American States Water Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American States Water Bundle

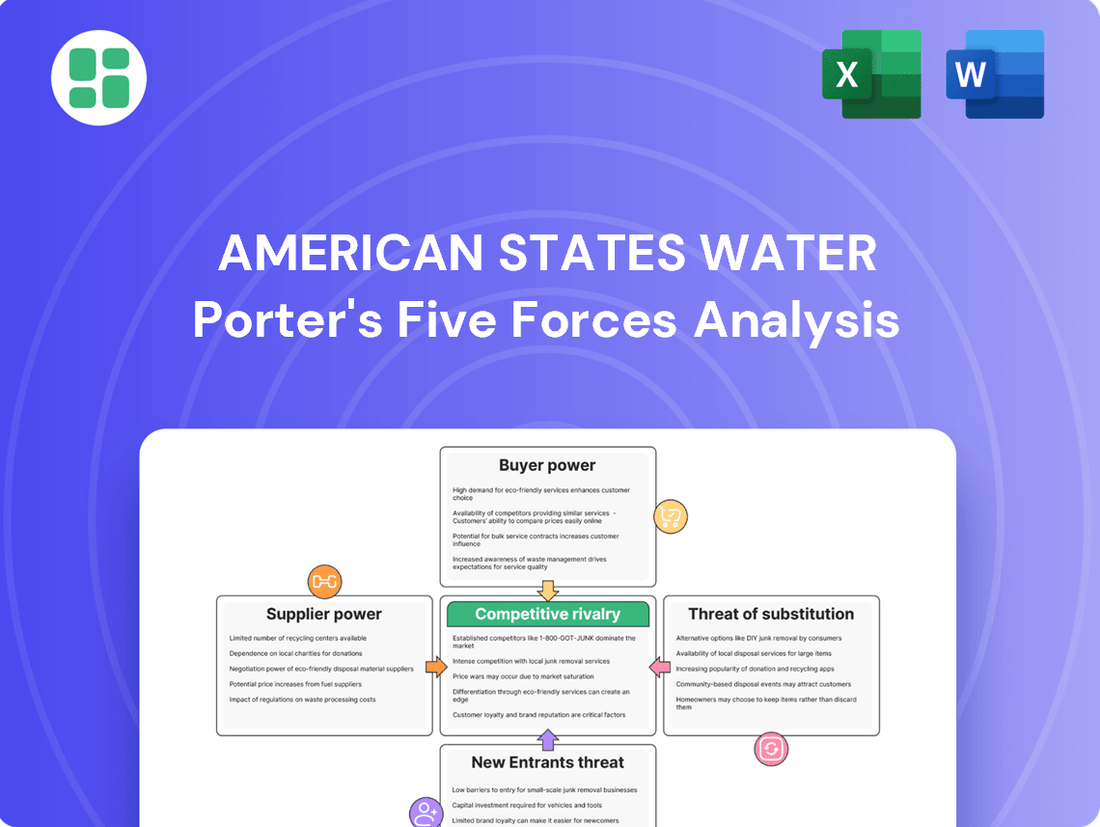

American States Water operates within a regulated utility environment, but Porter's Five Forces reveals nuanced competitive pressures. Understanding the bargaining power of buyers (customers) and suppliers (equipment, labor) is crucial for profitability. The threat of substitutes, while low for essential water services, can emerge in alternative water sources or conservation technologies.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore American States Water’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

American States Water Company, especially its utility operations, depends on specialized suppliers for crucial infrastructure like water treatment systems and pumping equipment. This reliance means a few key manufacturers often hold considerable sway over pricing.

The market for such specialized water infrastructure components is quite concentrated. For instance, the global water infrastructure equipment market reached a substantial $78.6 billion in 2023, indicating a significant industry where a few major players can exert considerable influence.

The bargaining power of suppliers for American States Water is significantly influenced by high switching costs related to its core infrastructure. Replacing or upgrading major components like water treatment systems can incur costs between $2.3 million and $7.5 million per facility, not including the substantial expenses from operational downtime.

