Assertio SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assertio Bundle

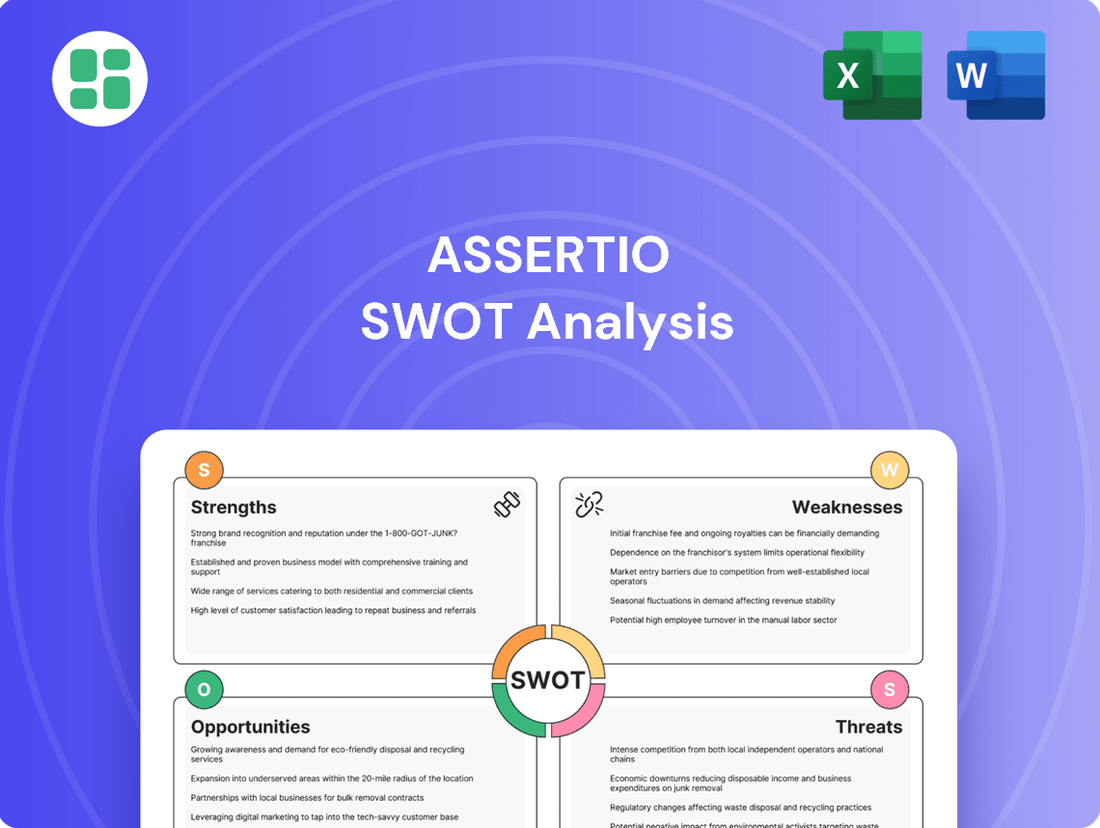

Assertio's strategic positioning is built on a foundation of specialized pharmaceutical products, but understanding the full depth of their market opportunities and potential challenges requires a comprehensive view. Our detailed SWOT analysis dives deep into their unique strengths, potential weaknesses, competitive landscape, and future growth avenues.

Want to truly grasp Assertio's market potential and navigate their competitive environment with confidence? Purchase the complete SWOT analysis to gain access to actionable insights, expert commentary, and a professionally formatted report designed to empower your strategic decisions.

Strengths

Assertio's strength lies in its specialized product portfolio, focusing on neurology, hospital, and pain management. This allows them to cater to specific patient needs, often enabling premium pricing and strong positions in niche markets.

Key growth drivers like Rolvedon and Sympazan are central to their strategy, demonstrating the company's ability to bring differentiated products to market. In 2023, net product sales reached $350.2 million, with Rolvedon alone contributing $118.5 million, highlighting the success of this specialized approach.

