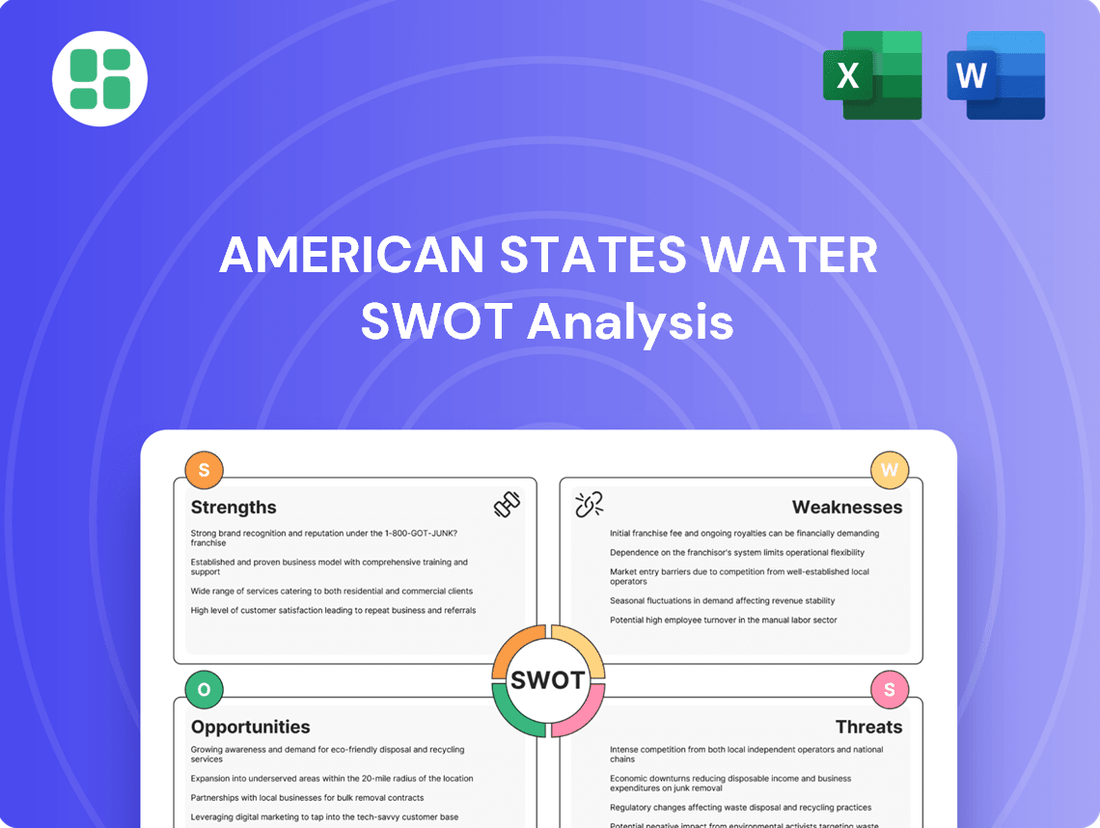

American States Water SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American States Water Bundle

The American States Water SWOT analysis reveals critical insights into their market position, highlighting strong operational efficiencies and a stable customer base as key strengths. However, it also uncovers potential vulnerabilities related to regulatory changes and infrastructure investment needs.

Want the full story behind American States Water's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

American States Water Company benefits significantly from its operations in regulated water and electric utility markets, ensuring stable and predictable revenue. In 2023, the company reported total operating revenues of $423.4 million, a testament to the consistent demand for its essential services.

The California Public Utilities Commission (CPUC) plays a crucial role by approving rate adjustments, allowing American States Water to recover operational costs and achieve a fair return on its substantial infrastructure investments. This regulatory oversight cushions the company against the unpredictable swings often seen in less regulated industries.

American States Water (AWR) stands out with an impressive 71 consecutive years of increasing its annual dividends. This remarkable streak highlights the company's financial stability and dedication to rewarding its shareholders consistently.

