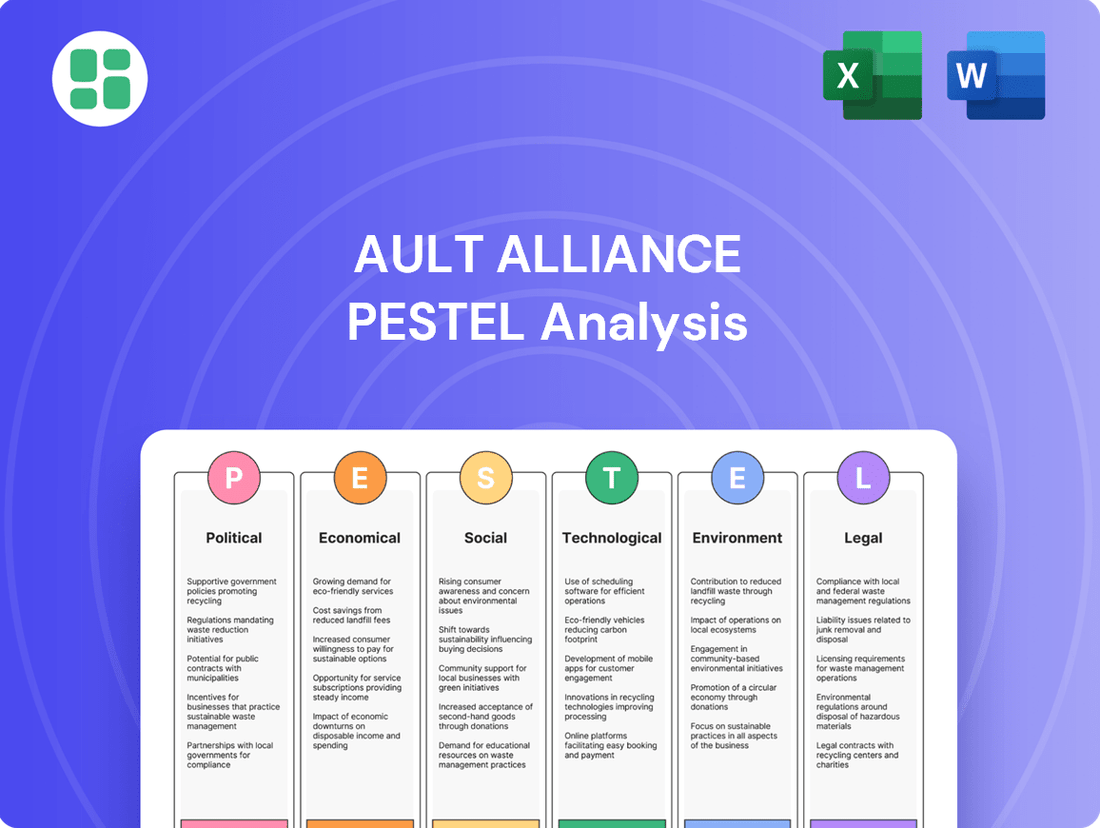

Ault Alliance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

Navigate the complex external forces shaping Ault Alliance's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and threats. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Governments globally are intensifying their focus on cryptocurrency, a move that directly influences Ault Alliance's past ventures in bitcoin mining. New tax frameworks, anti-money laundering (AML) mandates, and potential limitations on crypto-related business in various jurisdictions present significant challenges to profitability and the breadth of operations. For instance, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) continues to emphasize AML compliance for digital asset service providers, a trend mirrored internationally.

Government policies significantly shape the energy landscape for Ault Alliance. For instance, the Inflation Reduction Act of 2022, which provides substantial tax credits for renewable energy, directly supports Ault Alliance's strategy to utilize clean energy for its data centers. This policy could reduce the operational costs for their planned Michigan AI data center, making it more competitive.

Conversely, potential carbon taxes or regulations targeting energy-intensive industries could increase operational expenses. While specific punitive measures for data centers are still evolving, a broader energy policy shift could impact Ault Alliance's cost structure. For example, if fossil fuel-based energy sources face stricter regulations, the cost of electricity for their operations could rise, affecting profitability.

Ault Alliance's global operations, particularly in sourcing data center and mining hardware, are directly impacted by international trade relations. For instance, ongoing trade disputes, such as those involving major technology suppliers, can lead to increased tariffs. In 2024, the global trade landscape continues to be shaped by geopolitical shifts, potentially affecting the cost and availability of critical components.

