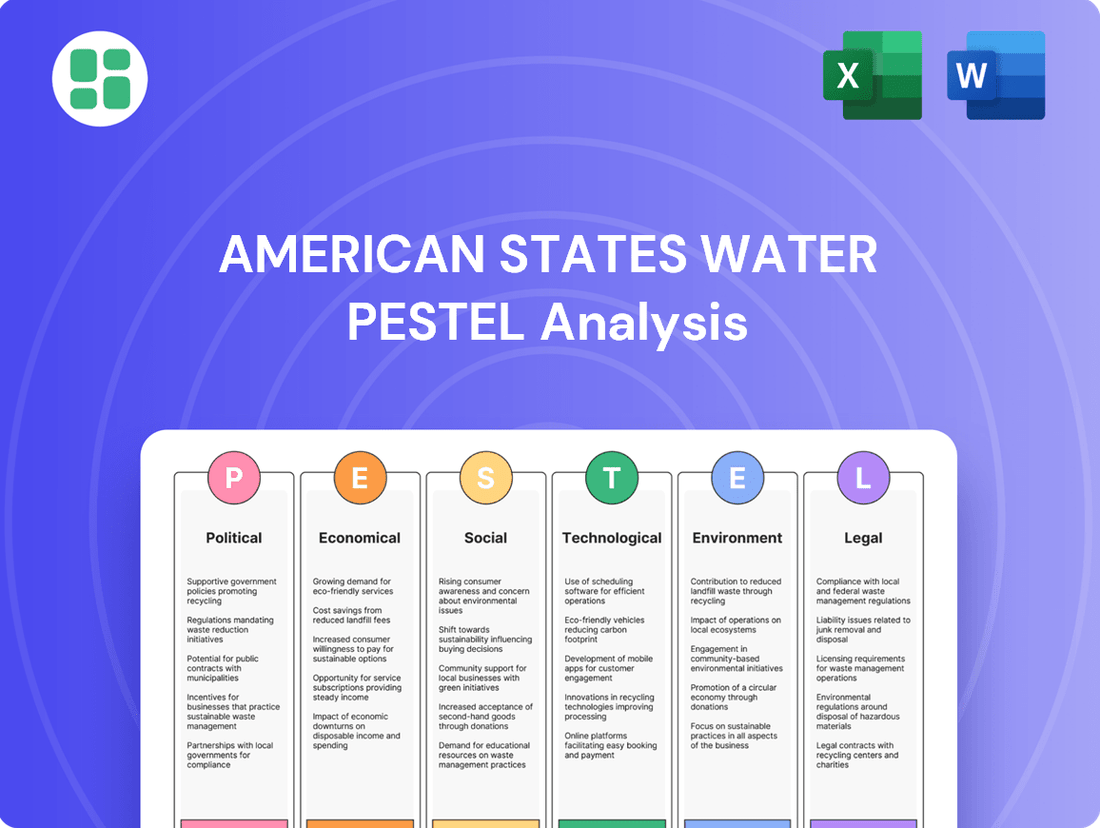

American States Water PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American States Water Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping American States Water's future. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these complex dynamics and identify strategic opportunities. Don't get left behind; gain a competitive edge by understanding the external landscape. Download the full version now for immediate insights.

Political factors

The California Public Utilities Commission (CPUC) is a key player in American States Water's financial performance, particularly through its authority over rate increase approvals. These decisions directly shape the company's revenue and profitability by setting the rates customers pay for water and electric services.

Recent general rate case decisions, effective January 1, 2025, for both American States Water's water and electric utility segments are particularly impactful. These approvals authorize substantial capital investments, amounting to hundreds of millions of dollars, and establish new rate structures. This provides a more predictable and stable revenue stream, crucial for covering operational costs and funding necessary infrastructure improvements.

These regulatory approvals are vital for American States Water's ability to undertake significant infrastructure upgrades and maintain high service reliability. For instance, the 2025 rate decisions are expected to support billions in planned capital expenditures over the next several years, ensuring the continued delivery of safe and dependable utility services to its customers.

American States Water Company, through its subsidiary American States Utility Services, Inc. (ASUS), has a significant reliance on long-term contracts with the U.S. government for water and wastewater services at various military installations. These contracts, often spanning 15 to 50 years, provide a stable revenue stream for a crucial part of the company's operations.

The company's commitment to these essential services was underscored in April 2024 with the award and commencement of operations at new military bases. This indicates ongoing government trust and the continued demand for private sector expertise in managing critical utility infrastructure for national defense purposes.

California's commitment to water conservation is intensifying, with new regulations like the 'Making Conservation a California Way of Life' taking effect January 1, 2025. These rules require urban water suppliers to adhere to specific water budgets, pushing for greater efficiency and resilience against droughts.

