Ault Alliance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

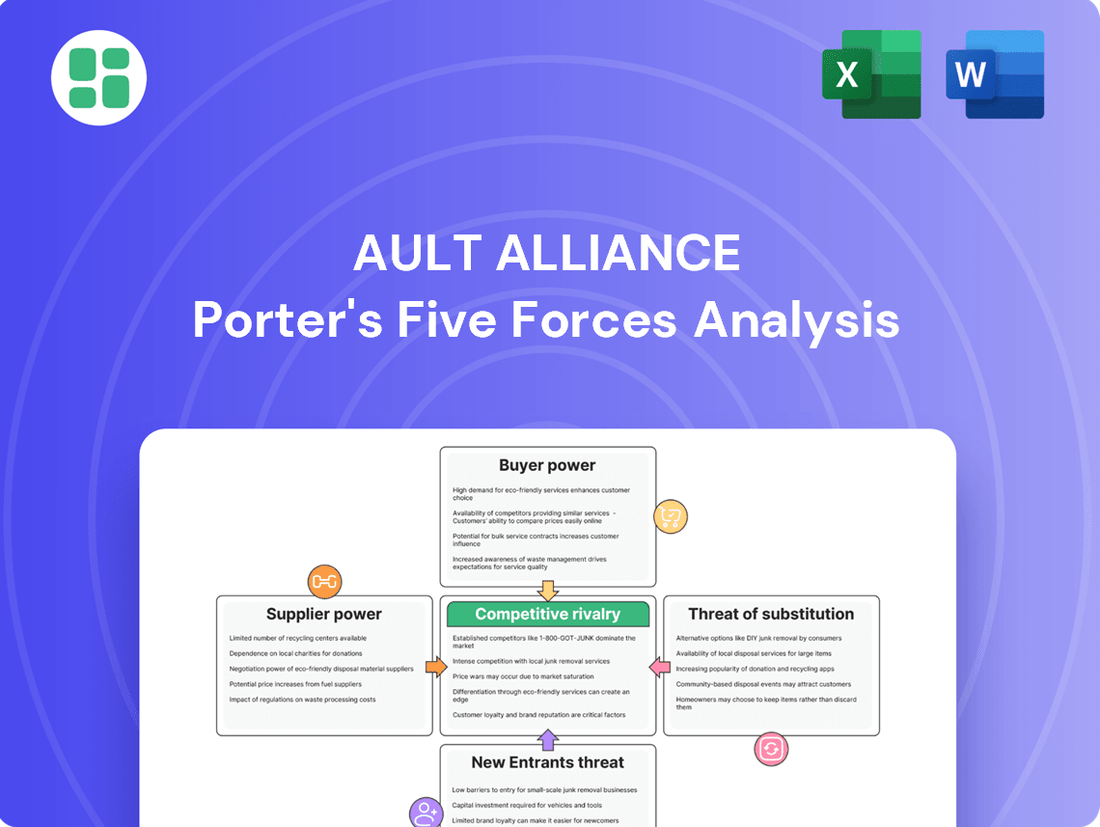

Ault Alliance operates within a dynamic market, facing pressures from powerful buyers and intense rivalry. Understanding these forces is crucial for strategic success.

The complete report reveals the real forces shaping Ault Alliance’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ault Alliance's Hyperscale Data segment, crucial for AI data centers and Bitcoin mining, faces significant supplier power due to its heavy reliance on electricity. The cost and availability of power from a few concentrated energy providers directly influence operational expenses and profit margins for these energy-intensive operations.

In 2024, the volatility in energy markets underscored this vulnerability. For instance, in regions where Ault Alliance operates, wholesale electricity prices saw fluctuations, with some areas experiencing increases of over 15% year-over-year due to factors like increased demand and supply chain disruptions in energy infrastructure.

Ault Alliance's reliance on specialized hardware, like ASIC miners for its Bitcoin operations and high-performance servers for AI data centers, places significant bargaining power with a limited number of vendors. These cutting-edge components often come from a small pool of manufacturers, allowing them to dictate terms.