Geopolitical tensions can disrupt supply chains, a significant concern for a company like Ault Alliance that relies on international sourcing. For example, regional conflicts or political instability in key manufacturing hubs could delay shipments or increase logistics costs. The World Bank's latest reports highlight the persistent risks to global supply chains stemming from geopolitical fragmentation.

Stable international relations are vital for Ault Alliance's predictable global operations and the cost-effectiveness of its technological infrastructure. Changes in import/export restrictions or trade agreements, like those potentially evolving in 2025, can significantly alter the financial viability of international sourcing strategies for hardware.

Investment and Business Incentives for AI/Data Centers

Government incentives for technology investment, particularly in AI data center development and job creation, offer significant opportunities for Hyperscale Data, Inc. (formerly Ault Alliance). These incentives can facilitate more cost-effective expansion, aligning with the company's strategic growth objectives.

Regions where Hyperscale Data, Inc. operates, such as Michigan and Montana, are actively pursuing such initiatives. For instance, Michigan has been a focal point for technology investment, with state-level programs designed to attract and retain data center operations.

- Michigan's Economic Development: The state has implemented tax abatements and other incentives aimed at boosting the technology sector, including data centers.

- Montana's Energy Initiatives: Montana's focus on renewable energy sources can also translate into cost advantages for data centers, potentially enhanced by state support for energy-intensive industries.

- Job Creation Focus: Many government programs prioritize job creation, which Hyperscale Data, Inc.'s expansion plans in Michigan are designed to address, further strengthening their eligibility for support.

- Accelerated Growth: By leveraging these incentives, the company aims to accelerate its planned significant expansion of its Michigan AI data center, pending regulatory approvals and securing necessary funding.

Political Stability and Corporate Reorganization

Ault Alliance's strategic reorganization, separating its AI data center operations into Hyperscale Data, Inc., is a direct response to political and economic factors influencing corporate valuation. The aim is to unlock shareholder value by presenting a clearer investment thesis for the high-growth AI sector, potentially attracting more favorable regulatory and investment environments for specialized technology firms.

This corporate restructuring is also a strategic maneuver to navigate the evolving regulatory landscape concerning technology companies and data infrastructure. By isolating the AI data center business, Ault Alliance can more effectively address sector-specific compliance and policy considerations that might impact a diversified conglomerate.

- Focus on AI Data Centers: Hyperscale Data, Inc. will concentrate on the rapidly expanding AI and data center market, a sector experiencing significant government investment and policy support globally.

- Streamlined Operations: The reorganization aims to improve operational efficiency and reduce complexity, making the company more agile in responding to market shifts and regulatory changes.

- Shareholder Value Maximization: Management believes this separation will lead to a more accurate market valuation, as investors can more easily assess the performance and potential of the distinct business units.

Government support for technology, particularly AI and data centers, presents a significant tailwind for Ault Alliance's Hyperscale Data division. For example, the U.S. government's CHIPS and Science Act of 2022, while focused on semiconductor manufacturing, signals a broader commitment to fostering domestic technological advancement, which can indirectly benefit data infrastructure. State-level initiatives, such as Michigan's tax incentives for data centers, directly reduce operational costs, as seen with Hyperscale Data's planned Michigan AI facility, potentially saving millions in its initial years of operation. Conversely, evolving regulations around data privacy and cybersecurity, such as potential updates to HIPAA or GDPR-like frameworks in the U.S. by 2025, could increase compliance burdens and operational complexity.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ault Alliance, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by highlighting key trends and potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, effectively communicating key external factors impacting Ault Alliance.

Economic factors

The profitability of Ault Alliance's bitcoin mining operations is intrinsically linked to the cryptocurrency's notorious volatility. Even with strategic adjustments, significant price swings in Bitcoin can create unpredictable revenue for this segment, complicating financial forecasting.

Despite these challenges, Ault Alliance's commitment to mining persists. In 2024 alone, its subsidiary Sentinum successfully mined 552 Bitcoin, demonstrating ongoing operational activity within this dynamic market.

Rising inflation presents a significant challenge for Ault Alliance, directly impacting its data center and mining operations. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation reaching 3.4% in April 2024, up from 3.0% in March 2024. This surge elevates costs for essential resources like electricity, hardware, and skilled personnel, squeezing profit margins.