This sustained dividend growth is a strong indicator of AWR's robust financial health and efficient operations, making it a compelling choice for investors prioritizing income generation. The company has a stated goal of achieving a compound annual growth rate in its dividend exceeding 7% over the long haul.

American States Water (AWR) boasts strong credit ratings, reflecting its solid financial standing. Standard & Poor's has awarded AWR an 'A' rating and Golden State Water Company an 'A+' rating. Moody's also provides a favorable 'A2' rating for Golden State Water.

These high ratings underscore the company's financial stability and its capacity to manage debt responsibly. This financial strength is crucial for securing capital at competitive rates, enabling continued investment in essential infrastructure upgrades and maintenance.

Long-Term Contracts with Military Bases

American States Utility Services (ASUS), a key subsidiary, benefits from long-term privatization contracts, many extending up to 50 years, to manage water and wastewater systems on U.S. military bases. This structure guarantees a consistent and predictable revenue stream for the company's contracted services segment.

These enduring agreements provide significant stability. For instance, as of the first quarter of 2024, ASUS had secured over $600 million in capital improvement projects, offering a clear line of sight for sustained growth and investment in infrastructure.

- Stable Revenue: Long-term contracts, often 50 years, provide predictable income from military base services.

- Growth Visibility: Recent awards of capital upgrade projects, totaling over $600 million in Q1 2024, highlight future revenue potential.

- Strategic Partnerships: These contracts represent strong, enduring relationships with government entities.

- Infrastructure Investment: The projects ensure ongoing modernization and service enhancement for military facilities.

Approved Capital Investment Programs

American States Water (AWR) benefits significantly from approved capital investment programs, particularly those authorized by the California Public Utilities Commission. These approvals provide a strong foundation for predictable revenue streams and earnings growth.

Recent decisions have greenlit almost $650 million in capital investments for AWR's regulated utility operations. This substantial funding allows for crucial upgrades and expansions of essential infrastructure, ensuring reliable service delivery.

The company anticipates capital investments to range between $170 million and $210 million in 2025 alone. This focused investment strategy directly supports AWR's long-term growth trajectory by enhancing its operational capabilities and service quality.

- Approved Capital Investments: Nearly $650 million authorized by the California Public Utilities Commission.

- 2025 Projected Investments: Estimated between $170-$210 million.

- Growth Driver: Enables infrastructure upgrades and expansion, supporting future revenue and earnings.

- Regulatory Support: Clear path for growth through commission-approved rate cases and investment plans.

American States Water Company's strengths lie in its stable, regulated utility operations and its long-standing commitment to shareholder returns. The company's regulated water and electric utilities provide a predictable revenue base, further bolstered by the California Public Utilities Commission's approval of rate adjustments that allow for cost recovery and a return on infrastructure investments. This stability is underscored by an impressive 71 consecutive years of dividend increases, signaling robust financial health and a dedication to investors.

Furthermore, American States Water benefits from its subsidiary, American States Utility Services (ASUS), which secures long-term privatization contracts, many lasting up to 50 years, for managing water and wastewater systems on U.S. military bases. These contracts offer a consistent and predictable revenue stream, with over $600 million in capital improvement projects secured by ASUS as of Q1 2024, demonstrating clear growth visibility.

The company's financial strength is also reflected in its high credit ratings from agencies like Standard & Poor's ('A' for AWR, 'A+' for Golden State Water) and Moody's ('A2' for Golden State Water), which facilitate access to capital for essential infrastructure upgrades. Approved capital investment programs, such as the nearly $650 million authorized by the California Public Utilities Commission, provide a strong foundation for predictable revenue and earnings growth, with projected investments of $170 million to $210 million in 2025 alone.

| Metric | Value | Year | Source |

|---|---|---|---|

| Total Operating Revenues | $423.4 million | 2023 | Company Filings |

| Consecutive Dividend Increases | 71 years | As of 2024 | Company Investor Relations |

| ASUS Capital Improvement Projects Secured | Over $600 million | Q1 2024 | Company Filings |

| California Capital Investments Approved | ~$650 million | Recent Decisions | Company Filings |

| Projected 2025 Capital Investments | $170 - $210 million | 2025 | Company Filings |

What is included in the product

Analyzes American States Water’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical water resource challenges.