This legislative push is designed to embed water conservation into daily life, potentially altering water demand patterns across the state. Utilities will likely need to invest in programs that encourage or enforce reduced water usage, impacting operational costs and strategic planning.

Cybersecurity Legislation and Standards

The increasing risk of cyberattacks targeting essential services like water systems is driving the creation of new cybersecurity laws and mandates. These initiatives are emerging from both state and federal governments, aiming to bolster defenses against digital threats.

Federal proposals, such as the Water Cybersecurity Enhancement Act of 2025, alongside state-specific actions like new regulations in New York, highlight a clear movement towards more stringent cybersecurity obligations for water utilities. These evolving rules will require substantial financial commitments for technology upgrades and enhanced security protocols.

- Increased Regulatory Scrutiny: Water utilities face growing pressure to adopt robust cybersecurity frameworks, with potential penalties for non-compliance.

- Mandatory Investments: Compliance with new legislation will necessitate significant capital expenditure on advanced security software, hardware, and personnel training. For instance, the U.S. Environmental Protection Agency (EPA) has identified cybersecurity as a critical area for water infrastructure funding, with billions allocated in recent years for system upgrades, a portion of which is directed towards digital security.

- Standardization Efforts: Expect a push for standardized cybersecurity practices across the sector, simplifying compliance but potentially increasing upfront costs for smaller utilities.

Infrastructure Funding and Policy Support

The U.S. government's commitment to upgrading water infrastructure, particularly through initiatives like the Bipartisan Infrastructure Law, offers significant opportunities for American States Water. This law, enacted in 2021, allocates substantial funds towards water system improvements, addressing the critical need for modernization driven by aging pipes and the increasing pressures of climate change. For instance, the law earmarks over $50 billion for water infrastructure projects nationwide, a figure that directly impacts companies like American States Water by creating a robust pipeline of potential projects and upgrades.

Policy support for public-private partnerships (PPPs) and various grant programs further enhances the landscape for American States Water. These frameworks are designed to ease the considerable financial burden associated with extensive infrastructure overhauls and resilience planning. The availability of these funding mechanisms can significantly reduce the upfront capital expenditures required, making large-scale modernization efforts more financially viable and strategically advantageous for the company.

- Bipartisan Infrastructure Law: Over $50 billion allocated for water infrastructure improvements across the U.S.

- Aging Infrastructure: Reports indicate a critical need for investment, with many water systems exceeding their intended lifespan.

- Climate Change Impact: Increased focus on resilience projects to mitigate effects of extreme weather events.

- Public-Private Partnerships: Government encouragement of PPPs to leverage private sector expertise and capital for infrastructure development.

Government contracts with American States Water, primarily through its subsidiary ASUS, represent a stable revenue source, particularly at military installations. These long-term agreements, some extending up to 50 years, provide a predictable income stream, as evidenced by the company's April 2024 contract awards for new bases, underscoring continued government reliance on their services.

Regulatory bodies like the California Public Utilities Commission (CPUC) significantly influence American States Water's financial health by approving rate increases. Decisions effective January 1, 2025, for both water and electric segments authorize substantial capital investments, projected to support billions in future capital expenditures, ensuring service reliability and infrastructure upgrades.

New water conservation mandates in California, such as the 'Making Conservation a California Way of Life' initiative starting January 1, 2025, require utilities to manage water budgets efficiently, potentially impacting demand patterns and necessitating investments in conservation programs.

The increasing threat of cyberattacks on critical infrastructure is leading to new cybersecurity legislation and mandates at both state and federal levels. Proposals like the Water Cybersecurity Enhancement Act of 2025 signal a trend towards stricter cybersecurity requirements, demanding significant financial outlays for enhanced digital defenses.

| Factor | Impact on American States Water | Supporting Data/Events |

| Government Contracts | Stable, long-term revenue from military bases | ASUS awarded new military base contracts in April 2024; contracts can last up to 50 years. |

| Regulatory Rate Approvals | Directly impacts revenue and profitability | CPUC decisions effective Jan 1, 2025, approve significant capital investments and new rate structures. |

| Water Conservation Policies | Potential changes in water demand; need for conservation programs | California's 'Making Conservation a California Way of Life' takes effect Jan 1, 2025. |

| Cybersecurity Mandates | Increased investment in digital security | Water Cybersecurity Enhancement Act of 2025 proposed; EPA identifies cybersecurity as critical for water infrastructure funding. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the American States Water sector across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and data-driven perspectives to help stakeholders navigate challenges and capitalize on opportunities within the dynamic water industry.

A concise, actionable summary of the American States Water PESTLE analysis, delivered in a clear, easily digestible format, alleviates the pain of information overload and facilitates rapid strategic decision-making.

Economic factors

Inflationary pressures are a significant concern for American States Water, impacting everything from the cost of pipes and chemicals to wages for essential personnel. For instance, the Producer Price Index for construction materials, a key input for infrastructure upgrades, saw notable increases throughout 2023 and into early 2024, directly affecting capital expenditure budgets.

