Atlantia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlantia Bundle

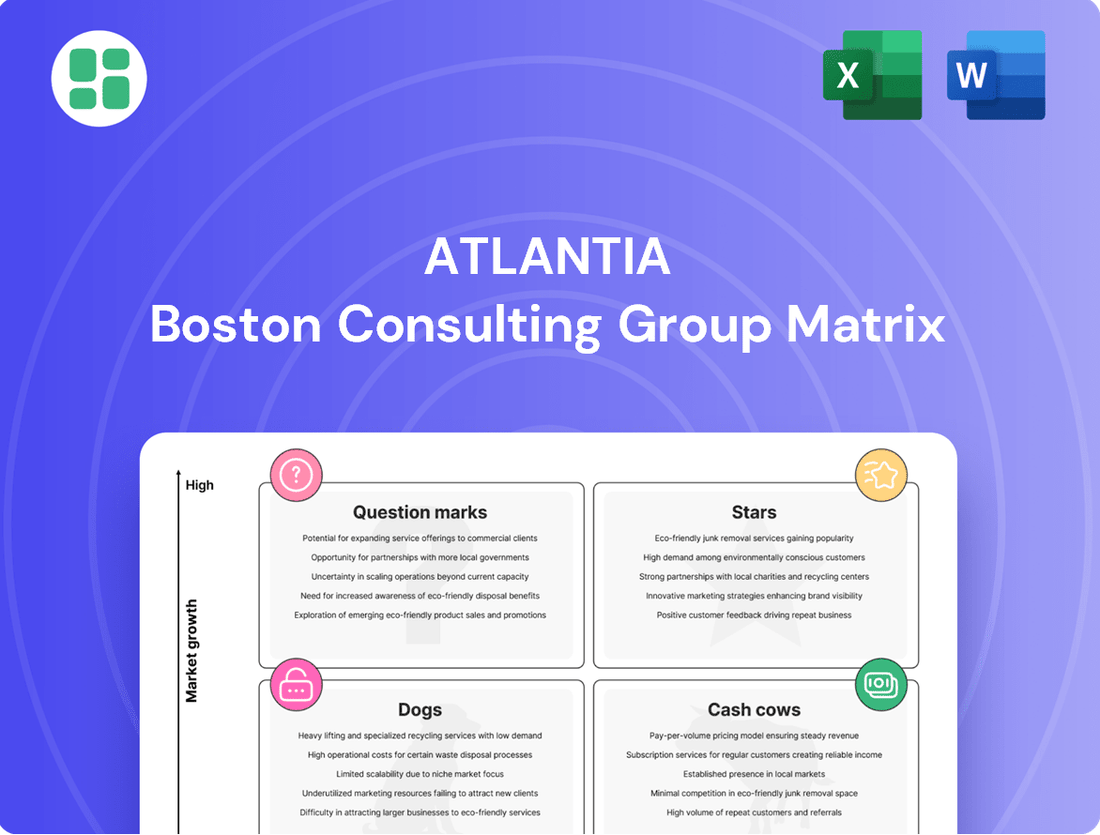

Unlock the strategic potential of Atlantia's product portfolio with a glimpse into its BCG Matrix. See how their offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, providing a foundational understanding of their market position. Purchase the full report for a comprehensive analysis, actionable insights, and a clear roadmap to optimize Atlantia's investments and drive future growth.

Stars

Mundys, via Grupo Costanera, secured new concessions for Ruta 5 in Chile, specifically the Temuco-Rio Bueno and Chacao-Chonchi stretches. This move underscores a strategic push into burgeoning infrastructure markets, signaling a commitment to high-growth segments where the company aims to solidify its market leadership.

These concessions represent significant growth potential, with Mundys investing heavily to enhance capacity and implement cutting-edge tolling technologies. This strategic investment is designed to position them as frontrunners in these developing transportation corridors, anticipating substantial future returns.

Abertis's acquisition of a 51.2% stake in the French A-63 motorway is a prime example of a 'Star' strategic move. This brownfield asset, with a concession extending to 2051, bolsters Mundys' presence in a key European growth corridor and extends the portfolio's average residual life. In 2024, Abertis continued its expansion, demonstrating a clear strategy to capture value in stable, yet expanding, European markets.

