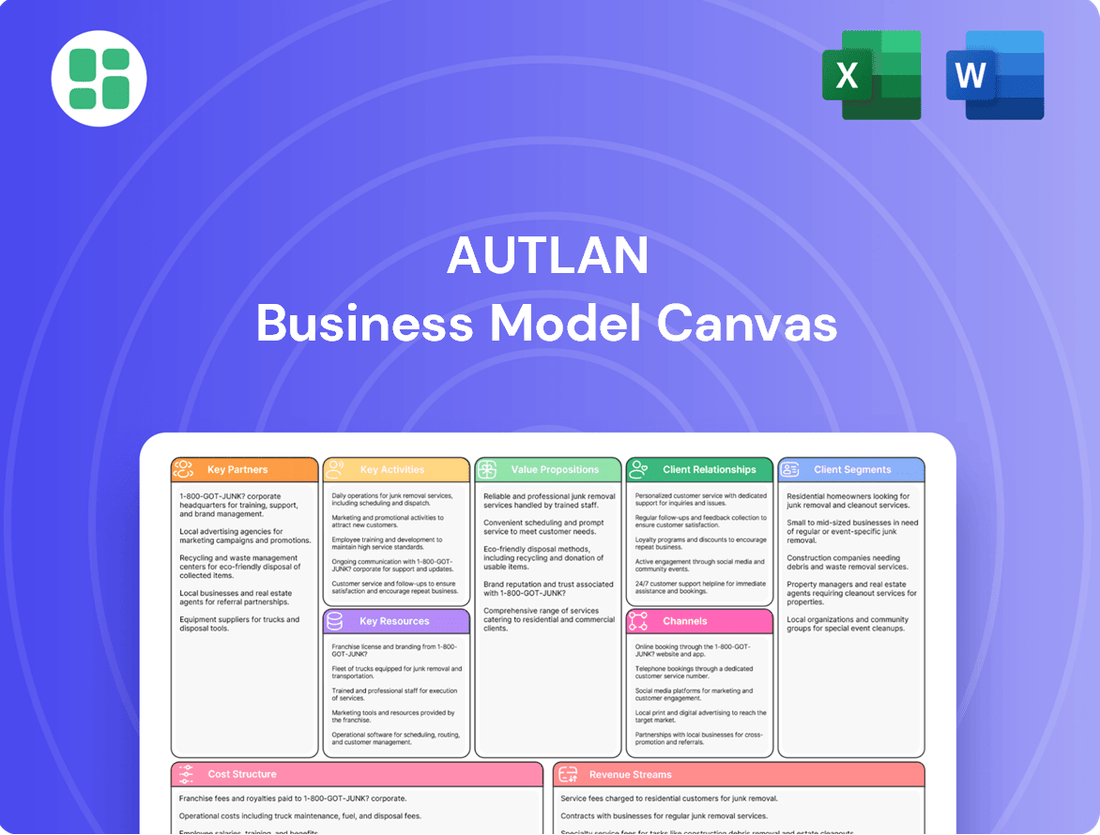

Autlan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autlan Bundle

Curious about Autlan's winning formula? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the complete, editable template to gain a competitive edge.

Partnerships

Autlán's core partnerships are with major global and regional steel manufacturers. These clients rely on Autlán for essential ferroalloys, critical components that significantly improve steel's strength, hardness, and corrosion resistance. For instance, in 2024, the global steel industry produced approximately 1.8 billion tonnes, highlighting the immense demand for these raw materials.

The company cultivates robust business-to-business relationships, ensuring these industrial giants receive a consistent and dependable supply of high-quality ferroalloys. This reliability is paramount for their continuous production cycles, making Autlán a vital link in their supply chain.

Autlan's key partnerships with technology and equipment suppliers are vital for maintaining operational excellence and driving innovation. These collaborations provide access to advanced mining equipment, crucial for efficient extraction of resources like manganese. For instance, partnerships ensure the sourcing of specialized machinery necessary for manganese ore dressing plants, enabling the production of various mineral grades tailored to market demands.

Furthermore, securing partnerships with suppliers of ferroalloy production technology is paramount. This allows Autlan to integrate cutting-edge processes for transforming raw materials into high-value ferroalloys, a core component of their business. These relationships also extend to suppliers of hydroelectric power plant components, supporting Autlan's commitment to sustainable and cost-effective energy generation for its operations.

Autlán's operations rely heavily on logistics and transportation providers to move manganese ore from its mines to processing facilities and then deliver finished ferroalloys and electricity to customers. In 2024, the company continued to leverage partnerships with various shipping, rail, and trucking firms to ensure efficient and cost-effective supply chain management.

These strategic alliances are crucial for Autlán's ability to meet delivery schedules and manage transportation expenses, which directly impact profitability. The company's integrated approach includes its own private sea terminal, facilitating direct trading operations and further optimizing its logistics network.

Government and Regulatory Bodies

Autlán's engagement with government and regulatory bodies is foundational for its mining and energy operations. Securing and retaining mining concessions, environmental permits, and electricity generation licenses hinges on these crucial collaborations. This ensures adherence to national and international standards, fostering responsible and sustainable practices throughout its business.

These partnerships are vital for maintaining operational legitimacy and demonstrating commitment to good corporate citizenship. Autlán's consistent recognition as a Socially Responsible Enterprise for 16 consecutive years underscores the effectiveness of these relationships in upholding high operational and ethical benchmarks.

- Mining Concessions: Essential for legal extraction rights.

