Atlas Copco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Copco Bundle

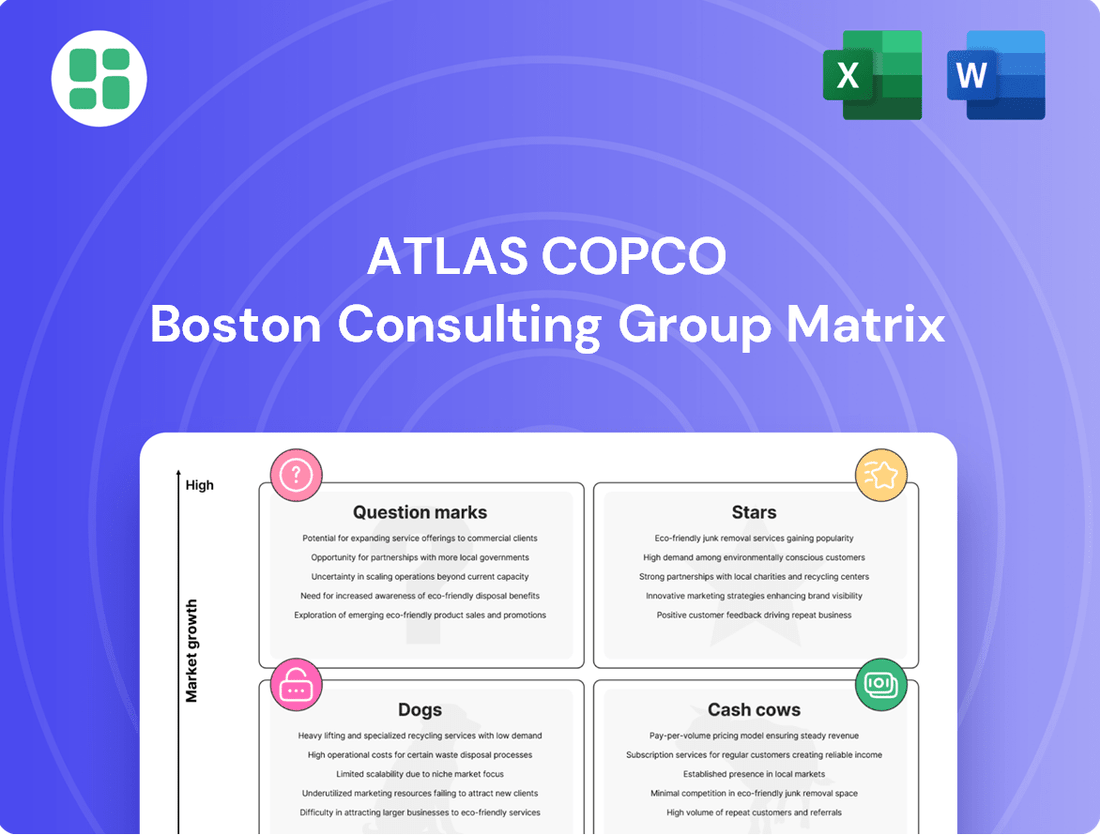

Atlas Copco's BCG Matrix offers a powerful lens to understand its product portfolio's performance and potential. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, you can quickly grasp market dynamics and strategic priorities. Don't miss out on the actionable insights that can guide your investment decisions and drive growth.

Unlock the full potential of Atlas Copco's strategic positioning with the complete BCG Matrix. This comprehensive analysis provides a detailed breakdown of each product's quadrant placement, along with data-driven recommendations for optimizing your portfolio. Purchase the full report to gain a competitive edge and make informed strategic moves.

Stars

Atlas Copco's Vacuum Technique business area is a significant player, with its vacuum solutions for semiconductor manufacturing fueling substantial growth. This segment is benefiting from the escalating demand for advanced equipment in the chip-making industry.

In the third quarter of 2024, Atlas Copco reported a robust 10% organic increase in order intake within its Vacuum Technique segment. This performance underscores its strong market position and the high demand for its specialized vacuum technologies.

Looking ahead to the first quarter of 2025, the trend is expected to continue, with heightened demand for vacuum equipment anticipated in the semiconductor and flat panel display sectors, particularly across Asian markets.

