Atlantia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlantia Bundle

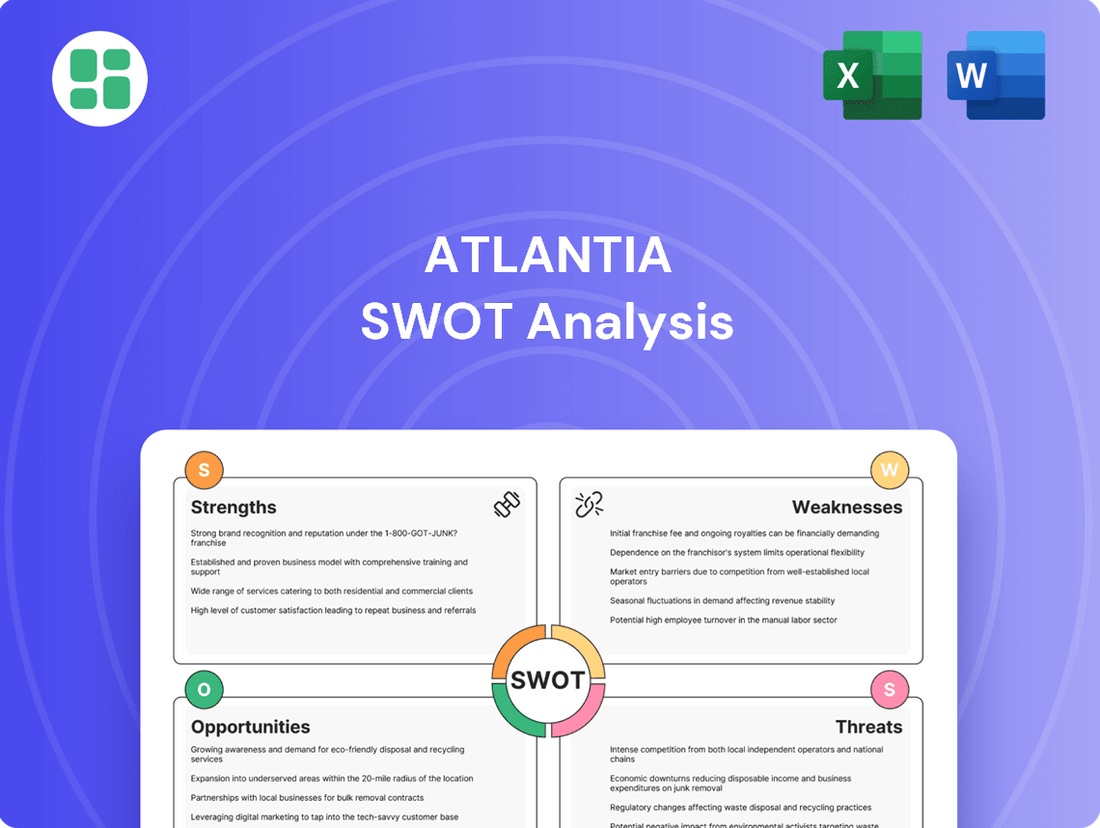

Atlantia's strengths lie in its diversified portfolio and strong market presence, but potential weaknesses in debt management could pose challenges. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Atlantia's opportunities for expansion and the threats it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Mundys, formerly Atlantia, commands a robust global infrastructure portfolio, managing over 14,000 kilometers of toll motorways across 16 countries. This extensive network, coupled with significant airport operations in Italy and France, including Aeroporti di Roma, offers substantial diversification. This geographical spread inherently mitigates risks associated with localized economic downturns, providing a stable foundation for revenue generation.

Mundys showcased impressive financial strength in 2024, reporting an 8% revenue surge and a 12% EBITDA increase over 2023. This growth was fueled by higher motorway traffic and a rebound in airport passenger numbers.