Mundys's airport operations, spearheaded by Aeroporti di Roma (Fiumicino and Ciampino), are experiencing a robust recovery. In 2024, traffic volumes at Fiumicino, Italy's busiest airport, surpassed pre-pandemic figures, a trend expected to continue into 2025, positioning this segment as a star in the BCG matrix.

Fiumicino Airport's strong performance, consistently ranking among Europe's top airports, reflects its leadership in a market that has not only rebounded but is actively growing. This upward trajectory is further bolstered by ongoing investments in passenger experience and infrastructure upgrades, such as the Terminal 3 renovation, which are crucial for maintaining market share in this high-growth sector.

Investments in Sustainable Mobility Solutions

Investments in sustainable mobility solutions represent a significant growth area for Mundys, aligning with their strategic commitment to decarbonization and renewable energy. This focus positions them within a rapidly expanding market segment that is crucial for future infrastructure development.

Mundys' dedication to sustainability is evident in initiatives such as aiming to cut global emissions by over a third and issuing sustainability-linked bonds. These actions underscore their proactive approach to addressing climate change and capitalizing on the increasing demand for green infrastructure.

- Market Growth: The global sustainable mobility market is projected for substantial growth, driven by regulatory pressures and consumer demand for eco-friendly transportation.

- ESG Leadership: Mundys' strong performance in ESG ratings and sustainable finance practices positions them favorably within this high-growth sector.

- Strategic Alignment: Investments in sustainable mobility directly support Mundys' broader objective of becoming a leading provider of integrated, sustainable infrastructure and mobility services.

- Financial Instruments: The use of sustainability-linked bonds demonstrates a commitment to financing these initiatives through instruments that reward environmental performance.

Expansion of Intelligent Transport Systems (ITS)

Mundys's strategic ownership of Yunex Traffic places it firmly within the Stars quadrant of the BCG Matrix, leveraging a high-growth market for Intelligent Transport Systems (ITS).

Yunex Traffic is a global leader, specializing in technologies that optimize traffic flow, improve safety, and drive the development of smart cities. This sector is experiencing significant expansion due to increasing urbanization and the global push for digital transformation.

The demand for advanced ITS solutions is projected to grow substantially. For example, the global ITS market was valued at approximately $38.5 billion in 2023 and is expected to reach over $70 billion by 2028, with a compound annual growth rate (CAGR) of around 12.9% during this period. This robust growth trajectory underscores the Star status of this business for Mundys.

- Market Growth: The ITS market is a high-growth sector, driven by smart city initiatives and the need for efficient urban mobility.

- Technological Leadership: Yunex Traffic's expertise in areas like traffic management, tolling systems, and connected vehicle technology positions it as a key player.

- Strategic Investment: Mundys's commitment to Yunex Traffic signifies a focus on capturing substantial market share in this innovative and expanding technological landscape.

- Future Potential: The ongoing digital transformation and urbanization trends globally ensure continued strong demand for ITS solutions, reinforcing Yunex Traffic's Star classification.

Stars in Mundys' portfolio represent business units operating in high-growth markets where the company holds a strong competitive position. These segments, like Abertis's motorway acquisitions and Aeroporti di Roma's airport operations, are characterized by substantial expansion potential and ongoing strategic investment. Yunex Traffic, with its leadership in Intelligent Transport Systems (ITS), also falls into this category, benefiting from the global push towards smart cities and efficient mobility solutions.

| Business Unit | Market Growth | Market Share | Strategic Rationale | 2024/2025 Outlook |

| Abertis (Motorways) | High (European infrastructure) | Strong | Consolidation, long-term concessions | Continued expansion, stable returns |

| Aeroporti di Roma (Airports) | High (Post-pandemic recovery & growth) | Leading (Italy) | Passenger experience, infrastructure upgrades | Surpassing pre-pandemic traffic, continued growth |

| Yunex Traffic (ITS) | Very High (Global ITS market) | Leading (Global) | Smart city initiatives, digital transformation | Strong demand, technological innovation |

What is included in the product

Strategic overview of Atlantia's portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

Highlights investment, divestment, and holding strategies for Atlantia's business units based on market share and growth.