These considerable financial and operational barriers effectively tie American States Water to its current suppliers. This lack of flexibility limits the company's leverage when negotiating terms with vendors, as the investment required to switch is often prohibitive.

The heavily regulated nature of the water utility market significantly impacts the bargaining power of suppliers. In 2023, a substantial 87.6% of water utility equipment procurement faced strict regulatory oversight. This limits American States Water's flexibility in switching suppliers or negotiating favorable terms, often bolstering the position of established, compliant vendors.

Dependence on Water Sources and Treatment Chemicals

American States Water Company's reliance on consistent water sources and necessary treatment chemicals is a key factor in understanding supplier bargaining power. The company sources water from various locations, including groundwater, surface water, and through purchases, all of which are subject to geographical constraints and regulatory oversight. This inherent dependence on specific regions and permits can limit their options.

The supply of water treatment chemicals presents a more direct avenue for supplier influence. If the market for these essential chemicals is concentrated among a few producers, those suppliers may gain leverage. For instance, the increasing focus on regulating emerging contaminants like PFAS has led to a greater demand for specialized treatment chemicals, potentially increasing the bargaining power of the companies that produce them. This can translate into higher costs for American States Water.

- Water Source Dependence: Geographic and regulatory limitations on water sourcing can reduce American States Water's flexibility.

- Chemical Supplier Concentration: A limited number of producers for critical water treatment chemicals can empower those suppliers.

- Impact of New Regulations: Evolving regulations, such as those for PFAS, can increase demand for specialized chemicals, potentially boosting supplier pricing power.

Long-Term Contracts and Relationships for Military Services

American States Utility Services, Inc. (ASUS) operates under 50-year privatization contracts with the U.S. government for military bases. This long-term commitment fosters deep, established relationships with specific equipment and service providers crucial for maintenance and construction management. For instance, ASUS's reliance on these established vendor partnerships for specialized military infrastructure projects can reduce its immediate bargaining power when seeking new suppliers.

These long-term agreements, while ensuring revenue stability for ASUS, inherently bind the company to existing supplier networks. This can limit ASUS's ability to leverage competitive pricing or explore alternative, potentially more cost-effective solutions from new vendors in the short to medium term. The specialized nature of military services further concentrates the supplier pool, potentially increasing supplier leverage.

- Long-Term Contracts: 50-year privatization contracts with the U.S. government for military bases.

- Supplier Relationships: Established, long-term partnerships with providers for maintenance and construction.

- Reduced Flexibility: Limited immediate ability to switch suppliers for specialized military operations.

The bargaining power of suppliers for American States Water is elevated due to the specialized nature of its infrastructure needs and the high costs associated with switching. For example, the company's reliance on specific water treatment systems and pumping equipment means a limited number of manufacturers often dictate pricing. The global water infrastructure equipment market, valued at $78.6 billion in 2023, is a testament to this industry's scale, where key players can wield significant influence.

Switching costs are a major factor, with replacing major components potentially costing between $2.3 million and $7.5 million per facility, not including operational disruptions. Furthermore, the heavily regulated water utility sector, where 87.6% of equipment procurement faced strict oversight in 2023, limits American States Water's flexibility in vendor selection, often strengthening the position of established suppliers.

The company's dependence on specific water sources and treatment chemicals also plays a role. Geographic and regulatory constraints on water sourcing reduce flexibility, while a concentrated market for essential treatment chemicals, particularly those addressing emerging contaminants like PFAS, can empower producers and lead to higher costs for American States Water.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Example |

|---|---|---|

| Specialized Infrastructure Needs | Increases supplier power due to limited alternatives. | Reliance on specific water treatment systems and pumping equipment. |

| High Switching Costs | Deters switching, reinforcing existing supplier relationships. | $2.3M - $7.5M per facility for major component replacement. |

| Market Concentration (Infrastructure) | Concentrated markets allow dominant suppliers to exert influence. | Global water infrastructure equipment market valued at $78.6B in 2023. |

| Regulatory Oversight | Limits flexibility in vendor selection, favoring compliant suppliers. | 87.6% of water utility equipment procurement faced strict regulation in 2023. |

| Dependence on Treatment Chemicals | Concentration in chemical supply can increase supplier leverage. | Increased demand for PFAS treatment chemicals boosts power of specialized producers. |

What is included in the product

This analysis delves into the five forces shaping American States Water's operating environment, assessing the intensity of rivalry, threat of new entrants, bargaining power of suppliers and buyers, and the threat of substitutes.