Assertio's strategic acquisition of Spectrum Pharmaceuticals in 2023 for $243 million was a pivotal move, significantly bolstering its oncology portfolio with the addition of Rolvedon. This acquisition directly addresses a key growth driver for Assertio, expanding its therapeutic reach and diversifying its revenue base beyond its existing pain management franchise.

Rolvedon has quickly become a cornerstone of Assertio's commercial strategy, demonstrating the company's effectiveness in integrating and commercializing acquired assets. In the first quarter of 2024, Rolvedon generated $24.5 million in net sales, a substantial increase from $16.4 million in the same period of 2023, highlighting its growing contribution to Assertio's overall financial performance.

Assertio's strong balance sheet is a key strength, evidenced by its substantial cash and short-term investments. As of March 31, 2025, the company held $87.3 million in these liquid assets, following a $100.1 million position at the close of 2024. This financial cushion provides significant operational stability and the capacity for opportunistic ventures.

Furthermore, Assertio benefits from manageable debt levels, with no major repayment obligations until September 2027. This long runway before significant debt maturities grants the company considerable financial flexibility. It allows Assertio to pursue strategic investments, potential acquisitions, or other growth initiatives without immediate refinancing concerns.

Proactive Legal Risk Mitigation

Assertio has made significant strides in proactively mitigating legal risks. By settling major legal issues like the DOJ False Claims Act lawsuit and the Glumetza antitrust case, the company has demonstrably reduced its exposure. This proactive approach is crucial for financial stability and investor confidence.

A key strategic move involved transferring opioid-related liabilities to a subsidiary, effectively ring-fencing the parent company from potentially massive, multi-billion-dollar litigation. This de-risking maneuver is a critical strength, allowing for a more focused allocation of capital and management attention towards growth opportunities. For instance, by resolving these past liabilities, Assertio can now better invest in its product pipeline and market expansion efforts.

- Settlement of DOJ False Claims Act lawsuit and Glumetza antitrust action

- Transfer of opioid-related liabilities to a subsidiary

- Shielding of parent company from multi-billion-dollar litigation

- Reallocation of capital and management focus to core business growth

Focused Growth Strategy on Key Products

Assertio's focused growth strategy on key products like Rolvedon and Sympazan is a significant strength. The company has strategically reallocated resources to these promising assets, with a revised promotional approach for Sympazan already demonstrating success in driving prescription growth.

Looking ahead, Assertio anticipates sustained strong demand for Rolvedon, projecting increased sales throughout 2025, further bolstered by expanding payer coverage which enhances its market penetration. This concentrated investment and commercial effort on its most viable products allows for more efficient execution and maximizes their potential.

Key aspects of this focused growth include:

- Prioritization of Growth Assets: Reallocation of corporate resources to Rolvedon and Sympazan.

- Effective Promotional Strategy: A revised approach for Sympazan is driving prescription growth.

- Projected Rolvedon Sales Increase: Anticipated continued strong demand and sales growth throughout 2025.

- Enhanced Market Penetration: Expanded payer coverage for Rolvedon supports its market access.

Assertio's focused strategy on key products like Rolvedon and Sympazan is a significant strength, with resources strategically reallocated to these assets. The company anticipates continued strong demand for Rolvedon throughout 2025, further supported by expanding payer coverage, which enhances its market penetration.

The acquisition of Spectrum Pharmaceuticals in 2023 for $243 million was a pivotal move, significantly bolstering its oncology portfolio with Rolvedon. This acquisition directly addresses a key growth driver for Assertio, expanding its therapeutic reach and diversifying its revenue base.

Assertio's strong balance sheet, evidenced by $87.3 million in cash and short-term investments as of March 31, 2025, provides significant operational stability and capacity for opportunistic ventures. Manageable debt levels with no major repayment obligations until September 2027 grant considerable financial flexibility.