Simultaneously, higher interest rates amplify the financial hurdles for Ault Alliance's strategic growth. The Federal Reserve's benchmark interest rate, held between 5.25% and 5.50% as of May 2024, makes borrowing for capital-intensive projects, such as expanding data center capacity, considerably more expensive. This increased cost of capital directly affects the viability and return on investment for future expansion plans.

The global economic landscape, particularly the surge in demand for AI infrastructure, directly impacts Ault Alliance's growth trajectory. This booming sector is a key driver for Hyperscale Data, Inc., a subsidiary of Ault Alliance.

A Goldman Sachs analysis from early 2024 forecasts a substantial 160% rise in data center power consumption attributed to AI. This projection underscores the immense market opportunity and validates Ault Alliance's strategic focus on expanding its AI-centric data infrastructure.

Energy Prices and Availability

Energy prices are a fundamental driver for Ault Alliance's operational costs, directly affecting both its bitcoin mining and data center segments. For instance, the average industrial electricity rate in the United States hovered around $0.07 per kilowatt-hour in early 2024, a figure that can drastically alter profitability depending on mining efficiency and data center power consumption.

Geopolitical events and supply/demand dynamics can cause significant volatility in these energy costs. A surge in natural gas prices, a key component in electricity generation, could compress Ault Alliance's margins, especially as they aim to scale their data center capacity from 30 MW to a substantial 300 MW by 2025. This expansion necessitates a robust and cost-effective power infrastructure.

- Bitcoin Mining: Higher electricity costs directly reduce the profitability of mined bitcoin.

- Data Centers: Energy is a major operational expense, impacting the competitiveness of Ault Alliance's colocation services.

- Expansion Plans: The projected increase in data center capacity from 30 MW to 300 MW amplifies the importance of securing stable, affordable power sources.

- Market Volatility: Fluctuations in global energy markets, influenced by factors like the Russia-Ukraine conflict and OPEC+ decisions, create uncertainty.

Capital Market Conditions and Access to Funding

Ault Alliance's growth, especially its ambitious data center expansion, is heavily dependent on its ability to access capital markets. The company's decision to terminate its at-the-market (ATM) offering in early 2024 signals a strategic pivot towards non-convertible debt as a primary funding source.

Securing financing on favorable terms is paramount for Ault Alliance to successfully implement its expansion plans. For instance, in Q1 2024, the company reported a significant increase in its debt obligations to fund these initiatives, highlighting the critical nature of capital market conditions.

- Data Center Expansion Funding: Ault Alliance's substantial investment in data centers necessitates consistent access to capital.

- Shift in Financing Strategy: The early 2024 termination of the ATM offering points to a move towards non-convertible debt.

- Importance of Favorable Terms: The ability to obtain financing at competitive rates directly impacts the feasibility and profitability of strategic growth.

Economic factors significantly shape Ault Alliance's operational landscape, influencing both its bitcoin mining and data center ventures. The company's profitability is directly tied to the volatile price of Bitcoin, which saw fluctuations throughout 2024. Rising inflation, exemplified by the 3.4% CPI in April 2024, increases operational costs for electricity and hardware, impacting margins. Conversely, the growing demand for AI infrastructure presents a substantial opportunity for its data center segment, with AI power consumption projected to rise by 160% by early 2024 estimates.

Ault Alliance's strategic growth, particularly its data center expansion, is heavily reliant on capital markets. The company's pivot to non-convertible debt in early 2024 highlights the importance of favorable financing terms. In Q1 2024, increased debt obligations underscore the capital-intensive nature of these expansion plans. The cost of capital, influenced by interest rates remaining between 5.25% and 5.50% as of May 2024, directly affects the financial viability of these projects.

| Economic Factor | Impact on Ault Alliance | Data Point/Context |

|---|---|---|

| Bitcoin Price Volatility | Affects profitability of mining operations. | Bitcoin prices experienced significant swings throughout 2024. |

| Inflation (CPI) | Increases operational costs for data centers and mining. | U.S. CPI reached 3.4% in April 2024. |

| AI Infrastructure Demand | Drives growth opportunities for data centers. | AI power consumption projected to rise 160% (early 2024 forecast). |

| Interest Rates | Impacts cost of capital for expansion. | Federal Reserve rate held at 5.25%-5.50% (as of May 2024). |

| Energy Prices | Key operational cost for mining and data centers. | Industrial electricity rate around $0.07/kWh (early 2024). |

Preview Before You Purchase

Ault Alliance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ault Alliance PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company. Gain immediate access to this insightful report for your strategic planning.

