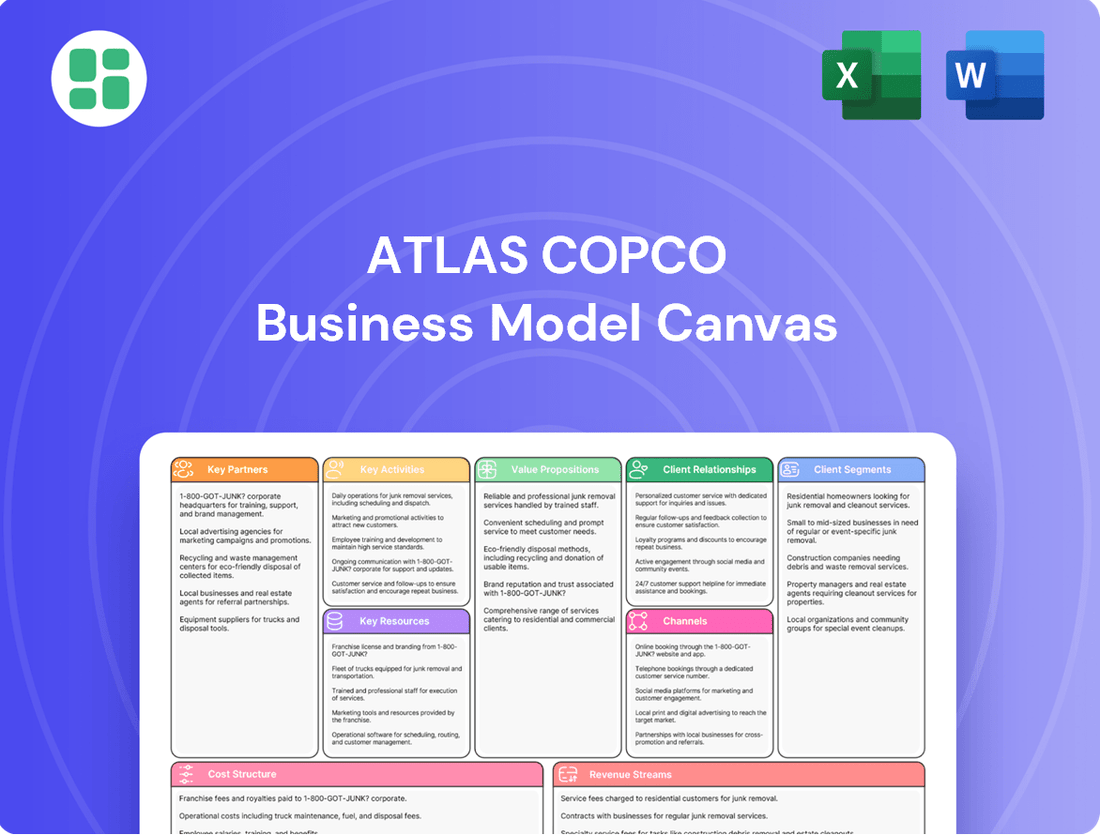

Atlas Copco Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlas Copco Bundle

Discover the strategic engine behind Atlas Copco's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to replicate that strategic thinking?

Partnerships

Atlas Copco actively partners with technology firms and leading research institutions to foster innovation, particularly in crucial areas such as advanced automation, artificial intelligence, and sustainable energy solutions. These collaborations are fundamental to their strategy for developing next-generation products and securing a competitive advantage in dynamic industrial sectors.

These strategic alliances enable Atlas Copco to seamlessly integrate state-of-the-art technologies into their diverse range of equipment and sophisticated systems. For instance, in 2023, their investments in R&D reached approximately SEK 8.7 billion, underscoring the significant financial commitment to these technology-driven partnerships and their impact on product development.

Atlas Copco leverages an extensive global network of distributors and dealers, crucial for accessing a wide array of customer segments and offering localized sales and support. This partnership model is fundamental for achieving deep market penetration and ensuring broad product availability, particularly in areas where direct sales channels are less effective.

These alliances are critical for Atlas Copco's market reach, enabling them to serve diverse geographical regions and customer needs efficiently. For instance, in 2023, the company continued to integrate and expand its distributor network, a strategy that historically underpins its ability to deliver specialized solutions and after-sales service across various industries.

Atlas Copco's strategic relationships with component and raw material suppliers are critical for its operational success. These partnerships ensure access to high-quality parts and materials, which directly impacts the performance and reliability of their equipment. For instance, in 2023, the company continued to focus on building resilient supply chains, a trend amplified by global economic conditions.

Maintaining robust supplier relationships allows Atlas Copco to secure a stable flow of necessary inputs, thereby guaranteeing production consistency. This stability is vital for meeting customer demand and upholding their reputation for dependable machinery. In 2024, the company is expected to further leverage these partnerships to navigate potential material shortages and price volatility.

By effectively managing its supplier network, Atlas Copco can also optimize costs and mitigate risks associated with supply chain disruptions. This proactive approach helps them maintain competitive pricing and operational efficiency. Their commitment to long-term supplier agreements underscores the importance of these key partnerships in their overall business strategy.

Acquisition Targets

Atlas Copco's acquisition strategy focuses on integrating niche players and specialized firms to bolster its product offerings, market presence, and technological prowess. These acquisitions are a cornerstone of their expansion, supplementing internal development by injecting new skills and market access.

In 2023, Atlas Copco completed several strategic acquisitions. For instance, the acquisition of the compressor business of Shandong Blower Works Co., Ltd. in China expanded their vacuum solutions portfolio in a key growth region. This move, along with others, underscores their commitment to inorganic growth as a vital component of their overall business strategy.

- Acquisition of Shandong Blower Works Co., Ltd. (2023): Enhanced vacuum solutions in China, a significant market.

- Focus on Niche Technologies: Targets companies with specialized expertise to fill portfolio gaps.

- Complementary Growth Strategy: Acquisitions work in tandem with organic growth to accelerate market penetration and innovation.

