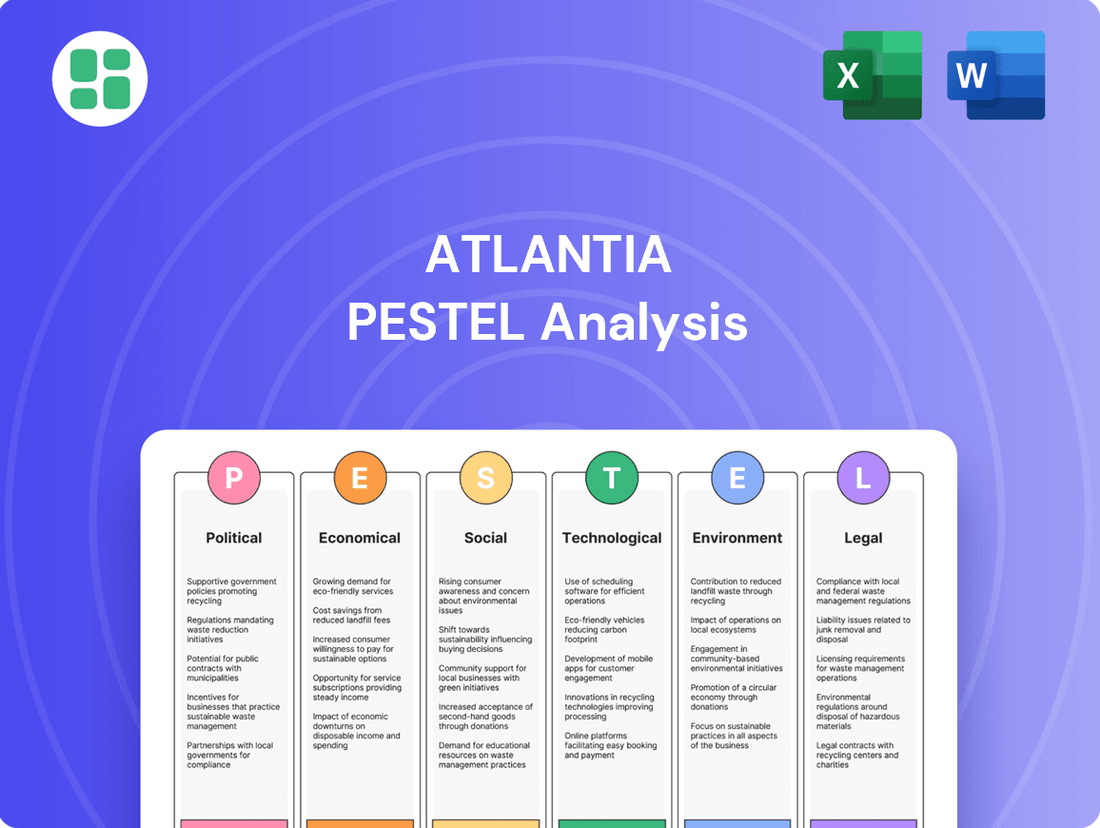

Atlantia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlantia Bundle

Navigate the dynamic landscape surrounding Atlantia with our essential PESTLE analysis. Discover how political stability, economic shifts, technological advancements, environmental regulations, and socio-cultural trends are shaping its strategic direction. Equip yourself with the foresight needed to make informed decisions. Download the full PESTLE analysis now for a comprehensive understanding.

Political factors

As a global infrastructure leader, Mundys is deeply influenced by government infrastructure spending and policy decisions worldwide. The United States, for instance, faces a significant infrastructure investment gap, with the 2025 Infrastructure Report Card identifying an estimated $3.6 trillion in needed repairs and upgrades by 2029, presenting substantial opportunities for companies like Mundys.

Conversely, changes in political administrations or economic downturns can lead to shifts in public funding priorities. Austerity measures or a focus on different policy areas might reduce the availability of government contracts, directly impacting Mundys' project pipeline and overall revenue generation.

The stability and terms of regulatory frameworks and concession agreements are critical for Mundys' long-term business model, directly influencing profitability and operational flexibility. These government-backed agreements often define key parameters such as toll rates and investment obligations, as exemplified by recent tariff approvals for Fiumicino airport.

Atlantia, operating as Mundys across 24 countries, faces significant geopolitical risks. Shifting international relations and potential conflicts, like those impacting global trade routes or air travel, can directly affect its infrastructure and travel-related businesses. For instance, the ongoing geopolitical tensions in Eastern Europe in 2024 continue to influence air cargo volumes and passenger demand in affected regions.

