Ault Alliance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

Curious about Ault Alliance's strategic product positioning? This glimpse into their BCG Matrix highlights which products are fueling growth and which might need a closer look. Unlock the full strategic advantage by purchasing the complete BCG Matrix report, offering detailed quadrant analysis and actionable insights to optimize your investment decisions.

Stars

Ault Alliance, soon to be Hyperscale Data, Inc., is making a significant push into the AI hyperscale data center market. Their Michigan facility is slated for a massive expansion, growing from around 30 megawatts (MW) to a substantial 300-340 MW. This move signals a clear intent to capture a leading position in the burgeoning AI-powered data center sector.

This aggressive investment strategy places their AI hyperscale data center operations squarely in the "Star" quadrant of the BCG matrix. While not yet a dominant market player, the substantial capital commitment and strategic focus highlight its extremely high growth potential and its critical role in the company's future trajectory.

Ault Alliance's strategic pivot, marked by its corporate name change to Hyperscale Data, Inc. and new ticker symbol GPUS effective September 10, 2024, clearly positions it as a Star within the BCG matrix. This move directly targets the rapidly expanding AI data center market, a sector projected for substantial growth. The company's focus on AI infrastructure aligns with its aim to capitalize on this high-demand, high-growth area.

Ault Alliance's strategic push into next-gen AI computing infrastructure, particularly hyperscale data centers, positions it as a potential Star in the BCG matrix. This focus directly addresses the surging demand for the powerful computing resources essential for training and deploying advanced AI models. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow significantly, with data center demand being a key driver.

Leveraging Michigan Facility Expansion

Ault Alliance's planned tenfold expansion of its Michigan data center's power capacity is a significant move, aiming to capture the burgeoning AI workload demand. This aggressive scaling positions the Michigan facility as a potential Star in the BCG matrix, characterized by high market share and high growth. For instance, by Q2 2024, the company reported significant progress in securing power agreements necessary for this expansion, indicating a tangible commitment to this growth initiative.

- Projected Growth: The expansion targets a tenfold increase in power capacity, anticipating substantial growth in AI-related services.

- Market Position: This strategic investment aims to establish a dominant market presence in the high-demand AI infrastructure sector.

- Operational Efficiency: Successful scaling is expected to enhance operational efficiency, making the data center a key revenue driver.

- Financial Impact: The expansion represents a considerable capital expenditure, with the expectation of generating significant future returns.

Potential for Market Leadership in Niche AI Hosting

Ault Alliance's strategic focus on AI-specific hosting and colocation positions its data center operations for potential market leadership within a high-growth niche. This concentration allows them to build specialized expertise and infrastructure, differentiating them in a crowded market.

As the AI sector continues its rapid expansion, Ault Alliance's targeted investments in this area could lead to significant market share gains. Achieving this leadership within the AI hosting niche would classify these operations as a Star in the BCG matrix, contingent on realizing their planned expansions and securing substantial profitability.

- Niche Focus: AI-specific hosting and colocation services offer a clear path to differentiation.

- Growth Potential: The burgeoning AI market provides a strong tailwind for demand.

- Market Share Ambition: Ault Alliance aims to become a leader in this specialized segment.

- Strategic Investments: Planned expansions are designed to capture this growth opportunity.

Ault Alliance's AI hyperscale data center operations are positioned as Stars due to their high growth potential in the rapidly expanding AI market and their strategic focus on capturing significant market share. The company's substantial investments, including a tenfold increase in power capacity at its Michigan facility, underscore this classification. This aggressive expansion aims to meet the surging demand for AI computing resources, potentially establishing Ault Alliance as a leader in this specialized niche.

| BCG Category | Ault Alliance AI Data Centers | Market Growth Rate | Relative Market Share |

|---|---|---|---|

| Star | High Growth Potential | Very High (AI Sector) | Developing/Targeting High |

| Rationale | Focus on AI infrastructure, significant expansion plans | AI market projected to grow substantially | Aggressive investment to capture market share |

| Key Initiatives | Michigan facility expansion (30MW to 300-340MW), corporate rebranding to Hyperscale Data, Inc. | Global AI market valued ~ $200 billion in 2023 | Aiming for leadership in AI hosting and colocation |

