Ault Alliance SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

Ault Alliance's strengths lie in its diversified portfolio and strategic acquisitions, but its weaknesses include potential integration challenges. Understanding these dynamics is crucial for navigating its market position.

Want the full story behind Ault Alliance's opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Ault Alliance, Inc. is strategically repositioning itself, rebranding as Hyperscale Data, Inc., with a core focus on AI data center operations. This pivotal shift aims to capture the burgeoning demand for artificial intelligence infrastructure.

The company plans a substantial expansion of its Michigan data center capacity, increasing it tenfold from 30 megawatts to 300 megawatts. This aggressive expansion directly addresses the escalating need for robust AI-driven infrastructure.

Ault Alliance possesses a tangible asset base with its existing data center infrastructure, including a key facility in Michigan. This operational foundation is crucial for its strategic ambitions.

The company is actively expanding this footprint, notably with new sites under development in Montana. This expansion is designed to support the burgeoning demand from AI ecosystems and other data-intensive industries.

Sentinum, a wholly-owned subsidiary, plays a vital role in managing and operating these data centers, underscoring the company's direct involvement and expertise in this sector.

Ault Alliance's Sentinum subsidiary is a key player in Bitcoin mining, demonstrating a strong operational track record. In 2024 alone, the company mined 552 Bitcoin, adding to its cumulative total of 2,894 Bitcoin mined since its inception.

Despite a strategic shift in focus for the company, these Bitcoin mining operations remain a significant revenue generator. This ongoing contribution directly impacts Ault Alliance's overall financial performance, providing a consistent stream of income.

Ault Alliance maintains transparency regarding its cryptocurrency activities by providing regular quarterly updates on its Bitcoin mining results. This allows stakeholders to track the performance and revenue contribution of this segment.

Improved Financial Efficiency and Debt Management

Ault Alliance has shown significant strides in improving its financial efficiency and managing its debt. In the first half of 2024, the company successfully reduced its general and administrative expenses by a notable $17 million. This focused effort on cost control directly contributes to a stronger bottom line.

Furthermore, Ault Alliance has made substantial progress in managing its debt obligations. Interest expenses saw a remarkable 59% decrease during the same period. This reduction is a testament to the company's strategic approach to debt management, aiming to lower financial burdens and enhance overall operational efficiency.

- $17 million reduction in general and administrative expenses (H1 2024).

- 59% decrease in interest expenses (H1 2024).

- $38.5 million of senior secured debt repaid in late 2023.

Diversified Asset Portfolio (during transition)

Prior to its strategic shift, Ault Alliance's diversified asset portfolio offered a significant strength. This included not only data centers and Bitcoin mining but also hotel and real estate, defense operations, and lending activities. This broad base provided stability during its transition phase.

The diverse segments demonstrated their value by contributing to revenue growth in early 2024. For example, the company reported a significant increase in revenue from its various segments, showcasing the resilience of its multifaceted business model during this period of strategic realignment.

- Diversified Revenue Streams: Reduced reliance on any single market segment, offering a buffer against sector-specific downturns.

- Early 2024 Growth: Various segments contributed positively to the company's financial performance in the initial months of 2024.

- Strategic Flexibility: The broad asset base allowed for greater maneuverability in executing its divestiture and transition plans.

Ault Alliance's strategic pivot to AI data centers is supported by a solid foundation of existing infrastructure and aggressive expansion plans. The company is significantly scaling its Michigan data center capacity tenfold, from 30 megawatts to 300 megawatts, to meet the surging demand for AI-driven computing power.

The company's Sentinum subsidiary not only manages these data centers but also contributes a consistent revenue stream through Bitcoin mining. In 2024, Ault Alliance mined 552 Bitcoin, demonstrating operational proficiency in this area.

Financial efficiency has been a key strength, with a $17 million reduction in general and administrative expenses and a 59% decrease in interest expenses in the first half of 2024, showcasing effective cost management and debt reduction.

The company's previous diversified asset portfolio, including hotels, real estate, and defense operations, provided revenue growth in early 2024 and strategic flexibility during its transition.

| Segment | H1 2024 G&A Reduction | H1 2024 Interest Expense Reduction | 2024 Bitcoin Mined | Michigan Data Center Capacity (Current/Planned) |

|---|---|---|---|---|

| Overall Operations | $17 million | 59% | 552 | 30 MW / 300 MW |

| Sentinum (Bitcoin Mining) | N/A | N/A | 552 | N/A |

| Data Centers | N/A | N/A | N/A | 30 MW / 300 MW |

What is included in the product

Analyzes Ault Alliance’s competitive position through key internal and external factors, including its financial strengths and market opportunities.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, transforming potential weaknesses into manageable challenges.