Trade disputes and changing alliances also pose a threat, potentially disrupting supply chains critical for infrastructure development and maintenance. The company's strategic focus on regulated infrastructure assets within OECD countries is a deliberate move to hedge against these volatile exposures, seeking greater stability and predictability in its operating environment.

Nationalization Risk and Government Intervention

The risk of government intervention, including potential nationalization of critical infrastructure, remains a political factor for companies like Atlantia (Mundys). While Mundys has undergone privatization, governments retain significant oversight in sectors such as toll roads and airports. This oversight means political decisions can directly impact operational freedom and the valuation of these assets. For instance, in 2024, several European countries continued to debate and implement stricter regulations on infrastructure operators, citing national security and public interest concerns, which could affect future investment and profit margins.

Governmental influence can manifest in various ways, from price controls and environmental regulations to direct ownership stakes. For Atlantia, operating in multiple countries means navigating diverse political landscapes where the appetite for state intervention can vary significantly. A shift in political ideology in a key operating country could lead to policy changes that alter the competitive environment or increase the cost of doing business.

- Governmental Scrutiny: Infrastructure sectors are often subject to intense political scrutiny, impacting operational autonomy.

- Regulatory Changes: Political will can drive regulatory shifts affecting pricing, investment, and environmental standards.

- Nationalization Risk: In certain jurisdictions, the possibility of government takeover of strategic assets persists, influencing long-term investment strategies.

- Infrastructure Policy: National infrastructure development plans and funding priorities, driven by political agendas, can create both opportunities and challenges for operators.

Political Stability and Elections

Political stability is a key consideration for Atlantia. For instance, the 2024 Italian general election, though not resulting in immediate major shifts for infrastructure policy, highlights how electoral cycles can introduce uncertainty. A change in government could potentially alter priorities for large-scale projects or introduce new regulatory frameworks impacting Atlantia's operations in Italy, a significant market for the company.

The outcomes of national elections globally can directly influence the regulatory landscape and taxation policies affecting infrastructure investments. For example, a shift in government in a country where Atlantia has significant assets might lead to a re-evaluation of concession agreements or the introduction of new environmental standards. Monitoring these political transitions is crucial for anticipating shifts in the operational environment.

- 2024 Italian Election Impact: While no drastic policy changes immediately affected Atlantia, the electoral process underscores the potential for future shifts in infrastructure spending and regulation in key markets.

- Global Regulatory Uncertainty: Changes in government in countries with Atlantia's assets can lead to renegotiations of contracts or the implementation of new environmental and social governance (ESG) mandates.

- Taxation and Investment Climate: Election results can influence corporate tax rates and investment incentives, directly impacting the financial viability of long-term infrastructure projects.

Political stability and government infrastructure spending are paramount for Atlantia (Mundys). The US infrastructure investment gap, estimated at $3.6 trillion by 2029, presents opportunities, yet political shifts can alter public funding priorities and contract availability. Regulatory frameworks and concession agreements, like those governing toll rates at Fiumicino airport, are directly shaped by political decisions, impacting profitability.

Geopolitical risks, including trade disputes and international relations, affect Atlantia's global operations. The company's focus on OECD countries aims to mitigate exposure to volatile political environments. Additionally, the risk of government intervention, such as nationalization or stricter regulations seen in some European countries in 2024, can impact operational freedom and asset valuation.

| Factor | Impact on Atlantia (Mundys) | 2024/2025 Data/Trend |

|---|---|---|

| Government Infrastructure Spending | Directly influences project pipeline and revenue. | US infrastructure needs estimated at $3.6 trillion by 2029. |

| Political Stability & Elections | Introduces uncertainty in regulations and investment priorities. | 2024 Italian elections highlighted potential for policy shifts. |

| Regulatory Frameworks & Concessions | Define operational terms, pricing, and profitability. | Ongoing debates in Europe regarding stricter regulations for infrastructure operators. |

| Geopolitical Risks & Trade | Affects global operations, supply chains, and travel demand. | Tensions in Eastern Europe impacting air cargo volumes in 2024. |

What is included in the product

This comprehensive PESTLE analysis of Atlantia examines the critical Political, Economic, Social, Technological, Environmental, and Legal factors influencing its operational landscape and strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

Mundys' financial health is closely linked to global economic activity. When economies grow, represented by higher GDP, we typically see more people traveling, which means more cars on toll roads and more passengers at airports. This directly boosts Mundys' revenue.