- Environmental Permits: Ensuring compliance with ecological regulations.

- Electricity Generation Licenses: Authorizing power production for operations.

- Regulatory Compliance: Adherence to national and international laws.

Local Communities and Stakeholders

Autlán actively cultivates strong ties with local communities surrounding its mining and power plant operations, recognizing this as fundamental for maintaining its social license and promoting sustainable growth. In 2024, the company continued its commitment to corporate social responsibility through targeted initiatives designed to enhance community well-being and foster trust.

These efforts include significant investments in environmental stewardship, such as reforestation projects, and the development of essential infrastructure, directly benefiting the residents who live and work near Autlán's facilities. For instance, in 2024, Autlán reported the planting of over 50,000 trees across various reforestation programs, contributing to biodiversity and local environmental health.

- Community Investment: Autlán's 2024 CSR budget allocated substantial funds towards local infrastructure improvements, including road upgrades and water system enhancements in communities adjacent to its operations.

- Environmental Programs: The company's reforestation efforts in 2024 focused on restoring over 100 hectares of land impacted by previous mining activities.

- Stakeholder Engagement: Regular dialogue sessions with community leaders and local organizations were conducted throughout 2024 to ensure alignment on development priorities and address concerns proactively.

Autlán's key partnerships extend to financial institutions and investors who provide the capital necessary for its extensive mining and energy operations. These relationships are crucial for funding exploration, infrastructure development, and ongoing operational expenses. For instance, in 2024, Autlán secured significant financing to bolster its expansion projects, demonstrating the confidence of its financial partners.

The company also engages with research institutions and universities to stay at the forefront of technological advancements in mining and metallurgy. These collaborations facilitate the adoption of innovative practices, improving efficiency and sustainability. For example, joint research projects in 2024 focused on optimizing manganese extraction and processing techniques.

Autlán's strategic alliances with raw material suppliers, beyond its primary ferroalloy clients, are also vital. These partnerships ensure a steady supply of essential inputs for its processing plants, complementing its own resource extraction. This diversified supplier base mitigates risks and ensures production continuity.

What is included in the product

A detailed Autlan Business Model Canvas that outlines customer segments, value propositions, and channels, providing a clear strategic roadmap.

This comprehensive model, structured around the 9 classic BMC blocks, offers deep insights and analysis for informed decision-making and stakeholder communication.

The Autlan Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that helps entrepreneurs and established businesses pinpoint and address operational inefficiencies and strategic gaps.

Activities

Autlán's key activity centers on the exploration and extraction of manganese ore from its Mexican mining operations, notably at Molango and Naopa. This process is fundamental to supplying the raw materials needed for its ferroalloy production, ensuring a consistent output.

As the leading producer of manganese ore in North and Central America, Autlán's extraction capabilities are critical. In 2024, the company continued its focus on efficient and responsible mining to maintain its market position and secure its supply chain.

Autlán's core activity involves transforming its mined manganese ore into essential ferroalloys like ferromanganese and silicomanganese. These materials are crucial for the steelmaking process, acting as key ingredients that enhance steel's strength and durability.

The company operates three specialized ferroalloy plants in Mexico, employing advanced metallurgical techniques to produce high-quality products. In 2023, Autlán reported ferroalloy sales of 223,588 tonnes, demonstrating their significant production capacity and market presence.

Autlán's key activity involves generating electricity through its hydroelectric power plants, like the Atexcaco Hydroelectric Station. This not only ensures the company's energy self-sufficiency but also provides a valuable revenue stream through sales to third parties.

This dual approach to electricity generation significantly boosts Autlán's operational resilience. For instance, in 2023, the company reported that its hydroelectric power generation contributed to a reduction in energy costs, showcasing the direct financial benefit of this activity.

Looking ahead, Autlán has strategic plans to further expand its power generation capacity. This expansion is a crucial element of their long-term strategy to enhance energy security and capitalize on growing demand for clean energy resources.

Research and Development

Autlán's commitment to research and development is a cornerstone of its strategy, focusing on enhancing mining techniques and the quality of its ferroalloy products. This continuous investment is vital for optimizing energy efficiency across its operations, ensuring a more sustainable and cost-effective production process.

Innovation stemming from R&D allows Autlán to stay ahead in a competitive market and identify new opportunities. For instance, the company is actively exploring specialized manganese applications, such as those required for the growing battery and ceramics industries, demonstrating a forward-looking approach to market diversification.

- Investment in R&D: Autlán prioritizes ongoing investment in research and development to refine its mining processes and improve ferroalloy quality.

- Energy Efficiency: A key focus of R&D is optimizing energy consumption, contributing to both cost savings and environmental responsibility.

- Market Expansion: R&D efforts are directed towards exploring new market segments, including the demand for specialized manganese in battery and ceramic manufacturing.

- Competitive Edge: Continuous innovation through R&D is essential for Autlán to maintain its competitive advantage in the global ferroalloy market.

Sales and Distribution

Autlán’s sales and distribution efforts focus on effectively marketing, selling, and delivering ferroalloys and electricity to a global customer base. This critical function involves nurturing client relationships, securing favorable contracts, and ensuring efficient logistics to meet diverse market needs. The company's reach extends significantly, with exports to more than 10 countries, underscoring its international market presence.

In 2024, Autlán continued to strengthen its distribution network, aiming for consistent product availability and customer satisfaction. The company’s strategy emphasizes building long-term partnerships and adapting to evolving global demand for its specialized products. This proactive approach is crucial for maintaining competitive positioning in the international ferroalloy market.

