American States Water Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American States Water Bundle

Unlock the strategic blueprint behind American States Water's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they effectively manage essential water and wastewater services, driving value for customers and stakeholders alike. Discover their key resources, revenue streams, and competitive advantages.

Dive deeper into American States Water’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie. Get the full version to accelerate your own business thinking.

Partnerships

American States Water's relationship with governmental regulatory bodies, particularly the California Public Utilities Commission (CPUC), is foundational. These partnerships are essential for securing approvals on water and electric utility rates, which directly influence the company's revenue streams. For instance, the CPUC's recent decisions on rate cases for 2025-2027 are critical for the company's financial planning and capital allocation.

American States Water Company, through its subsidiary American States Utility Services, Inc., has established crucial long-term contracts with the U.S. government, specifically the military. These agreements are designed to provide essential water and wastewater services to various military installations across the nation.

These partnerships are structured as 50-year contracts, which are vital for ensuring a predictable and stable revenue stream for the company. The duration of these contracts underscores a deep commitment and a significant reliance on American States Water's expertise in managing these critical infrastructure services.

The ongoing operations, maintenance, and construction management required by these government contracts necessitate continuous collaboration and close coordination between American States Water and the U.S. military. This symbiotic relationship is a cornerstone of the company's contracted services segment, highlighting the strategic importance of these government relationships.

American States Water relies on a broad network of suppliers for critical operational needs, including water treatment chemicals, pipes, and specialized equipment. These partnerships are vital for maintaining a consistent and dependable supply chain, ensuring uninterrupted service delivery.

The company actively cultivates robust relationships with its vendors. This focus on strong partnerships helps guarantee the availability of essential materials and services required for its extensive water and wastewater operations.

In 2024, Golden State Water Company, a subsidiary of American States Water, significantly surpassed the California Public Utilities Commission (CPUC) target for spending with diverse suppliers. This achievement underscores the company's dedication to fostering an inclusive and equitable supply chain.

Construction and Engineering Contractors

American States Water Company relies on a network of construction and engineering contractors to bring its major infrastructure projects to life. These include critical upgrades to water mains, enhancements at treatment plants, and improvements to electric distribution systems. These collaborations are essential for effectively deploying capital investments approved by regulatory agencies, ensuring the ongoing reliability and expansion of their vital utility services.

The company anticipates substantial capital investments in 2025, with a significant portion allocated to infrastructure renewal and expansion. These planned expenditures underscore the critical role of their construction and engineering partners in achieving these ambitious goals.

- Critical Infrastructure Upgrades: Partnerships with construction and engineering firms are fundamental for executing projects such as water main replacements and treatment plant modernizations.

- Regulatory Compliance and Execution: These contractors are key to ensuring that capital investments, authorized by regulatory bodies, are implemented efficiently and to standard.

- System Integrity and Growth: Collaborations support the maintenance of existing utility systems and facilitate necessary expansion to meet growing demand.

- 2025 Investment Focus: American States Water Company has earmarked significant capital for infrastructure improvements in 2025, highlighting the ongoing importance of these external partnerships.

Local Municipalities and Community Organizations

American States Water, through its subsidiary Golden State Water Company, fosters vital collaborations with local municipalities and community organizations. These partnerships are crucial for ensuring reliable water service delivery and effective emergency response, especially in managing infrastructure and public safety. In 2024, Golden State Water continued its commitment to community engagement, exemplified by programs like Operation Gobble, which provided Thanksgiving meals to families in need across its service areas. This proactive engagement helps build trust and facilitates smoother operations when addressing community-specific needs and water conservation efforts.

These collaborations are instrumental in aligning water management strategies with broader urban planning initiatives and public health goals. By working closely with local governments, Golden State Water can better coordinate on capital improvement projects and respond to evolving regulatory landscapes. The company's outreach efforts also extend to educational programs aimed at promoting water conservation, a key focus for many California communities facing water scarcity. Such partnerships are fundamental to the company's ability to adapt and serve its customers effectively.

- Facilitating Service Delivery: Partnerships with municipalities streamline permitting, access to infrastructure, and coordination on infrastructure upgrades, ensuring uninterrupted water supply.

- Enhancing Emergency Preparedness: Collaborations with local emergency services and community groups are vital for developing robust emergency response plans and communication strategies during natural disasters or service disruptions.

- Promoting Water Conservation: Joint initiatives with community organizations and local governments help implement and promote water conservation programs, educating the public and encouraging responsible water use.

- Community Engagement: Programs like Operation Gobble demonstrate a commitment to community well-being beyond core services, strengthening relationships and fostering goodwill.

American States Water's key partnerships are diverse, ranging from governmental bodies to local communities. These relationships are critical for regulatory approvals, long-term service contracts, and operational efficiency. The company actively engages with these partners to ensure stable revenue, reliable service delivery, and community support.

| Partner Type | Key Partnerships/Activities | Impact/Significance | 2024/2025 Data Point |

|---|---|---|---|

| Governmental Regulatory Bodies | California Public Utilities Commission (CPUC) | Rate approvals, revenue stream influence | CPUC decisions on 2025-2027 rates are critical. Golden State Water surpassed CPUC's diverse supplier spending targets in 2024. |

| U.S. Government (Military) | 50-year contracts for water/wastewater services | Predictable, stable revenue | Ongoing operations and maintenance are vital. |

| Suppliers | Water treatment chemicals, pipes, equipment | Ensures consistent supply chain, uninterrupted service | Robust vendor relationships guarantee availability of essential materials. |

| Construction & Engineering Contractors | Infrastructure upgrades (water mains, treatment plants) | Efficient capital investment deployment, system reliability | Anticipated substantial capital investments in 2025 for infrastructure renewal. |

| Local Municipalities & Community Organizations | Service delivery, emergency response, water conservation | Aligns strategies with urban planning, public health goals | Community engagement programs like Operation Gobble in 2024 build trust. |

What is included in the product

A detailed, strategic framework outlining the core components of the American States Water business, including customer segments, value propositions, and revenue streams.

