American States Water Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American States Water Bundle

Discover how American States Water leverages its product offerings, pricing strategies, distribution channels, and promotional activities to maintain its market leadership. This analysis delves into the core of their marketing mix, revealing the strategic choices that drive customer engagement and satisfaction.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for American States Water. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

American States Water Company's essential utility services, provided through Golden State Water and Bear Valley Electric, are the core of its offering. These are not just services; they are fundamental necessities for over one million people across California. The company's commitment is to deliver a reliable and high-quality supply, meeting all regulatory requirements to ensure public health and safety.

In 2023, American States Water reported total operating revenues of $1.1 billion, with its water and wastewater segment contributing significantly. This highlights the consistent demand and essential nature of their product. The company invests heavily in infrastructure to maintain and upgrade its systems, ensuring the dependability of water and electricity for its diverse customer base, from homes to large industrial operations.

American States Water, through its subsidiary ASUS, offers specialized contracted water and wastewater services primarily to military installations. This product is a comprehensive package including operations, maintenance, and construction management, designed for a niche institutional market. These long-term agreements, often spanning 30 to 50 years, provide a stable revenue stream, with ASUS currently managing 16 such contracts as of early 2024.

Reliability and quality assurance are foundational to American States Water's product. As a regulated utility, the company prioritizes delivering safe, clean drinking water and consistent electric service, a commitment reinforced by ongoing infrastructure upgrades and strict adherence to health and safety regulations.

This dedication is crucial for maintaining public trust and meeting environmental and public health mandates. For instance, in 2023, American States Water reported capital expenditures of $307.7 million, a significant portion of which is directed towards enhancing the reliability and quality of its water and wastewater systems, ensuring compliance with evolving standards.

Infrastructure Development and Modernization

American States Water's product offering is deeply rooted in the continuous development and modernization of essential infrastructure. This encompasses everything from upgrading water treatment plants to replacing aging water mains and enhancing electricity distribution networks. These improvements are not just about maintenance; they are vital for ensuring future service capabilities and long-term value.

Significant capital investments are crucial for this ongoing renewal. For instance, in 2023, American States Water invested approximately $520 million in capital improvements across its water and electric utilities. These investments are typically authorized by regulatory bodies, allowing the company to upgrade systems, bolster resilience against disruptions, and guarantee the reliability of its services for years to come.

The tangible results of these investments are evident in the improved quality and availability of essential services. Key areas of focus include:

- Water Treatment and Distribution: Enhancing the safety and efficiency of water delivery.

- Wastewater Management: Upgrading systems to meet environmental standards and improve capacity.

- Electric Infrastructure: Modernizing power grids for greater reliability and efficiency.

- Resilience and Sustainability: Investing in infrastructure that can withstand environmental challenges and promote sustainable practices.

Customer Value Enhancement

American States Water (AWR) enhances customer value by investing in technology to boost operational efficiency and customer service. This includes proactive upgrades to its water and electric infrastructure, ensuring reliable delivery of essential services. For instance, in 2023, AWR reported capital expenditures of $210.8 million, a significant portion of which was directed towards infrastructure modernization to improve service quality and reliability for its customers.

The company's commitment extends to building robust water supply portfolios and increasing its reliance on renewable electric sources. This strategic focus not only ensures a stable supply of water but also aligns with sustainability goals, offering customers greater value through environmentally conscious operations. AWR's dedication to efficient service delivery directly contributes to the economic stability and well-being of the communities it serves, fostering long-term customer loyalty.

Key aspects of customer value enhancement include:

- Technological Investment: Proactive adoption of new technologies to improve operational efficiency and customer interaction.

- Infrastructure Modernization: Ongoing capital expenditures, such as the $210.8 million in 2023, to ensure reliable water and electric supply.

- Renewable Energy Integration: Increasing the use of renewable electric supply to meet customer demand sustainably.

- Community Well-being: Efficient provision of essential services that support the overall economic stability of served communities.

American States Water's product is the reliable delivery of essential water and electricity services, underpinned by significant infrastructure investment. The company's core offering ensures public health and safety by providing clean water and consistent power to over a million Californians. In 2023, capital expenditures of $307.7 million were dedicated to system upgrades, enhancing service dependability.

The specialized contracted services for military installations represent a distinct product line. These long-term agreements, often 30-50 years, provide a stable revenue stream, with ASUS managing 16 such contracts as of early 2024. This niche offering leverages the company's expertise in water and wastewater operations and maintenance.