Service and Aftermarket Partners

Atlas Copco strengthens its global service capabilities by collaborating with independent service providers and specialized repair shops. These partnerships are crucial for delivering timely and expert aftermarket support, ensuring that customers receive efficient maintenance and repairs for their installed equipment. This network expansion directly contributes to the longevity of Atlas Copco's products and solidifies customer loyalty.

These alliances are designed to extend the operational life of Atlas Copco's machinery and generate consistent, recurring revenue. This is achieved through a combination of service agreements, which guarantee ongoing maintenance, and the sale of genuine spare parts, ensuring optimal performance and reliability. For instance, in 2024, Atlas Copco reported that its Service division revenue grew by 8% year-on-year, highlighting the impact of a robust aftermarket network.

- Global Reach: Partnerships with service providers extend Atlas Copco's aftermarket coverage to a wider geographical area, ensuring support is available even in remote locations.

- Expertise: Collaborating with specialized repair shops brings in specific technical expertise, allowing for more efficient and effective servicing of complex equipment.

- Revenue Streams: Service contracts and genuine parts sales from these partnerships create predictable and recurring revenue, contributing significantly to the company's financial stability.

- Customer Satisfaction: Enhanced service availability and quality lead to higher customer satisfaction and retention, reinforcing Atlas Copco's market position.

Atlas Copco's key partnerships are essential for innovation, market reach, and operational efficiency. These include collaborations with technology firms and research institutions for R&D, a vast network of distributors and dealers for market penetration, and strategic relationships with suppliers for quality components. Additionally, acquiring niche companies enhances their product portfolio and market presence, while partnerships with independent service providers bolster aftermarket support.

| Partnership Type | Key Role | Impact/Example |

| Technology & Research Institutions | Driving innovation, developing next-gen products | R&D investment of SEK 8.7 billion in 2023 |

| Distributors & Dealers | Market access, localized sales & support | Ensuring broad product availability globally |

| Component & Material Suppliers | Ensuring quality, stable production flow | Focus on resilient supply chains in 2024 |

| Acquisitions (Niche Firms) | Portfolio expansion, technological enhancement | Acquisition of Shandong Blower Works Co., Ltd. in 2023 |

| Independent Service Providers | Aftermarket support, customer loyalty | Service division revenue grew by 8% year-on-year in 2024 |

What is included in the product

Atlas Copco's Business Model Canvas focuses on delivering innovative compressor and vacuum solutions, leveraging a strong customer-centric approach and a robust service network to create recurring revenue streams.

It details key partnerships in technology and distribution, efficient cost structures driven by operational excellence, and diverse revenue streams from equipment sales, rentals, and aftermarket services.

Atlas Copco's Business Model Canvas acts as a pain point reliver by offering a structured, visual overview that simplifies complex strategies, allowing for rapid identification of inefficiencies and opportunities for improvement.

It streamlines strategic planning by providing a clear, actionable framework, thus alleviating the pain of convoluted or time-consuming business model development.

Activities

Atlas Copco's commitment to Research and Development is a cornerstone of its strategy, driving the creation of innovative and sustainable productivity solutions. This includes advancements in industrial tools, compressors, and vacuum systems, all aimed at enhancing customer efficiency and supporting decarbonization efforts.

The company's R&D investment reflects a forward-looking approach, with a significant focus on integrating digitization and artificial intelligence into its service models. This strategic allocation of resources is designed to foster future-transforming technologies that directly address evolving market demands and environmental concerns.

In 2023, Atlas Copco reported a substantial increase in R&D expenditure, underscoring its dedication to staying at the forefront of technological innovation. This investment fuels the development of cutting-edge products and services, particularly in areas like green technology, ensuring the company remains competitive and responsive to global sustainability trends.

Atlas Copco's core activity centers on the meticulous manufacturing of a diverse portfolio of industrial equipment. This includes sophisticated air compressors, robust industrial tools, and specialized construction and mining machinery, all requiring precision engineering, expert assembly, and stringent quality control to ensure high performance and unwavering reliability.

To foster speed and maintain operational agility, Atlas Copco frequently employs an outsourced production model. This strategic approach allows them to adapt quickly to market demands and leverage specialized manufacturing capabilities, contributing to their efficient global supply chain. In 2024, the company continued to invest in advanced manufacturing technologies to enhance product quality and sustainability.

Atlas Copco's sales and distribution strategy is a cornerstone of its global reach, utilizing both direct sales teams and a vast network of independent distributors. This dual approach allows them to effectively penetrate diverse markets and cater to a wide range of customer needs across more than 180 countries.

The company's sales activities involve rigorous market analysis to identify opportunities and targeted customer outreach. Managing the intricate logistics of delivering industrial equipment worldwide is a critical component, ensuring timely and efficient product availability for their global clientele.

In 2023, Atlas Copco reported vacuum solutions sales of SEK 58,937 million, highlighting the significant revenue generated through these sales and distribution channels. This demonstrates the scale and effectiveness of their operational network in bringing their products to market.

Aftermarket Service and Support

Atlas Copco’s aftermarket service and support is a crucial key activity. This involves offering comprehensive services like maintenance, repairs, and the supply of spare parts and upgrades for their installed equipment.

These services are vital for ensuring that customer equipment operates at its best and lasts longer. This focus on post-sale support not only drives significant revenue but also plays a key role in building strong, lasting relationships with customers.

In 2024, service solutions accounted for a substantial 37% of Atlas Copco's total revenues, highlighting the financial importance of this operational area.

- Maintenance and Repair: Ensuring equipment uptime and optimal performance through scheduled and reactive servicing.

- Parts Supply: Providing genuine and readily available spare parts to minimize downtime.

- Upgrades and Modernization: Offering solutions to enhance existing equipment capabilities and efficiency.

- Remote Monitoring and Diagnostics: Leveraging technology to proactively identify and address potential issues.

Strategic Acquisitions and Integration

Atlas Copco actively pursues strategic acquisitions as a cornerstone of its growth. This involves identifying, acquiring, and integrating new companies to enhance its technological capabilities, broaden its market reach, and diversify its product portfolio.

The company's commitment to this strategy was evident in 2024, a year where Atlas Copco achieved a record number of acquisitions. Specifically, they completed 33 acquisitions during that year, underscoring the consistent and significant role this activity plays in their overall business model.

