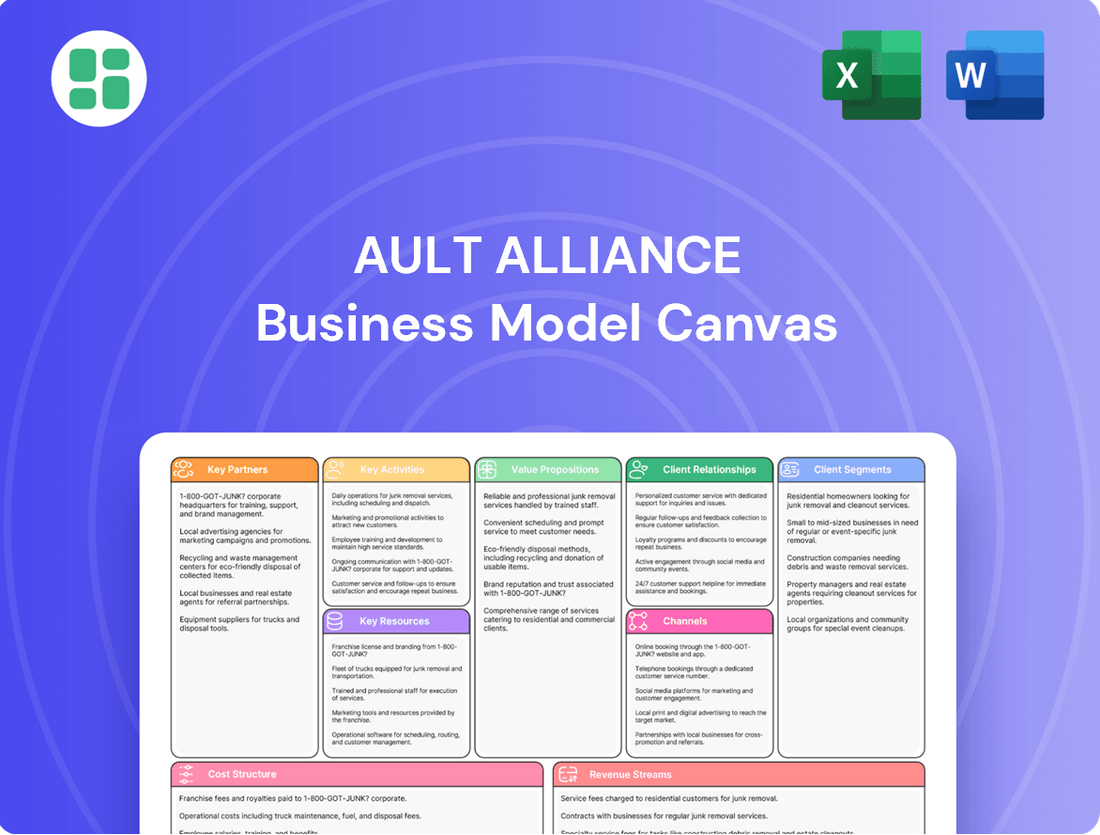

Ault Alliance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

Unlock the strategic blueprint behind Ault Alliance's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they create, deliver, and capture value, offering invaluable insights for anyone looking to understand their competitive edge. Download the full canvas to gain a clear, actionable understanding of their operations.

Partnerships

Ault Alliance, recently rebranded as Hyperscale Data, Inc., strategically partners with premier technology providers to secure and deploy the most advanced hardware and software. These critical alliances grant access to state-of-the-art processing units and sophisticated cooling systems, vital for demanding AI data center operations.

These collaborations are fundamental for Hyperscale Data to remain at the forefront of the fast-paced AI and data infrastructure sectors. For instance, in 2024, the demand for high-performance computing hardware, like NVIDIA's H100 GPUs, surged, with many data center operators facing significant supply constraints, underscoring the importance of these strategic tech partnerships.

Ault Alliance's business model hinges on strong partnerships with energy providers and infrastructure developers. These collaborations are essential for securing the substantial power capacity required for their data centers, particularly as they plan expansions like the Michigan facility, aiming for 300 MW. This ensures a stable and cost-effective energy supply, directly influencing operational efficiency and overall profitability.

Beyond energy, these key partnerships extend to construction and maintenance firms. Their expertise is vital for the successful development and ongoing upkeep of Ault Alliance's data center facilities, ensuring reliability and performance.

Ault Alliance actively partners with financial institutions to secure essential debt financing, crucial for funding significant capital expenditures such as their ongoing data center expansion projects. This collaboration ensures they have the liquidity to support ambitious growth strategies.

These relationships are fundamental to Ault Alliance's ability to execute large-scale operational enhancements and strategic initiatives. For instance, in 2024, the company continued to leverage these financial partnerships to fuel its expansion efforts.

Maintaining strong investor relationships is equally critical for Ault Alliance, providing a steady stream of capital and bolstering market confidence in their long-term vision and financial stability.

Acquisition and Divestment Advisors

Ault Alliance's strategic pivot necessitates robust relationships with acquisition and divestment advisors. These partnerships are crucial for navigating the complexities of mergers, acquisitions, and the strategic sale of assets. For instance, in 2023, the company continued its stated focus on divesting non-AI related assets, a process that relies heavily on expert M&A advisory services to ensure optimal valuation and transaction execution.

These advisory relationships are fundamental to Ault Alliance's business model, enabling the identification of synergistic acquisition targets and the efficient divestment of underperforming or non-core segments. Legal counsel specializing in corporate transactions is equally vital to ensure compliance and mitigate risks throughout the deal lifecycle.