Instantly identify and mitigate competitive threats with a visual representation of each of Porter's Five Forces, streamlining strategic planning.

Customers Bargaining Power

American States Water Company's (AWR) water and electric utility rates are determined by regulatory bodies such as the California Public Utilities Commission (CPUC). This regulatory framework substantially curtails the bargaining power of customers, as they typically must accept the approved tariffs for essential services, preventing individual negotiation or demands for price reductions.

Water and electricity are fundamental necessities, and for most consumers, there are very few direct substitutes available. This scarcity of alternatives significantly limits a customer's ability to switch providers, especially since American States Water Company often operates within exclusive service territories for its regulated business.

The indispensable nature of these services means customers are generally less sensitive to price fluctuations, as long as those changes remain within the bounds set by regulatory bodies. For instance, in 2023, American States Water reported that approximately 89% of its revenue came from regulated water and wastewater operations, highlighting the essential nature of its services and the limited bargaining power of its customer base in those segments.

The customer base for American States Water's regulated utility segments, encompassing water and electric services, is remarkably fragmented. This includes hundreds of thousands of individual residential, commercial, and industrial connections across its service territories.

This widespread distribution means that no single customer or even a small cluster of customers possesses substantial purchasing volume. Consequently, they lack the leverage to significantly influence pricing or terms with American States Water.

For instance, in 2023, American States Water served approximately 260,000 water customers and 48,000 electric customers, highlighting the dispersed nature of its consumer base.

Government as a Customer in Contracted Services

American States Water Company's subsidiary, American States Utility Services, Inc., operates under long-term contracts with the U.S. government for services at military bases. The government, as a major customer, wields considerable bargaining power due to its sheer size and established procurement procedures.

This significant leverage allows the government to dictate precise contract terms and stringent performance expectations. For instance, in 2023, the U.S. Department of Defense awarded numerous contracts for utility management and infrastructure upgrades, often with competitive bidding processes that can drive down service costs for the government.

- Government's substantial volume of business grants significant negotiation leverage.

- Complex procurement processes and detailed specifications can increase customer control.

- The ability to set specific performance metrics and penalties empowers the government.

- Long-term contracts, while stable, can be subject to renegotiation or renewal terms influenced by government priorities.

Conservation Mandates and Customer Behavior

New urban water conservation regulations in California, taking effect January 1, 2025, will require water suppliers to adopt more efficient water usage practices and achieve defined water use targets. While these mandates don't represent direct customer negotiation, they can indirectly shape customer demand and affect utility revenues. This regulatory shift pushes water providers to actively promote conservation through programs and adjusted rate structures.

These conservation mandates can indirectly impact the bargaining power of customers by influencing their behavior and expectations regarding water usage. For instance, if customers are incentivized or required to reduce consumption, they may become more sensitive to pricing and service quality. In 2023, California experienced a significant reduction in water use, with urban water agencies reporting a 13% decrease compared to 2020 levels, demonstrating the potential impact of conservation efforts on demand patterns.

- Regulatory Impact: California's 2025 conservation regulations shift focus to water use efficiency, potentially altering customer demand.

- Indirect Influence: While not direct bargaining, these rules can affect customer behavior and revenue, prompting utilities to encourage conservation.

- Customer Sensitivity: Increased conservation focus may lead customers to be more attuned to water pricing and service quality.

- Past Trends: California's 2023 urban water savings of 13% (vs. 2020) highlight the potential for behavioral shifts due to conservation initiatives.