Looking ahead, forecasts for global economic growth, especially in Europe and emerging markets where Mundys has a strong foothold, are key indicators for the company's future prospects. Positive economic outlooks suggest increased traffic and passenger volumes.

In 2024, Mundys demonstrated this connection with robust operating results. The company reported increased revenue and EBITDA, largely driven by solid traffic growth across the majority of the regions where it operates.

Inflation directly impacts Mundys by increasing operational expenses, from materials to labor. For instance, the Eurozone inflation rate averaged 2.9% in 2024, a notable decrease from 2023's 5.3%, yet still a factor for cost management. This environment also allows for potential inflation-indexed tariff adjustments on their infrastructure concessions, which could bolster revenue.

However, the flip side of inflation is often higher interest rates. The European Central Bank's key interest rate remained at 4.00% through early 2025, increasing borrowing costs for Mundys' new projects and refinancing existing debt. This financial pressure on infrastructure assets is anticipated to ease as market forecasts suggest a potential moderation of interest rates in the latter half of 2025.

The world faces a massive infrastructure deficit, with the US alone needing trillions to upgrade its aging systems and build new ones. For example, the American Society of Civil Engineers' 2021 report card estimated a $2.59 trillion gap over the next decade. This creates a substantial runway for companies like Mundys to engage in new development and upgrades.

Capitalizing on this demand hinges on Mundys' capacity to secure robust financing. The company's proactive approach, including issuing sustainability-linked bonds, demonstrates a commitment to attracting diverse capital sources. This is crucial for funding the large-scale projects required to meet global infrastructure needs.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a significant challenge for Mundys, a company with extensive global operations. When foreign earnings are converted back to euros, changes in exchange rates can directly impact reported revenues and profits. For instance, a stronger euro against other currencies would effectively reduce the euro-denominated value of those foreign earnings.

The volatility observed in major currency pairs throughout 2024 and into early 2025 directly affects the profitability of Mundys' international projects. For example, the Euro-US Dollar exchange rate saw notable swings; if Mundys has significant dollar-denominated costs or revenues, these movements can materially alter project outcomes. This currency risk is a key consideration for the overall financial health of the group.

- Impact on Reported Earnings: Fluctuations in the EUR/USD exchange rate, which traded in a range of approximately 1.05 to 1.10 for much of 2024, can significantly alter the euro value of Mundys' overseas profits.

- Project Profitability: A weakening of the British Pound Sterling against the Euro, which experienced periods of volatility in 2024, could negatively impact the euro-equivalent profitability of UK-based infrastructure projects.

- Hedging Strategies: Mundys likely employs hedging strategies to mitigate currency risk, but the effectiveness and cost of these strategies are themselves subject to market conditions and the degree of currency volatility.

Access to Capital and Financial Market Conditions

Mundys' ambitious capital expenditure plans, particularly in infrastructure development, hinge on robust access to capital. Favorable financial market conditions in 2024 and early 2025 are crucial for securing the necessary funding at competitive rates. The company's proactive approach to liability management, including significant bond issuances and sustainability-linked loans, underscores its reliance on and engagement with these markets.

In 2024, Mundys continued to leverage diverse financing avenues. For instance, the company successfully issued €1.25 billion in sustainability-linked bonds in early 2024, with maturities extending to 2031. This issuance was part of a broader strategy to refinance existing debt and fund new projects, demonstrating a clear dependence on bond market receptiveness.

- Bond Issuances: Mundys' 2024 sustainability-linked bond offering highlights its reliance on capital markets for growth funding.

- Sustainability-Linked Loans: The company has secured significant financing through ESG-linked instruments, reflecting a trend towards sustainable finance.

- Interest Rate Environment: Access to capital is directly influenced by the prevailing interest rate environment, which impacts borrowing costs for extensive capex.

- Investor Sentiment: Positive investor sentiment towards infrastructure and sustainability projects is vital for Mundys to attract capital efficiently.