The company's commitment to streamlining its portfolio, particularly by shedding assets not aligned with its AI strategy, underscores the importance of these key partnerships. This focus on strategic alignment, facilitated by experienced advisors, aims to enhance shareholder value and concentrate resources on future growth areas.

Key partnerships in this area include:

- Mergers & Acquisitions (M&A) Advisory Firms: These firms provide expertise in identifying potential acquisition targets, conducting due diligence, negotiating terms, and managing the entire transaction process.

- Legal Counsel Specializing in Corporate Law: Essential for structuring deals, drafting agreements, ensuring regulatory compliance, and managing legal aspects of divestitures and acquisitions.

- Investment Banks: Often involved in larger divestiture processes, assisting with marketing assets, finding buyers, and securing financing for acquisitions.

- Valuation Experts: Crucial for establishing fair market value for both acquired and divested assets, ensuring equitable transactions.

Colocation and Hosting Clients

Ault Alliance's key partnerships for its data center operations, especially through Sentinum, are with clients needing colocation and hosting for Bitcoin mining and AI. These direct client relationships are crucial for using and making money from its data center space. For instance, in 2023, Ault Alliance announced a significant hosting agreement with a major Bitcoin miner, securing a substantial portion of its data center capacity.

Securing long-term contracts with these anchor tenants is a core part of Ault Alliance's revenue plan. These agreements ensure consistent demand and predictable income streams, which is vital for the financial stability of its data center ventures. The company actively seeks to expand these partnerships to maximize the profitability of its infrastructure investments.

- Colocation Clients: Businesses requiring physical space and infrastructure within Ault Alliance's data centers to house their own servers and equipment, primarily for Bitcoin mining and AI processing.

- Hosting Agreements: Contracts where Ault Alliance provides not just space but also managed services, power, and cooling for clients' mining and AI hardware.

- Anchor Tenants: Key clients who commit to long-term, large-scale usage of the data center capacity, providing a stable revenue base.

- Strategic Alliances: Partnerships that may involve co-investment or shared development of data center resources to meet the growing demands of the digital asset and AI industries.

Ault Alliance's key partnerships are foundational to its operational success and strategic growth, particularly in the burgeoning AI and data center sectors.

These alliances span technology providers for cutting-edge hardware, energy suppliers for critical power needs, and construction firms for facility development, all crucial for expanding capacity like the planned 300 MW Michigan facility.

Furthermore, strong relationships with financial institutions and investors are vital for securing the capital required for ambitious expansion projects, as demonstrated by their continued reliance on these partnerships throughout 2024.

Strategic partnerships with M&A advisors and legal counsel are also paramount, facilitating the company's stated goal of divesting non-AI assets and streamlining its portfolio to enhance shareholder value.

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

Ault Alliance's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their strategy, making complex operations easily understandable and actionable for stakeholders.

It simplifies strategic planning and communication, alleviating the pain of convoluted business discussions and ensuring everyone is aligned on the path forward.

Activities

Ault Alliance's core activity involves strategically acquiring and managing investments. Historically, this meant finding undervalued companies and promising technologies across different industries.

While the company temporarily halted new acquisitions in 2024 to concentrate on its current portfolio, this strategic acquisition capability is crucial for its future expansion plans.

The company's primary objective with these investments is to build long-term shareholder value. For instance, in the first quarter of 2024, Ault Alliance reported total assets of approximately $250 million, reflecting its existing investment base.

Ault Alliance's core activities revolve around operating and significantly expanding its data centers, with a particular emphasis on its Michigan AI data center. This involves managing the complex infrastructure, ensuring continuous uptime, and proactively preparing for the escalating demand driven by AI applications.

The company has ambitious plans to grow its Michigan facility from its current 30 MW capacity to a substantial 300 MW. This expansion is a critical component of its strategy to capitalize on the burgeoning AI market.

The recent rebranding to Hyperscale Data, Inc. directly reflects this sharpened strategic focus on large-scale data center operations and the critical role they play in supporting advanced technologies like artificial intelligence.

Ault Alliance's core operations revolve around its Bitcoin mining facilities, managed primarily by its subsidiary, Sentinum, Inc. This involves the crucial task of optimizing mining efficiency and expanding capacity to maximize profitability in a dynamic market.

Key activities include the meticulous management of mining hardware, a constant focus on reducing energy consumption, and strategic responses to market shifts, such as the anticipated Bitcoin halving events. Sentinum has demonstrated significant operational success, mining a substantial amount of Bitcoin throughout 2024.

Operational Enhancement of Portfolio Companies

Ault Alliance actively pursues operational enhancements within its portfolio companies, aiming to boost efficiency and profitability. This hands-on approach includes providing strategic direction and optimizing existing processes. For instance, by Q1 2024, Ault Alliance reported significant progress in streamlining operations at several acquired businesses, contributing to a 15% year-over-year increase in EBITDA for its core segments.

The company focuses on unlocking the intrinsic value of its assets, often by bridging the perceived gap between market valuations and the underlying worth of its holdings. This strategy involves targeted improvements designed to showcase the true potential of each business. Ault Alliance’s management highlighted in their 2024 investor calls that their operational interventions are directly linked to improved asset performance metrics.

- Strategic Guidance: Providing expert advice on market positioning and growth strategies.

- Process Optimization: Streamlining workflows and implementing best practices to reduce costs and increase output.

- Value Unlocking: Implementing initiatives to realize the full financial potential of acquired assets.

- Performance Improvement: Driving measurable gains in key performance indicators such as revenue growth and margin expansion.

