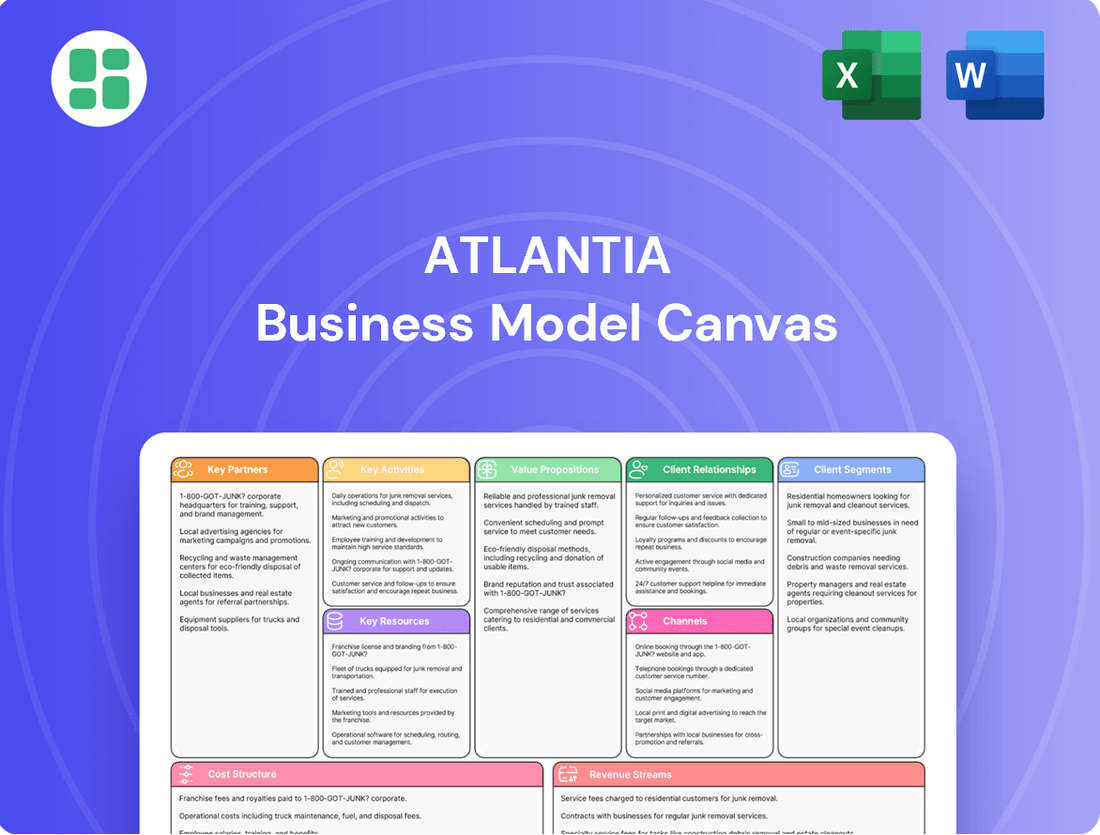

Atlantia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlantia Bundle

Unlock the strategic blueprint behind Atlantia's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they connect with customers, generate revenue, and manage costs. Gain a competitive edge by understanding their core operations.

Want to dissect Atlantia's winning strategy? Our full Business Model Canvas provides a clear, actionable breakdown of their value propositions, key resources, and revenue streams. Perfect for anyone looking to learn from industry leaders.

See exactly how Atlantia structures its business for growth and profitability. This in-depth Business Model Canvas is your key to understanding their customer relationships, channels, and cost structure. Download it now to elevate your own business acumen.

Partnerships

Mundys, operating as a global infrastructure entity, secures its core business through extensive, long-term concession agreements. These are granted by national and local governmental bodies, forming the bedrock of its operational rights for managing vital assets like motorways and airports in diverse international markets.

The company's capacity to maintain and grow its extensive infrastructure network is intrinsically tied to the strength of these governmental relationships. Successful renewal of existing concessions and the acquisition of new ones are critical for Mundys' continued expansion and revenue generation.

For instance, in 2024, Mundys' Italian operations, primarily through its subsidiary Autostrade per l'Italia, continued to navigate complex regulatory environments and concession terms with the Italian government, a key partnership for its substantial motorway network.

Atlantia, now operating under the Mundys brand, actively pursues strategic joint ventures to bolster its global infrastructure presence. A prime example is its collaboration with ACS Group in managing Abertis, a move that solidified its leadership in the toll road sector. These alliances are crucial for tackling more ambitious projects and broadening its asset base.

These partnerships are instrumental in sharing specialized knowledge and distributing risk across complex international endeavors. For instance, in 2023, Mundys' stake in Abertis was valued significantly, reflecting the strength derived from such strategic alliances. By teaming up with industry leaders, Mundys enhances its capacity to undertake large-scale infrastructure development and management.

Atlantia’s strategic alliances with technology and innovation providers are fundamental to its growth, especially in areas like intelligent transport systems (ITS). These partnerships are key to upgrading operational efficiency and enriching customer experiences. For instance, collaborations on advanced electronic tolling systems, such as Telepass, are critical for seamless transit.

Investments in smart infrastructure, often through joint ventures with tech firms, underscore Atlantia's commitment to digitalization. These alliances are vital for improving service delivery across its extensive network, ensuring Atlantia remains at the forefront of modern mobility solutions.

Financial Institutions and Investors

Mundys cultivates robust connections with banks, investment funds, and other financial players to secure the necessary capital for its significant infrastructure investments and expansion plans. For instance, in 2024, Atlantia, Mundys' parent company, successfully issued €1.25 billion in sustainability-linked bonds, with the proceeds earmarked for general corporate purposes and refinancing existing debt, underscoring a focus on ESG-aligned financing.

