Autlan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autlan Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Autlan's future. Our expertly crafted PESTLE analysis provides actionable intelligence to navigate these external forces. Don't get left behind; download the full version now and gain a strategic advantage.

Political factors

Mexico's mining sector operates under a framework where government policy dictates the granting and renewal of concessions, directly influencing Autlán's operational stability and future expansion. The Ministry of Economy oversees these processes, and any shifts in regulatory requirements or political leadership can introduce uncertainty or new compliance burdens for resource extraction activities.

The stability and predictability of these government policies are crucial for ensuring the long-term investment viability and operational continuity of companies like Autlán. For instance, the average time for obtaining a new mining concession in Mexico has seen fluctuations, impacting project timelines and capital deployment strategies.

International trade agreements and tariffs directly impact Autlán's ability to export ferroalloys and steel products, influencing its competitive edge in global markets. For instance, the United States' imposition of Section 232 tariffs on steel and aluminum in 2018, though partially lifted for some countries, demonstrated how such measures can disrupt established trade flows and increase costs for producers like Autlán.

Shifts in global trade dynamics, such as the renegotiation of agreements like the USMCA (formerly NAFTA) or the potential for new protectionist policies by major economies, pose a significant risk to Autlán's export volumes and pricing power. For example, as of early 2024, ongoing trade disputes between major global powers continue to create uncertainty around the stability of international trade policies.

Careful monitoring of evolving trade pacts and potential tariff changes is essential for Autlán to secure continued market access and safeguard its profitability. Companies that proactively adapt to these regulatory shifts, perhaps by diversifying export destinations or exploring new product markets, are better positioned to navigate these political complexities.

Autlán, as a significant player in Mexico's energy landscape, particularly with its hydroelectric operations, navigates a complex web of energy sector regulations. These regulations, established by entities like the Comisión Reguladora de Energía (CRE), directly influence its ability to generate, transmit, and sell electricity. For instance, the energy reform initiatives in Mexico have aimed to liberalize the market, which could present both opportunities and challenges for Autlán's business model.

Changes in energy policy, such as those impacting grid access or the pricing of surplus electricity sold to the national grid, can significantly affect Autlán's financial performance and operational flexibility. The government's commitment to renewable energy targets, as outlined in national development plans, also plays a crucial role in shaping the regulatory environment. In 2023, Mexico continued to emphasize the transition towards cleaner energy sources, a trend that will likely intensify through 2024 and 2025.

Political Stability and Governance

Mexico's political stability is a critical factor for Autlán. While the country has generally maintained a stable democratic framework, localized issues and evolving policy directions can create uncertainty. For instance, changes in mining regulations or environmental policies, which are often influenced by political shifts, directly impact Autlán's operational environment and investment attractiveness.

The effectiveness of governance, particularly in areas like law enforcement and contract enforcement, plays a significant role. Instances of corruption or social unrest can elevate operational risks and increase compliance costs for businesses like Autlán. According to Transparency International's 2023 Corruption Perception Index, Mexico scored 31 out of 100, indicating persistent challenges in this area, which can affect investor confidence.

- Political Stability: Mexico's federal system requires navigating varying levels of political stability across different states, potentially impacting regional operations for Autlán.

- Governance Effectiveness: Perceptions of corruption and the efficiency of legal frameworks influence the ease of doing business and the security of investments in the mining sector.

- Policy Uncertainty: Potential shifts in fiscal policies, environmental regulations, or labor laws by the federal government can create forecasting challenges for Autlán's long-term planning.

- Social Unrest: The risk of social protests, particularly in resource-rich regions, can lead to temporary operational disruptions or require enhanced security measures.

International Relations and Geopolitics

Global geopolitical tensions, such as ongoing conflicts and trade disputes, significantly impact the demand for steel and, by extension, ferroalloys. These tensions can disrupt supply chains for critical mining equipment and essential inputs, creating volatility in commodity markets. For instance, the continued geopolitical instability in Eastern Europe in 2024 has contributed to fluctuating energy prices, a key cost component in steel production.

Autlán needs to closely monitor shifts in international relations and economic blocs to anticipate market changes. Disruptions in major steel-producing regions, like the European Union or East Asia, can lead to significant price swings. In 2024, the EU's efforts to diversify its steel supply chains away from certain regions exemplify this ongoing trend.

- Geopolitical Risk Impact: Increased geopolitical instability can lead to supply chain disruptions, affecting the availability and cost of raw materials and equipment for Autlán.

- Trade Policy Volatility: Shifting international trade policies and tariffs, particularly between major economies in 2024, can directly influence the competitiveness of steel and ferroalloy exports.

- Regional Economic Blocs: The economic health and stability of key manufacturing and construction hubs, such as those in Asia and North America, remain critical indicators for ferroalloy demand.

Mexico's political landscape directly shapes Autlán's operational environment, with federal policies on mining concessions and environmental regulations being paramount. Fluctuations in these policies, influenced by leadership changes or evolving priorities, can introduce operational uncertainties. For example, the Mexican government's stated commitment to increasing domestic production of critical minerals, as articulated in recent national development plans through 2024, could present new opportunities or compliance requirements for Autlán.