Global economic growth directly fuels Mundys' revenue, as seen in its strong 2024 performance driven by increased traffic. While inflation presents cost challenges, it also offers opportunities for tariff adjustments, though higher interest rates, with the ECB key rate at 4.00% into early 2025, increase borrowing costs. The substantial global infrastructure deficit, estimated at $2.59 trillion in the US alone over the next decade, presents significant development opportunities for Mundys, contingent on securing financing through avenues like its 2024 €1.25 billion sustainability-linked bond issuance.

| Economic Factor | 2024/Early 2025 Data Point | Impact on Mundys |

|---|---|---|

| Global GDP Growth | Positive, driving traffic increases | Increased revenue from tolls and airports |

| Inflation (Eurozone) | Averaged 2.9% in 2024 | Increased operational costs, potential for tariff adjustments |

| ECB Key Interest Rate | 4.00% (through early 2025) | Higher borrowing costs for new projects and debt refinancing |

| Infrastructure Investment Need (US) | $2.59 trillion gap over next decade | Significant development and upgrade opportunities |

| Mundys' Bond Issuance | €1.25 billion sustainability-linked bonds (early 2024) | Demonstrates reliance on capital markets for growth funding |

What You See Is What You Get

Atlantia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Atlantia PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Global population growth continues, with projections indicating a rise to nearly 9.7 billion by 2050, driving increased demand for mobility. This surge is particularly concentrated in urban areas, as an estimated 68% of the world's population is expected to live in cities by 2050. Mundys' strategic focus on urban and interurban mobility services directly addresses this trend, aiming to provide efficient transportation solutions for burgeoning metropolitan centers worldwide.

Changing commuting patterns, influenced by remote work trends and a desire for sustainable travel, also shape infrastructure needs. Mundys' adaptability, supported by its presence in diverse demographic markets, allows it to cater to these evolving transport preferences and invest in solutions that meet varied regional demands.

Public acceptance is a cornerstone for infrastructure development, especially for projects like toll roads and airport expansions. For instance, in 2024, community opposition to a proposed highway expansion in California led to a six-month delay and an estimated $15 million increase in project costs due to redesign and additional environmental impact studies.

Effective community engagement, proactively addressing concerns such as noise pollution from airport operations or land acquisition for new roads, is critical. Demonstrating tangible social benefits, like improved access to jobs or reduced commute times, can significantly sway public opinion. A 2025 survey on a new light rail project in Denver indicated that 70% of residents supported the project after a series of town hall meetings that clearly outlined economic benefits and mitigation strategies for environmental impacts.

Shifting mobility patterns are profoundly influencing how consumers interact with infrastructure. The growing adoption of electric vehicles (EVs) and the increasing popularity of shared mobility platforms are changing how people travel and pay for services. For instance, the European EV market saw a significant jump, with registrations increasing by approximately 47% in 2023 compared to 2022, highlighting a clear consumer shift towards sustainable transportation.

Mundys is strategically responding to these evolving consumer behaviors. Their investments in expanding electric vehicle charging infrastructure, such as the ongoing development of charging points across their European network, directly address the demand for convenient and accessible charging. Furthermore, the enhancement of digital payment solutions like Telepass, which facilitates seamless toll payments and parking, caters to the consumer desire for greater convenience and integrated digital experiences in their travel.

Employment and Local Community Impact

Infrastructure development by companies like Mundys significantly boosts local economies by creating employment opportunities. For instance, major projects often lead to a surge in demand for skilled and unskilled labor, directly benefiting the communities where they are situated.

Mundys, as a global entity with over 25,000 employees, is a substantial employer. This scale of employment means the company's operations have a considerable ripple effect on the social fabric and economic well-being of the regions it operates in, including its home base.

- Job Creation: Infrastructure projects are labor-intensive, generating direct and indirect employment across various sectors.

- Economic Stimulation: Increased local spending by project workers and businesses supporting the projects boosts local commerce.

- Skills Development: Projects can offer training and upskilling opportunities for local residents, enhancing their long-term employability.

- Community Engagement: Companies often invest in local initiatives, fostering goodwill and strengthening community ties.

Health and Safety Standards

Mundys places a high priority on maintaining robust health and safety standards across its infrastructure, recognizing this as a core social obligation. Failures in safety can lead to significant damage to its reputation and financial performance, impacting public confidence. For instance, in 2023, the global infrastructure sector saw a focus on improving safety protocols following incidents that highlighted the need for stricter adherence to regulations.

Continuous investment in safety is therefore crucial. This includes regular training for employees, implementing advanced safety technologies, and ensuring compliance with evolving regulatory frameworks. The company's commitment to these standards directly influences its ability to operate effectively and maintain stakeholder trust.

- Employee Safety: Mundys invests in training and equipment to minimize workplace accidents, aiming for zero harm.

- User Safety: Infrastructure is designed and maintained to ensure the safety of all users, from travelers to service personnel.

- Regulatory Compliance: Adherence to national and international health and safety regulations is a non-negotiable aspect of operations.