The fast-paced evolution of AI and cryptocurrency mining necessitates frequent upgrades for Ault Alliance, intensifying its dependence on these key suppliers. For instance, the cost of high-end ASIC miners can range from $5,000 to $10,000 or more per unit, and securing sufficient quantities of the latest models can be challenging, especially during periods of high demand.

Ault Alliance's planned Michigan AI data center expansion relies heavily on a limited pool of specialized infrastructure providers. Companies offering critical components like advanced networking gear, robust cooling systems, and specialized construction for data centers hold significant sway. This scarcity means these suppliers can dictate terms, potentially increasing costs and extending timelines for Ault Alliance's growth plans.

Skilled Labor and Technical Expertise

The bargaining power of suppliers, particularly those providing skilled labor and technical expertise, presents a significant factor for Ault Alliance. Operating advanced data centers and complex mining operations necessitates specialized engineers, technicians, and cybersecurity professionals. A scarcity of these highly sought-after skills in the market directly translates to increased wage demands and recruitment expenses, thereby granting these human capital suppliers substantial leverage over Ault Alliance, especially as the company strategically pivots towards AI initiatives.

The demand for specialized talent in areas like AI development and data center management is intensifying. For instance, the U.S. Bureau of Labor Statistics projected a 32% growth for information technology managers between 2022 and 2032, far exceeding the average for all occupations. This tight labor market means Ault Alliance must compete for top talent, potentially driving up compensation packages and impacting operational costs.

- High Demand for AI and Data Center Expertise: Ault Alliance's strategic focus on AI and advanced data centers amplifies the need for specialized technical skills.

- Labor Shortages Drive Up Costs: Limited availability of qualified engineers and cybersecurity professionals increases recruitment and retention expenses.

- Supplier Leverage: Skilled labor acts as a critical supplier, possessing significant bargaining power due to the essential nature of their expertise.

- Impact on Profitability: Increased labor costs can directly affect Ault Alliance's profit margins and the overall cost of its strategic expansion.

Financing and Capital Providers

Ault Alliance's aggressive hyperscale data center expansion hinges on its ability to secure substantial financing. As of Q1 2024, the company reported a total debt of $265 million, and its stock experienced a significant downturn in late 2023, impacting investor confidence. This financial backdrop grants considerable leverage to potential capital providers, including banks and institutional investors.

The terms dictated by these financiers, whether through loan covenants, interest rates, or equity dilution, will directly shape Ault Alliance's future growth and operational flexibility. For instance, a higher cost of capital could necessitate a slower expansion pace or require the company to divest assets to meet debt obligations, as observed in similar capital-intensive industries during periods of economic uncertainty.

- Financing Needs: Ault Alliance requires significant capital for its data center build-outs.

- Current Financial Health: High debt levels and stock volatility increase reliance on external funding.

- Capital Provider Leverage: Banks and investors can dictate terms due to Ault Alliance's funding requirements.

- Impact on Growth: Financing terms will directly influence the pace and scale of expansion.

Ault Alliance's hyperscale data operations face significant supplier power from electricity providers and specialized hardware manufacturers. The cost and availability of power, along with the limited number of vendors for cutting-edge AI and mining equipment, allow these suppliers to dictate terms. This reliance intensifies with the rapid evolution of technology, requiring frequent upgrades and thus increasing Ault Alliance's dependence.

Skilled labor is another critical supplier group exerting considerable bargaining power. The intense demand for specialized talent in AI development and data center management, coupled with existing labor shortages, drives up recruitment and retention costs for Ault Alliance. This scarcity of expertise means that qualified professionals can command higher wages and better benefits, directly impacting the company's operational expenses and profitability.