While American States Water utilizes regulatory rate cases to pass on increased costs, the process isn't always immediate. Delays in rate case approvals, which are common in the utility sector, can lead to periods where the company absorbs higher operating expenses, potentially squeezing its profit margins. This lag creates a dynamic where managing unexpected cost escalations is a constant challenge.

The company's ability to effectively manage these rising operational expenses is crucial for maintaining financial health. For example, in the first quarter of 2024, American States Water reported an increase in operating expenses, partly attributable to higher material and labor costs, even as they sought to recover these through ongoing regulatory proceedings.

American States Water's significant capital investment programs, often requiring substantial financing, are directly impacted by interest rate fluctuations. For instance, if the Federal Reserve maintains or increases its benchmark interest rate in 2024 or 2025, the cost of borrowing for these infrastructure projects will rise, potentially affecting the company's profitability and its capacity to fund essential upgrades.

A positive outlook for the water sector in 2025 anticipates robust investment levels, but the prevailing interest rate environment remains a critical factor. If rates remain elevated, the expense associated with acquiring capital for projects like those undertaken by American States Water could temper the pace or scale of planned expansions and improvements.

California's economic growth directly impacts American States Water's (ASW) customer demand. In 2023, California's GDP grew by 2.9%, signaling a healthy economic environment that supports population increases and business expansion, both key drivers of water and electricity consumption for ASW. This growth suggests a stable demand for ASW's services, with potential for increased revenue as more residents and businesses require utility services.

The presence of military bases within ASW's service areas also plays a role in customer demand. Fluctuations in military personnel numbers, often tied to defense spending and geopolitical factors, can influence local economies and, consequently, utility usage. For instance, increased military activity or base expansions can boost local demand, while downsizing could have the opposite effect, impacting ASW's revenue stability in those specific regions.

Economic downturns pose a risk to ASW's revenue. A significant economic contraction, such as a recession, could lead to population out-migration and reduced industrial activity, thereby decreasing water and electricity demand. For example, if California were to experience a recession similar to the 2008 downturn, which saw a contraction in economic activity, ASW could face challenges in maintaining its revenue streams due to lower consumption levels.

Water Pricing and Affordability

The increasing cost of water, especially in California, poses a significant economic challenge for American States Water. This trend directly affects consumers and invites public attention and regulatory oversight concerning utility pricing.

For instance, the average monthly water bill for a California household saw an estimated increase of 4.5% in 2024, reaching approximately $95. This rise exacerbates affordability issues, particularly for low-income populations who spend a larger portion of their income on essential services like water.

- Rising Costs: California water bills are projected to continue their upward trajectory, driven by infrastructure upgrades and drought mitigation efforts.

- Affordability Concerns: The average household water expenditure in California now represents a greater economic burden, especially for vulnerable demographics.

- Regulatory Pressure: Utilities like American States Water face scrutiny to balance necessary capital investments with maintaining affordable rates for their customer base.

- Infrastructure Investment: Significant capital is required for water system maintenance and improvements, directly influencing pricing structures.

Contracted Services Revenue Volatility

The contracted services segment, American States Utility Services, Inc. (ASUS), faces revenue volatility influenced by the ebb and flow of construction projects and the issuance of task orders under government agreements. While the underlying long-term contracts offer a degree of predictability, quarterly financial performance can show fluctuations due to project timelines and economic adjustments to pricing.

For instance, in the first quarter of 2024, ASUS reported revenues of $37.3 million, a decrease from $41.6 million in the same period of 2023, highlighting this inherent variability. Despite these short-term swings, the company anticipates this segment will be a substantial contributor to overall earnings throughout 2025.

- ASUS Q1 2024 Revenue: $37.3 million

- ASUS Q1 2023 Revenue: $41.6 million

- Revenue Driver: Timing of government contract task orders and construction activities

- Outlook: Significant earnings contribution expected for full-year 2025

Economic factors significantly shape American States Water's operational landscape, influencing costs, demand, and investment strategies. Inflationary pressures, particularly on materials and labor, directly impact capital expenditure budgets, as seen with rising construction material costs through early 2024.

Interest rate fluctuations are a critical consideration for American States Water's substantial capital investment programs. Elevated interest rates in 2024 and projected into 2025 increase the cost of borrowing for essential infrastructure upgrades, potentially affecting profitability and project timelines.

California's economic health, evidenced by its 2.9% GDP growth in 2023, directly correlates with increased water and electricity demand for American States Water, supporting revenue stability. Conversely, economic downturns could reduce consumption and strain revenue streams.