The company's strategic investment approach is evident in recent acquisitions, including motorway concessions in Chile and France. These moves are designed to lengthen concession periods, thereby securing and enhancing long-term cash flow generation and solidifying Mundys' market position.

Mundys demonstrates a robust commitment to sustainability through its detailed plan encompassing Planet, People, and Prosperity, alongside a dedicated Climate Action Plan. This strategic focus is underscored by the successful issuance of sustainability-linked bonds in 2024, directly supporting its decarbonization objectives.

The company has achieved notable advancements in reducing direct emissions and boosting the use of renewable electricity, reflecting tangible progress in its environmental stewardship. This strong ESG leadership not only bolsters Mundys' corporate image but also aligns it with the increasing expectations of investors and regulatory bodies worldwide.

Resilient Concession-Based Business Model

Atlantia's (operating as Mundys) core strength lies in its resilient concession-based business model, primarily focused on motorways and airports. These long-term agreements provide a foundation of stable and predictable cash flows, insulating the company from short-term market volatility.

This model's inherent stability is demonstrated by consistent performance, with traffic volumes showing positive growth in both motorway and airport segments throughout 2024. For instance, Mundys reported a notable increase in traffic across its Italian motorway network and a rebound in air passenger traffic at its managed airports during the year.

- Stable Revenue Streams: Concession agreements ensure consistent revenue generation, even during economic downturns.

- Traffic Growth: Evidence from 2024 shows positive traffic trends in both motorway and airport operations.

- Portfolio Expansion: Strategic acquisitions in recent years have bolstered the company's concession portfolio, enhancing long-term viability.

Strong Ownership and Governance Structure

Following its delisting and acquisition by Edizione and Blackstone, Mundys, formerly Atlantia, now operates under a focused ownership structure. This private ownership, completed in 2022, provides a long-term oriented shareholder base that is committed to the company's strategic direction and sustainable growth initiatives.

The current ownership by Edizione, the Benetton family's holding company, and global investment firm Blackstone, allows Mundys significant strategic flexibility. This structure is designed to fully support the company's long-term investment strategy, particularly in infrastructure development and upgrades, without the short-term pressures often faced by publicly traded entities.

Mundys maintains a robust corporate governance framework. This includes clear oversight bodies and established procedures to ensure responsible management and operational integrity. This governance structure is crucial for managing its extensive portfolio of toll road and airport assets effectively.

- Focused Long-Term Ownership: Edizione and Blackstone's backing provides stability and a commitment to sustained investment.

- Strategic Flexibility: Private ownership enables quicker decision-making and execution of long-term growth plans.

- Robust Governance: A strong framework ensures accountability and responsible management of operations.

Mundys' core strength is its resilient concession-based business model, primarily in motorways and airports, ensuring stable, predictable cash flows. This is supported by positive traffic growth in 2024, with Italian motorways and managed airports seeing increased volumes. Strategic acquisitions, like those in Chile and France, further bolster the portfolio, extending concession periods and securing long-term revenue.

| Segment | 2024 Performance Indicator | Data Point |

|---|---|---|

| Motorways | Traffic Growth | Positive trend observed |

| Airports | Passenger Traffic | Rebound noted |

| Portfolio | Acquisitions | Chile, France (concession extensions) |

What is included in the product

Delivers a strategic overview of Atlantia’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Atlantias SWOT analysis offers a clear, actionable framework to identify and address critical business challenges, transforming potential roadblocks into strategic advantages.

Weaknesses

Despite efforts to deleverage, Mundys (formerly Atlantia) maintained a significant net financial debt of €30.3 billion as of the close of 2024. This substantial debt burden, while reduced from prior periods, presents a notable weakness.

High leverage can restrict the company's financial agility, making it more vulnerable to shifts in interest rates. Furthermore, this debt load may necessitate additional financing for future growth initiatives, potentially diluting existing shareholder value or limiting the scope of new investments.

