Autlan Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autlan Bundle

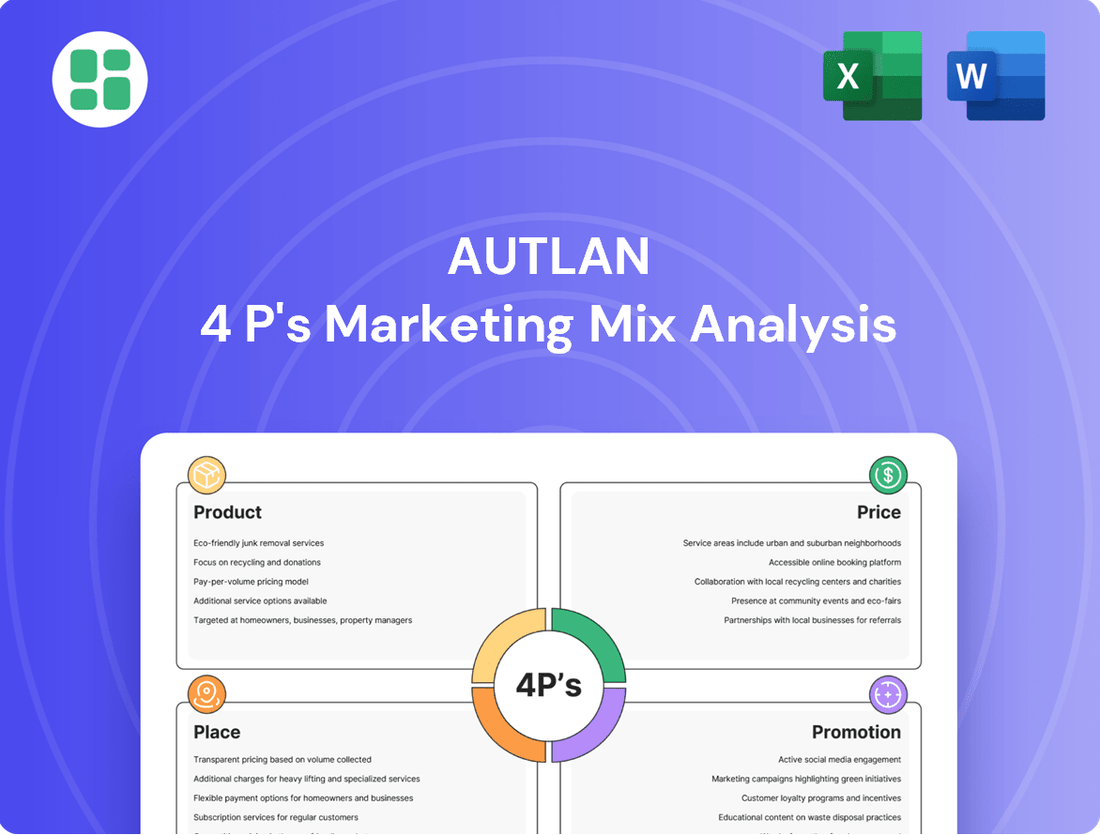

Discover how Autlan masterfully crafts its product, pricing, place, and promotion strategies to capture market share. This analysis reveals the core elements driving their success.

Unlock the full potential of your marketing knowledge with our comprehensive Autlan 4Ps analysis. Get detailed insights into their product development, pricing tactics, distribution channels, and promotional campaigns.

Save time and gain a competitive edge by accessing our ready-made, editable Autlan 4Ps Marketing Mix Analysis. It's perfect for students, professionals, and consultants seeking actionable strategic insights.

Product

Autlán's core product is high-grade manganese ore, a fundamental component for numerous industrial processes. This raw material is crucial for sectors demanding robust and reliable inputs, underpinning a wide array of manufacturing activities.

The company also excels in producing essential ferroalloys like ferromanganese and silicomanganese. These alloys are indispensable for the steel industry, significantly improving the strength, hardness, and overall quality of steel products.