The bargaining power of customers for American States Water (AWR) is generally low due to the essential nature of water and electricity, limited substitutes, and regulatory oversight that sets prices. The fragmented customer base across its regulated utility operations, serving hundreds of thousands of dispersed residential, commercial, and industrial connections, prevents any single customer or small group from wielding significant influence. For example, in 2023, AWR served approximately 260,000 water customers and 48,000 electric customers, underscoring this lack of concentrated power.

However, a notable exception exists with the U.S. government, a major customer for AWR's subsidiary, American States Utility Services, Inc., operating at military bases. The government's substantial purchasing volume and stringent procurement processes grant it considerable leverage to negotiate contract terms and performance standards, as evidenced by the competitive bidding processes common for Department of Defense utility contracts in 2023.

New California urban water conservation regulations, effective January 1, 2025, will indirectly influence customer behavior and expectations regarding water usage. This shift may increase customer sensitivity to pricing and service quality, although it doesn't translate into direct price negotiation power. For instance, California's 2023 urban water savings of 13% compared to 2020 levels demonstrates the potential impact of conservation initiatives on demand patterns.

| Customer Segment | Bargaining Power Factor | Impact on AWR |

|---|---|---|

| General Utility Customers (Water & Electric) | Fragmented Base, Essential Service, Regulatory Pricing | Low; Limited ability to negotiate prices or terms. |

| U.S. Government (Military Bases) | Large Volume, Government Procurement, Contractual Terms | High; Significant leverage to dictate contract specifics and pricing. |

| Conservation-Minded Customers (Post-2025 Regs) | Behavioral Influence, Potential Price Sensitivity | Indirect/Moderate; May drive demand for efficiency programs and influence service quality expectations. |

Preview the Actual Deliverable

American States Water Porter's Five Forces Analysis

This preview showcases the complete American States Water Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the water utility sector. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. This detailed analysis will equip you with the insights needed to understand industry attractiveness and competitive intensity.

Rivalry Among Competitors

American States Water Company benefits from geographic monopolies in its regulated utility operations, meaning it's the sole provider of water and electricity in its designated service areas. This inherently limits direct competition from other utility companies, as new entrants face significant regulatory hurdles and infrastructure investment requirements. For instance, in 2023, the company served approximately 2.8 million people across California, highlighting the scale of its exclusive service territories.

Within the specific geographic areas served by its subsidiaries, Golden State Water Company and Bear Valley Electric Service, Inc., American States Water Company experiences very limited direct competition. This lack of alternative providers for essential water and electricity services means customers have no choice but to rely on American States Water's offerings, solidifying its market position.

While American States Water's subsidiary, American States Utility Services, Inc. (ASUS), secures long-term military base contracts, the initial bidding process is highly competitive. Other specialized utility service providers actively compete for these privatization opportunities, vying for contracts to manage water and wastewater systems on military installations.

In 2024, the defense sector continued to see robust activity in outsourcing utility management. While specific contract values for ASUS's competitive bids aren't publicly detailed, the general trend indicates a market where multiple firms with proven track records in infrastructure management and government contracting contend for these lucrative, multi-year agreements.

Industry Consolidation Trends

The water utility sector has experienced a degree of consolidation, with mergers and acquisitions becoming more common. This trend can reshape the competitive dynamics across the broader utility market. For American States Water Company, a prominent entity, this means that while direct market competition might be limited due to regulation, acquiring other regulated water utilities is a likely outcome of this consolidation.

- Consolidation Activity: The water utility industry has seen mergers and acquisitions, indicating a trend towards fewer, larger players.

- Impact on Competition: Ongoing consolidation can alter the competitive landscape, though for regulated utilities like American States Water, this often involves acquiring smaller regulated entities rather than intense head-to-head market competition.

- Strategic Implications: For American States Water, staying abreast of consolidation trends is crucial for identifying potential acquisition targets that align with its growth strategy within the regulated utility space.

Indirect Competition from Decentralized Solutions

While American States Water (AWR) primarily faces direct competition from other regulated water and wastewater utilities, indirect competition from decentralized solutions is emerging. For instance, advanced water recycling systems adopted by large industrial users can reduce their demand for municipal water supplies. Similarly, rooftop solar installations can decrease reliance on traditional electricity grids, though this is less of a direct threat to water utilities.

