Atlas Copco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Copco Bundle

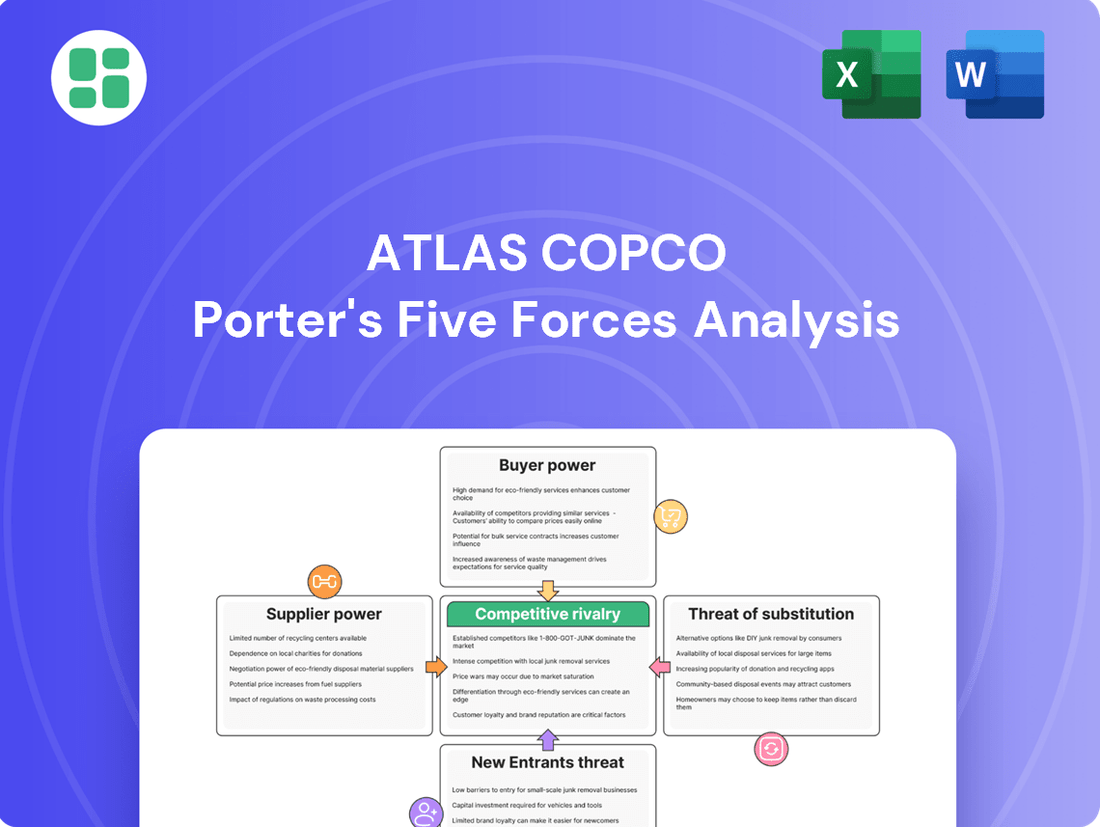

Atlas Copco operates within a dynamic industrial equipment sector, where understanding competitive forces is crucial for sustained success. Our analysis reveals how buyer power, the threat of new entrants, and the intensity of rivalry significantly shape their market landscape.

The complete report reveals the real forces shaping Atlas Copco’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Atlas Copco's reliance on a concentrated supplier base for specialized components and advanced technologies grants these suppliers significant bargaining power. This is particularly true for critical inputs needed for their sophisticated industrial equipment. For instance, in 2024, disruptions in the supply of certain high-performance materials, which are sourced from a few key providers, could directly impact Atlas Copco's production schedules and cost structures, as highlighted in their ongoing risk assessments.

Switching suppliers for highly specialized components, like those integral to Atlas Copco's advanced compressors and vacuum solutions, often incurs substantial costs. These can include expenses for re-tooling manufacturing lines, redesigning existing products to accommodate new parts, and the rigorous process of re-certifying the final equipment, which can take months and involve significant investment.

This dependency on specialized suppliers significantly amplifies their bargaining power. Atlas Copco may find itself more beholden to existing relationships, making it challenging to negotiate favorable pricing or contractual terms. For instance, a delay in a critical component shipment from a sole-source supplier could halt production lines, highlighting the supplier's leverage.