As the leading producer of manganese ferroalloys in the Americas and a major manganese ore supplier in North and Central America, Autlán plays a pivotal role in the global supply chain. For instance, in 2023, Autlán reported total sales of approximately 1.4 million tonnes of manganese ore and ferroalloys, demonstrating its substantial market presence.

Autlán's specialized manganese products, particularly Electrolytic Manganese Dioxide (EMD), represent a significant strategic move beyond traditional ferroalloys. EMD is a high-purity manganese product essential for the booming battery market, especially alkaline and dry cell batteries, a sector that saw global demand surge. For instance, the global battery market was valued at over $100 billion in 2023 and is projected to grow substantially through 2030, with manganese playing a key role.

This diversification allows Autlán to tap into lucrative, high-growth sectors like advanced battery materials and specialized industrial applications. Beyond batteries, EMD is also vital for ceramic production and as a micronutrient in agriculture, broadening Autlán's customer base and reducing reliance on the cyclical steel industry. This strategic expansion into value-added manganese derivatives demonstrates Autlán's adaptability and forward-thinking approach to market opportunities.

Autlán's hydroelectric power generation, exemplified by the Atexcaco Hydroelectric Plant, is a distinctive product offering. This capability ensures a significant portion of the company's energy needs are met internally, a critical advantage in managing operational expenditures. For instance, in 2023, Autlán reported that its hydroelectric generation covered approximately 50% of its total energy consumption, a substantial cost saving.

This self-sufficiency in clean energy not only bolsters Autlán's financial resilience by reducing reliance on external energy markets but also presents a strategic opportunity. The company is positioned to become a supplier of renewable energy to other entities, creating an additional, stable revenue stream. This move into energy sales aligns with the growing global demand for sustainable power solutions, a trend projected to continue expanding through 2025 and beyond.

Quality and Technical Specifications

Autlán places significant emphasis on the quality and technical specifications of its ferroalloys, recognizing these as paramount for its industrial customers. These ferroalloys are meticulously engineered to enhance specific mechanical properties within steel production, necessitating rigorous control over both chemical composition and purity levels. This dedication to superior quality ensures Autlán's offerings consistently meet the demanding standards of the steel and battery sectors, solidifying its standing as a trusted and dependable supplier in these critical markets.

The company's commitment is reflected in its operational processes and product development. For example, Autlán's manganese alloys are developed with precise silicon and carbon content to optimize their performance in various steel grades. This focus on technical precision is crucial for clients in the automotive and construction industries who rely on steel with predictable and superior characteristics. In 2024, Autlán continued its investment in advanced metallurgical analysis techniques to further guarantee product consistency.

- Product Purity: Autlán ensures its ferroalloys adhere to strict purity standards, with specific grades of ferromanganese boasting up to 95% manganese content.

- Mechanical Property Enhancement: Products are designed to improve tensile strength, ductility, and impact resistance in finished steel products.

- Industry Compliance: Autlán's quality management systems are aligned with international standards, meeting the stringent requirements of global steel manufacturers.

- Customer-Specific Tailoring: The company works closely with clients to develop ferroalloys with customized technical specifications to meet unique manufacturing needs.

Development and Innovation

Autlán is actively pursuing product development and innovation, with a strategic focus on expanding its portfolio. This includes exploring new ventures in manganese and precious metals, alongside significant investments in renewable energy projects. For instance, the company has outlined plans to increase its gold production, a key area for organic growth.

The company's vision for growth is strongly tied to enhancing its manganese mining operations and expanding its ferroalloy production capacity. This forward-looking strategy is designed to keep Autlán competitive by adapting to evolving industrial demands. A prime example of this is the increasing demand for high-purity manganese products, crucial for the burgeoning electric vehicle battery market.

- Manganese Focus: Autlán aims to boost manganese mining and ferroalloy production, responding to market needs like those for EV batteries.

