Atlas Copco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Copco Bundle

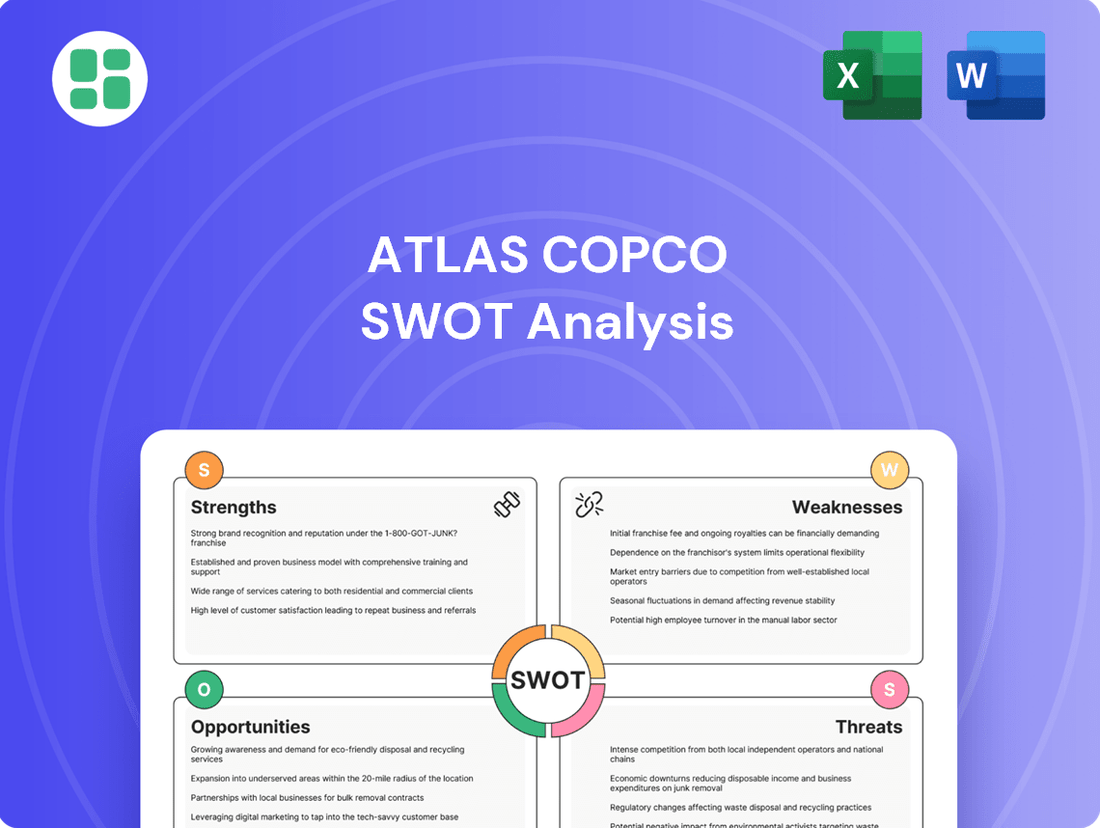

Atlas Copco, a leader in industrial productivity, boasts strong brand recognition and a diverse product portfolio, but faces intense competition and evolving market demands. Our comprehensive SWOT analysis delves into these critical areas, revealing actionable strategies for capitalizing on opportunities and mitigating threats.

Want the full story behind Atlas Copco’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Atlas Copco's dominant position as a global leader in providing sustainable productivity solutions is a significant strength. Their reach extends across diverse sectors like manufacturing, construction, and mining, ensuring a robust market presence.

This diversification is further bolstered by a broad product portfolio, including industrial tools, advanced air compressors, and specialized assembly systems. Such a wide offering effectively minimizes dependence on any single industry, creating a more resilient business model.

With customers in over 180 countries, Atlas Copco's expansive global footprint demonstrates its market leadership and adaptability. This extensive network allows them to quickly respond to evolving business conditions worldwide.

Atlas Copco has consistently showcased impressive financial health, with 2024 revenues reaching a record SEK 160 billion. This robust performance is underpinned by stable profitability and a strong operating cash flow, which stood at SEK 28 billion for the same period. The company's return on capital employed (ROCE) remains a healthy 25%, demonstrating its efficient use of invested capital.