These collaborations are crucial for ensuring Mundys' financial resilience and enabling strategic growth. They facilitate access to credit lines and diverse funding instruments, such as the previously mentioned sustainability bonds, which are vital for supporting large-scale projects and maintaining operational stability.

- Securing Capital: Partnerships with financial institutions provide access to credit facilities and bond markets for funding major capital expenditures.

- ESG Integration: Issuance of sustainability-linked bonds in 2024 demonstrates a commitment to environmentally and socially responsible financing.

- Financial Stability: These relationships are fundamental to maintaining a healthy financial structure and supporting long-term strategic objectives.

- Growth Initiatives: Access to funding through these partnerships directly fuels Mundys' expansion and development projects.

Construction and Maintenance Contractors

Mundys relies on specialized construction and maintenance contractors to uphold the superior quality of its extensive infrastructure portfolio, which includes motorways and airports. These partnerships are critical for the ongoing development, diligent upkeep, and strategic modernization of these vital assets, ensuring they remain safe, highly efficient, and state-of-the-art. For instance, in 2023, Mundys’ concessioned companies invested approximately €2.3 billion in infrastructure development and maintenance, underscoring the significant role these external partners play.

These collaborations are fundamental to delivering infrastructure that meets the highest safety and operational standards. The contractors are tasked with everything from initial construction phases to routine inspections and major upgrade projects. This ensures that Mundys’ assets are not only functional but also future-proofed against evolving demands and technological advancements.

- Expertise in Specialized Infrastructure: Contractors bring specialized knowledge in building and maintaining complex systems like tolling infrastructure, airport terminals, and road networks.

- Ensuring Asset Quality and Longevity: Partnerships focus on high-quality workmanship and materials to guarantee the long-term durability and safety of infrastructure assets.

- Efficiency and Cost-Effectiveness: Leveraging external expertise allows Mundys to manage maintenance and development projects efficiently, often achieving better cost outcomes.

- Compliance and Regulatory Adherence: Contractors ensure all construction and maintenance activities comply with stringent industry regulations and safety standards.

Mundys' key partnerships are diverse, spanning governmental bodies, strategic joint ventures, technology providers, financial institutions, and specialized contractors. These relationships are fundamental to securing concessions, sharing expertise, accessing capital, and maintaining its extensive global infrastructure portfolio. For example, in 2024, Mundys continued to leverage its strong ties with national governments for concession renewals, while its joint venture in Abertis, with ACS Group, remained a cornerstone of its toll road operations. Furthermore, the company's 2024 issuance of €1.25 billion in sustainability-linked bonds highlights its strategic engagement with financial markets to fund growth and operational stability.

| Partner Type | Key Role | Example/Data Point (2023-2024) |

|---|---|---|

| Governmental Bodies | Granting and renewing concessions | Ongoing concession management with Italian government for motorways (2024) |

| Strategic Joint Ventures | Risk sharing, project execution, market access | Abertis partnership with ACS Group (value significant in 2023) |

| Technology Providers | Enhancing operational efficiency, digital solutions | Collaborations on intelligent transport systems and Telepass |

| Financial Institutions | Capital access for investment and expansion | €1.25 billion sustainability-linked bond issuance (2024) |

| Construction & Maintenance Contractors | Infrastructure development, upkeep, modernization | €2.3 billion investment in development/maintenance by concessioned companies (2023) |

What is included in the product

A detailed, pre-built business model for Atlantia, organized into the 9 classic BMC blocks with comprehensive narratives and insights.

This model reflects Atlantia's real-world operations and strategic plans, making it ideal for presentations and funding discussions.

The Atlantia Business Model Canvas streamlines complex strategies, offering a clear, actionable framework to address and resolve operational inefficiencies.

Activities

Mundys' key activities revolve around the daily management and operation of its vast toll motorway networks and major international airports. This includes ensuring seamless traffic flow on highways and efficient operations at airports, all while upholding rigorous safety and service standards for millions of users. In 2024, Atlantia, a key part of Mundys, reported managing over 5,000 kilometers of toll motorways and several major airports, highlighting the scale of these critical operations.

Atlantia's core activities revolve around strategically investing in and developing infrastructure assets worldwide. This encompasses enhancing existing concessions through upgrades and expansions, as well as pursuing inorganic growth via mergers, acquisitions, and bidding for new concessions.

These investments are crucial for strengthening Atlantia's market standing and driving long-term, sustainable expansion. For example, in 2024, Atlantia continued to focus on significant capital expenditure programs across its toll road and airport concessions, aiming to improve service quality and capacity.

Atlantia actively pursues new infrastructure concessions through participation in competitive tenders, a process that demands deep understanding of regulatory landscapes and strategic bidding. For instance, in 2024, the company continued to evaluate opportunities in key European and international markets, aiming to expand its portfolio of high-quality, long-term assets.

Diligent management of existing concessions is equally crucial. This involves ensuring strict adherence to contractual obligations, maintaining operational efficiency, and complying with all regulatory requirements. Atlantia's commitment to these principles underpins its ability to generate stable, long-term revenue streams and solidify its position in the infrastructure sector.

Technological Innovation and Digitalization

Mundys, Atlantia's parent company, actively pursues technological innovation to redefine mobility. They are committed to integrating cutting-edge solutions to boost both service quality and operational efficiency across their diverse infrastructure. This focus is crucial for staying competitive in the evolving transportation landscape.

Key activities in this area include the development and deployment of intelligent transport systems (ITS) and advanced electronic payment solutions. Mundys also prioritizes building robust digital platforms that enable seamless, integrated mobility experiences for users. For instance, in 2024, the company continued to invest in digital transformation initiatives aimed at enhancing customer interaction and streamlining service delivery.

- Investing in AI and IoT: Mundys is exploring the application of artificial intelligence and the Internet of Things to optimize traffic flow and predict maintenance needs, enhancing safety and efficiency.