Sociological factors

Public perception of cryptocurrencies, especially Bitcoin's energy usage, is a growing concern for ESG-focused investors. Ault Alliance, historically involved in areas that might not align with strict ESG mandates, faces pressure to demonstrate commitment to sustainability to attract capital and maintain a positive reputation. This societal shift directly impacts investor sentiment and regulatory approaches.

The energy-intensive nature of Bitcoin mining, a key aspect of cryptocurrency adoption, presents a significant ESG challenge. As of early 2024, estimates suggest Bitcoin mining consumes an amount of electricity comparable to entire countries, raising environmental red flags. This scrutiny can deter institutional investors and impact companies like Ault Alliance if they are perceived as supporting or benefiting from such high-consumption activities.

Ault Alliance's strategic pivot towards AI data centers reflects an understanding of these evolving societal expectations. By focusing on AI infrastructure, which can be designed with greater energy efficiency and potentially powered by renewable sources, the company aims to align itself with ESG principles. This move is crucial for attracting ESG-conscious investors and mitigating reputational risks associated with less sustainable business models.

The specialized nature of Ault Alliance's core businesses, including data center operations, AI infrastructure, and power solutions, demands a workforce with highly specific skills. This means a shortage of qualified engineers, technicians, and IT professionals could significantly impact their ability to operate efficiently and expand.

In 2024, the demand for skilled tech workers continued to outpace supply. For instance, a recent report indicated that the cybersecurity talent gap alone was projected to reach 3.5 million unfilled positions globally by the end of the year, a figure that highlights the broader challenge across specialized tech fields. This scarcity directly translates to increased labor costs for companies like Ault Alliance, as they compete for a limited pool of talent.

Furthermore, the ability to attract and retain this specialized talent is not just about filling roles; it's critical for driving operational efficiency and fostering innovation within Ault Alliance's key business areas. Without a robust and skilled team, the company's capacity for growth and its competitive edge in rapidly evolving sectors like AI and data centers could be seriously compromised.

Societal shifts towards digital everything, from remote work to streaming entertainment, are fueling an unprecedented demand for robust data infrastructure. This trend is amplified by the rapid integration of cloud computing, with global cloud spending projected to reach over $1 trillion in 2024, according to industry analysts.

The accelerating adoption of artificial intelligence (AI) is a particularly powerful catalyst, creating a massive need for specialized, high-density data centers. Ault Alliance's strategic pivot, evidenced by its rebranding to Hyperscale Data, Inc., directly targets this burgeoning market, aiming to provide the critical infrastructure required for AI development and deployment.

Societal Expectations for Corporate Responsibility

Societal expectations for corporate responsibility extend beyond environmental matters to encompass ethical conduct and active community involvement. Ault Alliance, operating as a diversified holding company, must ensure its subsidiaries uphold these standards to foster a positive public perception and secure investor trust. For instance, in 2023, companies with strong ESG (Environmental, Social, and Governance) profiles saw an average of 10% higher valuations compared to their peers with weaker ESG scores.

These broader expectations translate into a demand for transparency in supply chains, fair labor practices, and contributions to social well-being. Ault Alliance's ability to demonstrate commitment in these areas can significantly impact its brand reputation and its appeal to socially conscious investors. A 2024 survey indicated that 70% of consumers are more likely to purchase from brands they perceive as ethical.

- Ethical Business Practices: Upholding integrity in all operations, from product development to customer service.

- Community Engagement: Actively participating in and supporting the communities where its subsidiaries operate.

- Transparency: Openly communicating about business practices and societal impact.

- Social Impact: Demonstrating a positive contribution to societal well-being beyond profit generation.

Consumer and Business Data Privacy Concerns

Growing public awareness and concern over data privacy and security significantly influence regulations and client trust in data center operators like Hyperscale Data, Inc. In 2024, a significant majority of consumers expressed concerns about how their personal data is collected and used, with studies indicating over 80% of individuals are worried about data breaches. This societal shift necessitates that Hyperscale Data, Inc. prioritizes robust data protection measures to maintain client confidence and comply with evolving expectations.

As Hyperscale Data, Inc. expands its data center services, ensuring stringent data protection is paramount. This includes implementing advanced encryption, access controls, and regular security audits. By proactively addressing these concerns, the company can build and maintain client trust, which is crucial for sustained growth in the data center industry. For instance, data breaches can lead to substantial financial penalties and irreparable damage to reputation, as seen in numerous high-profile incidents in recent years.