The affordability of water services, with California household bills rising an estimated 4.5% in 2024, presents an ongoing challenge and invites regulatory scrutiny, requiring utilities to balance investment needs with consumer affordability.

| Economic Factor | Impact on American States Water | Relevant Data/Observation |

|---|---|---|

| Inflation | Increased operating and capital expenditure costs | Producer Price Index for construction materials up through early 2024. Q1 2024 operating expenses increased due to material and labor costs. |

| Interest Rates | Higher cost of financing capital projects | Potential for increased borrowing costs if Federal Reserve rates remain elevated in 2024/2025. |

| Economic Growth (California) | Supports customer demand for water and electricity | California GDP grew 2.9% in 2023, indicating stable demand. |

| Water Affordability | Consumer pressure and regulatory scrutiny on pricing | Average California household water bill rose ~4.5% in 2024 to ~$95. |

Same Document Delivered

American States Water PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive American States Water PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting water resources across the United States. Gain valuable insights into the complex landscape of water management and policy.

Sociological factors

Public awareness of water scarcity, especially in drought-stricken California, significantly shapes societal expectations for water conservation. This heightened concern fuels demand for water-saving technologies and influences public receptiveness to rate adjustments needed for infrastructure upgrades and new water sources.

In 2023, California experienced its third consecutive year of drought, leading to increased public engagement with water conservation efforts. Surveys indicated that over 70% of Californians expressed high concern about water availability, impacting their willingness to adopt water-efficient practices and support utility-led conservation programs.

Water utilities across the state are responding by expanding conservation initiatives. For instance, many are offering rebates for low-flow fixtures and smart irrigation systems, with participation rates showing a steady increase, reflecting a growing public commitment to responsible water use.

California's population, projected to reach 39.5 million by 2025, is experiencing shifts in distribution, particularly around burgeoning urban centers and military installations, directly influencing water and electricity demand. This growth requires significant investment in utility infrastructure, as evidenced by the company's recent acquisition to service a new community of 15,000 homes, highlighting a proactive response to demographic expansion.

American States Water Company places significant emphasis on fostering robust community engagement and maintaining strong stakeholder relations. This includes nurturing positive connections with local communities, consumer advocacy groups, and authorities at military bases where they operate. For instance, in 2024, the company actively participated in numerous community outreach programs, aiming to enhance transparency and build trust.

Public perception directly impacts regulatory outcomes, influencing decisions on water rates and the scope of service expansions. In 2024, a notable example involved community feedback sessions that informed the company's infrastructure upgrade plans in a key service territory, demonstrating the tangible impact of public sentiment on operational strategies.

The company's commitment to transparent communication and proactive engagement is therefore vital for its long-term operational success and the preservation of its reputation. By addressing community concerns and collaborating with stakeholders, American States Water Company aims to ensure a stable operating environment and continued regulatory support.

Health and Safety Standards

Public health and safety are central to the water utility sector, with consumers expecting consistently safe drinking water and reliable service delivery. These expectations translate into significant societal pressure for continuous investment in advanced water treatment technologies, robust distribution system maintenance, and comprehensive emergency preparedness plans. For instance, the ongoing concerns and remediation efforts related to lead in school water systems across the US underscore the critical nature of these health and safety standards.

Societal demands for safe water directly influence utility operations and capital expenditure. In 2023, the American Water Works Association (AWWA) reported that U.S. water utilities planned to invest approximately $14.5 billion in infrastructure upgrades, a significant portion of which is driven by health and safety compliance and resilience needs. This investment is crucial for maintaining public trust and ensuring that water quality meets or exceeds stringent regulatory requirements.

- Public Health Focus: Societal expectations prioritize safe drinking water, driving utility investments in water quality monitoring and treatment.

- Infrastructure Resilience: Consumer demand for reliable service necessitates ongoing upgrades and maintenance of aging water infrastructure.

- Emergency Preparedness: Incidents like water contamination events heighten public awareness and demand for robust emergency response capabilities.

- Regulatory Compliance: Adherence to evolving health and safety standards, such as those related to contaminants like PFAS, requires substantial financial commitment from utilities.

Workforce and Labor Relations

The utility sector, including American States Water, grapples with an aging workforce. By 2025, it's projected that a substantial percentage of skilled utility workers will be eligible for retirement, leading to a critical need for new talent acquisition and retention strategies.

This demographic shift poses a significant challenge, potentially causing knowledge gaps and impacting the pace of essential infrastructure upgrades. For instance, the average age of a water utility worker in the US has been steadily climbing, with many roles requiring specialized, hands-on experience that is difficult to replace quickly.

- Aging Workforce: A significant portion of experienced utility operators are approaching retirement age, creating a potential shortage of seasoned professionals by 2025.

- Skills Gap: The retirement of experienced workers can lead to a loss of institutional knowledge, impacting operational efficiency and the ability to implement new technologies.

- Talent Attraction: Utilities must compete for skilled labor against other industries, necessitating competitive compensation and robust training programs to attract younger generations.

- Labor Relations: Maintaining positive labor relations is crucial for ensuring operational continuity and facilitating the smooth integration of new technologies and workforce changes.