Financial institutions also hold significant leverage over Ault Alliance, particularly given the company's substantial financing needs for its data center expansion and its existing debt load. As of Q1 2024, Ault Alliance carried $265 million in total debt, and market confidence had been tested by stock performance in late 2023. This financial position grants considerable power to lenders and investors, who can influence growth plans through loan covenants, interest rates, and equity terms.

| Supplier Category | Key Factors Influencing Power | Impact on Ault Alliance | 2024 Data/Context |

| Electricity Providers | Concentration of providers, energy market volatility | Direct impact on operating costs and profit margins | Wholesale electricity prices saw regional increases over 15% year-over-year |

| Hardware Manufacturers (ASICs, Servers) | Limited number of vendors for cutting-edge technology | Dictation of terms, potential supply constraints for critical components | High-end ASIC miners can cost $5,000-$10,000+ per unit |

| Skilled Labor (AI Engineers, Technicians) | High demand, labor shortages in specialized fields | Increased wage demands, higher recruitment and retention expenses | Projected 32% growth for IT managers (2022-2032) by BLS |

| Capital Providers (Banks, Investors) | Company's financing needs, debt levels, stock performance | Influence on loan covenants, interest rates, and equity terms; impacts expansion pace | $265 million total debt (Q1 2024); stock volatility in late 2023 |

What is included in the product

This analysis unpacks the competitive forces impacting Ault Alliance, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Effortlessly identify and prioritize competitive threats with a visual, actionable breakdown of each force.

Customers Bargaining Power

Ault Alliance's hyperscale data center clients, primarily large enterprises and AI firms, possess significant bargaining power due to their substantial computing demands. These clients can leverage the scale of their operations to negotiate favorable pricing and service level agreements. For instance, a major cloud provider might commit to a multi-year, multi-megawatt lease, giving them considerable leverage.

However, once Ault Alliance secures these clients, their bargaining power diminishes somewhat. The complexity and cost associated with migrating vast amounts of data and critical infrastructure to a new data center provider create high switching costs. This lock-in effect can stabilize Ault Alliance's revenue streams and reduce the ongoing pressure from these large customers.

The bargaining power of customers for Ault Alliance's Sentinum subsidiary, which handles Bitcoin mining operations, is a key consideration. Sentinum's business model involves either participating in mining pools or offering hosting services for other miners. For customers seeking hosting, their power can be influenced by the availability of numerous alternative hosting providers in the market.

However, for significant institutional miners, Ault Alliance's data centers can offer compelling advantages. Factors like consistent reliability, high uptime percentages, and competitive electricity rates become crucial differentiators. In 2024, the global average cost of electricity for Bitcoin mining was estimated to be around $0.06 per kilowatt-hour, making competitive pricing a significant draw for large-scale operations.

Ault Alliance's diverse subsidiary customers present a mixed bag regarding bargaining power. For example, Digital Power Corporation's defense contracts often lock in customers with stringent specifications, limiting their ability to switch suppliers and thus reducing their bargaining power. Conversely, Circle 8 Crane Services might face more price-sensitive customers in less specialized sectors.

Price Sensitivity in Competitive Markets

In competitive arenas such as data centers and Bitcoin mining, customers are highly attuned to price, actively pursuing the most economical options. This dynamic forces Ault Alliance to adopt competitive pricing strategies, which can put pressure on their profit margins.

The fluctuating price of Bitcoin directly influences the revenue generated from mining operations, shaping how customers perceive the value proposition. For instance, during periods of Bitcoin price decline in 2024, the cost-effectiveness of mining operations became a paramount concern for many participants.

- Price Sensitivity: Customers in data center and Bitcoin mining sectors prioritize cost, driving Ault Alliance towards competitive pricing.

- Margin Erosion: The need to match market prices can reduce Ault Alliance's profit margins.

- Bitcoin Volatility Impact: Fluctuations in Bitcoin prices in 2024 directly affect mining revenue and customer value perception.