As a global infrastructure operator, Mundys faces significant exposure to regulatory and political risks across its diverse portfolio. Changes in government policies, concession agreements, and tariff structures in key markets like Italy, Spain, and Brazil can directly impact revenue streams and profitability. For instance, the Italian government's ongoing review of highway concession contracts, including those held by Mundys' subsidiary, could lead to revised terms or increased scrutiny.

Political instability or shifts in government priorities in operating regions can create uncertainty and potentially disrupt long-term investment plans. Past instances of increased regulatory oversight, such as investigations into toll road pricing in certain European countries, highlight the vulnerability of concessionaires to evolving political landscapes. This susceptibility can affect operational autonomy and necessitate costly adjustments to business practices.

Even though the company now operates under the name Mundys, the shadow of its former identity, Atlantia, lingers. This legacy is tied to significant public and political scrutiny stemming from past infrastructure failures. Rebuilding and consistently maintaining a positive public image, particularly in its home markets, continues to be a considerable hurdle for the company.

This ongoing challenge directly impacts public trust and community relations, potentially complicating efforts to secure new concessions or expand current operational footprints. For instance, in 2024, ongoing public discourse around infrastructure safety in Italy, a key market, continued to influence sentiment, highlighting the persistent need for robust communication and visible safety improvements.

Geographical Concentration Risks

While Atlantia (now Mundys) has a global presence, a notable portion of its revenue and operational activities remain concentrated in specific countries and regions. For instance, as of late 2023, Italy and Spain continued to represent significant hubs for its toll road concessions.

This geographical concentration exposes Mundys to heightened risks. Economic slowdowns, political instability, or adverse regulatory shifts within these key markets could have a disproportionately negative effect on the company's overall financial health and operational stability. For example, a significant contraction in Italian GDP could directly impact toll revenue more than a diversified global portfolio would.

- Concentration Risk: Despite diversification efforts, a substantial share of Mundys' revenue is tied to its Italian and Spanish toll road networks.

- Vulnerability to Localized Events: Economic downturns or regulatory changes in these core markets pose a greater threat than if its assets were more evenly distributed globally.

- Impact on Performance: Adverse conditions in concentrated regions can significantly disrupt overall company performance, potentially outweighing positive contributions from other areas.

- Diversification Imperative: Continuous strategic management of its geographical footprint is crucial to mitigate these inherent concentration risks.

Capital Expenditure Requirements

Maintaining and upgrading Atlantia's vast infrastructure network, including motorways and airports, demands significant and continuous capital expenditure. For instance, Mundys reported capital expenditures of €1.5 billion in 2024. These substantial investment requirements can strain cash flow and impact profitability, particularly if unforeseen maintenance needs emerge or if projected traffic growth falls short.

- High Ongoing Capex: Substantial investment is consistently needed for infrastructure upkeep and modernization.

- Financial Pressure: Significant capital outlays can limit financial flexibility and profitability.

- Risk of Underperformance: Lower-than-expected traffic growth can exacerbate the impact of high capex.

Despite efforts to deleverage, Mundys (formerly Atlantia) maintained a significant net financial debt of €30.3 billion as of the close of 2024. This substantial debt burden, while reduced from prior periods, presents a notable weakness. High leverage can restrict the company's financial agility, making it more vulnerable to shifts in interest rates. Furthermore, this debt load may necessitate additional financing for future growth initiatives, potentially diluting existing shareholder value or limiting the scope of new investments.

As a global infrastructure operator, Mundys faces significant exposure to regulatory and political risks across its diverse portfolio. Changes in government policies, concession agreements, and tariff structures in key markets like Italy, Spain, and Brazil can directly impact revenue streams and profitability. For instance, the Italian government's ongoing review of highway concession contracts, including those held by Mundys' subsidiary, could lead to revised terms or increased scrutiny.