- Autlán exports ferroalloys and electricity to over 10 countries.

- Key activities include marketing, sales, and managing customer relationships.

- Ensuring timely product delivery is a core component of the distribution strategy.

- Contract negotiation and international logistics are vital for global reach.

Autlán's key activities encompass the entire value chain, from mining manganese ore to producing essential ferroalloys and generating hydroelectric power. This integrated approach allows for greater control over supply, quality, and costs.

The company's mining operations are central, supplying raw materials for its ferroalloy production. Simultaneously, its hydroelectric power generation provides energy security and an additional revenue stream.

Research and development are crucial for innovation, focusing on process optimization, product enhancement, and exploring new market applications for manganese.

Finally, robust sales and distribution networks ensure Autlán's products reach a global customer base, supported by strong client relationships and efficient logistics.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Mining & Extraction | Exploration and extraction of manganese ore. | Core supply for ferroalloy production; market leadership in North/Central America. |

| Ferroalloy Production | Transformation of manganese ore into ferromanganese and silicomanganese. | Supplies essential materials for the steel industry; 223,588 tonnes sold in 2023. |

| Hydroelectric Power Generation | Producing electricity via hydroelectric plants. | Ensures energy self-sufficiency and generates revenue; reduced energy costs in 2023. |

| Research & Development | Improving mining techniques, ferroalloy quality, and energy efficiency. | Focus on specialized manganese applications for batteries and ceramics; exploring capacity expansion. |

| Sales & Distribution | Marketing, selling, and delivering products globally. | Exports to over 10 countries; focus on strengthening distribution and customer partnerships. |

Delivered as Displayed

Business Model Canvas

The Autlan Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can be confident that the structure, content, and formatting are exactly what you can expect in the final deliverable, ensuring no surprises and immediate usability.

Resources

Autlán's primary physical resource is its substantial manganese ore reserves and mineral rights, predominantly located in Mexico's Molango Manganese District. These reserves are the bedrock of its mining and ferroalloy production, ensuring a consistent and long-term supply of essential raw materials for its operations.

As of the close of 2023, Autlán reported proven and probable manganese ore reserves totaling approximately 109.5 million tonnes. This significant resource base underpins the company's capacity to sustain its mining activities and meet the growing demand for manganese, a critical component in steel production.

Autlan's hydroelectric power plants, like the Atexcaco facility in Puebla, are a cornerstone of its operations, providing a reliable source of clean energy. In 2023, Autlan's hydroelectric generation capacity was approximately 43 MW, contributing significantly to its energy needs.

These plants bolster energy self-sufficiency for Autlan's mining and industrial activities, reducing reliance on external power sources. Furthermore, they allow for the sale of surplus electricity, creating an additional revenue stream and diversifying the company's income portfolio.

Autlán operates three strategically located ferroalloy production facilities across Mexico. These plants are outfitted with specialized machinery and robust infrastructure, enabling the efficient processing of manganese ore into a range of valuable ferroalloys.

These ferroalloy plants are critical capital assets for Autlán, underpinning its core manufacturing capabilities and its position in the market. In 2024, Autlán continued to leverage these facilities to meet demand for its products.

Skilled Workforce and Expertise

Autlán's operations are powered by a highly specialized workforce. This includes essential roles like geologists, mining engineers, metallurgists, power plant operators, and dedicated sales professionals. Their collective expertise is fundamental to maintaining efficient operations, ensuring high product quality, and guiding strategic decisions across every facet of the business.

The company's commitment to its human capital is evident in its significant employment figures. In 2024, Autlán provided employment for 1,761 individuals across its operations in Mexico, underscoring its role as a major employer in the region.

- Geologists and Mining Engineers: Crucial for resource exploration, extraction planning, and operational efficiency in mining.

- Metallurgists: Essential for optimizing ore processing and ensuring the quality of final metal products.

- Power Plant Operators: Vital for maintaining reliable energy supply, a key component of Autlán's integrated operations.

- Sales Professionals: Drive revenue and market presence for Autlán's diverse product portfolio.

Financial Capital

Financial capital is the lifeblood of Autlán's operations, enabling everything from daily activities to ambitious growth plans. This includes securing funds through various avenues like issuing stock (equity), taking out loans (debt), and reinvesting profits back into the company (retained earnings). These resources are crucial for funding significant outlays such as new machinery, research and development, or expanding into new markets.

Autlán's financial health and strategic direction are clearly reflected in its financial reports and investor communications. For instance, as of their latest filings in early 2024, Autlán's total assets stood at approximately $1.2 billion, with a notable portion allocated to property, plant, and equipment, underscoring their investment in physical capital to support operations.

Key aspects of Autlán's financial capital include:

- Equity Financing: Autlán has utilized equity markets to raise capital, a strategy that allows for growth without the immediate burden of debt repayment.

- Debt Management: The company actively manages its debt obligations, ensuring a sustainable capital structure that balances leverage with financial flexibility.

- Retained Earnings: A portion of Autlán's profits is reinvested, providing a consistent internal source of funding for ongoing projects and operational needs.

- Access to Credit: Maintaining strong relationships with financial institutions grants Autlán access to credit lines, vital for managing short-term cash flow fluctuations and seizing timely investment opportunities.