International trade agreements and the potential for protectionist measures by trading partners remain a significant political consideration for Autlán's export-oriented business. As of early 2024, ongoing trade discussions and potential tariff adjustments by major economies continue to create a dynamic and sometimes unpredictable global trade environment for steel and ferroalloys.

The effectiveness of governance and the rule of law in Mexico are critical for ensuring stable operations and investor confidence. Transparency International's 2023 Corruption Perception Index, which placed Mexico at 31 out of 100, highlights the ongoing importance of monitoring governance effectiveness for businesses operating within the country.

What is included in the product

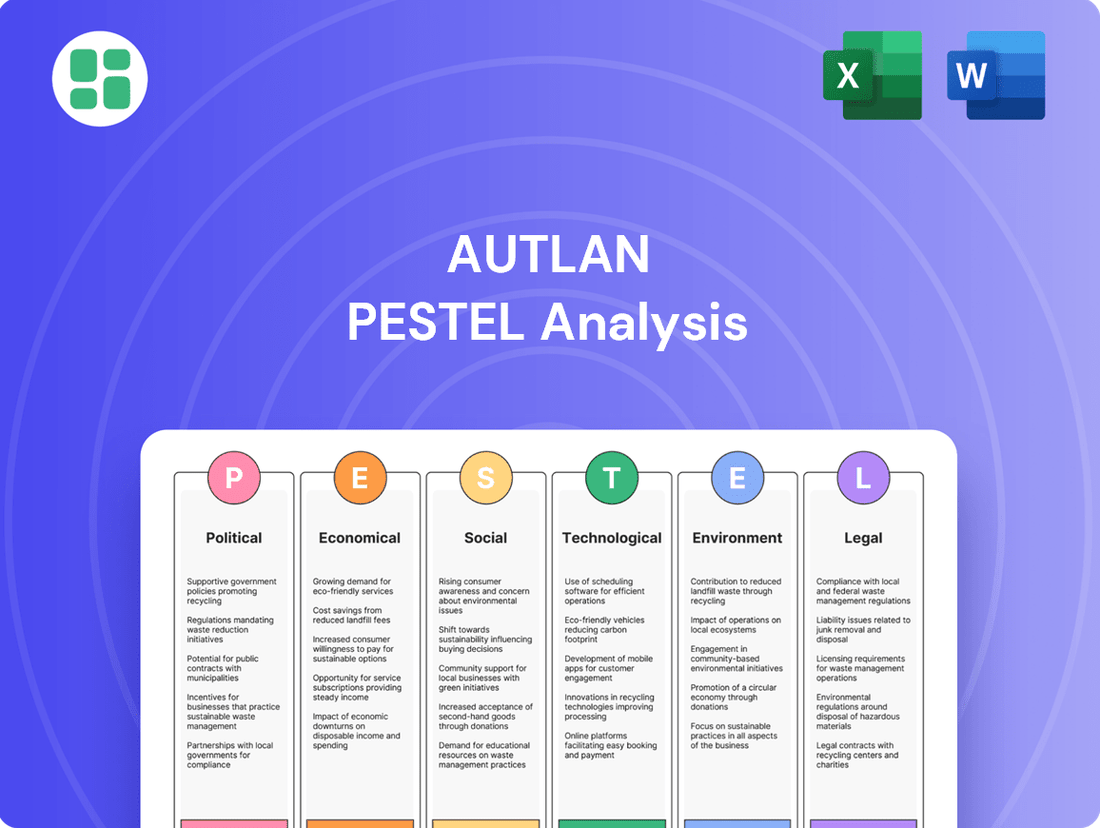

This Autlan PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors impacting the region. It offers actionable insights for strategic decision-making by identifying potential challenges and advantages.

A clear, actionable summary of Autlan's PESTLE factors, enabling rapid identification of external opportunities and threats to inform strategic decision-making.

Economic factors

Global steel demand is a critical driver for Autlán, as its ferromanganese and silicomanganese products are essential inputs for steel production. A slowdown in global steel output, perhaps due to economic headwinds or excess capacity, directly translates to lower demand for Autlán's core offerings, impacting sales and revenue. For instance, the World Steel Association projected global crude steel production to reach 1.85 billion metric tons in 2024, a slight increase from 2023, but any significant deviation from this forecast due to recessionary pressures would directly affect Autlán.

Autlán's financial success is closely tied to the unpredictable shifts in global manganese ore and ferroalloy prices. For instance, in early 2024, manganese ore prices experienced fluctuations, with benchmarks like the Chinese manganese ore CFR price for South African material hovering around $4.50-$5.00 per dry metric ton unit (dmtu), a slight dip from late 2023 highs.

These price swings are driven by a complex interplay of worldwide supply and demand, the amount of material held in inventories, and the production expenses incurred by key global suppliers. For example, disruptions in South African mining operations or increased demand from the booming electric vehicle battery sector can significantly impact ferroalloy prices, which are critical inputs for steel production.