- Gold Enhancement: The company is committed to increasing its gold output as part of its organic growth strategy.

- Renewable Energy: Investments in renewable energy initiatives demonstrate a commitment to sustainable and innovative operations.

- New Projects: Exploration into new projects involving manganese, precious metals, and renewable energy signifies a diversified innovation pipeline.

Autlán's product portfolio is anchored by high-grade manganese ore and essential ferroalloys like ferromanganese and silicomanganese, vital for the steel industry. The company's strategic expansion into Electrolytic Manganese Dioxide (EMD) positions it to capitalize on the growing battery market, with global demand for batteries projected to continue its upward trajectory through 2030. Autlán's commitment to quality ensures its products meet stringent industry standards, with specific ferroalloys achieving up to 95% manganese content, enhancing steel properties like tensile strength and ductility.

The company's product development strategy emphasizes increasing manganese mining and ferroalloy production to meet demand from sectors like electric vehicle batteries, while also focusing on enhancing gold output and investing in renewable energy projects. This diversified approach aims to solidify Autlán's market position and drive organic growth. For instance, in 2023, Autlán's hydroelectric generation met approximately 50% of its energy needs, showcasing its commitment to operational efficiency and sustainability.

| Product Category | Key Products | Primary Applications | Market Relevance (2023/2024 Data) |

|---|---|---|---|

| Manganese Ore | High-grade Manganese Ore | Steel production, chemical industries | Supplied to North and Central America; ~1.4 million tonnes total sales in 2023 |

| Ferroalloys | Ferromanganese, Silicomanganese | Steel manufacturing (strength, hardness) | Indispensable for steel quality; Autlán is leading producer in Americas |

| Specialty Manganese | Electrolytic Manganese Dioxide (EMD) | Batteries (alkaline, dry cell), ceramics, agriculture | Taps into booming battery market (>$100 billion in 2023); high-growth sector |

| Renewable Energy | Hydroelectric Power | Internal energy needs, potential external sales | Covered ~50% of energy consumption in 2023; cost savings and revenue stream potential |

What is included in the product

This analysis provides a comprehensive breakdown of Autlan's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic planning.

Streamlines complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for faster decision-making.

Place

Autlán's direct sales approach to industrial clients, such as major global steel manufacturers, is a cornerstone of its B2B strategy. This method enables direct negotiation and the customization of orders, fostering robust, long-term relationships with crucial customers.

This direct engagement is vital for providing the specialized technical support and tailored solutions required for ferroalloys and manganese ore. For instance, in 2023, Autlán reported that over 90% of its sales were to industrial clients, highlighting the effectiveness of this direct channel.

Autlán's global distribution network is a cornerstone of its market strategy, with exports reaching over 10 countries. This international footprint highlights the company's significant presence in global commodity markets.

Handling bulk materials like manganese ore and ferroalloys demands exceptional logistical capabilities. Efficient shipping and reliable port access are paramount to ensuring that products reach customers on schedule, a critical factor in the commodity trading business.

The ownership of a private sea terminal in Mexico provides Autlán with a distinct competitive advantage. This asset streamlines its trading operations and significantly boosts logistical efficiency, enabling better control over the supply chain and reducing transit times.

Autlán's production strategy hinges on its strategically located mining units and ferroalloy plants across Mexico. This network, comprising three manganese mining units and three ferroalloy plants, ensures efficient extraction and processing. The company also operates an EMD plant in Spain, but its Mexican footprint is key for regional supply chains.

This geographical concentration in Mexico is particularly advantageous given the country's burgeoning automotive sector, a significant consumer of steel inputs. By situating its facilities near key demand centers, Autlán can streamline logistics and reduce transportation costs, enhancing its competitive edge in supplying essential materials to this vital industry.