Proactive mitigation of legal risks, including the settlement of the DOJ False Claims Act lawsuit and the Glumetza antitrust case, has demonstrably reduced exposure. Furthermore, transferring opioid-related liabilities to a subsidiary shields the parent company from potentially massive litigation, allowing for a more focused capital allocation towards growth.

| Product | Q1 2024 Net Sales | Q1 2023 Net Sales | YoY Growth |

| Rolvedon | $24.5 million | $16.4 million | 50% |

What is included in the product

Offers a full breakdown of Assertio’s strategic business environment, detailing its internal capabilities and external market dynamics.

Assertio's SWOT analysis offers a clear, actionable framework to identify and leverage strengths, mitigate weaknesses, capitalize on opportunities, and address threats, thereby relieving the pain point of strategic uncertainty and guiding effective pain management solutions.

Weaknesses

Assertio's recent financial reports highlight a significant concern: widening net losses. In the first quarter of 2025, the company posted a net loss of $13.54 million, a substantial 200.2% increase compared to the same period in the previous year. This sharp rise in losses, coupled with a revenue decrease to $26.49 million from $32.45 million in Q1 2024, signals a challenging operational environment.

While Assertio has maintained its full-year financial guidance, the downward trend in revenue and the escalating net loss in early 2025 are undeniable weaknesses. These figures can create investor apprehension about the company's ability to achieve profitability and manage its operations effectively in the near term.

Assertio's legacy product, Indocin, is facing significant headwinds from escalating generic competition. This intensified competition is directly contributing to a decline in both sales volume and pricing power for Indocin, impacting the company's overall revenue stream.

The erosion of revenue from established, albeit aging, products like Indocin underscores a critical strategic challenge: the urgent need for Assertio to successfully pivot and drive growth through its newer product portfolio. This transition is vital to offset the diminishing returns from its legacy assets.

Furthermore, the company's ongoing efforts to divest declining or non-core assets highlight the inherent difficulty in effectively managing a product lineup characterized by diverse life cycles, where older products are naturally succumbing to market pressures.

Assertio's key growth assets, particularly Rolvedon, are facing significant pricing pressures. This is evident in the reported decrease in net product sales for Rolvedon in Q1 2025 compared to the previous year, even though sales volume increased. This trend underscores the challenge of maintaining revenue growth when pricing power erodes.

The ongoing pricing pressure on critical products like Rolvedon can directly impede Assertio's ability to grow its revenue and maintain healthy profit margins. Even with a higher number of units sold, the reduced price per unit limits the overall financial upside, highlighting the intense competition within the pharmaceutical sector.

This situation necessitates a robust and adaptive approach to market access strategies. Assertio must continually evaluate and refine its methods for ensuring its products remain accessible and competitively priced to counter these persistent market dynamics and secure future revenue streams.

Increased Operating Expenses and Adjusted EBITDA Decline

Assertio faced a significant challenge with rising operating expenses in early 2025. Selling, General, and Administrative (SG&A) costs saw an uptick, largely driven by increased legal charges and settlements. This surge directly impacted profitability, evidenced by a sharp decline in Adjusted EBITDA.

The company's Adjusted EBITDA fell dramatically from $7.4 million in the first quarter of 2024 to just $0.2 million in the first quarter of 2025. While Assertio is working to mitigate its legal exposure, these elevated costs are a clear impediment to short-term financial performance. Effectively managing and streamlining its cost structure remains a key hurdle for the company moving forward.

- SG&A Expense Increase: Q1 2025 saw higher SG&A costs compared to Q1 2024.

- Legal Charges Impact: Increased legal charges and settlements were the primary drivers of this expense growth.

- Adjusted EBITDA Decline: Adjusted EBITDA dropped from $7.4 million (Q1 2024) to $0.2 million (Q1 2025).

- Profitability Pressure: These higher costs are negatively affecting Assertio's short-term profitability.

Fluctuating Analyst and Market Sentiment

Analyst sentiment for Assertio has shown a downward trend, with revised estimates for full-year 2025 and 2026 revenue and earnings per share indicating a less optimistic outlook. This shift in analyst expectations can directly influence how the market perceives the company's future performance.