Weaknesses

Ault Alliance's stock price has been notably volatile, reflecting significant market uncertainty. As of early 2024, the company's price-to-book (P/B) ratio has been exceptionally low, often trading at a substantial discount to its stated book value. This suggests investors are skeptical about the company's intrinsic value or its future earnings potential under its current strategy.

The market's reaction has been harsh, with the stock experiencing considerable negative returns in recent periods. This underperformance, evidenced by a significantly low P/B multiple, points to a lack of investor confidence, potentially stemming from the market's perception of its past diversified holding company structure and the challenges in realizing value from its various segments.

Ault Alliance's ambitious growth, particularly the expansion of its Michigan AI data center to 300 megawatts, heavily relies on obtaining sufficient external financing. This dependence introduces a significant risk, as any delays or outright failure to secure this capital could directly hinder its strategic expansion plans.

The company intends to fund this expansion primarily through debt. For example, as of the first quarter of 2024, Ault Alliance reported total debt of $196.8 million, highlighting its existing leverage and the need for careful management of new debt obligations to support growth without overextending.

Ault Alliance's historical diversification across sectors like defense, telecommunications, and real estate presented significant management complexities. This wide operational scope often made it challenging to efficiently allocate resources and foster synergies among its varied business units.

Exposure to Bitcoin Market Volatility

Ault Alliance's reliance on Bitcoin mining as a revenue stream exposes it to significant market volatility. Fluctuations in Bitcoin's price directly impact the profitability of its mining operations, which can lead to unpredictable revenue streams. For instance, during periods of sharp price declines, the cost of energy and hardware can outweigh the value of mined Bitcoin, potentially turning a profit center into a loss. The company's financial projections, therefore, must account for these inherent market risks.

Changes in Bitcoin mining difficulty also present a substantial challenge. As more miners join the network, the difficulty of finding new blocks increases, requiring more computational power and energy to achieve the same results. This dynamic can erode profit margins even if Bitcoin prices remain stable. Ault Alliance's strategy must therefore consider the ongoing arms race in mining efficiency and capacity.

- Bitcoin Price Sensitivity: The company's digital asset mining segment's profitability is directly tied to the market price of Bitcoin.

- Mining Difficulty Impact: Increased competition and network hash rates raise mining difficulty, potentially reducing output per unit of energy.

- Revenue Uncertainty: These factors create inherent uncertainty in revenue forecasts for the digital asset mining segment.

- Operational Cost Management: Maintaining profitability requires vigilant management of energy costs and hardware efficiency in a competitive landscape.

Integration Risks and Challenges with Acquisitions

Ault Alliance's historical reliance on acquisitions for growth presented significant integration risks. Merging diverse company cultures, IT systems, and operational frameworks often proved complex and resource-intensive, potentially hindering synergy realization. For instance, the successful integration of multiple acquired entities in past years would have required substantial management attention and capital allocation, diverting resources from organic growth initiatives.

While the company is pivoting towards optimizing existing assets and strategic divestitures, the legacy of past integrations may still present challenges. These can include lingering inefficiencies from poorly assimilated operations or ongoing costs associated with managing previously acquired businesses that did not fully meet integration expectations. The company's 2023 financial reports, for example, may show continued amortization expenses related to past intangible assets acquired, indirectly reflecting the integration efforts.

Specific integration challenges can manifest in several ways:

- Cultural Clashes: Difficulty in aligning management styles and employee expectations across acquired businesses.

- System Incompatibilities: The high cost and complexity of integrating disparate accounting, CRM, or operational software.

- Operational Synergies: Delays or failures in achieving projected cost savings or revenue enhancements from combined operations.

- Management Bandwidth: The strain on leadership to oversee multiple integration processes simultaneously, potentially impacting strategic focus.

Ault Alliance's stock performance has been a significant concern, with its price-to-book ratio consistently trading at a substantial discount to its book value as of early 2024. This market sentiment suggests a lack of investor confidence in the company's valuation and future prospects, potentially stemming from its past diversified structure.