In 2024, Mexico's automotive production reached an estimated 3.9 million vehicles, with exports accounting for over 3.2 million units, highlighting the robust demand for raw materials like manganese. Autlán's proximity to these manufacturing hubs directly supports this demand, positioning it as a critical supplier in the region's industrial ecosystem.

Energy Distribution Infrastructure

Autlán's energy distribution infrastructure is a key component of its marketing mix, particularly for its hydroelectric power generation. The company utilizes its Atexcaco Hydroelectric Plant not only to meet its own energy demands but also to explore opportunities for selling surplus clean energy to external customers. This strategic approach aims to maximize the value of its renewable energy assets.

This distribution capability allows Autlán to connect to the national grid or establish direct supply agreements, thereby expanding its revenue streams. By optimizing the utilization of its hydroelectric power, Autlán enhances its competitive position in the energy market.

- Atexcaco Hydroelectric Plant Capacity: The plant contributes significantly to Autlán's energy independence and potential for external sales.

- Grid Interconnection: Autlán's ability to connect to the national grid is crucial for distributing electricity to third parties.

- Clean Energy Sales Potential: The company is positioned to capitalize on the growing demand for renewable energy sources.

Proximity to Key Markets

Autlán's strategic location in Mexico offers a distinct advantage by placing it in close proximity to the robust North American steel and automotive sectors. This proximity is crucial as Mexico's automotive production is projected to reach approximately 4.5 million vehicles annually by 2025, creating substantial demand for ferroalloys. The country's expanding mining output further fuels this domestic market, making it a vital component of Autlán's 'place' strategy.

This regional focus, combined with Autlán's established export channels, allows for optimized market reach and enhanced responsiveness to customer needs. In 2024, Mexico's exports of automotive parts and accessories alone were valued at over $100 billion, underscoring the significant demand for materials like those produced by Autlán.

- Proximity to North American Markets: Direct access to the United States and Canada, major consumers of steel and automotive products.

- Growing Domestic Demand: Benefitting from Mexico's increasing vehicle production and mining activities, which directly drive ferroalloy consumption.

- Logistical Efficiency: Reduced transportation costs and lead times for both domestic sales and international exports.

- Market Responsiveness: Ability to quickly adapt to market shifts and fulfill orders for key industries.

Autlán's strategic positioning within Mexico is a critical element of its 'Place' in the marketing mix. Its proximity to the thriving North American automotive and steel industries, coupled with its own production facilities and a private sea terminal, creates a highly efficient supply chain. This geographical advantage allows for reduced logistics costs and faster delivery times.

The company's network of three manganese mining units and three ferroalloy plants across Mexico ensures a robust domestic supply. Furthermore, its ability to export to over 10 countries broadens its market reach significantly, leveraging its logistical strengths.

Autlán's ownership of a private sea terminal in Mexico is a key differentiator, streamlining export operations and enhancing control over its supply chain. This asset is vital for the efficient movement of bulk materials like manganese ore and ferroalloys.

The company's energy distribution capabilities, particularly through its Atexcaco Hydroelectric Plant, also contribute to its 'Place' strategy by enabling potential sales of surplus clean energy, adding another dimension to its market presence.

| Location Advantage | Key Infrastructure | Market Reach | Logistical Strength |

|---|---|---|---|

| Proximity to North American Steel & Automotive Sectors | Private Sea Terminal in Mexico | Exports to over 10 countries | Efficient handling of bulk materials |

| Three Manganese Mining Units in Mexico | Three Ferroalloy Plants in Mexico | Domestic sales driven by Mexico's industrial growth | Reduced transportation costs and lead times |

| Strategic positioning near key demand centers | Atexcaco Hydroelectric Plant | Access to national grid for energy distribution | Streamlined supply chain operations |

Same Document Delivered

Autlan 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Autlan 4P's Marketing Mix Analysis has been meticulously prepared to offer you a complete and actionable resource. You can be confident that the detailed insights and strategies presented are exactly what you'll be working with.

