Atlas Copco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Copco Bundle

Uncover the external forces shaping Atlas Copco's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements create both challenges and opportunities for the company. Gain the strategic foresight you need to navigate this complex landscape. Download the full analysis now for actionable intelligence.

Political factors

Government policies significantly shape Atlas Copco's operating environment. Regulations concerning manufacturing efficiency, emissions standards, and infrastructure development directly impact demand for their compressors, vacuum solutions, and power technique equipment. For instance, in 2024, many nations are reinforcing environmental regulations, potentially increasing the need for energy-efficient industrial equipment like Atlas Copco's offerings.

Industrial subsidies present both opportunities and challenges. As of early 2025, many governments are actively promoting green technologies and advanced manufacturing through financial incentives. A notable trend is the increased funding for renewable energy projects, which often require robust compressed air and vacuum systems, thereby benefiting Atlas Copco's Power Technique and Industrial Technique segments.

Shifts in industrial policy can rapidly alter market dynamics. For example, a government's decision to boost domestic manufacturing through tariffs or local content requirements could either favor Atlas Copco if they have a strong local presence or pose a challenge if they rely heavily on imported components. The ongoing global focus on supply chain resilience, particularly evident in 2024-2025, means that government industrial strategies are closely watched by companies like Atlas Copco.

Global trade policies, including tariffs and trade agreements, significantly impact Atlas Copco's supply chain and market access. For instance, in 2024, ongoing trade tensions between major economic blocs continue to create uncertainty, potentially affecting the cost of imported components and the competitiveness of Atlas Copco's exported machinery.

The imposition of new tariffs, such as those seen in recent trade disputes, can increase raw material costs or make exports less competitive, potentially reducing demand from customers. These shifts can directly influence Atlas Copco's profitability and strategic sourcing decisions as they navigate varying import duties and export regulations across different markets.

Atlas Copco's operations are significantly influenced by political stability across its key markets and customer regions. For instance, in 2024, regions experiencing heightened political instability, such as parts of Eastern Europe and the Middle East, present direct challenges to Atlas Copco's supply chain resilience and demand forecasts. The company's 2024 annual report explicitly notes that geopolitical shifts are a material consideration impacting its business outlook.

Geopolitical tensions, including trade disputes and regional conflicts, directly affect Atlas Copco by creating supply chain disruptions and increasing operational risks. For example, the ongoing geopolitical events in 2024 have led to increased logistics costs and a more unpredictable demand environment for industrial equipment in affected areas, impacting Atlas Copco's ability to maintain consistent production and sales volumes.

Regulatory Environment and Compliance

Atlas Copco's operations are significantly influenced by a complex web of regulations. These include stringent industrial standards for emissions, safety, and energy efficiency, which directly impact product design and manufacturing processes. For instance, evolving emissions standards in key markets like the European Union and North America necessitate continuous investment in cleaner technologies for their compressors and vacuum solutions.

Navigating these diverse regulatory landscapes globally presents a key challenge. Compliance requirements vary widely, demanding tailored approaches to product development and market entry strategies. In 2024, Atlas Copco continued to adapt its product portfolio to meet regional environmental regulations, such as those related to refrigerants and noise pollution, which can influence market access and competitive positioning.

While stricter regulations can increase upfront compliance costs, they also act as a catalyst for innovation. Atlas Copco often finds that meeting these higher standards drives demand for their more advanced, energy-efficient, and environmentally compliant equipment. This is evident in the growing market for variable speed drive compressors, which are favored for their energy savings and ability to meet fluctuating demand while adhering to stricter energy performance directives.

Key regulatory considerations for Atlas Copco include:

- Emissions Standards: Adherence to global air quality and greenhouse gas regulations, impacting engine and electric motor technologies.

- Energy Efficiency Directives: Compliance with mandates for improved energy performance in industrial equipment, driving demand for VSD and IE5 motor technologies.

- Product Safety and Certification: Meeting diverse safety standards (e.g., ATEX for explosive atmospheres) in different operating regions.

- Chemical Regulations: Compliance with rules governing the use of substances like refrigerants in their equipment.

Government Investment in Infrastructure

Governments worldwide are significantly increasing their investment in infrastructure, a trend that directly benefits companies like Atlas Copco. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, allocates over $1 trillion to upgrade roads, bridges, public transit, and water systems, creating substantial demand for construction equipment. Similarly, many European nations are channeling funds into high-speed rail networks and renewable energy projects, further bolstering the market for heavy machinery.

These government initiatives, particularly in smart city developments and ongoing urbanization efforts, are major catalysts for industrial machinery sales. As cities expand and become more technologically integrated, the need for advanced construction and mining equipment escalates. This surge in urban development projects, from new transportation hubs to upgraded utility networks, is a key growth driver for Atlas Copco's Power Technique and Construction Technique segments.