The company's ambitious expansion plans, particularly for its Michigan AI data center, are heavily reliant on external financing, creating a considerable risk if capital acquisition is delayed or unsuccessful. Ault Alliance's existing debt, reported at $196.8 million in Q1 2024, underscores the need for careful management of new debt to support growth without overleveraging.

The company's historical diversification across multiple sectors presented management complexities, making efficient resource allocation and synergy realization challenging. Furthermore, its reliance on Bitcoin mining exposes Ault Alliance to the inherent volatility of cryptocurrency prices and increasing mining difficulty, which directly impacts revenue predictability and profit margins.

Past acquisition-driven growth strategies have introduced integration risks, including cultural clashes and system incompatibilities, which can hinder synergy realization and divert management focus. Even with a pivot towards asset optimization and divestitures, legacy integration challenges may persist, potentially impacting overall operational efficiency and financial performance.

Preview the Actual Deliverable

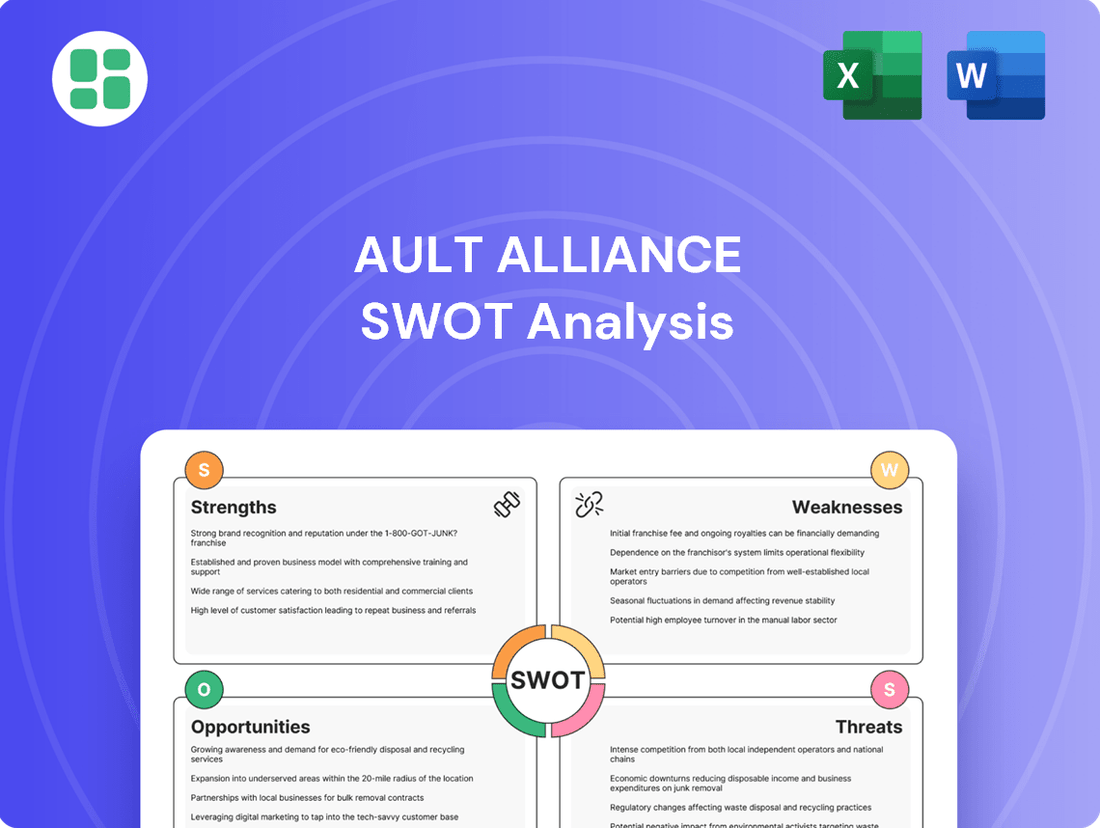

Ault Alliance SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Ault Alliance SWOT analysis, so you know exactly what you're getting. Purchase now to access the full, detailed report.

Opportunities

Hyperscale Data, Inc. is well-positioned to benefit from the explosive growth in demand for AI infrastructure. The company's strategic expansion of its AI data center capacity directly addresses projected increases in data center power consumption, a trend expected to drive significant revenue growth and market share expansion.