Weaknesses

American States Water Company's heavy reliance on California for its utility operations presents a significant weakness. In 2023, approximately 89% of the company's total revenue was generated from its California utility segment, highlighting this substantial geographic concentration.

This concentration exposes AWR to heightened risks tied to California's specific regulatory environment, which is known for its stringent environmental standards and evolving water management policies. For instance, the state's ongoing drought conditions and climate change impacts directly affect water availability, potentially increasing operational costs and limiting growth opportunities for the company.

The contracted services segment of American States Water, while benefiting from long-term military contracts, can exhibit significant quarter-to-quarter earnings fluctuations. This volatility stems from the inherent timing of construction projects and their completion schedules.

For example, in the second quarter of 2025, this segment experienced a downturn in earnings. This dip was primarily attributed to reduced construction activity during that period, even though the company maintained strong projections for the full year.

American States Water, like many in its sector, contends with the persistent issue of aging infrastructure. This necessitates significant and ongoing investment to maintain operational efficiency and meet regulatory standards.

The broader U.S. water utility sector faces a projected need for over $1.2 trillion in infrastructure investment through 2040. This substantial capital expenditure requirement underscores the continuous financial commitment American States Water must undertake to guarantee reliable service and compliance.

Intensifying Regulatory Compliance Burden and Costs

American States Water faces a growing challenge from intensifying regulatory compliance burdens and associated costs. New Environmental Protection Agency (EPA) standards for per- and polyfluoroalkyl substances (PFAS), often called forever chemicals, are a prime example. Meeting these evolving environmental mandates will require substantial capital outlays for advanced testing, treatment technologies, and ongoing monitoring programs.

These compliance obligations directly translate into increased operational expenses, potentially affecting the company's financial health. Utilities like American States Water, which may require significant infrastructure upgrades to meet these new benchmarks, are particularly susceptible to these cost pressures. For instance, the EPA's proposed PFAS drinking water standards, released in March 2023, could necessitate billions in nationwide investments for water systems, impacting companies across the sector.

- Increased Capital Expenditures: Significant investments are anticipated for PFAS treatment and monitoring infrastructure.

- Higher Operating Costs: Ongoing expenses for testing, compliance reporting, and maintenance will rise.

- Potential Impact on Profitability: Increased costs without commensurate revenue increases could pressure profit margins.

- Regulatory Uncertainty: Evolving regulations create ongoing planning and financial risk.

Sensitivity to Financial Market Conditions

American States Water's financial performance is susceptible to shifts in the broader financial market. For instance, during the first half of 2025, the company experienced adverse impacts on its consolidated diluted earnings per share. These were primarily due to losses recorded on investments designated for retirement plans and the dilutive effect stemming from equity issued through its at-the-market (ATM) program.

- Market Volatility Impact: Broader financial market downturns can negatively affect investment portfolios held for employee retirement plans, directly reducing reported earnings.

- Equity Issuance Dilution: The use of ATM programs to raise capital, while beneficial for funding, can dilute existing shareholders' earnings per share if not managed carefully against earnings growth.

- Q1-Q2 2025 Performance: Specific periods, such as Q1 and Q2 of 2025, highlighted these sensitivities, showing a tangible reduction in EPS due to these market-related factors.

American States Water's substantial reliance on California, with 89% of its 2023 revenue from the state, poses a significant weakness. This geographic concentration exposes the company to California's stringent regulatory environment, including evolving water management policies and climate change impacts, which can increase operational costs and limit growth.

The company's contracted services segment can experience earnings volatility due to the timing of construction projects, as seen in a Q2 2025 downturn in segment earnings from reduced construction activity. Furthermore, aging infrastructure requires continuous, significant capital investment, a challenge amplified by the sector's projected $1.2 trillion infrastructure need through 2040.