The global infrastructure spending forecast paints a robust picture for the coming years. According to various industry reports, global infrastructure investment is projected to reach trillions of dollars by 2030. This sustained government focus on infrastructure development provides a strong, predictable demand stream for Atlas Copco's product portfolio.

- Infrastructure Investment and Jobs Act (US): Over $1 trillion allocated for infrastructure upgrades.

- Global Infrastructure Spending: Projected to reach trillions by 2030, driving equipment demand.

- Smart City Initiatives: Increasing urbanization fuels need for advanced industrial machinery.

- Atlas Copco's Exposure: Direct benefit to Power Technique and Construction Technique business areas.

Government policies, including environmental regulations and industrial subsidies, directly influence Atlas Copco's market opportunities. For example, in 2024, many nations intensified their focus on green technologies, offering incentives that boost demand for energy-efficient industrial equipment. This trend is particularly beneficial for Atlas Copco's Power Technique and Industrial Technique segments, as renewable energy projects often require advanced compressed air and vacuum systems.

Trade policies and geopolitical stability are critical factors affecting Atlas Copco's global operations. Trade tensions and regional conflicts in 2024 have led to increased logistics costs and supply chain disruptions, impacting the company's ability to maintain consistent production and sales volumes. The company's 2024 annual report highlighted geopolitical shifts as a material consideration impacting its business outlook.

Infrastructure development spending by governments worldwide presents significant growth avenues for Atlas Copco. Initiatives like the US Infrastructure Investment and Jobs Act, with over $1 trillion allocated for upgrades, and similar projects in Europe, are driving demand for construction and mining equipment. Global infrastructure investment is projected to reach trillions by 2030, providing a strong, predictable demand stream.

| Policy Area | Impact on Atlas Copco | 2024/2025 Trend/Data |

| Environmental Regulations | Drives demand for energy-efficient solutions | Stricter emissions standards in EU/US necessitate cleaner technologies |

| Industrial Subsidies | Supports adoption of advanced manufacturing | Increased funding for green tech and renewable energy projects |

| Trade Policies | Affects supply chain costs and market access | Ongoing trade tensions increase logistics costs and create uncertainty |

| Infrastructure Spending | Boosts demand for construction and mining equipment | US Infrastructure Act ($1T+), global spending projected to reach trillions by 2030 |