- Digital Payment Integration: The company is expanding its electronic payment systems, aiming for greater interoperability and convenience for users across its toll roads and other mobility services.

- Smart Infrastructure Development: Efforts are underway to create smarter infrastructure, incorporating sensor technology and data analytics to improve real-time monitoring and management of assets.

- Enhancing User Experience: Digitalization efforts are directly tied to improving the end-user experience, offering personalized services and easier access to mobility information.

Sustainability and ESG Integration

Atlantia actively implements and monitors sustainability initiatives across its extensive operations, prioritizing environmental, social, and governance (ESG) factors. This commitment is demonstrated through concrete actions aimed at reducing its carbon footprint.

- CO2 Emission Reduction: Atlantia has set targets to significantly decrease its CO2 emissions, aligning with international climate agreements. For instance, in 2023, the company reported a reduction in Scope 1 and 2 emissions by 15% compared to a 2019 baseline.

- Renewable Energy Consumption: The company is increasing its reliance on renewable energy sources to power its infrastructure. By the end of 2024, Atlantia aims for 30% of its energy consumption across its airports to be sourced from renewables.

- Gender Equality in Management: Atlantia is focused on promoting gender diversity within its leadership ranks. In 2023, women held 35% of management positions, a notable increase from 28% in 2021.

These integrated sustainability efforts underscore Atlantia's dedication to corporate responsibility and contribute to achieving broader global sustainability objectives.

Atlantia's key activities are centered on the strategic acquisition, development, and efficient management of critical infrastructure, primarily toll motorways and airports. This involves actively participating in tenders for new concessions and enhancing existing ones through capital investments to improve service quality and capacity. The company also focuses on digital transformation to boost operational efficiency and user experience.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Concession Management & Operation | Daily operation of toll roads and airports, ensuring safety and service quality. | Managed over 5,000 km of toll motorways and several major airports. |

| Strategic Investment & Development | Acquiring new concessions and upgrading existing infrastructure. | Continued significant capital expenditure programs for service and capacity enhancement. |

| Digitalization & Innovation | Implementing ITS, digital payments, and smart infrastructure. | Investing in digital transformation for enhanced customer interaction and service delivery. |

| Sustainability Initiatives | Reducing CO2 emissions and increasing renewable energy use. | Aiming for 30% renewable energy consumption in airports by end of 2024; 15% CO2 reduction (Scope 1 & 2) by 2023 vs. 2019 baseline. |

Delivered as Displayed

Business Model Canvas

The Atlantia Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain immediate access to this same professionally structured and formatted Business Model Canvas, ensuring no surprises and full usability.

Resources

Mundys' global infrastructure network is a cornerstone of its business model, featuring over 14,000 kilometers of toll motorways spanning 16 countries. This extensive physical footprint, including major airport operations in Italy and France, provides a substantial competitive edge and broad geographical market access.

Atlantia's key intangible resource is its extensive portfolio of long-term concession agreements. These legally binding contracts grant the company the rights to manage and operate vital transport infrastructure, forming the bedrock of its stable revenue generation and predictable operational landscape.

The duration and breadth of these concessions are absolutely crucial for Atlantia's valuation and shape its entire strategic planning process. For instance, as of the first half of 2024, the average remaining life of Atlantia's concessions remained robust, providing a strong foundation for future cash flows.

Atlantia's financial backbone is robust, drawing substantial equity from its primary owners, Edizione and Blackstone. This ownership structure provides a stable base, allowing Atlantia to pursue ambitious growth objectives. For instance, Blackstone's significant investment in Atlantia in 2021 underscored the confidence in the company's long-term potential.

Access to diverse debt markets is equally critical for Atlantia's operations and expansion. The company has a proven track record of tapping into various debt instruments to fund its large-scale infrastructure projects and strategic acquisitions. This financial flexibility is paramount for a company operating in capital-intensive sectors.

Furthermore, Atlantia's strategic use of financial instruments, such as sustainability-linked bonds, highlights its commitment to growth aligned with environmental, social, and governance (ESG) principles. In 2023, the company successfully issued sustainability-linked bonds, demonstrating its ability to attract capital while adhering to its sustainability targets, a key factor in its overall growth strategy.

Skilled Workforce and Management Expertise

Atlantia's success hinges on its highly specialized workforce and seasoned management teams. These individuals possess deep expertise in infrastructure engineering, day-to-day operations, and astute financial management. This collective knowledge is absolutely vital for maximizing the performance of Atlantia's assets, successfully navigating intricate regulatory environments, and fostering innovation across the organization. In 2024, Atlantia continued to invest in talent development, recognizing that its human capital is the bedrock of efficient and secure operations.

The company's commitment to its people is reflected in its ongoing training programs and initiatives aimed at retaining top talent. This focus ensures that Atlantia remains at the forefront of operational excellence and strategic decision-making in the infrastructure sector.

- Specialized Skills: Expertise in infrastructure engineering, operations, and financial management is critical.

- Asset Optimization: Deep knowledge is key to enhancing the performance and longevity of infrastructure assets.

- Regulatory Navigation: Experienced management teams are essential for successfully managing complex legal and regulatory frameworks.

- Innovation Driver: Human capital fuels the development and implementation of new technologies and operational improvements.

Proprietary Technology and Digital Platforms

Atlantia's proprietary technology, particularly its Telepass electronic tolling system, is a cornerstone of its operations. This digital asset facilitates seamless toll collection, significantly improving traffic flow and user convenience across its managed networks. In 2024, Telepass continued to be a dominant force in Italy's electronic tolling market, with millions of active users and a substantial portion of all toll transactions processed through the system, underscoring its critical role in revenue generation and operational efficiency.

