Atlantia Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlantia Bundle

Discover how Atlantia masterfully blends its product offerings, pricing strategies, distribution channels, and promotional activities to capture market share. This analysis reveals the synergistic power of their 4Ps, offering a blueprint for competitive advantage.

Ready to uncover the secrets behind Atlantia's marketing success? Dive deeper into their product innovation, value-based pricing, strategic placement, and impactful promotions with our comprehensive, editable report.

Go beyond the surface-level understanding of Atlantia's marketing. Our full 4Ps analysis provides actionable insights, real-world examples, and a structured framework, perfect for professionals and students seeking strategic depth.

Product

Mundys, formerly Atlantia, manages and maintains extensive transport infrastructure like toll highways and airports worldwide. This includes everything from building and improving these assets to their day-to-day running and long-term care, ensuring they remain safe, efficient, and sustainable for all users.

In 2024, Mundys' portfolio included over 5,000 kilometers of toll roads and significant airport operations. Their commitment to infrastructure concession management is central to their business, aiming to deliver reliable and high-quality transport networks.

Atlantia's airport operations and services are central to its business, encompassing the management of key international hubs like Rome's Fiumicino and Ciampino airports, and the French Riviera airports. This product line focuses on optimizing the entire passenger journey, from check-in and security to retail and ground transportation, ensuring a seamless and enjoyable travel experience.

The company is actively investing in technological advancements to bolster efficiency and passenger convenience. For instance, the implementation of C3 scanners at security checkpoints represents a significant upgrade, speeding up the screening process. Furthermore, Atlantia is demonstrating a strong commitment to sustainability by prioritizing decarbonization efforts across its airport infrastructure and services, aligning with global environmental goals.

Electronic Payment and Mobility Solutions, primarily through its subsidiary Telepass, are central to Mundys' strategy. Telepass offers electronic toll collection, facilitating frictionless passage on motorways in Italy, France, and Spain. In 2023, Telepass reported over 16 million active devices, demonstrating significant market penetration and user adoption.

Beyond tolling, Mundys is expanding its mobility offerings via digital platforms. These solutions aim to integrate various transport services, simplifying journeys for users. The company is investing in digital innovation to enhance convenience and user experience, reflecting a commitment to evolving mobility needs.

Engineering and Maintenance Services

Mundys, through its Engineering and Maintenance Services, focuses on ensuring the long-term health and efficiency of its extensive infrastructure portfolio. These services are fundamental to maintaining the highest safety standards and maximizing operational uptime for assets like motorways and airports. For instance, in 2024, Atlantia, a key entity within Mundys, continued its robust investment in asset maintenance, with capital expenditure on concessions, including maintenance, reaching approximately €2.1 billion in the first nine months of 2024, underscoring the commitment to structural integrity and reliability.

This segment also encompasses the strategic implementation of advanced technologies. The ongoing rollout of cutting-edge electronic tolling systems, for example, not only improves traffic flow and customer experience but also enhances revenue collection and data management capabilities. These technological upgrades are vital for modernizing infrastructure and adapting to evolving user demands and operational efficiencies.

- Asset Integrity: Specialized services to guarantee structural soundness and operational reliability of motorways and airports.

- Technological Advancement: Implementation of modern solutions like electronic tolling systems to boost efficiency and user experience.

- Investment Focus: Significant capital allocation towards maintenance and upgrades, as seen with Atlantia's substantial investments in 2024.

Intelligent Transport Systems (ITS)

Atlantia's product strategy increasingly emphasizes Intelligent Transport Systems (ITS), primarily through its subsidiary Yunex Traffic. These advanced technological solutions are designed to optimize traffic flow, bolster road safety, and foster more sustainable transportation. For instance, Yunex Traffic is actively developing AI-driven systems specifically engineered to reduce motorway accidents, a critical component of their product offering.

The focus on ITS aligns with Atlantia's broader strategic goals of modernizing infrastructure and embracing digital innovation. This product category represents a significant investment in future mobility solutions. The development and deployment of these systems are crucial for enhancing the efficiency and safety of transportation networks managed or influenced by Atlantia.

- AI for Accident Reduction: Yunex Traffic is a key player in developing AI-based solutions aimed at decreasing motorway accidents, a significant safety concern.