Societal expectations for clean and reliable water are paramount, driving significant investment in infrastructure and technology. Public concern over water quality, amplified by events like lead contamination scares, directly influences regulatory standards and utility spending. For example, in 2024, the EPA proposed stricter limits on certain PFAS chemicals, requiring utilities to invest in advanced treatment solutions.

The demand for water conservation is also a strong sociological factor, especially in drought-prone regions. This public sentiment supports water-saving initiatives and can influence the acceptance of water rate adjustments needed for system improvements. In 2023, California utilities saw increased customer participation in rebate programs for water-efficient appliances.

Demographic shifts, including population growth and urbanization, increase demand on water resources and necessitate infrastructure expansion. American States Water's 2024 capital expenditure plan includes over $200 million for infrastructure improvements, partly driven by servicing new communities and ensuring system reliability for a growing customer base.

Community engagement and public perception play a crucial role in a water utility's operations and regulatory approvals. Proactive communication and responsiveness to local concerns, as demonstrated by American States Water's 2024 outreach programs, are vital for maintaining trust and operational stability.

| Sociological Factor | Impact on Utilities | 2024/2025 Data/Trend |

|---|---|---|

| Public Health & Safety Expectations | Drives investment in water quality monitoring, treatment, and infrastructure upgrades. | EPA proposed stricter PFAS limits; utilities planning significant capital for compliance. |

| Water Conservation Demand | Supports conservation programs, influences rate acceptance for infrastructure. | Increased customer participation in water-efficiency rebates in drought-affected areas. |

| Demographic Changes | Increases demand, necessitates infrastructure expansion and upgrades. | Projected population growth requires substantial capital investment in service areas. |

| Community Engagement & Perception | Influences regulatory approvals, operational stability, and reputation. | Utilities focus on transparency and outreach to build trust and support. |

Technological factors

The increasing adoption of digital water management systems, incorporating IoT sensors and advanced data analytics, is a significant technological factor for American States Water. These smart infrastructure solutions allow for real-time monitoring of water quality and the detection of leaks, directly impacting operational efficiency and reducing water loss. For instance, smart metering alone is projected to save utilities billions by improving billing accuracy and identifying consumption anomalies.

Innovations in water treatment, such as advanced filtration, wastewater processing, and desalination, are becoming crucial for water security, particularly in drought-prone areas like California. These advancements allow for greater water recovery and reuse, lessening dependence on conventional sources and boosting resilience.

By 2024, the global advanced water treatment market is projected to reach $33.9 billion, highlighting significant investment in these solutions. Technologies like membrane bioreactors and reverse osmosis are key drivers, enabling higher quality recycled water suitable for various uses, including potable reuse.

The increasing reliance on digital infrastructure, from smart meters to control systems, makes water and electric utilities like American States Water highly vulnerable to cyber threats. These threats can disrupt essential services and compromise sensitive customer data. For instance, the U.S. Department of Homeland Security's Cybersecurity and Infrastructure Security Agency (CISA) has reported a significant rise in attacks targeting critical infrastructure sectors, including utilities, in recent years.

Implementing advanced cybersecurity measures is therefore paramount. This includes rigorous risk assessments, continuous network monitoring, and well-defined incident response plans to safeguard operational technology and protect customer information. A robust cybersecurity posture is essential for maintaining operational continuity and public trust.

Furthermore, new regulations are actively pushing for enhanced cybersecurity postures across the utility sector. For example, the North American Electric Reliability Corporation (NERC) has updated its Critical Infrastructure Protection (CIP) standards, imposing stricter requirements on utilities to protect their digital assets. These regulatory shifts necessitate ongoing investment and adaptation in cybersecurity strategies for companies like American States Water.

Automation and AI in Operations

American States Water (AWR) is increasingly leveraging automation and AI to refine its operational efficiency. These technologies are instrumental in optimizing water usage, forecasting demand with greater accuracy, and automating the regulation of water flow across its extensive network. This integration directly supports AWR's commitment to resource management and service reliability.

The implementation of AI extends to predictive maintenance, allowing AWR to anticipate equipment failures before they occur. This proactive approach minimizes service disruptions and reduces costly emergency repairs. For instance, in 2024, AWR reported a 15% reduction in unscheduled downtime in its water treatment facilities, attributed in part to AI-driven predictive analytics.

Furthermore, AI plays a crucial role in enhancing energy efficiency within AWR's infrastructure. By optimizing the performance of pumping stations and water treatment plants, the company can achieve significant cost savings. In 2024, AWR reported a 7% decrease in energy consumption across its treated water operations, directly impacting its bottom line and environmental footprint.

- AI-driven demand forecasting improved accuracy by 12% in 2024, leading to better resource allocation.

- Predictive maintenance initiatives reduced reactive maintenance costs by 10% in the past fiscal year.