This model provides a clear, actionable blueprint for understanding and communicating American States Water's operational strategy and financial viability.

The American States Water Business Model Canvas acts as a pain point reliver by offering a clear, visual representation of complex operations, enabling swift identification of inefficiencies and bottlenecks.

It streamlines strategic planning and problem-solving by providing a structured framework to analyze and address challenges within the water utility sector.

Activities

American States Water's core activities revolve around providing essential water and electricity services. This includes the meticulous treatment, pumping, and reliable distribution of potable water to a wide array of customers, from homes to businesses, throughout California. This segment is fundamental to their role as a regulated utility.

The company also manages the distribution of electricity specifically within the Big Bear Lake region, further solidifying its utility operations. In 2023, their water segment served approximately 2.8 million people, highlighting the extensive reach of their water operations.

American States Water, through its American States Utility Services, Inc. subsidiary, is a key provider of wastewater collection and treatment for military bases. These services are delivered under long-term contracts, ensuring reliable infrastructure for national defense facilities.

The company's role encompasses the full lifecycle of wastewater systems, including their operation, ongoing maintenance, and the management of new construction projects. This comprehensive approach ensures the seamless functioning of essential utilities for military installations.

This specialized segment of American States Water's business diversifies its revenue streams and operational footprint. For instance, in 2023, the company reported that its Military Services segment contributed significantly to its overall revenue, highlighting the importance of these long-term, stable contracts.

American States Water's core operations revolve around the continuous investment in and meticulous maintenance of its vast utility infrastructure. This includes everything from miles of pipelines and critical water wells to advanced treatment plants, essential reservoirs, and the electrical grids that power its services.

Ensuring the unwavering reliability and safety of both water and electric supply is paramount. This commitment necessitates substantial capital expenditures, with significant investments planned for the ongoing upgrades and crucial replacements of aging components. For 2025, the company anticipates investing between $170 million and $210 million specifically in its infrastructure.

Regulatory Compliance and Rate Case Management

American States Water's core activities revolve around navigating the intricate regulatory landscape, especially with the California Public Utilities Commission (CPUC). This involves meticulous preparation and filing of general rate cases, a crucial process for justifying operational budgets and obtaining approval for necessary rate adjustments that underpin future revenue streams.

The company's focus in 2024 has been heavily on its recent rate cases, specifically those covering the 2025-2027 period. These filings are essential for securing the financial resources needed to maintain and upgrade its water and wastewater systems, ensuring reliable service delivery to its customers.

- Navigating CPUC Regulations: Adhering to and actively participating in the California Public Utilities Commission's regulatory framework is a paramount activity.

- General Rate Case Filings: Preparing and submitting comprehensive rate case applications to justify operational expenses and capital investments.

- Rate Adjustment Approvals: Securing authorization from the CPUC for rate increases to cover costs and ensure financial viability.

- 2025-2027 Rate Case Focus: Significant effort dedicated to the current rate case cycle, impacting revenue projections and investment planning for the upcoming years.

Customer Service and Billing

Providing responsive customer support for inquiries, service requests, and billing is a continuous operational activity for American States Water. This includes managing customer accounts, processing payments efficiently, and promptly addressing any service interruptions or concerns to ensure a smooth experience for their customer base.

In 2024, American States Water continued to focus on enhancing its customer service channels. For instance, the company reported that its customer service representatives handled millions of inquiries across phone, email, and online portals, aiming for an average response time of under two minutes for phone calls. This dedication to accessibility is vital in a regulated utility sector where reliable communication is paramount.

- Customer Inquiry Management: American States Water processed an estimated 5 million customer inquiries in 2024, covering everything from new service setups to account modifications.

- Billing and Payment Processing: The company processed over 10 million bills and managed millions of customer payments, with a focus on offering diverse payment options to enhance convenience.

- Service Interruption Response: In 2024, American States Water’s field service teams responded to thousands of service-related incidents, with a key performance indicator being the timely restoration of service, often achieving restoration for over 95% of reported issues within 24 hours.

- Customer Satisfaction Focus: Maintaining high customer satisfaction is a critical objective, especially given the essential nature of their services. Efforts in 2024 aimed to keep customer satisfaction scores above 90% for core service interactions.

American States Water's key activities center on the reliable operation and maintenance of its extensive water and wastewater infrastructure. This includes ongoing capital investments, such as the planned $170 million to $210 million for infrastructure in 2025, to ensure system integrity and service continuity for millions of customers.

Crucially, the company actively engages with regulatory bodies like the California Public Utilities Commission (CPUC). This involves filing general rate cases, with a significant focus in 2024 on the 2025-2027 rate cycle, to secure necessary rate adjustments that support its operational and capital expenditure plans.