What is included in the product

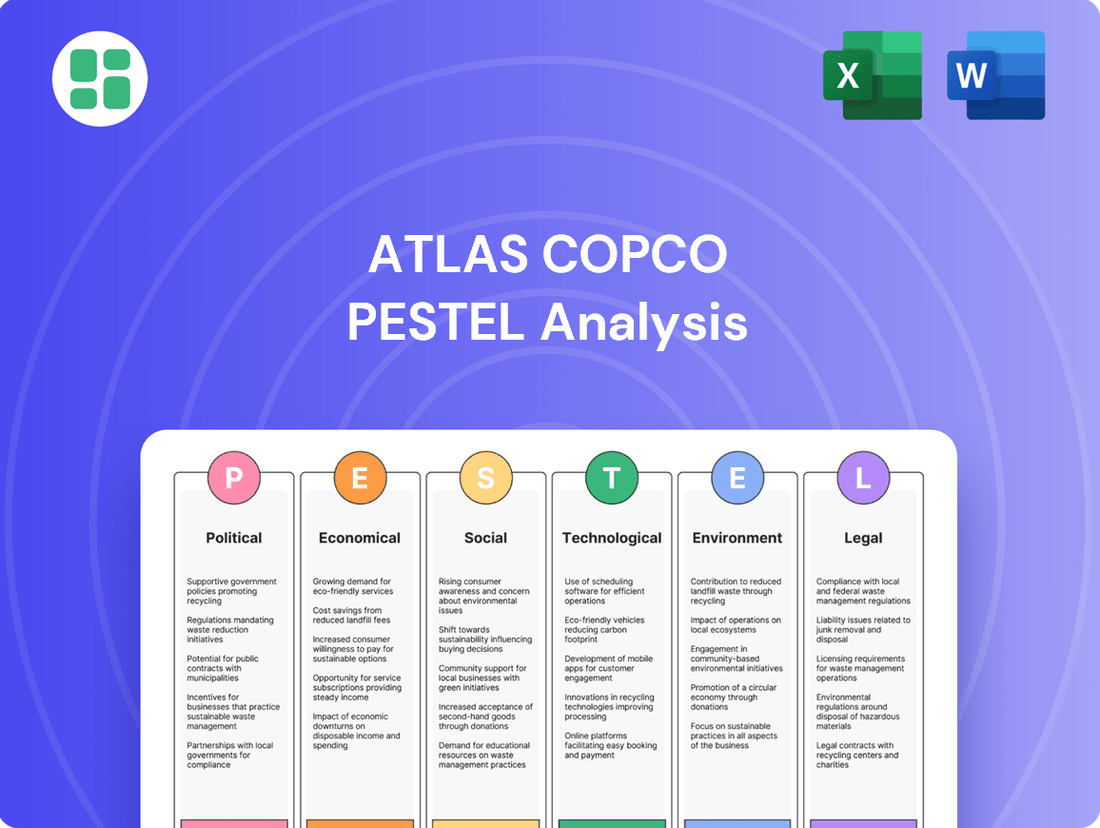

This PESTLE analysis provides a comprehensive examination of how external macro-environmental factors influence Atlas Copco's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on external factors impacting Atlas Copco.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining political, economic, social, technological, environmental, and legal influences.

Economic factors

Atlas Copco's business is intrinsically linked to the pace of global economic expansion and the vitality of key industrial sectors like manufacturing, construction, and mining. While 2024 experienced modest growth in global manufacturing output, projections for 2025 and subsequent years indicate a more robust upward trend.

This anticipated acceleration in industrial machinery market growth, with an estimated valuation of USD 743.1 billion by 2025, presents a favorable environment for Atlas Copco, directly supporting demand for its equipment and services.

Inflationary pressures in 2024 and early 2025 are directly impacting Atlas Copco by increasing the cost of essential raw materials like steel and copper, as well as critical components. This rise in input expenses squeezes profit margins, making it harder to maintain the company's competitive pricing and operational efficiency.

Manufacturers, including those supplying Atlas Copco, anticipate continued growth in raw material and other input costs throughout 2024 and into 2025. This persistent upward trend creates a challenging business environment where managing these escalating expenses becomes paramount for sustaining profitability and financial health.

Fluctuations in interest rates significantly influence Atlas Copco's customer investment decisions, particularly concerning capital equipment. When interest rates rise, the cost of borrowing increases, making large capital expenditures less attractive for businesses. This can lead to a slowdown in demand for Atlas Copco's products as companies postpone or scale back investments in new machinery and production lines.

For instance, in early 2024, many central banks maintained higher interest rate environments to combat inflation, which likely dampened capital spending across various industrial sectors. However, the impact isn't uniform. In North America, a strong push towards automated production lines is creating sustained demand for advanced equipment, even amidst higher borrowing costs, as companies prioritize efficiency and labor cost reduction.

Currency Exchange Rate Fluctuations

As a global player, Atlas Copco's financial results are inherently sensitive to shifts in currency exchange rates. When earnings from international operations are translated back into its reporting currency, typically Swedish Krona (SEK), fluctuations can significantly alter reported revenues and profitability. For instance, a stronger SEK against currencies where Atlas Copco generates substantial revenue would reduce the reported value of those earnings.

These currency movements can also create noticeable price discrepancies across different stock exchanges where Atlas Copco is listed. If the SEK strengthens considerably, the SEK-denominated share price might appear higher relative to prices on exchanges in countries with weaker currencies, even after accounting for the exchange rate, potentially affecting investor perception and trading patterns.

Consider the impact in 2024: Atlas Copco reported a substantial positive currency translation impact on operating profit in the first half of 2024, amounting to SEK 1,100 million. This highlights how favorable currency movements can boost reported earnings, while adverse ones can have the opposite effect.

The company actively manages this exposure through hedging strategies. For example, in the first half of 2024, Atlas Copco's hedging activities resulted in a net positive impact of SEK 300 million on operating profit, demonstrating a proactive approach to mitigating currency risks.

- Currency Impact on Revenue: Fluctuations directly affect reported sales when foreign currency earnings are converted to SEK.

- Profitability Distortion: Exchange rate changes can create artificial gains or losses, impacting the reported bottom line.

- Stock Price Dispersion: Differences in currency strength can lead to varied share prices across global listings.

- Hedging Effectiveness: Atlas Copco's hedging strategies, which contributed SEK 300 million positively to operating profit in H1 2024, aim to stabilize financial results.

Market Demand in Key Industries

Demand from sectors like manufacturing, construction, infrastructure, and natural resources is a major driver for Atlas Copco's revenue. The construction industry, a substantial part of the industrial machinery market in 2024, is projected for continued expansion due to ongoing infrastructure development initiatives.

Furthermore, the capital expenditure trends within the semiconductor industry directly influence the performance of Atlas Copco's Vacuum Technique division. For example, in 2024, significant investments were seen in advanced semiconductor manufacturing facilities, boosting demand for specialized vacuum solutions.