Technological investment and infrastructure modernization are key to the product's value proposition. In 2023, capital expenditures of $210.8 million were invested in upgrading water and electric infrastructure, improving service quality and reliability. The company also focuses on renewable energy integration for sustainable operations.

| Product Aspect | Description | Key Data Point (2023/2024) |

|---|---|---|

| Essential Utility Services | Reliable water and electricity delivery | Serving over 1 million customers |

| Infrastructure Investment | Modernization for reliability and quality | $307.7 million capital expenditures |

| Specialized Services | Contracted water/wastewater for military | 16 contracts managed by ASUS (early 2024) |

What is included in the product

This analysis provides a comprehensive examination of American States Water's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for stakeholders.

Simplifies complex water marketing strategies by clearly outlining Product, Price, Place, and Promotion, alleviating the pain of understanding and executing effective water resource management plans.

Place

American States Water Company’s geographic service areas are concentrated in California, where its subsidiary Golden State Water Company provides essential water utility services to numerous communities. This focused presence allows for specialized knowledge of local infrastructure and customer needs within the Golden State.

Beyond water, Bear Valley Electric Service, Inc., another subsidiary, serves the Big Bear Lake area with electricity distribution. This dual utility focus within California highlights their regulated market strategy, requiring adherence to specific state and local regulations.

As of the first quarter of 2024, Golden State Water Company reported serving over one million customers across 76 communities in California, underscoring the breadth of their water operations within their primary geographic footprint.

American States Water's 'place' in its marketing mix is defined by its direct delivery of essential water and wastewater services to residential, commercial, and industrial customers. This is achieved through a vast, regulated network of physical infrastructure, including over 7,000 miles of water mains and service connections. The company's operations are inherently localized, with its service territories meticulously defined and integrated into the fabric of the communities it serves, ensuring water reaches every tap directly.

American States Water's 'Place' strategy includes a significant segment serving military bases across various states. These operations are governed by long-term government contracts, necessitating specialized on-site teams and infrastructure management within secure federal facilities. This represents a distinct, non-public market with unique logistical and operational requirements.

Infrastructure Network as Distribution Channel

American States Water's extensive physical infrastructure, encompassing treatment facilities, reservoirs, and an intricate pipeline network, functions as its core distribution channel for water and electricity services. The company's commitment to maintaining and upgrading these assets is paramount, directly influencing service delivery and customer satisfaction. For instance, in 2023, American States Water reported capital expenditures of $387.8 million, a substantial portion of which is allocated to maintaining and expanding its distribution systems, ensuring reliable access to essential utilities for its customers.

This robust infrastructure network is not merely a delivery system but a critical component of its marketing mix, ensuring the product—clean water and reliable electricity—reaches the end consumer efficiently. The reliability of these assets is a key differentiator, especially in regions facing water scarcity or aging utility systems. The company consistently invests in technology and upgrades to enhance the efficiency and resilience of its distribution channels.

- Infrastructure as Distribution: Treatment plants, reservoirs, pipelines, and electric grids are the primary means of delivering water and electricity.

- Impact on Availability: The efficiency and reliability of this infrastructure directly determine how accessible and consistently available these essential services are to customers.

- Capital Investment: Significant ongoing capital investments are dedicated to the expansion, maintenance, and modernization of this critical delivery network. In 2023, capital expenditures reached $387.8 million, highlighting this commitment.

Accessibility and Service Reach

Accessibility and service reach for American States Water (AWR) are paramount, ensuring that essential water and wastewater services are consistently available. This involves maintaining robust infrastructure and operational readiness to address any service disruptions promptly, 24 hours a day, seven days a week. AWR's commitment to accessibility means strategically positioning its resources to serve its entire customer base efficiently.

In 2023, American States Water reported serving approximately 2.8 million customers across its regulated utilities. The company's extensive network of water treatment plants and distribution systems, spanning California, Texas, and Arizona, underscores its broad service reach. This infrastructure is designed for resilience, aiming to minimize downtime and ensure uninterrupted service delivery.

Key aspects of AWR's accessibility strategy include:

- 24/7 Operations: Maintaining constant operational monitoring and emergency response teams to address issues as they arise.

- Strategic Facility Placement: Locating treatment plants, pumping stations, and maintenance depots to optimize response times and service coverage within their territories.

- Infrastructure Investment: Continuously investing in the upgrade and maintenance of its distribution networks to prevent leaks and ensure water quality and availability.

- Customer Service Accessibility: Providing multiple channels for customer communication and support, ensuring ease of access for inquiries and service requests.