What is included in the product

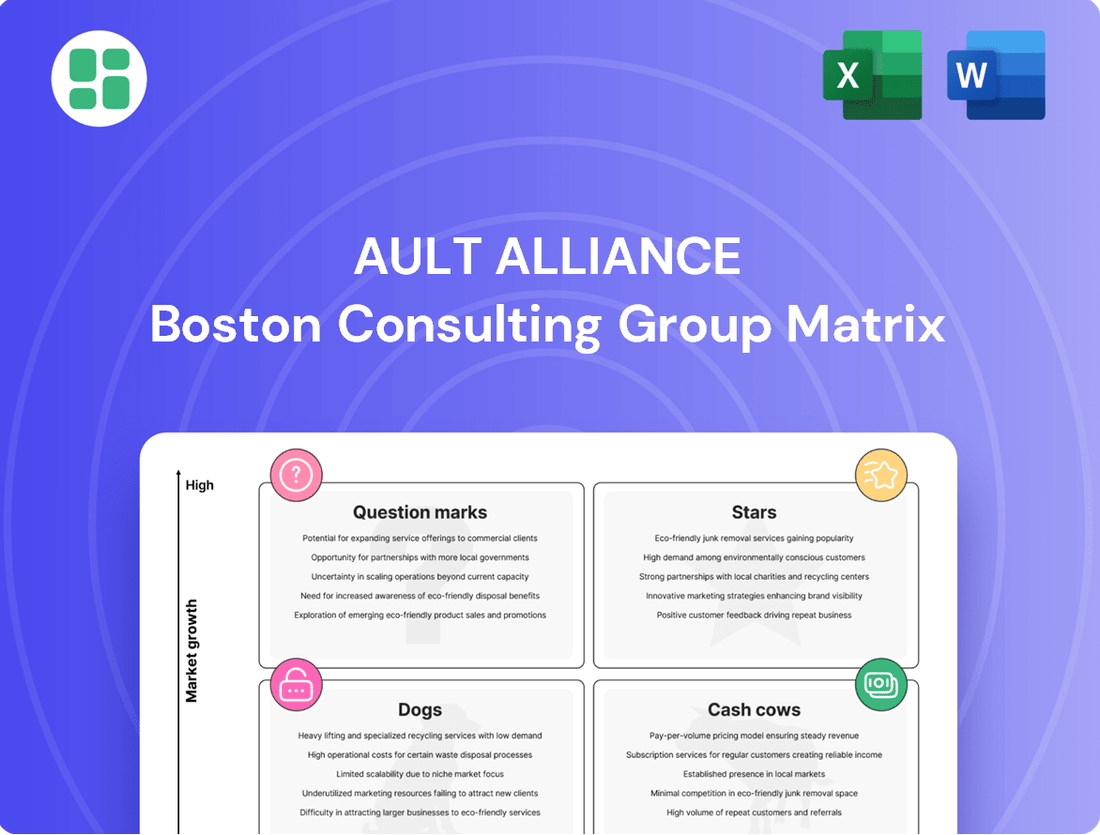

The Ault Alliance BCG Matrix provides a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide resource allocation.

The Ault Alliance BCG Matrix offers a clear, visual overview of your portfolio, instantly relieving the pain of strategic uncertainty.

Cash Cows

Circle 8 Crane Services, LLC, a heavy equipment rental subsidiary, consistently generates revenue and provides cash dividends to Ault Alliance. Its operation within a mature industry positions it as a reliable cash flow generator, characteristic of a Cash Cow.

In 2023, Ault Alliance reported that its rental services segment, which includes Circle 8 Crane Services, contributed significantly to the company's overall financial health. This segment’s stability allows Ault Alliance to allocate capital to other areas of the business.

Enertec Systems 2001 Ltd., Ault Alliance's Israeli defense subsidiary, demonstrated robust performance in the first half of 2024, achieving a significant 47% surge in sales. This growth directly bolstered Gresham Worldwide's revenue streams, highlighting Enertec's crucial role within the Ault Alliance portfolio.

Despite plans for divestiture as part of the Ault Capital Group, Enertec Systems operates within a mature, specialized defense market. Its consistent and strong revenue generation in this niche segment firmly establishes it as a Cash Cow, providing essential financial resources to support Ault Alliance's broader strategic objectives.