Intensifying regulatory compliance, particularly with new EPA standards for PFAS, presents another weakness. Meeting these evolving environmental mandates, like the proposed PFAS drinking water standards from March 2023, necessitates substantial capital outlays for treatment and monitoring, potentially increasing operational expenses and impacting profitability.

Financial market volatility also affects American States Water. In the first half of 2025, the company's consolidated diluted earnings per share were negatively impacted by losses on investments for retirement plans and dilution from equity issued via its ATM program.

| Weakness Category | Specific Issue | Impact/Example |

|---|---|---|

| Geographic Concentration | High reliance on California revenue (89% in 2023) | Exposure to California's regulatory and environmental risks |

| Segment Volatility | Timing of construction projects in contracted services | Quarter-to-quarter earnings fluctuations; Q2 2025 downturn |

| Infrastructure | Aging utility infrastructure | Need for significant, ongoing capital investment; sector needs $1.2T by 2040 |

| Regulatory Compliance | New EPA PFAS standards | Increased capital for treatment/monitoring; higher operating costs |

| Financial Market Sensitivity | Investment losses and equity issuance | Negative impact on EPS (e.g., H1 2025); dilution risk from ATM programs |

Preview Before You Purchase

American States Water SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The U.S. faces a critical need for water infrastructure upgrades, with projected municipal capital expenditures for water and wastewater treatment expected to surpass $515 billion by 2035. This massive undertaking addresses a funding deficit exceeding $1.2 trillion over the next two decades.

This presents a substantial opportunity for American States Water to capitalize on the demand for essential services. The company is well-positioned to secure new contracts, expand its operational footprint, and invest in modernizing existing water systems, directly contributing to its future revenue streams and market share.

American States Water, through its subsidiary American States Utility Services (ASUS), is well-positioned to capitalize on the expansion of military base operations. ASUS has a proven track record and deep expertise in managing water and wastewater systems on these installations, making it a prime candidate for new privatization contracts. For instance, in 2023, the U.S. Army continued its privatization initiatives, awarding contracts that represent significant long-term revenue streams for successful bidders.

Securing additional long-term contracts for military base water and wastewater services offers a substantial opportunity for American States Water to further diversify its revenue streams and enhance earnings stability. These agreements often span decades, providing predictable cash flows that can support ongoing investment and growth. The Department of Defense's commitment to infrastructure modernization, including water systems, suggests a continued pipeline of opportunities in the coming years.

The growing adoption of smart water management technologies, including IoT sensors and advanced data analytics, offers American States Water (AWR) a significant opportunity to boost its operational efficiency. This shift in the water utility sector allows for better monitoring and control, directly impacting how water resources are managed.

By embracing these digital advancements, AWR can target a reduction in non-revenue water loss, a critical metric for utility profitability. For instance, in 2023, the water utility industry continued to grapple with water loss, with estimates suggesting that a substantial percentage of treated water is lost before reaching customers, highlighting the potential for savings.

Furthermore, investing in digital transformation enables optimized resource allocation and predictive maintenance strategies. This proactive approach can lead to considerable cost savings and bolster AWR's commitment to sustainability, ensuring more reliable service delivery and improved customer satisfaction.

Growing Demand for Water Conservation and Reuse Solutions

The escalating global population and the intensifying impact of climate change on water availability are fueling a significant increase in the demand for effective water supply, conservation, and reuse strategies. This presents a prime opportunity for American States Water (AWR) to expand its offerings and expertise.

AWR can capitalize on this trend by strategically investing in cutting-edge water treatment technologies, exploring desalination projects, and championing water recycling initiatives. Such investments directly address the growing need for water security and sustainability, aligning perfectly with regulatory pressures and public demand for responsible water management.

- Increased Investment: The global water and wastewater treatment market was valued at approximately $650 billion in 2023 and is projected to grow significantly, with reuse and conservation technologies being key drivers.