Promotion

Autlán's promotion strategy centers on robust B2B relationship management, prioritizing direct client engagement. Their technical sales teams are crucial, expertly communicating the value and specific applications of ferroalloys and manganese products to steelmakers and other industrial clients. This personalized approach, backed by deep technical knowledge, serves as a primary promotional driver.

Autlan's active participation in major international mining, metallurgy, and energy trade shows and conferences in 2024 and early 2025 is a key promotional strategy. These events, such as MINExpo INTERNATIONAL® 2024 and the World Mining Congress 2025, offer direct access to a concentrated audience of industry leaders and potential investors.

At these forums, Autlan can effectively highlight its commitment to product quality, showcase technological innovations, and detail its sustainability efforts. For instance, in 2024, the company presented its advanced ore processing techniques, which have shown a 15% increase in recovery rates in pilot studies.

These gatherings are crucial for building and reinforcing business relationships. In 2024, Autlan reported securing three new significant supply contracts directly attributable to connections made at the International Mining Congress, representing an estimated $25 million in new revenue for 2025.

Autlán's commitment to open communication shines through its investor relations efforts. They regularly release detailed quarterly and annual financial reports, alongside investor news and sustainability updates. These publications offer critical insights into operational successes, financial health, and their dedication to environmental responsibility, fostering investor confidence.

Sustainability and CSR Reporting

Autlán actively promotes its dedication to sustainable development and corporate social responsibility (CSR) as a core element of its promotional strategy. This commitment is demonstrated through tangible actions and transparent reporting. For instance, in 2023, Autlán achieved a significant milestone by obtaining ISO 14001 certification for its environmental management system, underscoring its adherence to international environmental standards.

The company's promotional materials frequently showcase its responsible water management practices, a critical aspect given its operational context. Autlán reported a 15% reduction in water consumption per ton of product in its 2024 sustainability report compared to the previous year. Furthermore, its reforestation programs are a key talking point, with over 50,000 trees planted in 2024 across its operational areas to combat deforestation and improve biodiversity.

Autlán also emphasizes its positive impact on local communities, highlighting its contributions to social welfare and economic development. These efforts resonate strongly with a growing segment of investors and clients who are increasingly scrutinizing supply chains for ethical and sustainable practices. By showcasing these initiatives, Autlán not only bolsters its brand reputation but also attracts partnerships with organizations that share its values.

- Environmental Certifications: Autlán's ISO 14001 certification in 2023 signals a robust environmental management system.

- Water Conservation: A 15% reduction in water consumption per ton of product in 2024 highlights operational efficiency and environmental stewardship.

- Reforestation Efforts: Over 50,000 trees planted in 2024 demonstrate a commitment to ecological restoration and biodiversity.

- Community Engagement: Contributions to local communities are a key promotional focus, appealing to socially conscious stakeholders.

Digital Presence and Online Information Dissemination

Autlán actively utilizes its corporate website and various online channels to share details about its offerings, corporate ethos, and operational segments. This digital infrastructure is crucial for reaching a broad spectrum of stakeholders, from individual investors to industry analysts.

The company's website functions as a primary repository for vital corporate information. It provides easy access to financial statements, investor relations updates, and in-depth descriptions of its core business areas, which include manganese, ferroalloys, and energy. For instance, in their 2024 reports, Autlán highlighted significant production figures for manganese, reaching over 1.5 million tonnes, underscoring the importance of these digital platforms for transparency.

- Corporate Website: Serves as the central hub for all official company information.

- Investor Relations: Provides direct access to financial reports, press releases, and shareholder information.

- Business Unit Details: Offers insights into operations in manganese, ferroalloys, and energy sectors.

- Global Accessibility: Ensures stakeholders worldwide can easily obtain comprehensive and up-to-date information.