American States Water's 'Place' is deeply rooted in its physical infrastructure, acting as the direct conduit for its essential services. This includes extensive water mains, treatment facilities, and electric grids, all meticulously maintained to ensure reliable delivery. In 2023, the company demonstrated this commitment through capital expenditures totaling $387.8 million, a significant portion of which directly supports and enhances its distribution network, ensuring consistent availability to its customer base.

| Metric | 2023 Value | Significance for 'Place' |

|---|---|---|

| Capital Expenditures | $387.8 million | Direct investment in infrastructure maintenance and expansion, crucial for service delivery. |

| Miles of Water Mains | Over 7,000 miles | Represents the physical reach and accessibility of water services across its territories. |

| Customers Served (Regulated Utilities) | Approx. 2.8 million (2023) | Indicates the broad geographic penetration and customer density within its service areas. |

Preview the Actual Deliverable

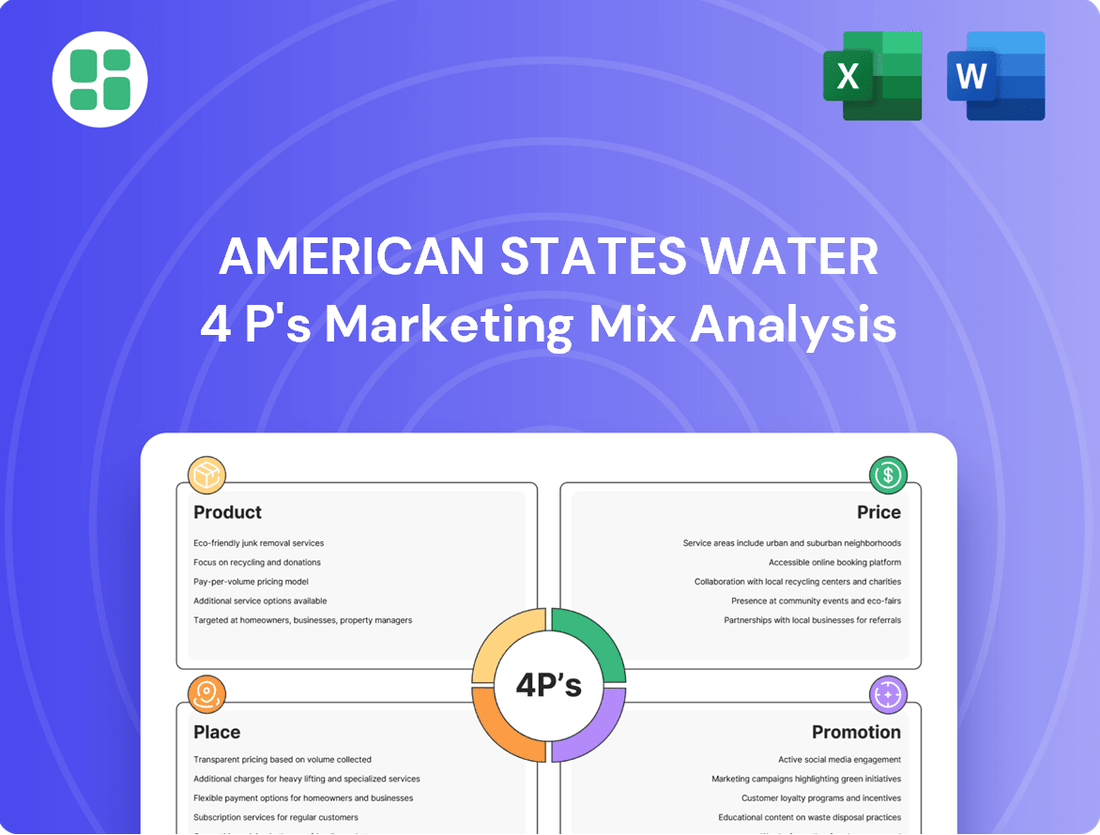

American States Water 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the American States Water 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

As a regulated utility, American States Water (AWR) places significant emphasis on public relations and transparent communication with regulatory bodies, particularly the California Public Utilities Commission (CPUC). This focus is crucial for securing approvals on rate cases and infrastructure projects. In 2023, AWR invested $230.9 million in capital improvements, a key area communicated to both regulators and the public to demonstrate commitment to service reliability and system upgrades.

American States Water actively engages its communities through various outreach programs. In 2023, the company participated in over 100 community events, reaching thousands of residents. This focus on education aims to inform customers about vital topics like water conservation, ensuring responsible usage and highlighting the essential role of utility services.

American States Water's promotional efforts heavily emphasize investor relations, a critical component for attracting and retaining capital. The company actively communicates its financial performance, strategic growth plans, and consistent dividend history to shareholders and the investment community.