- Construction Sector Growth: The global construction market was valued at approximately $13.5 trillion in 2024 and is expected to see a compound annual growth rate (CAGR) of over 4% through 2030, benefiting Atlas Copco's equipment sales.

- Infrastructure Investment: Many governments worldwide announced substantial infrastructure spending packages in 2024, with projections indicating continued investment in areas like transportation and energy networks.

- Semiconductor Capital Expenditure: Leading semiconductor manufacturers planned capital expenditures exceeding $200 billion globally for 2024, a key indicator for Atlas Copco's Vacuum Technique segment.

Global economic growth directly fuels demand for Atlas Copco's industrial equipment. While 2024 saw moderate expansion, projections for 2025 indicate a stronger upward trend, especially in manufacturing and construction, with the industrial machinery market expected to reach USD 743.1 billion by 2025.

Inflationary pressures in 2024 and 2025 are increasing raw material costs, impacting Atlas Copco's profitability by squeezing margins on essential inputs like steel and copper.

Interest rate hikes in early 2024 influenced customer investment in capital equipment, making borrowing more expensive and potentially slowing demand, though specific sectors like North American automation are showing resilience.

Currency fluctuations significantly affect Atlas Copco's reported earnings; for instance, a positive translation impact of SEK 1,100 million on operating profit was reported in H1 2024, alongside a SEK 300 million positive impact from hedging activities.

| Economic Factor | 2024/2025 Data/Trend | Impact on Atlas Copco |

| Global Economic Growth | Modest in 2024, projected stronger in 2025. Industrial machinery market to reach USD 743.1 billion by 2025. | Increased demand for equipment and services. |

| Inflation | Persistent upward pressure on raw material costs (steel, copper). | Squeezed profit margins, challenges in competitive pricing. |

| Interest Rates | Higher rates in early 2024, impacting capital expenditure decisions. | Potential slowdown in demand for capital equipment. |

| Currency Exchange Rates | Significant fluctuations impacting reported earnings. H1 2024 saw SEK 1,100 million positive translation impact on operating profit. | Affects reported revenue and profitability; hedging strategies mitigate risk (SEK 300 million positive impact in H1 2024). |

Full Version Awaits

Atlas Copco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Atlas Copco PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. You can trust that the insights and structure you see are precisely what you'll gain access to.

Sociological factors

Atlas Copco's ability to access skilled labor is crucial, especially in specialized areas like advanced manufacturing and digital technologies. The global skills gap in industrial and technical fields directly affects their capacity for innovation and operational efficiency, potentially slowing expansion.

In 2024, reports indicated a persistent shortage of engineers and technicians across many developed economies, a trend expected to continue. For instance, a 2024 study by the World Economic Forum highlighted that over 50% of all employees will require reskilling by 2025, underscoring the need for proactive talent development.

To counter this, Atlas Copco's investment in robust training and development programs is paramount. These initiatives are designed not only to bridge existing skill deficiencies but also to cultivate future competencies, ensuring the company remains competitive in attracting and retaining top talent in a demanding global market.

Customers are increasingly vocal about their desire for sustainable and energy-efficient products. This shift directly impacts how companies like Atlas Copco approach product design and marketing, with a growing emphasis on solutions that minimize environmental impact. For instance, a significant portion of consumers, particularly in developed markets, now actively seek out brands demonstrating strong environmental, social, and governance (ESG) credentials, influencing purchasing decisions and brand loyalty.

Rapid urbanization is a significant driver for Atlas Copco, as cities worldwide expand, creating a substantial demand for new infrastructure. This includes everything from residential and commercial buildings to vital transportation networks and essential utility systems.

This global push for urban development directly translates into increased demand for Atlas Copco's construction and industrial equipment. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, highlighting the sustained need for construction machinery.

The industrial machinery market, especially within the construction sector, experiences robust growth fueled by these urbanization trends. This provides a fertile ground for companies like Atlas Copco to supply the tools and equipment necessary for building and maintaining modern urban environments.

Health and Safety Standards in Workplaces

The growing focus on workplace health and safety, particularly in industrial and construction sectors, directly influences demand for safer equipment. Atlas Copco's commitment to meeting these evolving standards, such as those outlined by OSHA in the US, drives innovation in their product lines, ensuring features that minimize operator risk. For instance, advancements in dust suppression technology on their drilling equipment are a direct response to stricter regulations concerning airborne particulate matter, a key concern in mining and construction.

These stringent safety requirements translate into significant investment in research and development for companies like Atlas Copco. Meeting global safety certifications, like CE marking in Europe, requires rigorous testing and adherence to specific design parameters, often leading to the integration of advanced safety features. This not only enhances product appeal but also reduces liability for both the manufacturer and the end-user. In 2024, the global industrial safety market was valued at over $50 billion, with a projected compound annual growth rate of 6% through 2030, underscoring the market's responsiveness to safety imperatives.