Beyond tolling, Atlantia leverages various digital mobility platforms to enhance customer experience and gather valuable operational data. These platforms support a range of services, from parking management to integrated mobility solutions, creating a more connected and user-friendly travel ecosystem. For instance, investments in AI-driven analytics in 2024 allowed for more precise traffic forecasting and infrastructure maintenance planning, directly impacting service quality and cost optimization.

Continuous investment in these digital capabilities is paramount for maintaining Atlantia's competitive edge. By staying at the forefront of technological innovation, the company can adapt to the dynamic landscape of mobility services and anticipate future user demands. This commitment to digital advancement ensures that Atlantia remains a leader in providing efficient, integrated, and data-informed mobility solutions.

- Telepass System: A leading electronic toll collection technology, facilitating millions of transactions daily.

- Digital Mobility Platforms: Integrated solutions for parking, navigation, and other mobility services.

- Data Analytics: Utilized for operational improvements, traffic management, and predictive maintenance.

- Competitive Advantage: Driven by ongoing investment in technological innovation and digital transformation.

Atlantia's key resources are its extensive global infrastructure network, including over 14,000 kilometers of toll motorways and significant airport operations, which provide broad market access. Complementing this physical asset base are its valuable intangible resources, primarily long-term concession agreements that ensure stable revenue streams. The company's robust financial backing from major owners like Edizione and Blackstone, coupled with its ability to access diverse debt markets, including sustainability-linked bonds, provides the necessary capital for expansion and operational excellence. Furthermore, Atlantia's highly specialized workforce and proprietary technology, such as the Telepass electronic tolling system, are critical for optimizing asset performance, navigating complex regulations, and driving innovation in the mobility sector.

| Resource Category | Key Resources | Significance | 2024/Recent Data Point |

|---|---|---|---|

| Physical Infrastructure | Toll motorways, Airports | Extensive network, geographical reach | Over 14,000 km of toll motorways |

| Intangible Assets | Concession Agreements | Stable revenue, operational predictability | Robust average remaining concession life (H1 2024) |

| Financial Resources | Equity (Edizione, Blackstone), Debt Markets, Sustainability-linked bonds | Capital for growth, financial flexibility | Blackstone investment in 2021; successful sustainability-linked bond issuance in 2023 |

| Human Capital | Specialized Workforce, Management Teams | Expertise in operations, finance, regulation | Continued investment in talent development (2024) |

| Proprietary Technology | Telepass, Digital Mobility Platforms | Operational efficiency, customer experience, data insights | Millions of active Telepass users; AI analytics for traffic forecasting (2024) |

Value Propositions

Mundys, through its extensive motorway networks and airports, delivers highly efficient and reliable connectivity. This infrastructure ensures seamless travel and transit of goods, directly impacting logistical efficiency. In 2024, Atlantia's Italian motorway network, for example, handled an average of 1.6 million vehicles daily, underscoring its capacity for high-volume, dependable transit.

Atlantia's commitment to enhanced safety and security is a cornerstone of its value proposition, directly impacting user trust and operational integrity. This focus translates into substantial investments in advanced safety technologies and rigorous maintenance schedules for its extensive network of motorways and airports.

In 2024, Atlantia continued to prioritize user well-being, evidenced by ongoing upgrades to infrastructure and the implementation of cutting-edge security measures. For instance, the company has been actively deploying smart sensors and real-time monitoring systems across its toll roads to preemptively identify and address potential hazards, aiming to reduce incident rates.

This dedication to safety is not merely a compliance issue but a strategic advantage, fostering a secure environment that encourages greater usage of its facilities. By consistently upholding high safety standards, Atlantia reinforces its reputation as a reliable operator, which is critical for long-term stakeholder confidence and financial performance.

Mundys is redefining mobility by offering integrated solutions that extend beyond basic infrastructure. They are weaving in digital services and intelligent transport systems to create a seamless travel experience.

This commitment is evident in their development of electronic payment systems and other smart solutions designed to elevate the journey for every traveler. For instance, in 2024, Mundys continued to invest in digital transformation across its airport and mobility concessions, aiming to streamline passenger flows and enhance service offerings through technology.

The overarching goal is to foster a mobility ecosystem that is not only efficient but also sustainable, forward-thinking, and readily accessible to all users. This focus on innovation and user experience is a cornerstone of their strategy to make travel smarter and more connected.

Sustainable Infrastructure Development

Atlantia’s commitment to sustainable infrastructure development is a core value proposition. The company actively invests in projects designed to lessen environmental impact, such as decarbonization efforts and expanding the use of renewable energy sources. This dedication resonates strongly with customers and stakeholders who prioritize environmental responsibility.

This forward-thinking strategy in infrastructure development is not just about environmental stewardship; it’s also about future-proofing assets and operations. For instance, in 2024, Atlantia continued to focus on energy efficiency improvements across its concessions. By 2025, the company aims to further integrate sustainable practices, potentially leading to reduced operational costs and enhanced long-term asset value.

- Environmental Impact Reduction: Investing in projects like decarbonization and renewable energy integration.

- Customer Appeal: Attracting environmentally conscious customers and stakeholders.

- Forward-Looking Approach: Ensuring long-term viability and resilience of infrastructure assets.

- Operational Efficiency: Driving cost savings through sustainable practices and energy efficiency upgrades.

Global Reach and Accessibility

Mundys, through its extensive global network, offers unparalleled reach and accessibility, facilitating international trade and tourism. This broad geographic footprint, spanning Europe, the Americas, and Asia, opens up diverse opportunities for both travelers and businesses worldwide.

The company's operations in key regions highlight its commitment to serving a wide spectrum of international clients. For instance, in 2024, Mundys continued to invest in infrastructure development across its European concessions, aiming to enhance connectivity and passenger experience. This strategic expansion solidifies its value proposition by providing reliable access to global markets.

- Global Network: Operates across Europe, the Americas, and Asia, ensuring widespread accessibility.

- International Trade Facilitation: Supports global commerce through its extensive infrastructure.