The stock's performance has mirrored this cautious sentiment, trading near its 52-week low. Despite some analyses suggesting potential undervaluation, recent market reactions to earnings reports, including a notable post-earnings stock price decline, highlight investor apprehension. This volatility in market perception can impact investor confidence and potentially hinder access to capital for crucial future initiatives.

- Declining Analyst Estimates: Full-year 2025 and 2026 revenue and EPS estimates have seen reductions.

- Stock Performance: Assertio's stock has been trading near its 52-week low, reflecting market concerns.

- Market Reaction to Earnings: A post-earnings stock price decrease indicates a cautious reception of recent financial results.

- Investor Confidence Impact: Fluctuating market sentiment can erode investor confidence and affect capital raising efforts.

Assertio's financial performance in early 2025 reveals significant weaknesses, including widening net losses and declining revenues. The company reported a net loss of $13.54 million in Q1 2025, a substantial increase from the previous year, alongside a revenue drop to $26.49 million. This trend raises concerns about profitability and operational efficiency.

The company's legacy product, Indocin, is struggling against intense generic competition, leading to reduced sales and pricing power. Simultaneously, key growth assets like Rolvedon are experiencing pricing pressures, where increased sales volume in Q1 2025 did not translate to higher net product sales due to lower per-unit pricing.

Rising operating expenses, particularly in SG&A due to increased legal charges and settlements, have severely impacted profitability. This is starkly illustrated by the drop in Adjusted EBITDA from $7.4 million in Q1 2024 to a mere $0.2 million in Q1 2025, highlighting a critical need for cost management.

Analyst sentiment has soured, with revised downward estimates for future revenue and earnings per share. This cautious outlook is reflected in the stock's performance, trading near its 52-week low, and a negative market reaction to recent earnings reports, indicating investor apprehension.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Net Loss | -$4.51 million | -$13.54 million | +200.2% |

| Revenue | $32.45 million | $26.49 million | -18.4% |

| Adjusted EBITDA | $7.4 million | $0.2 million | -97.3% |

Preview the Actual Deliverable

Assertio SWOT Analysis

This preview reflects the real Assertio SWOT analysis document you'll receive upon purchase. You're seeing the actual content, meaning no surprises, just professional quality analysis. Unlock the full, detailed report after completing your purchase.

Opportunities

Assertio's growth hinges on strategic acquisitions, aiming to integrate commercial assets that boost scale and immediate growth. The company's robust cash position, with no debt due before 2027, provides significant financial flexibility for these moves.

In 2024, Assertio continued to signal its intent for M&A, with management actively seeking opportunities. For instance, the company highlighted its commitment to deploying capital towards accretive acquisitions during its Q1 2024 earnings call, emphasizing a focus on assets that align with its commercialization expertise.

Successful integration of new products could expand Assertio's therapeutic areas and market penetration, leveraging its established sales force and commercial infrastructure. This strategy aims to diversify revenue streams and capitalize on synergies, driving long-term shareholder value.

Assertio views Rolvedon and Sympazan as crucial engines for future expansion, with strategic investments planned to bolster market presence. Rolvedon has already secured a notable share within community oncology settings.

Sympazan is demonstrating consistent year-over-year prescription growth, indicating positive market reception. The company anticipates substantial organic growth through enhanced commercial strategies and broader payer access for these key products.

Assertio Holdings has significantly reduced its legal liabilities through the successful settlement of multiple opioid-related matters. This strategic move, finalized in early 2024, transferred substantial future legal costs and exposure, estimated to be in the hundreds of millions of dollars, thereby freeing up considerable capital.

The capital previously earmarked for legal defense and potential settlements, estimated at over $150 million as of Q1 2024, can now be reinvested. This reallocation supports key growth areas such as expanding the sales force for existing products and funding research and development for new therapeutic areas.

This de-risking of the balance sheet not only bolsters Assertio's financial standing but also improves its operational flexibility, making it a more attractive prospect for potential strategic partnerships or acquisitions in the evolving pharmaceutical landscape.

Optimizing Corporate Structure and Divesting Non-Core Assets

Assertio's strategic focus for 2025 includes simplifying its corporate structure and divesting non-core assets. This move is designed to boost operational efficiency and cut down on overhead expenses, allowing the company to concentrate its resources on its most profitable products.