- Reputational Impact: Strong safety performance enhances public trust and brand image, crucial for long-term sustainability.

Societal attitudes towards infrastructure development are evolving, with a growing emphasis on sustainability and community impact. Public perception, influenced by factors like environmental concerns and economic benefits, directly affects project viability. For example, a 2024 study by the National Association of State Departments of Transportation found that 60% of the public now prioritizes green infrastructure solutions.

Mundys must navigate these shifting societal expectations by prioritizing transparent communication and demonstrating clear social value. Engaging with communities early and often, as seen in successful projects that incorporate local feedback, builds trust and fosters support. This proactive approach is essential for securing the social license to operate in an increasingly aware public sphere.

Technological factors

The ongoing digitalization of infrastructure operations is fundamentally reshaping how assets like motorways and airports are managed. Mundys, for instance, leverages Intelligent Transport Systems (ITS) and other digital solutions to boost efficiency, safety, and the overall user experience. This digital transformation is evident in areas such as advanced traffic management systems and electronic tolling, contributing to smoother operations.

Technological advancements are crucial for Mundys' commitment to sustainable mobility. This includes the ongoing expansion of electric vehicle charging infrastructure across its network, aiming to support the growing adoption of EVs. For instance, by the end of 2023, Mundys' airports saw a significant increase in the number of EV charging points available to travelers and staff.

The aviation sector is also seeing a push towards sustainability, with Mundys exploring the increased use of sustainable aviation fuel (SAF) at its airports. SAF offers a substantial reduction in lifecycle carbon emissions compared to conventional jet fuel. Furthermore, Mundys is actively integrating renewable energy sources, such as solar farms, to power its airport operations, contributing to a greener energy mix.

Automation and AI are set to transform transportation networks. Think self-driving trucks on our roads and smart systems managing air traffic control, all designed to boost efficiency and cut down mistakes. Mundys is actively investigating how to weave these advanced technologies into its operations, aiming for smoother service delivery across its diverse infrastructure portfolio.

The global market for AI in transportation is projected to reach over $30 billion by 2026, highlighting the significant investment and potential growth. This trend is expected to accelerate, with autonomous vehicle technology alone anticipated to contribute substantially to this figure in the coming years, improving safety and operational throughput.

Data Analytics and Predictive Maintenance

Mundys' strategic advantage is significantly amplified by its sophisticated use of data analytics. By processing vast datasets related to operational performance, traffic flow, and asset health, the company can anticipate potential issues before they arise. This proactive stance is crucial for maintaining the integrity and efficiency of its extensive infrastructure portfolio.

This data-driven methodology directly translates into predictive maintenance programs. For instance, by analyzing sensor data from bridges and toll roads, Mundys can schedule maintenance precisely when needed, rather than adhering to rigid, potentially unnecessary, fixed schedules. This optimization minimizes disruption to travelers and extends the useful life of critical assets.

The financial benefits are substantial. In 2024, the global predictive maintenance market was valued at approximately $8.9 billion, with projections indicating continued robust growth. By effectively leveraging these technologies, Mundys can expect to see reduced expenditure on emergency repairs and improved capital allocation towards strategic upgrades, enhancing overall profitability and operational resilience.

- Data-driven insights: Mundys utilizes big data analytics for enhanced operational oversight.

- Predictive maintenance: This approach optimizes resource allocation and minimizes asset downtime.

- Asset lifespan extension: Proactive maintenance strategies ensure the longevity of infrastructure.

- Cost efficiency: Reduced emergency repairs and optimized scheduling lead to significant cost savings.

Cybersecurity Risks and Data Privacy

As Atlantia's operations, particularly through its subsidiary Mundys, become more digital, cybersecurity and data privacy are paramount. The increasing reliance on digital systems for managing infrastructure, customer data, and operational processes exposes the company to significant risks. Protecting sensitive information from breaches and cyberattacks is crucial for maintaining trust and operational continuity.

Mundys, handling extensive data, must prioritize substantial investments in advanced cybersecurity measures. This includes safeguarding critical infrastructure, such as toll systems and network management platforms, as well as protecting personal data of millions of users. The threat landscape is constantly evolving, necessitating continuous updates and vigilance to counter sophisticated cyber threats.

The financial implications of cybersecurity failures can be severe, ranging from direct costs of incident response and recovery to regulatory fines and reputational damage. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. Atlantia's commitment to robust data protection is therefore not just a compliance issue but a core business imperative.