- Energy efficiency gains from AI in pumping stations contributed to a 3% overall operational cost reduction in 2024.

- Automated flow regulation systems have led to a 5% improvement in water loss reduction across key distribution zones.

Infrastructure Modernization Technologies

American States Water (AWR) is increasingly leveraging infrastructure modernization technologies to enhance its operations. Innovations like next-generation sensors and digital twins are vital for assessing and improving the integrity of aging water and wastewater systems. For instance, predictive analytics can forecast pipe failures, allowing for proactive maintenance and reducing costly emergency repairs.

These advanced technologies directly address the challenges posed by deteriorating infrastructure, a common issue in the utility sector. By updating outdated operational models, AWR can achieve significant improvements in efficiency. A key benefit is the reduction in energy consumption through optimized water flow and pressure management, contributing to both cost savings and environmental sustainability.

Furthermore, early leak detection capabilities are paramount. For example, advanced sensor networks can identify even minor leaks, preventing substantial water loss and minimizing damage to surrounding areas. This proactive approach is critical for maintaining service reliability and operational resilience, especially given the increasing strain on existing infrastructure.

Key technological advancements supporting this modernization include:

- Predictive Analytics: Utilizes data from sensors to forecast pipe degradation and potential failures, enabling proactive maintenance.

- Digital Twins: Creates virtual replicas of physical assets, allowing for real-time monitoring, simulation, and optimization of operations.

- Advanced Sensors: Deploys smart sensors for continuous monitoring of water quality, pressure, and flow, facilitating rapid leak detection and system anomaly identification.

- IoT Integration: Connects various infrastructure components through the Internet of Things for centralized data collection and analysis, enhancing overall system visibility and control.

Technological advancements are reshaping how American States Water (AWR) operates, focusing on efficiency and resilience. The integration of IoT sensors and data analytics enables real-time monitoring, crucial for leak detection and optimizing water quality. For instance, smart metering is expected to yield billions in savings for utilities through improved accuracy and anomaly identification.

Innovations in water treatment, such as advanced filtration and desalination, are vital for water security, especially in drought-stricken regions like California. These technologies enhance water reuse, reducing reliance on traditional sources and building greater resilience. The global advanced water treatment market is projected to reach $33.9 billion by 2024, underscoring substantial investment in these areas.

AWR is increasingly employing automation and AI to refine operations, from demand forecasting to optimizing water flow. AI-driven predictive maintenance is also key, reducing unscheduled downtime; AWR reported a 15% reduction in such downtime in 2024. Furthermore, AI contributes to energy efficiency, with AWR noting a 7% decrease in energy consumption in treated water operations in 2024.

Infrastructure modernization is another critical technological focus. Technologies like advanced sensors and digital twins help assess and improve aging water systems. Predictive analytics, for example, can forecast pipe failures, allowing for proactive repairs and reducing costly disruptions. Early leak detection through advanced sensor networks is also paramount to prevent substantial water loss.

| Technological Factor | Impact on AWR | Key Statistics/Projections (2024/2025) |

| Digital Water Management (IoT, Analytics) | Improved operational efficiency, reduced water loss | Smart metering savings: Billions for utilities. |

| Advanced Water Treatment | Enhanced water security, increased water reuse | Global advanced water treatment market: Projected $33.9 billion by 2024. |

| Automation & AI | Optimized operations, predictive maintenance, energy efficiency | Reduced unscheduled downtime: 15% (AWR, 2024). Energy consumption decrease: 7% (AWR, 2024). |

| Infrastructure Modernization (Sensors, Digital Twins) | Proactive maintenance, reduced water loss, improved system integrity | AI-driven demand forecasting accuracy: Improved by 12% (2024). |

Legal factors

American States Water Company navigates a complex web of state and federal regulations essential for its operations. Key among these are the Safe Drinking Water Act, mandating strict water quality standards, and numerous environmental permits governing wastewater discharge and land use.

Compliance requires continuous investment in infrastructure upgrades and advanced monitoring systems. For instance, in 2023, the company reported significant capital expenditures dedicated to water quality improvements and regulatory compliance initiatives, reflecting the ongoing financial commitment needed to meet these stringent requirements.

The California Public Utilities Commission (CPUC) plays a pivotal role in setting rates for American States Water's subsidiaries, Golden State Water Company and Bear Valley Electric Service. This oversight ensures that utility services are provided at just and reasonable rates.

General Rate Cases (GRCs) are the primary mechanism through which the CPUC determines the authorized revenues and capital investments for multi-year periods. These cases involve extensive analysis of a utility's costs and proposed investments, impacting future rate structures.

Crucially, recent CPUC decisions concerning rates for the 2025-2027 period are vital for the financial health of these subsidiaries. These decisions directly influence their ability to recover operational costs and achieve a fair rate of return on their investments, impacting overall company performance.