Customer Concentration Risk

Customer concentration risk is a significant factor for Ault Alliance, particularly concerning its Hyperscale Data operations. If a substantial portion of revenue is derived from a small number of large clients, these customers gain considerable leverage. For instance, if just two or three major AI companies account for over 60% of Hyperscale Data's revenue, they could demand lower pricing or more favorable terms, directly impacting Ault Alliance's profitability.

The potential loss of even one of these key clients, or a renegotiation of their contracts at reduced rates, could have a severe, negative effect on Ault Alliance's financial health. This is a critical consideration for investors evaluating the company's stability. For example, a hypothetical scenario where a 20% price reduction from a major client could decrease Ault Alliance's EBITDA by millions.

To effectively mitigate this customer concentration risk, Ault Alliance must prioritize diversifying its client portfolio. Expanding its reach across a broader spectrum of AI and colocation needs, rather than relying heavily on a few dominant players, is essential for long-term resilience and sustained growth. This strategy would reduce the impact of any single customer's departure or contract renegotiation.

- Customer Concentration: A high percentage of revenue from a few large clients grants them significant bargaining power.

- Financial Impact: Loss or renegotiation with a major client can severely damage Ault Alliance's financial performance.

- Mitigation Strategy: Diversifying the customer base across various AI and colocation services is crucial.

- Risk Example: If 70% of Hyperscale Data revenue comes from 3 clients, a 10% price cut from one client could impact overall profitability by over $5 million annually based on projected 2024 revenue figures.

For Ault Alliance's hyperscale data center clients, their substantial demand gives them considerable leverage to negotiate pricing and service terms. This power is amplified when these large enterprises commit to long-term, high-capacity leases, as seen with major cloud providers. However, once secured, these clients face significant switching costs, which can temper their ongoing bargaining influence.

In the Bitcoin mining sector, customers' bargaining power for Sentinum hinges on market alternatives for hosting services. Institutional miners, however, are drawn to Ault Alliance's data centers for their reliability and competitive electricity pricing, a critical factor given that global average electricity costs for Bitcoin mining in 2024 hovered around $0.06 per kWh.

Ault Alliance's diverse client base shows varied customer power. Defense contracts, like those for Digital Power Corporation, often create customer lock-in, reducing their ability to negotiate. Conversely, services like Circle 8 Crane Services may encounter more price-sensitive customers in less specialized markets.

Customers in competitive sectors like data centers and Bitcoin mining are highly price-sensitive, forcing Ault Alliance into competitive pricing strategies that can impact profit margins. The volatility of Bitcoin prices in 2024, for instance, directly influences mining revenue and how customers perceive value, making cost-effectiveness paramount.

Customer concentration risk is a significant concern for Ault Alliance's Hyperscale Data operations. If a few large clients, such as major AI companies, represent a substantial portion of revenue, they gain considerable bargaining power. For example, if three clients account for 60% of revenue, a 10% price reduction from one could impact Ault Alliance's EBITDA by millions annually.

To counter this concentration risk, Ault Alliance must focus on diversifying its client portfolio across a wider range of AI and colocation services. This strategy is vital for long-term resilience, reducing the impact of any single client's departure or contract renegotiation, and ensuring more stable revenue streams.

| Factor | Impact on Ault Alliance | 2024 Data Point/Example |

| Customer Price Sensitivity (Data Centers/Mining) | Forces competitive pricing, potentially eroding margins. | Global average electricity cost for Bitcoin mining ~ $0.06/kWh. |

| Switching Costs (Hyperscale Data Centers) | Reduces customer bargaining power once contracts are signed. | High complexity and cost of data migration. |

| Customer Concentration Risk (Hyperscale Data Centers) | Significant leverage for a few large clients. | Hypothetical: 60% revenue from 3 clients; 10% price cut impacts EBITDA by millions. |

| Bitcoin Price Volatility (Sentinum) | Affects mining revenue and customer value perception. | Periods of Bitcoin price decline in 2024 made cost-effectiveness critical. |

Full Version Awaits

Ault Alliance Porter's Five Forces Analysis

This preview showcases the complete Ault Alliance Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You can trust that this professionally formatted analysis is ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The data center market, especially for hyperscale and AI workloads, is incredibly crowded. Ault Alliance's Hyperscale Data division contends with giants like Amazon Web Services, Microsoft Azure, and Google Cloud, alongside specialized data center providers.