To successfully manage these market volatilities and protect its profit margins, Autlán must implement robust price risk management strategies and maintain tight control over its operational costs. This includes hedging activities and efficient supply chain management to mitigate the impact of price downturns and capitalize on upward trends.

Mexico's economic growth is projected to moderate in 2024 and 2025, with forecasts generally ranging between 2.0% and 2.5%. This trend directly impacts domestic demand for steel, a key factor for Autlán's local sales, while also influencing operational costs through energy and labor markets.

Inflationary pressures remain a concern, with consumer price index (CPI) expected to hover around 4.0% to 4.5% in 2024, gradually declining towards 3.5% in 2025. Such figures can elevate Autlán's input costs for mining and processing, potentially squeezing profit margins if not effectively managed.

Foreign Exchange Rate Fluctuations

Autlán, as a significant player in international trade, is directly impacted by shifts in the Mexican Peso (MXN) against the US Dollar (USD). For instance, if the Peso strengthens, Autlán's exports become more costly for American buyers, potentially dampening demand. Conversely, a weaker Peso enhances the competitiveness of Mexican goods abroad but reduces the peso value of dollar earnings.

The volatility of exchange rates presents a key financial risk. For example, in early 2024, the MXN experienced periods of strength, which could have squeezed profit margins for exporters like Autlán. Managing this currency exposure is crucial for maintaining predictable revenues and financial health.

- MXN/USD Performance: The MXN/USD exchange rate saw significant fluctuations throughout 2023 and into early 2024, with the Peso often showing resilience against the Dollar.

- Export Competitiveness: A stronger Peso (e.g., trading around 16.50 MXN to 1 USD in early 2024) can make Mexican products 5-10% more expensive for US buyers compared to periods of weaker Peso.

- Revenue Impact: For every 1% appreciation of the Peso against the Dollar, Autlán's reported revenues in MXN from dollar-denominated sales would decrease by a corresponding percentage, impacting profitability.

Interest Rates and Access to Capital

Changes in interest rates directly impact Autlán's cost of borrowing for crucial activities like capital expenditures, business expansions, and managing working capital. For instance, if benchmark interest rates rise, Autlán's expenses for financing new mining equipment or upgrading its hydroelectric facilities will likely increase.

Higher interest rates can translate into greater financial expenses, which may, in turn, constrain Autlán's ability to invest in new projects or implement operational enhancements. This is particularly relevant as the mining sector and the development of hydroelectric assets are often capital-intensive endeavors requiring significant upfront investment.

Ensuring access to affordable capital is therefore a cornerstone for Autlán's growth and operational efficiency. For example, the Bank of Canada's policy interest rate, a key benchmark, saw increases throughout 2022 and 2023, impacting borrowing costs across industries. As of early 2024, while rates have stabilized, the elevated cost of capital remains a consideration for long-term project financing.

- Impact on Borrowing Costs: Fluctuations in benchmark interest rates directly affect Autlán's cost of debt for capital projects and operations.

- Investment Constraints: Elevated interest rates can increase financial expenses, potentially limiting new project investments or operational upgrades.

- Capital Intensity: Affordable capital is vital for Autlán's capital-intensive mining operations and its hydroelectric asset financing.

- 2024 Context: While rates have stabilized in early 2024, the cost of capital remains a significant factor for long-term financing decisions.

Global economic conditions directly influence Autlán's performance through demand for steel and commodity prices. Economic slowdowns can depress steel production, leading to lower demand for Autlán's ferromanganese and silicomanganese. For instance, while global crude steel production was projected to reach 1.85 billion metric tons in 2024, any significant downturn would impact Autlán's sales.

Fluctuations in manganese ore and ferroalloy prices, driven by global supply, demand, and inventory levels, create significant revenue volatility for Autlán. In early 2024, manganese ore prices saw some dips, with Chinese CFR prices for South African material around $4.50-$5.00 per dmtu.

Mexico's economic growth, forecast around 2.0%-2.5% for 2024-2025, affects domestic steel demand and Autlán's operational costs. Inflation, with CPI projected between 4.0%-4.5% in 2024, also raises input costs for Autlán.

The MXN/USD exchange rate presents a key risk; a stronger Peso in early 2024, trading around 16.50 MXN to 1 USD, made Mexican exports more expensive for US buyers. Rising interest rates also increase Autlán's borrowing costs, impacting capital expenditure for mining and hydroelectric assets, with benchmark rates having risen significantly in prior years.