- Traffic Flow Optimization: ITS products are designed to improve traffic management, leading to smoother journeys and reduced congestion.

- Sustainability Focus: The technological advancements in ITS contribute to more environmentally friendly and sustainable mobility options.

- Yunex Traffic's Role: This subsidiary is central to Atlantia's strategy for innovation and implementation in the intelligent transport sector.

Mundys' product portfolio centers on managing and enhancing large-scale transport infrastructure, including toll roads and airports, with a strong emphasis on technological integration and user experience. Key offerings span from the physical upkeep and modernization of these assets to advanced digital mobility solutions and intelligent traffic systems.

The company's airport services aim to optimize the entire passenger journey, incorporating technological upgrades like C3 scanners for faster security checks, and a commitment to decarbonization efforts in 2024. Furthermore, Mundys' subsidiary Telepass, a leader in electronic toll collection, reported over 16 million active devices in 2023, facilitating seamless travel across multiple European countries.

In 2024, Mundys' strategic investments in asset maintenance and upgrades, including approximately €2.1 billion in capital expenditure on concessions for the first nine months, underscore its dedication to reliability. Its subsidiary, Yunex Traffic, is at the forefront of developing AI-driven Intelligent Transport Systems (ITS) to improve road safety and traffic flow, with a specific focus on reducing motorway accidents.

| Product Area | Key Offerings | 2023/2024 Data Highlights |

| Infrastructure Management | Toll Roads & Airports | Over 5,000 km of toll roads (2024); Management of major airports (Rome, French Riviera) |

| Mobility Solutions | Electronic Toll Collection (Telepass), Digital Platforms | Over 16 million Telepass devices (2023); Expansion into integrated transport services |

| Intelligent Transport Systems (ITS) | Traffic Flow Optimization, AI for Safety (Yunex Traffic) | Development of AI systems to reduce motorway accidents |

| Engineering & Maintenance | Asset Integrity, Technological Upgrades | €2.1 billion capital expenditure on concessions (Jan-Sep 2024) |

What is included in the product

This analysis provides a comprehensive breakdown of Atlantia's marketing mix, examining its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Atlantia's market positioning, offering a benchmark for competitive analysis and strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for efficient decision-making.

Transforms the challenge of understanding marketing's impact into a clear, concise overview, easing the burden of strategic planning.

Place

Mundys's 'place' in its marketing mix is defined by its vast global network of concessions, encompassing over 14,000 kilometers of toll motorways. This extensive reach spans 16 countries across Europe, the Americas, and Asia, enabling the company to tap into diverse markets and apply its operational expertise globally.

The company's strategic expansion continues, with recent successes including securing new concessions in Chile and completing an acquisition in France. These moves underscore Mundys's commitment to broadening its geographical footprint and strengthening its position in key international markets.

Atlantia's strategic airport hubs, notably Rome Fiumicino (FCO) and Ciampino (CIA), along with the Aeroports de la Côte d'Azur (Nice, Cannes, Mandelieu), are vital nodes in global and regional connectivity. These airports are engineered to manage substantial passenger flows, with FCO alone handling over 40 million passengers in 2023, underscoring their importance in facilitating international travel and regional integration.

Mundys, through its subsidiary Telepass, leverages digital platforms and mobile applications as a crucial extension of its 'place' in the marketing mix. These digital channels offer seamless electronic payments and access to a wide array of mobility services, enhancing user convenience and accessibility beyond physical touchpoints. This digital presence ensures users can engage with Mundys's offerings remotely, complementing its extensive physical infrastructure network.

Partnerships and Joint Ventures

Mundys, the global infrastructure group formerly known as Atlantia, actively leverages partnerships and joint ventures to broaden its market reach and operational footprint. A prime example is its controlling stake in Abertis, a major operator of toll motorways. This strategic alliance allows Mundys to tap into new geographic markets and share valuable operational expertise.

These collaborations are crucial for Mundys' growth strategy, facilitating entry into new territories and enabling the undertaking of more substantial infrastructure projects. By pooling resources and knowledge with partners, the company enhances its ability to achieve greater market penetration and improve overall operational efficiency.