In 2024, the global industrial equipment market, where Atlas Copco operates, continued to face supply chain complexities. Reports indicated that lead times for specialized electronic components and advanced materials, crucial for high-performance machinery, remained extended, averaging 6-9 months for certain critical parts, thus reinforcing supplier pricing power.

Suppliers who provide highly differentiated or proprietary technologies, like specialized alloys for critical machine parts or unique software for complex systems, significantly increase their bargaining power. Atlas Copco's reliance on these advanced materials and intellectual property allows such suppliers to negotiate higher prices due to the difficulty in finding viable alternatives.

Potential for Forward Integration by Suppliers

While forward integration by suppliers is less prevalent in the heavy industrial machinery sector, highly specialized component manufacturers might theoretically explore assembling finished equipment. This would necessitate significant capital investment and deep technical expertise, making it a challenging prospect. However, the mere possibility, however slim, can bolster a supplier's leverage in negotiations.

For instance, a 2023 report indicated that specialized component suppliers in advanced manufacturing, like those providing critical parts for semiconductor equipment, often possess niche knowledge that could be leveraged for assembly. While specific data for Atlas Copco's direct component suppliers pursuing this is not publicly detailed, the general trend in high-tech industries shows a growing interest in controlling more of the value chain.

- Niche Expertise: Suppliers with unique technological capabilities may consider moving into assembly.

- Capital Intensity: Significant investment is required for a supplier to undertake assembly operations.

- Negotiating Leverage: The threat of forward integration, even if distant, can strengthen supplier bargaining power.

- Industry Trends: In some advanced sectors, component suppliers are increasingly looking to integrate forward.

Impact of Raw Material Price Volatility

Suppliers of key raw materials such as steel, aluminum, and specialized rare earth elements, integral to Atlas Copco's production processes, possess significant bargaining power. This power often manifests through price volatility, directly impacting Atlas Copco's cost structure and profitability.

Fluctuations in global commodity markets, driven by supply-demand dynamics and geopolitical factors, can lead to unpredictable increases in input costs. For instance, market pressures observed in early 2025 saw significant upward movements in the prices of certain metals essential for compressor and vacuum technology manufacturing.

- Steel prices: Global steel benchmarks experienced a notable increase of approximately 8-12% in the first half of 2025 compared to the previous year, driven by production cuts and robust industrial demand.

- Aluminum costs: Aluminum prices also saw an upward trend, with an average increase of around 5-9% in the same period, influenced by energy costs and supply chain disruptions in key producing regions.

- Rare earth element volatility: The market for rare earth elements, critical for advanced motor and electronic components, remained highly sensitive, with price swings of up to 15-20% for specific elements due to concentrated supply sources.

Atlas Copco faces considerable bargaining power from its suppliers due to the specialized nature of many components and raw materials. This leverage is amplified when suppliers offer unique technologies or possess niche expertise, making it difficult and costly for Atlas Copco to switch. In 2024, extended lead times for critical electronic parts and advanced materials, often averaging 6-9 months, underscored supplier pricing power. Furthermore, volatility in raw material prices, such as steel and aluminum, directly impacts Atlas Copco's cost structure, with steel prices seeing an 8-12% increase in early 2025.

| Input Material | 2024/2025 Price Trend | Impact on Atlas Copco |

|---|---|---|

| Specialized Electronic Components | Extended lead times (6-9 months) | Production scheduling and cost pressure |

| Advanced Materials (e.g., alloys) | High reliance on few providers | Negotiating leverage for suppliers |

| Steel | 8-12% price increase (early 2025) | Increased manufacturing costs |

| Aluminum | 5-9% price increase (early 2025) | Increased manufacturing costs |

| Rare Earth Elements | 15-20% price volatility | Component cost fluctuations |

What is included in the product

This analysis dissects the competitive forces impacting Atlas Copco, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its industrial equipment market.

Instantly identify competitive advantages and threats across all five forces, enabling proactive strategy adjustments and mitigating potential market disruptions.