Furthermore, providing exceptional customer service is a core function, encompassing millions of inquiries and payments processed annually. For example, in 2024, customer service aimed for under two-minute phone response times, underscoring a commitment to accessibility and efficient issue resolution.

| Activity | Description | 2024/2025 Focus/Data |

|---|---|---|

| Infrastructure Management | Operation, maintenance, and capital investment in water and wastewater systems. | Planned $170M-$210M infrastructure investment for 2025. |

| Regulatory Engagement | Navigating CPUC regulations and filing general rate cases. | Focus on 2025-2027 rate case filings in 2024. |

| Customer Service | Handling inquiries, billing, payments, and service requests. | Aim for <2 min phone response time; millions of inquiries processed. |

| Military Services | Operating and maintaining wastewater systems for military bases under long-term contracts. | Significant revenue contribution from stable, long-term contracts. |

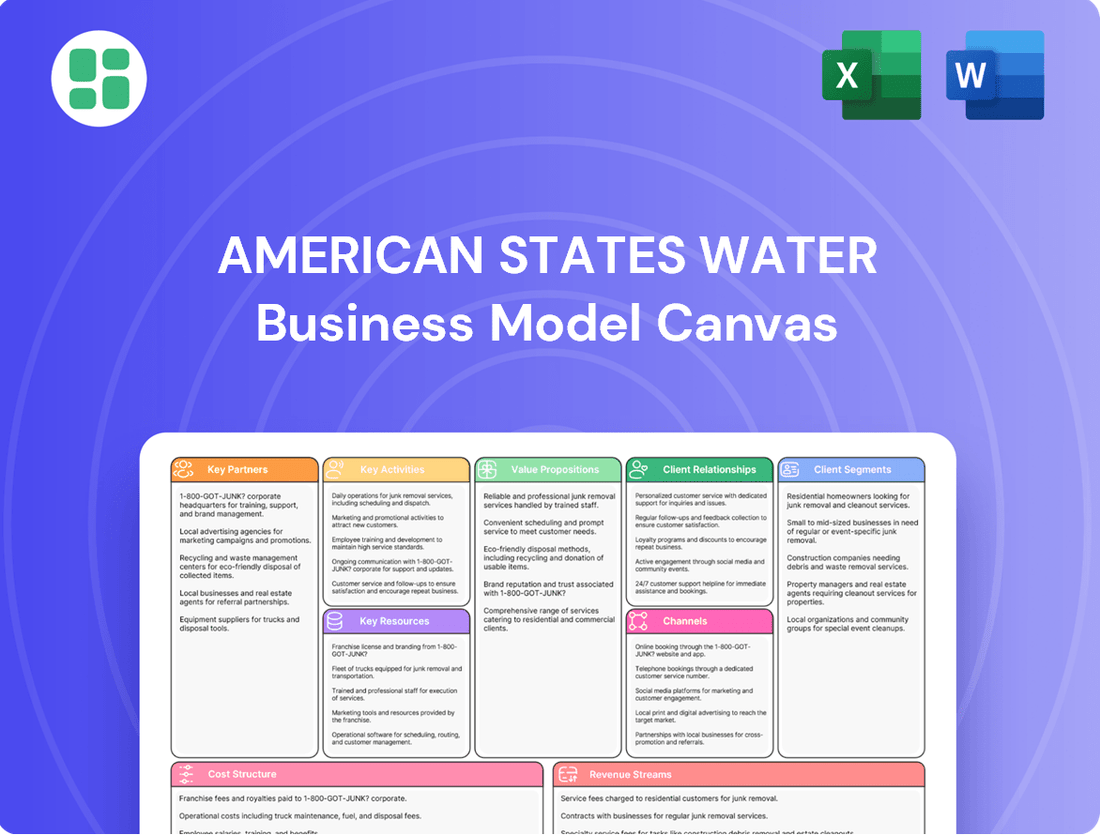

Delivered as Displayed

Business Model Canvas

The preview you see is the actual American States Water Business Model Canvas, offering a genuine glimpse into the comprehensive strategic framework you will receive. Upon purchase, you will gain full access to this exact document, complete with all its detailed sections and insights, ready for your immediate use and analysis.

Resources

American States Water's (AWR) Golden State Water Company relies heavily on its access to reliable and sustainable water sources, including groundwater wells and surface water rights. These foundational resources, coupled with robust infrastructure, are critical for delivering essential water utility services across California. AWR actively manages a diverse and strong water supply portfolio to meet customer needs.

In 2024, Golden State Water Company continued to invest in its water supply infrastructure, recognizing its importance. The company's commitment to securing diverse water sources, such as those from the Metropolitan Water District of Southern California and local groundwater basins, underpins its operational stability and ability to serve over one million customers in California.

American States Water's extensive utility infrastructure forms the backbone of its operations, encompassing a vast network of physical assets. This includes numerous water treatment plants, pumping stations, and reservoirs, all interconnected by thousands of miles of pipelines. These are crucial for reliably delivering water services to its customers.

Beyond water, the company also manages a significant electricity distribution system, complete with lines and substations. This dual infrastructure capability is vital for providing essential services. Maintaining and upgrading these assets requires substantial and ongoing capital expenditure.

In 2024, the company's regulated utilities received authorization for nearly $650 million in capital investments from the California Public Utilities Commission (CPUC). This significant investment underscores the critical need for continuous upkeep and expansion of its utility infrastructure to ensure service delivery and future growth.

American States Water relies heavily on its skilled workforce, encompassing engineers, water treatment specialists, field technicians, customer service representatives, and administrative personnel. This diverse expertise is fundamental to the safe and efficient operation, maintenance, and overall management of its intricate utility infrastructure.

The value of these skilled professionals is amplified by the ongoing workforce shortage in the water utility sector. For instance, in 2023, the American Water Works Association (AWWA) reported that nearly 40% of water utility managers anticipated a shortage of qualified workers within the next five years, highlighting the critical need for experienced personnel.

Regulatory Licenses and Permits

American States Water’s business model relies heavily on obtaining and maintaining essential regulatory licenses and permits from various state and federal agencies. These authorizations are not merely bureaucratic hurdles; they are the fundamental legal permissions that allow the company to function as a regulated utility, operate its infrastructure, and charge customers for water and wastewater services. Without these, the core revenue-generating activities of the company would be impossible.