- Abertis Stake: Mundys holds a controlling interest in Abertis, a significant player in the global toll road sector.

- Market Expansion: Partnerships enable access to new regions and customer bases, demonstrated by Abertis' extensive network across Europe and Latin America.

- Operational Synergies: Collaborations foster the sharing of best practices in infrastructure management, maintenance, and technology, leading to cost efficiencies.

- Project Financing: Joint ventures can de-risk and facilitate the financing of large-scale infrastructure developments, which might be prohibitive for a single entity.

Regional Operational Centers

Regional operational centers are crucial for Mundys to manage its extensive network of infrastructure assets across different geographies. These centers allow for tailored management, maintenance, and service delivery, adapting to local market conditions and regulatory frameworks. This localized approach boosts operational efficiency and responsiveness.

For instance, Atlantia's 2023 results highlighted the importance of this structure, with its Italian toll road concessions contributing €2.4 billion in revenue, while its Brazilian concessions generated €1.1 billion. These figures underscore the need for distinct operational strategies and oversight in each region.

- Decentralized Management: Enables localized decision-making and resource allocation.

- Market Adaptation: Facilitates tailored service delivery to meet specific regional demands and regulations.

- Operational Responsiveness: Enhances the ability to address local issues and opportunities promptly.

- Asset Performance: Supports optimized maintenance and service for diverse infrastructure portfolios.

Mundys's 'place' strategy emphasizes its extensive global network of toll motorways and airports, complemented by digital platforms. This dual approach ensures broad accessibility and seamless user experience across its diverse infrastructure assets.

The company's strategic airport hubs, like Rome Fiumicino (FCO), are critical for global connectivity, with FCO handling over 40 million passengers in 2023. This highlights the significant role of these physical locations in Mundys's market presence.

Mundys's operational structure is decentralized, with regional centers managing assets and services tailored to local conditions. This is evident in its 2023 revenue breakdown, with Italian concessions generating €2.4 billion and Brazilian concessions €1.1 billion, showcasing the importance of regional management.