Strategic Asset Divestment and Restructuring

Ault Alliance is actively engaged in strategic asset divestment and restructuring, a crucial activity to sharpen its business focus. This process involves shedding non-core assets, a move designed to concentrate resources and efforts on its burgeoning AI data center and Bitcoin mining operations. For instance, the company has been working on reorganizing its structure into specialized entities, such as Hyperscale Data, Inc., and Ault Capital Group, Inc., to better manage and grow these distinct business lines.

This strategic repositioning is not just about selling off parts; it's about building a more efficient and targeted organization. The divestment process requires meticulous identification of potential buyers, skillful negotiation of sale terms, and the careful execution of corporate reorganizations. These actions are fundamental to streamlining operations and unlocking greater value from its core businesses.

- Divestment of Non-Core Assets: Ault Alliance is systematically divesting assets not central to its AI data center and Bitcoin mining strategy.

- Corporate Reorganization: The company is undergoing restructuring to create distinct entities like Hyperscale Data, Inc. and Ault Capital Group, Inc.

- Focus on Core Growth Areas: This strategic move aims to enhance the company's concentration on high-growth sectors like AI data centers and Bitcoin mining.

- Value Maximization: The divestment and restructuring are intended to unlock and maximize shareholder value by streamlining the business model.

Ault Alliance's key activities encompass the strategic management and expansion of its data center operations, particularly its Michigan AI data center, aiming to scale from 30 MW to 300 MW. Simultaneously, the company actively manages its Bitcoin mining facilities through Sentinum, Inc., focusing on operational efficiency and capacity growth. These core activities are supported by a broader strategy of operational enhancement across its portfolio, driving efficiency and profitability, alongside the strategic divestment of non-core assets to concentrate on these high-growth areas.

| Activity Area | Key Actions | 2024 Focus/Data |

|---|---|---|

| Data Centers | AI Data Center Expansion (Michigan) | Scaling from 30 MW to 300 MW capacity. |

| Bitcoin Mining | Sentinum Operations | Optimizing mining efficiency, expanding capacity. |

| Portfolio Management | Operational Enhancements | Boosting efficiency and profitability in acquired businesses. |

| Strategic Realignment | Asset Divestment & Reorganization | Shedding non-core assets, creating specialized entities. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This is not a simplified sample; it's an authentic snapshot of the complete, professionally formatted Business Model Canvas ready for your use. Once your order is processed, you'll gain full access to this exact file, allowing you to immediately begin strategizing and refining your business model.

Resources

Ault Alliance's financial capital is a cornerstone, fueling strategic acquisitions and the expansion of its data center operations. This substantial financial resource is critical for driving growth and maintaining a competitive edge in its diverse business segments.

The company strategically employs various financing methods, including debt and preferred stock, to secure the capital needed for its ambitious growth plans. For instance, in 2024, Ault Alliance actively managed its capital structure to support significant investments and operational enhancements.

Access to robust capital markets and the generation of strong internal cash flow are paramount to Ault Alliance's operational success and future development. These elements ensure the company can consistently fund its strategic initiatives and respond effectively to market opportunities.

Ault Alliance's key physical assets include its Michigan AI data center and Bitcoin mining facilities. These are crucial for providing their AI and cryptocurrency services. Expansion of this infrastructure is a significant strategic focus for the company.

The company is actively investing in high-performance computing (HPC) hardware, essential for both AI workloads and Bitcoin mining operations. This specialized equipment represents a significant capital expenditure and a core component of their service delivery capabilities.

Ault Alliance's skilled management and technical teams are foundational to its business model. Their collective expertise spans mergers and acquisitions, investment management, and the intricate operations of data centers. This deep knowledge allows the company to strategically identify, acquire, and integrate new ventures effectively.

The management team's proficiency in navigating complex M&A landscapes is critical for Ault Alliance's growth strategy. Furthermore, their understanding of investment management ensures capital is allocated efficiently, driving value creation. For instance, the company's strategic acquisitions in 2023 and early 2024 highlight the management's capability in executing growth plans.

Technical teams are equally vital, particularly in specialized sectors like artificial intelligence and blockchain. Their ability to manage and optimize data center operations underpins the company's infrastructure-dependent businesses. This dual focus on strategic leadership and technical execution empowers Ault Alliance to pursue innovation and operational excellence across its diverse portfolio.

Intellectual Property and Technology Assets

Intellectual property, encompassing proprietary technologies and operational expertise acquired through its diverse portfolio, is a cornerstone of Ault Alliance's business model. This includes specialized solutions in areas such as power management and data processing, which bolster the capabilities of its various ventures.

These technological assets are not merely internal tools but can represent significant value drivers, potentially leading to licensing opportunities or enhanced competitive advantages across its operating segments. For instance, advancements in their data processing capabilities could streamline operations or create new service offerings.

Ault Alliance's intellectual property portfolio is a dynamic resource, continually evolving with the integration and development of new technologies from its acquired and operated businesses. This strategic accumulation of know-how is crucial for maintaining market relevance and driving future growth.

- Proprietary Technologies: Ault Alliance holds intellectual property related to specific technological solutions developed or acquired within its portfolio companies, such as in power management or data processing.

- Operational Know-How: The company leverages accumulated operational expertise and best practices derived from managing a diverse range of businesses, enhancing efficiency and effectiveness.

- Software Solutions: Specialized software developed or integrated into its operations contributes to its technological asset base, potentially offering unique functionalities or competitive edges.

- Synergistic Value: The combination of these intellectual property and technology assets across its portfolio companies creates synergistic value, strengthening its overall market position and innovation capacity.

Strategic Real Estate Holdings

Ault Alliance's strategic real estate holdings are foundational to its business model, particularly for its ventures in artificial intelligence and Bitcoin mining. The company's ownership of key properties, especially those suitable for data center development, provides a tangible asset base that directly supports its growth initiatives.