- Continuous Identification and Integration: Atlas Copco consistently seeks out and integrates new businesses to bolster its competitive edge.

- Record Acquisition Activity in 2024: The company completed 33 acquisitions in 2024, highlighting this as a primary growth driver.

- Expansion of Capabilities and Market Presence: Acquisitions are strategically chosen to expand technological expertise and geographic market penetration.

- Diversification of Product Offerings: The integration of acquired companies allows Atlas Copco to offer a wider range of products and solutions to its customers.

Atlas Copco's key activities revolve around the manufacturing of industrial equipment, including compressors, vacuum solutions, and power tools. They also focus on providing extensive aftermarket services and support, which is crucial for customer retention and revenue generation. Furthermore, strategic acquisitions are a significant driver of their growth, enabling them to expand their technological capabilities and market presence.

The company's dedication to innovation is demonstrated through substantial R&D investments, aiming to develop sustainable and digitally integrated productivity solutions. This multifaceted approach ensures they remain competitive and responsive to global market demands.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Manufacturing | Precision engineering and assembly of industrial equipment. | Continued investment in advanced manufacturing technologies in 2024. |

| Aftermarket Services | Maintenance, repair, parts supply, and upgrades for installed equipment. | Service solutions accounted for 37% of total revenues in 2024. |

| Research & Development | Creation of innovative and sustainable productivity solutions. | Substantial increase in R&D expenditure reported for 2023. |

| Strategic Acquisitions | Acquiring companies to enhance capabilities and market reach. | Completed a record 33 acquisitions in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Atlas Copco Business Model Canvas preview you are viewing is the complete, final document you will receive upon purchase. This is not a sample or a mockup; it is an exact representation of the deliverable, ensuring you know precisely what you are acquiring. Once your order is processed, you will gain full access to this same comprehensive Business Model Canvas, ready for your strategic analysis and application.

Resources

Atlas Copco's intellectual property is a cornerstone of its business, encompassing a vast portfolio of patents, proprietary designs, and deep technological expertise across its core segments like compressed air, vacuum, and industrial tools. This rich intellectual capital fuels their continuous innovation and provides a significant competitive edge in the global market.

In 2023, Atlas Copco reported significant investment in research and development, highlighting their commitment to expanding their technological know-how. This focus on intellectual property is crucial for maintaining leadership in energy-efficient solutions and advanced manufacturing technologies.

Atlas Copco's global manufacturing facilities are the backbone of its efficient production strategy. The company boasts a network of advanced plants strategically located across the globe, allowing for both high-quality industrial output and the localization of products to better serve diverse regional markets. This widespread presence ensures proximity to customers, reducing lead times and transportation costs.

In 2024, Atlas Copco continued to invest in its manufacturing capabilities, focusing on automation and sustainability. For instance, their facilities are equipped with state-of-the-art machinery to maintain rigorous quality standards across their extensive product portfolio, which includes compressors, vacuum solutions, and power tools. This commitment to advanced infrastructure underpins their ability to deliver reliable and innovative solutions worldwide.

Atlas Copco’s operations are underpinned by a highly skilled workforce, encompassing engineers, R&D specialists, manufacturing personnel, and service technicians. This human capital is crucial for driving innovation and maintaining product quality. For instance, in 2023, Atlas Copco invested significantly in training and development, with employees participating in an average of 30 hours of training, a testament to their commitment to expertise.

The specialized knowledge of these employees is a key differentiator, enabling the company to develop cutting-edge technologies and provide expert customer support. This technical proficiency directly translates into the high performance and reliability of Atlas Copco’s equipment, a factor that significantly contributes to customer loyalty and market leadership.

Extensive Distribution and Service Network

Atlas Copco's extensive distribution and service network is a cornerstone of its business model. This global infrastructure, comprising numerous sales offices, authorized distributors, and dedicated service centers, ensures efficient market penetration and direct customer engagement. This widespread reach is critical for delivering products promptly and offering responsive after-sales support.

The company's commitment to a robust service network translates into tangible benefits for customers, including reduced downtime and optimized equipment performance. For instance, Atlas Copco reported that its service business accounted for approximately 30% of its total revenues in 2023, highlighting the importance of this resource.

- Global Reach: Operates in over 180 countries, facilitating access to a diverse customer base.

- Service Excellence: Employs thousands of service technicians worldwide, ensuring rapid response and expert maintenance.

- Customer Proximity: Strategically located service points minimize travel time and maximize operational uptime for clients.

- Aftermarket Revenue: The network is vital for generating recurring revenue through spare parts, maintenance contracts, and upgrades.

Strong Brand Portfolio and Reputation

Atlas Copco leverages a powerful corporate brand, complemented by a diverse portfolio of over 70 specialized brands such as Edwards, Isra, and Leybold. Each of these brands offers a distinct value proposition, catering to specific market needs and customer segments. This multi-brand strategy enhances market penetration and allows for targeted customer engagement.

The significant brand equity built across this extensive portfolio translates directly into heightened customer trust and loyalty. This strong reputation is a critical asset, enabling Atlas Copco to maintain market leadership and command premium pricing for its innovative solutions. For instance, in 2023, Atlas Copco reported revenues of SEK 141 billion (approximately $13.5 billion USD), underscoring the commercial success driven by its brand strength.

- Brand Diversity: Over 70 distinct brands, including Edwards, Isra, and Leybold, each serving unique market niches.

- Customer Trust: Strong brand equity fosters deep customer loyalty and confidence in Atlas Copco's offerings.

- Market Leadership: The robust brand portfolio underpins the company's ability to lead in its various operating segments.

- Financial Impact: In 2023, Atlas Copco's revenue of SEK 141 billion highlights the commercial success linked to its brand strength.

Atlas Copco's key resources extend beyond tangible assets to include invaluable intellectual property, a global manufacturing footprint, a highly skilled workforce, an extensive distribution and service network, and a powerful multi-brand portfolio.

These resources are fundamental to the company's ability to innovate, produce efficiently, engage with customers effectively, and maintain its competitive edge across diverse industrial sectors.