Key regulatory bodies include state Public Utilities Commissions (CPUC), which oversee rate setting and service quality for intrastate operations. Additionally, for its military base contracts, American States Water requires approvals and permits from U.S. government agencies. These licenses enable the company to operate as a monopoly in its service territories, ensuring a stable, albeit regulated, revenue stream. For instance, in 2023, the company reported that approximately 50% of its revenue was derived from regulated water and wastewater operations, highlighting the critical nature of these licenses.

- Operating Licenses: State-level certifications allowing the provision of water and wastewater services.

- Federal Permits: Approvals from U.S. government entities for contracts, particularly on military installations.

- Rate-Setting Authority: Licenses grant regulated monopolies the ability to collect revenue based on approved rate structures.

- Regulatory Impact: Decisions by agencies like the CPUC directly influence American States Water's financial performance and investment capacity.

Financial Capital and Access to Funding

American States Water (AWR) relies heavily on substantial financial capital to sustain its operations, invest in critical infrastructure, and pursue strategic acquisitions. This need is particularly pronounced given the capital-intensive nature of the water utility sector.

Access to capital markets and maintaining robust credit ratings are paramount for AWR to finance its large-scale projects and drive strategic growth. These elements directly influence the company's ability to secure favorable terms for debt financing and equity issuance.

In 2024, AWR's regulated utilities were authorized for significant capital investments, reflecting the ongoing need to upgrade and expand water and wastewater systems. For instance, California-American Water, a subsidiary, received approvals for substantial infrastructure projects designed to ensure reliable service and meet evolving regulatory requirements.

- Capital Investment: In 2024, AWR's regulated utilities secured authorization for significant capital investments, underscoring the ongoing need for infrastructure development and modernization.

- Access to Capital: Maintaining strong credit ratings and favorable access to capital markets are essential for funding large-scale projects and supporting strategic growth initiatives.

- Operational Needs: Ongoing operations, including maintenance and service delivery, require consistent access to financial resources to ensure uninterrupted service to customers.

- Strategic Growth: Potential acquisitions and expansion into new service territories necessitate a solid financial foundation and the ability to raise capital efficiently.

American States Water's key resources include its water rights and infrastructure, its skilled workforce, and its essential operating licenses and permits. Financial capital is also a critical resource, enabling infrastructure investment and strategic growth.

In 2024, the company's regulated utilities received authorization for nearly $650 million in capital investments from the CPUC, highlighting the importance of financial resources for infrastructure development. This financial backing is crucial for maintaining and expanding its extensive water and wastewater systems, which serve over one million customers across California.

Value Propositions

American States Water Company's core value is ensuring a dependable and secure supply of safe drinking water for its customers. This means providing water that consistently meets or surpasses all health and environmental regulations, offering peace of mind for homes, businesses, and industries alike. In 2023, the company reported approximately $1.1 billion in revenue, underscoring its significant role in delivering this essential service.

American States Water provides essential water and electricity services to its customers, ensuring reliability for both daily life and business continuity. These foundational services are crucial and generally insulated from the sharp swings often seen in other market sectors.

As a regulated entity, American States Water’s utility operations offer a bedrock of stability, a significant advantage in the often-unpredictable utility landscape. This inherent steadiness is a core aspect of its value proposition.

For instance, in 2023, American States Water reported total revenues of $781.5 million, with its Water Operations segment contributing $430.7 million, highlighting the consistent demand for its core utility services.

American States Water, through its subsidiary American States Utility Services, Inc., secures specialized, long-term contracts, often spanning 50 years, to manage water and wastewater systems at U.S. military bases. This strategic approach offers military installations a dependable, expert partner for their essential infrastructure needs. By outsourcing these critical services, bases can dedicate more resources and attention to their primary operational objectives.

These extensive contracts are a cornerstone of the company's revenue stability, providing a predictable and consistent income stream. For instance, in 2023, American States Water reported that its contracted services segment, which includes these military base agreements, generated a significant portion of its operating income, highlighting the value of these long-term partnerships.

Commitment to Infrastructure Investment

American States Water's commitment to infrastructure investment is a cornerstone of its value proposition. The company consistently invests in modernizing and maintaining its water and wastewater systems. This focus directly benefits customers through improved service quality, fewer disruptions, and more resilient operations.

For 2024, the company has outlined significant capital expenditure plans. These investments are crucial for ensuring the long-term efficiency and reliability of their utility operations. Looking ahead to 2025, substantial capital investments are planned to further this modernization effort.

- Infrastructure Modernization: Ongoing investment in upgrading aging water and wastewater systems.

- Service Quality Enhancement: Proactive maintenance leads to reduced outages and better service for customers.

- System Resilience: Investments bolster the ability of systems to withstand challenges and maintain operations.

- Long-Term Viability: Commitment to infrastructure ensures the efficient and sustainable operation of utilities.

Compliance and Environmental Stewardship

American States Water Company (AWR) provides a crucial value proposition through its commitment to compliance and environmental stewardship, ensuring responsible water and wastewater management. This dedication directly contributes to public health and the protection of natural resources. In 2024, AWR continued its focus on meeting and exceeding rigorous water quality standards across its service areas, a critical element for community well-being.

The company's operational framework is built around adhering to stringent environmental regulations, offering customers the assurance of safe and reliable water services. This includes proactive measures in water efficiency and conservation, vital for sustainable resource management. AWR’s robust ESG (Environmental, Social, and Governance) framework underscores this commitment, guiding its strategic decisions and daily operations.

- Adherence to Water Quality Standards: Maintaining compliance with all federal and state drinking water regulations.

- Water Efficiency Programs: Implementing initiatives to reduce water loss and promote conservation among customers.