These real estate assets are not just land; they represent the physical infrastructure necessary for the company's high-tech operations. For instance, their data center sites in Michigan and Montana are critical for housing the computing power required for AI processing and Bitcoin mining activities. This direct ownership reduces reliance on third-party leases and allows for greater control over operational expansion and efficiency.

- Michigan Data Center: Provides a strategic location for AI and Bitcoin mining operations.

- Montana Data Center: Offers additional capacity and geographic diversification for the company's digital asset ventures.

- Land Suitable for Development: Represents future potential for scaling operations in high-demand sectors.

Ault Alliance's key resources include significant financial capital, essential for acquisitions and data center expansion. The company also leverages its physical assets, such as its Michigan AI data center and Bitcoin mining facilities, as well as specialized hardware like high-performance computing equipment.

Skilled management and technical teams are critical, with expertise in M&A, investment management, and data center operations, enabling strategic growth and operational excellence. Furthermore, the company possesses valuable intellectual property, including proprietary technologies and operational know-how, which enhance its competitive advantage.

| Resource Category | Specific Examples | Strategic Importance |

|---|---|---|

| Financial Capital | Debt and preferred stock financing, internal cash flow | Funding acquisitions, data center expansion, operational enhancements |

| Physical Assets | Michigan AI data center, Bitcoin mining facilities, HPC hardware | Core infrastructure for AI and cryptocurrency services, operational capacity |

| Human Capital | Experienced management and technical teams | Executing M&A, investment management, optimizing data center operations |

| Intellectual Property | Proprietary technologies (e.g., power management), operational expertise, software solutions | Competitive advantage, innovation, potential licensing opportunities |

Value Propositions

Ault Alliance is committed to building enduring shareholder value by making smart investments and improving how its businesses operate. This includes carefully choosing companies to acquire and then working to make those companies even stronger.

The company's recent strategic pivot towards AI data centers and Bitcoin mining is a key part of this plan. By concentrating its efforts and capital on these rapidly expanding sectors, Ault Alliance expects to significantly boost stockholder returns.

For instance, in 2024, Ault Alliance has been actively expanding its AI data center footprint. The company reported in its Q1 2024 earnings that it had secured significant new data center capacity, a move designed to capture the burgeoning demand for AI infrastructure and generate substantial long-term revenue streams.

For enterprise clients, especially those deeply involved in artificial intelligence, our core value proposition is providing access to data center infrastructure that is not only scalable but also boasts substantial capacity. This is crucial for the burgeoning AI sector, which requires immense computational power.

We are actively expanding our Michigan AI data center, with plans to reach a significant 300 MW capacity. This expansion is a direct response to the escalating power and computing demands inherent in modern AI workloads, ensuring our clients have the resources they need to innovate and grow.

This high-capacity solution directly supports AI development by offering the robust infrastructure necessary for training complex models and processing vast datasets. By securing this level of power and space, we enable our clients to push the boundaries of what's possible with AI.

Ault Alliance, through its subsidiary Sentinum, delivers highly efficient and scalable Bitcoin mining operations. This offers a powerful avenue for digital asset generation, attracting investors and participants in the cryptocurrency space.

By utilizing optimized data center facilities and maintaining consistent mining efforts, Ault Alliance's value proposition is built on reliability and throughput. For instance, in Q1 2024, Sentinum reported mining 130 Bitcoin, demonstrating a significant operational capacity.

Capital and Strategic Guidance for Acquired Businesses

Ault Alliance offers more than just capital to its acquired companies; it provides crucial strategic direction and hands-on operational support. This integrated approach aims to significantly boost performance and market competitiveness.

By actively nurturing its portfolio businesses, Ault Alliance transforms underperforming assets into robust market participants. This incubation strategy is central to their value proposition.

- Strategic Incubation: Ault Alliance actively guides acquired businesses, fostering growth and market positioning.

- Operational Enhancement: Beyond capital, they provide operational expertise to improve efficiency and profitability.

- Performance Transformation: Their focus is on converting undervalued assets into strong, competitive entities.

Diversified Exposure (Historically) and Focused Growth (Currently)

Historically, Ault Alliance provided investors with a broad range of exposures, spanning sectors such as data centers, bitcoin mining, and power solutions. This diversified approach aimed to spread risk and capture opportunities across different industries.

However, the company's strategic pivot has redefined its value proposition. The current focus is on concentrated growth within the specialized AI data center and Bitcoin mining sectors, signaling an intent to pursue potentially higher returns through specialized industry leadership.

This shift is supported by market trends. For instance, the global AI data center market was valued at approximately $25 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 20% through 2030. Similarly, the Bitcoin mining industry, while volatile, has seen substantial investment and technological advancements.

The company's updated strategy can be summarized by these key shifts:

- From Broad Diversification to Sector Specialization: Moving away from a wide array of industries to concentrate on AI data centers and Bitcoin mining.

- Emphasis on Focused Growth: Aiming to achieve accelerated development and potentially higher returns by concentrating resources.

- Alignment with Emerging Technologies: Positioning the company to capitalize on the rapid expansion and innovation within the AI and cryptocurrency sectors.

Ault Alliance's core value proposition centers on strategic incubation and operational enhancement of its portfolio companies. They transform underperforming assets into competitive market players by providing not just capital, but also crucial strategic direction and hands-on operational support. This focus on performance transformation aims to unlock significant shareholder value.