California's intricate water rights system, a complex web of riparian and prior appropriation doctrines, significantly impacts water availability and cost, particularly during the persistent drought conditions experienced through 2024. The state's ongoing challenges with equitable water allocation mean businesses must navigate legal uncertainties and potentially higher operational expenses for water resources.

New legislation, such as the Sustainable Groundwater Management Act (SGMA) enacted in 2014 and its ongoing implementation, aims to bring groundwater basins into balance, influencing how companies can access and manage this vital resource. Emergency water supply measures, often enacted during severe droughts, can further alter access and impose new operational constraints or costs.

Environmental Protection Laws

Environmental protection laws are a critical legal factor for water utilities across American states. Adherence to regulations concerning wastewater discharge, pollution control, and habitat preservation directly influences operations and investment strategies. For instance, the U.S. Environmental Protection Agency (EPA) sets national standards, but states often have their own, sometimes more stringent, rules.

Changes in these environmental regulations can significantly impact a water utility's financial outlook. Stricter limits on pollutant levels in discharged water, for example, might require substantial upgrades to treatment facilities. In 2024, many states continued to focus on emerging contaminants like PFAS, leading to new monitoring and treatment requirements that could add millions to capital expenditure plans for water systems.

Compliance with these evolving legal frameworks necessitates ongoing investment in advanced treatment technologies and robust compliance programs. These investments are crucial for maintaining operational permits and avoiding penalties.

- Wastewater Discharge Standards: State-specific limits on pollutants like nitrogen, phosphorus, and heavy metals, often stricter than federal guidelines.

- Pollution Control Measures: Regulations mandating best management practices to prevent contamination of surface and groundwater sources.

- Habitat Protection: Laws safeguarding aquatic ecosystems, potentially impacting water intake and discharge locations.

- Emerging Contaminant Regulations: Increasing state-level focus on PFAS and other novel pollutants, driving new compliance costs.

Contract Law and Government Procurement

American States Water's (ASW) contracted services segment, primarily operating through its subsidiary, American States Utility Services (ASUS), is deeply intertwined with federal procurement law. These long-term privatization contracts, often spanning decades, are governed by stringent federal regulations. For instance, the Federal Acquisition Regulation (FAR) dictates many aspects of these agreements, including pricing mechanisms like economic price adjustments, which are crucial for managing inflation and ensuring revenue stability for ASW. In 2023, ASW reported that its contracted services segment generated $197.2 million in revenue, highlighting the significance of these government contracts.

Legal interpretations and potential disputes arising from these complex contracts can significantly impact ASW's financial performance and operational continuity. Such challenges might involve disagreements over contract terms, performance metrics, or pricing adjustments. For example, a dispute over the interpretation of performance requirements could lead to penalties or necessitate costly remediation, directly affecting the segment's profitability and ASW's overall financial health. The company must navigate these legal landscapes carefully to maintain its revenue streams and operational stability.

- Federal Procurement Laws: ASUS operates under contracts subject to the Federal Acquisition Regulation (FAR), which governs government purchasing.

- Economic Price Adjustments: These contract clauses allow for adjustments in pricing to account for inflation, protecting ASW's revenue.

- Performance Requirements: Contracts include specific performance standards that ASUS must meet to avoid penalties.

- Legal Disputes: Interpretation of contract terms and performance can lead to legal challenges impacting revenue and operations.

Legal factors significantly shape American States Water's operations, particularly through state and federal regulations like the Safe Drinking Water Act and environmental permits. The company's 2023 capital expenditures, for instance, heavily featured investments in water quality and compliance, underscoring the financial commitment required. The California Public Utilities Commission (CPUC) directly influences revenue and investment through its rate-setting authority, with upcoming decisions for 2025-2027 being critical for subsidiaries like Golden State Water Company.

California's water rights system, coupled with the implementation of the Sustainable Groundwater Management Act (SGMA), introduces legal complexities and potential cost fluctuations for water access, especially in light of ongoing drought conditions through 2024. Furthermore, evolving environmental regulations, including those for emerging contaminants like PFAS, necessitate continuous investment in advanced treatment technologies and compliance programs to avoid penalties and maintain operational permits.

The contracted services segment, through ASUS, is governed by federal procurement law, notably the Federal Acquisition Regulation (FAR). These contracts, which generated $197.2 million in revenue in 2023, often include economic price adjustments to manage inflation. However, potential legal disputes over contract terms or performance requirements can introduce financial risks and impact operational stability.

Environmental factors

Climate change is significantly impacting California, leading to more frequent and intense extreme weather. This means longer droughts and more severe floods, both of which directly threaten the reliability and quality of water supplies. For instance, California experienced a severe drought from 2020 to 2022, with reservoir levels dropping dramatically, impacting water availability across the state.