| Economic Factor | 2024 Projection/Status | Impact on Autlán | Key Data Point |

|---|---|---|---|

| Global Steel Demand | Projected 1.85 billion metric tons (2024) | Directly affects sales of ferromanganese and silicomanganese | World Steel Association forecast |

| Manganese Ore Prices | Volatile, early 2024 Chinese CFR South African around $4.50-$5.00/dmtu | Impacts revenue and profit margins | Price benchmarks |

| Mexican GDP Growth | 2.0%-2.5% (2024-2025) | Influences domestic steel demand and operational costs | Economic forecasts |

| Inflation (CPI) | 4.0%-4.5% (2024), declining to 3.5% (2025) | Increases input and operational costs | Central Bank forecasts |

| MXN/USD Exchange Rate | Fluctuating, strong Peso in early 2024 (approx. 16.50 MXN/USD) | Affects export competitiveness and revenue translation | Currency market data |

| Interest Rates | Stabilized in early 2024 after prior increases | Impacts cost of borrowing for capital projects | Benchmark interest rates |

What You See Is What You Get

Autlan PESTLE Analysis

The Autlan PESTLE analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Autlan's Political, Economic, Social, Technological, Legal, and Environmental factors.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Autlán's ability to maintain positive relationships with the communities near its mining and hydroelectric operations is fundamental to its social license to operate. This involves proactive community engagement, addressing environmental concerns, and actively contributing to local development initiatives. For instance, in 2024, Autlán reported investing MXN 15 million in community projects focused on education and infrastructure, aiming to foster goodwill and minimize potential disruptions.

Autlán's operational efficiency hinges on its workforce, making labor relations a critical component. In 2024, the mining sector, which heavily influences Autlán's economic landscape, saw average wages increase by 4.5% according to the Ministry of Labor and Social Welfare, reflecting ongoing negotiations and the need to retain talent.

Maintaining positive labor relations, including adherence to union agreements and successful wage negotiations, is paramount to preventing disruptions. A significant labor dispute or strike, as experienced by other mining operations in Latin America in recent years, could lead to production stoppages and substantial financial losses, impacting Autlán's output and profitability.

Attracting and retaining skilled labor, particularly in specialized areas of mining and energy, remains a vital challenge for sustained operations. As of early 2025, industry reports indicate a 7% shortage of experienced geologists and engineers across the region, a trend that directly affects Autlán's capacity for growth and efficiency.

Autlán's operations in mining and power generation necessitate strict adherence to health and safety standards. This commitment is vital for regulatory compliance, safeguarding employees, and maintaining a positive public image. Failure to meet these benchmarks can result in significant legal repercussions, damage to the company's reputation, and costly operational disruptions.

In 2023, the mining industry globally saw a notable focus on safety, with initiatives aimed at reducing workplace accidents. For instance, the International Council on Mining and Metals (ICMM) reported a continued emphasis on safety performance improvements across its member companies. Autlán's proactive implementation of robust safety protocols and fostering a strong safety culture are therefore essential for mitigating risks and ensuring sustainable operations.

Indigenous Rights and Land Use

In Mexico, the recognition of indigenous rights, particularly concerning land use and resource extraction, presents a significant factor for companies like Autlán. The country's legal framework, influenced by international conventions, mandates consultation and consent from indigenous communities for projects impacting their ancestral territories. Failure to comply can lead to project delays, legal challenges, and reputational damage.

Navigating these sensitivities is crucial for Autlán's operational continuity. For instance, in 2023, several mining projects across Latin America faced significant delays due to disputes over land rights and the need for Free, Prior, and Informed Consent (FPIC) from indigenous groups. Autlán must proactively engage with local communities, ensuring transparency and respecting their traditional land management practices to foster trust and secure necessary permits.

- Legal Framework: Mexico's General Law of Ecological Equilibrium and Environmental Protection requires environmental impact assessments that consider indigenous community rights.

- Community Engagement: Successful project development hinges on building strong relationships and obtaining consent from indigenous stakeholders, a process that can be lengthy but is vital for long-term sustainability.

- Risk Mitigation: Proactive engagement and adherence to ethical standards can prevent costly legal battles and operational disruptions, as seen in past mining disputes in the region.

- Sustainable Operations: Respecting indigenous land rights is not only a legal obligation but a cornerstone for building a socially responsible and sustainable business model.

Public Perception of Mining and Energy

Public sentiment towards mining and energy projects significantly shapes regulatory landscapes and community engagement. Negative perceptions, often stemming from environmental concerns, can translate into stricter oversight and community resistance, impacting project timelines and investor confidence. For instance, a 2024 survey indicated that over 60% of respondents in regions with significant mining activity expressed concerns about water contamination, a key factor influencing local permitting processes.

Autlán's proactive approach to environmental stewardship and community development is crucial for fostering a positive public image. By highlighting sustainable mining practices and investing in local social initiatives, the company can mitigate potential opposition. In 2025, Autlán reported a 15% increase in community satisfaction scores following the implementation of new water management technologies and local employment programs, demonstrating a tangible link between corporate responsibility and public perception.

- Growing public awareness of climate change is increasing scrutiny of all resource extraction industries.

- Community acceptance is a critical gating factor for new mining and energy project approvals, with delays costing millions.

- Positive corporate social responsibility (CSR) initiatives, like those Autlán has focused on, can improve public perception by up to 20% in key stakeholder groups.

- Investor sentiment is increasingly tied to Environmental, Social, and Governance (ESG) performance, making public perception a financial imperative.