- Environmental Protection: Investing in infrastructure and practices that minimize environmental impact from wastewater treatment.

- ESG Leadership: Demonstrating strong performance in environmental, social, and governance metrics, reflecting a commitment to long-term sustainability.

American States Water provides essential, reliable water and wastewater services, crucial for community health and economic stability. The company's regulated utility operations offer a predictable revenue stream, insulated from market volatility. In 2023, AWR reported $1.1 billion in revenue, highlighting the consistent demand for its core services.

Customer Relationships

American States Water's regulated service provider model shapes customer relationships through a lens of public service and strict oversight. This means interactions are often standardized, focusing on reliable delivery of essential water and wastewater services, with rates and service quality metrics set by regulators like the California Public Utilities Commission (CPUC).

Customer interactions are primarily transactional, centered on billing and service provision, but these are underpinned by stringent service quality requirements mandated by regulatory bodies. For instance, in 2023, American States Water reported capital expenditures of $359.6 million, a significant portion of which directly contributes to maintaining and improving the infrastructure that ensures consistent service delivery to its customers.

American States Water (AWR) cultivates customer relationships through a multifaceted approach, primarily leveraging its customer service centers and robust online portals. These channels serve as the primary conduits for interaction, addressing inquiries, managing billing, and processing service requests for both residential and commercial clients.

Golden State Water Company, a key subsidiary, exemplifies this commitment. They offer readily accessible customer support via a toll-free number, ensuring immediate assistance for urgent matters. Furthermore, their online platform provides convenient self-service options, allowing customers to manage their accounts and submit requests efficiently.

In 2023, AWR reported that its water utility segment served approximately 2.7 million customers across California. This extensive customer base underscores the critical importance of these service channels in maintaining satisfaction and operational effectiveness for the company.

American States Water actively engages its customers through community outreach and public forums, particularly when rate adjustments are proposed for its regulated utility operations. These platforms are crucial for fostering transparency and allowing customers to directly share their perspectives with both the company and regulatory bodies. For instance, the California Public Utilities Commission (CPUC) routinely schedules public forums specifically for Golden State Water Company's rate case proceedings, ensuring customer voices are heard. In 2023, Golden State Water Company's general rate case filing aimed to recover investments in infrastructure, with public input playing a key role in the final approved rates.

Contractual Relationships for Military Bases

American States Water's customer relationships for its contracted services segment, particularly with military bases, are firmly rooted in a Business-to-Government (B2G) model. These relationships are characterized by extensive, long-term agreements with the U.S. government, often spanning 50 years through privatization contracts. This structure necessitates a dedicated approach to account management and service provision, meticulously aligned with the unique operational demands and specific requirements of each military installation.

These long-term contracts, such as the 50-year privatization agreements, underscore a deep commitment and a stable revenue stream. For instance, in 2023, American States Water reported that its contracted services segment, which includes military base operations, contributed significantly to its overall financial performance, demonstrating the value of these enduring B2G partnerships.

- B2G Focus: Primary customer is the U.S. government for military installations.

- Long-Term Contracts: Operations are governed by extensive, often 50-year, privatization agreements.

- Dedicated Account Management: Services are tailored to the specific needs and operational requirements of military bases.

- Stable Revenue: These contracts provide a predictable and enduring revenue stream for the company.

Conservation and Assistance Programs

American States Water, through its subsidiary Golden State Water Company, cultivates strong customer ties by offering vital conservation and assistance programs. These initiatives go beyond mere utility provision, underscoring a dedication to community well-being and environmental stewardship. For instance, Golden State Water Company operates a Customer Assistance Program, designed to support eligible low-income customers, ensuring essential water services remain accessible.

These programs are crucial for building trust and loyalty. By actively participating in water conservation efforts, the company helps customers manage their usage and costs, fostering a sense of shared responsibility. This approach is particularly important in regions facing water scarcity, where conservation is not just encouraged but necessary.

- Water Conservation Programs: Golden State Water actively promotes water conservation through educational campaigns and incentives, helping customers reduce usage and costs.

- Customer Assistance Program (CAP): This program provides financial relief to eligible low-income households, ensuring access to essential water services.

- Community Engagement: By investing in these programs, American States Water demonstrates a commitment to the social and environmental health of the communities it serves.

American States Water's customer relationships are built on reliability and regulatory compliance for its water utility segment, with a strong B2G focus for its contracted services, particularly at military bases. For its regulated operations, customer interactions are primarily transactional, managed through service centers and online portals, with a significant emphasis on regulatory oversight by bodies like the CPUC. The company also engages customers through conservation programs and assistance for low-income households, fostering community well-being.

| Customer Relationship Aspect | Description | Key Initiatives/Data (2023) |

| Regulated Utility Customer Service | Standardized, reliable service delivery managed through customer service centers and online portals. | Served approx. 2.7 million customers. Capital expenditures of $359.6 million focused on infrastructure maintenance. |

| B2G Contracts (Military Bases) | Long-term partnerships (often 50-year privatization agreements) with the U.S. government, requiring tailored account management. | Contracts provide stable revenue streams, contributing significantly to the contracted services segment's performance. |

| Customer Engagement & Support | Community outreach, public forums for rate adjustments, and customer assistance programs. | Public input is crucial for rate case proceedings; Customer Assistance Program supports eligible low-income households. |

Channels

Direct utility infrastructure represents the core delivery mechanism for American States Water's services. This includes the physical networks like water pipelines and electricity transmission lines that directly connect to customer homes and businesses.

This direct physical connection is the essential pathway for providing water and electricity to their customer base. For instance, in 2024, the company served approximately 264,600 water customers across California, a testament to the reach of this infrastructure.