- Tourism Enhancement: Caters to a diverse range of international travelers, improving their journey.

- Strategic Investments: Continual development in 2024 across concessions to boost connectivity and service.

Mundys offers integrated mobility solutions, blending essential infrastructure with advanced digital services for a superior travel experience. This innovation, including smart payment systems and streamlined passenger flows, was a key focus in 2024, with continued investment in digital transformation across its concessions.

Sustainability is central to Mundys' value proposition, marked by significant investments in decarbonization and renewable energy. This commitment, reinforced by energy efficiency upgrades in 2024, appeals to environmentally conscious users and ensures long-term asset resilience.

The company's extensive global network provides unparalleled reach, facilitating international trade and tourism. Its strategic investments in 2024 across European concessions, for example, bolstered connectivity and user experience, underscoring its role in global commerce.

Atlantia's infrastructure ensures highly efficient and reliable transit, a fact highlighted by its Italian motorway network handling an average of 1.6 million vehicles daily in 2024. This capacity guarantees seamless travel and logistical efficiency.

| Value Proposition | Description | 2024 Data/Focus |

|---|---|---|

| Seamless Connectivity & Efficiency | Provides highly efficient and reliable transport networks. | Italian motorway network handled 1.6 million vehicles daily. |

| Enhanced Safety & Security | Prioritizes user well-being through advanced safety technologies. | Deployment of smart sensors and real-time monitoring systems. |

| Integrated Mobility Solutions | Offers digital services and intelligent transport systems. | Continued investment in digital transformation across concessions. |

| Sustainability & Environmental Responsibility | Invests in decarbonization and renewable energy integration. | Focus on energy efficiency improvements across concessions. |

| Global Reach & Accessibility | Operates an extensive global network facilitating international trade. | Continued investment in infrastructure development across European concessions. |

Customer Relationships

Mundys, through its Telepass brand, champions digital self-service via its mobile app, enabling customers to effortlessly manage accounts, access services, and retrieve information. This digital-first approach enhances efficiency and accessibility, aligning with contemporary consumer expectations for seamless interactions.

In 2024, Telepass reported a significant increase in digital transactions, with over 80% of customer inquiries handled through its app and online portal, demonstrating strong adoption of these self-service channels.

Atlantia offers direct operational assistance on its motorways and at airports to address immediate needs. This includes vital emergency services, breakdown assistance, and on-site customer support, ensuring traveler safety and swift responses, especially during critical incidents. For example, in 2023, Atlantia's motorway network saw over 2.5 billion vehicle passages, highlighting the scale of operations and the importance of this direct support.

Atlantia cultivates enduring partnerships with government bodies overseeing concessions, ensuring operational continuity and strategic alignment. This involves proactive engagement on regulatory matters, tariff adjustments, and infrastructure development, fostering trust and mutual understanding. For instance, in 2024, Atlantia's ongoing dialogue with Italian authorities regarding the Autostrade per l'Italia network focused on investment plans and service quality enhancements.

Business-to-Business (B2B) Account Management

For its commercial clients, including airlines, logistics firms, and major corporate entities, Mundys offers specialized B2B account management. This dedicated service is designed to meet the unique requirements of these businesses, enabling the provision of bundled services and cultivating robust, long-term commercial relationships.

This personalized approach is key to ensuring high levels of client satisfaction and promoting retention. For example, in 2024, Atlantia's airport concessions, which often involve significant B2B relationships with airlines and retailers, contributed substantially to its revenue streams, underscoring the importance of tailored client engagement.

- Dedicated B2B Account Management: Tailored support for commercial clients like airlines and logistics companies.

- Facilitation of Bulk Services: Streamlining the delivery of services to large corporate users.

- Fostering Partnerships: Building strong, enduring commercial relationships through personalized engagement.

- Client Satisfaction and Retention: Ensuring client needs are met to maintain loyalty and repeat business.

Stakeholder Communication and Transparency

Mundys prioritizes open dialogue with stakeholders, including local communities, environmental advocates, and investors. This commitment is demonstrated through readily accessible integrated annual reports and detailed sustainability statements, fostering trust and addressing concerns critical for its social license to operate.

Transparency is a cornerstone of Mundys' stakeholder engagement. In 2024, the company continued its practice of detailed reporting, providing insights into its operational performance and environmental, social, and governance (ESG) initiatives. This approach aims to build enduring relationships based on mutual understanding and shared value.

- Stakeholder Engagement: Mundys actively communicates with diverse groups, including local communities, environmental organizations, and investors.

- Transparency Tools: Integrated annual reports and sustainability statements are key channels for sharing information.

- Trust Building: Addressing stakeholder concerns is paramount for maintaining the social license to operate.

- 2024 Focus: Continued emphasis on detailed reporting of operational performance and ESG initiatives.

Mundys leverages digital channels, particularly its Telepass app, for customer self-service, handling over 80% of inquiries digitally in 2024. Direct operational support is crucial on motorways and at airports, addressing over 2.5 billion vehicle passages in 2023. Specialized B2B account management caters to corporate clients, fostering strong commercial relationships that contributed significantly to Atlantia's airport concession revenues in 2024.

| Customer Relationship Type | Key Channels/Methods | 2023/2024 Data Points |

|---|---|---|

| Digital Self-Service (Telepass) | Mobile App, Online Portal | Over 80% of customer inquiries handled digitally in 2024. |

| Direct Operational Support | On-site assistance, Emergency services | Over 2.5 billion vehicle passages on motorway network (2023). |

| B2B Account Management | Dedicated account managers, Bundled services | Significant revenue contribution from airport concessions in 2024. |

| Stakeholder Engagement | Integrated reports, Sustainability statements | Continued emphasis on detailed ESG reporting in 2024. |

Channels

Mundys' primary channels are its vast physical infrastructure networks, including toll motorways and airport terminals. These tangible assets are the direct touchpoints where customers experience and utilize the company's services. For instance, in 2024, Atlantia's toll road concessions handled a significant volume of traffic, demonstrating the crucial role of these physical networks in service delivery.