Atlas Copco's energy-efficient air and gas compressors are a cornerstone of their product portfolio, reflecting the company's commitment to sustainability and cost reduction for its clients. These advanced solutions are designed to minimize energy consumption, a crucial factor for businesses navigating rising energy prices and environmental regulations. The company's dedication to this area is evident in its significant research and development spending, which fuels continuous innovation.

This segment is a vital engine for Atlas Copco's organic growth. For instance, in 2023, the company reported robust performance in its Compressor Technique segment, which includes these energy-efficient solutions, contributing substantially to its overall revenue and profitability. This strong performance underscores the market's demand for technologies that offer both operational savings and a reduced carbon footprint, aligning with global decarbonization efforts and increasing customer focus on ESG (Environmental, Social, and Governance) metrics.

Atlas Copco's Industrial Technique business area, a leader in advanced assembly systems and DC torque tools, is experiencing robust growth. This expansion is fueled by the increasing demand for automation in manufacturing, particularly within the burgeoning electric vehicle (EV) sector. The precision and data capabilities of DC torque tools are crucial for modern assembly lines, ensuring quality and efficiency.

The global DC torque tool market is on a significant upward trajectory, with projections indicating substantial growth in the coming years. For instance, the market was valued at approximately USD 1.2 billion in 2023 and is expected to reach over USD 2.1 billion by 2030, growing at a compound annual growth rate (CAGR) of around 8.5%. This surge is directly linked to the automotive industry's push for Industry 4.0 adoption and the intricate assembly requirements of EVs.

Digitalization and AI-driven Service Models

Atlas Copco is heavily investing in digitalization and AI to create smarter service models. This focus aims to boost efficiency and accuracy for their clients. These advancements, such as predictive maintenance, are positioned as a significant growth avenue, with the potential to reshape how service revenue is generated through data and AI.

These digital initiatives are crucial for Atlas Copco's future growth. For instance, in 2023, the company reported that its digital solutions contributed significantly to its overall performance, with a notable increase in recurring service revenues driven by these innovations. This demonstrates a clear strategic shift towards data-driven service offerings.

- Smart Technology Investment: Atlas Copco is channeling substantial resources into digital and AI-driven service models.

- Predictive Maintenance: Key innovations include predictive maintenance tools designed to anticipate equipment failures.

- Service Revenue Redefinition: The company aims to transform service revenue streams by leveraging data analytics and artificial intelligence.

- Growth Potential: These smart technology advancements represent a high-growth area with the capacity to redefine customer service in the industrial sector.

Specialty Rental Solutions for Emerging Applications

Atlas Copco Specialty Rental is actively pursuing growth by developing solutions for emerging applications. A prime example is their investment in bubble curtain technology, designed for marine conservation efforts. This strategic move targets high-growth niche markets, signaling a commitment to innovation and addressing evolving environmental and industrial demands.

This diversification into areas like marine conservation showcases Atlas Copco Specialty Rental's forward-thinking approach. By offering specialized equipment for these new applications, they are positioning themselves to capture significant market share in sectors with substantial growth potential. For instance, the global marine equipment rental market is projected to see robust expansion, driven by increased offshore activities and environmental regulations.

- Bubble Curtain Technology: Addressing environmental concerns in marine construction and conservation projects.

- Niche Market Focus: Capitalizing on specialized needs in sectors like offshore wind, aquaculture, and environmental remediation.

- High Growth Potential: Targeting emerging applications with significant expansion prospects.

- Innovation Leadership: Demonstrating a commitment to developing and providing cutting-edge rental solutions.

Atlas Copco's Vacuum Technique segment, driven by semiconductor manufacturing demand, is a clear Star. Its robust 10% organic order intake growth in Q3 2024 highlights its market leadership and the ongoing need for advanced chip-making equipment. This segment is poised for continued success, particularly in Asian markets, through the first quarter of 2025.

The Compressor Technique segment, with its energy-efficient solutions, also exhibits Star-like qualities. The company's substantial R&D investment in this area, which contributed significantly to its 2023 performance, demonstrates a commitment to innovation that meets market demands for cost savings and sustainability. This segment is a vital engine for Atlas Copco's organic growth.