This consistent cash generation provides Atlas Copco with significant financial flexibility. This allows the company to pursue strategic investments, explore acquisition opportunities, and importantly, return value to its shareholders through dividends and share buybacks, reinforcing its financial stability.

Atlas Copco's strategic acquisitions are a significant strength, evidenced by their completion of 33 acquisitions in 2024. This aggressive M&A approach allows them to quickly enter new niche markets and diversify their revenue base, strengthening their overall market position.

This inorganic growth is powerfully combined with a relentless focus on innovation. Atlas Copco consistently develops cutting-edge technologies and solutions designed to boost customer productivity, improve energy efficiency, and enhance operational safety.

The company's dedication to pioneering new advancements is a crucial factor in securing its long-term competitive advantage and driving future success in a dynamic industrial landscape.

Strong Service Business and Customer Focus

Atlas Copco's strong global service business is a key advantage, consistently demonstrating healthy growth in order intake across its various segments. This service arm not only generates recurring revenue but also deepens customer relationships.

The company's commitment to fostering trust and building enduring partnerships is central to its success. This customer-centric approach, coupled with a decentralized structure, ensures Atlas Copco remains closely attuned to client needs, facilitating the development of customized solutions and driving ongoing innovation.

- Robust Service Growth: Atlas Copco reported continued growth in its service business order intake throughout 2024.

- Customer Proximity: The decentralized model allows for direct engagement and understanding of diverse customer requirements.

- Long-Term Relationships: Focus on trust building strengthens customer loyalty and repeat business.

- Tailored Value: Deep customer understanding enables the delivery of specific, high-value solutions.

Commitment to Sustainability and Ethical Practices

Atlas Copco demonstrates a strong commitment to sustainability, integrating ambitious environmental, social, and governance (ESG) targets into its core strategy. This dedication is evident in its science-based targets for greenhouse gas emission reductions. By 2027, the company aims to embed circularity principles across all new and redesigned products, showcasing a forward-thinking approach to resource management.

The company's unwavering focus on ethical business practices, reinforced by a robust Code of Conduct and impactful initiatives like 'Water for All,' significantly bolsters its brand reputation. This ethical stance resonates with a growing base of stakeholders who prioritize responsible corporate citizenship, further solidifying Atlas Copco's market position.

- Commitment to ESG Targets: Aligns business strategy with measurable environmental, social, and governance goals.

- Circularity by 2027: Aims to integrate circular economy principles into all new and redesigned products.

- Enhanced Brand Reputation: Strong ethical practices and initiatives like 'Water for All' appeal to conscious stakeholders.

- Reduced Environmental Impact: Focus on science-based targets for greenhouse gas emission reductions.

Atlas Copco's strong financial performance is a key strength, with 2024 revenues reaching SEK 160 billion and operating cash flow at SEK 28 billion. Their commitment to innovation is evident in their continuous development of cutting-edge technologies that boost customer productivity and efficiency.

The company's expansive global service business, which consistently shows robust growth in order intake, provides a stable recurring revenue stream and deepens customer relationships.

| Metric | 2024 Value (SEK Billion) | Significance |

|---|---|---|

| Revenue | 160 | Demonstrates market leadership and broad demand. |

| Operating Cash Flow | 28 | Indicates strong operational efficiency and financial health. |

| Return on Capital Employed (ROCE) | 25% | Highlights efficient use of invested capital. |

What is included in the product

Delivers a strategic overview of Atlas Copco’s internal and external business factors, identifying key strengths and opportunities alongside potential weaknesses and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Atlas Copco's organic growth has experienced a noticeable slowdown, with order volumes in 2024 and the early part of 2025 failing to meet projections. This trend suggests a growing dependence on acquisitions rather than internal expansion for revenue increases.

The company's management has acknowledged this challenge, projecting a weaker customer activity environment that will likely further constrain organic growth. This presents a risk if acquisition-driven growth falters or if market conditions significantly impact core business performance.

Atlas Copco has faced significant margin pressure, with operating margins declining in the second quarter of 2025. This compression was attributed to factors such as restructuring costs, increased investment in research and development, and higher functional expenses.

Currency fluctuations represent a persistent weakness for Atlas Copco. These ongoing foreign exchange swings create headwinds that challenge the company's ability to achieve and maintain stable profitability, particularly in an unpredictable global economic environment.