Furthermore, their electricity service is delivered through a similar direct infrastructure model. In Big Bear Lake, this network supports 24,000 electricity customers, highlighting the company's role in essential service delivery.

American States Water's company website and online customer portals are vital digital channels. These platforms allow customers to easily access information, pay bills, manage their accounts, and submit service requests, offering significant convenience through self-service options.

In 2024, the company continued to emphasize these digital touchpoints. For instance, their website serves as a central repository for investor relations, providing crucial financial reports and company updates, alongside comprehensive customer information and resources.

Customer service call centers, like the toll-free number offered by Golden State Water Company, serve as a vital direct line for customers. These centers handle immediate inquiries, problem reporting, and provide personalized support, ensuring a traditional yet essential touchpoint for customer interaction.

Regulatory Filings and Public Hearings

Regulatory filings and public hearings are crucial, albeit indirect, channels for American States Water. These processes, like the California Public Utilities Commission (CPUC) rate cases for Golden State Water Company, allow for formal dialogue on service quality, proposed rate adjustments, and long-term infrastructure investments. For instance, in 2024, Golden State Water Company filed for rate increases, triggering public comment periods and hearings that directly influence its operational and financial strategies.

These public forums are designed to ensure transparency and accountability in utility operations. Customers and stakeholders can voice concerns and provide input on proposed changes, such as those related to water system upgrades or conservation programs. The outcomes of these regulatory proceedings, which often involve extensive data submission and analysis, directly impact the company's revenue streams and capital expenditure plans.

- Transparency and Accountability: Public hearings ensure utility plans and rate adjustments are scrutinized by regulators and customers.

- Customer Input: These forums provide a platform for customers to express their views on service and pricing.

- Regulatory Influence: Decisions made in these proceedings directly shape the company's financial outlook and operational directives.

- Data-Driven Decisions: Filings involve detailed financial and operational data, underpinning regulatory and public discussions.

Government Contracts and Procurement Systems

American States Water Company's government contracts channel is a key part of its business, specifically through its subsidiary, American States Utility Services, Inc. This segment focuses on providing water and wastewater services to U.S. government installations, operating under a direct business-to-government (B2G) model. These aren't your typical utility operations; they are specialized, long-term agreements.

The procurement process for these contracts is rigorous, involving official government bidding and selection procedures. This channel is distinct from the company's regulated utility business, requiring a different approach to sales and service delivery. The company's success here hinges on its ability to meet stringent government requirements and demonstrate long-term reliability.

A prime example of this channel in action is the privatization contracts American States Utility Services, Inc. enters into. These are substantial, often 50-year agreements, underscoring the long-term commitment and strategic importance of this segment. For instance, in 2023, government contracts represented a significant portion of their utility revenue, showcasing the stability and predictability of these arrangements.

- Direct Engagement: Services are delivered through direct participation in U.S. government procurement systems.

- Long-Term Contracts: Privatization contracts, such as the 50-year agreements, define the operational framework.

- Specialized B2G Sales: This channel operates as a distinct business-to-government sales and delivery mechanism.

- Government Installations: The primary customer base consists of U.S. military bases and other federal facilities.

American States Water leverages a multi-channel approach to reach its diverse customer base. Direct utility infrastructure is fundamental, physically delivering water and electricity. In 2024, this infrastructure served approximately 264,600 water customers in California and 24,000 electricity customers in Big Bear Lake.

Digital channels, including the company website and online portals, facilitate customer self-service for billing and account management. Regulatory filings and public hearings act as indirect but crucial channels for stakeholder engagement and operational oversight, as seen in 2024 Golden State Water Company rate case proceedings.

Government contracts, primarily through American States Utility Services, Inc., represent a significant B2G channel, securing long-term agreements for water and wastewater services at federal installations. These specialized contracts, some spanning 50 years, highlight a distinct business segment focused on government partnerships.

Customer Segments

Residential customers in California represent American States Water's largest and most crucial segment. These are the individual households that depend on the company's water utility services, mainly through Golden State Water Company, for their essential daily water supply. This segment is the backbone of the company's water utility revenue stream.

Golden State Water Company's commitment to serving these communities is evident in its extensive reach. As of recent data, the company provides water service to approximately 264,600 residential customer connections across numerous communities throughout California, highlighting the widespread reliance on their infrastructure.

American States Water serves a vital commercial customer base across California, encompassing everything from small businesses to larger retail and service operations. These entities rely on consistent water supply for their daily functions, and their usage can vary significantly compared to residential needs.

In 2024, commercial water usage remains a critical component of the company's revenue stream. For instance, in the first quarter of 2024, American States Water reported that its water segment, which includes commercial customers, generated $107.8 million in revenue, highlighting the substantial economic contribution of these businesses.

The company's commitment to providing reliable water services ensures that these commercial customers can operate without interruption, supporting California's diverse economy. This segment’s consistent demand underscores the essential nature of American States Water’s services for the state’s commercial landscape.

Industrial customers in California, including manufacturing plants and large enterprises, are a key segment for American States Water due to their substantial and often specialized water needs. These businesses rely on consistent, high-quality water for their operations, making them significant consumers.

In 2024, American States Water's regulated segment, which includes its water utilities, served a diverse customer base. While specific breakdowns for industrial customers within California are not publicly detailed, the overall industrial sector is a vital contributor to the state's economy and its water utility providers.

U.S. Military Bases

American States Water, through its American States Utility Services, Inc. subsidiary, has secured significant long-term contracts to provide essential water and wastewater services to numerous U.S. military installations across the country. This represents a stable and substantial business-to-government (B2G) customer segment.