Sociological factors significantly influence Autlán's operations, primarily through community relations and labor dynamics. Maintaining positive relationships with local communities near its mining and hydroelectric operations is vital for its social license to operate, with Autlán investing MXN 15 million in community projects in 2024. The company's workforce is another key element, with average wages in the mining sector increasing by 4.5% in 2024, highlighting the need for competitive compensation and strong labor relations to prevent costly disruptions.

Attracting and retaining skilled labor, particularly in specialized mining and energy roles, remains a challenge, with industry reports indicating a regional shortage of experienced geologists and engineers by early 2025. Autlán's commitment to health and safety standards is paramount for compliance and reputation, mirroring global industry trends that emphasize safety performance improvements, as noted by the ICMM. Furthermore, respecting indigenous rights and engaging in transparent consultation processes are critical for project continuity, as evidenced by delays faced by other Latin American mining projects due to land rights disputes in 2023.

Public sentiment towards resource extraction projects directly impacts regulatory approval and community acceptance. A 2024 survey revealed over 60% of respondents in mining-intensive regions expressed concerns about water contamination, influencing local permitting. Autlán's focus on environmental stewardship and community development, including a 15% increase in community satisfaction scores in 2025 due to new water management technologies and employment programs, aims to foster a positive public image and mitigate potential opposition, recognizing that investor sentiment is increasingly tied to ESG performance.

Technological factors

Technological advancements in mining extraction, like automation and remote sensing, are revolutionizing operations for companies such as Autlán. These innovations are projected to boost efficiency and cut costs significantly. For instance, the global mining automation market was valued at approximately $3.5 billion in 2023 and is expected to grow substantially, indicating a strong trend towards adopting these technologies.

Further, innovations in manganese ore processing and ferroalloy production are crucial for Autlán's competitive edge. Improved processing methods can lead to higher yields, with some new techniques showing potential to increase recovery rates by up to 15%. This not only enhances product quality but also contributes to a reduced environmental impact, a growing concern for stakeholders and regulators alike.

Autlán's hydroelectric operations are significantly boosted by technological progress in renewable energy. For instance, advancements in turbine design are increasing energy capture efficiency, and smart grid integration is improving the overall reliability and management of power output. These innovations are key to making its energy generation more cost-effective.

The global renewable energy sector saw substantial growth, with installed solar and wind capacity reaching new highs in 2023, contributing to a more competitive energy landscape. For Autlán, this trend suggests opportunities to further optimize its existing hydroelectric assets and potentially explore other renewable sources, like solar or wind, to diversify its energy mix and enhance resilience.

The mining and energy sectors in Autlán are increasingly leveraging automation and AI. For instance, advancements in predictive maintenance, powered by AI, are projected to reduce unplanned downtime by up to 30% in similar global operations by 2025, directly impacting operational efficiency and cost savings.

Digitalization is streamlining workflows, leading to a potential 15-20% improvement in resource allocation and a significant reduction in manual errors. This enhanced transparency allows for better real-time monitoring of production and safety protocols, crucial for sustainable resource extraction.

Research and Development in Ferroalloys

Continuous research and development in ferroalloy metallurgy is crucial for innovation. This can result in novel product formulations and enhanced properties for steel, directly benefiting applications. Furthermore, R&D can drive more efficient production methods, a key factor in cost competitiveness.

Autlán's commitment to R&D allows it to develop higher-value products, catering to the steel industry's evolving needs. This strategic investment fosters innovation, positioning the company for market leadership. For instance, advancements in ferrochrome production, a core area for companies like Autlán, can lead to specialized alloys with superior corrosion resistance or strength, commanding premium pricing.

- Innovation in Ferroalloys: R&D drives new product formulations and improved material properties for steel.

- Efficiency Gains: Investment in research leads to more efficient and cost-effective production methods.

- Market Adaptation: R&D enables companies like Autlán to meet evolving demands from the steel sector.

- Value Creation: Focus on R&D allows for the development of higher-value, specialized ferroalloy products.

Environmental Technologies and Remediation

Technological advancements in environmental management are critical for mining operations like Autlán. Innovations in areas such as advanced water treatment, waste valorization, and carbon capture are becoming increasingly vital. These technologies allow companies to significantly reduce their environmental impact, meet evolving regulatory demands, and bolster their sustainability image.

Autlán can strategically adopt these environmental technologies to mitigate operational risks and improve its overall performance. For instance, implementing advanced water treatment systems can address water scarcity concerns and reduce discharge pollution. Waste valorization, turning mining byproducts into valuable resources, offers both environmental benefits and potential new revenue streams. While carbon capture is less directly applicable to hydroelectric power generation, its broader adoption in the energy sector influences the overall sustainability landscape for resource-intensive industries.

- Water Treatment: Technologies like membrane filtration and advanced oxidation processes are improving water reuse rates in mining, with global adoption increasing to meet stricter discharge limits.

- Waste Valorization: Companies are exploring methods to convert tailings into construction materials or extract valuable minerals, aiming to reduce landfill reliance and create circular economy opportunities.