Atlas Copco's reliance on cyclical industries presents a significant weakness. For instance, the semiconductor sector, a key market for its Vacuum Technique division, experienced a slowdown in capital expenditures by global chipmakers in late 2023 and early 2024, impacting order intake.

Similarly, the Industrial Technique division faces challenges due to weak demand in the European automotive market. This downturn can lead to reduced sales volumes, potentially pressuring profit margins and overall order intake for the company.

High Valuation Concerns

Atlas Copco's stock valuation is a point of concern for some analysts. Forecasts for 2025 suggest price-to-earnings ratios that could surpass 30x. This suggests that the market may have already priced in substantial future growth.

Such a high valuation can temper expectations for future returns. Investors might find it challenging to achieve significant double-digit gains from current price levels. This situation often leads to a more cautious stance, with some analysts recommending a 'hold' rather than a 'buy' on the stock.

- High P/E Ratios: Expected to exceed 30x in 2025 forecasts.

- Limited Upside Potential: May cap substantial double-digit returns for investors.

- Overvaluation Risk: Could indicate the stock is priced beyond its intrinsic value.

R&D Lag for Margin Recovery

Atlas Copco's substantial investment in research and development, a key driver for future growth, currently presents a weakness in terms of immediate margin impact. There's a noticeable lag of approximately 12 to 18 months for these R&D efforts to fully materialize into improved profitability and margin recovery. This temporal gap means that while the company is building a strong pipeline of innovative products and solutions, the financial benefits are not instantaneous, potentially contributing to ongoing pressure on near-term margins.

This R&D lag directly affects the company's ability to quickly translate innovation into enhanced financial performance. For instance, while Atlas Copco reported strong revenue growth in its 2024 fiscal year, its operating margin saw a slight dip compared to the previous year, partly attributable to the upfront costs of these long-term development projects. The challenge lies in balancing the necessary investment in innovation for future competitiveness with the immediate need to optimize profitability and satisfy investor expectations for quicker returns.

- R&D Investment Cycle: Investments made in 2024 might not show significant margin benefits until late 2025 or early 2026.

- Near-Term Margin Pressure: The time lag can create a perception of slower margin improvement despite underlying innovation.

- Competitive Landscape: Competitors who can bring innovations to market faster may gain a short-term advantage.

- Financial Planning: Requires careful financial forecasting to manage expectations during the R&D realization period.

Atlas Copco's organic growth has slowed, with order volumes in 2024 and early 2025 not meeting expectations, pushing reliance towards acquisitions. Management anticipates a weaker customer activity environment, further constraining this organic growth, which poses a risk if acquisitions falter or market conditions worsen.

The company is experiencing margin pressure, with operating margins declining in Q2 2025 due to restructuring costs, R&D investments, and higher functional expenses. This is compounded by currency fluctuations creating headwinds for stable profitability.

Reliance on cyclical industries like semiconductors, which saw reduced capital expenditures from chipmakers in late 2023 and early 2024, impacts Atlas Copco's Vacuum Technique division. Similarly, weak demand in the European automotive market affects the Industrial Technique division, potentially reducing sales and pressuring margins.

Atlas Copco's stock valuation is a concern, with 2025 forecasts suggesting P/E ratios exceeding 30x. This high valuation may limit substantial double-digit returns for investors, leading some analysts to recommend a hold position due to potential overvaluation.

Significant R&D investments, crucial for future growth, currently impact short-term margins, with benefits typically lagging 12-18 months. This temporal gap means that while innovation is being built, immediate profitability improvements are delayed, potentially affecting investor expectations.

| Metric | 2024 (Est.) | 2025 (Est.) | Key Concern |

|---|---|---|---|

| Organic Growth Rate | Low Single Digits | Low Single Digits | Dependence on acquisitions, weaker customer activity |

| Operating Margin | ~15-16% | ~15-17% | Pressure from R&D costs, restructuring, currencies |

| P/E Ratio | ~28-30x | >30x | Potential overvaluation, limited upside |

What You See Is What You Get

Atlas Copco SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Atlas Copco SWOT analysis, providing a clear overview of its strategic position. Purchase unlocks the complete, in-depth report, offering comprehensive insights into its Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Atlas Copco's proven acquisition strategy, highlighted by 33 completed deals in 2024, is a significant opportunity for expansion. These acquisitions not only diversify revenue streams into high-margin niche markets but also rapidly integrate new technologies and strengthen regional market presence.