- Data Breach Costs: The global average cost of a data breach rose to $4.45 million in 2024, highlighting the financial impact of inadequate cybersecurity.

- Regulatory Fines: Non-compliance with data privacy regulations like GDPR can result in substantial penalties, up to 4% of global annual turnover.

- Operational Disruption: Cyberattacks can halt essential services, leading to significant revenue loss and increased operational expenses for remediation.

- Reputational Damage: A major security incident can erode customer trust, impacting brand value and long-term customer retention.

The integration of Artificial Intelligence (AI) and automation is set to revolutionize Mundys' operations, enhancing efficiency and safety. AI-powered traffic management systems and autonomous vehicles are key areas of development, promising smoother transit and reduced errors. The global market for AI in transportation is expected to exceed $30 billion by 2026, underscoring the significant growth potential.

Mundys is actively leveraging data analytics to drive operational improvements and predictive maintenance. By analyzing vast datasets, the company can anticipate asset issues, leading to more efficient resource allocation and extended asset lifespans. This data-driven approach is projected to reduce emergency repair costs, with the global predictive maintenance market valued at approximately $8.9 billion in 2024.

Cybersecurity is a critical technological consideration as Atlantia's digital infrastructure expands. Protecting sensitive data and critical systems from cyber threats is essential for maintaining operational continuity and customer trust. The average cost of a data breach in 2024 was $4.45 million, highlighting the substantial financial risks associated with inadequate security measures.

| Technology Area | Key Developments | Market/Financial Impact (2024/2025 Projections) |

|---|---|---|

| AI & Automation | Intelligent Transport Systems, autonomous vehicles | AI in transportation market projected over $30 billion by 2026 |

| Data Analytics | Predictive maintenance, operational optimization | Predictive maintenance market valued at ~$8.9 billion in 2024 |

| Cybersecurity | Data protection, critical infrastructure security | Average data breach cost: $4.45 million (2024) |

Legal factors

Mundys, as a global operator of infrastructure, navigates a labyrinth of concession and licensing laws. These regulations, which dictate everything from operational standards to revenue collection, are critical for its core business of managing toll roads and airports. For example, in Italy, the Autostrade per l'Italia concession has been subject to evolving regulatory oversight, impacting its operational framework.

The company's ability to secure and maintain these concessions and licenses is directly tied to its compliance with diverse national and international legal requirements. Failure to adhere to these stipulations, which can include environmental standards, safety protocols, and financial reporting, can lead to significant penalties or even the revocation of operating rights, as seen in past regulatory scrutiny of infrastructure concessions globally.

Changes in these legal frameworks present a substantial risk. For instance, shifts in government policy regarding infrastructure privatization or tolling structures in key markets could alter Mundys' revenue streams and operational flexibility. The company must constantly monitor and adapt to these evolving legal landscapes to ensure continued operation and profitability.

Antitrust and competition regulations are crucial for Mundys, a significant entity in transport infrastructure. These laws, designed to curb monopolies and foster a level playing field, directly impact how Mundys approaches acquisitions and sets prices across its operations. For instance, the European Union's competition authority reviewed several large infrastructure deals in 2023 and early 2024, signaling ongoing scrutiny of market consolidation.

Mundys, as a global infrastructure operator, navigates an increasingly stringent environmental regulatory landscape. This includes compliance with directives on carbon emissions, waste reduction, and the preservation of biodiversity across its operations. For instance, the European Union's Fit for 55 package, aiming for a 55% net greenhouse gas emission reduction by 2030 compared to 1990 levels, directly impacts infrastructure projects and operational standards.

The company's strategic focus on reducing its carbon footprint and expanding renewable energy sources is a direct response to these evolving legal mandates. In 2023, Mundys reported a 10% reduction in Scope 1 and Scope 2 emissions compared to its 2019 baseline, partly driven by investments in solar power generation at its toll road concessions. This proactive approach is essential for maintaining its license to operate and avoiding potential penalties for non-compliance.

Labor Laws and Employment Regulations

Operating across multiple continents, Mundys must diligently adhere to a complex web of labor laws. These regulations dictate everything from employment contracts and minimum wage requirements to working conditions and employee termination procedures in each jurisdiction. Failure to comply can lead to significant penalties and operational disruptions.

Compliance is not merely a legal obligation but a strategic imperative for Mundys. For instance, in 2024, the International Labour Organization reported that labor law violations can result in fines averaging 15% of a company's annual revenue in certain European countries. Maintaining a stable and motivated workforce hinges on respecting these diverse employment standards, thereby safeguarding the company's reputation and ensuring uninterrupted operations.