By shedding underperforming assets, Assertio can generate capital to reinvest in areas with greater growth potential. For instance, the company's commitment to this strategy was evident in its 2023 divestitures, which aimed to streamline operations and enhance financial flexibility.

- Streamlined Operations: Simplification of corporate structure to improve efficiency.

- Cost Reduction: Lowering overhead through divestment of non-core assets.

- Capital Generation: Freeing up funds from underperforming segments for reinvestment.

- Focus on Core Strengths: Directing resources towards high-potential products and therapeutic areas.

Potential for Significant Upside from Undervaluation

Despite facing recent financial headwinds, Assertio's stock is trading near its 52-week low, hinting at potential undervaluation. Analysts, however, largely maintain an 'Outperform' rating, with a considerable average price target upside, suggesting confidence in future recovery.

This perceived undervaluation, coupled with Assertio's ongoing strategic transformation and a focused effort to strengthen its balance sheet, creates a compelling opportunity for investors looking for long-term value appreciation. The company's strategy is geared towards achieving sustainable near-term growth and enhancing long-term shareholder value.

- Undervalued Stock: Assertio's stock price hovering near its 52-week low suggests potential for significant upside if market sentiment shifts.

- Analyst Confidence: A majority of analysts rate Assertio as 'Outperform,' with an average price target indicating substantial room for growth from current levels.

- Strategic Transformation: The company's ongoing efforts to de-risk its balance sheet and execute strategic initiatives could unlock hidden value.

- Long-Term Value Focus: Assertio's stated aim for sustainable near-term growth and increased long-term value positions it as a potential target for patient investors.

Assertio's strategic focus on acquiring and integrating commercial assets, supported by a strong cash position and no debt due before 2027, presents a significant growth opportunity. The company actively pursued M&A in 2024, signaling its intent to deploy capital towards accretive acquisitions that align with its commercialization expertise.

The successful integration of new products like Rolvedon and Sympazan, which are showing positive prescription growth and market penetration, offers further expansion potential. Assertio plans strategic investments to bolster the market presence of these key products, aiming for substantial organic growth through enhanced commercial strategies and improved payer access.

The settlement of opioid-related matters in early 2024 has substantially reduced legal liabilities, freeing up capital estimated at over $150 million as of Q1 2024. This capital can now be reinvested in growth areas such as sales force expansion and R&D, while also improving operational flexibility and attractiveness for partnerships.

Assertio's 2025 strategy includes simplifying its corporate structure and divesting non-core assets to boost efficiency and reduce overhead. This allows for resource concentration on profitable products and generates capital for reinvestment in higher-growth areas, building on 2023 divestiture efforts.

The company's stock trading near its 52-week low, coupled with a majority of analysts maintaining an 'Outperform' rating and a considerable average price target upside, suggests potential undervaluation. This creates a compelling opportunity for investors seeking long-term value appreciation through Assertio's strategic transformation and balance sheet strengthening.

Threats

Assertio faces significant pressure from generic competition, especially impacting products like Indocin. This erosion of market share and pricing power is a constant challenge in the pharmaceutical sector, as generics can quickly diminish the profitability of established brands.

The rapid entry of generic alternatives means Assertio must continually innovate and develop new products to offset the declining revenue streams from its older, off-patent drugs. For instance, in the first quarter of 2024, Assertio reported a 14% decrease in net sales for its anti-inflammatory products, largely attributed to generic competition impacting Indocin.

Assertio's current strategy is heavily weighted towards the success of a few core products, notably Rolvedon and Sympazan, which are expected to fuel revenue expansion. This focused approach, while allowing for concentrated resource allocation, inherently introduces a significant concentration risk.

Any adverse developments impacting these flagship products, whether through the emergence of new competitors, shifts in regulatory landscapes, or unexpected manufacturing disruptions, could have a disproportionately negative effect on Assertio's financial health and overall stability.