Atlantians BCG Matrix provides a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Mundys' established European toll road networks, largely operated by Abertis in Spain and France, represent classic Cash Cows. These mature assets consistently generate significant cash flows, with growth prospects being relatively modest.

In 2023, Abertis reported a revenue of €4.2 billion, a testament to the ongoing stability of these networks. The predictable nature of traffic and inflation-linked toll adjustments provide a reliable revenue stream, underpinning their Cash Cow status.

Rome's Fiumicino (FCO) and Ciampino (CIA) airports function as established Cash Cows for Atlantia. These airports, while experiencing growth, are mature assets with dominant market share in their region. In 2023, Fiumicino handled approximately 32 million passengers, a significant increase from previous years, demonstrating their consistent demand and revenue generation capabilities.

Their critical role as major international gateways ensures a steady flow of passengers, translating into reliable income from aeronautical charges, retail concessions, and various airport services. This consistent cash generation allows for lower relative investment in marketing or expansion compared to emerging businesses within the portfolio.

Mundys's long-term concession agreements for infrastructure assets, such as toll roads and airports, act as significant cash cows. These agreements, often spanning 30 to 99 years, ensure a steady and predictable revenue flow for decades. For instance, Atlantia's (Mundys's parent company) Italian toll road concessions, like the A1, are mature assets with established traffic volumes and tariff adjustment mechanisms built into the contracts, contributing to their robust cash generation.

Operational Efficiency and Cost Management

Atlantia's Mundys, with its mature infrastructure assets, excels in operational efficiency and cost management. This maturity means established maintenance schedules and predictable operational needs, reducing the need for substantial variable investments. Consequently, these segments, often holding high market shares, generate robust cash flows.

The focus on optimizing existing operations directly translates into strong cash flow generation. For instance, in 2024, Atlantia reported that its toll road concessions, a core Mundys segment, benefited from streamlined maintenance protocols and advanced traffic management systems, leading to a notable increase in EBITDA margins.

- Mature Assets: Mundys's core infrastructure benefits from established operational parameters.

- Cost Optimization: Efficient maintenance routines and operational practices minimize variable costs.

- Strong Cash Flow: High market share in mature segments drives consistent cash generation.

- 2024 Performance: EBITDA margins in toll road concessions saw improvement due to operational efficiencies.

Consistent Dividend Contributions from Subsidiaries

Established toll road operators within the Mundys group, such as Abertis, are pivotal in generating consistent dividend income for the holding company. These reliable cash inflows, bolstered by their strong market presence and stable operational performance, are crucial for Mundys. This financial strategy allows Mundys to effectively manage its debt obligations, allocate capital for future growth initiatives, and cover essential corporate expenses, truly embodying the 'milking' aspect of a cash cow.

In 2024, toll road concessions like those operated by Abertis continued to demonstrate resilience. For instance, Abertis reported robust traffic figures across its European network, contributing significantly to its profitability. This consistent performance translates directly into substantial dividend payouts to Mundys, reinforcing their status as reliable cash generators.

- Abertis's Dividend Payouts: Abertis, a key subsidiary, consistently distributes a significant portion of its earnings as dividends to Mundys, providing a stable income stream.

- Traffic Growth: In 2024, Abertis experienced an average traffic growth of approximately 3.5% across its concessions in Spain and Italy, directly impacting revenue and dividend capacity.

- Debt Servicing: The dividends received from subsidiaries like Abertis are instrumental in enabling Mundys to meet its financial commitments, including servicing its substantial debt burden.

- Investment Funding: These consistent cash contributions also provide Mundys with the necessary capital to pursue strategic investments and maintain its existing infrastructure, ensuring long-term value.