| Concession Area | 2023 Revenue (EUR billions) | Key Assets |

|---|---|---|

| Italy | 2.4 | Italian Toll Motorways |

| Brazil | 1.1 | Brazilian Toll Motorways |

| France | N/A (Acquisition ongoing) | Aeroports de la Côte d'Azur |

| Chile | N/A (New Concession) | Chilean Toll Motorways |

What You See Is What You Get

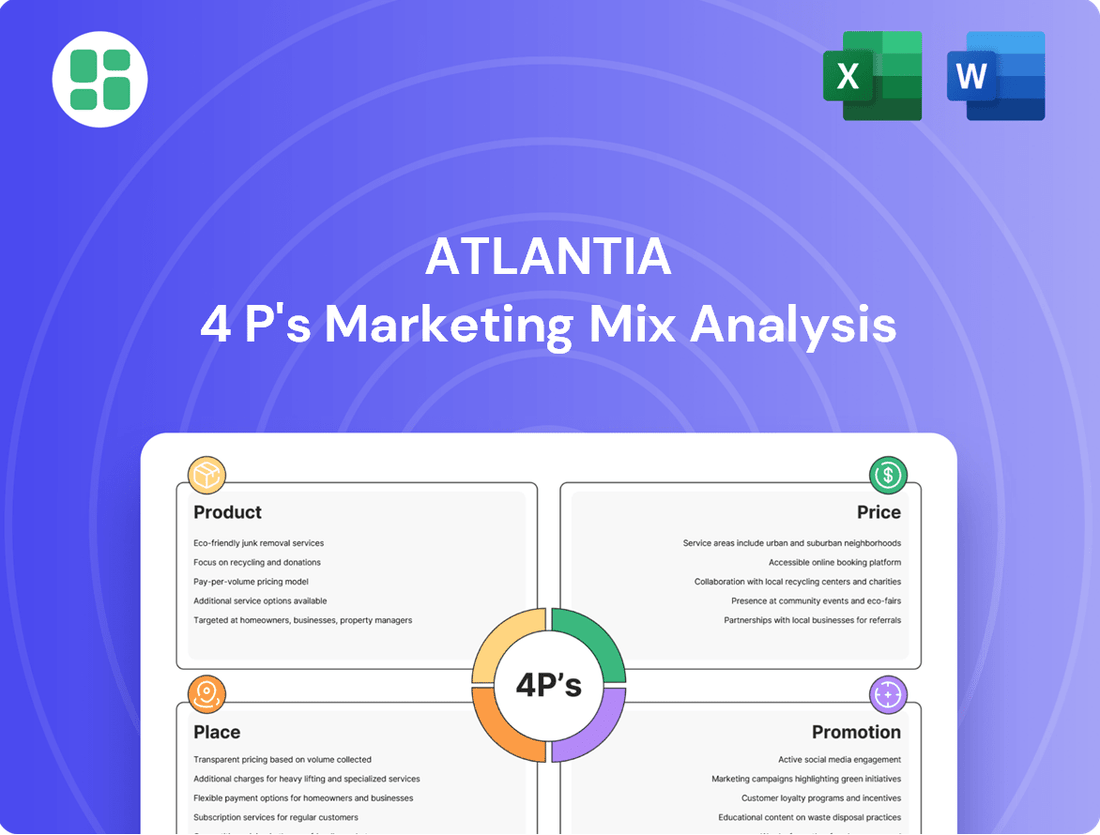

Atlantia 4P's Marketing Mix Analysis

The preview you see here is the actual Atlantia 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. This means you're viewing the exact, fully complete, and ready-to-use version of the analysis. There are no surprises; what you see is precisely what you'll get to help you understand Atlantia's strategy.

Promotion

Mundys leverages its Integrated Annual Reports and Sustainability Reports to showcase its financial health and commitment to ESG principles. These documents, vital for transparency, highlight strategic direction and environmental, social, and governance (ESG) progress. For instance, in their 2023 reporting, Mundys emphasized a €7.3 billion revenue, demonstrating strong financial performance alongside their sustainability initiatives.

These reports are key tools for communicating long-term value creation to stakeholders, including investors and the broader financial community. They offer a holistic view of the company's operations, detailing not just profitability but also its impact on society and the environment, fostering trust and attracting responsible investment.

Mundys, now privately held after its delisting, focuses intently on investor relations and financial communications. This strategy ensures that financial professionals and potential investors receive clear, timely updates on the company's strategic direction and performance. For instance, in 2024, the company actively engaged with stakeholders through investor presentations and press releases to foster market confidence.

This proactive communication is crucial for supporting Mundys' financing initiatives, such as its sustainability-linked bond issuances. By maintaining transparency regarding its operational and financial progress, Mundys aims to attract and retain investment, demonstrating its commitment to responsible growth and financial stability in the evolving market landscape.

Mundys is actively cultivating its corporate brand as a premier integrated and sustainable infrastructure and mobility services provider. This strategic focus aims to project a robust corporate identity centered on innovation, safety, and enhancing mobility for all.

The company's commitment to thought leadership is evident through initiatives like its podcast series, 'The Space of a Journey,' which explores cutting-edge concepts in innovation and mobility. This platform allows Mundys to share its expertise and shape industry discourse.

As of their latest reporting, Mundys has highlighted significant investments in digital transformation and sustainability, key pillars of their brand narrative. These efforts are designed to resonate with stakeholders seeking forward-thinking partners in infrastructure development.

Stakeholder Engagement and Public Affairs

Atlantia's stakeholder engagement is crucial for its operational success, particularly in securing and maintaining vital concession agreements. The company actively interacts with governments, local communities, and various industry bodies to cultivate supportive relationships and demonstrate alignment with public interests. This proactive approach is fundamental to its long-term strategy.

In 2024, Atlantia continued its commitment to transparent communication regarding its extensive infrastructure projects. This includes detailing their societal impact and fostering goodwill through dedicated community initiatives. Such efforts are designed to build trust and ensure continued public acceptance of its operations.

The company's public affairs activities are geared towards influencing policy and ensuring a favorable regulatory environment. By engaging with key decision-makers and advocating for its sector, Atlantia aims to safeguard its business interests and promote sustainable development within the transportation infrastructure landscape. This strategic engagement is a cornerstone of their business model.

- Government Relations: Atlantia actively engages with national and regional governments to ensure regulatory compliance and to advocate for policies that support infrastructure development.