- Regulatory Tailwinds: Many states are implementing stricter regulations and offering incentives for water conservation and reuse, creating a favorable environment for AWR's solutions.

- Technological Advancement: Innovations in membrane technology, advanced oxidation processes, and smart water management systems are making water reuse more efficient and cost-effective.

- Customer Demand: Both residential and industrial customers are increasingly seeking sustainable water solutions, driving demand for AWR's conservation and recycling services.

Leveraging Public-Private Partnerships

The increasing emphasis on public-private partnerships (PPPs) for infrastructure projects presents a significant opportunity for American States Water (AWR). As municipalities grapple with aging water systems and substantial capital requirements, AWR's established financial stability and operational acumen position it to be a key partner in these ventures.

AWR can capitalize on this trend by actively seeking and participating in PPPs to fund critical water infrastructure upgrades and expansions. This approach allows the company to access new revenue streams and contribute to essential public services while managing project risks and returns.

- Growing Infrastructure Funding Gap: U.S. water infrastructure needs an estimated $1 trillion investment over the next 25 years according to the EPA, creating a demand for alternative financing.

- AWR's Financial Strength: As of Q1 2024, American States Water reported total assets of approximately $4.4 billion, providing a solid foundation for engaging in large-scale PPP projects.

- Expertise in Water Management: AWR's long history of managing water systems for diverse communities enhances its appeal as a partner for public entities seeking reliable operational expertise.

- Innovation in Financing: PPPs can unlock innovative financing mechanisms, allowing AWR to participate in projects that might otherwise be beyond the scope of traditional utility investments.

The substantial need for water infrastructure upgrades across the U.S., with an estimated $1.2 trillion funding deficit over the next two decades, creates a prime opportunity for American States Water (AWR). The company's subsidiary, American States Utility Services (ASUS), is also well-positioned to secure new privatization contracts for water and wastewater systems on military bases, building on its proven track record and the Department of Defense's ongoing infrastructure modernization efforts.

AWR can leverage the growing adoption of smart water management technologies to improve operational efficiency and reduce water loss, a critical issue for utilities. Furthermore, the increasing global demand for water security, driven by population growth and climate change, allows AWR to expand its offerings in water treatment, desalination, and recycling initiatives.

The increasing reliance on public-private partnerships (PPPs) for infrastructure projects offers AWR a chance to finance critical water system upgrades and expansions, leveraging its financial strength, estimated at $4.4 billion in total assets as of Q1 2024, and its extensive expertise in water management.

Threats

Climate change presents a substantial risk to Golden State Water Company's operations in California, a key service area. The state's reliance on snowpack for water storage is directly threatened by warming temperatures, potentially reducing available supply. This impacts water availability and could increase the costs associated with securing and treating water.

More frequent and intense droughts and floods, coupled with rising sea levels, further exacerbate these challenges. Droughts can lead to direct supply shortages, while floods can contaminate water sources and damage infrastructure. Rising sea levels also pose a threat to coastal water quality through saltwater intrusion, necessitating more advanced and costly treatment processes.

These environmental shifts are likely to result in increased operational expenses for water treatment and infrastructure resilience. Furthermore, heightened regulatory scrutiny regarding water quality and supply reliability is anticipated, potentially leading to compliance costs and operational adjustments for American States Water.

Environmental regulations are becoming tougher and more complex, posing a real challenge for American States Water. For instance, new standards for chemicals like PFAS are emerging, and places like California are implementing stricter rules on urban water use. These changes mean the company has to adapt quickly.

Meeting these evolving environmental mandates often demands significant financial outlay for updated treatment systems and infrastructure upgrades. This can directly affect American States Water's bottom line, potentially squeezing profit margins. Furthermore, any necessary rate increases to cover these compliance costs could face pushback from the public, creating an additional hurdle.

Rising interest rates pose a significant threat to American States Water (AWR) by increasing the cost of debt financing for its capital-intensive infrastructure projects. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a target range of 5.25%-5.50% by July 2023, directly impact AWR's borrowing costs for essential upgrades and expansions.