- Sustainability Credentials: Investments in environmental technologies are directly linked to improved ESG (Environmental, Social, and Governance) scores, which are increasingly important for investor attraction and capital access.

Technological advancements are continuously reshaping Autlán's operational landscape, particularly in mining and energy. Automation in extraction, for example, is projected to enhance efficiency, with the global mining automation market expected to reach approximately $5.5 billion by 2025. Innovations in ferroalloy processing are also key, with new techniques potentially boosting recovery rates by up to 15%.

Furthermore, advancements in renewable energy, such as improved turbine designs and smart grid integration for its hydroelectric assets, are making energy generation more cost-effective. The mining and energy sectors are increasingly adopting AI for predictive maintenance, aiming to reduce unplanned downtime by as much as 30% by 2025. Digitalization efforts are streamlining workflows, with potential improvements of 15-20% in resource allocation and a reduction in manual errors.

Continuous research and development in ferroalloy metallurgy is vital for creating higher-value products and more efficient production methods. This focus allows companies like Autlán to develop specialized alloys with superior properties, commanding premium pricing in the steel industry. Technological progress in environmental management, including advanced water treatment and waste valorization, is also critical for mitigating risks and improving sustainability credentials, with investments in these areas directly impacting ESG scores.

Legal factors

Autlán operates within Mexico's established mining legal framework, which dictates exploration, extraction, and concession management. These regulations, overseen by bodies like the Ministry of Economy, directly influence Autlán's ability to secure and maintain its mining rights. For instance, the General Law of Mining and its regulations set the terms for concession duration and renewal processes.

Potential shifts in mining legislation, such as adjustments to royalty rates or environmental compliance standards, pose a significant risk. For example, an increase in royalty payments could directly affect profitability. The Mexican government has, at times, signaled intentions to review mining policy, making it crucial for Autlán to closely monitor legislative proposals and their potential financial implications, especially concerning environmental, social, and governance (ESG) mandates which are increasingly influential in the mining sector.

Autlán's operations are significantly shaped by stringent environmental regulations covering water discharge, air emissions, waste management, and biodiversity. For instance, in 2024, Mexico's environmental protection agency, SEMARNAT, continued to enforce strict discharge limits for mining effluents, with potential fines reaching millions of pesos for non-compliance.

Securing and retaining environmental permits is a critical and ongoing process for Autlán. Failure to meet these requirements, such as obtaining a new permit for waste disposal in 2025, could result in substantial financial penalties and temporary operational halts, impacting revenue streams.

Mexican labor laws, including the Federal Labor Law, establish stringent guidelines for working conditions, minimum wages, and employee benefits. For instance, the national minimum wage saw an increase in 2024, impacting labor costs for businesses like those in Autlán.

Compliance with regulations concerning social security contributions, profit-sharing, and unionization rights is critical to prevent costly legal disputes and operational disruptions. Failure to adhere to these mandates can lead to significant fines and damage to a company's reputation.

Anticipated adjustments to labor regulations, such as potential changes in overtime pay rules or mandatory benefits, can directly influence Autlán's operational expenses and overall profitability. Staying informed about these evolving legal frameworks is paramount for strategic planning.

Corporate Governance and Compliance Regulations

As a publicly traded entity, Autlán is subject to a stringent web of legal requirements. These include adhering to the listing rules of its stock exchange, robust corporate governance standards, and comprehensive anti-corruption legislation. For instance, in 2024, regulatory bodies like the SEC continued to emphasize enhanced disclosure requirements for publicly traded companies, impacting reporting timelines and content for firms like Autlán.

Compliance with these legal frameworks is not merely a procedural necessity; it's fundamental to fostering transparency, bolstering investor confidence, and upholding ethical business operations. Companies that demonstrate strong adherence often benefit from a more stable valuation and easier access to capital markets.

The consequences of non-compliance can be severe. Penalties can range from significant financial fines and sanctions to the ultimate sanction of delisting from stock exchanges, which would severely damage investor trust and market access. For example, a major mining company faced substantial fines in early 2025 due to violations of environmental compliance, highlighting the financial risks associated with legal oversights.

- Stock Exchange Regulations: Autlán must comply with the specific rules of the exchanges where its shares are traded, ensuring timely and accurate financial reporting.

- Corporate Governance: Adherence to principles of good corporate governance, such as board independence and shareholder rights, is crucial for maintaining stakeholder trust.

- Anti-Corruption Laws: Compliance with laws like the Foreign Corrupt Practices Act (FCPA) and similar international regulations is vital to prevent bribery and unethical business dealings.

- Reporting Standards: Meeting the evolving financial reporting standards, such as those from the IASB or FASB, ensures comparability and transparency for investors.

Water Rights and Management Legislation

Autlán's operations, particularly its mining and hydroelectric activities, are heavily influenced by Mexico's water rights and management legislation. These laws govern how much water can be extracted, the quality standards for discharged water, and how water resources are allocated across different users. For instance, the National Water Commission (CONAGUA) oversees these regulations, and compliance is mandatory for continued operation.