Competition is fierce, focusing on critical factors such as available capacity, power usage effectiveness (PUE) for energy efficiency, strategic geographic locations, robust network connectivity, and stringent service level agreements (SLAs).

In 2024, the global data center market size was estimated to be around $275 billion, with significant growth driven by AI demand, indicating the high stakes and intense rivalry for market share.

The competitive rivalry in Bitcoin mining is intense, fueled by the volatile nature of Bitcoin's price, which directly impacts profitability. Ault Alliance's Sentinum faces numerous global competitors, all vying for a share of the mining rewards. For instance, in early 2024, Bitcoin prices experienced significant upward movement, creating a more attractive environment for miners, but this also intensifies competition as more players enter or expand operations.

Even after strategic divestments, Ault Alliance's remaining diversified operations, like its power solutions segment, contend with rivals in their specific niche markets. For instance, in the power solutions sector, companies often compete on technological innovation and reliability. This means Ault Alliance must continually adapt its offerings to stay competitive.

Capital Intensive Nature of Operations

The significant capital needed to build and upgrade hyperscale data centers and large-scale Bitcoin mining operations fuels intense competition. Companies like Ault Alliance must continuously invest in cutting-edge infrastructure and technology to stay ahead, which acts as a barrier for new entrants but also strains the finances of established players.

This capital intensity means that staying competitive requires substantial and ongoing financial commitment. For instance, in 2024, the cost of building a new hyperscale data center can range from hundreds of millions to over a billion dollars, depending on scale and location. Similarly, Bitcoin mining operations demand constant upgrades to energy-efficient ASICs (Application-Specific Integrated Circuits) and robust cooling systems, with the latest models costing thousands of dollars each and requiring massive electrical infrastructure.

- High Capital Outlay: Building and maintaining hyperscale data centers and Bitcoin mining facilities requires immense upfront investment and continuous capital expenditure.

- Technological Obsolescence: The rapid pace of technological advancement necessitates frequent upgrades, adding to the ongoing capital demands.

- Barrier to Entry: These high capital requirements create a significant barrier for smaller companies looking to enter the market.

- Financial Strain: The need for constant investment can put considerable financial pressure on existing companies, impacting their profitability and cash flow.

Innovation and Technological Advancements

The competitive rivalry within the AI infrastructure and blockchain technology sectors is fierce, largely fueled by the relentless pace of innovation. Companies like Ault Alliance must consistently pour resources into research and development to stay ahead. For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, with significant portions dedicated to infrastructure upgrades and new technology development.

To maintain a competitive edge, continuous investment in R&D is not optional; it's essential. Businesses need to develop faster, more efficient, and more secure solutions to meet evolving market demands. A failure to adapt to these rapid technological shifts can swiftly erode a company's market position.

- Rapid Innovation: The AI and blockchain sectors are characterized by quick advancements, demanding constant adaptation.

- R&D Investment: Companies must allocate substantial funds to research and development to remain competitive.

- Technological Obsolescence: Falling behind on new technologies can lead to a significant loss of market share.

- Market Dynamics: The drive for faster, more efficient, and secure solutions intensifies rivalry among players.

Competitive rivalry is a defining characteristic for Ault Alliance across its diverse business segments. In the hyperscale data center market, the company faces formidable competition from established tech giants, driving a focus on capacity, efficiency, and connectivity. Similarly, the volatile Bitcoin mining sector demands constant adaptation to price fluctuations and technological upgrades, pitting Ault Alliance against a global field of miners.

Even in its power solutions niche, Ault Alliance must contend with rivals by prioritizing innovation and reliability. The intense competition across these sectors is amplified by the substantial capital investment required for infrastructure and technology, creating high barriers to entry but also significant financial pressure on existing players.