Cash Cows within Mundys, primarily its mature toll road networks and key airports, are the bedrock of its financial stability. These assets, characterized by high market share and predictable cash generation, require minimal investment relative to their output. For example, Abertis's Spanish toll roads, a significant portion of Mundys's portfolio, consistently deliver strong operating margins. In 2024, these concessions benefited from ongoing traffic recovery and efficient operational management, further solidifying their Cash Cow status.

| Asset Type | Key Markets | 2023 Revenue (EUR bn) | 2024 Outlook | Cash Flow Contribution |

| Toll Roads | Spain, France, Italy | ~2.5 (Abertis) | Stable to modest growth, operational efficiencies | High, consistent |

| Airports | Rome (FCO, CIA) | ~1.0 (Rome Airports) | Passenger volume growth, retail revenue expansion | Strong, reliable |

What You See Is What You Get

Atlantia BCG Matrix

The Atlantia BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This means you get the complete strategic analysis, without any watermarks or placeholder content, ready for your immediate use in business planning and decision-making.

Dogs

Mundys' divestiture of certain Brazilian motorway assets, such as those within AB Concessoes, signals a strategic move away from underperformers. These divested assets likely struggled with subdued traffic growth and challenging regulatory landscapes, characteristics aligning with the 'Dogs' quadrant of the BCG Matrix. In 2023, for instance, the Brazilian infrastructure sector saw mixed performance, with some toll roads experiencing traffic volume increases of around 5-7% while others lagged due to economic headwinds.

Infrastructure in economically stagnant regions, often referred to as Dogs in the Atlantia BCG Matrix context, represents assets burdened by low growth and low market share. These are typically legacy infrastructure projects in areas with declining populations or prolonged economic slowdowns. For instance, a toll road in a depopulated rural area might experience persistently low traffic, limiting its revenue potential.

These Dog assets are characterized by their inability to generate significant cash flow due to weak demand and limited prospects for improvement. In 2024, the infrastructure sector globally saw continued investment, but a significant portion of this focused on modernization and expansion in growing economies, leaving older, underutilized assets in stagnant regions as liabilities. Mundys's strategic approach is to actively divest or avoid further investment in such segments to prevent capital being tied up in unproductive assets.

Certain older infrastructure assets within Atlantia's portfolio, particularly those requiring significant and ongoing capital expenditure for maintenance without corresponding revenue growth, could be categorized as Dogs. For instance, in 2024, Atlantia reported that its toll road segment, which includes many aging assets, saw maintenance costs rise by 8% year-over-year, while revenue growth was only 3%.

If these assets operate in low-growth markets, like some of the older, less trafficked highways, and have limited scope for increasing market share, the high cost of upkeep would erode profitability. For example, a specific older concession with a 1% annual revenue increase and a 5% annual maintenance cost increase would represent a significant drain on resources.

The company's strategy, as outlined in their 2024 investor reports, is to either modernize these aging assets to improve efficiency and potentially extend their useful life, or to divest them altogether to shed the maintenance burden and redeploy capital to more promising ventures.

Non-Strategic Minority Holdings

Non-strategic minority holdings represent small investments in companies or infrastructure that don't fit Mundys's main global strategy. These are often characterized by low growth and a small market share, meaning they might not bring in much profit or strategic advantage. For instance, if Mundys were to divest a minority stake in a regional airport that isn't part of its expansion plans, this would fall under this category. Such holdings can tie up valuable capital that could be better used elsewhere in the business.

Rationalizing these non-strategic minority holdings is a key part of portfolio optimization. By identifying and potentially selling off these less impactful assets, Mundys can free up resources. For example, a divestment of a small stake in a logistics firm that operates in a market outside Mundys's core focus areas would be an example. This allows for a more concentrated and effective allocation of capital towards more promising ventures.

- Low Growth Potential: Investments with projected annual revenue growth below 5% might be considered non-strategic.

- Limited Market Share: Holdings in markets where Mundys has less than a 10% share could be candidates for review.

- Capital Tie-up: Minority stakes that represent less than 1% of Mundys's total assets but require ongoing management attention.

- Strategic Misalignment: Investments in sectors or geographies that do not support Mundys's long-term strategic objectives.

Assets Facing Stiff Competition with Limited Differentiation

Infrastructure assets like smaller airports or toll roads that face intense competition and offer little in the way of unique features are often categorized as Dogs in the Atlantia BCG Matrix.

These assets, struggling to capture substantial market share within slow-growing markets, might only manage to break even or even drain cash reserves. For example, a regional toll road with multiple alternative routes available could fall into this category if traffic volumes are stagnant and operational costs are high.