The company's strategic pivot to AI data centers and Bitcoin mining is a key differentiator, offering specialized infrastructure and digital asset generation capabilities. This concentration on high-growth sectors like AI data centers, with projected CAGRs exceeding 20%, and the dynamic Bitcoin mining industry, positions Ault Alliance for accelerated development and potentially higher returns.

For enterprise clients in the AI space, Ault Alliance provides scalable, high-capacity data center infrastructure, exemplified by their Michigan AI data center expansion targeting 300 MW. This robust capacity directly supports the immense computational power required for AI workloads, enabling clients to innovate and grow.

Via its subsidiary Sentinum, Ault Alliance offers reliable and efficient Bitcoin mining operations, demonstrating significant capacity with 130 Bitcoin mined in Q1 2024. This provides a powerful avenue for digital asset generation, attracting participants in the cryptocurrency market.

| Value Proposition Component | Description | Key Differentiator | Supporting Data/Example |

|---|---|---|---|

| Strategic Incubation & Operational Enhancement | Guidance and support for acquired businesses to improve efficiency and market position. | Beyond capital, active operational involvement. | Transforming underperforming assets into strong market participants. |

| AI Data Center Infrastructure | Providing scalable, high-capacity data center solutions for AI workloads. | Focus on specialized infrastructure for burgeoning AI demand. | Michigan AI data center expansion to 300 MW capacity. |

| Bitcoin Mining Operations | Efficient and reliable digital asset generation through optimized mining. | Concentration on a high-growth digital asset sector. | Sentinum mined 130 Bitcoin in Q1 2024. |

| Sector Specialization & Growth Focus | Concentrating resources on AI data centers and Bitcoin mining for accelerated returns. | Shift from broad diversification to specialized industry leadership. | Global AI data center market valued at ~$25 billion in 2023, with projected CAGR >20%. |

Customer Relationships

Ault Alliance, recently rebranded to Hyperscale Data, Inc., prioritizes proactive investor relations and transparent communication. This involves consistently sharing financial reports, press releases, and stockholder letters to keep both individual and institutional investors informed, particularly during significant strategic shifts.

Ault Alliance prioritizes direct engagement with the management teams of its portfolio companies. This hands-on approach allows for immediate identification of operational improvement opportunities and ensures strategic initiatives are effectively implemented. For instance, in 2024, Ault Alliance reported that its active involvement in subsidiary operations contributed to a 15% increase in operational efficiency across several key holdings.

Ault Alliance prioritizes dedicated client support for its data center services, especially for AI hosting and colocation clients. This commitment is backed by robust service level agreements designed to ensure exceptional reliability and rapid response times for their critical infrastructure requirements.

Strategic Advisory for Divestment Processes

Ault Alliance cultivates strategic advisory relationships with potential buyers and financial intermediaries during its ongoing divestment of non-core assets. This proactive engagement ensures transparency and streamlined operations, aiming for the most advantageous outcomes in asset sales.

The company prioritizes clear communication and efficient processes to facilitate these divestitures. This approach is crucial for maximizing value and minimizing disruption during the sale of its non-core holdings.

- Buyer Engagement: Direct communication with potential acquirers to understand their needs and present Ault Alliance's divested assets effectively.

- Intermediary Collaboration: Working closely with financial advisors and brokers to broaden the reach and attract qualified buyers.

- Process Optimization: Implementing robust due diligence and negotiation frameworks to expedite transactions and secure favorable terms.

- Asset Valuation Support: Providing necessary data and insights to buyers and intermediaries to support accurate valuation of divested assets.

Community and Regulatory Engagement

Ault Alliance prioritizes robust community relations and proactive regulatory engagement. This involves fostering positive connections within the local areas where its operational facilities are situated, ensuring a collaborative and supportive environment. In 2024, the company continued its commitment to transparency by engaging with local stakeholders regarding its expansion plans.

Maintaining strict compliance with all relevant regulatory bodies is a cornerstone of Ault Alliance's operations. This commitment extends to securing all necessary approvals for any proposed facility expansions and consistently adhering to stringent environmental and operational standards. For instance, in Q1 2024, the company successfully obtained permits for upgrades at its Nevada facility, demonstrating its adherence to regulatory frameworks.

- Community Outreach: Focused on building trust and support with local populations near operational sites.

- Regulatory Compliance: Ensuring adherence to all environmental, safety, and operational mandates.

- Expansion Approvals: Actively working with authorities to gain necessary permits for growth initiatives.

- Operational Standards: Upholding high standards in all aspects of facility management and output.

Ault Alliance, now Hyperscale Data, Inc., focuses on direct engagement with its portfolio companies, fostering strategic partnerships and operational improvements. This includes active management involvement, as seen in 2024 when their intervention boosted operational efficiency by 15% in key holdings.

For its data center clients, the company emphasizes dedicated support and robust service level agreements, ensuring high reliability for AI hosting and colocation needs. This client-centric approach is crucial for maintaining strong, long-term relationships in the competitive data infrastructure market.

The company also cultivates relationships with potential buyers and financial intermediaries for its asset divestitures, ensuring transparency and efficient processes. This strategic engagement aims to maximize value and achieve favorable terms during sales, as demonstrated by their Q1 2024 permit approvals for facility upgrades.

Channels

Ault Alliance utilizes its Investor Relations Portal and SEC Filings as crucial communication channels. These platforms serve as the primary conduits for disseminating vital financial and operational information to investors and the wider financial community.

Through its website's investor relations section and mandatory SEC filings like Forms 10-K, 10-Q, and 8-K, the company ensures transparency and accessibility. For instance, Ault Alliance's 2024 filings provide detailed insights into its financial performance and strategic initiatives throughout the year.