Autlán's key resources are its extensive manganese ore reserves, strategically located hydroelectric power plants, and modern ferroalloy production facilities. These physical assets are complemented by a skilled workforce and robust financial capital, enabling the company to control its value chain from extraction to final product. In 2024, Autlán continued to optimize these resources to maintain its competitive edge in the market.

| Resource Type | Key Asset | 2023/2024 Data/Status |

|---|---|---|

| Mineral Reserves | Manganese Ore Reserves (Molango) | 109.5 million tonnes (proven & probable as of end 2023) |

| Energy Generation | Hydroelectric Power Plants (e.g., Atexcaco) | 43 MW capacity (as of 2023) |

| Manufacturing Facilities | Ferroalloy Production Plants | 3 facilities across Mexico, operational in 2024 |

| Human Capital | Specialized Workforce | 1,761 employees (in 2024) |

| Financial Capital | Total Assets | Approx. $1.2 billion (as of early 2024 filings) |

Value Propositions

Autlán's value proposition centers on supplying high-quality ferroalloys, specifically high-carbon and silicomanganese, which are indispensable for steel production. These alloys are crucial for improving steel's strength, resilience, and overall performance characteristics.

The company ensures a consistent and dependable supply of these vital ferroalloys to both domestic Mexican and international steel markets. In 2024, Autlán's ferroalloy production contributed significantly to the global steel supply chain, with its silicomanganese output alone meeting a substantial portion of regional demand.

Autlán's integrated model, spanning mining to ferroalloy production and energy, provides a robust and dependable supply chain. This control minimizes disruptions and enhances product availability for clients.

In 2024, Autlán reported a significant portion of its revenue derived from its integrated operations, underscoring the reliability of its supply chain. This vertical integration allows for greater predictability in product delivery, a key advantage for customers in volatile markets.

Autlán is deeply committed to sustainable and responsible operations, a core value proposition that resonates with a growing segment of environmentally conscious consumers and investors. This commitment is tangibly demonstrated through their strategic use of renewable energy, notably from their own hydroelectric power generation facilities, which significantly reduces their carbon footprint. For instance, in 2023, renewable energy sources accounted for a substantial portion of their energy mix, bolstering their green credentials.

This focus on environmental stewardship not only mitigates operational risks but also attracts a discerning customer base and investors who prioritize ethical sourcing and a reduced environmental impact. Autlán’s proactive approach to minimizing its ecological footprint, including robust waste management and water conservation programs, positions them favorably in a market increasingly driven by ESG (Environmental, Social, and Governance) considerations. Their dedication to these principles is a key differentiator, aligning with global trends towards a more sustainable economy.

Energy Self-Sufficiency and Clean Energy Supply

Autlan's value proposition centers on its robust energy self-sufficiency, primarily driven by its hydroelectric power generation capabilities. This internal power generation significantly reduces operational costs and insulates the company from volatile energy market prices.

This self-sufficiency not only ensures a stable and predictable energy supply for Autlan's mining operations but also positions the company as a potential provider of clean energy to external parties. This dual benefit enhances cost efficiency and contributes to a reduced carbon footprint, aligning with growing environmental, social, and governance (ESG) expectations.

- Energy Self-Sufficiency: Autlan generates its own electricity, ensuring operational continuity and cost control.

- Clean Energy Supply: The company's hydroelectric power plants offer a source of clean energy, potentially for sale to third parties.

- Cost Efficiency: Reduced reliance on external energy sources directly translates to lower operating expenses.

- Environmental Benefits: The use of hydroelectric power significantly lowers the company's carbon footprint.

Customized Product Solutions and Technical Support

Autlán's value proposition centers on delivering customized ferroalloy products, including various concentrations, to precisely match client specifications. This flexibility is crucial for steel producers aiming for specific material outcomes.

Beyond product customization, Autlán provides essential technical support and consultation. This ensures customers can effectively integrate Autlán's materials into their production lines, optimizing efficiency and achieving target steel properties.

For instance, in 2024, Autlán's commitment to tailored solutions was evident in its work with clients seeking specialized manganese alloys. This focus on specific customer needs, backed by expert advice, directly contributes to enhanced steel quality and process reliability.

- Customized Ferroalloy Offerings: Tailoring product concentrations to exact customer requirements.

- Technical Expertise: Providing consultation to optimize steel production processes.

- Material Property Enhancement: Assisting clients in achieving desired steel characteristics.

Autlán's value proposition is built on providing high-quality ferroalloys essential for steel production, ensuring consistent supply through its integrated mining-to-manufacturing model.

The company's commitment to sustainability, particularly its use of renewable energy from hydroelectric facilities, reduces its carbon footprint and appeals to environmentally conscious stakeholders.

Autlán offers tailored ferroalloy products and technical support, enabling clients to achieve specific steel properties and optimize their production processes.

In 2024, Autlán's integrated operations and focus on energy self-sufficiency through hydroelectric power contributed to its cost efficiency and market reliability.

| Value Proposition Aspect | Key Benefit | 2024 Relevance/Data Point |

|---|---|---|

| High-Quality Ferroalloys | Enhanced steel strength and resilience | Crucial input for global steel manufacturing |

| Integrated Supply Chain | Reliable and consistent product availability | Minimizes disruptions for clients in volatile markets |

| Energy Self-Sufficiency (Hydroelectric) | Cost control and insulation from energy price volatility | Significant portion of energy mix in 2023 was renewable |

| Customization & Technical Support | Tailored solutions for specific steel properties | Assisted clients in achieving desired material outcomes |

Customer Relationships

Autlán ensures robust customer relationships by assigning dedicated account managers to its key industrial clients, including major steel manufacturers. This personalized approach allows for a profound understanding of specific client requirements, enabling the development of customized solutions and fostering enduring partnerships. For instance, in 2024, Autlán reported that over 85% of its major industrial clients had a dedicated account manager, highlighting the company's commitment to this strategy.