These decentralized options, while growing, are not yet complete substitutes for the vast majority of residential and commercial customers who depend on the established infrastructure of utilities like AWR. The capital investment and complexity often make these alternatives impractical for widespread adoption across diverse customer segments.

- Decentralized Water Recycling: Industrial facilities increasingly implement on-site water treatment and recycling, potentially reducing their draw from AWR's network.

- Rooftop Solar: While impacting electricity providers, solar adoption has minimal direct impact on water utility services.

- Customer Reliance: For most customers, the convenience and reliability of AWR's existing infrastructure make decentralized alternatives less appealing for core water needs.

Competitive rivalry for American States Water is generally low in its core regulated utility segments due to significant barriers to entry. However, its subsidiary, American States Utility Services (ASUS), faces more direct competition in securing military base contracts, where multiple specialized firms vie for these agreements. The broader utility sector is also experiencing consolidation, which could lead to fewer, larger competitors in the long term.

| Segment | Competitive Rivalry Level | Key Competitive Factors |

|---|---|---|

| Regulated Water & Electricity Utilities | Low | Geographic monopolies, high regulatory hurdles, substantial infrastructure investment |

| Military Base Utility Services (ASUS) | Moderate to High | Bidding process for long-term contracts, specialized service providers, track record |

| Broader Utility Market (Consolidation) | Emerging | Mergers and acquisitions, potential for larger, more dominant players |

SSubstitutes Threaten

For essential water and wastewater services, the threat of direct substitutes is remarkably low. This is particularly true for entities like Golden State Water Company and American States Utility Services, Inc. Customers, from homes to businesses and even military installations, find it impractical and often cost-prohibitive to switch to alternatives such as private wells or individual septic systems for their core needs.

For American States Water's electric utility segment in Big Bear Lake, the threat of substitutes comes mainly from distributed generation, such as rooftop solar panels and backup generators. These alternatives can lessen dependence on the traditional grid, but they typically don't completely replace the need for a grid connection, often requiring grid tie-ins for reliability or intermittent supply.

As of early 2024, the adoption of residential solar in California, where Big Bear Lake is located, continues to grow, with data from the California Solar & Storage Association indicating thousands of new installations monthly. While these systems offer a degree of energy independence, they often still rely on the utility for power during non-generating periods or when demand exceeds local production, limiting their ability to fully substitute grid electricity.

Water conservation, spurred by regulations like California's 'Making Conservation a California Way of Life' which came into effect January 1, 2025, acts as an indirect substitute. These measures, along with growing public awareness, directly reduce the demand for water, impacting a utility's revenue streams. This shift forces water providers to explore new strategies beyond simply supplying more water.

Bottled Water and Rainwater Harvesting Limitations

While bottled water is a substitute for drinking water, it fails to address the substantial water volumes required for household, sanitation, and industrial needs. For instance, the average American household uses about 300 gallons of water per day, a quantity impractical to meet solely with bottled beverages.

Rainwater harvesting, though a supplementary source, faces significant hurdles. Its reliability is tied to precipitation patterns, and substantial investment in collection, storage, and advanced treatment systems is necessary to ensure potability and volume, making it an impractical widespread substitute for utility-provided water.

- Bottled Water Inadequacy: Insufficient for daily household and industrial water demands, which far exceed drinking water consumption.

- Rainwater Harvesting Constraints: Limited by weather dependency, requiring significant infrastructure for storage and purification.

- Scale and Reliability Issues: Neither substitute can reliably or affordably meet the consistent, high-volume water needs of modern society.

High Cost and Regulatory Barriers to Self-Sufficiency

The threat of substitutes for American States Water Company's services is significantly mitigated by the high costs and regulatory hurdles associated with achieving self-sufficiency. For instance, establishing independent water treatment and distribution systems requires enormous capital outlays, often running into millions of dollars, making it an impractical option for most residential and commercial customers.