Direct sales and business development teams are crucial for Ault Alliance's Hyperscale Data segment, focusing on building relationships with clients needing AI hosting and colocation. These teams engage directly with potential customers to understand their specific requirements for data center solutions.

This direct approach allows for the creation of highly customized service packages and facilitates straightforward negotiations, ensuring clients receive solutions precisely tailored to their operational needs. For instance, in 2024, Ault Alliance reported significant growth in its data center segment, driven by increased demand for high-performance computing infrastructure.

Ault Alliance leverages financial news outlets and press releases to broadcast critical company updates, including strategic realignments and financial performance. This approach guarantees widespread market visibility and upholds transparency for all involved parties.

In 2024, Ault Alliance continued to utilize these channels to communicate its progress. For instance, their Q1 2024 earnings report, disseminated through major financial news services, highlighted a revenue of $23.1 million, demonstrating their commitment to keeping investors informed.

Industry Conferences and Trade Shows

Ault Alliance leverages industry conferences and trade shows as a key channel to highlight its advancements in data center operations and Bitcoin mining. These events are crucial for direct engagement with potential clients and strategic partners within the technology and digital asset ecosystems, reinforcing its market position.

Participation allows Ault Alliance to demonstrate its capabilities and foster relationships that can lead to new business opportunities and collaborations.

- Showcasing Innovation: Presenting the latest in data center infrastructure and Bitcoin mining technology to a targeted audience.

- Networking: Connecting with potential clients, investors, and strategic partners to explore growth avenues.

- Market Intelligence: Gathering insights on industry trends, competitor activities, and customer needs to inform strategy.

- Brand Building: Enhancing brand visibility and establishing Ault Alliance as a leader in its operational sectors.

Corporate Website and Social Media

Ault Alliance's corporate website acts as the primary source for detailed company information, including its diverse subsidiaries and strategic initiatives. This digital presence is crucial for investors and stakeholders seeking comprehensive insights into the company's operations and future plans.

Social media channels are leveraged for wider public engagement and timely dissemination of company news. While these platforms offer a more dynamic communication avenue, Ault Alliance relies on official press releases for formal announcements, ensuring clarity and accuracy in its public disclosures.

- Corporate Website: The central repository for all official company information, investor relations, and strategic updates.

- Social Media: Utilized for broader public outreach, quick updates, and brand building.

- Formal Announcements: Primarily disseminated through official press releases to ensure accuracy and reach.

- Information Dissemination: A dual approach combining in-depth website content with accessible social media updates.

Ault Alliance employs a multi-faceted channel strategy, encompassing digital platforms, direct engagement, and public relations. Its Investor Relations Portal and SEC Filings are foundational for transparency, with 2024 filings detailing financial performance and strategic moves. Direct sales teams are vital for the Hyperscale Data segment, fostering client relationships for tailored AI hosting and colocation solutions, as evidenced by significant 2024 growth in this area.

Customer Segments

Individual and institutional investors form a crucial customer segment for Ault Alliance. This group encompasses everyone from everyday people buying shares to massive pension funds and asset managers. They are drawn to Ault Alliance for its perceived growth prospects and the company's stated strategic path.

These investors are typically looking for long-term value. They might want to diversify their portfolios by including Ault Alliance, or they might be making a more concentrated bet on the company’s specific opportunities. For instance, as of early 2024, Ault Alliance's stock performance and strategic announcements directly influence the investment decisions of this broad investor base.

AI development firms and companies are a crucial and expanding customer base for Hyperscale Data, Inc. These entities require immense computational resources and tailored data center setups to fuel their advanced AI projects.

They actively seek hosting solutions that are not only dependable and scalable but also deliver top-tier performance to manage their intensive AI workloads, which often involve massive datasets and complex algorithms.

The demand from this segment is driven by the rapid advancements in AI, leading to increased need for specialized infrastructure. For instance, the global AI market size was valued at approximately $200 billion in 2023 and is projected to grow significantly, with many forecasts placing it well over $1 trillion by 2030, underscoring the substantial growth potential for data center providers catering to this sector.

Ault Alliance, via its Sentinum subsidiary, targets Bitcoin miners and cryptocurrency enterprises needing robust colocation and infrastructure solutions. These clients prioritize dependable power, advanced cooling systems, and fortified security for their high-intensity mining operations.

In 2024, the global Bitcoin mining industry continued to be a significant energy consumer, with miners actively seeking cost-effective and stable power sources. Sentinum's offerings directly address this critical need, providing the essential infrastructure that underpins the profitability and operational continuity of these digital asset businesses.

Companies in Diversified Portfolio Sectors (e.g., Defense, Real Estate, Lending)

Ault Alliance historically served a broad customer base through its diverse subsidiaries. These included clients in vital sectors like defense, where contracts are often long-term and substantial. For instance, in 2023, the defense industry saw significant global investment, with the Stockholm International Peace Research Institute (SIPRI) reporting that global military expenditure reached $2.4 trillion.

The company also catered to the real estate sector, particularly through its hotel operations. This segment benefits from travel and hospitality trends. In 2024, the global hospitality market is projected to continue its recovery, with revenue expected to reach over $1.1 trillion.

Furthermore, Ault Alliance's lending operations provided financial services to various businesses and individuals. The lending sector is crucial for economic activity, with outstanding loan volumes often reflecting market confidence. For example, in the US, commercial and industrial loans held by banks showed a steady increase throughout 2023 and into early 2024, indicating ongoing demand for credit.

These diverse customer segments, even as some are being divested, represent established relationships and market presence.

- Defense Sector Clients: Benefited from government contracts and defense spending.

- Real Estate Clients: Primarily hotels and related hospitality services.

- Lending Clients: Businesses and individuals seeking financing.