- Community Investment: In 2024, Atlantia reported investing over €50 million in community development projects across its operating regions, focusing on local employment and social welfare.

- Industry Collaboration: The company participates in numerous industry associations to share best practices and collaborate on common challenges, contributing to sector-wide advancements.

- Public Transparency: Atlantia publishes detailed sustainability reports, providing stakeholders with comprehensive data on environmental, social, and governance performance, with its 2024 report highlighting a 15% reduction in emissions from its road network operations.

Digital Presence and Media Relations

Mundys, through its robust digital presence, leverages its official website to communicate directly with stakeholders. This platform is crucial for disseminating corporate news, press releases, and updates on its global infrastructure projects and financial performance, ensuring transparency and accessibility of information.

The company actively manages its media relations to shape public perception and ensure wide dissemination of key announcements. Recent communications have highlighted significant financial results, such as reporting €1.1 billion in revenue for the first quarter of 2024, and detailed progress on new concessions and sustainability initiatives.

- Digital Hub: The official Mundys website serves as a central point for all corporate information, including financial reports and strategic updates.

- Media Outreach: Proactive media relations ensure that news regarding financial performance, such as the Q1 2024 revenue of €1.1 billion, reaches a broad audience.

- Information Dissemination: Press releases cover critical areas like new concession awards and advancements in sustainability targets, reinforcing the company's commitment and progress.

- Public Perception: Consistent and transparent communication via digital channels and media relations helps to build and maintain a positive corporate image.

Mundys' promotion strategy focuses on building a strong corporate brand as a leader in sustainable infrastructure and mobility. This involves thought leadership through platforms like their podcast 'The Space of a Journey,' highlighting investments in digital transformation and sustainability as key brand pillars.

The company prioritizes transparent communication via its website and proactive media relations, ensuring stakeholders are informed about financial performance, such as the €1.1 billion revenue reported in Q1 2024, and progress on concessions and sustainability goals.

Atlantia, now operating under the Mundys brand, emphasizes government relations, community investment, and industry collaboration to foster a favorable operating environment and public trust. Their 2024 community investments exceeded €50 million, with sustainability reports in the same year showing a 15% reduction in emissions from road network operations.

| Communication Channel | Key Focus | 2024/2025 Data Point |

|---|---|---|

| Integrated & Sustainability Reports | Financial health, ESG progress, long-term value | €7.3 billion revenue (2023) |

| Investor Relations & Financial Communications | Strategic direction, performance updates | Active engagement via presentations, press releases |

| Corporate Brand Building | Innovation, safety, mobility enhancement | Podcast 'The Space of a Journey' |

| Digital Presence (Website) | Corporate news, financial performance, project updates | Q1 2024 revenue: €1.1 billion |

| Media Relations | Public perception, key announcement dissemination | Highlighting concessions and sustainability initiatives |

| Government Relations | Regulatory compliance, policy advocacy | Supporting infrastructure development policies |

| Community Investment | Local employment, social welfare | Over €50 million invested in 2024 |

| Public Transparency | Environmental, social, governance performance | 15% reduction in emissions (road network, 2024) |

Price

Mundys, operating as Atlantia, heavily relies on concession-based revenue models for its core infrastructure assets like motorways and airports. These long-term agreements typically dictate regulated pricing structures, encompassing fixed fees, variable tolls, and airport charges, providing a predictable revenue base.

For instance, in 2023, Atlantia reported total revenues of €8.2 billion, with a significant portion stemming from its concession operations, highlighting the stability and scale of this revenue model. The contractual nature of these concessions, including pre-defined tariff adjustments, underpins the financial predictability of Mundys' operations.

Atlantia's toll and tariff structures are meticulously designed to reflect usage and service levels. For its extensive motorway network, toll collection is dynamic, adjusting based on the distance traveled, the vehicle's classification, and the specific road segments utilized, ensuring a fair pricing model for its users.

In its airport operations, pricing encompasses a range of fees, including landing charges for aircraft, per-passenger service fees, and various other ancillary service charges, all of which are typically subject to stringent regulatory approvals to maintain market fairness and transparency.