In 2023, Atlas Copco's strong performance, with revenues reaching SEK 141 billion, demonstrates the commercial success derived from the strategic management and integration of these critical resources.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Intellectual Property | Patents, proprietary designs, technological expertise | Fuels innovation, competitive edge; R&D investment continues in 2024. |

| Manufacturing Facilities | Global network of advanced plants | Enables high-quality output, localization, reduced lead times; focus on automation and sustainability in 2024. |

| Skilled Workforce | Engineers, R&D, manufacturing, service personnel | Drives innovation, quality; employees received average 30 hours training in 2023. |

| Distribution & Service Network | Sales offices, distributors, service centers | Ensures market penetration, customer engagement, after-sales support; service revenue ~30% of total in 2023. |

| Brand Portfolio | Over 70 specialized brands (e.g., Edwards, Isra, Leybold) | Enhances market penetration, customer trust; strong brand equity supports market leadership. |

Value Propositions

Atlas Copco's Sustainable Productivity Solutions are designed to boost customer output while championing environmental responsibility. This is achieved through energy-efficient machinery and a commitment to circular economy principles, directly addressing the market's increasing desire for greener operations and the cost benefits of lower energy usage.

In 2024, Atlas Copco continued to emphasize these solutions, with a significant portion of their product development focused on reducing the environmental footprint of industrial processes. For instance, their advanced compressors are engineered for up to 30% energy savings compared to older models, a key driver for customers seeking to lower operational expenses and meet sustainability targets.

Atlas Copco's commitment to reliability and durability translates into equipment that customers can count on, even in the toughest conditions. This focus on robust engineering ensures that their industrial tools and machinery stand the test of time, minimizing the need for frequent replacements or repairs.

For businesses, this means significantly reduced operational downtime. For instance, in 2024, Atlas Copco's customers reported an average of 98% equipment uptime, a testament to the inherent quality and longevity of their products. This consistent performance directly contributes to enhanced productivity and predictable operational costs.

Atlas Copco's commitment to innovation is evident in its advanced compressed air and vacuum technologies, which deliver exceptional performance and efficiency. This focus on cutting-edge solutions helps customers reduce energy consumption and operational costs, a key value proposition in today's market. For instance, their VSD+ compressors, introduced in 2014, demonstrated significant energy savings, with some customers reporting reductions of up to 50% compared to older fixed-speed models.

Comprehensive Aftermarket Service

Atlas Copco's comprehensive aftermarket service is a cornerstone of its value proposition, focusing on ensuring equipment reliability and customer productivity. This includes a wide array of service contracts, readily available genuine parts, and specialized technical support designed to keep customer operations running smoothly.

By providing these essential services, Atlas Copco aims to minimize downtime and maximize the operational lifespan of its machinery. This proactive approach directly translates to reduced operational risks and enhanced uptime for their clients.

- Extensive Service Contracts: Offering tailored maintenance plans to prevent issues before they arise.

- Genuine Parts Availability: Ensuring customers receive high-quality, original components for optimal performance and longevity.

- Expert Technical Support: Providing access to skilled technicians for troubleshooting and maintenance advice.

- Lifecycle Management: Supporting equipment from installation through to decommissioning, maximizing value.

Customized Solutions and Application Expertise

Atlas Copco truly shines by offering customized solutions, backed by deep application expertise. They understand that no two customers are exactly alike, especially across diverse sectors like manufacturing, construction, and mining. This means they don't just sell equipment; they deliver solutions specifically designed for a customer's unique operational challenges.

Their ability to tailor offerings ensures customers get the most out of their investment. For instance, in 2024, Atlas Copco continued to refine its compressor technologies for specific industrial processes, leading to reported energy savings of up to 15% for certain clients by optimizing air delivery based on real-time demand.

- Tailored Equipment: Solutions are engineered to fit precise industrial requirements, enhancing efficiency and productivity.

- Industry-Specific Knowledge: Deep understanding of sector needs allows for optimized application of their technologies.

- Performance Enhancement: Customization directly translates to better operational performance and reduced waste for clients.

- Problem Solving: Atlas Copco acts as a partner, solving complex industrial challenges through specialized application knowledge.

Atlas Copco's value proposition centers on delivering sustainable productivity through energy-efficient and reliable equipment, complemented by comprehensive aftermarket services and customized solutions tailored to specific industry needs.

Their focus on innovation ensures customers benefit from advanced technologies that reduce operational costs and environmental impact. For example, in 2024, Atlas Copco's commitment to energy efficiency saw their latest compressor technologies offer up to 30% energy savings, directly addressing customer demands for lower operating expenses and improved sustainability metrics.

The company's dedication to durability and uptime, evidenced by an average of 98% equipment uptime reported by customers in 2024, translates into predictable operations and reduced total cost of ownership.

Furthermore, their deep industry expertise allows for the creation of bespoke solutions, ensuring optimal performance and problem-solving for diverse client challenges, as demonstrated by tailored compressor solutions in 2024 that achieved up to 15% energy savings for specific industrial processes.

| Value Proposition | Key Features | Customer Benefit | 2024 Data/Example |

|---|---|---|---|

| Sustainable Productivity | Energy-efficient machinery, circular economy principles | Reduced operational costs, environmental compliance, enhanced output | Compressors with up to 30% energy savings |

| Reliability & Durability | Robust engineering, high-quality components | Minimized downtime, reduced maintenance, extended equipment life | 98% average equipment uptime reported by customers |

| Innovation & Efficiency | Advanced compressed air & vacuum tech, VSD+ | Lower energy consumption, improved operational efficiency | VSD+ compressors (introduced 2014) offer up to 50% energy reduction |

| Comprehensive Aftermarket Service | Service contracts, genuine parts, technical support | Maximized uptime, minimized risks, extended equipment value | Proactive maintenance plans and readily available genuine parts |

| Customized Solutions | Tailored equipment, industry-specific knowledge | Optimized performance, problem-solving, enhanced productivity | Tailored compressor tech for specific processes, achieving up to 15% energy savings |

Customer Relationships

Atlas Copco solidifies customer loyalty by providing comprehensive aftermarket support. This includes proactive preventative maintenance programs and ensuring a readily available supply of genuine spare parts. Their commitment to expert technical assistance, available when needed, keeps equipment running optimally.