Furthermore, navigating the intricate web of federal, state, and local regulations governing water quality, environmental protection, and infrastructure development presents a formidable challenge. These regulatory complexities, coupled with the need for specialized expertise and ongoing compliance, act as substantial deterrents to potential self-sufficiency efforts.

- High Capital Investment: Developing independent water infrastructure can cost millions, far exceeding the capacity of most customers.

- Complex Regulatory Landscape: Compliance with numerous environmental and safety regulations is a significant barrier.

- Ongoing Maintenance Costs: Maintaining self-sufficient systems requires continuous investment in repairs and upgrades.

- Limited Feasibility for Customers: The combined financial and regulatory burdens make full substitution unviable for the majority of American States Water's customer base.

For essential water and wastewater services, the threat of substitutes remains low due to prohibitive costs and regulatory complexities. While distributed generation like solar impacts American States Water's electric utility segment, it rarely eliminates the need for grid connection. In 2024, California's solar growth continues, but grid reliance persists. Water conservation, driven by initiatives like California's 2025 'Making Conservation a California Way of Life,' indirectly substitutes for high water demand, influencing utility revenue strategies.

| Substitute Type | Feasibility for Water Services | Limitations for American States Water Customers |

|---|---|---|

| Private Wells/Septic Systems | Impractical and cost-prohibitive for most residential, commercial, and industrial users. | Requires significant capital investment (millions), complex regulatory compliance, and ongoing maintenance. |

| Bottled Water | Completely inadequate for daily household, sanitation, and industrial needs, which average 300 gallons per US household daily. | Cannot meet the scale or variety of water usage beyond basic drinking. |

| Rainwater Harvesting | Limited by precipitation dependency and requires substantial infrastructure for storage and treatment to ensure potability and volume. | Unreliable for consistent supply and high costs for adequate systems. |

| Distributed Generation (Electric Utility) | Can reduce reliance on the grid but often requires grid tie-ins for reliability. | While solar adoption is growing in California, it doesn't fully replace grid electricity needs. |

Entrants Threaten

Entering the regulated water and electric utility sector, like the one American States Water operates in, demands substantial upfront capital. This is primarily due to the necessity of building and maintaining extensive infrastructure. Think about the vast networks of pipelines for water or power lines for electricity, along with treatment plants and substations.

The sheer cost of developing this essential infrastructure presents a significant hurdle for potential newcomers. For instance, the cost of installing water mains alone can range from $1.5 million to $3 million per mile, a figure that underscores the prohibitive nature of these initial investments.

The utility sector, particularly water utilities like American States Water, operates under stringent oversight from state commissions, such as the California Public Utilities Commission (CPUC). This regulatory environment presents a significant barrier to new entrants.

Aspiring companies must navigate a complex and time-consuming process to secure essential licenses, permits, and rate approvals. This journey can extend over several years and necessitate considerable investment in legal and administrative resources. For instance, in 2023, the CPUC continued to process numerous applications for various utility services, highlighting the ongoing demand and complexity of these approvals.

Furthermore, evolving regulations, like those mandating increased water conservation efforts, introduce additional compliance burdens. These can involve substantial capital expenditures for infrastructure upgrades or changes in operational practices, making it more challenging for new players to compete effectively with established entities that have already adapted to these requirements.

American States Water Company (AWR) benefits from established and often exclusive service territories, frequently sanctioned by regulatory bodies. This creates significant barriers to entry, as duplicating the extensive water infrastructure already in place would be prohibitively expensive and inefficient for any new competitor. For instance, in 2023, AWR's regulated water segment served approximately 2.8 million customers across California, a state with stringent utility regulations that favor incumbent providers.

Economies of Scale and Experience

Existing utilities, including American States Water Company, leverage substantial economies of scale in their operations, maintenance, and procurement processes. For example, in 2023, American States Water reported operating revenues of $1.04 billion, reflecting a substantial operational footprint that smaller new entrants would find difficult to match in terms of cost efficiency.

New competitors would face considerable hurdles in achieving similar cost advantages without a large, established customer base and extensive existing infrastructure. This inherent disadvantage makes it challenging for new entrants to compete on price or profitability against established players like American States Water.