Ault Alliance's strategic spin-off into Hyperscale Data, Inc. and Ault Capital Group, Inc. is designed to unlock significant shareholder value. This move creates focused, pure-play businesses, allowing each to pursue distinct growth strategies in AI data centers, Bitcoin, and non-AI/Bitcoin assets respectively.

By separating these ventures, investors can more clearly assess the performance and potential of each distinct business line. This clarity is crucial for attracting targeted investment and potentially achieving higher valuations for each entity, especially in the rapidly evolving AI and digital asset sectors.

Ault Alliance is strategically positioned to capitalize on the burgeoning demand for high-density computing infrastructure. Beyond its core Bitcoin mining operations, the company has a significant opportunity to expand its colocation and hosting services, catering to the rapidly growing AI ecosystem and other data-intensive industries.

The planned expansion of its Michigan facility to a substantial 300 megawatts, coupled with ongoing exploration of additional power sources in Montana, directly underpins this growth trajectory. This expansion is crucial for meeting the immense power and cooling requirements of advanced AI workloads, offering Ault Alliance a clear path to diversification and increased revenue streams.

Monetization of Non-Core Assets

Ault Alliance's strategic move to monetize non-core assets, such as its intention to issue special dividends of stock in subsidiaries like Ault Capital Group, presents a significant opportunity. This action aims to unlock capital that can be strategically redeployed into its core Hyperscale Data operations, a key growth area within the burgeoning AI sector.

This capital generation is crucial for accelerating expansion and reinforcing its competitive position in the AI data center market. The company's focus on divesting or distributing non-essential holdings allows for a more concentrated investment in high-potential AI infrastructure, potentially driving substantial returns as AI adoption continues to surge through 2024 and into 2025.

- Capital Generation: Monetizing non-core assets provides a direct avenue to raise funds.

- Strategic Reinvestment: The generated capital can fuel growth in the AI data center business.

- Focus on Core Operations: Allows for a sharpened focus on high-growth AI sector opportunities.

- Enhanced Financial Flexibility: Increases the company's capacity for future investments and strategic initiatives.

Technological Advancements in AI and Blockchain

Ongoing advancements in AI and blockchain present significant opportunities for Ault Alliance, particularly through its Hyperscale Data subsidiary. These technologies can unlock new service models and enhance existing ones, driving innovation and market expansion. For instance, AI can optimize data center operations, improving efficiency and reducing costs, while blockchain offers secure and transparent data management solutions.

By integrating AI and blockchain, Hyperscale Data can develop cutting-edge solutions that cater to the growing demand for secure, efficient, and intelligent data infrastructure. This strategic adoption can lead to the creation of novel products and services, attracting a broader client base and strengthening the company's competitive edge. The global AI market is projected to reach over $1.5 trillion by 2030, and the blockchain market is expected to exceed $300 billion by 2027, indicating substantial growth potential.

- AI-driven data center optimization: Enhancing energy efficiency and predictive maintenance.

- Blockchain for secure data solutions: Offering immutable and transparent data storage and transaction services.

- Development of new AI/blockchain-integrated services: Creating unique offerings for enterprise clients.

- Market expansion: Tapping into the rapidly growing demand for advanced digital infrastructure.

Ault Alliance is poised to capitalize on the escalating demand for AI infrastructure by expanding its data center capacity. This strategic move directly addresses the projected surge in data center power consumption, a trend anticipated to fuel substantial revenue growth and market share gains through 2024 and into 2025.

The company's ability to secure and manage significant power resources, such as the planned 300-megawatt expansion in Michigan, positions it favorably to serve the intensive energy needs of AI workloads. This expansion is critical for capturing opportunities in the burgeoning AI sector, driving diversification and new revenue streams.

Furthermore, Ault Alliance can leverage its expertise in digital asset operations to offer specialized hosting and colocation services for AI-focused enterprises. This diversification strategy, coupled with the potential monetization of non-core assets to reinvest in its Hyperscale Data operations, presents a clear pathway for enhanced shareholder value and competitive positioning in the evolving tech landscape.

Threats

Ault Alliance faces substantial execution risks with its Michigan data center expansion, aiming to scale from 30 MW to 300 MW. This ambitious project could encounter significant delays, unexpected cost increases, and difficulties in securing essential regulatory permits and adequate funding. For instance, the company reported in its Q1 2024 earnings that capital expenditures for data center development were $12.1 million, highlighting the immediate financial commitment involved.