- Regulatory Compliance: Atlas Copco must ensure its equipment meets or exceeds international safety standards like ISO 45001, impacting product design and manufacturing processes.

- Innovation Driver: Increased safety demands spur the development of new technologies, such as advanced ergonomic designs and integrated safety interlocks, enhancing product competitiveness.

- Operational Impact: Customer adoption of Atlas Copco's products is influenced by their safety features, which can simplify compliance with local health and safety regulations at client sites.

- Market Demand: The global emphasis on worker well-being fuels demand for safer machinery, creating opportunities for Atlas Copco to differentiate through superior safety performance.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for companies to actively engage in corporate social responsibility are increasingly shaping business operations. This includes a strong emphasis on ethical sourcing of materials, ensuring fair labor practices throughout the supply chain, and meaningful community engagement initiatives. These factors significantly influence a company's brand reputation and its relationships with various stakeholders, from customers to investors.

Atlas Copco's approach to CSR is integrated into its core business strategy, as evidenced in its annual reporting. The company emphasizes a holistic view that encompasses economic performance alongside environmental stewardship and social responsibility. For instance, in its 2023 Sustainability Report, Atlas Copco detailed progress in areas such as reducing its environmental footprint and fostering an inclusive workplace, demonstrating a commitment to these evolving expectations.

- Ethical Sourcing: Atlas Copco aims to ensure that its suppliers adhere to strict ethical standards, including human rights and environmental protection.

- Fair Labor Practices: The company is committed to providing safe working conditions and fair compensation for its employees and those in its value chain.

- Community Engagement: Atlas Copco actively participates in local communities where it operates, supporting various social and environmental projects.

- Transparency: The company publishes detailed sustainability reports, providing stakeholders with data on its CSR performance and targets.

Societal shifts toward greater environmental awareness directly influence Atlas Copco's product development and market strategy. Consumers and businesses alike are prioritizing sustainability, pushing for energy-efficient machinery and solutions that minimize ecological impact. This trend is particularly strong in 2024, with a growing demand for products that align with Environmental, Social, and Governance (ESG) principles, impacting brand perception and purchasing decisions.

The increasing global focus on workplace safety and health is a significant factor for Atlas Copco. Stricter regulations and a heightened awareness of worker well-being drive demand for equipment with advanced safety features. For instance, in 2024, there was a notable increase in the adoption of smart safety technologies in industrial settings, directly influencing the design and marketing of machinery to reduce operational risks and ensure compliance with evolving standards.

Corporate social responsibility (CSR) is no longer optional; it's a core expectation for companies like Atlas Copco. This involves ethical sourcing, fair labor practices, and community involvement, all of which impact brand reputation and stakeholder relationships. Atlas Copco's 2023 Sustainability Report highlighted their ongoing efforts in these areas, demonstrating a commitment to responsible business practices that resonate with increasingly conscious consumers and investors.

Technological factors

Atlas Copco is well-positioned to capitalize on the accelerating trends of automation and digitalization in manufacturing. The company's smart tools and advanced assembly systems directly address the growing demand for enhanced efficiency and precision in industrial processes. For instance, the global industrial automation market was valued at approximately USD 237.2 billion in 2023 and is projected to reach USD 411.4 billion by 2030, growing at a CAGR of 8.1% during this period, according to Statista. This expansion highlights the significant market opportunities for Atlas Copco's offerings.

The broader industrial machinery market is undergoing a significant transformation, with a clear shift towards smart manufacturing principles, often referred to as Industry 4.0. This evolution is fueled by the increasing integration of advanced automation technologies. These include sophisticated robotics, Internet of Things (IoT) enabled machinery that allows for real-time data collection and analysis, and the application of artificial intelligence (AI) to optimize production workflows. Atlas Copco's strategic investments in these areas, such as its development of connected tools and data analytics platforms, directly align with these market demands, enabling customers to achieve greater operational intelligence and productivity.

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into industrial equipment, like Atlas Copco's compressors and vacuum solutions, is a significant technological driver. This synergy allows for predictive maintenance, meaning potential equipment failures can be identified and addressed before they occur, minimizing downtime. For instance, AI algorithms can analyze sensor data from IoT devices to forecast when a component might fail, enabling proactive servicing. This leads to substantial cost savings and improved operational continuity for customers.

Atlas Copco is actively investing in digitization and AI-driven service models. This strategic focus aims to enhance customer experience through remote monitoring and performance optimization. By leveraging AI, the company can offer more intelligent and efficient solutions, such as optimizing energy consumption in real-time. This positions Atlas Copco to capitalize on the growing demand for smart, connected industrial equipment and services in the coming years.