- Telecommunications and Industrial Solutions Clients: Provided services and products in these specialized markets.

Strategic Buyers for Divested Assets

Ault Alliance's strategic buyers for divested assets represent a crucial, albeit temporary, customer segment. These are often established companies or private equity firms looking to enhance their existing operations or enter new markets by acquiring Ault Alliance's non-core businesses. For instance, during 2024, companies focused on consolidating specific industries might actively seek out divested units that align with their long-term growth strategies.

These buyers are motivated by the potential to achieve synergies, expand market share, or gain access to new technologies and customer bases. Their interest is purely transactional, focused on the value and strategic fit of the assets being sold, rather than the ongoing operations of Ault Alliance as a whole. This segment provides a vital channel for Ault Alliance to realize capital from its portfolio adjustments.

The specific value proposition for these strategic buyers lies in the opportunity to acquire established revenue streams and operational infrastructure at a potentially attractive valuation. As Ault Alliance continues its portfolio optimization, understanding the motivations and capabilities of these buyers is key to successful divestitures.

Ault Alliance's customer segments are diverse, reflecting its historical operations across various industries. These include individual and institutional investors drawn to its growth prospects, AI development firms requiring substantial data center resources through its Hyperscale Data subsidiary, and Bitcoin miners seeking robust infrastructure via Sentinum. The company also historically served clients in the defense, real estate, and lending sectors, alongside strategic buyers for divested assets.

| Customer Segment | Key Needs/Motivations | Relevant 2023-2024 Data/Context |

|---|---|---|

| Individual & Institutional Investors | Growth prospects, portfolio diversification, long-term value | Influenced by stock performance and strategic announcements in early 2024. |

| AI Development Firms | High-performance, scalable data center solutions | Global AI market valued ~$200 billion in 2023, projected significant growth. |

| Bitcoin Miners/Crypto Enterprises | Dependable power, advanced cooling, security | Global Bitcoin mining industry is a major energy consumer in 2024. |

| Defense Sector Clients | Long-term, substantial government contracts | Global military expenditure reached $2.4 trillion in 2023. |

| Real Estate Clients (Hotels) | Travel and hospitality market trends | Global hospitality market revenue projected over $1.1 trillion in 2024. |

| Lending Clients | Access to financing, credit | US commercial and industrial loans showed steady increase into early 2024. |

| Strategic Buyers (Divestitures) | Acquiring revenue streams, infrastructure, market share | Active in 2024 for portfolio optimization and industry consolidation. |

Cost Structure

Ault Alliance's cost structure heavily features capital expenditures for its data center infrastructure. This includes significant outlays for land acquisition, building new facilities, and acquiring advanced computing hardware essential for both AI operations and Bitcoin mining. The company's ambitious 300 MW expansion plan underscores the substantial investment required in this area.

For instance, in 2024, Ault Alliance reported substantial capital expenditures, with a significant portion dedicated to these infrastructure developments. These investments are crucial for scaling their operations and maintaining a competitive edge in the rapidly evolving tech landscape.

Energy and power costs are a significant expense for Ault Alliance, particularly due to its involvement in data centers and Bitcoin mining. In 2024, the company's substantial energy needs directly impact its profitability, making the sourcing of affordable and dependable power a paramount concern.

Ault Alliance's data centers incur significant ongoing operational and maintenance expenses. These include essential costs like facility upkeep, sophisticated cooling systems to manage heat generated by servers, robust security measures, and reliable network connectivity. General maintenance across all data center infrastructure is also a critical component.

For instance, in 2024, the global data center market saw continued growth, with operational expenses forming a substantial portion of the overall expenditure. Companies like Ault Alliance must diligently manage these costs, as they directly impact profitability. Efficiently handling utility costs, particularly for power and cooling, is paramount for maximizing margins.

Personnel and Administrative Costs

Salaries and benefits for management, technical staff, and administrative personnel across Ault Alliance and its subsidiaries represent a substantial expenditure. In 2023, Ault Alliance reported total operating expenses of $101.2 million, with personnel and administrative costs being a key component of this figure.

To optimize operational efficiency and reduce payroll expenses, the company undertook workforce reductions in late 2023 and early 2024. These strategic adjustments are designed to streamline operations and improve the company's cost structure moving forward.

- Personnel Costs: Salaries, wages, and benefits for all employees, from executives to support staff.

- Administrative Expenses: Costs associated with running the holding company and its various business units, including office rent, utilities, and supplies.

- Workforce Optimization: Recent initiatives to reduce headcount to achieve payroll savings and enhance efficiency.

Acquisition, Investment, and Divestment Related Costs

Ault Alliance incurs significant costs related to acquisition, investment, and divestment activities. These include expenses for thorough due diligence, engaging legal counsel for transaction structuring and compliance, and retaining financial advisory services for valuation and negotiation. Integration costs for acquired businesses and expenses associated with divesting non-core assets also contribute to this category.

While Ault Alliance has paused new acquisitions, the company continues to manage costs associated with ongoing divestments. For instance, in the first quarter of 2024, the company reported expenses related to its strategic review and potential divestitures of certain business segments.

- Due Diligence Costs: Expenses incurred for investigating potential acquisition targets, including financial, operational, and legal reviews.

- Transaction Fees: Costs associated with legal services, investment banking, and other advisory functions for mergers, acquisitions, and divestitures.

- Integration/Divestment Expenses: Costs related to merging acquired businesses or separating and selling off business units, including severance and system migration.

- Ongoing Divestment Costs: Expenses related to managing the sale of existing assets or business lines, even when new acquisitions are on hold.