Atlas Copco's Industrial Technique business area, a leader in advanced assembly systems and DC torque tools, is experiencing robust growth, fueled by automation demand, especially in the EV sector. The projected growth of the DC torque tool market, from USD 1.2 billion in 2023 to over USD 2.1 billion by 2030, underscores its Star potential.

The company's strategic investment in digital and AI-driven service models, including predictive maintenance, positions these offerings as high-growth Stars. In 2023, these digital solutions significantly boosted performance and recurring service revenues, indicating a strong future trajectory.

| Business Area | BCG Category | Key Growth Drivers | 2024/2025 Outlook |

|---|---|---|---|

| Vacuum Technique | Star | Semiconductor manufacturing demand, advanced chip equipment | Continued strong demand, especially in Asia |

| Compressor Technique | Star | Energy efficiency, sustainability, automation | Robust performance driven by ESG focus and operational savings |

| Industrial Technique | Star | EV sector growth, automation, Industry 4.0 | Significant market growth for DC torque tools (e.g., 8.5% CAGR) |

| Digital & AI Services | Star | Predictive maintenance, data-driven service models | High growth potential, redefining service revenue |

What is included in the product

The Atlas Copco BCG Matrix analyzes its business units based on market share and growth to inform strategic decisions.

The Atlas Copco BCG Matrix offers a pain point reliever by providing a clear, one-page overview of each business unit's market position.

Cash Cows

The traditional industrial compressor service segment for Atlas Copco is a prime example of a Cash Cow within their BCG Matrix. This division consistently delivers strong, high-margin revenue streams, largely due to the extensive installed base of industrial compressors that necessitate regular maintenance, spare parts, and ongoing support.

This reliable demand for service translates into a stable and predictable cash flow for the company. For instance, Atlas Copco's Service division reported a revenue of SEK 32.5 billion in 2023, showcasing the significant financial contribution of this segment. This robust performance provides a crucial defensive buffer, ensuring resilient financial results even during periods of economic downturn.

Established oil-lubricated industrial air compressors represent Atlas Copco's largest segment within Compressor Technique. These reliable machines hold a dominant market share in mature industrial sectors, consistently generating substantial cash flow. While growth may be slower than newer technologies, their profitability remains a key strength.

Atlas Copco's General Industrial Vacuum Products, while not in a high-growth sector like semiconductors, represent a stable and mature market. These products are essential across a wide array of industries, ensuring consistent demand. For example, in 2023, Atlas Copco's Vacuum Solutions segment, which includes these industrial products, reported a revenue of SEK 30,322 million, demonstrating the significant contribution of these established offerings.

The reliability of these vacuum solutions in applications such as food packaging, medical devices, and general manufacturing translates into predictable revenue streams. This stability is crucial for Atlas Copco's overall financial health, allowing for robust operating profit and strong cash generation. The company's commitment to innovation in this segment ensures continued relevance and market share.

Standard Portable Energy Solutions (Generators, Light Towers)

Standard Portable Energy Solutions, encompassing generators and light towers, represent Atlas Copco’s robust Cash Cows within the Power Technique business area. These offerings are deeply entrenched in the construction and general industrial sectors, markets that are mature but consistently demand reliable power and illumination. Their established presence translates into significant market share, ensuring a stable and predictable inflow of cash for the company.

While the overall market growth for these products might be modest, Atlas Copco’s high penetration allows them to generate substantial and consistent revenue. This steady cash generation is crucial for funding other areas of the business, such as Stars or Question Marks, that require investment for future growth. For instance, in 2024, the portable generator market alone was valued at over $10 billion globally, with a significant portion attributed to established players like Atlas Copco.

- High Market Share: Atlas Copco commands a leading position in the portable generator and light tower segments.

- Mature Market: These products serve well-established construction and industrial markets with consistent demand.

- Steady Revenue: Despite moderate market growth, their strong market position ensures reliable cash flow.

- Strategic Importance: The cash generated fuels investment in other business units with higher growth potential.

Legacy Assembly Systems for Mass Production

Atlas Copco's legacy assembly systems, deeply entrenched in mass production sectors like traditional automotive manufacturing, command a substantial market share. These systems, while mature, remain critical for numerous global production lines, particularly those not yet fully transitioned to electric vehicle (EV) assembly. Their widespread adoption and established customer relationships translate into a predictable and robust cash flow stream for the company.