Failure to manage these execution challenges effectively could severely hamper Ault Alliance's projected growth and negatively impact its financial health. The sheer scale of the expansion, a tenfold increase in capacity, magnifies these inherent risks, demanding meticulous planning and robust project management to mitigate potential setbacks.

The AI data center market is a crowded space, with major players like Amazon Web Services, Microsoft Azure, and Google Cloud investing heavily, alongside numerous specialized providers. Hyperscale Data, Inc. must contend with this intense rivalry for both customers and skilled personnel. For instance, in 2024, hyperscale data center construction spending globally was projected to reach over $200 billion, highlighting the scale of investment and competition.

Ault Alliance's significant exposure to Bitcoin mining means it faces considerable risks from regulatory shifts and market price swings. For instance, the U.S. government has been exploring various approaches to cryptocurrency regulation, which could impact mining operations. The price of Bitcoin itself experienced substantial volatility in 2024, with significant fluctuations affecting revenue streams for mining companies.

Capital Market Conditions and Access to Funding

Ault Alliance's history of stock price fluctuations and relatively small market capitalization presents a significant hurdle in securing substantial funding for growth initiatives. This is particularly true when capital markets are less favorable, potentially forcing the company to issue new shares at depressed values, leading to shareholder dilution, or face higher interest rates on any debt financing obtained. As of early 2024, Ault Alliance's market cap has remained below $100 million, underscoring this challenge.

The company's access to capital is directly impacted by prevailing market sentiment and the overall economic climate. In periods of economic uncertainty or rising interest rates, lenders and investors become more risk-averse, making it harder and more expensive for companies like Ault Alliance to raise the necessary funds for strategic expansion or operational needs. This can constrain growth opportunities and force a reliance on internal cash flows, which may not be sufficient for ambitious plans.

- Market Volatility: Ault Alliance's stock has experienced significant price swings, impacting investor confidence and the attractiveness of its equity as a funding source.

- Limited Market Capitalization: A smaller market cap generally translates to less access to large-scale institutional investment and potentially higher borrowing costs.

- Economic Sensitivity: Adverse capital market conditions, such as increased interest rates or reduced liquidity, directly threaten the company's ability to raise capital efficiently.

- Financing Costs: If capital is raised, it may come at a premium due to perceived risk, increasing the company's debt burden or diluting existing shareholders.

Economic Downturns Affecting Investment Climate

Broader economic downturns pose a significant threat to Ault Alliance by potentially dampening demand for its data center services. Businesses facing economic headwinds may cut back on IT spending, impacting revenue streams. For instance, a projected slowdown in global GDP growth for 2024-2025 could directly correlate with reduced client investment in essential infrastructure like data centers.

Furthermore, a weakening economy could slow investment in crucial growth areas such as AI technologies, a sector Ault Alliance is keen to capitalize on. This macro-economic factor could lead to delayed expansion plans for clients and a general decrease in their willingness to commit to long-term data center contracts, thereby affecting Ault Alliance's asset valuation and overall financial performance.

- Reduced Client Spending: Economic slowdowns typically lead to decreased corporate IT budgets, impacting demand for data center capacity.

- Delayed AI Investment: A tougher economic climate can cause businesses to postpone or scale back investments in new technologies like AI, affecting growth opportunities.

- Valuation Pressure: Broader market sentiment during downturns can negatively impact the valuation of technology-dependent assets and companies.

Ault Alliance faces intense competition in the AI data center market from established hyperscale providers and specialized firms, making customer acquisition and talent retention challenging. Global hyperscale data center construction spending was projected to exceed $200 billion in 2024, underscoring the significant capital investment and competitive landscape Ault Alliance must navigate.

The company's substantial exposure to Bitcoin mining presents risks from cryptocurrency market volatility and evolving regulatory frameworks. Bitcoin's price experienced significant fluctuations throughout 2024, directly impacting mining revenue streams, while regulatory discussions in the US could affect mining operations.

Ault Alliance's relatively small market capitalization and stock price volatility hinder its ability to secure substantial funding. With a market cap often below $100 million in early 2024, raising capital for expansion may necessitate issuing shares at lower valuations or incurring higher borrowing costs.

Broader economic downturns pose a threat by potentially reducing corporate IT spending and slowing investment in AI technologies, impacting demand for data center services and growth opportunities. Projected global GDP slowdowns for 2024-2025 could correlate with reduced client investment in data center infrastructure.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and actionable strategic overview.