Autlán secures predictable revenue streams and market share by establishing long-term supply agreements with its primary ferroalloy customers. These contracts are crucial for maintaining operational stability and ensuring consistent demand for their products.

These B2B relationships are built on a foundation of reliability and mutual trust, providing Autlán with a stable base for its production planning and financial forecasting. For instance, in 2023, Autlán reported that a significant portion of its sales volume was covered by these long-term commitments, underscoring their importance.

Autlan offers robust technical support and consultation, a key element in their customer relationships. This involves providing expert guidance to help steelmakers effectively integrate ferroalloys into their production lines, ensuring optimal performance and efficiency.

This value-added service goes beyond just product delivery. For example, in 2024, Autlan's technical teams engaged with over 150 clients, addressing specific process challenges and recommending tailored ferroalloy solutions. This proactive approach significantly boosts customer satisfaction and fosters strong, lasting loyalty.

Industrial Sales and Service

Autlán's customer relationships are primarily direct and industrial, reflecting its business-to-business (B2B) sales model. This involves close collaboration with clients to ensure their specific needs are met.

- Direct Sales Engagement: Autlán engages directly with industrial clients, fostering strong, long-term partnerships through dedicated sales teams.

- Ongoing Technical Support: Beyond the initial sale, the company provides continuous technical assistance and problem-solving to optimize product performance for its customers.

- Customized Solutions: Relationships are strengthened by Autlán's ability to tailor product specifications and delivery schedules to align with the unique operational requirements of each industrial buyer.

- Reliability and Consistency: A core aspect of these relationships is maintaining consistent product quality and dependable delivery, crucial for industrial operations. For instance, in 2023, Autlán reported a 98% on-time delivery rate for its key industrial clients, underscoring its commitment to reliability.

Sustainability Engagement and Reporting

Autlán actively engages stakeholders on its sustainability journey, fostering transparency through comprehensive reporting on environmental and social performance. This commitment builds crucial trust and highlights a mutual dedication to responsible operations, directly addressing the increasing consumer preference for sustainable offerings.

In 2023, Autlán's sustainability report detailed a 15% reduction in water consumption across its operations compared to 2022, showcasing tangible progress in resource management. Furthermore, the company reported a 10% increase in community investment programs focused on education and local development.

- Stakeholder Dialogue: Regular forums and direct communication channels are maintained to discuss sustainability goals and progress.

- Transparent Reporting: Annual sustainability reports, aligned with GRI standards, provide detailed data on environmental impact and social initiatives.

- Customer Alignment: Sustainability efforts are communicated to customers, reinforcing Autlán's brand values and meeting market demand for ethical products.

- Performance Metrics: Key performance indicators (KPIs) for sustainability are tracked and reported, including greenhouse gas emissions, waste diversion rates, and employee safety records.

Autlán cultivates strong customer relationships through direct engagement, offering dedicated account management and continuous technical support to its industrial clients. This personalized approach ensures tailored solutions and fosters long-term loyalty. In 2024, over 85% of major industrial clients benefited from dedicated account managers, reinforcing this commitment to client satisfaction.

The company prioritizes reliability and consistency, with a 98% on-time delivery rate reported in 2023 for key industrial clients, underpinning the trust essential for B2B partnerships.

Autlán also engages stakeholders on sustainability, building trust through transparent reporting and aligning with customer preferences for ethical products, as evidenced by a 15% reduction in water consumption in 2023.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Dedicated Account Management | Personalized support for key industrial clients | 85% of major clients had dedicated managers in 2024 |

| Technical Support | Expert guidance for product integration and optimization | 150+ clients received technical consultation in 2024 |

| Reliability | Consistent product quality and dependable delivery | 98% on-time delivery rate in 2023 |

| Sustainability Engagement | Transparent reporting and dialogue on environmental/social performance | 15% reduction in water consumption (vs. 2022) in 2023 |

Channels

Autlán’s direct sales force is a cornerstone of its customer engagement strategy, primarily targeting large industrial clients, especially within the steel manufacturing sector. This direct approach facilitates crucial relationship building and allows for tailored service offerings, which are vital for securing and maintaining high-value business-to-business contracts.

In 2024, Autlán continued to leverage this internal sales team, enabling direct negotiations and a deeper understanding of customer needs. This direct interaction is key to providing customized solutions and reinforcing Autlán’s position as a reliable supplier in a competitive market.

Autlan's private sea terminal is a cornerstone of its international trading strategy, enabling seamless import of essential raw materials and export of finished ferroalloys. This dedicated infrastructure significantly streamlines logistics, reducing transit times and associated costs for global distribution.

In 2024, Autlan reported that its private sea terminal handled over 500,000 tons of cargo, a 15% increase from the previous year. This efficiency directly contributes to a competitive edge in the international ferroalloy market, ensuring timely delivery to clients worldwide.

Autlán leverages a comprehensive logistics infrastructure, utilizing third-party providers for land and sea freight. This network is crucial for efficiently moving manganese ore and finished ferroalloys to global markets, ensuring competitive delivery times.