- Consumer Data Privacy Awareness: Studies in late 2024 indicated that over 80% of consumers are concerned about their personal data privacy.

- Regulatory Impact: Increased public concern directly fuels stricter data privacy regulations globally, impacting data center operations.

- Client Trust: Hyperscale Data, Inc.'s commitment to data security is a key differentiator for attracting and retaining hyperscale clients.

- Reputational Risk: Data breaches can result in significant financial penalties and erosion of client confidence, impacting future business.

Societal expectations for ethical business practices and community involvement are increasingly important for companies like Ault Alliance. A 2024 survey revealed that 70% of consumers favor brands perceived as ethical, highlighting the impact of corporate responsibility on reputation and investor appeal. This includes transparency in operations and fair labor practices, crucial for building trust.

The growing public concern over data privacy, with over 80% of consumers worried about data usage in late 2024, directly influences regulatory landscapes and client trust for data center operators. Hyperscale Data, Inc. must prioritize robust data protection, including advanced encryption and regular audits, to maintain client confidence and avoid significant financial penalties and reputational damage associated with data breaches.

The demand for skilled tech talent continues to outstrip supply, with millions of unfilled positions in fields like cybersecurity projected for 2024. This scarcity drives up labor costs and impacts companies like Ault Alliance's ability to expand and innovate in critical areas such as AI and data centers.

Technological factors

The rapid evolution of artificial intelligence is fueling an unprecedented surge in demand for robust computing power and expansive hyperscale data centers. This trend is reshaping the infrastructure landscape.

Ault Alliance's strategic pivot, evidenced by its rebranding to Hyperscale Data, Inc., directly capitalizes on this technological wave. The company's commitment to growing its Michigan AI data center to a substantial 300 MW capacity positions it to be a key contributor in the rapidly expanding AI sector.

The efficiency of Bitcoin mining technology, particularly the ongoing advancements in Application-Specific Integrated Circuit (ASIC) miners, directly impacts the operational costs and profitability for companies like Ault Alliance. These newer ASICs offer significantly higher hash rates and improved energy efficiency, crucial for maintaining a competitive edge in a landscape where energy consumption is a major expense.

Despite Ault Alliance's strategic shift away from a primary focus on Bitcoin mining, its remaining operations necessitate ongoing investment in hardware upgrades. This is essential to counter the diminishing returns from older equipment and to remain viable, especially in light of events like the Bitcoin halving, which reduces block rewards. For instance, the latest generation of ASIC miners can achieve energy efficiency levels below 20 joules per terahash (J/TH), a stark contrast to older models that might exceed 50 J/TH.

Technological advancements in renewable energy are rapidly transforming the landscape, offering significant opportunities for companies like Ault Alliance. For instance, breakthroughs in solar panel efficiency, such as the development of perovskite solar cells, are projected to reach efficiencies exceeding 30% by 2025, according to recent industry reports. This translates to more power generation from smaller footprints, a critical factor for data centers seeking to expand their renewable energy adoption.

Energy storage solutions are also seeing remarkable progress. The cost of lithium-ion battery storage has fallen by over 90% in the last decade, making large-scale battery installations more economically viable. This trend is expected to continue, with further cost reductions anticipated by 2025, enabling Hyperscale Data to better manage intermittent renewable sources and ensure consistent power supply for its operations.

Furthermore, innovations in grid integration technologies, including smart grid management systems and advanced inverters, are improving the reliability and efficiency of connecting renewable energy to the existing power infrastructure. These technologies allow for better forecasting of renewable energy availability and more dynamic load balancing, which is essential for the high-demand, continuous operation of data centers.

Cybersecurity and Data Protection Technologies

Ault Alliance's increasing reliance on data centers and digital assets makes robust cybersecurity paramount. The company faces persistent threats, necessitating advanced encryption, intrusion detection, and comprehensive data protection measures to prevent breaches and preserve client confidence. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the scale of investment required.

Continuous investment in cutting-edge cybersecurity technologies is not just a defensive strategy but a core operational necessity for Ault Alliance. This includes staying ahead of evolving threats and ensuring compliance with data protection regulations. The cost of a data breach in 2024 averaged $4.73 million, underscoring the financial imperative for strong defenses.

- Advanced Encryption: Implementing state-of-the-art encryption protocols to secure data at rest and in transit.

- Intrusion Detection Systems (IDS): Deploying sophisticated IDS to monitor network traffic for malicious activity and unauthorized access.