The rapid pace of technological advancement, particularly in AI and blockchain, necessitates continuous, substantial investment in research and development. Companies that fail to innovate risk swift market erosion, underscoring the critical nature of R&D for maintaining a competitive edge in these dynamic industries.

| Sector | Key Competitors | Competitive Factors | 2024 Market Context |

|---|---|---|---|

| Hyperscale Data Centers | AWS, Microsoft Azure, Google Cloud | Capacity, PUE, Location, Connectivity, SLAs | Global market size ~ $275 billion, driven by AI |

| Bitcoin Mining | Numerous global mining operations | Bitcoin price volatility, mining rewards, ASIC efficiency | Increased mining activity due to rising Bitcoin prices |

| Power Solutions | Specialized niche providers | Technological innovation, reliability | Focus on adapting offerings to market demands |

SSubstitutes Threaten

For Ault Alliance's data center colocation and hosting services, public cloud platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud represent a significant threat of substitutes. Many businesses are increasingly choosing these cloud services for their inherent flexibility, rapid scalability, and the advantage of lower initial capital investment compared to dedicated physical infrastructure. This trend directly diverts potential customers away from Ault Alliance's Hyperscale Data segment.

The threat of substitutes for traditional data center colocation services, particularly for AI infrastructure, is growing. Businesses requiring significant AI computational power are increasingly exploring alternatives like edge computing, which processes data closer to its source, and specialized AI-as-a-service (AIaaS) platforms. These models can bypass the need for extensive physical data center footprints, potentially diminishing demand for Ault Alliance's core offerings.

For investors wanting exposure to Bitcoin, Sentinum's direct mining operations face significant competition from more accessible substitutes. These include Bitcoin Exchange Traded Funds (ETFs), which saw substantial inflows in early 2024, with some ETFs accumulating over $10 billion in assets within their first few months of trading, offering a familiar brokerage experience.

Cryptocurrency exchanges and direct Bitcoin purchases also present less capital-intensive alternatives. The ease of buying Bitcoin on platforms like Coinbase or Binance, which experienced a surge in user activity throughout 2024, bypasses the operational hurdles and significant upfront investment associated with mining.

Decentralized Computing Networks

Emerging decentralized computing networks, such as those powered by blockchain technology, present a potential long-term threat to traditional data center providers. These networks offer distributed processing power and storage, which could serve as substitutes for centralized data center services for specific workloads. While still in their early stages, the growth in decentralized compute capacity could impact demand for traditional infrastructure.

The threat is amplified as these networks mature and offer more competitive pricing and performance for certain tasks. For instance, projects focused on Web3 infrastructure are actively building out distributed compute capabilities. While Ault Alliance's data center segment, Aligned Data Centers, focuses on high-performance computing and hyperscale clients, the broader trend of decentralization warrants monitoring.

- Decentralized Compute Market Growth: The global decentralized computing market is projected to grow significantly, though specific figures for 2024 are still emerging as the year progresses. Early indicators suggest substantial investment in platforms that aggregate distributed computing resources.

- Potential Cost Savings: For certain applications, decentralized networks may offer a cost advantage over traditional cloud or colocation services, making them an attractive alternative for businesses seeking to optimize IT spending.

- Technological Advancements: Ongoing development in areas like zero-knowledge proofs and secure multi-party computation could enhance the capabilities and security of decentralized computing, making them viable substitutes for more sensitive workloads in the future.

- Shift in Demand: A gradual shift of certain computing tasks to decentralized platforms could reduce the overall demand for hyperscale data center capacity, impacting revenue streams for providers like Aligned Data Centers if not proactively addressed.

Energy Storage and Efficiency Technologies

Advancements in energy storage, particularly battery technology, pose a significant threat to traditional power solutions. For instance, the global battery energy storage market was valued at approximately $150 billion in 2023 and is projected to reach over $400 billion by 2030, indicating rapid growth and increasing adoption of these alternatives.