Simultaneously, persistent inflationary pressures in 2024 and into 2025 are driving up AWR's operational expenses. Costs for labor, construction materials like pipes and treatment chemicals, and energy are all subject to upward pressure, potentially squeezing profit margins if these increased costs cannot be promptly passed on through regulatory-approved rate adjustments.

Public and Political Opposition to Rate Increases

As a regulated utility, American States Water Company (AWR) must obtain regulatory approval for rate increases to cover operational costs and fund necessary infrastructure upgrades. These requests frequently encounter public and political resistance, potentially delaying approvals or resulting in lower-than-requested adjustments. For instance, in California, where AWR operates a significant portion of its business, rate case proceedings can be lengthy and subject to intense scrutiny from consumer advocates and elected officials. This opposition can directly impact the company's ability to achieve its targeted returns and execute its capital investment plans, which are crucial for maintaining and enhancing its water and wastewater systems.

The financial implications of delayed or reduced rate increases can be substantial. In 2024, AWR was seeking rate increases across its service territories. While specific outcomes are subject to ongoing regulatory processes, the historical pattern suggests that negotiated settlements or modified approvals are common. This environment necessitates careful financial planning and robust advocacy to ensure that rate adjustments adequately reflect the company's costs and investment needs.

- Regulatory Lag: Delays in rate case approvals can postpone revenue recovery, impacting earnings and cash flow.

- Reduced Rate Adjustments: Public and political opposition can lead to rate increases being lower than initially requested, affecting profitability.

- Investment Deferral: Insufficient rate relief may force AWR to defer or scale back critical infrastructure projects, potentially impacting service quality and future growth.

Potential for Reduced Federal Funding or Policy Shifts

Changes in federal water policy, especially with new administrations, can significantly impact funding and environmental regulations. For instance, a shift towards deregulation could lessen the financial strain on utilities for compliance but might also reduce federal infrastructure grants.

The potential for reduced federal funding presents a significant threat. In 2024, federal infrastructure spending, while substantial, is subject to political winds. A decrease in federal aid could force utilities like American States Water to shoulder more of the costs for critical upgrades, potentially impacting rate structures.

- Reduced Federal Grants: A potential decrease in federal grants for water infrastructure projects could increase the financial burden on American States Water for essential upgrades.

- Policy Shifts: Changes in federal environmental regulations, driven by new administrations, might require increased compliance spending without corresponding federal support.

- Increased Capital Expenditures: Without robust federal assistance, the company might need to accelerate its capital expenditure plans, funded through higher rates or debt.

- Uncertainty in Funding: The unpredictable nature of federal funding can create uncertainty in long-term financial planning for major infrastructure investments.

Intensifying competition from other water utilities and private water companies could pressure American States Water's market share and pricing power. Furthermore, the company faces the threat of technological obsolescence if it fails to invest in and adopt advanced water management and treatment technologies, potentially leading to higher operational costs and reduced efficiency compared to more innovative competitors.

| Threat Category | Specific Threat | Impact on American States Water | Example/Data Point (2024-2025) |

|---|---|---|---|

| Competition | Increased competition from other utilities/private firms | Potential loss of market share, pressure on pricing | Emergence of new private water management contracts in similar service areas. |

| Technological Obsolescence | Failure to adopt advanced water technologies | Higher operational costs, reduced efficiency, potential service quality decline | Competitors adopting smart metering and AI-driven leak detection systems, improving operational efficiency by an estimated 10-15%. |

| Cybersecurity Risks | Attacks on water infrastructure control systems | Service disruption, data breaches, reputational damage, significant recovery costs | Increased reports of ransomware attacks on critical infrastructure globally, with estimated recovery costs averaging $4.6 million per incident in 2024. |

SWOT Analysis Data Sources

This analysis draws upon a comprehensive range of data, including state-level water resource reports, federal environmental agency data, and economic impact studies, to provide a robust understanding of the American states' water landscape.