These established systems are considered Cash Cows within the BCG Matrix framework. They operate in a stable, albeit slow-growing, market. The consistent demand for maintenance, upgrades, and spare parts for these widely deployed systems ensures a steady revenue generation. For instance, the automotive industry, a primary user of these systems, saw global production reach approximately 78.5 million vehicles in 2023, underscoring the continued relevance of efficient assembly solutions.

- High Market Share: Dominant presence in traditional automotive and mass production assembly.

- Mature Industry: Operates within established, albeit evolving, manufacturing sectors.

- Consistent Cash Flow: Generates significant and predictable revenue from widespread use and ongoing support.

- Strategic Importance: Essential for maintaining existing production capabilities globally.

Atlas Copco's industrial vacuum solutions represent a significant Cash Cow. These products, essential for diverse industries like food packaging and medical devices, benefit from a broad customer base and consistent demand, ensuring stable revenue. For example, Atlas Copco's Vacuum Solutions segment reported SEK 30,322 million in revenue in 2023, highlighting the segment's financial strength.

The predictability of these revenue streams is a key characteristic of a Cash Cow. This stability allows Atlas Copco to maintain profitability and generate substantial cash flow, which can then be reinvested in other growth areas of the business. The segment's mature market position and established product lines contribute to its reliable performance.

The company's commitment to innovation within this mature segment ensures continued relevance and market share. This focus on incremental improvements helps maintain their competitive edge and sustains the strong cash-generating capabilities of these vacuum products.

| Segment | Revenue (SEK million) 2023 | BCG Category |

| Vacuum Solutions | 30,322 | Cash Cow |

| Compressor Technique (Service) | 32,500 | Cash Cow |

| Power Technique (Portable Energy) | N/A (Market value > $10 billion globally for portable generators in 2024) | Cash Cow |

What You See Is What You Get

Atlas Copco BCG Matrix

The Atlas Copco BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means you can confidently assess the strategic insights and professional presentation of the report, knowing that no watermarks or demo content will be present in your final download. You'll gain immediate access to this analysis-ready file, empowering you to integrate it directly into your business planning and strategic decision-making processes without any further modifications.

Dogs

Atlas Copco is strategically retiring older positioning systems, like the Torque Positioning System (TPS) and its associated Posi arms (SMS/SML T Posi), to focus on advanced solutions such as the ILG. This transition reflects the natural lifecycle of technology, where older products enter a declining phase. By 2024, the company's investment in these legacy systems has significantly decreased as resources are redirected towards innovation.

While Atlas Copco actively pursues acquisitions, some smaller, niche purchases might not fully integrate or gain the expected market traction. These could be considered 'dogs' if they operate in slow-growth areas or struggle to gain market share after being acquired, draining resources without delivering significant returns.

A general risk in mergers and acquisitions is that not all deals will pan out as planned. For instance, in 2024, the industrial sector saw a significant number of M&A deals, but a substantial portion of these experienced integration challenges or failed to meet initial performance expectations, highlighting the inherent difficulties in achieving synergies.

Older generation air treatment products from Atlas Copco, those not meeting today's stringent energy efficiency standards, are likely classified as dogs in the BCG matrix. This is because the market is rapidly shifting towards sustainability, with customers actively seeking out eco-friendly options that minimize environmental impact and operational costs. For instance, in 2024, the global demand for energy-efficient industrial equipment continues to surge, making older, less efficient models increasingly unattractive and less competitive in the marketplace.

Standardized, Highly Commoditized Basic Industrial Tools

Standardized, highly commoditized basic industrial tools, often found in the Dogs category of the BCG matrix, face significant challenges. In 2024, the global industrial tools market, while robust, sees intense competition in these basic segments. Products lacking advanced features or connectivity, such as basic pneumatic drills or standard wrenches, are particularly vulnerable.

These commoditized tools are subject to fierce price wars, eroding profit margins. For instance, reports from early 2024 indicate that the average gross margin for basic hand tools has fallen below 15% in highly competitive regions. This lack of differentiation limits growth potential as market share is often determined by the lowest price point.

- Low Differentiation: Basic industrial tools offer minimal unique selling propositions, making them easily substitutable.

- Price Sensitivity: Demand is highly elastic, with customers prioritizing cost over features.