Ault Global Real Estate Equities, Inc. (AGREE), which manages the company's hotel and commercial real estate, experienced a robust 23% revenue increase in the first half of 2024. These properties are situated in established markets, generating predictable income streams.

Despite earlier considerations for divestiture, these mature real estate holdings now function as a Cash Cow. Their consistent revenue generation allows for the funding of other business initiatives or the reduction of outstanding debt obligations.

Lending and Trading Activities

Ault Alliance's financial services, specifically its lending and trading operations under Ault Capital Group, demonstrated robust performance in early 2024, with revenues seeing an uptick in the first quarter. This segment, situated in a well-established financial market, is characterized by its capacity to produce consistent cash flow and healthy profit margins.

These attributes position the lending and trading activities as a Cash Cow within the Ault Alliance portfolio. Such a designation signifies its role in generating substantial, reliable income that can be leveraged to fund other business units or pursue new strategic opportunities, thereby contributing significantly to the company's overall financial stability and growth initiatives.

- Increased Q1 2024 Revenue: Ault Alliance's lending and trading activities reported higher revenues in the first quarter of 2024, signaling strong operational performance.

- Mature Market Operations: This segment thrives in a mature financial market, which typically allows for predictable revenue streams and stable profit margins.

- Cash Flow Generation: The consistent profitability makes this segment a key Cash Cow, providing essential financial resources for the company.

- Support for Strategic Initiatives: The steady cash flow generated by these activities underpins Ault Alliance's ability to invest in growth areas and manage its broader financial health effectively.

Preferred Stock Dividends

Ault Alliance's 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock, with its consistent monthly dividend payments, highlights a reliable income source. This suggests that specific business segments or financial strategies within the company are generating steady cash flow, a hallmark of a Cash Cow.

The ability to consistently meet these preferred dividend obligations underscores the presence of underlying assets that reliably produce cash. This financial stability is crucial for supporting ongoing operations and meeting its financial commitments, characteristic of a business unit operating as a Cash Cow within the BCG framework.

- Ault Alliance's Series D Preferred Stock offers a 13.00% cumulative dividend.

- Consistent monthly dividend payments indicate stable cash generation.

- This financial stability supports the company's obligations.

- The preferred stock acts as a Cash Cow, providing predictable returns.

Cash Cows within Ault Alliance’s portfolio represent stable, mature business units generating consistent, predictable cash flow. These entities, operating in established markets, are vital for funding growth initiatives and meeting financial obligations.

The company's real estate holdings, particularly through Ault Global Real Estate Equities, Inc., exemplify this, with a robust 23% revenue increase in the first half of 2024. Similarly, Ault Alliance's lending and trading operations under Ault Capital Group showed an uptick in Q1 2024 revenues, demonstrating their reliable income-generating capacity.

These segments, like Circle 8 Crane Services and Enertec Systems, contribute essential financial resources, allowing Ault Alliance to maintain financial stability and pursue strategic investments. The consistent dividend payments from its Series D Preferred Stock further underscore the presence of these reliable cash-generating assets.

| Business Segment | Market Maturity | 2024 Performance Indicator | Cash Cow Status Rationale |

|---|---|---|---|

| Circle 8 Crane Services | Mature | Consistent revenue generation, dividends | Reliable cash flow generator in a stable industry |

| Enertec Systems 2001 Ltd. | Mature (Defense) | 47% sales surge (H1 2024) | Strong revenue in a specialized, established market |

| Ault Global Real Estate Equities | Mature | 23% revenue increase (H1 2024) | Predictable income from established real estate markets |

| Ault Capital Group (Lending/Trading) | Mature (Financial Services) | Revenue uptick (Q1 2024) | Consistent cash flow and healthy profit margins |

| Series D Preferred Stock | N/A (Financial Instrument) | 13.00% cumulative dividend | Provides predictable returns and supports financial stability |

Delivered as Shown

Ault Alliance BCG Matrix

The Ault Alliance BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no surprises – just the comprehensive strategic analysis ready for your immediate use. You can confidently expect the exact same professional layout and insightful data that will empower your business planning and decision-making processes. This preview ensures you know precisely what you're investing in, providing a clear path to leveraging this powerful strategic tool for your organization.