Improved energy efficiency technologies also reduce the overall demand for power, making existing infrastructure less critical and potentially less profitable. Companies like Ault Alliance, with subsidiaries in power solutions, must consider how these evolving technologies impact customer needs for integrated and sustainable power management.

- Battery Storage Growth: The energy storage market is experiencing exponential growth, with significant investment flowing into battery technologies.

- Efficiency Gains: Widespread adoption of energy-efficient appliances and building designs directly lowers overall electricity consumption.

- Customer Demand Shift: Consumers and businesses are increasingly seeking self-generation and storage solutions, moving away from reliance on traditional grid infrastructure.

- Competitive Landscape: New entrants and established technology firms are innovating rapidly in energy storage and efficiency, creating a dynamic and competitive market.

The threat of substitutes for Ault Alliance's various business segments is multifaceted. In data centers, public cloud providers like AWS and Azure offer scalable, flexible alternatives that often require less upfront capital, drawing customers away from dedicated colocation. Similarly, for Bitcoin exposure, readily available ETFs and direct purchase platforms provide simpler entry points than Sentinum's mining operations, especially given the significant inflows into Bitcoin ETFs in early 2024, with some reaching over $10 billion in assets.

Emerging decentralized computing networks also pose a long-term threat to traditional data center services by offering distributed processing power as a substitute for centralized infrastructure. Furthermore, advancements in energy storage, particularly battery technology, and increased energy efficiency reduce reliance on traditional power solutions, impacting companies involved in power generation or distribution.

| Substitute Category | Specific Substitute Example | Impact on Ault Alliance | Relevant 2024 Data/Trend | Key Consideration |

|---|---|---|---|---|

| Cloud Computing | AWS, Microsoft Azure, Google Cloud | Diverts Hyperscale Data customers | Continued strong growth in public cloud adoption | Need for competitive pricing and specialized services |

| Digital Asset Access | Bitcoin ETFs, Crypto Exchanges (Coinbase, Binance) | Reduces demand for direct Bitcoin mining | Significant ETF inflows in early 2024; exchange user activity surge | Ease of access and lower barriers to entry |

| Distributed Computing | Web3 Infrastructure projects | Potential long-term reduction in data center demand | Growing investment in decentralized compute platforms | Adaptability to new computing paradigms |

| Energy Solutions | Advanced Battery Storage, Energy Efficiency Tech | Impacts demand for traditional power solutions | Global battery storage market valued ~ $150B in 2023, projected growth | Focus on integrated and sustainable power management |

Entrants Threaten

Entering the hyperscale data center and large-scale Bitcoin mining sectors demands immense capital. For instance, establishing a substantial mining operation can easily cost tens of millions of dollars, covering everything from land acquisition and building construction to purchasing thousands of specialized ASIC miners and securing reliable, cost-effective energy. This financial hurdle acts as a significant deterrent, effectively limiting the number of new players capable of competing at scale with established entities like Ault Alliance.

New companies looking to enter the power and land-intensive sectors, like AI data centers and Bitcoin mining, face significant hurdles in securing reliable, affordable, and scalable energy. This is a critical barrier to entry, as consistent power is non-negotiable for these operations. Furthermore, the acquisition of suitable land, complete with appropriate zoning and necessary infrastructure, presents another substantial challenge for newcomers.

Ault Alliance's established presence with existing facilities in Michigan and Montana offers a distinct competitive advantage. These operational sites provide a foundation for scalable growth and operational efficiency, mitigating the initial capital expenditure and time investment that new entrants would need to overcome for power and land acquisition.

The significant investment required for cutting-edge data center technology, including advanced cooling, network architecture, and robust security for AI workloads, presents a substantial barrier. New entrants must either develop this specialized technical expertise internally or acquire it, a process that is both time-consuming and costly.