- Economies of Scale: Utilities benefit from lower per-unit costs as output increases, a barrier for new, smaller operations.

- Experience Curve: American States Water's operational history since 1931 translates to accumulated expertise in efficiency and regulatory navigation.

- Capital Intensity: The significant upfront investment required for water infrastructure further deters potential new entrants.

- Regulatory Hurdles: Navigating complex and stringent regulations in the water utility sector adds another layer of difficulty for new market participants.

Access to Water Rights and Resources

The threat of new entrants into the water utility sector, specifically for companies like American States Water, is significantly dampened by the formidable challenge of securing water rights and access to essential water resources. These rights are not easily obtained; they are often deeply entrenched, legally complex, and represent a substantial hurdle for any potential newcomer. In 2024, this barrier is particularly pronounced in regions facing water scarcity, such as California, where competition for existing rights is already intense.

New companies would face immense difficulty in replicating the established infrastructure and long-term water supply agreements that current players, like American States Water, have meticulously built over decades. The capital investment required to acquire or secure new water sources, coupled with the intricate regulatory approvals, acts as a powerful deterrent. For instance, obtaining new water rights in California involves navigating a maze of state and federal regulations, often requiring extensive environmental impact studies and public consultations, a process that can take many years and incur significant costs.

- Limited Availability of Unallocated Water Rights: Many prime water sources are already fully allocated, making it challenging for new entrants to secure rights.

- High Cost of Water Acquisition: Purchasing existing water rights or developing new water sources involves substantial upfront capital.

- Complex Regulatory Environment: Obtaining permits and approvals for water extraction and distribution is a lengthy and intricate process.

- Established Infrastructure and Distribution Networks: Existing utilities possess extensive, costly infrastructure that new entrants would need to replicate.

The threat of new entrants in the water utility sector, where American States Water operates, is notably low due to extreme capital intensity and significant regulatory barriers. Building the necessary infrastructure, such as extensive pipeline networks and treatment facilities, requires billions of dollars. For example, in 2024, the cost of developing new water infrastructure projects often runs into the hundreds of millions, if not billions, of dollars, making it nearly impossible for new companies to compete with established players.

Furthermore, securing the necessary licenses, permits, and rate approvals from state commissions is a lengthy and complex process. This regulatory labyrinth, coupled with the need for established water rights, acts as a substantial deterrent. In 2023, the California Public Utilities Commission (CPUC) continued to manage intricate approval processes for utilities, underscoring the difficulty new entrants face in gaining market access.

Established utilities like American States Water also benefit from significant economies of scale, achieved through their vast operational footprint and customer base. In 2023, American States Water reported operating revenues of $1.04 billion, a scale that new entrants would struggle to match, thereby limiting their ability to compete on cost efficiency.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Requirements | Extensive infrastructure (pipelines, treatment plants) requires massive upfront investment. | Extremely high, deterring most potential entrants. | Cost of new water infrastructure projects often in the hundreds of millions to billions of dollars. |

| Regulatory Hurdles | Complex licensing, permits, and rate approvals needed from state commissions. | Significant time and resource commitment, creating a lengthy entry process. | CPUC's ongoing complex approval processes for utilities in 2023. |

| Economies of Scale | Established utilities have lower per-unit costs due to large operations. | New entrants face higher operating costs and difficulty competing on price. | American States Water's 2023 operating revenue of $1.04 billion indicates substantial scale advantages. |

| Water Rights & Resources | Securing access to water sources is legally complex and often limited. | A major obstacle, especially in water-scarce regions, making supply unreliable for newcomers. | Intense competition for water rights in California in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for American states' water utilities is built upon a foundation of publicly available data, including state-level regulatory filings, annual reports from water providers, and economic data from government agencies like the EPA and Census Bureau.

We leverage industry-specific reports from organizations such as the American Water Works Association (AWWA) and market intelligence from financial data providers to assess competitive intensity, bargaining power, and the threat of new entrants and substitutes.