This dedication to service isn't just about customer satisfaction; it's a key revenue driver. In 2024, Atlas Copco reported that its Service division continued to be a significant contributor to overall profitability, underscoring the value customers place on reliable, long-term equipment uptime and expert support.

Atlas Copco's direct sales and key account management strategy focuses on cultivating strong partnerships with major industrial clients. These dedicated teams work closely with strategic accounts to deeply understand their unique operational challenges and deliver tailored solutions, fostering significant customer engagement and loyalty.

For instance, in 2024, Atlas Copco's commitment to key accounts was evident in their continued investment in specialized sales forces, aiming to provide unparalleled support and drive value for their largest customers across various sectors.

Atlas Copco leverages digital platforms and IoT solutions, such as their SMARTLINK system, to offer customers remote monitoring and valuable data-driven insights. This allows for optimized equipment performance and predictive maintenance, fostering stronger customer relationships through enhanced efficiency and trust.

In 2024, Atlas Copco continued to expand its digital service offerings. For instance, SMARTLINK adoption saw a significant increase, with over 80% of new compressor installations in key markets being connected. This digital engagement allows for proactive service interventions, reducing unplanned downtime for customers by an average of 15%.

Training and Knowledge Sharing

Atlas Copco provides comprehensive training programs designed to equip customers with the knowledge to operate and maintain their equipment efficiently. This focus on customer education ensures they can maximize the value derived from their investments.

By sharing their deep expertise, Atlas Copco fosters a collaborative environment, building customer capability and strengthening long-term relationships. This commitment goes beyond just selling products; it's about ensuring customer success.

- Enhanced Equipment Uptime: Training directly contributes to reduced downtime by enabling customers to perform routine maintenance and identify potential issues early.

- Improved Operational Efficiency: Customers learn best practices for operating equipment, leading to optimized performance and energy savings.

- Knowledge Transfer: Atlas Copco's commitment to sharing expertise empowers customers with the skills needed for self-sufficiency in many operational aspects.

- Long-Term Partnership: This investment in customer knowledge builds trust and positions Atlas Copco as a valuable partner rather than just a supplier.

Strategic Partnerships with Customers

Atlas Copco positions itself as a strategic partner, not just a supplier. This involves working closely with customers to understand their unique operational challenges and sustainability objectives. By engaging in collaborative development, Atlas Copco aims to co-create solutions that drive mutual growth and long-term success.

This partnership approach is exemplified by their focus on providing tailored solutions that enhance customer productivity. For instance, in 2024, Atlas Copco continued to invest heavily in digital services and predictive maintenance, offering customers insights to optimize equipment performance and reduce downtime. This proactive engagement fosters deeper relationships beyond the initial sale.

- Collaborative Development: Jointly creating solutions to meet specific customer needs.

- Sustainability Focus: Aligning offerings with customer environmental and efficiency goals.

- Long-Term Growth: Prioritizing relationships that foster mutual benefit and ongoing value.

- Digital Integration: Leveraging technology for enhanced customer support and performance optimization.

Atlas Copco cultivates strong customer relationships through a multi-faceted approach, emphasizing comprehensive aftermarket support, direct engagement with key accounts, and leveraging digital innovation. Their commitment extends to customer education and positioning themselves as strategic partners focused on mutual growth and sustainability.

In 2024, Atlas Copco's Service division continued to be a significant profit driver, highlighting the value customers place on reliable equipment and expert support. The widespread adoption of their SMARTLINK system, with over 80% of new compressor installations in key markets connected, demonstrates a strong embrace of digital engagement for proactive service and an average 15% reduction in unplanned downtime for customers.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Aftermarket Support | Preventative maintenance, genuine spare parts, expert technical assistance | Significant contributor to profitability; ensures equipment uptime |

| Key Account Management | Dedicated sales teams, tailored solutions, understanding operational challenges | Fosters significant customer engagement and loyalty; investment in specialized sales forces |

| Digital Platforms & IoT | Remote monitoring, data-driven insights (SMARTLINK) | Optimized performance, predictive maintenance; over 80% SMARTLINK adoption in key markets |

| Customer Education | Training programs on operation and maintenance | Empowers customers, enhances self-sufficiency, builds trust |

| Strategic Partnership | Collaborative development, sustainability focus | Co-creating solutions, driving mutual growth, enhancing productivity |

Channels

Atlas Copco’s direct sales force is a cornerstone for engaging major industrial clients and managing intricate global projects. This approach facilitates detailed technical consultations and the development of tailored solutions, fostering robust client relationships.

In 2024, Atlas Copco continued to invest in its direct sales capabilities, recognizing their importance in delivering high-value, complex equipment and services. This direct channel is crucial for understanding specific customer needs in sectors like mining, infrastructure, and manufacturing, enabling the company to provide specialized expertise and support.

Atlas Copco leverages an extensive global distributor network, comprising independent distributors and dealers, to effectively reach a wide array of customers. This network is particularly crucial for serving small to medium-sized enterprises (SMEs) and customers located in geographically dispersed regions.

These local partners are instrumental in providing essential sales, service, and support, ensuring that customers receive timely assistance and expertise. For instance, in 2023, Atlas Copco reported that its aftermarket services, heavily reliant on this distributor network, continued to be a significant revenue driver, demonstrating the channel's ongoing importance.

Atlas Copco leverages its corporate website, dedicated product microsites, and various digital platforms to connect with customers. These digital channels are crucial for providing detailed product information, offering customer support, and facilitating e-commerce transactions, thereby driving lead generation and enabling remote monitoring capabilities.

In 2024, Atlas Copco continued to enhance its digital customer experience. Their online platforms are designed to empower customers with self-service options, reducing reliance on traditional support methods and improving overall efficiency. This digital-first approach is key to their strategy for engaging a global customer base.

Service Centers and Field Technicians

Atlas Copco leverages a vast global network of service centers and highly skilled field technicians. This infrastructure is fundamental to delivering essential support for equipment installation, proactive maintenance, and timely repairs.