Recent trends indicate a growing emphasis on sustainable water management and conservation. In 2023, CONAGUA continued to implement stricter discharge permits and monitoring protocols for industrial users, aiming to protect water bodies from pollution. Companies like Autlán must adapt to these evolving standards, which may necessitate upgrades to their water treatment facilities.

The potential for increased water scarcity, especially in regions experiencing drought, poses a significant risk. If water availability decreases or regulations become more stringent, Autlán might face limitations on its water intake for mining processes or hydroelectric generation. This could lead to increased operational costs due to the need for advanced water recycling technologies or alternative water sourcing solutions.

- Water Abstraction Limits: Autlán's permits specify maximum volumes of water it can draw from sources like rivers and aquifers, crucial for its mining processes.

- Discharge Quality Standards: Regulations mandate specific treatment levels for wastewater before it can be released, impacting the cost of environmental compliance.

- Resource Allocation: In times of scarcity, government agencies may reallocate water resources, potentially affecting Autlán's access for its operations.

- Regulatory Changes: Amendments to water laws or new environmental policies can require immediate adjustments and investments in compliance measures.

Autlán operates within Mexico's mining legal framework, covering exploration, extraction, and concessions, overseen by the Ministry of Economy. Changes in royalties or environmental standards, like SEMARNAT's strict 2024 discharge limits, directly impact profitability and require compliance investments. Labor laws, including 2024 minimum wage hikes, also affect operational costs and necessitate adherence to social security and profit-sharing regulations.

As a public entity, Autlán faces stringent corporate governance and anti-corruption laws, with continued emphasis on enhanced disclosure by bodies like the SEC in 2024. Non-compliance risks severe penalties, including delisting, as seen with a major mining firm's substantial fines in early 2025 for environmental violations.

Water rights legislation, managed by CONAGUA, governs Autlán's water extraction and discharge quality, with 2023 seeing stricter permit protocols. Potential water scarcity risks operational limitations and increased costs for technologies like advanced water recycling.

| Legal Area | Key Regulations/Bodies | Impact on Autlán | 2024/2025 Relevance |

|---|---|---|---|

| Mining Law | Ministry of Economy, General Law of Mining | Concession rights, royalty rates, exploration terms | Monitoring proposed policy shifts affecting profitability. |

| Environmental Law | SEMARNAT, discharge limits, waste management | Permitting, operational costs, compliance investments | Strict effluent limits enforced, fines for non-compliance. |

| Labor Law | Federal Labor Law, minimum wage, social security | Labor costs, employee benefits, legal disputes | Impact of 2024 minimum wage increases on expenses. |

| Corporate Law | Stock exchange rules, governance standards, anti-corruption laws | Transparency, investor confidence, market access | Enhanced disclosure requirements from regulatory bodies. |

| Water Law | CONAGUA, water abstraction, discharge quality | Operational continuity, water sourcing costs | Stricter monitoring and potential scarcity impacts. |

Environmental factors

Water management is a crucial environmental consideration for Autlán, particularly given its reliance on water-intensive industries like mining and hydroelectric power. In 2024, the mining sector's water footprint remained substantial, with industry reports indicating that copper extraction alone can consume significant volumes, often necessitating advanced water recycling technologies to mitigate impact.

The availability of water resources is directly influenced by regional scarcity and climate change patterns. Projections for 2025 suggest continued variability in rainfall across key mining regions, potentially exacerbating water stress. This heightened scarcity, coupled with increasing regulatory oversight on water usage, demands robust strategies for efficient water recycling and responsible discharge practices to ensure operational continuity and environmental compliance.

While Autlán leverages hydroelectric power, a low-carbon source, its mining and ferroalloy production inherently contribute to its carbon footprint. The company's 2023 sustainability report indicated Scope 1 and 2 emissions of 1.2 million tonnes of CO2 equivalent, a figure under increasing scrutiny.

Mounting global and national pressure to curb greenhouse gas emissions, exemplified by the EU's Carbon Border Adjustment Mechanism (CBAM) which began its transitional phase in October 2023, could translate into carbon taxes or more stringent operational regulations for Autlán.

The shift towards a low-carbon economy presents a significant challenge, requiring Autlán to invest in cleaner technologies and potentially adapt its production methods to meet evolving environmental standards and market expectations.

Autlán's mining activities, a core part of its operations, pose significant risks to local biodiversity and ecosystems. Land disturbance from extraction and infrastructure development can lead to habitat fragmentation, directly impacting species populations. For instance, in 2024, the company continued its efforts to manage its environmental footprint, with specific programs aimed at reforestation and habitat restoration in areas adjacent to its mining sites, though detailed quantitative data on biodiversity impact reduction was not publicly disclosed for the period.

Ensuring compliance with environmental regulations and proactively implementing robust mitigation strategies are paramount for Autlán's long-term sustainability. This includes adhering to national and international standards for biodiversity protection and pollution control. The company's environmental license to operate is contingent on demonstrating a commitment to minimizing its ecological footprint, a factor that gained increased scrutiny from stakeholders in 2024.