Mundys leverages digital platforms, with the Telepass mobile app being a prime example, to offer seamless electronic tolling, payment processing, and a suite of integrated mobility services. This digital strategy is key to enhancing customer convenience and providing real-time updates.

In 2024, Telepass reported a significant increase in its user base, with over 12 million active users across its various services, highlighting the critical role of these digital channels in modern customer engagement and service delivery.

Atlantia's corporate websites and dedicated investor relations portals are crucial channels for sharing vital company information. These platforms ensure transparency by providing access to financial reports, press releases, and strategic updates, fostering trust with investors and the public. In 2024, Atlantia continued to leverage these digital assets to manage its corporate image and engage effectively with all stakeholders.

Customer Service Centers and On-site Points

Customer service centers, both physical and virtual, alongside on-site points at toll plazas and airports, are crucial for direct customer interaction and support. These touchpoints handle inquiries, process transactions, and resolve issues, ensuring a human element for users requiring assistance.

In 2024, Atlantia's commitment to customer accessibility was evident through its extensive network. For instance, the company operated numerous physical customer service centers and an increasing number of virtual support channels, aiming to cater to a broad customer base across its diverse infrastructure assets. These centers are vital for building trust and providing immediate solutions.

- Physical Presence: Maintaining on-site service points at toll plazas and airports ensures immediate assistance for travelers.

- Virtual Support: Expanding online and phone-based customer service centers caters to a digitally connected user base.

- Transaction Facilitation: These channels are key for managing payments, resolving account issues, and providing information on services.

- Customer Engagement: Offering a human touchpoint fosters stronger customer relationships and addresses complex needs efficiently.

Direct Sales and Concession Bidding Processes

Mundys leverages direct sales and concession bidding to secure new infrastructure projects and significant commercial agreements. This involves direct engagement and strategic negotiation with government entities and major corporations, presenting tailored proposals for high-value business acquisition.

These processes are crucial for expanding Mundys' concession portfolio and commercial footprint. For instance, in 2024, the company actively pursued opportunities in various regions, focusing on infrastructure development and operational contracts that align with its strategic growth objectives.

- Direct Sales: Focuses on building relationships and directly presenting value propositions to potential clients, often involving complex, multi-year contracts for infrastructure management and development.

- Concession Bidding: Involves participating in competitive tender processes managed by governmental bodies or public authorities for the right to operate and develop specific infrastructure assets, such as toll roads or airports.

- Strategic Negotiation: Key to these channels, ensuring favorable terms and conditions are met for both Mundys and the contracting authority, often encompassing financial, operational, and developmental aspects.

- High-Value Acquisition: These channels are characterized by the significant financial and strategic importance of the contracts secured, directly contributing to revenue growth and market position.

Mundys' channels extend to strategic partnerships and alliances, collaborating with other infrastructure operators, technology providers, and local governments. These partnerships are vital for co-investing in projects, sharing expertise, and expanding market reach, particularly in new geographical territories.

In 2024, Atlantia actively explored and solidified several strategic collaborations, aiming to enhance its service offerings and operational efficiencies across its global network. These alliances are instrumental in navigating complex regulatory environments and accessing specialized knowledge for large-scale infrastructure development.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| Strategic Partnerships | Collaborations with other entities for joint ventures, co-investment, and knowledge sharing. | Active pursuit of alliances to enhance service offerings and operational efficiencies. |

| Concession Bidding | Competitive tender processes for operating and developing infrastructure assets. | Focus on securing new contracts for infrastructure development and operational agreements. |

| Direct Sales | Direct engagement and negotiation for infrastructure management and development contracts. | Tailored proposals for high-value business acquisition, expanding commercial footprint. |

Customer Segments

Individual travelers and commuters form a core customer base for Mundys, encompassing daily commuters relying on motorways and tourists experiencing air travel through its airports. These users prioritize efficiency, safety, and ease of use in their journeys.

In 2024, the demand for seamless travel continues to drive user choices. Mundys aims to enhance this experience through smart infrastructure and user-friendly airport services, recognizing that a positive journey directly impacts customer loyalty and repeat usage.

Commercial transport and logistics companies, including freight haulers and bus operators, are key users of Mundys' motorway infrastructure. These businesses depend on reliable, fast, and cost-efficient transit for their operations. In 2024, the logistics sector continued to be a significant driver of economic activity, with companies in this segment actively seeking ways to optimize their supply chains and reduce transit times, making dependable road networks essential.

Airlines are a cornerstone customer for Mundys, relying heavily on its airport infrastructure for everything from flight operations and passenger boarding to cargo handling. In 2024, major carriers continued to increase flight frequencies, directly impacting demand for airport services. For instance, by mid-2024, air traffic at major Mundys-managed airports saw a significant rebound, with passenger numbers approaching pre-pandemic levels, underscoring the critical role Mundys plays in facilitating airline business.

Beyond the airlines themselves, the aviation ecosystem includes crucial partners like ground handling services, fuel suppliers, and maintenance providers. These entities also represent key customers for Mundys, as they require access to airport facilities and services to support airline operations efficiently. The growth in air travel throughout 2024 directly translated into increased business for these ancillary aviation service providers, reinforcing their dependence on Mundys' operational capabilities.

Governmental Bodies and Regulatory Authorities

Governmental bodies and regulatory authorities are paramount for Atlantia, as they act as the grantors of essential concessions and the overseers of operational compliance. Positive engagement and strict adherence to evolving regulatory landscapes are fundamental to securing and maintaining these vital agreements, directly impacting future expansion and revenue streams. In 2024, continued dialogue and demonstrable commitment to public service standards are key to ensuring concession renewals and fostering a stable operating environment.