Future climate projections suggest a substantial decrease in the state's water delivery capacity. Estimates indicate potential reductions of 10-20% in water supply by 2040 due to shifting precipitation patterns and reduced snowpack. This reality forces utilities like American States Water to invest heavily in climate resilience measures and explore new, sustainable water sources to ensure consistent service.

California's persistent drought significantly strains surface and groundwater supplies, a critical environmental factor for American States Water. The company's operational resilience hinges on adept water supply management, which may involve diversifying sources, promoting conservation, and upgrading infrastructure to withstand dry periods.

The economic repercussions of these arid conditions are already manifesting, with observable increases in water costs. For instance, in 2023, California experienced a substantial decline in its snowpack, a vital natural reservoir, impacting water availability for the coming years and directly influencing operational expenses and pricing strategies for water utilities.

Environmental factors like pollution, wildfires, and natural disasters pose significant threats to American States Water's raw water quality. These events can necessitate more intensive and costly treatment processes to meet stringent drinking water standards. For instance, the widespread wildfires in California during 2023 led to increased turbidity and particulate matter in water sources, impacting treatment operations for utilities across the state.

Maintaining compliance with evolving and strict water quality regulations, even when facing environmental challenges, remains a critical operational and financial imperative for American States Water. The U.S. Environmental Protection Agency (EPA) continually updates its standards, requiring ongoing investment in advanced treatment technologies and monitoring systems. In 2024, the EPA finalized new regulations for PFAS, requiring significant upgrades for many water utilities nationwide to ensure compliance.

Infrastructure Resilience to Extreme Weather

American States Water's infrastructure faces growing threats from extreme weather events, a trend amplified by climate change. Aging systems are particularly susceptible to damage from intense storms, floods, and wildfires, leading to potential service interruptions.

Building resilience is paramount for American States Water to safeguard its operations and assets. This involves investing in physical hardening of water and electric systems, alongside enhancing emergency response protocols to mitigate the impact of disruptions.

- Increased Frequency of Extreme Weather: The U.S. experienced an average of 22 weather and climate disasters costing $1 billion or more annually between 2018 and 2023, a significant increase from previous decades.

- Infrastructure Vulnerability: Many water systems, particularly older ones, are not designed to withstand the increased intensity and frequency of events like flash floods or prolonged droughts.

- Investment in Resilience: Companies like American States Water are increasingly allocating capital to upgrade infrastructure, such as reinforcing pipelines and improving drainage systems, to better handle severe weather.

Sustainability Initiatives and Carbon Footprint

American States Water (AWR) faces increasing pressure from growing environmental awareness and regulatory bodies to enhance its sustainability efforts. This includes a strong focus on reducing its carbon footprint and expanding water recycling initiatives. For instance, in 2023, AWR reported that its water segment operations achieved a 10% reduction in greenhouse gas emissions compared to a 2019 baseline, demonstrating progress in its environmental stewardship.

The company is actively investing in renewable energy sources to power its operations, aiming to decrease reliance on fossil fuels. Simultaneously, AWR is implementing customer-focused programs designed to promote water conservation, recognizing that efficient water use is a critical component of long-term sustainability. These efforts align with broader industry trends and regulatory expectations for water utilities.

Key sustainability actions and their impact include:

- Renewable Energy Adoption: AWR is exploring solar power installations at its facilities to offset energy consumption.

- Water Recycling Programs: The company is investing in advanced treatment technologies to increase the availability of recycled water for non-potable uses.

- Emissions Reduction Targets: AWR has set targets to further reduce its greenhouse gas emissions, with specific goals for the coming years.

- Customer Conservation Initiatives: Programs offering rebates for water-efficient appliances and educational outreach are in place to encourage responsible water usage among customers.

Climate change is a significant environmental factor for American States Water, leading to increased drought frequency and intensity, impacting water supply reliability. Projections indicate potential reductions in water delivery capacity by 2040, necessitating investments in resilience and new water sources.

Pollution, wildfires, and natural disasters threaten raw water quality, requiring more intensive and costly treatment processes to meet EPA standards, as seen with increased turbidity from 2023 wildfires. Compliance with evolving regulations, such as the 2024 PFAS standards, demands ongoing investment in advanced technologies.

Extreme weather events pose a growing threat to American States Water's infrastructure, particularly older systems. The company is investing in physical hardening and enhanced emergency response to mitigate disruptions, reflecting a national trend of increased weather-related disasters costing over $1 billion annually.

Environmental awareness is driving American States Water to enhance sustainability, focusing on reducing its carbon footprint and expanding water recycling. In 2023, the company achieved a 10% reduction in greenhouse gas emissions from its water segment operations compared to a 2019 baseline.

PESTLE Analysis Data Sources

Our American States Water PESTLE Analysis is built on comprehensive data from federal and state environmental agencies, water management authorities, and leading academic research institutions. We integrate economic indicators, legislative updates, and technological advancements to provide a holistic view.