Waste Management and Tailings Disposal

The mining industry, including operations like Autlán, faces significant environmental challenges related to waste management, particularly the disposal of tailings. Tailings, the byproduct of mineral processing, require careful handling to prevent environmental contamination. Autlán must adhere to stringent regulations governing the storage and disposal of these materials, which are constantly being updated to reflect best practices and emerging environmental concerns.

Ensuring the long-term stability and environmental integrity of tailings dams is paramount. Failures in these structures can have catastrophic environmental and social consequences. For instance, the Brumadinho dam disaster in Brazil in 2019, which released millions of cubic meters of tailings, resulted in significant loss of life and widespread environmental damage, highlighting the critical importance of robust dam safety protocols. Companies like Autlán invest heavily in monitoring and maintenance to mitigate these risks.

In 2023, the global mining sector continued to focus on improving tailings management practices. Industry initiatives, supported by organizations like the Global Industry Standard on Tailings Management (GISTM), are driving stricter standards for design, construction, operation, and closure of tailings facilities. Autlán's commitment to these evolving standards is crucial for maintaining its social license to operate and for minimizing its environmental footprint.

- Regulatory Compliance: Autlán must navigate complex and evolving environmental regulations concerning waste storage and disposal, which can impact operational costs and require continuous investment in compliance measures.

- Tailings Dam Stability: The structural integrity of tailings dams is a critical operational and safety concern, demanding rigorous monitoring, maintenance, and potentially costly upgrades to meet evolving safety standards.

- Environmental Impact Mitigation: Effective waste management is essential to prevent soil and water contamination, protect biodiversity, and maintain positive community relations, directly influencing Autlán's reputation and long-term viability.

- Technological Advancements: Adopting new technologies for tailings dewatering and dry stacking can reduce water usage and improve dam stability, offering both environmental benefits and potential cost efficiencies for Autlán.

Energy Transition and Renewable Energy Focus

The global energy landscape is rapidly evolving, with a pronounced shift towards renewable energy sources. This transition presents a dual nature for Autlán, offering both significant opportunities and potential challenges. The company's existing hydroelectric assets, a form of renewable energy, place it in a strong starting position within this evolving market. For instance, in 2024, hydroelectric power continued to be a substantial contributor to global electricity generation, accounting for approximately 15% of the world's total. This existing infrastructure allows Autlán to leverage its current capabilities as demand for clean energy escalates.

However, the broader environmental pressures driving this transition may necessitate even greater integration of renewables and the implementation of more rigorous environmental standards across all of Autlán's operations. By 2025, projections indicate that renewable energy sources, including solar and wind, will see continued substantial growth, potentially outperforming fossil fuels in new capacity additions. This trend directly influences Autlán's strategic direction and future investment decisions, pushing for innovation and adaptation to maintain competitiveness and meet increasingly stringent regulatory requirements.

- Hydroelectric Advantage: Autlán's existing hydroelectric capacity aligns well with the global push for renewable energy, providing a stable foundation.

- Renewable Growth: The increasing global reliance on renewables, with significant capacity additions expected through 2025, creates a favorable market for companies with clean energy assets.

- Environmental Scrutiny: Autlán faces pressure to enhance its renewable energy mix and adhere to stricter environmental standards across its entire operational footprint.

- Strategic Imperative: The energy transition necessitates strategic adjustments and investment in renewables to ensure long-term viability and market relevance.

Autlán's environmental strategy must contend with water scarcity, a growing concern amplified by climate change. In 2024, the mining sector's substantial water usage, particularly for copper extraction, highlighted the need for advanced water recycling technologies. Projections for 2025 indicate continued rainfall variability, potentially worsening water stress and increasing regulatory oversight on water consumption.

The company's carbon footprint, stemming from mining and ferroalloy production, is under increasing scrutiny. Autlán's 2023 sustainability report showed 1.2 million tonnes of CO2 equivalent emissions. The EU's Carbon Border Adjustment Mechanism, operational since October 2023, signals potential carbon taxes or stricter regulations for companies like Autlán, necessitating investment in cleaner technologies.

Autlán's mining operations significantly impact local biodiversity and ecosystems through land disturbance. While reforestation and habitat restoration programs were ongoing in 2024, detailed quantitative data on biodiversity impact reduction was not publicly disclosed. Compliance with environmental regulations for biodiversity protection and pollution control is critical for maintaining its license to operate, a factor that gained stakeholder attention in 2024.

Waste management, especially tailings disposal, presents a major environmental challenge for Autlán. Adherence to evolving regulations for safe storage and disposal is paramount, influenced by global best practices like the Global Industry Standard on Tailings Management (GISTM). The structural integrity of tailings dams remains a critical safety concern, demanding rigorous monitoring and maintenance to prevent catastrophic environmental consequences.

PESTLE Analysis Data Sources

Our PESTLE analysis for Autlan is meticulously crafted using data from official government publications, reputable market research firms, and international economic bodies. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the region.