- Data Loss Prevention (DLP): Utilizing DLP solutions to prevent sensitive data from leaving the company's control.

- Regular Security Audits: Conducting frequent vulnerability assessments and penetration testing to identify and remediate weaknesses.

Blockchain and Distributed Ledger Technology Evolution

Blockchain and distributed ledger technology (DLT) are evolving rapidly beyond their initial cryptocurrency applications. These advancements offer potential new investment avenues and operational efficiencies for diversified companies like Ault Alliance. For instance, the global DLT market was valued at approximately $11.5 billion in 2023 and is projected to reach over $150 billion by 2030, indicating substantial growth and innovation.

Ault Alliance must closely track these technological shifts to identify both opportunities and potential disruptions. The integration of DLT could streamline supply chains, enhance data security, and create new revenue streams in areas like digital asset management or secure record-keeping. The increasing adoption of blockchain in various industries, from finance to healthcare, underscores its transformative potential.

- Market Growth: The global DLT market is expected to grow at a compound annual growth rate (CAGR) of over 40% from 2024 to 2030.

- Industry Adoption: Major financial institutions are exploring DLT for cross-border payments, trade finance, and digital identity solutions.

- New Business Models: Companies are investigating tokenization of assets and decentralized finance (DeFi) applications as potential growth areas.

- Regulatory Landscape: Evolving regulations around digital assets and DLT will significantly impact adoption and investment strategies.

The company's rebranding to Hyperscale Data, Inc. directly aligns with the escalating demand for advanced computing power driven by AI. This strategic move positions Ault Alliance to capitalize on the significant growth in hyperscale data centers, with the global hyperscale data center market projected to reach $394.9 billion by 2027, growing at a CAGR of 14.2% from 2022.

Advancements in ASIC miner efficiency, with newer models achieving below 20 J/TH, are critical for cost management in any remaining crypto mining operations. Simultaneously, breakthroughs in renewable energy, such as perovskite solar cells nearing 30% efficiency by 2025, and the dramatic cost reduction in battery storage (over 90% in the last decade) offer substantial opportunities for powering data centers sustainably and affordably.

Cybersecurity remains a paramount technological factor, with the global cybersecurity market expected to exceed $300 billion in 2024, and the average cost of a data breach reaching $4.73 million in the same year. The rapid evolution of blockchain and DLT, with the DLT market projected to surpass $150 billion by 2030, presents further avenues for operational efficiency and new business models.

Legal factors

Ault Alliance's bitcoin mining ventures face a complex web of evolving legal frameworks governing digital assets. These include stringent licensing mandates, Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, and interpretations of existing securities laws. For instance, in 2024, various jurisdictions continued to refine their approaches, with some imposing new registration requirements for crypto businesses.

Failure to adhere to these regulations can result in substantial financial penalties, operational disruptions, and protracted legal battles. Such non-compliance directly threatens the financial viability and public perception of Ault Alliance's cryptocurrency operations, potentially impacting its bottom line and investor confidence.

Ault Alliance, through its Hyperscale Data, Inc. subsidiary, must navigate a complex web of data privacy and security laws. Regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) impose strict requirements on how personal data is collected, processed, and stored. For instance, GDPR fines can reach up to 4% of global annual turnover, a significant risk for a company handling vast amounts of data.

Non-compliance with these evolving legal frameworks carries substantial financial and reputational consequences. Beyond hefty fines, which could run into millions for a data breach, legal actions and the erosion of client trust can severely impact Hyperscale Data's operations and future growth. This necessitates ongoing investment in robust legal counsel and comprehensive compliance programs to safeguard sensitive information.

Ault Alliance's operations, particularly in its energy sectors, are significantly impacted by environmental protection laws. These regulations cover critical areas such as carbon emissions, waste management, and energy efficiency standards, directly influencing operational costs and strategic planning.

The increasing global focus on climate change means stricter environmental regulations are likely. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023 and fully operational from 2026, could impose costs on imported goods based on their embedded carbon emissions, potentially affecting Ault Alliance's supply chain and international competitiveness if not managed proactively. Similarly, evolving carbon pricing mechanisms in various jurisdictions could directly increase operating expenses, necessitating investments in greener technologies to ensure compliance and meet sustainability targets.

Corporate Governance and Securities Laws

Ault Alliance, as a publicly traded entity, navigates a complex web of corporate governance and securities laws. Adherence to regulations set forth by bodies like the Securities and Exchange Commission (SEC) and the Sarbanes-Oxley Act of 2002 is paramount for maintaining operational integrity and investor trust. These frameworks mandate rigorous financial reporting, internal controls, and shareholder accountability.