This commitment is evident in the regular publication of detailed annual reports and SEC filings, ensuring transparency and accessibility of crucial financial data. For instance, in the first quarter of 2024, American States Water reported diluted earnings per share of $0.80, demonstrating a stable financial footing and reinforcing investor confidence.

Furthermore, the company hosts quarterly earnings calls, providing a direct forum for analysts and investors to engage with management. These calls, coupled with investor presentations, are designed to foster a deeper understanding of the company's operations and future outlook, thereby supporting its stock valuation and overall market perception.

Digital Presence and Information Dissemination

American States Water (AWR) leverages its corporate website and digital channels as primary tools for information dissemination, effectively reaching a broad audience. This digital presence is crucial for sharing vital company updates, including news releases, comprehensive financial reports, and detailed ESG reports. For instance, in their 2023 annual report, the company highlighted its commitment to transparency by providing extensive data on environmental stewardship and community engagement.

These platforms act as a direct conduit for communication, fostering transparency with diverse stakeholders such as customers, investors, and the general public. By offering readily accessible information, AWR builds trust and ensures all parties are informed about its operations and strategic direction. This approach is particularly important in the utility sector, where public perception and investor confidence are paramount.

Key information disseminated includes:

- Financial Performance: Quarterly and annual earnings reports, providing investors with up-to-date financial health.

- Operational Updates: Information on service reliability, infrastructure investments, and regulatory compliance.

- ESG Initiatives: Detailed reports on environmental impact, social responsibility, and corporate governance practices, reflecting growing stakeholder interest in sustainability.

- Customer Information: Details on services, billing, and water conservation efforts for residential and business customers.

Crisis Communication and Reliability Messaging

American States Water's promotion strategy for its essential services heavily leans on robust crisis communication. This is crucial for maintaining public trust during unforeseen events like water main breaks or service disruptions. Their messaging consistently highlights their commitment to swift restoration and the critical nature of uninterrupted water supply.

In 2023, American States Water demonstrated its reliability through various operational achievements. For instance, the company invested significantly in infrastructure upgrades, with capital expenditures totaling $413.2 million in 2023, aimed at enhancing service reliability and preventing future interruptions.

- Proactive Infrastructure Investment: Capital spending of $413.2 million in 2023 underscores a commitment to preventing service disruptions and ensuring reliability.

- Emergency Preparedness: Communication during outages emphasizes rapid response and restoration efforts, reinforcing public confidence.

- Reliability Messaging: Consistent emphasis on the safe and dependable delivery of water services is a core component of their promotional efforts.

- Community Engagement: Informing the public about service status and restoration timelines builds transparency and trust during challenging periods.

American States Water's promotional strategy centers on investor relations and transparent communication regarding its financial stability and growth. The company actively highlights its consistent dividend history and capital investments, such as the $413.2 million spent on infrastructure in 2023, to bolster investor confidence.

Digital channels, including their corporate website, are key for disseminating financial reports and ESG initiatives, ensuring broad stakeholder access to crucial information. This digital presence also facilitates direct engagement through quarterly earnings calls, reinforcing their commitment to transparency.

Community outreach and public relations are also vital, with over 100 community events attended in 2023 to educate the public on water conservation and the company's essential services. This focus on engagement builds trust and reinforces their role as a reliable utility provider.

Crisis communication is paramount, emphasizing swift restoration during service disruptions and the critical nature of uninterrupted water supply. This proactive approach, supported by significant capital expenditures aimed at reliability, reassures customers and stakeholders.

| Key Promotional Focus | 2023 Data/Activity | 2024 Data/Activity (Q1) |

|---|---|---|

| Investor Relations | Consistent dividend history communicated | Diluted EPS of $0.80 reported |

| Community Engagement | Over 100 community events | Ongoing outreach programs |

| Infrastructure Communication | $413.2 million in capital improvements | Continued investment in system upgrades |

| Digital Dissemination | Comprehensive annual and ESG reports published | Regular website updates and news releases |

Price

American States Water's pricing is largely dictated by regulatory agencies, notably the California Public Utilities Commission (CPUC). The CPUC uses a General Rate Case (GRC) process to establish rates, ensuring they reflect the company's operational costs and necessary investments. This process allows for a fair return on equity for the company, rather than being driven by market forces.

American States Water's pricing strategy is meticulously crafted to ensure the recovery of operational expenses, prominently featuring the cost of water supply. This approach is fundamental to maintaining the company's financial health and its capacity for future growth and essential service delivery.

Furthermore, the approved rate structure is directly linked to funding substantial capital investments. These investments are crucial for the ongoing modernization and improvement of the company's extensive water infrastructure, ensuring both safety and reliability for its customer base.