Even though the company now operates under the name Mundys, the shadow of its former identity, Atlantia, lingers. This legacy is tied to significant public and political scrutiny stemming from past infrastructure failures. Rebuilding and consistently maintaining a positive public image, particularly in its home markets, continues to be a considerable hurdle for the company. This ongoing challenge directly impacts public trust and community relations, potentially complicating efforts to secure new concessions or expand current operational footprints. For instance, in 2024, ongoing public discourse around infrastructure safety in Italy, a key market, continued to influence sentiment, highlighting the persistent need for robust communication and visible safety improvements.

While Atlantia (now Mundys) has a global presence, a notable portion of its revenue and operational activities remain concentrated in specific countries and regions. For instance, as of late 2023, Italy and Spain continued to represent significant hubs for its toll road concessions. This geographical concentration exposes Mundys to heightened risks. Economic slowdowns, political instability, or adverse regulatory shifts within these key markets could have a disproportionately negative effect on the company's overall financial health and operational stability. For example, a significant contraction in Italian GDP could directly impact toll revenue more than a diversified global portfolio would.

Maintaining and upgrading Mundys' vast infrastructure network, including motorways and airports, demands significant and continuous capital expenditure. For instance, Mundys reported capital expenditures of €1.5 billion in 2024. These substantial investment requirements can strain cash flow and impact profitability, particularly if unforeseen maintenance needs emerge or if projected traffic growth falls short.

| Weakness | Description | Financial Year Data |

| High Debt Levels | Significant net financial debt restricts financial agility and can limit growth opportunities. | €30.3 billion (Net Financial Debt, end of 2024) |

| Regulatory and Political Risks | Vulnerability to policy changes, concession renegotiations, and political instability in operating regions. | Ongoing review of concession contracts in Italy (2024). |

| Reputational Legacy | Lingering public and political scrutiny from past infrastructure issues impacts trust and new business opportunities. | Continued public discourse on infrastructure safety in Italy (2024). |

| Geographical Concentration | Revenue heavily reliant on Italy and Spain, increasing exposure to localized economic and political downturns. | Significant revenue hubs in Italy and Spain (as of late 2023). |

| High Capital Expenditure Requirements | Continuous substantial investment needed for infrastructure maintenance and upgrades, impacting cash flow. | €1.5 billion (Capital Expenditures, 2024) |

Full Version Awaits

Atlantia SWOT Analysis

The preview you see is the actual Atlantia SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This means you can be confident in the content and structure you're evaluating. Unlock the complete, in-depth report by completing your purchase.

Opportunities

The global infrastructure market is poised for substantial expansion, with projections indicating it will surpass $15 trillion by 2040. This growth is fueled by increasing urbanization, greater government investment, and the critical need to adapt to climate change.

This macro trend offers Mundys significant opportunities to broaden its current concession portfolio and secure new projects. These opportunities span both established and developing economies, allowing Mundys to leverage its proven development and management capabilities.

The global smart cities market is projected to reach $2.5 trillion by 2026, driven by a growing emphasis on sustainable urban development and efficient infrastructure. Atlantia's investment in Intelligent Transport Systems (ITS) directly taps into this expanding sector, aligning with the increasing demand for integrated mobility solutions.

By enhancing traffic management and electronic payment systems, Atlantia can unlock new revenue streams and boost operational efficiency. For instance, the adoption of contactless payment technologies in tolling, which saw a significant surge in 2024, can be further leveraged to improve traveler experience and reduce operational costs.

Mundys, the parent company of Atlantia, is strategically targeting expansion into promising new markets, including India and Australia. This move is designed to create a more geographically diverse and balanced airport portfolio, thereby mitigating existing concentration risks.

This diversification into high-growth regions like India, which saw its passenger traffic rebound strongly in 2023, aims to broaden Mundys' revenue base and solidify its global leadership in the transport infrastructure sector.

Leveraging Sustainability for Green Financing and Innovation

Mundys' robust dedication to sustainability, evidenced by its ambitious decarbonization targets and the issuance of sustainability-linked bonds, creates significant advantages in securing green financing. This strategic alignment with environmental, social, and governance (ESG) principles is increasingly attractive to investors prioritizing sustainable portfolios.