This commitment to comprehensive service directly translates into enhanced customer satisfaction and maximized equipment uptime. For instance, in 2023, Atlas Copco reported a significant portion of its revenue derived from service agreements, underscoring the critical role of this channel.

- Global Reach: Over 100 countries served by its service network.

- Uptime Focus: Technicians trained to minimize downtime, crucial for industrial operations.

- Customer Loyalty: Reliable service fosters repeat business and strong customer relationships.

- Revenue Stream: Service contracts and parts sales represent a substantial and recurring revenue source.

Trade Shows and Industry Events

Atlas Copco actively participates in key industrial trade shows and exhibitions, such as Hannover Messe and bauma, to demonstrate its latest innovations in compressed air, vacuum, and power solutions. These events are crucial for direct customer engagement and gathering market intelligence.

In 2024, participation in these events allows Atlas Copco to connect with a broad audience of potential buyers and industry professionals, reinforcing its market presence and facilitating lead generation. The company leverages these platforms to showcase its commitment to sustainability and energy efficiency.

- Product Showcase: Demonstrating new energy-efficient compressors and vacuum pumps to a targeted industrial audience.

- Customer Engagement: Direct interaction with existing and potential clients to understand evolving needs and provide tailored solutions.

- Brand Visibility: Enhancing brand recognition and perception as a leader in industrial technology through prominent event presence.

- Market Feedback: Gathering immediate feedback on product performance and market trends from industry experts and users.

Atlas Copco utilizes a multi-channel strategy encompassing direct sales, a robust distributor network, digital platforms, and extensive service centers to reach its diverse customer base. This integrated approach ensures comprehensive market coverage and tailored customer engagement across various segments.

In 2024, the company continued to emphasize digital enhancements for customer interaction and support, aiming for greater efficiency and self-service capabilities. This digital focus complements their established physical channels, reinforcing their commitment to customer accessibility and satisfaction.

The company's service network, operating in over 100 countries, is critical for maintaining equipment uptime and fostering customer loyalty through proactive maintenance and repairs. This vital channel also contributes significantly to recurring revenue streams through service agreements and parts sales.

Trade shows and exhibitions remain important for product showcases and direct customer engagement, allowing Atlas Copco to demonstrate innovations and gather market intelligence. In 2024, these events provided platforms to highlight energy-efficient solutions and reinforce the brand's leadership in industrial technology.

| Channel | Key Function | Customer Segment Focus | 2024 Emphasis | Impact |

|---|---|---|---|---|

| Direct Sales | High-value solutions, major projects | Large industrial clients | Strengthening technical consultation | Deep client relationships, tailored solutions |

| Distributor Network | Broad market reach, SME support | SMEs, geographically dispersed customers | Leveraging local expertise | Widespread accessibility, timely support |

| Digital Platforms (Website, etc.) | Product info, e-commerce, support | All customer segments, self-service | Enhancing digital customer experience | Lead generation, remote monitoring, efficiency |

| Service Centers & Technicians | Installation, maintenance, repair | All equipment owners | Maximizing uptime, customer satisfaction | Recurring revenue, customer loyalty |

| Trade Shows & Exhibitions | Product demonstration, market intelligence | Industry professionals, potential buyers | Showcasing innovation, sustainability | Brand visibility, lead generation |

Customer Segments

The manufacturing industry is a core customer segment for Atlas Copco, encompassing diverse sectors like automotive, electronics, and food and beverage. These manufacturers rely on Atlas Copco's extensive portfolio, including industrial tools, advanced assembly systems, and critical compressed air solutions, to optimize their production lines and intricate processes.

These customers are driven by a fundamental need for enhanced operational efficiency, unwavering precision in their output, and dependable reliability across all their manufacturing activities. For instance, in 2024, the global manufacturing sector experienced significant investment in automation, with companies like General Motors investing billions in electric vehicle production, directly benefiting from the precision and efficiency offered by advanced assembly tools.

The construction and infrastructure sector represents a significant customer base for Atlas Copco, encompassing construction companies, rental firms, and infrastructure developers. These clients demand equipment that is not only powerful but also exceptionally durable and reliable, capable of withstanding harsh outdoor conditions. For instance, in 2024, the global construction equipment market was valued at over $200 billion, highlighting the scale of this industry and its need for robust machinery.

Key equipment needs within this segment include portable air compressors, generators, and dewatering solutions, all of which are critical for project execution. The emphasis is consistently on performance and longevity, as equipment downtime can lead to substantial project delays and cost overruns. Atlas Copco's offerings are designed to meet these stringent requirements, ensuring operational efficiency for these demanding customers.

The mining and natural resources sector is a cornerstone for Atlas Copco, encompassing companies focused on extracting minerals, metals, and other resources. These operations rely heavily on Atlas Copco's robust drilling rigs, powerful compressors, and essential ventilation equipment for both underground and surface activities. In 2024, the global mining industry continued to invest in new equipment to boost efficiency and safety, with Atlas Copco’s solutions being critical for these demanding environments.

Customers in this segment prioritize durability, operational safety, and maximizing output. They need equipment that can withstand extreme conditions and ensure the well-being of their workforce. Atlas Copco's commitment to innovation directly addresses these needs, providing technologies that enhance productivity while adhering to stringent safety standards.

General Industrial and Utilities

The General Industrial and Utilities segment encompasses a wide array of businesses and service providers, including manufacturing plants, power generation facilities, and wastewater treatment operations. These entities rely heavily on compressed air, vacuum systems, and industrial tools for their day-to-day functions. A key driver for these customers is the pursuit of enhanced energy efficiency to reduce operational costs. For instance, Atlas Copco's energy-efficient compressors can significantly lower electricity consumption, a major expense in these sectors.

Customers in this segment place a premium on reliable and consistent operational performance. Downtime can be extremely costly, impacting production schedules and service delivery. Therefore, they seek solutions that offer high uptime and minimal maintenance requirements. Atlas Copco's commitment to robust engineering and predictive maintenance solutions directly addresses these critical needs. In 2024, the industrial sector continued to focus on operational resilience, with energy efficiency and reliability being paramount concerns for utility providers managing critical infrastructure.