- Intense Competition: Numerous manufacturers compete on price, leading to margin compression.

- Limited Growth: The market for these tools is often mature, with growth tied to broader industrial output rather than product innovation.

Non-Core, Divested Construction Equipment Lines (Pre-Epiroc Split Remaining)

Following the spin-off of Epiroc, Atlas Copco's remaining construction equipment lines within its Power Technique segment, especially those that are older or less specialized, could be categorized as dogs in the BCG matrix. These might represent areas with low market share in slow-growing segments, facing intense competition from more focused players. The broader mining equipment market, for instance, is experiencing only modest growth, impacting the potential for these legacy lines to become stars.

Atlas Copco's strategic shift post-Epiroc spin-off means that some of the divested construction equipment lines, now remaining within the Power Technique business, might struggle to gain traction. If these units operate in markets with limited expansion prospects or have seen their competitive edge erode, they would fit the 'dog' profile. For example, some segments of the portable compressor market, while essential, may not offer the high growth rates seen in more advanced drilling or automation technologies.

- Market Share Erosion: Certain older or less differentiated construction equipment lines may have experienced declining market share as Atlas Copco focused resources on higher-growth areas like Epiroc and its core industrial businesses.

- Low Market Growth: Segments of the construction equipment market that these remaining lines serve might be characterized by low overall growth, limiting their potential to become market leaders. For instance, the global construction equipment market is projected to grow at a CAGR of around 4-5% in the coming years, with some sub-segments experiencing even slower growth.

- Competitive Landscape: Specialized competitors focusing on niche construction applications could be outperforming these remaining Atlas Copco lines, further solidifying their 'dog' status if they lack a clear competitive advantage.

Products like older, less energy-efficient air treatment systems and basic, commoditized industrial tools often fall into the 'dog' category for Atlas Copco. These items face declining demand due to market shifts towards sustainability and intense price competition, leading to low profitability. For example, in 2024, the demand for eco-friendly industrial equipment surged, making less efficient models increasingly unattractive.

These 'dogs' lack differentiation and are highly price-sensitive, with intense competition eroding margins. Reports in early 2024 indicated gross margins for basic hand tools were below 15% in competitive regions. This limits growth potential, as market share is often dictated by the lowest price.

Some legacy construction equipment lines remaining after the Epiroc spin-off might also be considered dogs. These operate in slow-growing market segments with low market share and a diminished competitive edge, such as certain portable compressor markets which show modest growth compared to advanced technologies.

The company strategically manages these by reducing investment or considering divestment to reallocate resources to more promising areas. For instance, Atlas Copco has been retiring older positioning systems like TPS, redirecting investment towards advanced solutions.

Question Marks

Atlas Copco's recent acquisitions, such as Neadvance Machine Vision, signal a deliberate expansion into the burgeoning fields of machine vision and artificial intelligence for industrial use. These strategic moves place these new entities squarely in the "Question Marks" category of the BCG matrix.

Operating in rapidly expanding markets, these companies possess high growth potential but likely hold a comparatively small market share within Atlas Copco's portfolio at present. For instance, the global machine vision market was valued at approximately USD 3.5 billion in 2023 and is projected to reach over USD 8.5 billion by 2030, showcasing the substantial growth opportunity.

Significant investment will be crucial for Atlas Copco to nurture these acquisitions, develop their technologies, and capture a larger market share. This investment is necessary to transform them from nascent players into potential future stars for the company.

Atlas Copco is a key player in the burgeoning electric vehicle (EV) battery production sector, supplying essential tools and systems. This market is experiencing rapid expansion fueled by the global shift towards sustainable energy. For instance, the global EV battery market was valued at approximately $65 billion in 2023 and is projected to reach over $200 billion by 2030, showcasing its Star potential.

Atlas Copco's advanced water reduction systems represent a potential star in their BCG matrix. These systems, lauded for their significant waste reduction capabilities, tap into a burgeoning market for sustainable industrial solutions.

While the exact market share for these specific systems isn't publicly detailed, their innovative nature and alignment with global sustainability trends suggest high growth potential. For instance, the industrial water treatment market alone was valued at over $140 billion globally in 2023 and is projected to expand significantly, driven by stricter environmental regulations and corporate ESG (Environmental, Social, and Governance) initiatives.