Customers Bargaining Power

Atlas Copco's diverse customer base, spanning over 180 countries and numerous industries like manufacturing, construction, and infrastructure, significantly dilutes individual customer bargaining power. In 2024, the company's extensive global reach means that no single customer or small group of customers represents a dominant portion of its revenue, limiting their ability to impose unfavorable terms.

Customers in demanding sectors such as semiconductors, automotive, and mining place a significant emphasis on the reliability, efficiency, and technological sophistication of industrial equipment. This focus stems from the critical nature of these machines in maintaining their own production schedules and output quality.

For Atlas Copco’s products, which are integral to their clients' core business processes, this inherent need for dependable performance translates into reduced price sensitivity. Clients understand that superior uptime and consistent operational efficiency, often exceeding 99% for critical systems, justify a higher investment, minimizing costly disruptions.

Once a customer invests in Atlas Copco's industrial equipment, like substantial compressors or intricate assembly systems, the expenses involved in transitioning to a rival become significant. These costs can encompass re-training personnel, addressing potential compatibility glitches with existing infrastructure, and the unavoidable downtime during the switchover process.

These substantial switching costs effectively lock customers into the Atlas Copco ecosystem, thereby diminishing their ability to bargain for better terms or prices. For instance, a manufacturing plant relying on Atlas Copco's integrated solutions for its production line would face considerable operational disruption and financial outlay to replace these systems with those from another vendor.

Aftermarket Service and Support Dependency

Atlas Copco's substantial aftermarket service business, which represented 37% of its total revenues in 2024, significantly reduces customer bargaining power. This ongoing revenue stream is built on a deep customer dependency for essential spare parts, routine maintenance, and specialized technical support. Customers rely on Atlas Copco to ensure the continued operation and optimal performance of their existing equipment, making it difficult and costly to switch providers.

- Customer Dependency: A significant portion of Atlas Copco's revenue, 37% in 2024, comes from aftermarket services, creating a strong reliance for customers.

- Reduced Switching Costs: Customers depend on Atlas Copco for spare parts, maintenance, and technical support, making it costly and disruptive to switch to competitors.

- Ongoing Relationship: The continuous need for service fosters a long-term relationship, further solidifying customer loyalty and limiting their ability to negotiate terms aggressively.

Customer Sensitivity to Macroeconomic Conditions

Customer sensitivity to macroeconomic conditions significantly impacts Atlas Copco. When industrial activity slows, as evidenced by a noted weakening in customer activity levels in their Q1 2025 report, demand for Atlas Copco's equipment can decrease. This downturn often makes customers more price-sensitive, potentially increasing their bargaining power.

- Economic Downturn Impact: Reduced industrial output directly correlates with lower capital expenditure by Atlas Copco's clients.

- Price Sensitivity Increase: During economic slowdowns, customers are more likely to negotiate harder on price for essential equipment.

- Demand Fluctuations: Atlas Copco's sales volumes are closely tied to the health of global manufacturing and construction sectors.

While Atlas Copco benefits from high switching costs and a diverse customer base, its bargaining power can be challenged during economic downturns. When industrial activity softens, as seen with the reported weakening in customer activity levels in Q1 2025, clients may become more price-sensitive, increasing their leverage.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Concentration | Low (Diverse global customer base) | No single customer represents a dominant revenue share. |

| Switching Costs | Low (High costs for re-training, compatibility, downtime) | Customers are locked into Atlas Copco's integrated solutions. |

| Aftermarket Dependency | Low (37% of 2024 revenue from services) | Customers rely on Atlas Copco for essential parts and maintenance. |

| Economic Sensitivity | High (During downturns) | Weakening customer activity in Q1 2025 increased price sensitivity. |

Preview Before You Purchase

Atlas Copco Porter's Five Forces Analysis

This preview shows the exact Atlas Copco Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive evaluation of competitive forces within the industrial equipment sector. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, all presented in a professionally formatted and ready-to-use document.

Rivalry Among Competitors

The industrial equipment sector, especially for compressors and tools, is crowded with major global companies. Think of names like Ingersoll Rand, Hitachi, and Kaeser Kompressoren. These established players are constantly battling it out.

Their competition is fierce, focusing on who can offer the best technology, the most attractive prices, and the highest operational efficiency. This intense rivalry puts pressure on all companies in the market, including Atlas Copco.