Assertio operates within a pharmaceutical sector heavily influenced by evolving regulatory frameworks and shifting reimbursement strategies. For instance, in 2024, ongoing discussions around drug pricing reforms and potential changes to Medicare Part D could introduce new cost pressures or alter market access for Assertio's portfolio.

These external shifts, often unpredictable, directly impact product demand and profitability. A significant change in payer coverage for key therapeutic areas, for example, could reduce patient access and, consequently, Assertio's revenue generation capabilities.

Challenges in Integrating Acquisitions and Realizing Synergies

Assertio's growth hinges on successful acquisitions, but integrating companies like Spectrum Pharmaceuticals presents significant hurdles. Challenges include merging distinct corporate cultures, retaining essential talent post-acquisition, and aligning diverse operational workflows. These integration complexities can hinder the realization of expected financial synergies, potentially impacting overall performance.

Failure to smoothly integrate acquired entities can lead to tangible negative financial consequences. For instance, the integration of Spectrum Pharmaceuticals, completed in April 2023, involved significant upfront costs and the potential for disruption. Assertio's ability to manage these integration risks directly influences its capacity to unlock value from its strategic expansion efforts.

- Cultural Integration: Merging different organizational cultures is a persistent challenge, potentially leading to employee dissatisfaction and reduced productivity.

- Talent Retention: Key personnel from acquired companies may depart, taking valuable knowledge and relationships with them, thus diminishing the acquisition's strategic value.

- Operational Harmonization: Integrating IT systems, supply chains, and administrative processes across different entities is complex and can cause operational inefficiencies.

- Synergy Realization: Achieving projected cost savings and revenue enhancements from an acquisition often proves more difficult and time-consuming than initially anticipated.

Broader Market and Economic Headwinds

Assertio navigates a challenging macroeconomic landscape, with broader market and economic headwinds posing significant threats. Inflationary pressures and potential economic downturns can dampen consumer spending and impact healthcare demand, affecting sales volumes and pricing power. The company's Q1 2025 performance, which saw a net loss of $35.7 million, underscores the sensitivity to these dynamic market conditions, potentially jeopardizing its ability to achieve its financial guidance for the year.

These external factors, coupled with sector-specific challenges within the pharmaceutical industry, create an unfavorable operating environment. Shifts in investor sentiment and increased market volatility can also affect Assertio's stock performance and access to capital, potentially hindering its capacity to fund growth initiatives or pursue strategic acquisitions. For instance, the broader market's reaction to rising interest rates in late 2024 and early 2025 has created a more cautious investment climate, impacting valuations across various sectors, including healthcare.

- Inflationary Pressures: Rising costs for raw materials, manufacturing, and distribution can erode profit margins.

- Economic Slowdown: A general economic downturn could reduce patient access to treatments or lead to increased pricing scrutiny.

- Investor Sentiment: Negative market sentiment can depress stock prices and make capital raising more difficult.

- Regulatory Uncertainty: Evolving healthcare policies and regulations can introduce unforeseen operational and financial risks.

Assertio faces intense competition from generic drug manufacturers, which significantly erodes the market share and pricing power of its established products. This threat is particularly evident with drugs like Indocin, where generic entry has already impacted sales. The company’s reliance on a concentrated product portfolio, such as Rolvedon and Sympazan, also presents a substantial risk if these key products encounter unforeseen challenges.

Navigating a dynamic regulatory environment and evolving reimbursement policies poses another significant threat, as changes in healthcare legislation or payer coverage can directly impact product demand and profitability. Furthermore, macroeconomic headwinds like inflation and potential economic downturns can negatively affect consumer spending on healthcare and create a more challenging investment climate for Assertio.

The integration of acquired companies, such as the Spectrum Pharmaceuticals acquisition in April 2023, introduces complexities related to cultural alignment, talent retention, and operational harmonization, which can hinder the realization of expected financial synergies and impact overall performance.

SWOT Analysis Data Sources

This analysis is built upon a foundation of credible data, including Assertio's official financial filings, comprehensive market research reports, and expert industry commentary to provide a robust and insightful SWOT assessment.