- Energy Efficiency Focus: Customers prioritize reducing electricity consumption, a significant operational expense.

- Operational Reliability: Consistent performance and minimal downtime are crucial for uninterrupted production and service delivery.

- Broad Application: Solutions are needed for general factory operations, power generation, and essential services like wastewater treatment.

- Cost-Conscious Decisions: Investment in equipment is often driven by long-term total cost of ownership, including energy savings and maintenance.

Semiconductor and High-Tech Industries

The semiconductor and high-tech industries represent a rapidly expanding customer segment for vacuum solutions. These sectors, including advanced manufacturing, scientific research, and material processing, demand extreme precision and ultra-clean environments, making reliable vacuum technology indispensable.

Atlas Copco's offerings are crucial for these demanding applications. For instance, the global semiconductor market was valued at approximately $600 billion in 2023 and is projected to grow significantly, driven by increasing demand for chips in AI, automotive, and consumer electronics. This growth directly translates to a heightened need for specialized vacuum pumps and systems that ensure contamination-free processes.

- Growing Demand: The semiconductor industry's expansion fuels the need for high-performance vacuum equipment.

- Precision Requirements: Manufacturing advanced microchips necessitates vacuum systems that maintain ultra-clean and stable environments.

- Technological Advancement: Research and development in areas like quantum computing and advanced materials also rely heavily on specialized vacuum technology.

- Reliability is Key: Downtime in these high-stakes industries is extremely costly, making the reliability of vacuum solutions paramount.

Atlas Copco serves a diverse range of industrial customers who rely on their equipment for critical operational needs. Key segments include manufacturing, construction, mining, general industrial and utilities, and the high-tech sector, particularly semiconductors.

These customers prioritize efficiency, reliability, and durability, often facing demanding environments and stringent process requirements. For example, the global manufacturing sector’s investment in automation in 2024, with companies like General Motors investing billions, highlights the need for precision tools. Similarly, the construction equipment market, valued over $200 billion in 2024, demands robust machinery.

The mining industry's continued investment in new equipment in 2024 underscores the demand for durable and safe solutions, while the semiconductor market, projected for significant growth driven by AI and other technologies, requires ultra-clean and precise vacuum systems.

| Customer Segment | Key Needs | 2024 Market Context/Examples |

|---|---|---|

| Manufacturing | Operational efficiency, precision, reliability | Global automation investment, e.g., GM's EV production |

| Construction & Infrastructure | Power, durability, reliability in harsh conditions | Global construction equipment market >$200 billion |

| Mining & Natural Resources | Durability, safety, maximizing output | Continued industry investment in efficiency and safety |

| General Industrial & Utilities | Energy efficiency, operational reliability, cost-effectiveness | Focus on operational resilience and reduced electricity consumption |

| Semiconductor & High-Tech | Extreme precision, ultra-clean environments, reliability | Global semiconductor market growth, demand for specialized vacuum tech |

Cost Structure

Atlas Copco's commitment to innovation is reflected in its significant investment in Research and Development (R&D). This R&D spending is a major cost component, encompassing salaries for highly skilled engineers and scientists, the upkeep of advanced research facilities, and the purchase of materials for experimentation and prototyping. These investments are crucial for developing groundbreaking new technologies and continuously enhancing their existing product lines.

In 2023, Atlas Copco reported R&D expenses of SEK 6,587 million (approximately $620 million USD), an increase from SEK 5,957 million in 2022. This upward trend underscores their dedication to staying at the forefront of technological advancements in their various market segments, ensuring a pipeline of competitive and innovative solutions.

Atlas Copco's manufacturing and production costs are a significant component of its overall expense base. These costs encompass everything from the raw materials and specialized components needed for their industrial equipment to the wages of their skilled production labor across numerous global facilities.

Given the complexity and scale of their machinery, material costs, including metals, specialized alloys, and electronic components, represent a substantial portion of their manufacturing expenses. For instance, in 2023, Atlas Copco reported cost of sales of SEK 108,269 million, a clear indicator of the significant investment in production inputs.

Furthermore, the labor involved in assembling and testing their advanced industrial solutions contributes heavily to these costs. This includes not only direct assembly line workers but also the engineers and technicians ensuring quality and efficiency in their manufacturing processes worldwide.

Atlas Copco's commitment to a global presence means significant investment in its sales, marketing, and distribution infrastructure. These costs encompass the compensation and incentives for a worldwide sales force, the development and execution of extensive marketing campaigns, and the intricate management of a complex global distribution network, including transportation and logistics.

In 2024, the company's operational expenses reflect these ongoing investments. For instance, Atlas Copco's selling and administrative expenses, which include these sales, marketing, and distribution costs, represented a substantial portion of their overall expenditure, demonstrating the critical role these functions play in their business model.

Service and Aftermarket Support Costs

Atlas Copco's vast global service network, a critical component of its business model, incurs substantial costs. These expenses cover the deployment and upkeep of field technicians, managing a comprehensive spare parts inventory to ensure quick client response, ongoing training programs for service personnel, and the operational costs of numerous service centers worldwide. These are significant operational expenditures, even though they also contribute to revenue generation.

In 2023, Atlas Copco reported that its service revenues continued to grow, underscoring the importance of this segment. While specific cost breakdowns for aftermarket support aren't always granularly detailed in public reports, the scale of operations suggests that costs associated with skilled labor, logistics for parts, and maintaining a global presence are major drivers within this cost structure.

- Field Technician Operations: Costs include salaries, benefits, travel expenses, and specialized equipment for a global workforce.

- Spare Parts Management: Expenses related to inventory holding, warehousing, logistics, and procurement of parts for a wide range of equipment.

- Training and Development: Investments in continuous training to keep technicians updated on new technologies and service protocols.

- Service Center Infrastructure: Costs associated with maintaining and operating service facilities, including rent, utilities, and administrative staff.

Acquisition and Integration Costs

Atlas Copco's growth-by-acquisition strategy necessitates significant upfront investment in due diligence, legal fees, and the actual purchase price of target companies. These costs are crucial as they represent strategic bets on future market expansion and synergy realization.