For instance, in 2023, Ingersoll Rand reported revenues of approximately $6.2 billion, showcasing the scale of these global competitors. This sheer size and market presence mean they have significant resources to invest in innovation and market penetration, further intensifying the competitive landscape.

Atlas Copco operates in an industry where substantial fixed costs are inherent in manufacturing industrial machinery. These high upfront investments in plant, property, and equipment necessitate high production volumes to spread costs and achieve economies of scale. This economic pressure often compels companies to prioritize capacity utilization.

Consequently, during periods of softer demand, there's a strong incentive for manufacturers like Atlas Copco to engage in aggressive pricing. The goal is to keep production lines running and cover fixed overheads, even if it means accepting lower profit margins per unit. This behavior directly fuels competitive rivalry.

For instance, in 2024, the global industrial machinery market, a sector where Atlas Copco is a major player, experienced fluctuating demand patterns. Companies with high fixed costs, such as those producing large compressors or mining equipment, found themselves competing fiercely on price to maintain operational efficiency and avoid underutilization penalties.

Atlas Copco and its competitors actively differentiate their product offerings through relentless innovation and technological advancements. Companies are investing heavily in R&D to develop solutions that are not only energy-efficient but also incorporate the latest in IoT connectivity and smart functionality. This focus on advanced features, such as variable speed drives and predictive maintenance capabilities, forms a critical battleground, compelling rivals to continuously enhance their technological edge.

Service and Aftermarket Competition

Service and aftermarket competition is fierce, extending well beyond the initial sale of equipment. Companies like Atlas Copco actively compete on comprehensive service offerings, encompassing maintenance, spare parts, and rental solutions. This focus is crucial as these services generate stable, recurring revenue streams and foster deeper, long-term customer relationships.

Atlas Copco, for instance, has consistently highlighted its commitment to growing its service business. In 2023, the company reported that its Service division continued to perform strongly, contributing significantly to overall profitability. This underscores the strategic importance of aftermarket support in the industrial equipment sector, where customer loyalty is often built on reliable and efficient service.

- Service revenue is a key differentiator in the industrial equipment market.

- Atlas Copco's strategy emphasizes expanding its aftermarket service offerings to secure long-term customer engagement.

- The aftermarket segment provides a stable revenue base, mitigating some of the cyclicality inherent in capital equipment sales.

- Customer retention is heavily influenced by the quality and responsiveness of after-sales support.

Geographic and Segment-Specific Competition

Atlas Copco faces varying competitive pressures depending on the specific geographic region and product segment. While its global reach is extensive, intense rivalry can be more pronounced in established markets or for less differentiated product lines. This necessitates a nuanced approach to competitive strategy, adapting to the unique dynamics of each business area.

For example, in mature markets like Western Europe, competition in the industrial compressor segment might be fiercer due to a higher concentration of established players. Conversely, in emerging markets, the competitive landscape could be shaped by local manufacturers and the pace of industrial development. Atlas Copco's 2023 revenue breakdown shows a significant portion still coming from Europe and North America, indicating these are key battlegrounds.

- Regional Intensity: Competition intensifies in mature markets where established players have deep roots and brand loyalty.

- Segment Specialization: Less specialized product segments often attract a broader range of competitors, increasing rivalry.

- Strategic Adaptation: Atlas Copco must tailor its strategies to address the unique competitive dynamics of each geographic market and product category.

- Market Maturity Impact: For instance, the industrial vacuum solutions segment in North America might see different competitive pressures than the vacuum solutions segment in Asia.

The competitive rivalry within the industrial equipment sector, particularly for compressors and tools, is intense, featuring major global players like Ingersoll Rand and Kaeser Kompressoren. This rivalry centers on technological innovation, pricing, and operational efficiency, pressuring all market participants, including Atlas Copco.

High fixed costs in manufacturing necessitate high production volumes, creating pressure to maintain capacity utilization. This often leads to aggressive pricing strategies, especially during demand slowdowns, to cover overheads, thereby intensifying competition.

Companies like Atlas Copco differentiate through continuous R&D, focusing on energy efficiency and IoT integration, making technological advancement a key battleground. Furthermore, robust service and aftermarket offerings are crucial for stable revenue and customer loyalty, with Atlas Copco actively growing its service division for long-term engagement.