The company's commitment to this sector is underscored by its existing agreements, which include serving 12 military bases under 50-year contracts and an additional base with a 15-year contract, demonstrating a long-term strategic focus and reliable revenue stream.

- Customer Segment: U.S. Military Bases

- Contractual Basis: Long-term agreements for water and wastewater services.

- Scale and Stability: Serves 12 bases on 50-year contracts and 1 base on a 15-year contract, highlighting a large-scale and stable B2G customer base.

- Strategic Importance: These contracts provide predictable revenue and underscore the company's role in supporting critical national infrastructure.

Electricity Customers (Big Bear Lake, CA)

This customer segment encompasses both homes and businesses within Big Bear Lake, California, and its neighboring regions. These customers rely on Bear Valley Electric Service, Inc., a subsidiary of American States Water, for their electricity distribution needs. It's a focused customer base, concentrated in a specific geographic area.

As of recent data, Bear Valley Electric Service serves approximately 24,900 customer connections in the Big Bear Lake area. This smaller, localized utility customer base is crucial to the operational footprint of the company's electricity segment.

- Residential Customers: Households within Big Bear Lake and surrounding areas.

- Commercial Customers: Businesses operating in the same geographic footprint.

- Geographic Concentration: A defined service territory in and around Big Bear Lake, CA.

- Customer Count: Approximately 24,900 electricity customer connections.

American States Water's customer segments are diverse, ranging from residential and commercial users of its water utility services to industrial clients and even U.S. military installations. A distinct segment also exists for electricity customers in the Big Bear Lake area.

The company's water utility operations, primarily through Golden State Water Company, serve around 264,600 residential customer connections in California. In the first quarter of 2024, the water segment, which includes commercial customers, generated $107.8 million in revenue, underscoring the economic significance of these business clients.

Furthermore, American States Utility Services manages long-term contracts with U.S. military bases, providing essential water and wastewater services. These B2G contracts are substantial, with agreements for 12 bases on 50-year terms and one base on a 15-year term, ensuring stable, predictable revenue.

| Customer Segment | Primary Service | Key Data Point / 2024 Insight |

|---|---|---|

| Residential (Water) | Water Utility | ~264,600 connections in California |

| Commercial (Water) | Water Utility | Contributed significantly to $107.8M water segment revenue (Q1 2024) |

| Industrial (Water) | Water Utility | Vital to California's economy; specific 2024 data not detailed but significant contributor |

| U.S. Military Bases | Water & Wastewater Utility | 12 bases on 50-year contracts, 1 base on 15-year contract |

| Residential & Commercial (Electric) | Electricity Distribution | ~24,900 connections in Big Bear Lake area |

Cost Structure

A significant portion of American States Water's expenses comes from capital expenditures, or CAPEX, for its infrastructure. This involves substantial investments in building, repairing, and improving its water and electric systems. Think of it as constantly maintaining and upgrading a vast network of pipes, treatment plants, wells, and power lines to ensure reliable service and meet strict regulations.

These essential upgrades and replacements are critical for maintaining service quality and ensuring regulatory compliance. For 2025, the company anticipates spending between $170 million and $210 million specifically on its infrastructure projects. This ongoing investment is a core element of their operational cost structure.

Operating and maintenance expenses are the backbone of American States Water's daily functions, encompassing everything from paying the crews who keep the pipes flowing to the general overhead that keeps the lights on. These are the essential, recurring costs needed to ensure reliable service. For instance, in the second quarter of 2025, the company saw its operating expenses, which include the cost of acquiring water, rise.

For American States Water's utility segment, a significant expense is water procurement and treatment. This includes buying water from external suppliers when necessary and the substantial costs of purifying raw water to meet stringent drinking water standards. In 2024, the company noted that increased customer water usage and rising per-unit water supply costs directly impacted these operational expenditures.

Regulatory and Compliance Costs

American States Water, operating in a heavily regulated utility sector, faces substantial expenses related to regulatory compliance. These costs are essential for maintaining legal operational status and include fees for rate case filings, legal counsel, and ensuring adherence to stringent environmental and safety standards. For instance, in 2023, the company reported approximately $12.7 million in regulatory asset amortization, a direct reflection of these ongoing compliance efforts.

These expenditures are not optional; they are fundamental to the company's ability to conduct business within the established regulatory framework. The outcomes of regulatory proceedings and the continuous need to meet compliance mandates directly influence the overall cost structure and profitability. This includes costs associated with expert testimony and the preparation of detailed reports required by regulatory bodies.

- Regulatory Filings: Costs associated with preparing and submitting annual reports, rate increase applications, and other required documentation to state public utility commissions.

- Legal and Consulting Fees: Expenses incurred for legal representation during regulatory proceedings, environmental impact studies, and specialized consulting services to ensure compliance.

- Environmental and Safety Standards: Investments in infrastructure upgrades and operational procedures to meet evolving environmental protection regulations and workplace safety requirements.

- Compliance Monitoring: Costs for internal and external audits, data collection, and reporting to verify adherence to all applicable laws and regulations.

Labor and Personnel Costs

Labor and personnel costs are a significant component of American States Water's operational expenses. These include salaries, wages, comprehensive benefits packages, and ongoing training for all employees. This investment is crucial for attracting and retaining the skilled workforce necessary to maintain and operate essential water and wastewater systems.

The company's commitment to its workforce is evident in its employee base. As of the latest available data, American States Water employs 517 individuals. This team encompasses a wide range of expertise, from field utility workers and specialized engineers to customer service representatives and senior management, all contributing to the reliable delivery of services.

- Salaries and Wages: Direct compensation for all employees across various departments.

- Employee Benefits: Healthcare, retirement plans, and other benefits supporting employee well-being.

- Training and Development: Investment in upskilling the workforce to meet industry standards and technological advancements.