The drive for energy efficiency and green technologies is a significant technological factor impacting Atlas Copco. The increasing demand for low-carbon and zero-emission equipment in sectors like construction and manufacturing directly influences the development of their compressed air and power solutions. For instance, the global market for industrial energy efficiency is projected to reach $50 billion by 2028, highlighting the scale of this shift.

Atlas Copco is actively responding to this trend through innovation. Their development of battery-driven portable screw compressors and advanced energy storage systems demonstrates a commitment to offering more sustainable alternatives. This aligns with the broader technological push towards electrification and reduced environmental impact across heavy industries, with many major equipment manufacturers setting ambitious targets for zero-emission fleets by the mid-2030s.

Research and Development (R&D) Investment

Atlas Copco's commitment to innovation is underscored by its consistent investment in Research and Development (R&D). This strategic focus is crucial for the company to stay ahead in a competitive market and to consistently bring new, advanced products and solutions to its customers.

The company allocates approximately 4% of its annual revenue towards R&D initiatives. For instance, in 2023, Atlas Copco reported revenues of approximately SEK 155 billion, meaning R&D investments likely approached SEK 6.2 billion. This significant funding ensures a robust pipeline of next-generation technologies.

- R&D Investment: Atlas Copco consistently invests around 4% of its revenue in R&D.

- Impact: This investment fuels the development of innovative products and maintains a competitive edge.

- 2023 Revenue: The company's 2023 revenue was approximately SEK 155 billion.

- Estimated R&D Spend: This translates to an estimated R&D expenditure of around SEK 6.2 billion in 2023.

Additive Manufacturing and Advanced Materials

The increasing adoption of additive manufacturing, commonly known as 3D printing, alongside the continuous development of advanced materials, presents significant opportunities and challenges for companies like Atlas Copco. These technological advancements are reshaping how industrial tools and components are designed and produced, leading to more efficient and highly customized solutions. For instance, by 2024, the global 3D printing market is projected to reach over $50 billion, indicating a rapid expansion that will likely influence manufacturing strategies across industries.

Atlas Copco can leverage these trends to innovate its product lines, potentially creating lighter, stronger, and more complex parts than traditional manufacturing methods allow. This could translate into improved performance for their equipment, such as compressors or mining machinery, and also open doors for entirely new product categories. The ability to produce on-demand or highly specialized components can also streamline supply chains and reduce waste, aligning with sustainability goals.

- Additive manufacturing adoption is growing rapidly, with market projections indicating continued expansion through 2025.

- Advanced materials offer enhanced properties like increased strength-to-weight ratios, impacting product durability and efficiency.

- Customization capabilities through 3D printing allow for tailored solutions, meeting specific client needs and niche market demands.

- These technologies can lead to optimized production processes, potentially reducing lead times and manufacturing costs for complex components.

Technological advancements are a primary driver for Atlas Copco, particularly in automation and digitalization. The company's smart tools and assembly systems cater to the increasing demand for efficiency and precision in manufacturing. The global industrial automation market, valued at approximately USD 237.2 billion in 2023, is expected to grow significantly, presenting substantial opportunities for Atlas Copco's offerings.

The integration of AI and IoT into industrial equipment, such as Atlas Copco's compressors, enables predictive maintenance, reducing downtime and costs. Furthermore, the company's investment in digitization and AI-driven services enhances customer experience through remote monitoring and performance optimization, aligning with the growing demand for smart, connected industrial solutions.

Atlas Copco's commitment to R&D, allocating around 4% of its revenue, fuels innovation in areas like energy efficiency and sustainable technologies. With 2023 revenues of approximately SEK 155 billion, this translates to an estimated R&D spend of SEK 6.2 billion, ensuring a pipeline of advanced products.

| Factor | Description | Atlas Copco Relevance | Market Data (2023-2030) |

| Automation & Digitalization | Smart manufacturing, IoT, AI | Core to product development and service models | Industrial Automation Market: USD 237.2B (2023) to USD 411.4B (2030) at 8.1% CAGR |

| Energy Efficiency Tech | Low-carbon, zero-emission equipment | Development of battery-driven solutions, energy storage | Industrial Energy Efficiency Market: Projected USD 50B by 2028 |

| Additive Manufacturing | 3D printing, advanced materials | Opportunities for lighter, stronger, customized components | Global 3D Printing Market: Projected over USD 50B by 2024 |

| R&D Investment | Continuous innovation | Ensures competitive edge and new product pipeline | Approx. 4% of revenue (SEK 6.2B on SEK 155B revenue in 2023) |

Legal factors

Stricter environmental regulations, especially concerning carbon emissions and industrial pollution, are shaping Atlas Copco's product development and manufacturing. For instance, upcoming regulations in 2025 are designed to significantly reduce industrial emissions into air, water, and soil, directly influencing the design of their heavy equipment and machinery.