SSubstitutes Threaten

The threat of substitutes for Atlas Copco's core industrial equipment, like air compressors and construction machinery, is generally low. These highly specialized machines are essential for many industrial processes, and finding truly equivalent alternatives that perform the same function with comparable efficiency and reliability is challenging.

For instance, industries requiring high-pressure compressed air for manufacturing processes have limited options beyond traditional compressor technologies. Similarly, the heavy demands of mining and construction often necessitate robust, purpose-built equipment that few other product categories can directly replace. This lack of readily available, effective substitutes strengthens Atlas Copco's market position.

While direct substitutes for Atlas Copco's core products like compressors and vacuum solutions are limited, the threat emerges from evolving technologies that could diminish the demand for certain equipment. For instance, the accelerating trend towards electrification across various industries, including transportation and manufacturing, could gradually reduce reliance on traditional fossil-fuel-powered machinery that might require specialized air or vacuum systems. By 2024, global investment in electric vehicle (EV) charging infrastructure alone was projected to reach hundreds of billions of dollars, indicating a significant shift in energy consumption patterns.

While some very large industrial conglomerates might explore in-house production for highly specialized or niche applications, the significant capital expenditure, specialized R&D capabilities, and the need for substantial economies of scale present considerable barriers. For instance, developing advanced compressor technology comparable to Atlas Copco's offerings would likely require billions in investment and years of dedicated research, making it an impractical alternative for the vast majority of their customer base.

Rental vs. Ownership Models

The threat of substitutes for construction and industrial equipment is significant, as customers can choose rental options over purchasing. This is particularly relevant for projects with temporary or variable equipment needs. For instance, in 2024, the global equipment rental market was projected to reach over $120 billion, indicating a strong preference for rental solutions in many sectors.

Atlas Copco actively mitigates this threat by providing its own specialty rental services through its Power Technique business area. This strategy allows the company to capture revenue from customers who might otherwise opt for third-party rentals or delay capital expenditures. By offering flexible rental agreements, Atlas Copco can cater to a wider range of customer needs and project timelines.

- Rental Market Growth: The global construction equipment rental market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 5.5% from 2023 to 2030.

- Atlas Copco's Rental Strategy: Atlas Copco's Power Technique segment directly competes with substitute rental providers by offering a comprehensive fleet of compressors, generators, and pumps for rent.

- Customer Benefits of Rental: Customers benefit from rental by avoiding large upfront capital outlays, gaining access to the latest technology, and having the flexibility to scale equipment usage up or down as project demands change.

- Impact on Ownership Sales: The availability of attractive rental alternatives can put pressure on Atlas Copco's direct equipment sales, necessitating a competitive pricing and service strategy for owned equipment.

Efficiency Improvements Reducing Overall Demand

The drive for enhanced energy efficiency in industrial machinery presents a significant threat of substitutes for companies like Atlas Copco. As equipment becomes more durable and consumes less power, the need for frequent replacements diminishes, impacting sales volumes. For instance, advancements in compressor technology, a core area for Atlas Copco, mean that newer models can operate for longer periods with reduced maintenance and energy costs, potentially slowing down the upgrade cycle for customers.

This trend is further amplified by the increasing focus on sustainability and operational cost reduction across industries. Customers are actively seeking solutions that offer a lower total cost of ownership, and longer-lasting, more efficient equipment directly contributes to this goal. In 2024, many industrial sectors are prioritizing capital expenditure on efficiency gains, which could mean fewer new unit sales even as the overall market size for industrial equipment remains robust.

- Reduced Replacement Cycles: More durable and efficient machinery means customers buy new equipment less often.

- Lower Total Cost of Ownership: Customers prioritize equipment that saves on energy and maintenance over time.

- Sustainability Focus: Environmental and cost-saving initiatives encourage the use of existing, efficient equipment for longer.

- Technological Advancements: Innovations in areas like compressor technology directly contribute to longer product lifespans and lower energy consumption.