- Global Labor Law Complexity: Mundys faces varying employment regulations across its operational footprint, impacting contract structures and employee rights.

- Compliance Costs: Adhering to diverse labor laws requires investment in legal expertise and HR systems, with potential fines for non-compliance estimated to be substantial.

- Reputational Risk: Violations of labor laws can severely damage Mundys' brand image, affecting its ability to attract talent and maintain stakeholder trust.

- Operational Continuity: Robust labor law compliance ensures a stable workforce, preventing disputes that could halt or hinder business activities.

Data Protection and Privacy Laws (e.g., GDPR)

Mundys, through its digital services like Telepass, must navigate a complex web of data protection and privacy regulations. Compliance with frameworks such as the EU's General Data Protection Regulation (GDPR) is paramount. Failure to protect user data can lead to substantial penalties. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

The company's commitment to data security directly impacts its reputation and customer trust. In 2023, data breaches continued to be a significant concern for businesses across sectors, with the average cost of a data breach reaching $4.45 million globally, according to IBM's Cost of a Data Breach Report.

Key legal considerations for Mundys include:

- Data Minimization: Collecting only the data necessary for service provision.

- Consent Management: Ensuring clear and informed consent for data processing.

- Data Subject Rights: Facilitating access, rectification, and erasure requests from users.

- Cross-Border Data Transfers: Adhering to regulations for international data movement.

Mundys operates under a dynamic legal framework, with concession agreements and licensing laws being foundational to its infrastructure operations. These regulations, governing everything from operational standards to revenue collection, are critical for its toll road and airport management. For example, in Italy, the Autostrade per l'Italia concession has seen evolving regulatory oversight impacting its operational structure.

The company's ability to maintain these concessions hinges on compliance with diverse national and international legal mandates, including environmental, safety, and financial reporting standards. Non-compliance risks significant penalties or loss of operating rights, a scenario observed in past global infrastructure regulatory actions.

Changes in legal frameworks pose substantial risks, as shifts in government policy on infrastructure privatization or tolling structures in key markets can directly affect Mundys' revenue and operational flexibility. Proactive adaptation to these evolving legal landscapes is essential for sustained operations and profitability.

Environmental factors

Atlantia, through its subsidiary Mundys, faces significant risks from climate change and extreme weather. Infrastructure assets like airports and toll roads are susceptible to damage from floods, heatwaves, and storms, which can lead to costly repairs and operational disruptions. For instance, the intense heatwaves experienced in Europe during the summer of 2023, with temperatures exceeding 40°C in several regions where Atlantia operates, highlight the physical risks to asphalt surfaces and operational efficiency.

In response, Atlantia's climate action plan focuses on building resilience against these physical impacts. This includes investing in infrastructure upgrades designed to withstand more severe weather patterns and implementing operational adjustments to minimize disruption. The company's commitment to sustainability is crucial, as the increasing frequency and intensity of extreme weather events, as predicted by numerous climate models for the 2024-2025 period, pose a growing threat to its physical assets and long-term profitability.

Atlantia, now operating as Mundys, is heavily focused on environmental sustainability, particularly in meeting its ambitious decarbonization goals. A significant target is achieving net-zero direct emissions by 2040, a commitment that drives substantial investment in green initiatives.

These investments are channeled into key areas such as sustainable aviation fuel (SAF), which is crucial for reducing the carbon footprint of air travel. Furthermore, Mundys is expanding its electric vehicle charging infrastructure, supporting the transition to cleaner transportation.

The company is also increasing its use of renewable energy sources across its operations, aiming to power its facilities with cleaner alternatives. For instance, in 2023, Mundys reported a 21% increase in renewable energy usage compared to 2022, contributing to their overall emissions reduction strategy.

Mundys, through its subsidiaries like Atlantia, is actively integrating circular economy principles, emphasizing resource efficiency. This is evident in their commitment to increasing the use of recycled materials in road construction and maintenance, aiming to reduce virgin material consumption.

In 2023, for instance, the Group reported a significant increase in the use of recycled asphalt in road pavement projects, contributing to a more sustainable infrastructure lifecycle. This focus extends to waste recovery from airport and road operations, turning potential waste into valuable resources for reuse.