By continuing to pursue strategic acquisitions, Atlas Copco can accelerate its entry into emerging segments and consolidate its market leadership. This approach allows for the swift acquisition of cutting-edge technologies and valuable intellectual property, fostering sustained growth and competitive advantage.

Atlas Copco is strategically positioned to capitalize on the expected upturns in crucial industrial markets. The company's robust presence in sectors like construction, which is anticipated to see increased infrastructure investment, directly bolsters its compressor and tool businesses.

Analysts are observing a growing trend favoring construction-related companies, a sector where Atlas Copco holds significant market share. This anticipated surge in infrastructure spending, projected to gain momentum through 2025, will likely translate into higher demand for Atlas Copco's core offerings.

Moreover, the semiconductor industry's projected stabilization by 2026 presents a significant opportunity for Atlas Copco's Vacuum Technique division. This stabilization is expected to drive a recovery in the division's order backlog, contributing positively to overall revenue.

The escalating global focus on sustainability and energy efficiency creates a substantial opportunity for Atlas Copco. As industries worldwide strive to lower their environmental impact and use resources more wisely, the demand for solutions that facilitate these goals is on the rise.

Atlas Copco's portfolio, featuring advanced compressors, vacuum technologies, and industrial tools, directly addresses this growing need. These products are instrumental for businesses looking to reduce their carbon footprint and enhance operational efficiency, positioning the company favorably in a market increasingly driven by environmental consciousness.

The market for energy-efficient solutions, particularly oil-free compressors, is anticipated to expand significantly. This projected growth aligns perfectly with Atlas Copco's ongoing product development and strategic direction, offering a clear avenue for increased market share and revenue generation in the coming years.

Digitalization and Smart Manufacturing Adoption

The increasing adoption of smart manufacturing and digitalization presents a significant opportunity for Atlas Copco. By integrating advanced digital controls, IoT capabilities, and AI-driven optimization into their products, the company can help clients boost efficiency and reduce operating expenses. This trend is fundamentally altering the industrial equipment market.

Atlas Copco's commitment to innovation in this space is evident. For instance, their vacuum solutions are increasingly incorporating smart features for remote monitoring and predictive maintenance, enhancing customer uptime. The global market for industrial IoT is projected to reach hundreds of billions of dollars in the coming years, highlighting the immense potential.

- Enhanced Efficiency: Smart manufacturing features allow for real-time performance monitoring and adjustments, leading to optimized production processes.

- Cost Reduction: Predictive maintenance enabled by IoT reduces downtime and lowers repair costs for customers.

- New Revenue Streams: Digital services and data analytics can create ongoing revenue opportunities beyond initial equipment sales.

- Market Leadership: Early and effective adoption of these technologies can solidify Atlas Copco's position as an industry leader.

Talent Acquisition and Development

Atlas Copco’s global presence presents a significant opportunity to tap into a diverse and skilled talent pool across various regions. This allows the company to attract top-tier professionals essential for driving innovation in areas like vacuum technology and industrial tools. For instance, in 2024, the company continued its focus on attracting talent for its advanced manufacturing and digital solutions divisions.

Investing in robust employee development programs is key to nurturing this talent and ensuring a workforce capable of meeting future market challenges. Atlas Copco can leverage this by offering specialized training in areas such as sustainable technologies and digital transformation, critical for maintaining its competitive edge. The company's commitment to employee growth was evident in its 2024 training initiatives, which saw a notable increase in participation for digital skills development.

A strong company culture that emphasizes collaboration and continuous improvement further enhances Atlas Copco's ability to retain its valuable employees. This creates an environment where skilled individuals are motivated to stay and contribute to the company's long-term success and operational excellence.

The opportunity lies in strategically leveraging these elements to build a future-ready workforce. This includes:

- Attracting global talent with expertise in emerging technologies.

- Investing in continuous learning for digital and sustainable innovation.

- Cultivating a culture that promotes employee retention and engagement.

- Expanding apprenticeship and graduate programs to build a pipeline of future leaders.