Atlas Copco must navigate a complex web of product safety and quality standards, which vary significantly by region. For instance, the European Union's General Product Safety Regulation (GPSR), updated in 2024, imposes stricter obligations on manufacturers regarding product traceability and risk assessment, directly impacting Atlas Copco's product development lifecycle and supply chain management.

Adherence to these evolving regulations is not merely a compliance issue but a critical factor in maintaining brand reputation and customer trust. Failure to meet standards, such as those set by the U.S. Consumer Product Safety Commission (CPSC) or international bodies like ISO, can result in costly recalls and reputational damage, as seen in past industry-wide incidents affecting heavy machinery manufacturers.

Changes in labor laws, such as adjustments to minimum wage and overtime regulations, can directly impact Atlas Copco's operational expenses and how it manages its workforce across various countries. For instance, a significant increase in the federal minimum wage in a key market like the United States, which has seen discussions around raising it to $15 per hour by 2025, could necessitate cost adjustments.

Furthermore, evolving rules around independent contractor classifications, like those seen in California with Assembly Bill 5 and subsequent modifications, require careful attention to ensure compliance and avoid potential penalties. Staying updated on these state-specific and global employment law shifts is crucial for maintaining efficient and legally sound workforce practices.

Intellectual Property Rights and Patents

Intellectual property rights are foundational for Atlas Copco, safeguarding its advanced technologies and product designs. Robust patent protection is crucial for maintaining its edge in competitive markets, especially given the company's substantial investments in research and development. For instance, Atlas Copco actively manages its patent portfolio to prevent unauthorized use of its innovations, a strategy vital for recouping R&D expenditures and sustaining market leadership.

The legal framework surrounding intellectual property directly impacts Atlas Copco's ability to innovate and compete. Strong patent laws and their rigorous enforcement worldwide are indispensable for preventing competitors from replicating proprietary technologies, thereby securing the company's market position. This legal protection is paramount, especially as Atlas Copco continues to invest heavily in developing new solutions, with R&D spending often representing a significant portion of its operational budget.

- Patent Portfolio: Atlas Copco holds thousands of active patents globally, covering a wide range of its technologies and product innovations.

- R&D Investment: The company consistently invests heavily in R&D, with figures often exceeding SEK 3 billion annually, underscoring the critical need for IP protection.

- Market Advantage: Effective IP management allows Atlas Copco to differentiate its offerings and maintain premium pricing power against imitative products.

Antitrust and Competition Laws

Atlas Copco must strictly adhere to antitrust and competition laws across all its operating regions to foster fair market practices and avoid monopolistic tendencies. This commitment is crucial, especially given the company's strategic reliance on mergers and acquisitions for growth.

In 2023, the European Commission continued its robust enforcement of competition law, with significant fines levied against companies for cartel activities and abuses of dominant market positions. For instance, a major industrial supplier faced a substantial penalty for price-fixing, underscoring the scrutiny applied to large industrial players.

- Merger Control: Atlas Copco's acquisition plans are subject to review by competition authorities in various jurisdictions, ensuring that such deals do not harm competition.

- Market Dominance: The company must ensure its market share in key segments does not lead to anti-competitive practices, such as predatory pricing or exclusive dealing.

- Regulatory Scrutiny: In 2024, regulators globally are expected to maintain or increase their focus on market concentration in industrial sectors, potentially impacting future M&A activities.

Atlas Copco operates within a dynamic legal landscape, necessitating strict adherence to environmental, product safety, and labor regulations. For example, upcoming EU directives in 2025 targeting industrial emissions will directly influence the design of their machinery, while updated product safety rules in 2024, like the GPSR, demand enhanced traceability. These legal frameworks are not just compliance hurdles but are crucial for maintaining brand integrity and avoiding costly penalties, as demonstrated by past industry-wide recalls affecting heavy equipment manufacturers.

Environmental factors

Global and national climate change policies, such as the Paris Agreement's goal to limit warming to 1.5°C, are increasingly shaping market demand. These regulations, including carbon pricing mechanisms and stricter energy efficiency standards, directly boost the need for Atlas Copco's energy-efficient compressors and vacuum solutions.

Atlas Copco's commitment to decarbonization, evidenced by its Science Based Targets aiming to reduce Scope 1, 2, and 3 emissions in line with the Paris Agreement, is a significant driver. For instance, in 2023, Atlas Copco reported a 12% reduction in its Scope 1 and 2 emissions compared to its 2019 baseline, demonstrating tangible progress that resonates with environmentally conscious customers.