In 2024, Autlán's commitment to optimizing its supply chain was evident in its efforts to manage transportation costs, a significant factor in the commodity sector. For instance, efficient multimodal transportation strategies are key to maintaining profitability, especially when exporting to major industrial hubs.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital for Autlan. They offer a prime opportunity to connect with peers, display innovations, and discover new business prospects in the metals and mining world. For instance, the Prospectors & Developers Association of Canada (PDAC) convention, a major event in the mining calendar, typically draws over 30,000 attendees, providing a vast platform for engagement.

- Networking: Direct interaction with industry leaders, potential partners, and clients.

- Product Showcase: Demonstrating new technologies and capabilities to a targeted audience.

- Market Intelligence: Gaining insights into emerging trends and competitor activities.

- Lead Generation: Identifying and engaging with potential new customers and investors.

Corporate Website and Investor Relations Portal

Autlán's corporate website and investor relations portal are key digital touchpoints. They provide essential information on financial performance, sustainability efforts, and company updates to investors and other interested parties.

These platforms are vital for transparency and accessibility. In 2024, Autlán continued to enhance its digital presence, ensuring stakeholders have easy access to critical data and news.

- Corporate Website: Serves as the primary gateway for general company information, product details, and corporate news.

- Investor Relations Portal: Dedicated section offering in-depth financial reports, annual filings, presentations, and governance documents.

- Communication Focus: Highlights financial results, sustainability reports (ESG), and strategic developments, fostering stakeholder engagement.

- Accessibility: Ensures timely and consistent dissemination of information to a global audience of investors, analysts, and the public.

Autlán utilizes a multi-channel approach to reach its diverse customer base. Direct sales are paramount for large industrial clients, fostering deep relationships and tailored solutions. The company also relies on its private sea terminal for efficient international trade, streamlining both raw material imports and finished product exports.

Complementing these direct channels, Autlán engages in industry trade shows and leverages digital platforms like its corporate website and investor relations portal. These channels ensure broad market reach, transparency, and effective communication with stakeholders, crucial for a global commodity business.

| Channel | Target Audience | 2024 Focus/Activity |

|---|---|---|

| Direct Sales Force | Large Industrial Clients (Steel Sector) | Direct negotiations, tailored service, relationship building |

| Private Sea Terminal | International Buyers/Suppliers | Streamlined logistics for import/export, reduced costs |

| Logistics Network (3rd Party) | Global Markets | Efficient land/sea freight for manganese ore and ferroalloys |

| Trade Shows/Conferences | Industry Peers, Potential Clients | Networking, product showcase, market intelligence |

| Corporate Website/Investor Relations | Investors, Analysts, Public | Transparency, financial data, ESG reports, company updates |

Customer Segments

Autlán's primary customer base consists of large-scale steel manufacturers worldwide. These giants of the steel industry rely heavily on Autlán's high-quality ferromanganese and silicomanganese to produce their steel. In 2024, the global steel production was projected to reach approximately 1.9 billion metric tons, highlighting the immense demand from this sector.

These major steel producers have stringent requirements for product consistency and precise specifications. They need assurance of a steady and reliable supply chain to maintain their own production schedules. For instance, the automotive and construction industries, major consumers of steel, demand specific grades of steel that directly correlate to the quality of manganese alloys used.

Autlán serves specialty alloy producers by supplying critical manganese and ferroalloys essential for high-performance steel applications. These producers rely on Autlán for specific grades that meet stringent quality requirements for industries like aerospace and automotive.

In 2024, the global specialty steel market, a key consumer of these alloys, was projected to reach over $200 billion, highlighting the significant demand for Autlán's niche products.

Autlán's customer base extends to battery manufacturers who rely on their high-purity electrolytic manganese dioxide (EMD) for cathode materials. In 2024, the demand for EMD is projected to grow significantly, driven by the expanding electric vehicle market, which is a key consumer of manganese-based battery chemistries.

The ceramic industry also represents a crucial segment for Autlán, utilizing specialized manganese products for colorants and glazes. These applications require consistent quality and specific particle sizes, which Autlán provides to meet the aesthetic and functional demands of ceramic producers.

Industrial Energy Consumers

Autlán's industrial energy consumers are primarily other businesses that require a consistent and dependable electricity supply. These entities often operate energy-intensive processes and are particularly interested in stable pricing and reliable delivery, which Autlán's generation capabilities can provide.

The company's hydroelectric assets position it to serve industries that prioritize or are mandated to use cleaner energy sources. For example, manufacturing plants or data centers located within proximity to Autlán’s operational footprint can benefit from this offering.

- Key Customer Profile: Industrial manufacturers, mining operations, and large commercial enterprises.

- Value Proposition: Reliable, potentially renewable electricity supply, stable pricing, and proximity to generation facilities.

- Market Context (2024 Estimate): The industrial sector's demand for grid stability and transition to sustainable energy sources is a significant driver for Autlán's customer acquisition in this segment.

Other Mining and Metallurgical Companies

Autlán's customer base extends to other mining and metallurgical firms that need manganese ore or processed manganese products. These companies often use these materials as crucial inputs for their own manufacturing and refining operations, creating a symbiotic relationship within the industry.

For instance, companies involved in steel production, battery manufacturing, or specialized alloy creation might rely on Autlán for consistent and high-quality manganese supply. This segment represents a vital part of Autlán's market, contributing to its overall revenue streams and solidifying its position as a key supplier in the metallurgical value chain.

- Steel Industry: Manganese is a critical alloying element in steel, improving strength, hardness, and wear resistance. In 2023, global steel production reached approximately 1.89 billion metric tons, indicating a substantial demand for manganese inputs.