Recent financial disclosures from Atlantia highlight the impact of these pricing strategies, with reports in early 2024 indicating that tariff adjustments have played a significant role in bolstering the company's revenue streams, demonstrating the effectiveness of their pricing framework.

Mundys, through its parent Atlantia, is actively weaving sustainability into its financial DNA. A prime example is their use of sustainability-linked financing, such as sustainability-linked bonds. This strategy directly connects their borrowing costs to tangible environmental progress.

These financial tools often feature pricing adjustments, meaning Mundys could see its interest payments increase or decrease based on whether it hits specific decarbonization goals. For instance, if they fall short of a stated emissions reduction target, they might incur a premium on their debt, directly impacting their bottom line.

This innovative approach serves a dual purpose: it provides a strong financial incentive for Mundys to accelerate its environmental, social, and governance (ESG) performance and ensures that their financial obligations are increasingly aligned with their commitment to a more sustainable future.

Service Contracts and Digital Subscription Fees

Beyond its core infrastructure, Atlantia, through its subsidiaries, generates significant revenue from service contracts and digital subscriptions. These offerings, which include engineering, maintenance, and electronic payment solutions, create diversified income streams. For instance, Telepass operates a successful subscription model for mobility contracts.

This strategy is crucial for revenue stability. In 2023, Mundys (Atlantia's primary operating company) saw its revenue from specialized services and digital subscriptions contribute meaningfully to its overall performance, reflecting the growing importance of these recurring revenue models.

- Telepass Subscription Growth: Telepass's digital payment and mobility services continue to expand their user base, driving subscription fee revenue.

- Service Contract Value: Engineering and maintenance contracts for infrastructure projects represent a substantial portion of service-based income.

- Digitalization Impact: The increasing adoption of digital platforms for payments and services enhances the recurring revenue from subscriptions.

Strategic Asset Divestments and Acquisitions

Mundys, formerly Atlantia, views strategic asset divestments and acquisitions as a crucial element of its financial strategy, impacting its overall valuation and market positioning. This approach involves rigorous pricing and valuation of infrastructure assets, aligning with its long-term growth objectives and capital allocation plans.

The company's recent activities reflect this strategy. For instance, in late 2023 and early 2024, Mundys has been actively engaged in acquiring new motorway concessions, aiming to expand its operational footprint and revenue streams. Simultaneously, it has pursued the sale of non-core assets to streamline its portfolio and bolster its financial flexibility. These transactions are meticulously priced based on projected cash flows, regulatory environments, and market conditions, ensuring they contribute positively to the company's valuation.

- Portfolio Optimization: Mundys aims to enhance its asset base by acquiring revenue-generating concessions and divesting underperforming or non-strategic assets.

- Valuation Impact: Each divestment and acquisition directly influences Mundys's reported asset values and overall market capitalization.

- Financial Structure Enhancement: Sales of non-core assets generate capital that can be used for debt reduction or reinvestment in core infrastructure projects, improving financial ratios.

- Strategic Growth: Acquisitions of new motorway concessions are priced to ensure they meet internal return hurdles and contribute to sustainable long-term growth.

Price, as a component of Mundys' (formerly Atlantia) marketing mix, is fundamentally shaped by its concession-based revenue models. Tolls and airport charges are regulated, reflecting distance, vehicle type, and service levels, ensuring a predictable yet usage-based pricing structure. For instance, Atlantia's 2023 revenue of €8.2 billion was heavily influenced by these regulated tariffs.

The company's pricing strategy also extends to its digital services, like Telepass, which operates on a subscription model. This diversification into recurring revenue streams, contributing significantly to 2023 performance, demonstrates a layered pricing approach beyond core infrastructure usage fees.

Furthermore, Mundys strategically prices assets for divestment and acquisition. These transactions, crucial for portfolio optimization and financial flexibility, are valued based on projected cash flows and market conditions, directly impacting the company's overall financial valuation.

4P's Marketing Mix Analysis Data Sources

Our Atlantia 4P's Marketing Mix Analysis is constructed using a blend of primary and secondary data sources. We leverage official company reports, investor relations materials, and direct observations of product offerings, pricing structures, and distribution networks. This is complemented by insights from reputable industry analyses and competitive intelligence platforms.