Specialized Geared Front Attachments for Industrial Tools (GFA)

Atlas Copco's new Specialized Geared Front Attachments (GFA) are positioned to address a niche but growing demand within the industrial tooling market. These GFAs are designed to boost the performance and precision of existing tools, directly impacting operational efficiency and reducing downtime by ensuring quicker access to necessary components.

The GFA product line, while innovative, is in its nascent stages of market penetration. Atlas Copco's strategy likely places these GFAs in the question mark category of the BCG matrix, indicating high market growth potential but currently low market share. This segment is experiencing an estimated growth rate of 8-10% annually, driven by increased automation and the need for specialized, adaptable industrial solutions.

- Market Growth: The industrial automation sector, where GFAs are relevant, is projected to grow significantly, with some reports indicating a compound annual growth rate (CAGR) of over 12% through 2027.

- Market Share: As a new entrant, Atlas Copco's GFAs are still establishing their footprint, likely holding a market share below 5% in their specific sub-segment as of early 2024.

- Strategic Focus: The company's investment in GFAs signals a strategic intent to capture future market share in specialized tooling, leveraging their existing distribution and service network.

- Investment Needs: Significant investment in marketing, sales, and potentially further product development will be required to move GFAs from a question mark to a star in the BCG matrix.

Emerging Technologies for Decarbonization and Circularity

Atlas Copco is actively investing in emerging technologies to drive decarbonization and circularity within its operations and product offerings. This strategic focus positions the company to capitalize on the growing demand for environmentally sustainable solutions, aligning with its commitment to long-term climate targets.

These new product lines and services, designed to address environmental challenges, represent high-growth potential markets. However, they currently occupy small market shares, characteristic of early-stage ventures within a broader, established portfolio.

- Hydrogen Fuel Cell Technology: Atlas Copco is exploring applications of hydrogen fuel cells for zero-emission industrial equipment, aiming to reduce reliance on fossil fuels.

- Advanced Material Recycling: The company is developing technologies for enhanced recycling and remanufacturing of components, extending product lifecycles and minimizing waste.

- Carbon Capture Utilization and Storage (CCUS): Atlas Copco is investigating CCUS solutions for industrial processes, seeking to capture and repurpose CO2 emissions.

- Digitalization for Resource Efficiency: Leveraging digital tools and IoT, Atlas Copco is enhancing the efficiency of its equipment, reducing energy consumption and material usage throughout the value chain.

Question Marks within Atlas Copco's portfolio represent areas of high market growth but currently low market share. These are typically new technologies or market entries that require substantial investment to gain traction and potentially become future Stars. For example, Atlas Copco's investments in Neadvance Machine Vision and Specialized Geared Front Attachments (GFAs) are prime examples of such ventures.

The global machine vision market, where Neadvance operates, is expected to grow from approximately USD 3.5 billion in 2023 to over USD 8.5 billion by 2030. Similarly, the industrial automation sector, relevant to GFAs, is projected for a CAGR exceeding 12% through 2027. These figures highlight the significant growth potential for these nascent businesses.

Atlas Copco's strategic focus on emerging sustainable technologies, such as hydrogen fuel cells and advanced material recycling, also places these initiatives in the Question Mark category. While these markets are expanding rapidly due to global sustainability trends, their current market share within Atlas Copco's overall business is minimal, necessitating focused investment to foster growth.

| Business Unit/Product Line | Market Growth Potential | Current Market Share (Estimated) | Strategic Implication |

|---|---|---|---|

| Neadvance Machine Vision | High (Global market projected to exceed USD 8.5 billion by 2030) | Low (Early stage of market penetration) | Requires significant investment to capture market share. |

| Specialized Geared Front Attachments (GFAs) | High (Industrial automation sector CAGR > 12% through 2027) | Low (Likely < 5% in its sub-segment as of early 2024) | Investment in marketing and product development needed to grow. |

| Sustainable Technology Initiatives (e.g., Hydrogen Fuel Cells) | Very High (Driven by global decarbonization efforts) | Negligible (Nascent stage of development and adoption) | Long-term investment for future market leadership. |

BCG Matrix Data Sources

Our Atlas Copco BCG Matrix is built on robust data, integrating financial performance reports, market share analysis, and industry growth projections to provide strategic direction.