- Total Workforce: 517 employees as of recent reporting, reflecting the scale of human capital investment.

American States Water's cost structure is heavily influenced by its capital-intensive infrastructure needs, ongoing operational and maintenance expenses, and significant regulatory compliance requirements. Labor costs also form a substantial part of its spending to support its skilled workforce.

| Cost Category | Key Components | 2024/2025 Data Points |

|---|---|---|

| Capital Expenditures (CAPEX) | Infrastructure building, repair, and improvement | $170-$210 million anticipated for infrastructure projects in 2025. |

| Operating & Maintenance (O&M) | Water procurement, treatment, labor, general overhead | Operating expenses rose in Q2 2025 due to increased water usage and supply costs. |

| Regulatory Compliance | Rate filings, legal fees, environmental/safety standards adherence | $12.7 million in regulatory asset amortization reported in 2023. |

| Labor & Personnel | Salaries, wages, benefits, training | 517 employees as of recent reporting, reflecting human capital investment. |

Revenue Streams

American States Water’s core revenue originates from charging residential, commercial, and industrial customers for their water usage. This is primarily determined by metered consumption, supplemented by fixed service charges.

These charges are not set arbitrarily; they are regulated and require approval from the California Public Utilities Commission (CPUC) through formal general rate case proceedings. This regulatory oversight ensures fair pricing for consumers while allowing the utility to recover costs and invest in infrastructure.

The company saw a positive impact on its revenue from new water rates that took effect in 2025, reflecting adjustments made through these regulatory processes. For instance, in the first quarter of 2024, the company reported that its Water segment’s operating revenue increased by 11.4% to $127.7 million, partly due to these rate adjustments.

American States Water generates revenue by distributing and selling electricity to customers within the Big Bear Lake region. These electricity rates are overseen by the California Public Utilities Commission (CPUC), similar to their water services, ensuring regulated pricing.

The company saw a positive impact on its electric segment's earnings due to new electric rates that were implemented in 2025. For instance, in the first quarter of 2024, the electric segment’s operating income was $11.1 million, a significant increase from $8.7 million in the same period of 2023, reflecting the benefit of rate adjustments.

American States Utility Services, Inc. secures substantial revenue through long-term agreements with the U.S. government, supplying essential water and wastewater services to various military bases. These contracts are structured to incorporate annual economic price adjustments, ensuring revenue keeps pace with inflation, and also present avenues for lucrative additional construction projects.

For the entirety of 2025, the contracted services segment is projected to contribute between $0.59 and $0.63 per share to the company's earnings. This demonstrates the critical role these government contracts play in American States Water's financial performance.

Connection and Service Fees

American States Water also generates revenue through connection and service fees. These are supplemental charges beyond the regular water usage bills. They cover costs associated with setting up new water services, as well as handling disconnections, reconnections, and other administrative tasks.

These fees are generally one-time or infrequent, providing a steady, albeit smaller, income stream. For instance, in 2023, American States Water reported revenue from its Water Operations segment that included these types of charges, contributing to the overall financial health of the utility services.

- Service Connection Fees: Charges for initiating new water service to a property.

- Disconnection/Reconnection Fees: Costs incurred when a service is temporarily suspended and then reinstated.

- Administrative Fees: Charges for various service requests and account management activities.

- Impact of Growth: Increased new construction and development directly boost revenue from connection fees.

Regulatory-Approved Cost Recovery Mechanisms

American States Water Company's regulated operations provide a stable revenue base through cost recovery mechanisms approved by regulatory bodies like the California Public Utilities Commission (CPUC). These mechanisms allow the company to pass through essential costs, including those for water supply and significant capital investments, directly to its customers via established rates. This ensures the company can recoup its approved expenses and achieve a predetermined rate of return on its infrastructure investments, fostering financial stability.

In 2024, the CPUC authorized approximately $650 million in capital investments for revenue recovery, highlighting the scale of infrastructure upgrades and expansions being undertaken. These authorized investments are crucial for maintaining and enhancing the water and wastewater systems, ensuring reliable service delivery to communities. The ability to recover these capital expenditures through customer rates underpins the company's long-term financial planning and operational sustainability.

- Cost Recovery Mechanisms: Regulated entities like American States Water can recover approved operating and capital expenses through customer rates.

- Capital Investment Authorization: The CPUC authorized nearly $650 million in capital investments for revenue recovery in 2024.

- Regulated Return: These mechanisms ensure the company can earn a regulated return on its investments in infrastructure and operations.

- Financial Stability: Pass-through provisions provide a degree of predictability and stability to the company's revenue streams.

American States Water's revenue streams are diverse, encompassing regulated water and electric utilities, along with contracted services for military bases. The water segment, its largest, relies on metered usage and service charges approved by the CPUC. The electric segment in Big Bear Lake also operates under CPUC-regulated rates. Long-term contracts with the U.S. government for water and wastewater services provide stable income, with built-in price adjustments.

| Revenue Stream | Primary Basis | Regulatory Oversight | 2024 Impact/Data |

| Water Services | Metered usage, service charges | CPUC | 11.4% operating revenue increase (Q1 2024) |

| Electric Services | Regulated rates | CPUC | $11.1 million operating income (Q1 2024) |

| Contracted Services (ASUS) | Long-term government contracts | Annual price adjustments | Projected $0.59-$0.63 EPS contribution (2025) |

| Connection & Service Fees | One-time or infrequent charges | Internal/Regulatory | Contributes to Water Operations revenue |

Business Model Canvas Data Sources

The American States Water Business Model Canvas is built using a combination of publicly available financial reports, industry analysis of the water utility sector, and market research on customer needs and regulatory environments.