Growing concerns about resource scarcity, especially for vital raw materials like rare earth elements used in electric motors and advanced manufacturing, directly affect Atlas Copco's supply chain stability and operational costs. For instance, the International Energy Agency (IEA) highlighted in its 2024 Critical Minerals Outlook that demand for minerals like lithium and cobalt could increase by over 40 times by 2040 for clean energy technologies. This trend compels Atlas Copco to prioritize more efficient material utilization and investigate incorporating recycled content, thereby embracing circular economy principles and mitigating supply risks.

The global push towards waste reduction and circular economy principles creates a significant landscape for Atlas Copco. This shift encourages designing products for enhanced durability, easier repair, and eventual recyclability, directly impacting manufacturing processes and supply chains.

Businesses are increasingly adopting circularity not just for environmental compliance but for tangible economic benefits. For instance, the Ellen MacArthur Foundation reported in 2024 that a fully circular economy for plastics could generate billions in value annually, a trend Atlas Copco can leverage through its product lifecycle services and focus on resource efficiency.

Atlas Copco's commitment to sustainability, including initiatives like product longevity and offering services that extend product life, positions them to capitalize on this trend. By embracing circular economy models, they can reduce material costs, create new revenue streams through refurbishment and remanufacturing, and strengthen their market position in 2024 and beyond.

Energy Consumption and Efficiency Targets

Atlas Copco's operations and product offerings are significantly influenced by global energy consumption and efficiency targets. As a major provider of industrial equipment, the company is directly involved in helping its customers reduce their energy footprints. For instance, their advanced compressed air systems are engineered for optimal efficiency, leading to substantial energy savings and a corresponding decrease in CO2 emissions for users.

The company is actively investing in and developing innovative solutions to address the growing demand for sustainable power. This includes a focus on energy storage systems, which are crucial for managing intermittent renewable energy sources and ensuring a stable power supply for industrial operations. This strategic direction aligns with increasing regulatory pressures and market expectations for reduced environmental impact.

Atlas Copco's commitment to sustainability is also reflected in its internal operations and product development cycles. They aim to set ambitious targets for reducing their own energy consumption and greenhouse gas emissions. This dual approach—improving their own efficiency and enabling customer efficiency—positions them as a key player in the transition towards a lower-carbon industrial future.

- Energy Efficiency Focus: Atlas Copco's compressed air solutions can reduce customer energy consumption by up to 40%.

- CO2 Emission Reduction: Optimized systems contribute to significant CO2 emission reductions across various industries.

- Sustainable Power Solutions: Development of energy storage systems to support grid stability and renewable energy integration.

- Internal Targets: The company aims for a 50% reduction in scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2018 baseline.

Water Management and Pollution Control

Environmental regulations concerning water management and pollution control are tightening globally, directly impacting industrial operations. Atlas Copco, with its dewatering and fluid management solutions, must ensure its equipment and processes meet these evolving standards.

For instance, the European Union's Water Framework Directive continues to drive stricter controls on industrial wastewater discharge. Companies like Atlas Copco are investing in technologies that minimize water consumption and treat wastewater effectively. In 2023, the company reported a continued focus on sustainability in its product development, aiming to reduce the environmental footprint of its customers' operations.

- Stricter Discharge Limits: Many regions are lowering permissible levels for pollutants in industrial wastewater.

- Water Scarcity Concerns: Growing water scarcity in various regions necessitates more efficient water usage and recycling technologies.

- Technological Compliance: Atlas Copco's dewatering pumps and fluid handling systems are designed to meet stringent environmental performance benchmarks.

- Societal Pressure: Increased public awareness and demand for environmentally responsible manufacturing push companies to adopt best practices in water management.

Global climate policies, like the Paris Agreement's goals, are increasingly influencing market demand, favoring Atlas Copco's energy-efficient solutions. The company's commitment to decarbonization, with Science Based Targets and a 12% reduction in Scope 1 and 2 emissions by 2023 against a 2019 baseline, demonstrates tangible progress that resonates with environmentally conscious customers.

Resource scarcity, particularly for materials in electric motors, impacts Atlas Copco's supply chain. The IEA's 2024 outlook predicts a significant increase in demand for critical minerals, pushing Atlas Copco towards efficient material use and recycled content.

The growing emphasis on circular economy principles presents opportunities for Atlas Copco to enhance product durability and recyclability, aligning with business benefits highlighted by the Ellen MacArthur Foundation's 2024 report on circular plastics.

Atlas Copco's energy efficiency focus, with solutions reducing customer energy use by up to 40%, and internal targets for a 50% reduction in scope 1 and 2 greenhouse gas emissions by 2030 (vs. 2018 baseline), positions them as a key player in the low-carbon transition.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Atlas Copco is built upon a robust foundation of data from reputable sources, including international economic bodies, government regulatory bodies, and leading industry analysis firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to ensure a comprehensive and accurate assessment.