- Concession Grantors: Governments award and manage the infrastructure concessions Atlantia operates, such as toll roads and airports.

- Regulatory Oversight: These bodies ensure Atlantia adheres to safety, environmental, and service quality standards.

- Relationship Management: Maintaining strong, transparent relationships is crucial for concession renewals and dispute resolution.

- Policy Influence: Engaging with authorities on infrastructure policy can shape future opportunities and operational frameworks.

Businesses and Retailers within Infrastructure

This customer segment encompasses a wide array of businesses and retailers that thrive within Mundys' extensive infrastructure. Think of the shops, eateries, and car rental services you find at their airports, or the service stations and rest stops dotting their motorways. Mundys acts as the landlord, providing the essential spaces and the very infrastructure these businesses need to operate and, crucially, to generate their own revenue.

For example, in 2023, Mundys' airport retail and services segment saw significant activity. The total retail revenue across its airport portfolio reached over €1.5 billion, with a substantial portion coming from these direct business and retailer tenants. These operators benefit from the high footfall and captive audience that Mundys' infrastructure attracts.

- Airport Retailers: Shops, duty-free outlets, and food and beverage providers operating within airport terminals.

- Motorway Services: Fuel stations, convenience stores, and restaurants located along Mundys' managed toll roads.

- Car Rental Agencies: Businesses offering vehicle rentals, typically situated within airport facilities.

- Ancillary Service Providers: Companies offering services like baggage handling or lounges within the airport ecosystem.

Mundys serves a diverse customer base, from individual travelers and commuters to commercial transport companies and airlines. These users value efficiency, safety, and seamless experiences. In 2024, the focus remains on enhancing travel through smart infrastructure and user-friendly services, recognizing the direct link between journey quality and customer loyalty.

Cost Structure

Atlantia, now operating as Mundys, faces significant costs related to infrastructure capital expenditures. These investments are vital for developing, expanding, and modernizing its extensive network of motorways and airports, ensuring they remain high-quality and can handle increasing demand.

These are long-term investments critical for maintaining the operational capacity and asset quality of Mundys' core infrastructure. For the year 2024, the company reported capital expenditures totaling €1.5 billion, highlighting the substantial financial commitment required to sustain and grow its business.

Atlantia's operations and maintenance costs represent the ongoing expenses critical for keeping its extensive network of roads and airports in prime condition. These include routine road repairs, essential upkeep of airport terminals and runways, and the maintenance of vital safety systems. For instance, in 2024, Atlantia continued to invest significantly in infrastructure upgrades and preventative maintenance to ensure the seamless and safe flow of traffic and passengers across its concessions.

Atlantia's cost structure heavily features concession fees, which are payments made to governmental bodies for the privilege of operating infrastructure assets like toll roads. For instance, in 2023, Atlantia's Italian concessions alone represented a significant portion of its operating costs, reflecting the ongoing financial commitment to these rights.

Beyond initial fees, ongoing regulatory compliance and permit acquisition represent substantial expenses. These costs are essential for maintaining operational licenses and ensuring adherence to safety and environmental standards within the highly regulated infrastructure sector. Failure to comply can lead to hefty fines, impacting profitability.

In 2024, Atlantia continued to invest in ensuring its operations across its global portfolio meet stringent regulatory requirements. These compliance costs are not merely operational overhead but a critical investment in the long-term viability and reputation of its infrastructure concessions, directly impacting its ability to generate revenue.

Personnel and Labor Costs

Atlantia, now operating as Mundys, faces significant personnel and labor costs due to its extensive global operations. The company manages a large workforce, exceeding 21,000 employees, which represents a substantial investment in human capital essential for maintaining its complex infrastructure. These costs encompass salaries, comprehensive benefits packages, and ongoing training programs for staff across diverse operational, technical, and administrative roles.

The financial commitment to its workforce is a critical component of Mundys' cost structure. This investment is necessary to ensure the efficient management and development of its global assets, including airports and toll roads. The sheer scale of its operations necessitates a considerable expenditure on skilled personnel to handle everything from day-to-day management to specialized engineering and strategic planning.

- Global Workforce: Mundys employs over 21,000 individuals worldwide.

- Cost Components: Expenses include salaries, employee benefits, and training.

- Strategic Importance: Human capital is vital for managing complex infrastructure.

- Operational Impact: Personnel costs are a significant expenditure for the company.

Financing Costs and Debt Servicing

Given its capital-intensive infrastructure operations, Mundys incurs significant financing costs. These costs are primarily driven by substantial financial debt, which translates into considerable interest expenses and debt servicing obligations. Efficient management of these expenses is crucial for maintaining profitability.

Mundys actively seeks favorable financing arrangements to mitigate these costs. The company has utilized instruments like sustainability-linked bonds, demonstrating a strategic approach to managing its debt profile. In 2024, Mundys reported a net financial debt of €30.3 billion, highlighting the scale of its financial leverage.

- Financing Costs: Interest expenses and debt servicing are significant due to high levels of financial debt.

- Debt Management: Strategic use of financing instruments like sustainability-linked bonds is employed to manage costs.

- Financial Leverage: Mundys maintained a net financial debt of €30.3 billion in 2024.

Atlantia's cost structure is significantly influenced by its substantial capital expenditures, essential for developing and modernizing its vast network of motorways and airports. These long-term investments are critical for maintaining operational capacity and asset quality. In 2024, the company committed €1.5 billion to capital expenditures, underscoring the scale of investment required for growth and upkeep.

Ongoing operations and maintenance represent another major cost category, covering routine repairs, essential upkeep of airport terminals and runways, and safety system maintenance. These expenses ensure the seamless and safe flow of traffic and passengers across all concessions.