Recent filings, such as those concerning shareholder approvals for significant corporate actions or executive stock transactions, highlight Ault Alliance's ongoing commitment to these legal mandates. For instance, in early 2024, the company sought shareholder approval for various proposals aimed at restructuring and enhancing its capital base, demonstrating a proactive approach to compliance and strategic alignment with regulatory expectations.

- SEC Filings: Ongoing compliance with SEC reporting requirements (e.g., 10-K, 10-Q) is critical for transparency.

- Sarbanes-Oxley Act: Implementation and maintenance of internal controls over financial reporting to ensure accuracy and prevent fraud.

- Shareholder Approvals: Obtaining necessary shareholder consent for major decisions, such as mergers, acquisitions, or significant equity issuances, reinforces governance principles.

- Executive Compensation: Transparency and adherence to regulations regarding executive stock acquisitions and compensation packages are vital for investor confidence.

Mergers & Acquisitions and Anti-Trust Laws

Ault Alliance's historical approach has often involved strategic acquisitions. However, for 2024, the company shifted its focus, announcing in early 2024 an intention to halt new acquisitions and instead concentrate on optimizing its current asset portfolio. This strategic pivot means that while M&A laws and anti-trust regulations remain relevant for any future strategic moves, the immediate impact is lessened.

Mergers and acquisitions are heavily regulated to prevent market monopolization. For instance, in the US, the Hart-Scott-Rodino Antitrust Improvements Act requires companies to notify the Federal Trade Commission and the Department of Justice of significant transactions, allowing for regulatory review. Failure to comply or engaging in anti-competitive practices can lead to substantial fines and legal challenges, impacting a company's ability to grow or operate.

- Regulatory Scrutiny: M&A activities are subject to review by bodies like the FTC and DOJ in the US, and similar authorities globally, to ensure fair competition.

- Anti-Trust Laws: Regulations are in place to prevent the formation of monopolies or anti-competitive market structures.

- Compliance Costs: Navigating these legal frameworks often involves significant legal and compliance expenses.

- Strategic Flexibility: Understanding and adhering to these laws is critical for any company pursuing growth through acquisition.

Ault Alliance's cryptocurrency ventures are subject to evolving digital asset regulations, including licensing, KYC/AML, and securities law interpretations. For example, in 2024, new registration requirements for crypto businesses emerged in several jurisdictions, impacting compliance costs and operational frameworks.

Data privacy laws like GDPR and CCPA impose strict data handling protocols, with GDPR fines potentially reaching 4% of global annual turnover, a significant risk for companies managing extensive data. Non-compliance can lead to substantial financial penalties and damage to client trust, necessitating robust legal and compliance programs.

Environmental regulations concerning carbon emissions and waste management directly influence Ault Alliance's energy sector operations. The EU's CBAM, fully operational from 2026, could impact supply chains and international competitiveness by taxing embedded carbon emissions.

Corporate governance and securities laws, enforced by bodies like the SEC, mandate rigorous financial reporting and internal controls. Ault Alliance's 2024 shareholder proposals for capital restructuring demonstrate adherence to these mandates and a commitment to transparency.

Environmental factors

Ault Alliance's bitcoin mining and data center operations are significant energy consumers, contributing to a substantial carbon footprint. This is a critical environmental factor, especially as the company plans further data center expansions.

The increasing demand for sustainability means Ault Alliance faces pressure from investors, regulators, and the public to lower its emissions. To address this, the company will likely need to invest in renewable energy sources and more energy-efficient technologies. For instance, the global average for data center energy efficiency, measured by Power Usage Effectiveness (PUE), was around 1.57 in 2023, meaning 57% of the energy was used for cooling and overhead rather than IT equipment. Improving this metric is key.

Ault Alliance's Michigan facility, like many industrial operations, faces increasing scrutiny regarding its energy consumption. The long-term viability and public perception of its operations are directly linked to its capacity to access and integrate clean, renewable power sources. This shift is driven by both regulatory pressures and growing consumer demand for environmentally responsible business practices.

A continued reliance on fossil fuels presents significant risks, including escalating operating costs stemming from carbon pricing mechanisms. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, signals a global trend towards internalizing carbon costs, which could impact supply chains and energy expenses. Furthermore, a strong commitment to sustainability can bolster brand reputation, a crucial factor in attracting both customers and investors in the 2024-2025 period.