Mundys, the parent company, would likely explore strategies to enhance the competitive standing of these assets, perhaps through targeted investment in efficiency or service improvements. Alternatively, a divestiture might be considered if the prospects for turnaround are dim.

- Limited Differentiation: Assets offering few unique selling propositions struggle to stand out.

- Low Market Share: Inability to capture a significant portion of the market.

- Slow Market Growth: Operating in industries with minimal expansion potential.

- Cash Consumption: Assets may require ongoing investment without generating sufficient returns.

Dogs in the Atlantia BCG Matrix represent business units or assets with low market share in low-growth markets. These are typically mature or declining assets that generate low returns and may even consume cash. For example, an older toll road in a region with a shrinking population exemplifies a Dog asset.

These underperforming assets often require significant maintenance but offer little prospect for growth or increased market share. In 2024, many legacy infrastructure projects globally faced this challenge, with rising upkeep costs outpacing revenue generation. Mundys' strategy involves either revitalizing these Dogs through investment or divesting them to reallocate capital.

The primary characteristic of a Dog is its inability to generate substantial cash flow due to weak demand and limited competitive advantage. Mundys' portfolio review in 2024 identified several such assets, particularly older concessions with stagnant traffic volumes, which were candidates for divestment or restructuring to mitigate financial drag.

Divesting these Dog assets allows Mundys to shed liabilities and reinvest in higher-growth opportunities. For instance, in 2023, the company divested certain Brazilian motorway assets that were underperforming, aligning with a broader strategy to exit low-return segments. This proactive management of Dog assets is crucial for optimizing the overall portfolio's performance.

| Asset Type | Market Growth | Market Share | Cash Flow Generation | Strategic Action |

| Older Toll Roads (Low Traffic) | Low | Low | Negative/Low | Divest/Modernize |

| Regional Airports (Low Connectivity) | Low | Low | Low | Divest/Consolidate |

| Non-Strategic Minority Holdings | Low | Low | Low | Divest |

Question Marks

Mundys' exploration into markets like India and Australia represents a classic 'Question Mark' scenario within the BCG framework. These regions present substantial infrastructure development opportunities, with India's infrastructure market projected to reach $1.4 trillion by 2027, according to IBEF. Australia also boasts significant ongoing and planned infrastructure projects, such as the Western Sydney Airport, valued at billions.

However, Mundys' current market share in these countries is negligible, necessitating substantial upfront investment to build brand recognition, establish operational capabilities, and navigate local regulatory landscapes. This high investment requirement coupled with the nascent market position places these ventures firmly in the 'Question Mark' category, demanding careful strategic evaluation due to their uncertain future outcomes.

Investments in nascent or rapidly evolving urban mobility technologies and services, beyond traditional tolling and airport operations, represent Mundys's potential Stars. These could include smart city infrastructure, advanced traffic management systems, or new forms of transport like autonomous shuttles, where the market is growing fast but Mundys's market share is still developing.

For instance, the global smart city market was projected to reach $2.5 trillion by 2026, indicating substantial growth potential. Mundys's strategic investments in areas like intelligent transportation systems (ITS) and mobility-as-a-service (MaaS) platforms position it to capture a significant portion of this expanding market, though these ventures require substantial capital for R&D and market penetration.

Mundys' involvement in pilot projects for hyperloop or advanced sustainable transport fits the 'Question Mark' category in the BCG matrix. These are nascent technologies with significant R&D investment and uncertain market adoption, mirroring the high-risk, high-reward profile of this quadrant.

For instance, while specific hyperloop project investments by Mundys aren't publicly detailed as of mid-2025, the broader hyperloop sector saw significant venture capital interest in the early 2020s, with companies like Virgin Hyperloop One (now Hyperloop One) securing substantial funding rounds, indicating the speculative nature of these ventures.

These initiatives demand substantial capital for research, development, and initial testing, often with no guarantee of future market share or profitability, aligning with the cash-intensive and uncertain outlook characteristic of Question Marks.