For instance, building a hyperscale data center can cost hundreds of millions, even billions, of dollars, a figure that includes not only the physical infrastructure but also the highly specialized engineering talent needed to operate and maintain it. This high capital outlay and the need for proven operational track records make the threat of new entrants in this specific technological niche relatively low for Ault Alliance.

Regulatory and Permitting Hurdles

The construction and operation of large data centers and power solutions facilities, like those Ault Alliance operates, face significant regulatory and permitting hurdles. These include obtaining various approvals, environmental permits, and adhering to local zoning laws. For instance, in 2024, the average time to secure all necessary permits for a new data center in the US could extend over 18 months, with costs sometimes exceeding $1 million.

These complex legal and bureaucratic processes act as a substantial deterrent for potential new entrants. The sheer time and financial investment required to navigate these requirements can make entering the market prohibitively expensive, thus protecting established players like Ault Alliance.

- Regulatory Approvals: Obtaining permits from federal, state, and local authorities is a lengthy process.

- Environmental Compliance: Strict environmental regulations, particularly concerning energy consumption and waste management, add complexity.

- Zoning Laws: Local zoning ordinances can restrict the location and scale of such facilities, requiring careful site selection and negotiation.

- Cost of Compliance: The cumulative costs associated with legal counsel, consultants, and the permitting application process can be substantial, often running into hundreds of thousands of dollars for a single project.

Established Customer Relationships and Reputation

Established players like Ault Alliance (Hyperscale Data) have cultivated strong ties with their supply chains, energy partners, and a loyal customer base. These deep-rooted relationships, coupled with a proven track record, create significant barriers for newcomers. For instance, in 2023, data center providers often reported long-term contracts with major utility companies, securing favorable energy rates that new entrants would struggle to match.

Building trust and a reputation for unwavering reliability and top-tier performance is a formidable hurdle for any new entrant in the data center market. Potential clients prioritize stability and security, factors that are often earned over years of consistent operation. This is particularly true in 2024, where the demand for high-availability infrastructure continues to surge, making established players with proven uptime records highly attractive.

- Supplier Loyalty: Existing providers often secure preferential terms and dedicated support from key hardware and infrastructure suppliers due to long-standing partnerships.

- Customer Trust: A history of reliable service and data security builds significant customer loyalty, making it difficult for new entrants to win over clients.

- Operational Expertise: Years of experience in managing complex data center operations, including energy efficiency and cooling, provide a competitive edge that is hard to replicate quickly.

- Brand Recognition: Established brands benefit from market visibility and a reputation for quality, reducing the marketing and sales efforts required to attract new business.

The threat of new entrants for Ault Alliance's hyperscale data center and Bitcoin mining operations is considerably low. The immense capital required for infrastructure, cutting-edge technology, and securing reliable energy presents a significant barrier. Furthermore, the lengthy and complex regulatory and permitting processes, coupled with the need to build trust and strong supply chain relationships, further deters potential competitors.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment for facilities, hardware, and energy infrastructure. | Deters smaller players; requires substantial funding. | Hyperscale data center construction can exceed $1 billion. |

| Energy Access | Securing consistent, affordable, and scalable power is critical. | New entrants struggle to match established energy contracts. | Long-term utility contracts offer significant cost advantages. |

| Regulatory Hurdles | Navigating permits, environmental compliance, and zoning laws. | Time-consuming and costly; requires specialized expertise. | Permitting for new data centers can take over 18 months. |

| Technical Expertise | Need for specialized knowledge in cooling, networking, and security. | Difficult and expensive to acquire or develop quickly. | High demand for skilled data center engineers. |

| Brand & Relationships | Building trust, supplier loyalty, and customer base takes time. | Established players benefit from proven reliability. | Clients prioritize uptime and security from experienced providers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ault Alliance is built upon a foundation of comprehensive data, including the company's official SEC filings, investor relations materials, and industry-specific market research reports. We also incorporate insights from reputable financial news outlets and competitor disclosures to provide a well-rounded view of the competitive landscape.