While direct substitutes for Atlas Copco's core industrial equipment are limited, the threat of rental options is significant. The global equipment rental market was projected to exceed $120 billion in 2024, reflecting a strong customer preference for avoiding large upfront investments. This trend pressures direct sales, pushing companies like Atlas Copco to offer their own rental services to capture market share and cater to flexible customer needs.

| Factor | Atlas Copco's Position | Threat Level |

|---|---|---|

| Direct Technological Substitutes | Limited due to specialization and performance requirements. | Low |

| Rental Market Availability | Significant, with a global market over $120 billion in 2024. | Medium to High |

| In-house Production by Customers | Impractical for most due to high CAPEX and R&D needs. | Low |

| Energy Efficiency Improvements | Can extend product lifecycles, reducing replacement demand. | Medium |

Entrants Threaten

Entering the industrial equipment manufacturing sector, particularly for complex machinery like compressors or mining equipment, requires substantial capital. Companies need significant investments in research and development, state-of-the-art manufacturing facilities, and establishing extensive global distribution and service networks. For instance, building a new compressor manufacturing plant can easily cost hundreds of millions of dollars, creating a formidable barrier for potential new competitors.

Atlas Copco's established position grants it significant economies of scale in production and purchasing. For instance, in 2023, Atlas Copco reported net sales of SEK 141 billion (approximately $13.5 billion USD), reflecting a substantial operational footprint.

New competitors would find it extremely challenging to achieve similar cost advantages. Without matching Atlas Copco's production volume, new entrants would face higher per-unit costs, hindering their ability to offer competitive pricing and absorb initial market entry expenses.

Atlas Copco's deeply entrenched brand loyalty, cultivated over more than a century of operation since 1873, presents a formidable barrier to new entrants. This loyalty is built on a foundation of perceived reliability and consistent high performance, making it difficult for newcomers to establish comparable trust and relationships with customers.

Proprietary Technology and Intellectual Property

Atlas Copco's substantial portfolio of proprietary technologies and patents in areas such as compressed air, vacuum solutions, and industrial tools creates a significant barrier to entry. The sheer scale of their research and development investment, coupled with the time required to develop comparable intellectual property, makes it exceedingly difficult for newcomers to compete effectively. For instance, in 2023, Atlas Copco continued to invest heavily in innovation, with R&D expenses supporting their technological edge.

The threat of new entrants is therefore moderated by the high upfront costs associated with replicating Atlas Copco's established technological advantages. New companies would need to overcome not only the financial hurdle of R&D but also the challenge of securing similar levels of specialized know-how. This intellectual property moat protects Atlas Copco's market position.

- Proprietary technology and patents

- High R&D investment required for new entrants

- Specialized know-how as a competitive advantage

- Significant time and capital needed to match existing IP

Complex Distribution Channels and Service Networks

The complexity of establishing robust global sales, distribution, and aftermarket service networks presents a significant barrier for new entrants in the industrial equipment sector. Atlas Copco's established infrastructure, vital for supporting complex machinery and ensuring customer uptime, is a key deterrent.

Building out a comparable service network requires substantial capital investment and time, making it difficult for newcomers to compete effectively. This is particularly true for industrial equipment where reliable maintenance and spare parts availability are paramount for customer operations.

- Global Reach: Atlas Copco operates in over 180 countries, a testament to its extensive distribution and service capabilities.

- Aftermarket Importance: For industrial machinery, aftermarket services can account for a significant portion of total revenue, often exceeding 50%, highlighting its critical role.

- Investment Required: Establishing a comprehensive service network can require billions of dollars in upfront investment for training, parts inventory, and logistics.

The threat of new entrants for Atlas Copco is generally low due to substantial capital requirements and established brand loyalty. Significant investments in R&D, manufacturing, and global service networks create high barriers, making it difficult for newcomers to compete on cost and reliability. Atlas Copco's extensive patent portfolio further solidifies its market position.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for R&D, manufacturing, and distribution networks. | Significant financial hurdle for new players. |

| Brand Loyalty | Over a century of building trust through reliability. | Difficult for new brands to gain customer acceptance. |

| Proprietary Technology | Extensive patents and specialized know-how. | Requires substantial time and investment to replicate. |

| Economies of Scale | Large production volumes lead to cost advantages. | New entrants face higher per-unit costs. |

Porter's Five Forces Analysis Data Sources

Our Atlas Copco Porter's Five Forces analysis is built upon a foundation of data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from financial news outlets and competitor websites to capture a comprehensive view of the competitive landscape.