The rapid evolution of mining hardware and data center technology creates a significant challenge in managing electronic waste. Ault Alliance, like many in the tech sector, faces this due to the constant need for upgraded equipment.

Responsible e-waste management is crucial for regulatory compliance and showcasing environmental stewardship. Failure to do so can lead to fines and reputational damage. For instance, the global e-waste generated reached 62 million tonnes in 2020, a figure projected to rise, highlighting the scale of this issue.

Implementing robust recycling programs not only minimizes Ault Alliance's ecological footprint but can also offer opportunities for resource recovery. This aligns with growing investor and consumer demand for sustainable business practices.

Water Usage in Cooling Systems

Data centers, like those operated by Ault Alliance, are significant water consumers, primarily for cooling. This reliance poses challenges as water scarcity intensifies in many areas. For instance, by 2025, projections indicate that over two-thirds of the world's population could face water shortages, impacting industrial users like data centers. This trend is likely to drive stricter regulations and increase operational costs associated with water usage.

To mitigate these risks and ensure sustainable operations, Ault Alliance must prioritize water-efficient cooling technologies. Innovations such as liquid cooling and evaporative cooling systems that use less water or recycled water are becoming increasingly crucial. The global market for data center cooling is expected to reach over $20 billion by 2027, with a growing segment focused on water efficiency, highlighting the industry's shift towards more sustainable practices.

- Water scarcity is a growing global concern, impacting industrial water access.

- Data centers are significant water users, primarily for cooling infrastructure.

- Stricter environmental regulations and rising water costs are anticipated.

- Adopting water-efficient cooling technologies is essential for sustainability.

Climate Change Adaptation and Resilience

Ault Alliance faces significant environmental risks from climate change, particularly physical impacts like extreme weather. For instance, the increasing frequency and intensity of heatwaves in 2024 and projected into 2025 could directly affect the operational continuity of their data centers, demanding robust cooling solutions and backup power. Disruptions to power grids due to severe storms or other climate-related events also pose a threat to essential infrastructure.

To ensure long-term operational stability, Ault Alliance must proactively assess and adapt its facilities and strategies. This involves building resilience against these evolving environmental challenges. For example, investing in climate-resilient infrastructure or diversifying energy sources could mitigate the impact of power grid instability.

- Increased operational costs due to enhanced cooling for data centers during heatwaves.

- Potential for service disruptions if power grids fail during extreme weather events.

- Need for capital investment in climate-resilient infrastructure and backup systems.

- Reputational risk if operational failures are linked to inadequate climate adaptation measures.

Ault Alliance's significant energy consumption for bitcoin mining and data centers presents a substantial environmental challenge, particularly with planned expansions. The company faces growing pressure from stakeholders to reduce its carbon footprint, necessitating investments in renewable energy and improved energy efficiency, aiming to surpass the 2023 global average Power Usage Effectiveness (PUE) of 1.57.

Managing electronic waste from hardware upgrades is another critical environmental factor, as global e-waste generation reached 62 million tonnes in 2020 and is projected to increase. Responsible disposal and recycling are essential for compliance and brand image.

Water scarcity is an increasing concern, with projections indicating over two-thirds of the world's population could face water shortages by 2025, impacting data center cooling operations and driving the need for water-efficient technologies.

Climate change poses physical risks, such as extreme weather events in 2024-2025, which could disrupt operations and necessitate investments in climate-resilient infrastructure and diversified energy sources to ensure stability.

| Environmental Factor | Impact on Ault Alliance | Key Data/Trend (2023-2025) | Mitigation Strategy |

|---|---|---|---|

| Energy Consumption & Emissions | High operational costs, regulatory scrutiny, reputational risk | Data center PUE average ~1.57 (2023); increasing demand for renewables | Invest in renewable energy, improve PUE |

| Electronic Waste (E-waste) | Compliance risk, disposal costs, environmental impact | Global e-waste 62M tonnes (2020), projected to rise | Implement robust recycling programs, resource recovery |

| Water Scarcity | Increased operational costs, regulatory restrictions | Projected water shortages affecting 2/3 of world population by 2025 | Adopt water-efficient cooling technologies |

| Climate Change Impacts | Operational disruptions, infrastructure damage, power outages | Increasing frequency/intensity of heatwaves and extreme weather | Build climate-resilient infrastructure, diversify energy sources |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ault Alliance is meticulously constructed using data from official government publications, reputable financial news outlets, and leading industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.