Atlas Copco's strategic acquisition strategy, evidenced by 33 completed deals in 2024, offers a clear path for expansion into high-margin niche markets and integration of new technologies. This approach also strengthens their regional market presence, allowing for swift acquisition of cutting-edge intellectual property and fostering sustained growth.

The company is well-positioned to benefit from anticipated upturns in key industrial sectors, particularly construction, where increased infrastructure investment is expected to boost demand for their compressor and tool businesses through 2025. Furthermore, the projected stabilization of the semiconductor industry by 2026 presents a significant opportunity for Atlas Copco's Vacuum Technique division, likely leading to a recovery in its order backlog.

The global drive towards sustainability and energy efficiency is a major opportunity, with demand rising for solutions that reduce environmental impact and improve operational efficiency. Atlas Copco's portfolio, including advanced compressors and vacuum technologies, directly addresses this trend, especially in the expanding market for energy-efficient solutions like oil-free compressors.

The increasing adoption of smart manufacturing and digitalization presents another significant avenue for growth. By integrating IoT and AI into their products, Atlas Copco can enhance client efficiency and reduce operating expenses, tapping into the rapidly growing industrial IoT market. Their commitment to innovation in this area, such as smart vacuum solutions for remote monitoring, positions them for leadership.

| Opportunity Area | Description | 2024/2025 Relevance |

|---|---|---|

| Strategic Acquisitions | Expansion into niche markets, technology integration, regional strengthening. | 33 deals completed in 2024; continues to be a core growth driver. |

| Industrial Market Upturns | Capitalizing on growth in construction and other industrial sectors. | Expected infrastructure investment to boost compressor and tool demand through 2025. |

| Semiconductor Industry Recovery | Boosting Vacuum Technique division performance. | Projected stabilization by 2026 expected to improve order backlog. |

| Sustainability & Energy Efficiency | Meeting demand for environmentally friendly solutions. | Growing market for oil-free compressors and solutions reducing carbon footprint. |

| Digitalization & Smart Manufacturing | Integrating IoT and AI for enhanced efficiency and new revenue streams. | Significant growth potential in industrial IoT; enhances customer value through predictive maintenance. |

Threats

Global macroeconomic and geopolitical instability presents a significant threat to Atlas Copco. Economic downturns and shifts in trade policies can directly curb customer spending on capital equipment, impacting demand for Atlas Copco's products and services. For instance, the International Monetary Fund (IMF) projected a global growth slowdown to 2.9% in 2024, down from 3.0% in 2023, highlighting a challenging environment for industrial equipment sales.

Furthermore, ongoing geopolitical tensions, such as the conflicts in Eastern Europe and the Middle East, coupled with widespread election cycles in 2024, contribute to supply chain volatility and market uncertainty. These disruptions can lead to increased operational costs and hinder the timely delivery of essential components, affecting Atlas Copco's production efficiency and profitability.

The industrial equipment sector, where Atlas Copco operates, is characterized by fierce rivalry. Key competitors such as Ingersoll Rand and Hitachi are constantly vying for market share, which inevitably translates into significant pricing pressure. This competitive landscape necessitates ongoing, substantial investments in research and development to ensure Atlas Copco maintains its technological advantage and product differentiation.

Market leadership is largely held by diversified original equipment manufacturers (OEMs), presenting a formidable challenge. To stay ahead, Atlas Copco must continuously innovate its product lines and service offerings. For instance, in 2023, the industrial compressor market alone was valued at over $30 billion, with significant R&D budgets allocated by major players to capture this growth.

Currency fluctuations present a persistent challenge for Atlas Copco. For instance, in the first quarter of 2024, the company reported negative currency translation effects that weighed on its operating profit, highlighting the direct impact on earnings. This volatility can erode the value of international earnings when repatriated, affecting overall profitability.

Ongoing global trade tensions, such as the imposition of tariffs and the slow progress on trade agreements between major economies like the United States and the European Union, also pose a significant threat. These tensions can dampen customer sentiment and investment, potentially reducing demand for Atlas Copco's capital equipment. Furthermore, they complicate pricing strategies and the ability to maintain consistent profit margins across its diverse global markets.

Supply Chain Disruptions and Input Cost Volatility

Atlas Copco faces significant risks from disruptions in its global supply chain and fluctuating costs for raw materials and components. These issues can directly impact production schedules, leading to delays and increased operational expenses. For instance, in 2024, many industrial manufacturers experienced extended lead times for critical electronic components, a trend that continued from earlier periods, directly affecting output capacity. This volatility can squeeze profit margins if the company cannot pass on increased costs to customers effectively.