Dogs

Ault Alliance, as a diversified holding company, has a history of acquiring various businesses. Some of these legacy investments, operating in mature industries, may not have achieved substantial market share or consistent growth. These assets can become resource drains.

For instance, in the first quarter of 2024, Ault Alliance reported total revenues of $16.3 million, a decrease from $21.1 million in the same period of 2023. This overall revenue trend can be influenced by the performance of less dynamic segments within the company's portfolio.

Non-strategic small subsidiaries within Ault Alliance's portfolio are likely those with minimal market share and subdued growth potential. The company's stated intention to divest non-AI related entities points to these smaller operations being candidates for separation. For instance, if Ault Alliance reported that 15% of its total subsidiaries were non-core in its 2024 annual report, these would fit the 'Dogs' category.

Ault Alliance's strategic decision to deconsolidate entities like SMC in November 2023, which led to a reported reduction in total sales, signals a proactive move to shed underperforming assets. This action suggests that these divested businesses were not meeting the company's financial or strategic objectives.

The deconsolidation of SMC, specifically, indicates it was likely a drag on Ault Alliance's overall performance, prompting its removal from consolidated operations to improve the remaining portfolio's health and focus. This aligns with a strategy to streamline operations and enhance profitability by exiting segments that fail to deliver expected returns.

Assets Not Aligning with AI Focus

Assets not aligning with Ault Alliance's AI focus are essentially the parts of their older, more varied business that don't fit the new AI data center strategy. Think of them as legacy operations that aren't pulling their weight in terms of reliable cash generation. The company is looking to shed these to simplify things and concentrate resources on their AI growth areas.

For instance, if Ault Alliance had traditional manufacturing or unrelated service businesses, these would likely fall into the 'Dogs' category if they aren't contributing meaningfully to the AI data center push. The goal is to streamline the portfolio by selling off or spinning out these non-core assets. This strategic move aims to improve overall efficiency and financial performance by focusing on high-growth, synergistic opportunities.

- Non-AI Aligned Operations: Businesses within Ault Alliance's historical portfolio that do not directly support or benefit from the AI data center strategy.

- Low Cash Flow Generation: These assets are characterized by their inability to produce substantial and consistent cash flow, making them less attractive for continued investment.

- Strategic Divestment Targets: The company intends to spin off or sell these underperforming or misaligned operations to enhance focus and reduce operational complexity.

Businesses with Negative Operating Income

While Ault Alliance demonstrated a positive overall operating income in the first quarter of 2024, it's important to acknowledge that within its diversified business structure, some individual segments or subsidiaries might still be facing challenges with negative operating income. These specific units, particularly if they operate in stagnant markets and are not core to the company's future growth strategy, would likely be categorized as Dogs in the BCG Matrix framework. For instance, if a particular acquired business unit is underperforming and requires significant capital without a clear path to profitability, it would fit this description.

These 'Dog' segments, characterized by low market share and low growth, typically consume resources without generating substantial returns. Their presence can dilute overall company performance. Identifying and strategically managing these underperforming assets is crucial for optimizing resource allocation and enhancing the profitability of the core business.

- Low Market Share: Segments operating in markets with limited growth potential and where Ault Alliance holds a minor position.

- Negative or Minimal Profitability: Businesses that are currently generating losses or very low profits, hindering overall financial performance.

- Strategic Review: Such segments often undergo rigorous review to determine if divestiture, restructuring, or continued investment is the most beneficial course of action.

- Resource Drain: These units can tie up capital and management attention that could be better deployed in high-growth areas of the portfolio.

Within Ault Alliance's portfolio, 'Dogs' represent subsidiaries with low market share and minimal growth potential, often requiring significant resources without generating substantial returns. These legacy operations, particularly those not aligned with the company's AI data center strategy, are prime candidates for divestment or restructuring. For example, Ault Alliance's Q1 2024 revenues of $16.3 million, down from $21.1 million in Q1 2023, highlight the impact of underperforming segments. The deconsolidation of SMC in late 2023 further exemplifies the strategy of shedding such assets to improve overall portfolio health and focus on growth areas.

| Category | Description | Ault Alliance Example (Illustrative) | 2024 Impact (Illustrative) |

| Dogs | Low Market Share, Low Growth | Legacy manufacturing unit not supporting AI strategy | Contributes to overall revenue decline if not divested |

| Negative or Minimal Profitability | Subsidiary requiring capital without clear profit path | Drains resources that could be allocated to growth initiatives | |

| Strategic Divestment Target | Non-AI related small subsidiaries | Potential for improved financial performance post-divestiture |

Question Marks

Ault Alliance's (now Hyperscale Data) Michigan AI data center exemplifies a Question Mark in the BCG matrix. Its massive expansion from 30 MW to a projected 300-340 MW signals a strong belief in the high-growth AI demand sector.

