic environment that could dampen steel demand. This downturn directly impacts Autlán's sales volumes and profitability as reduced industrial activity translates to less need for steel and, by extension, ferroalloys.

The interconnected nature of global markets means that even localized economic contractions can have far-reaching consequences. A recession in any major economy could trigger a ripple effect, decreasing demand for manufactured goods that rely on steel, thereby impacting Autlán's export markets and overall revenue streams.

- Reduced Demand: Global economic slowdowns in 2024-2025 are expected to curb industrial output, leading to lower steel consumption.

- Market Volatility: Economic downturns can cause significant price fluctuations for commodities like ferroalloys, impacting Autlán's revenue predictability.

- Geopolitical Factors: Trade tensions and regional conflicts can exacerbate economic slowdowns, further pressuring demand for steel products and raw materials.

Supply Chain Disruptions and Geopolitical Risks

Autlán faces significant threats from global supply chain vulnerabilities, exacerbated by ongoing geopolitical instability. Events like the disruptions in the Red Sea in early 2024 have demonstrated how quickly shipping routes can be impacted, leading to increased freight costs and delivery delays. These challenges directly affect Autlán’s ability to reliably source essential raw materials and deliver finished products to its customers, potentially impacting production schedules and profitability.

The heightened geopolitical tensions and trade disputes prevalent in 2024 and projected into 2025 mean that the risk of further supply chain interruptions remains elevated. For instance, the International Monetary Fund (IMF) has repeatedly warned about the persistent inflationary pressures stemming from these disruptions, which can translate into higher input costs for companies like Autlán. This creates a volatile operating environment where managing inventory and ensuring timely fulfillment becomes increasingly complex and costly.

- Increased Transportation Costs: Freight rates saw significant spikes in late 2023 and early 2024 due to geopolitical events, adding to operational expenses.

- Delivery Delays: Supply chain bottlenecks can extend lead times for critical components, impacting production timelines.

- Input Availability: Geopolitical risks can restrict access to key raw materials, potentially hindering manufacturing output.

Autlán faces significant threats from volatile commodity prices, with ferroalloy markets experiencing considerable swings due to oversupply and shifting demand, as seen with double-digit percentage price changes in 2023. Increased competition from larger global players and industry consolidation also pose risks, potentially eroding market share and pricing power. Furthermore, stringent environmental regulations in Mexico could lead to higher operational costs and restrict mining practices.

A global economic slowdown, projected by the IMF to moderate in 2024, threatens to reduce steel demand, directly impacting Autlán's sales volumes and profitability. Supply chain disruptions, amplified by geopolitical instability and trade tensions, further increase transportation costs and delivery delays, impacting input availability and overall operational efficiency.

| Threat Category | Specific Threat | Impact on Autlán | Supporting Data/Event |

|---|---|---|---|

| Market Dynamics | Price Volatility | Uncertainty in revenue and profit margins | Ferroalloy prices saw double-digit percentage changes within quarters in 2023. |

| Competition | Industry Consolidation | Reduced market share and pricing power | Larger, combined entities gain economies of scale and market influence. |

| Regulatory Environment | Environmental Regulations | Increased operational costs, potential practice restrictions | Growing scrutiny on mining practices in Mexico. |

| Economic Conditions | Global Economic Slowdown | Lower steel demand, reduced sales volumes | IMF projected global growth to moderate to 2.9% in 2024. |

| Supply Chain | Geopolitical Instability | Increased transportation costs, delivery delays, input availability issues | Red Sea disruptions in early 2024 led to freight cost spikes. |

SWOT Analysis Data Sources

This Autlan SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.