Global events, such as ongoing geopolitical tensions and broader economic uncertainties, amplify these supply chain vulnerabilities. These factors can lead to sudden shortages or price spikes for essential inputs like steel, aluminum, and semiconductors. The company's reliance on a complex network of suppliers worldwide means that disruptions in one region can have a cascading effect across its entire production and distribution system. For example, trade disputes or natural disasters can swiftly alter the availability and cost of key materials, impacting Atlas Copco's ability to meet demand and maintain competitive pricing.

- Supply Chain Vulnerability: Atlas Copco's global operations expose it to potential disruptions from geopolitical events, trade restrictions, and logistical challenges.

- Input Cost Volatility: Fluctuations in the prices of raw materials such as steel and copper, as well as electronic components, can directly impact manufacturing costs and profitability.

- Operational Impact: Supply chain interruptions can lead to production delays, increased inventory holding costs, and a reduced ability to meet customer demand promptly.

- Profitability Squeeze: The inability to fully offset rising input costs through price adjustments can negatively affect Atlas Copco's profit margins.

Technological and Cyber Risks

The relentless pace of technological advancement, while offering avenues for growth, concurrently introduces significant threats. Atlas Copco's increasing reliance on sophisticated digital systems and interconnectedness, particularly in areas like IoT-enabled industrial equipment and advanced analytics, amplifies its vulnerability to cyber threats. In 2024, the global average cost of a data breach reached $4.45 million, underscoring the substantial financial and reputational damage such incidents can inflict.

The company faces the persistent risk of cyberattacks, including data breaches and ransomware incidents, which could disrupt operations, compromise sensitive customer and proprietary information, and lead to significant financial losses. As of early 2025, ransomware attacks continue to be a major concern for industrial sectors, with attackers increasingly targeting operational technology (OT) environments.

Furthermore, the potential for technological difficulties in product development, such as unforeseen challenges in integrating new technologies or ensuring the reliability of advanced systems, poses an ongoing threat. The pricing and market impact of competing products that leverage newer or more efficient technologies also require constant vigilance and strategic adaptation.

- Cybersecurity Threats: Increased reliance on digital infrastructure exposes Atlas Copco to a growing risk of cyberattacks, including ransomware and data breaches, with global average costs of breaches reaching $4.45 million in 2024.

- Technological Obsolescence: Rapid technological evolution necessitates continuous investment in R&D to avoid being outpaced by competitors offering more advanced or cost-effective solutions.

- Product Development Hurdles: Challenges in the timely and successful integration of new technologies into product lines can lead to delays and increased costs, impacting market competitiveness.

Atlas Copco faces significant threats from intensifying competition and the need for continuous innovation to maintain market leadership. Diversified OEMs and aggressive rivals like Ingersoll Rand and Hitachi exert considerable pricing pressure, demanding substantial R&D investment to ensure technological differentiation. For instance, the industrial compressor market, valued at over $30 billion in 2023, sees major players allocating significant budgets to capture growth, making it crucial for Atlas Copco to consistently enhance its product and service offerings.

| Threat Category | Specific Threat | Impact on Atlas Copco | Supporting Data/Context |

|---|---|---|---|

| Competition | Intensified Rivalry & Pricing Pressure | Erodes profit margins, necessitates higher R&D spending. | Key competitors include Ingersoll Rand and Hitachi. Industrial compressor market valued at over $30 billion in 2023. |

| Technological Advancement | Risk of Obsolescence & Integration Challenges | Requires constant R&D investment; delays in tech integration impact competitiveness. | Global average cost of a data breach was $4.45 million in 2024. Ransomware attacks continue to target industrial sectors in early 2025. |

| Economic & Geopolitical Instability | Global Slowdown & Trade Tensions | Reduces customer spending on capital equipment; increases supply chain volatility. | IMF projected global growth slowdown to 2.9% in 2024. Geopolitical tensions and election cycles in 2024 contribute to market uncertainty. |

SWOT Analysis Data Sources

This Atlas Copco SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market intelligence reports, and expert industry analyses to ensure a thorough and insightful strategic evaluation.