Autlán's promotion strategy is deeply rooted in building strong B2B relationships through direct engagement, leveraging technical sales expertise to convey product value to industrial clients. Participation in key industry events in 2024 and 2025, such as MINExpo INTERNATIONAL® and the World Mining Congress, provides direct access to target audiences for showcasing innovations and sustainability efforts.

The company emphasizes transparency and investor confidence through detailed financial reports and sustainability updates, highlighting operational successes and environmental responsibility. For example, Autlán's 2024 sustainability report detailed a 15% reduction in water consumption per ton of product, alongside planting over 50,000 trees.

Autlán's digital presence, particularly its corporate website, acts as a crucial platform for disseminating information about its offerings, financial performance, and commitment to sustainability. In 2024, the company reported manganese production exceeding 1.5 million tonnes, with these figures readily accessible online.

| Promotional Focus | Key Initiatives/Data (2023-2025) | Impact/Reach |

|---|---|---|

| B2B Engagement | Technical sales teams, direct client communication | Expertly communicating value to steelmakers and industrial clients |

| Industry Events | MINExpo INTERNATIONAL® 2024, World Mining Congress 2025 | Direct access to industry leaders and investors; secured 3 new contracts in 2024 worth an estimated $25 million for 2025 |

| Sustainability & CSR | ISO 14001 certified (2023), 15% water reduction per ton (2024), 50,000+ trees planted (2024) | Enhanced brand reputation, attracting ethically conscious partners |

| Digital Presence | Corporate website, investor relations portal | Dissemination of financial reports, operational data (e.g., 1.5M+ tonnes manganese production in 2024), and sustainability updates |

Price

Autlán's pricing strategy for its core products, manganese ore and ferroalloys, is deeply intertwined with global commodity market fluctuations. Prices for these materials are directly impacted by the ebb and flow of international supply and demand, particularly within the manganese and steel sectors. This makes continuous market monitoring crucial for maintaining competitive pricing.

Geopolitical events and production issues among major global suppliers can introduce significant volatility, as observed throughout 2024 and anticipated for 2025. For instance, disruptions in key manganese-producing regions could lead to price spikes, requiring Autlán to be agile in its pricing adjustments to remain competitive in this dynamic environment.

Autlán utilizes a dual approach to pricing, balancing long-term contracts with major industrial customers against opportunistic spot market sales. This strategy ensures a baseline of predictable revenue and demand through secured contracts, while spot sales offer the flexibility to capture higher margins when market conditions are favorable, particularly during periods of constrained supply.

For instance, in the first quarter of 2024, Autlán reported that its long-term contracts provided a stable revenue stream, while its spot market sales contributed to a significant increase in average selling prices during a period of heightened demand for its products. This mixed strategy is crucial for optimizing both risk management and overall revenue generation.

For specialized products like Electrolytic Manganese Dioxide (EMD) and specific ferroalloy formulations, Autlán can employ a cost-plus pricing strategy. This approach ensures that all production expenses, including the higher costs for achieving stringent purity levels and meeting precise technical specifications, are covered. For instance, if the cost to produce a ton of high-purity EMD reaches $2,500, a cost-plus model might add a 15% margin, setting the price at $2,875.

Alternatively, Autlán can leverage value-based pricing, particularly for inputs critical to niche industries like battery manufacturing. The unique value and performance advantages these materials offer, such as enhanced battery life or efficiency, justify a premium. If a competitor’s EMD yields 5% lower performance in a battery application, Autlán’s product, commanding a higher price of $3,000 per ton, reflects this superior value proposition.

Competitive Pricing in Regional Markets

Autlán's pricing strategy in regional markets, especially Mexico, is finely tuned to local demand dynamics, competitor pricing, and the expansion of crucial sectors like automotive and construction. This approach ensures they remain competitive while effectively serving domestic needs.

The Mexican ferroalloys market is anticipating robust growth, with projections indicating an uplift fueled by heightened vehicle manufacturing and mining operations. This trend directly impacts Autlán's pricing decisions, necessitating strategies that balance market competitiveness with the imperative to satisfy growing domestic demand.