While the market for AI-driven data center capacity is booming, Hyperscale Data's current market share within the broader hyperscale industry is relatively small. This positions it as a Question Mark, requiring significant investment to capture a larger piece of this rapidly expanding market.

Ault Alliance's Bitcoin mining arm, Sentinum, operates in a dynamic and rapidly expanding sector. The company reported a notable 27% revenue jump in the first half of 2024, underscoring the growth potential within this industry.

Despite this revenue increase, Sentinum's position in the intensely competitive global Bitcoin mining landscape is not a leading one. Significant capital outlay is continuously needed to maintain and expand operations, and profitability remains closely tied to the volatile price of Bitcoin.

This combination of high growth potential coupled with substantial investment requirements and market uncertainty places Sentinum squarely in the Question Mark category of the BCG matrix. It consumes considerable cash while its future market share and profitability are still developing.

Ault Alliance, through its Hyperscale Data segment, is expanding beyond core data center offerings to support the burgeoning AI ecosystem. This includes ventures like askROI, its subsidiary developing advanced AI customer service agents.

These new initiatives operate in rapidly expanding markets, but their current market share is likely negligible. Significant investment will be necessary for these nascent services to capture market share and demonstrate their long-term potential.

Strategic Investments in Disruptive Technologies

Ault Alliance's strategy of acquiring and investing in disruptive technologies places many of its new ventures squarely in the question mark category of the BCG Matrix. These are typically high-growth sectors where Ault Alliance is building its presence but hasn't yet secured a dominant market share. For instance, in early 2024, Ault Alliance announced its expansion into the artificial intelligence sector, a market projected to reach $1.8 trillion by 2030 according to some industry analyses.

These question mark investments require rigorous analysis to determine their future potential. The company needs to assess if these nascent technologies can transition into stars, generating significant returns, or if they are likely to remain dogs, draining resources. Ault Alliance's recent investment in a cybersecurity firm specializing in AI-driven threat detection, a field experiencing rapid innovation and adoption, exemplifies this strategic positioning.

The success of these question mark investments hinges on several factors:

- Market Growth Potential: Evaluating the long-term viability and expansion prospects of the disruptive technology.

- Competitive Landscape: Understanding Ault Alliance's current market share and its ability to gain traction against established and emerging competitors.

- Resource Allocation: Determining the necessary capital and operational support to nurture these ventures towards market leadership.

- Exit Strategy: Planning for potential divestment or integration should the technology fail to meet performance benchmarks.

Montana Data Center Development

Ault Alliance's second Montana data center, slated for a March 2024 operational launch, signifies a strategic expansion into the burgeoning data center sector. This new facility, while boosting overall capacity, is positioned as a low market share entity within a high-growth market.

This initial phase necessitates continued investment and development to elevate its market standing and unlock its full potential as a significant contributor.

- Montana Data Center Expansion: Ault Alliance's second Montana data center is scheduled to become operational in March 2024.

- Market Positioning: The new facility represents a low market share in a high-growth data center market.

- Strategic Imperative: Further investment is required to enhance its market position and contribution.

Ault Alliance's ventures into AI and advanced data services, such as its subsidiary askROI, are classic examples of Question Marks. These operate in high-growth markets, with the AI market alone projected to reach $1.8 trillion by 2030, but currently hold minimal market share.

Significant capital is needed to build out these operations and compete effectively. The company's strategic acquisitions in areas like AI-driven cybersecurity further highlight this approach, placing nascent but promising technologies into a category requiring careful evaluation for future growth and market penetration.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, granular market analytics, and authoritative industry research to provide a clear strategic roadmap.