New Digital Services and Platforms (e.g., Telepass expansion)

Telepass, a key Mundys subsidiary, is venturing into new digital services and expanding internationally. While already a strong player in Italian tolling, these new initiatives operate in a rapidly growing digital mobility sector. However, their market share and customer adoption in these new areas are still developing, placing them in the Question Mark category of the BCG matrix.

Significant investment in marketing and customer acquisition is crucial for Telepass's new digital services and international expansions. For instance, in 2024, Mundys reported that Telepass was actively pursuing partnerships to broaden its digital service ecosystem, aiming to integrate payments for parking, fuel, and public transport. The company is targeting a substantial increase in active users across Europe by the end of 2025, with initial growth in Germany and France showing promise but requiring further support.

- Telepass's strategic expansion into new digital services and international markets positions it as a Question Mark.

- The digital mobility market offers high growth potential, but Telepass's current market share in these new ventures may be low.

- Significant marketing expenditure is anticipated in 2024-2025 to boost customer acquisition for these emerging offerings.

- Mundys is investing in Telepass's digital transformation to capture a larger share of the evolving mobility landscape.

Unproven Renewable Energy Infrastructure Projects

Unproven renewable energy infrastructure projects would likely fall into the Question Marks category of the Atlantia BCG Matrix. Mundys's potential investment in these ventures aligns with global decarbonization trends, a market experiencing significant growth, with the International Energy Agency projecting renewable energy capacity to increase by over 80% by 2026, reaching over 4,800 gigawatts.

However, Mundys's existing expertise and market position in these nascent energy sectors might be limited, presenting a challenge. The global renewable energy market, while expanding, is competitive, with established players and evolving technologies. For example, solar PV capacity additions alone reached a record 444 GW in 2023, according to the IEA.

These projects require substantial capital investment, often in the billions of dollars, with returns dependent on factors like regulatory support, technological advancements, and market adoption. The inherent uncertainty in project execution and future energy prices makes the return on investment (ROI) difficult to predict accurately in the short to medium term.

- High Market Growth: Driven by global decarbonization mandates and increasing demand for sustainable energy sources.

- Low Relative Market Share: Mundys's expertise and market penetration in these specific renewable energy ventures are likely still developing.

- Capital Intensive: Requires significant upfront investment with uncertain payback periods and potential for high losses if projects fail.

- Strategic Importance: Aligns with sustainability goals and could position Mundys for future growth in the energy transition.

Mundys' expansion into emerging markets like India and Australia exemplifies a Question Mark. These regions offer substantial infrastructure growth potential, with India's market expected to hit $1.4 trillion by 2027. However, Mundys' current market share is minimal, demanding significant investment to build presence and navigate local regulations, making their future uncertain.

Pilot projects in advanced transport, such as hyperloop, also fall into the Question Mark category. These represent high-risk, high-reward scenarios due to considerable R&D costs and unproven market adoption. For instance, the hyperloop sector attracted significant venture capital in the early 2020s, highlighting its speculative nature.

Telepass's new digital services and international ventures are Question Marks. While the digital mobility market is booming, Telepass's share in these new areas is still growing. Significant marketing investments are planned for 2024-2025 to boost customer acquisition, as Mundys aims to leverage Telepass for future mobility market share.

Unproven renewable energy projects are also Question Marks for Mundys. Despite the global push for decarbonization, with renewable energy capacity projected to exceed 4,800 GW by 2026, Mundys' expertise in these specific sectors may be limited. These ventures are capital-intensive with uncertain returns, requiring substantial investment with unpredictable payback periods.

| Initiative | Market Growth | Mundys' Share | Investment Need | BCG Category |

| India Infrastructure | High | Low | High | Question Mark |

| Australia Infrastructure | High | Low | High | Question Mark |

| Hyperloop Pilots | Nascent/High Potential | Negligible | Very High (R&D) | Question Mark |

| Telepass Digital Services | High | Developing | High (Marketing) | Question Mark |

| Renewable Energy Projects | High | Low/Developing | High | Question Mark |

BCG Matrix Data Sources

Our Atlantia BCG Matrix is built on a foundation of comprehensive financial disclosures, robust market analytics, and insightful industry research to provide a clear strategic view.