A key factor enabling Autlán's competitive pricing is its energy self-sufficiency. This operational advantage translates into lower and more stable operating costs, which can be passed on to customers, strengthening their market position.

- Market Growth: Mexico's ferroalloys market is expected to see significant expansion, with forecasts indicating a compound annual growth rate (CAGR) of approximately 4.5% through 2028, driven by automotive and construction sectors.

- Competitive Landscape: Pricing is benchmarked against key regional players, with average ferrochrome prices in Mexico hovering around $1.20-$1.30 per pound as of early 2024.

- Cost Advantage: Autlán's investment in hydroelectric power generation provides an estimated 15-20% reduction in energy costs compared to competitors reliant on grid power.

- Demand Drivers: The automotive industry in Mexico, a major consumer of ferroalloys, saw production increase by 9.5% in 2023, directly influencing demand and pricing power for materials like ferrochrome.

Impact of Energy Costs on Production Pricing

Autlán's self-sufficiency in energy, generated by its own hydroelectric plants, significantly influences its production pricing. This internal energy generation shields Autlán from the unpredictable fluctuations often seen in external energy markets, offering a stable cost base. For instance, in 2024, many industrial producers faced rising electricity costs, with some regions seeing increases of over 15%. Autlán's model, however, allows it to maintain more consistent and often lower energy expenses.

This direct control over a major input cost provides Autlán with a distinct competitive edge. It translates into greater flexibility in setting product prices, whether that means offering more competitive rates to capture market share or retaining higher profit margins. This operational advantage is a cornerstone of Autlán's cost structure, directly impacting its ability to compete effectively in the market.

The impact on Autlán's pricing strategy is substantial:

- Reduced Cost Volatility: Autlán's reliance on self-generated hydroelectric power minimizes exposure to the energy price shocks that affected many competitors in 2024.

- Competitive Pricing Potential: Lower internal energy costs enable Autlán to price its products more aggressively, potentially gaining market share.

- Enhanced Profitability: Alternatively, Autlán can leverage these savings to improve its profit margins, boosting financial performance.

- Strategic Cost Management: This control over energy costs is a critical element in Autlán's overall efficient cost management strategy.

Autlán's pricing strategy is a dynamic interplay of global commodity trends, regional demand, and its unique cost advantages, particularly its energy self-sufficiency. This allows for a flexible approach, balancing long-term contracts with spot market opportunities to optimize revenue and competitiveness.

The company's energy independence, derived from its hydroelectric plants, provides an estimated 15-20% reduction in energy costs compared to competitors. This significant cost advantage, especially when contrasted with the 15% rise in electricity costs faced by some industrial producers in 2024, underpins Autlán's ability to offer competitive pricing or enhance profit margins.

In Mexico, the ferroalloys market, projected to grow at a 4.5% CAGR through 2028, sees ferrochrome prices around $1.20-$1.30 per pound in early 2024. Autlán's pricing is benchmarked against these figures, influenced by a 9.5% production increase in Mexico's automotive sector in 2023, a key consumer of its products.

| Product | Pricing Strategy | Key Influences | Example Pricing Factor (2024/2025) |

|---|---|---|---|

| Manganese Ore & Ferroalloys (Global) | Market-driven (Supply/Demand, Commodity Prices) | Geopolitical events, producer output, steel sector demand | Price volatility due to supply disruptions in key regions |

| Manganese Ore & Ferroalloys (Mexico) | Market-driven (Regional Demand, Competitor Pricing) | Automotive and construction sector growth, domestic competition | Benchmarked against regional ferrochrome prices ($1.20-$1.30/lb) |

| Specialty Products (EMD, Ferroalloys) | Cost-plus or Value-based | Production costs, purity levels, technical specifications, performance benefits | Cost-plus: $2,500/ton base + 15% margin for high-purity EMD; Value-based: premium for superior battery performance |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.