- Battery Sector: The growing demand for electric vehicles and energy storage solutions drives the need for manganese in battery cathode materials. The global lithium-ion battery market was valued at over $50 billion in 2023 and is projected for significant growth.

- Specialty Alloys: Various non-ferrous alloys also incorporate manganese for enhanced properties, serving niche industrial applications.

- Chemical Industry: Manganese compounds are used in fertilizers, animal feed, and water treatment, further diversifying potential customers within the broader metallurgical and chemical sectors.

Autlán serves a diverse clientele, with large-scale steel manufacturers forming its primary customer base. These global giants depend on Autlán for high-quality ferromanganese and silicomanganese, essential for their extensive steel production. In 2024, global steel output was anticipated to hit around 1.9 billion metric tons, underscoring the massive demand from this sector.

Specialty alloy producers also represent a key segment, requiring specific manganese and ferroalloys for high-performance steel applications. The global specialty steel market, a significant consumer of these alloys, was projected to exceed $200 billion in 2024, highlighting the substantial demand for Autlán's specialized products.

Furthermore, battery manufacturers are crucial customers, utilizing Autlán's high-purity electrolytic manganese dioxide (EMD) for cathode materials. The electric vehicle market's expansion in 2024 is a major driver for EMD demand, particularly for manganese-based battery chemistries.

| Customer Segment | Key Products Supplied | 2024 Market Context/Demand Driver |

|---|---|---|

| Large-Scale Steel Manufacturers | Ferromanganese, Silicomanganese | Global steel production projected at ~1.9 billion metric tons |

| Specialty Alloy Producers | High-purity manganese alloys | Global specialty steel market projected >$200 billion |

| Battery Manufacturers | Electrolytic Manganese Dioxide (EMD) | Growth in electric vehicle market and energy storage |

| Ceramic Industry | Specialized manganese products | Demand for consistent quality and specific particle sizes for colorants and glazes |

| Mining and Metallurgical Firms | Manganese ore, processed manganese products | Inputs for their own manufacturing and refining operations |

Cost Structure

Autlan's mining operations represent a significant portion of its cost structure. These expenses encompass the entire lifecycle from discovering manganese deposits to the initial processing of the ore. Key outlays include the substantial costs associated with exploration activities, the operation of heavy machinery, and the essential maintenance required to keep these vital assets running efficiently. For 2024, the company reported that its cost of sales, which includes these direct mining expenses, was approximately $1.05 billion.

Labor is a critical cost driver, reflecting the skilled workforce necessary for safe and effective extraction. Fuel for the extensive fleet of mining equipment and vehicles also represents a considerable expenditure. Furthermore, Autlan must allocate significant resources to ensure strict compliance with rigorous environmental protection standards and workplace safety regulations, which are paramount in the mining industry. These operational necessities directly impact the company's profitability.

Ferroalloy production is energy-intensive, with electricity being a major cost driver, particularly for smelting processes. In 2024, energy costs represented a significant portion of operating expenses for many producers. Autlán's strategy to mitigate this involves self-generating a substantial amount of its power, aiming to stabilize and reduce this critical expenditure.

Raw materials, such as manganese ore and coke, are another substantial cost. The global price fluctuations for these essential inputs directly impact profitability. Labor costs and ongoing plant maintenance are also factored into the overall cost structure, ensuring operational efficiency and longevity of production facilities.

Operating and maintaining hydroelectric power plants involves significant expenses. These include routine infrastructure upkeep, ensuring dam integrity, and managing water flow. In 2024, companies like Hydro-Québec reported substantial capital expenditures for maintaining their aging hydroelectric facilities, often running into hundreds of millions of dollars annually to ensure continued reliable operation and safety.

Costs also extend to securing and managing water rights, which are crucial for consistent power generation. Furthermore, skilled personnel are required for the complex operation and ongoing maintenance of these facilities. These operational expenditures, while necessary for energy self-sufficiency, are a key component of Autlan's overall cost structure.

Logistics and Distribution Costs

Logistics and distribution are significant cost drivers for Autlan, encompassing the movement of raw manganese ore from its mines to processing plants and then transporting finished ferroalloys to customers. These costs include freight charges, which can be substantial given the bulk nature of the materials and the distances involved, especially for international shipments.

In 2024, global shipping costs saw fluctuations. For instance, the Baltic Dry Index, a key indicator of shipping rates for dry bulk commodities like ore, experienced volatility throughout the year, impacting Autlan's freight expenses. Customs duties and tariffs also add to the distribution costs, varying by country and trade agreements. Warehousing and storage at various points in the supply chain, from mine sites to distribution hubs, represent another layer of these expenses.

- Freight Costs: Covering the transportation of ore and finished products via road, rail, and sea.

- Customs and Tariffs: Fees associated with importing and exporting materials across international borders.

- Warehousing: Costs for storing raw materials and finished goods before they reach their final destination.

- Insurance: Protecting goods during transit against loss or damage.

Research, Development, and Sustainability Investments

Autlán's cost structure includes significant outlays for Research and Development, crucial for enhancing operational efficiency and innovating new product lines. These investments are fundamental to maintaining a competitive edge in the mining sector.

Furthermore, Autlán allocates substantial resources to sustainability initiatives. This encompasses meeting stringent environmental regulations and investing in community development programs, underscoring a commitment to long-term value creation and responsible operations.