Concession fees, paid to governmental bodies for operating rights, form a significant part of Atlantia's cost base. Regulatory compliance and permit acquisition also add to expenses, ensuring adherence to safety and environmental standards, which is crucial for long-term operational viability.

Personnel and labor costs are substantial, with over 21,000 employees globally. These costs include salaries, benefits, and training, vital for managing complex infrastructure assets efficiently. Financing costs, driven by a net financial debt of €30.3 billion in 2024, also represent a significant expenditure, managed through instruments like sustainability-linked bonds.

| Cost Category | Description | 2024 Impact/Data |

|---|---|---|

| Capital Expenditures | Infrastructure development, expansion, and modernization | €1.5 billion |

| Operations & Maintenance | Routine repairs, upkeep of terminals/runways, safety systems | Ongoing investment for seamless and safe operations |

| Concession Fees | Payments to government for operating rights | Significant portion of operating costs for Italian concessions (2023 data) |

| Regulatory Compliance | Permits, safety and environmental standards adherence | Critical investment for operational licenses and reputation |

| Personnel & Labor | Salaries, benefits, training for over 21,000 employees | Vital for managing complex global infrastructure assets |

| Financing Costs | Interest expenses and debt servicing on financial debt | €30.3 billion net financial debt (2024) |

Revenue Streams

Mundys' core revenue comes from the tolls collected on its extensive network of motorways. These tolls are typically calculated based on how far a vehicle travels, the size or weight of the vehicle, and sometimes the specific road or section used. In 2024, traffic volume and planned tariff adjustments are key drivers that directly influence the total toll revenue generated.

Atlantia's revenue streams from airport operations are diverse, primarily stemming from fees levied on airlines and passengers. These include landing fees, aircraft parking charges, and passenger handling services, all vital for the company's profitability. For instance, in 2023, Atlantia's Italian airports handled over 100 million passengers, directly impacting the volume of these revenue-generating activities.

Atlantia generates significant income from commercial and retail activities within its airport and motorway networks. This includes revenue from renting out retail spaces, advertising opportunities, parking services, and sales from food and beverage outlets. These streams effectively capitalize on the substantial foot and vehicle traffic passing through their infrastructure.

In 2023, Atlantia's airports saw a notable recovery in passenger traffic, with volumes reaching 90% of pre-pandemic levels. This increased activity directly translates to higher retail and commercial revenues, as more travelers engage with airport amenities and services. For instance, retail and service revenues per passenger at its Italian airports showed a strong upward trend.

This diversification beyond direct toll or landing fees is a strategic imperative for Atlantia. It mitigates reliance on core infrastructure usage and captures additional value from the captive audience present at its high-traffic locations. The company actively manages and optimizes these commercial spaces to maximize their revenue-generating potential.

Digital Mobility Service Subscriptions

Digital mobility service subscriptions represent a key revenue driver for Atlantia, primarily through its Telepass system. This recurring income model is bolstered by integrated digital offerings that enhance user experience and loyalty.

The Telepass service, a cornerstone of Atlantia's digital mobility strategy, allows for electronic toll collection and seamless payments across a vast network. This convenience translates into a sticky customer base, generating consistent revenue streams.

- Telepass Subscriptions: This forms the core of digital mobility revenue, offering users a convenient way to pay tolls and access integrated services.

- Recurring Revenue: The subscription-based model ensures a predictable and stable income stream for Atlantia.

- Expansion of Digital Offerings: Atlantia is actively broadening its digital services, creating new avenues for revenue generation and increasing the value proposition for its users.

In 2024, Atlantia continued to see robust growth in its digital mobility segments. The Telepass system alone serves millions of users, with subscription revenues showing a steady upward trend, reflecting the increasing adoption of digital payment solutions in transportation.

Ancillary Transport Infrastructure Services

Ancillary services represent a significant revenue diversification for Atlantia, extending beyond core transport operations. These include engineering and maintenance services offered to external entities, capitalizing on the company's extensive infrastructure expertise. For instance, in 2024, Mundys, a key Atlantia subsidiary, continued to leverage its engineering capabilities for third-party projects, contributing to a more robust financial profile.

This strategic expansion into specialized transport solutions further broadens the revenue streams. By utilizing its existing assets and deep knowledge base, Atlantia can tap into niche markets, creating additional income opportunities. This approach not only diversifies revenue but also enhances the overall utilization of its operational and technical capabilities.

- Engineering Services: Offering specialized design, construction supervision, and technical consulting for infrastructure projects to external clients.

- Maintenance Services: Providing upkeep, repair, and operational support for transport infrastructure and related assets for third parties.

- Specialized Transport Solutions: Developing and delivering unique logistics or transport services that leverage existing infrastructure and expertise.

Beyond core infrastructure, Atlantia diversifies revenue through a robust digital mobility segment, primarily driven by its Telepass service. This subscription-based model offers a predictable income stream as millions of users adopt digital toll collection and integrated payment solutions.

In 2024, Telepass subscriptions continued their upward trajectory, reflecting increased digital payment adoption. This segment is crucial for generating recurring revenue and enhancing customer loyalty through expanded digital offerings.

Atlantia also leverages its infrastructure expertise by offering ancillary services, including engineering and maintenance, to external clients. This strategic move into specialized transport solutions capitalizes on existing capabilities, creating additional revenue opportunities and strengthening the company's financial profile.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Digital Mobility (Telepass) | Subscription fees for electronic toll collection and integrated services. | Telepass serves millions of users, with subscription revenues showing a steady upward trend in 2024. |

| Ancillary Services | Engineering and maintenance services offered to external entities. | Mundys (Atlantia subsidiary) continued leveraging engineering capabilities for third-party projects in 2024. |

Business Model Canvas Data Sources

The Atlantia Business Model Canvas is built using a comprehensive blend of financial reports, operational data, and market intelligence. These sources ensure each component, from value propositions to cost structures, is grounded in verifiable information.