This commitment acts as a powerful catalyst for innovation in sustainable mobility. Examples include the integration of renewable energy sources at airports and the ongoing development of eco-friendly infrastructure projects. These initiatives not only bolster the company's green credentials but also have the potential to lower financing costs by tapping into a growing pool of ESG-focused capital.

- Decarbonization Targets: Mundys aims for significant emissions reductions, aligning with global climate goals.

- Sustainability-Linked Bonds: The company has successfully issued these instruments, tying financial terms to sustainability performance.

- Green Financing Access: A strong ESG profile enhances access to favorable financing terms from environmentally conscious lenders and investors.

- Innovation in Sustainable Mobility: Investments in renewable energy integration and eco-friendly infrastructure development are key focus areas.

Technological Advancements and Digital Transformation

The integration of advanced technologies like AI and digital solutions is poised to significantly reshape operational efficiencies across Mundys' (Atlantia's new corporate identity) diverse assets. This digital transformation is key to unlocking future profitability and maintaining a competitive edge.

Embracing these advancements can lead to tangible improvements such as enhanced traffic flow management, a better customer experience, and more effective predictive maintenance strategies. For instance, in 2024, many infrastructure companies are investing heavily in AI for asset management, with some reporting up to a 15% reduction in maintenance costs through predictive analytics.

- AI-driven traffic management can optimize flow on toll roads, reducing congestion and improving travel times.

- Digital platforms enhance customer engagement and service delivery across airports and other transport hubs.

- Predictive maintenance utilizing IoT sensors and AI algorithms minimizes downtime and operational disruptions.

- Data analytics provides deeper insights for optimized asset management and strategic investment planning.

Atlantia's strategic focus on expanding its global infrastructure concessions presents a significant growth avenue, capitalizing on the projected $15 trillion global infrastructure market by 2040. This expansion is further bolstered by the burgeoning smart cities market, anticipated to reach $2.5 trillion by 2026, where Atlantia's investments in Intelligent Transport Systems (ITS) offer direct participation. Additionally, the company's commitment to sustainability, including decarbonization targets and sustainability-linked bonds, enhances its access to green financing, supporting innovation in eco-friendly mobility solutions.

Threats

Atlantia, through its subsidiary Mundys, faces a significant threat from economic downturns. Revenue streams are directly tied to traffic volumes on its motorways and passenger numbers at its airports. For instance, a global economic slowdown in 2024 or 2025 could curb discretionary travel and freight, leading to a noticeable drop in these key metrics.

Inflationary pressures also pose a risk, potentially reducing consumer spending power and thus impacting travel demand. Changes in travel patterns, perhaps driven by remote work trends or shifts in consumer preferences, could further exacerbate this sensitivity, directly impacting Atlantia's profitability and cash flow generation.

The infrastructure sector is seeing a surge in competition, with new players actively seeking to establish a foothold and existing ones consolidating their market share. This intensified rivalry directly impacts Mundys, the core operating company of Atlantia, as it navigates bidding processes for new concessions and the crucial renewal of existing agreements.

For instance, in the 2024-2025 period, Atlantia’s Italian toll road concessions, such as Autostrade per l'Italia, are subjects of ongoing discussions regarding renewal terms. Competitors are actively positioning themselves, potentially leading to more challenging negotiations. This aggressive competitive landscape could force Mundys to accept lower profit margins on its operations or even risk losing valuable, long-standing assets.

Mundys, with its substantial net financial debt, faces a significant threat from rising global interest rates. For instance, as of the first half of 2024, the company reported a net financial debt of €27.5 billion. An increase in benchmark interest rates directly translates to higher borrowing costs, potentially escalating debt servicing expenses by hundreds of millions of euros annually.