For instance, in 2024, American States Water projected capital expenditures of approximately $370 million, a significant portion of which is directly supported by customer rates. This demonstrates a clear commitment to reinvesting in the utility's assets to meet evolving service demands and regulatory requirements.

American States Water's regulated pricing structure, overseen by the California Public Utilities Commission (CPUC), ensures a fair return on investment for its shareholders. This is vital for securing the necessary capital for ongoing infrastructure upgrades and expansions. For instance, in its 2021 General Rate Case decision, the CPUC authorized a rate of return on rate base of 7.47%, including an authorized return on equity of 10.25%, reflecting a commitment to shareholder value.

Affordability and Consumer Impact

American States Water (AWR) navigates the crucial balance between recovering infrastructure investment costs and maintaining customer affordability. This means pricing decisions must carefully consider the impact on customer bills, especially given the necessity for ongoing capital expenditures to maintain and upgrade water systems.

Public forums are a key mechanism for AWR to engage with its customers on proposed rate adjustments. These discussions allow for direct customer input, which can significantly influence the final rates approved by regulatory bodies. For instance, in 2023, AWR's California utility, Golden State Water Company, filed for rate increases to support a $362 million capital investment plan for 2022-2024, with public input playing a role in the final outcome.

- Cost Recovery vs. Affordability: A core challenge is ensuring rates cover necessary infrastructure upgrades while remaining accessible to customers.

- Customer Input: Public forums are essential for gathering feedback on proposed rate changes.

- Regulatory Influence: Customer feedback and affordability concerns directly shape the rates ultimately approved by regulators.

- Investment Needs: Significant capital investments, such as Golden State Water's $362 million plan for 2022-2024, necessitate rate adjustments.

Annual Adjustments and Mechanisms

American States Water's pricing strategy incorporates annual adjustments to ensure rates keep pace with operational realities. This includes attrition increases, which account for rising costs of doing business, and adjustments tied to inflationary index values, reflecting the general increase in prices for goods and services. For instance, in 2024, the company navigated these adjustments to maintain service quality and fund necessary infrastructure upgrades.

Beyond routine annual changes, specific mechanisms are designed to provide flexibility. The Water Cost of Capital Mechanism (WCCM) is a key example, allowing for certain rate adjustments outside the full General Rate Case (GRC) process. This can help American States Water recover costs associated with significant capital investments or changes in the cost of capital more efficiently, ensuring financial stability and continued service reliability. In 2024, the WCCM played a role in addressing specific capital expenditure needs.

These pricing adjustments are crucial for American States Water's financial health and its ability to meet customer demand. The company's approach aims to balance the need for revenue recovery with affordability for its customer base. The data from 2024 highlights the ongoing efforts to manage these complexities.

- Annual Rate Adjustments: 2024 saw these adjustments implemented to cover rising operational costs.

- Inflationary Indexing: Rates were modified based on relevant inflation data to reflect economic changes.

- Water Cost of Capital Mechanism (WCCM): This mechanism facilitated specific cost recovery outside the standard GRC process in 2024.

- Capital Expenditure Funding: Pricing adjustments are designed to support ongoing infrastructure investment.

American States Water's pricing is primarily set by regulators like the CPUC, ensuring costs are covered and investments are funded, rather than market forces. This regulated approach allows for a fair return on equity, crucial for infrastructure development.

The company's pricing directly supports substantial capital investments, vital for modernizing its water infrastructure and ensuring service reliability. For instance, in 2024, American States Water projected capital expenditures of approximately $370 million, with rates playing a key role in funding these projects.

Customer affordability is a key consideration, balanced against the need to recover infrastructure costs. Public forums in 2023, for example, allowed customer input on rate adjustments for Golden State Water's $362 million capital investment plan.

Annual adjustments, including attrition increases and inflationary indexing, help rates keep pace with rising operational costs. The Water Cost of Capital Mechanism (WCCM) also provides flexibility for cost recovery on specific investments, as seen in 2024.

| Metric | 2023 (Actual/Estimate) | 2024 (Projected) |

|---|---|---|

| Projected Capital Expenditures (AWR) | $340 million | $370 million |

| Golden State Water Capital Plan (2022-2024) | $362 million (total) | |

| Authorized Return on Equity (2021 GRC) | 10.25% |

4P's Marketing Mix Analysis Data Sources

Our American States Water 4P's analysis is grounded in comprehensive data, including state-level regulatory filings, official company reports, and public financial disclosures. We also incorporate market research on consumer demand, competitor pricing, and distribution infrastructure to provide a holistic view.