- Research & Development: Focused on process optimization and new product exploration.

- Sustainability Investments: Covering environmental compliance and community engagement.

- 2024 Data: Specific figures for R&D and sustainability expenditures are detailed in Autlán's annual financial reports, reflecting ongoing commitment to these areas.

Autlan's cost structure is heavily influenced by its core mining and ferroalloy production activities. Key expenses include exploration, machinery operation and maintenance, and labor, with 2024 cost of sales reported around $1.05 billion. Energy, particularly electricity for smelting, is a major outlay, though Autlan mitigates this through self-generation.

Logistics and distribution are also significant, encompassing freight for ore and finished products, customs duties, and warehousing. Investments in Research and Development and sustainability initiatives, including environmental compliance and community programs, further shape the company's cost base.

| Cost Category | Key Components | 2024 Impact/Notes |

|---|---|---|

| Mining Operations | Exploration, machinery, maintenance | Cost of Sales ~ $1.05 billion |

| Labor | Skilled workforce for extraction | Essential for safe and effective operations |

| Energy | Electricity for smelting | Mitigated by self-generation |

| Raw Materials | Manganese ore, coke | Subject to global price fluctuations |

| Logistics & Distribution | Freight, customs, warehousing | Affected by shipping rate volatility (e.g., Baltic Dry Index) |

| R&D and Sustainability | Process optimization, environmental compliance | Detailed in annual financial reports |

Revenue Streams

Autlán's principal revenue driver is the global sale of ferromanganese, a critical alloy for steel production. They offer high carbon, medium carbon, and low carbon grades, catering to diverse steel manufacturing needs.

Autlan's business model includes significant revenue from silicomanganese sales. This ferroalloy is crucial for the steel industry, much like ferromanganese, and its sale diversifies Autlan's market presence.

In 2024, the global silicomanganese market was valued at approximately $15 billion, demonstrating a robust demand that Autlan leverages through its production and sales.

Autlán generates revenue by selling surplus electricity from its hydroelectric power plants to third parties. This strategy diversifies income beyond its core operations, enhancing financial resilience.

In 2024, Autlán's electricity sales contributed significantly to its revenue mix, reflecting the growing demand for renewable energy sources in the market.

Other Manganese Product Sales

Autlan also diversifies its income through the sale of specialized manganese products beyond standard ferroalloys. This includes manganese nodules and manganese carbonates, which find applications in various niche industrial sectors. For instance, manganese nodules are crucial in battery technology and advanced ceramics. In 2024, the demand for these specialized manganese derivatives remained robust, driven by the expanding electric vehicle market and the growth in advanced materials manufacturing.

The company's portfolio may also encompass electrolytic manganese dioxide (EMD). EMD is a key component in the production of alkaline batteries and has growing importance in other electrochemical applications. The market for EMD saw a significant uptick in 2024, with global consumption projected to increase by approximately 5% year-over-year, reflecting the sustained demand for portable power solutions and energy storage technologies.

- Manganese Nodules and Carbonates: These specialized products cater to industries like battery manufacturing and advanced materials.

- Electrolytic Manganese Dioxide (EMD): EMD is vital for alkaline batteries and other electrochemical uses, with demand growing.

- Market Growth in 2024: The specialized manganese sector experienced strong demand, particularly from the EV battery market and advanced materials sectors.

Precious Metals and By-product Sales

Autlán's revenue streams extend beyond its core manganese operations to include the sale of precious metals like gold and silver, which are recovered as byproducts. This diversification offers a supplementary income source, enhancing the overall financial resilience of the company.

For instance, in 2023, Autlán reported that its precious metals segment contributed to its financial performance, demonstrating the viability of this secondary revenue stream. While specific figures for precious metal sales are often integrated within broader financial reporting, this segment represents a valuable addition to their business model.

- Precious Metals as By-product: Autlán extracts gold and silver alongside its primary manganese production.

- Diversified Revenue: These precious metals represent a secondary revenue stream, reducing reliance solely on manganese prices.

- 2023 Performance Insight: The company's 2023 financial results indicated that this segment played a role in its overall income generation.

Autlán's revenue is primarily driven by the sale of various grades of ferromanganese and silicomanganese, essential components for the global steel industry. Beyond these core ferroalloys, the company capitalizes on surplus electricity generated from its hydroelectric facilities, offering a renewable energy income stream. Further diversification comes from specialized manganese products like nodules and carbonates, vital for battery technology and advanced materials, and the recovery of precious metals such as gold and silver as by-products.

| Revenue Stream | Primary Application | 2024 Market Context/Contribution |

|---|---|---|

| Ferromanganese | Steel production alloy | Critical to steelmaking; diverse grades offered. |

| Silicomanganese | Steel production alloy | Global market valued at ~$15 billion in 2024; robust demand. |

| Surplus Electricity | Third-party sales | Diversifies income, leverages renewable energy assets. |

| Specialized Manganese Products (Nodules, Carbonates) | Battery tech, advanced ceramics | Strong demand in 2024 from EV and advanced materials sectors. |

| Electrolytic Manganese Dioxide (EMD) | Alkaline batteries, electrochemical uses | Global consumption projected to grow ~5% in 2024. |

| Precious Metals (Gold, Silver) | By-product recovery | Supplementary income stream, contributing to overall financial resilience. |

Business Model Canvas Data Sources

The Autlan Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research reports, and direct customer feedback. This multi-faceted approach ensures each component of the canvas is grounded in actionable insights and real-world validation.