This amplified cost of debt repayment can severely impact Mundys' profitability, diverting crucial funds away from strategic investments in infrastructure development or technological upgrades. A tighter liquidity position could also emerge, making it more challenging and expensive to secure new financing or refinance existing debt obligations as they mature, particularly in a higher interest rate environment.

Geopolitical Instability and Macroeconomic Uncertainty

Geopolitical instability and macroeconomic uncertainty pose significant threats to Atlantia's operations. Ongoing global tensions and trade frictions, exemplified by the continued impact of the Russia-Ukraine conflict on energy markets, can severely disrupt supply chains and dampen economic growth worldwide. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, citing persistent inflation and geopolitical risks.

These volatile conditions directly impact Atlantia by affecting traffic volumes on its infrastructure and increasing operational costs. Fluctuating energy prices, a direct consequence of geopolitical events, can lead to higher fuel and maintenance expenses. Furthermore, the instability creates a less predictable environment for investments, potentially hindering future development projects across its diverse operating regions.

- Disrupted Supply Chains: Geopolitical events can interrupt the flow of goods and materials, increasing costs and delivery times for infrastructure projects and maintenance.

- Volatile Energy Prices: Fluctuations in global energy markets, driven by geopolitical instability, directly impact operational expenses for Atlantia's toll roads and airports.

- Economic Slowdown: Macroeconomic uncertainty, including inflation and potential recessions, can reduce consumer and business spending, leading to lower traffic volumes.

- Investment Risk: Heightened geopolitical and economic risks can make investors more cautious, potentially increasing the cost of capital for Atlantia's expansion plans.

Climate Change Impacts and Environmental Regulations

Atlantia faces significant threats from climate change, with physical risks to its infrastructure assets like airports and toll roads becoming more pronounced. For instance, extreme weather events, such as severe floods or heatwaves, can lead to costly repairs and prolonged operational disruptions. In 2023, global insured losses from natural catastrophes reached an estimated $130 billion, highlighting the increasing financial burden of such events.

Moreover, the company must navigate a landscape of increasingly stringent environmental regulations worldwide. These evolving standards can necessitate substantial investments in greener technologies and sustainable practices. Failure to adapt could result in additional compliance costs or even limit future expansion opportunities, impacting Atlantia's long-term growth trajectory.

- Physical Risks: Increased frequency and intensity of extreme weather events (e.g., floods, storms) impacting airport operations and road networks.

- Regulatory Costs: Escalating expenses for compliance with stricter environmental standards, potentially requiring significant capital outlays for emissions reduction and sustainability initiatives.

- Operational Disruptions: Potential for service interruptions and revenue loss due to climate-related damage or regulatory mandates affecting asset utilization.

The intensifying competition within the infrastructure sector presents a substantial threat to Atlantia, particularly impacting its subsidiary Mundys. This heightened rivalry could lead to more challenging negotiations for concession renewals and new bids, potentially forcing lower profit margins or even the loss of key assets. For example, ongoing discussions around the renewal terms for Atlantia’s Italian toll road concessions in 2024-2025 highlight this competitive pressure.

Rising global interest rates pose a significant financial threat to Mundys, given its substantial net financial debt, which stood at €27.5 billion in the first half of 2024. Increased borrowing costs can escalate debt servicing expenses, impacting profitability and potentially hindering future investment and refinancing efforts.

Geopolitical instability and macroeconomic uncertainty, as evidenced by the IMF's projected slowdown in global growth for 2024 to 2.9%, directly threaten Atlantia's operations by potentially reducing traffic volumes and increasing operational costs through volatile energy prices.

Climate change presents both physical and regulatory threats, with extreme weather events potentially causing costly damage and operational disruptions, while increasingly stringent environmental regulations may necessitate significant investment in sustainable practices, impacting long-term growth.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including Atlantia's official financial reports, comprehensive market research, and insights from industry experts to provide a thorough and accurate assessment.