The integration phase also incurs substantial expenses, including IT system consolidation, rebranding efforts, and potential restructuring costs to align acquired entities with Atlas Copco's operational standards. For instance, in 2023, Atlas Copco completed several acquisitions, and while specific integration cost figures are not publicly itemized for that year, the company consistently allocates substantial resources to ensure seamless transitions and unlock the full value of these strategic moves.

- Due Diligence & Purchase Prices: Costs associated with evaluating potential acquisitions and the actual acquisition price.

- Integration Expenses: Investment in merging systems, operations, and cultures of acquired companies.

- Strategic Investment: These costs are viewed as essential investments to fuel long-term growth and market consolidation.

Atlas Copco's cost structure is heavily influenced by its significant investment in research and development, aiming to drive innovation and maintain a competitive edge. Manufacturing and production expenses, covering raw materials, components, and labor for their advanced industrial equipment, form another substantial cost base.

Furthermore, the company incurs considerable costs related to its global sales, marketing, and distribution network, essential for reaching its diverse customer base. The extensive service network, vital for customer support and aftermarket revenue, also represents a significant operational expenditure.

Strategic acquisitions, while fueling growth, introduce upfront costs for due diligence, legal processes, and integration efforts, all contributing to the overall cost structure.

| Cost Category | 2023 (SEK Million) | 2024 (Estimated/Indicative) |

|---|---|---|

| R&D Expenses | 6,587 | Projected increase based on 2023 trend |

| Cost of Sales (Manufacturing) | 108,269 | Reflects ongoing material and labor costs |

| Selling & Administrative Expenses (Sales, Marketing, Distribution) | Indicative of significant global operational costs | Reflects ongoing investment in global reach |

| Service Network Operations | Significant operational expenditure | Costs supporting growing service revenue |

| Acquisition & Integration Costs | Associated with strategic acquisitions | Ongoing investment in growth through M&A |

Revenue Streams

Equipment Sales represent Atlas Copco's core revenue generation, stemming from the direct sale of new industrial tools, air compressors, and specialized construction and mining equipment. This segment also encompasses advanced assembly systems tailored to various manufacturing needs. In 2023, Atlas Copco's total order intake reached SEK 173,160 million, with a significant portion attributed to equipment sales across its diverse product portfolio.

Atlas Copco generates substantial and consistent income from its aftermarket operations. This includes selling spare parts, consumables, and offering maintenance contracts, repairs, and other specialized services for the equipment already in use by customers.

In 2024, these service solutions proved to be a significant contributor, making up 37% of Atlas Copco's total revenues, highlighting the importance of this revenue stream.

Atlas Copco generates significant revenue by renting out specialized equipment, especially within its Power Technique segment. This includes items like portable compressors and generators, offering customers a flexible operational expenditure model instead of a large upfront capital outlay.

In 2024, Atlas Copco's Power Technique division continued to see strong demand for its rental solutions. While specific rental revenue figures for 2024 are not yet fully detailed, the company has historically reported robust performance in this area, with rental services contributing a substantial portion to overall segment earnings.

Software and Digital Solutions Subscriptions

Atlas Copco is increasingly shifting towards a subscription-based model for its software and digital solutions. This includes revenue from platforms that enable remote monitoring of equipment, such as their SMARTLINK service, and advanced data analytics tools designed to boost operational efficiency and enable predictive maintenance.

This digital transformation is a significant driver of recurring revenue. For instance, in 2023, Atlas Copco reported substantial growth in its digital service offerings, contributing to the overall expansion of its aftermarket segment. The company's investment in these areas reflects a strategic move to provide ongoing value to customers beyond the initial equipment sale.

- Recurring Revenue Growth: Subscriptions to software platforms and remote monitoring services like SMARTLINK are key drivers.

- Data Analytics for Optimization: Revenue is generated from tools that analyze equipment data to improve performance and predict maintenance needs.

- Customer Value Enhancement: These digital solutions offer continuous value, fostering long-term customer relationships and predictable income streams.

- Strategic Digital Shift: This revenue stream represents Atlas Copco's commitment to digitization and service-oriented business models.

Energy Efficiency and Productivity Consulting

Atlas Copco generates revenue through specialized consulting services focused on enhancing customer energy efficiency and operational productivity. These services are often bundled with the deployment of the company's advanced equipment and technologies, directly supporting their commitment to sustainable productivity.

This consulting stream is particularly valuable as businesses globally, including major industrial players, are under increasing pressure to reduce their carbon footprint and operational costs. For instance, in 2024, many manufacturing sectors are actively seeking ways to cut energy expenses, which can represent a significant portion of their overhead.

- Consulting Fees: Direct revenue from providing expert advice on energy management and process optimization.

- Project-Based Revenue: Income derived from specific projects where Atlas Copco implements tailored solutions to achieve efficiency gains.

- Performance-Based Contracts: Revenue models where consulting fees are linked to the actual energy savings or productivity improvements realized by the customer.

Atlas Copco's revenue streams are diversified, encompassing equipment sales, aftermarket services, rentals, digital solutions, and consulting. The company's commitment to recurring revenue through subscriptions and services is a key strategic focus.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Equipment Sales | Direct sales of new industrial tools, compressors, and specialized equipment. | Total order intake SEK 173,160 million in 2023. |

| Aftermarket Services | Spare parts, consumables, maintenance, and repairs. | Accounted for 37% of total revenues in 2024. |

| Equipment Rentals | Rental of portable compressors, generators, and other equipment. | Strong performance in Power Technique segment in 2024. |

| Digital Solutions | Software subscriptions, remote monitoring (SMARTLINK), and data analytics. | Significant growth in digital service offerings in 2023. |

| Consulting Services | Energy efficiency and operational productivity advice. | Growing demand from industries seeking cost and carbon footprint reduction in 2024. |

Business Model Canvas Data Sources

The Atlas Copco Business Model Canvas is informed by a blend of internal financial reports, global market research, and competitive intelligence. These sources provide a comprehensive view of customer needs, operational efficiencies, and market opportunities.