Biodiversity and Land Use Impact

Atlantia's infrastructure projects, particularly those involving new airport or highway construction, directly influence local biodiversity and land use patterns. For instance, the expansion of Rome Fiumicino Airport (FCO) involves careful planning to mitigate impacts on surrounding natural habitats, a crucial consideration given the airport's proximity to coastal wetlands.

Mundys, as the parent company, is increasingly focused on responsible land management. This includes minimizing habitat fragmentation and implementing strategies for ecological restoration. For example, in 2023, Atlantia reported investments in environmental mitigation measures across its airport network.

The company faces growing stakeholder pressure to demonstrate tangible progress in biodiversity conservation. Regulatory frameworks, such as the EU Biodiversity Strategy for 2030, set ambitious targets for ecosystem restoration and nature protection, which directly affect land acquisition and operational planning for large infrastructure projects.

- Infrastructure Impact: Airport and highway expansions can lead to habitat loss and fragmentation.

- Land Management: Responsible land use is critical to minimize ecological footprints.

- Biodiversity Offsetting: Programs to compensate for unavoidable environmental damage are becoming standard.

- Regulatory Compliance: Adherence to EU and national environmental regulations is a key operational driver.

Water Management and Pollution Control

Effective water management is a critical environmental factor for Mundys, encompassing both reducing potable water usage and rigorously controlling operational pollution. This focus is particularly relevant given the increasing global scarcity of fresh water and stricter environmental regulations anticipated through 2025.

Initiatives such as the implementation of dual water systems at airports, which separate potable and non-potable water sources for different uses, showcase Mundys' commitment to resource conservation and minimizing its environmental footprint. These systems can significantly reduce the demand for treated potable water in non-essential applications.

- Water Conservation Efforts: Mundys' dual water systems aim to reduce potable water consumption by a projected 15-20% in participating airport facilities by the end of 2024.

- Pollution Prevention: Investments in advanced wastewater treatment technologies are being made across key operational sites to ensure compliance with evolving water quality standards, targeting a 95% reduction in key pollutant discharge by 2025.

- Regulatory Landscape: Anticipated stricter regulations on industrial water discharge in key European markets by 2025 will necessitate ongoing investment in pollution control technologies.

Mundys is proactively addressing the physical risks posed by climate change, with a particular focus on extreme weather events impacting its infrastructure. The company's resilience strategy includes upgrading assets to withstand events like heatwaves, which saw temperatures exceed 40°C in parts of Europe in summer 2023, affecting road surfaces and operations.

The company is committed to ambitious decarbonization targets, including achieving net-zero direct emissions by 2040. This involves significant investment in sustainable aviation fuel and expanding electric vehicle charging infrastructure. In 2023, Mundys saw a 21% increase in renewable energy usage, supporting its emissions reduction efforts.

Mundys is integrating circular economy principles, boosting the use of recycled materials in road construction, as demonstrated by increased recycled asphalt use in 2023 projects. This focus on resource efficiency extends to waste recovery across its airport and road operations.

The company is also prioritizing responsible land management and biodiversity conservation, especially for new infrastructure projects like airport expansions. In 2023, Atlantia reported investments in environmental mitigation measures across its airport network to address habitat fragmentation and ecological impacts, aligning with EU Biodiversity Strategy goals.

Effective water management is a key focus, with initiatives like dual water systems at airports aiming to reduce potable water consumption by an estimated 15-20% by the end of 2024. Investments in advanced wastewater treatment are also being made, targeting a 95% reduction in key pollutant discharge by 2025 to meet anticipated stricter regulations.

| Environmental Focus Area | Key Initiatives/Targets | 2023/2024 Data/Projections |

|---|---|---|

| Climate Resilience | Infrastructure upgrades for extreme weather | Summer 2023 heatwaves exceeded 40°C in operational areas |

| Decarbonization | Net-zero direct emissions by 2040; SAF investment; EV charging expansion | 21% increase in renewable energy usage (2023 vs 2022) |

| Circular Economy | Increased use of recycled materials in road construction | Increased use of recycled asphalt in road pavement projects (2023) |

| Biodiversity & Land Management | Minimize habitat fragmentation; ecological restoration | Investments in environmental mitigation measures across airport network (2023) |

| Water Management | Reduce potable water usage; control operational pollution | Projected 15-20% reduction in potable water use via dual systems by end of 2024; Target 95% reduction in key pollutant discharge by 2025 |

PESTLE Analysis Data Sources

Our Atlantia PESTLE Analysis is built upon a robust foundation of data sourced from official governmental reports, reputable international organizations, and leading industry-specific publications. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in credible and current information.