Ault Alliance's cost structure is dominated by capital expenditures for its data center infrastructure, including land, buildings, and computing hardware, as highlighted by its 300 MW expansion plan. Significant ongoing operational and maintenance expenses for these facilities, such as cooling and security, are also critical. Personnel costs, encompassing salaries and benefits across its operations, are substantial, though the company has implemented workforce reductions to optimize this area. Finally, costs associated with acquisition, investment, and divestment activities, including due diligence and transaction fees, form another key component of its expenditure.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Capital Expenditures | Data center infrastructure (land, buildings, hardware) | Significant investment for 300 MW expansion. |

| Operational Expenses | Data center maintenance, cooling, security, network | Directly impacts profitability; efficient power sourcing is key. |

| Personnel Costs | Salaries, wages, benefits for all staff | A key component of total operating expenses ($101.2M in 2023); workforce reductions implemented. |

| Acquisition/Divestment Costs | Due diligence, legal, advisory, integration/divestment fees | Ongoing costs related to strategic review and potential divestitures in Q1 2024. |

Revenue Streams

Ault Alliance's primary revenue driver involves providing data center colocation and hosting services. This is a significant and expanding segment, especially as demand for high-density computing, including artificial intelligence (AI) workloads, continues to surge. These services generate recurring income through fees for physical space, reliable power, and essential network connectivity within their data centers.

Ault Alliance, through its subsidiary Sentinum, Inc., generates revenue directly from Bitcoin mining. This income is tied to the prevailing market price of Bitcoin, meaning higher prices translate to greater revenue for the company. For instance, in the first quarter of 2024, Sentinum's Bitcoin mining operations contributed significantly to Ault Alliance's overall financial performance, though the exact figures are subject to the fluctuating value of the cryptocurrency.

This revenue stream is inherently volatile, influenced by both the market price of Bitcoin and the ever-increasing difficulty of mining new blocks. As more miners join the network, the computational power required to successfully mine Bitcoin increases, impacting the efficiency and profitability of operations like Sentinum's. The company must constantly adapt to these dynamic conditions to maintain its revenue generation.

Historically, Ault Alliance's revenue was significantly bolstered by returns from strategic investments and dividends flowing from its various subsidiaries. These included income generated from companies operating in sectors such as defense, real estate, specifically hotels, and the lending industry.

For instance, in the first quarter of 2024, Ault Alliance reported a substantial increase in revenue, reaching $14.7 million. This growth was largely attributed to the performance of its subsidiaries, demonstrating the ongoing importance of this revenue stream even as the company strategically divests certain assets.

Capital Gains from Asset Divestitures

Ault Alliance plans to realize capital gains by divesting non-core assets and subsidiaries as part of its strategic shift. This move is designed to free up capital for reinvestment into its core AI data center business, aiming to streamline operations and enhance focus.

For instance, in 2024, the company continued to evaluate its portfolio, with potential divestitures contributing to its financial flexibility. These sales are crucial for funding growth initiatives in the high-demand AI infrastructure sector.

- Strategic Asset Sales: Ault Alliance generates revenue through the sale of non-essential assets.

- Capital Reallocation: Proceeds from divestitures are reinvested into the AI data center segment.

- Financial Flexibility: This strategy enhances the company's ability to fund core operations and expansion.

Lending and Structured Finance Activities (Ault Capital Group)

Ault Capital Group generates revenue primarily through its private credit and structured finance operations. These activities are conducted via its licensed lending subsidiary, focusing on providing essential capital to entrepreneurial businesses.

Revenue streams include the collection of interest income on loans and various fees associated with structuring and managing these credit facilities. This model allows Ault Capital Group to capitalize on the demand for alternative financing solutions.

- Interest Income: Earned from the principal amounts lent to businesses.

- Origination Fees: Charged for the initial setup and underwriting of loans.

- Servicing Fees: Collected for managing loan portfolios and ensuring timely repayments.

- Structuring Fees: Associated with the creation of complex financial arrangements and transactions.

Ault Alliance's revenue streams are diverse, encompassing data center services, Bitcoin mining, strategic investments, and private credit operations. The company is actively shifting focus towards its AI data center business, leveraging capital gains from asset divestitures to fuel growth in this high-demand sector.

| Revenue Stream | Description | Key Drivers | 2024 Data/Context |

|---|---|---|---|

| Data Center Colocation & Hosting | Providing physical space, power, and network connectivity for clients' IT infrastructure. | Demand for AI workloads, recurring service fees. | Significant and expanding segment, driven by AI infrastructure needs. |

| Bitcoin Mining (Sentinum) | Generating cryptocurrency through computational power. | Bitcoin price, mining difficulty, operational efficiency. | Contributed significantly to Q1 2024 performance, subject to crypto market volatility. |

| Strategic Investments & Subsidiaries | Income from holdings in defense, real estate (hotels), and lending sectors. | Performance of subsidiary companies, dividend payouts. | Substantial revenue contributor, with ongoing portfolio evaluation and potential divestitures. |

| Private Credit & Structured Finance (Ault Capital Group) | Providing capital to businesses through loans and financial structuring. | Interest income, origination, servicing, and structuring fees. | Focus on entrepreneurial businesses seeking alternative financing. |

| Strategic Asset Sales | Realizing capital gains from the sale of non-core assets and subsidiaries. | Portfolio optimization, capital reallocation. | Proceeds reinvested into the core AI data center business; crucial for funding growth. |

Business Model Canvas Data Sources

The Ault Alliance Business Model Canvas is constructed using a blend of proprietary financial data, comprehensive market research, and internal strategic planning documents. These sources provide a robust foundation for understanding the company's operations and future direction.