Assertio PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assertio Bundle

Navigate the complex external forces impacting Assertio with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its market landscape. Gain a strategic advantage by leveraging these expert-level insights to inform your decisions and anticipate future challenges. Download the full PESTLE analysis now for actionable intelligence and a clearer path forward.

Political factors

Assertio, like other pharmaceutical firms, navigates a complex web of government healthcare policies that significantly shape its operating environment, especially concerning drug pricing and reimbursement. These regulations directly influence revenue streams and profitability for specialty pharmaceutical companies.

Legislative efforts such as the Inflation Reduction Act (IRA) of 2022 are actively seeking to lower prescription drug costs. For instance, the IRA allows Medicare to negotiate prices for a select number of high-cost drugs, a move that could impact revenue for drugs like those in Assertio's portfolio if they fall under such negotiations in future years. While specific Assertio drugs are not yet named in the initial IRA negotiation rounds, the precedent set by the IRA signals a growing trend towards government intervention in drug pricing.

The potential implementation of Most-Favored Nation (MFN) pricing models, which aim to tie U.S. drug prices to lower prices in other developed countries, also presents a challenge. Such policies could exert downward pressure on Assertio's pricing strategies for its specialty products, potentially affecting market access and overall financial performance. Companies are therefore compelled to adapt their commercial strategies in anticipation of these evolving policy landscapes.

The U.S. Food and Drug Administration (FDA) significantly influences Assertio's operations, from initial drug approvals to ongoing market monitoring and precise labeling. Any shifts in FDA policies, particularly concerning generic drug pathways or the integration of real-world evidence, can directly affect how quickly Assertio can bring its products to market and how they are positioned.

For instance, the FDA's accelerated approval pathway, while offering faster market access for certain drugs, also comes with stringent post-market requirements. In 2024, the FDA continued to refine its guidelines on real-world data and real-world evidence, impacting how pharmaceutical companies like Assertio can support their product claims and regulatory submissions.

Geopolitical tensions and shifting trade policies, including potential tariffs on essential imported raw materials and pharmaceutical ingredients, present significant risks to Assertio's global supply chain operations.

Ongoing investigations into the national security implications of pharmaceutical imports underscore a growing governmental emphasis on bolstering domestic production capabilities. This trend could potentially escalate manufacturing expenses for companies like Assertio or necessitate a strategic realignment of sourcing strategies to ensure supply chain resilience.

Intellectual Property Law Changes

Assertio's business model, which relies on differentiated pharmaceutical products, is significantly influenced by evolving intellectual property (IP) laws. Changes in patent eligibility, such as those debated around the patentability of naturally occurring substances or diagnostic methods, could impact the scope of protection for Assertio's existing and pipeline drugs. For instance, ongoing discussions regarding the America Invents Act (AIA) and its potential amendments, particularly concerning post-grant review proceedings, could affect the enforceability of Assertio's patents.

The standards for obviousness, a key factor in patentability, are also under continuous review. Assertio's R&D investments are geared towards developing unique formulations or delivery systems, and shifts in how obviousness is assessed could either strengthen or weaken their ability to secure and maintain patent protection for these innovations. The U.S. Patent and Trademark Office (USPTO) plays a crucial role here, with its examination guidelines and judicial interpretations of patent law directly shaping the IP landscape.

Furthermore, the recognition and enforcement of 'second medical use' patents, which protect new therapeutic applications for existing drugs, represent another critical area. Assertio's strategy may involve identifying and patenting such uses for its marketed products. Any legislative proposals or court decisions that alter the framework for these types of patents could have a direct bearing on Assertio's ability to extend market exclusivity and recoup R&D expenditures.

- Patent Eligibility Debates: Continued legal challenges and legislative discussions around patent eligibility standards, particularly concerning diagnostic methods and naturally occurring compounds, could impact the scope of protection for pharmaceutical innovations.

- Obviousness Standards Review: Evolving interpretations of obviousness by patent offices and courts directly influence the patentability of new drug formulations and delivery systems, affecting R&D investment protection for companies like Assertio.

- Second Medical Use Patents: The legal recognition and enforceability of patents for new therapeutic uses of existing drugs are critical for Assertio's strategy of extending product lifecycles and recouping R&D costs.

- USPTO Policy Shifts: Changes in examination guidelines or procedural rules at the U.S. Patent and Trademark Office can alter the ease and cost of obtaining and maintaining patent protection, directly impacting Assertio's IP portfolio.

Political Stability and Healthcare Agendas

The political climate significantly impacts Assertio's operations, particularly concerning healthcare agendas. Shifts in government policy regarding pharmaceutical pricing, patent protection, and regulatory oversight can create both opportunities and challenges. For instance, a more interventionist approach to drug pricing, as seen in some discussions around the Inflation Reduction Act's impact on Medicare drug negotiations, could affect Assertio's revenue streams for its established products.

New administrations often bring evolving healthcare priorities. Changes in focus towards specific therapeutic areas or increased scrutiny on research and development (R&D) spending can alter the investment landscape for specialty pharmaceutical companies like Assertio. The Biden administration's emphasis on lowering prescription drug costs, for example, continues to shape the environment in which Assertio operates.

Monitoring these political shifts is crucial for strategic adaptation. Assertio must remain agile to navigate potential changes in:

- Healthcare reform initiatives: Policies affecting patient access and reimbursement for specialty drugs.

- R&D funding and incentives: Government support or limitations on innovation in specific disease areas.

- Pharmaceutical industry oversight: Regulations concerning marketing, sales practices, and drug approvals.

Political factors significantly influence Assertio's operating landscape, particularly through government healthcare policies and legislative actions aimed at drug pricing and market access. The ongoing trend towards greater governmental oversight in the pharmaceutical sector, as exemplified by the Inflation Reduction Act of 2022, necessitates continuous strategic adaptation by companies like Assertio to manage potential impacts on revenue and profitability.

Assertio must closely monitor evolving regulatory frameworks, including FDA policies on drug approvals and post-market surveillance, as these directly affect product lifecycles and market positioning. Furthermore, shifts in intellectual property laws and patent eligibility standards, alongside geopolitical considerations impacting supply chains, demand proactive management to safeguard innovation and operational resilience.

The political environment's influence extends to R&D incentives and oversight of industry practices, requiring Assertio to remain agile in response to changing healthcare priorities and administrative agendas. This proactive approach is essential for navigating the complexities of healthcare reform initiatives and ensuring continued market access for its specialty pharmaceutical products.

What is included in the product

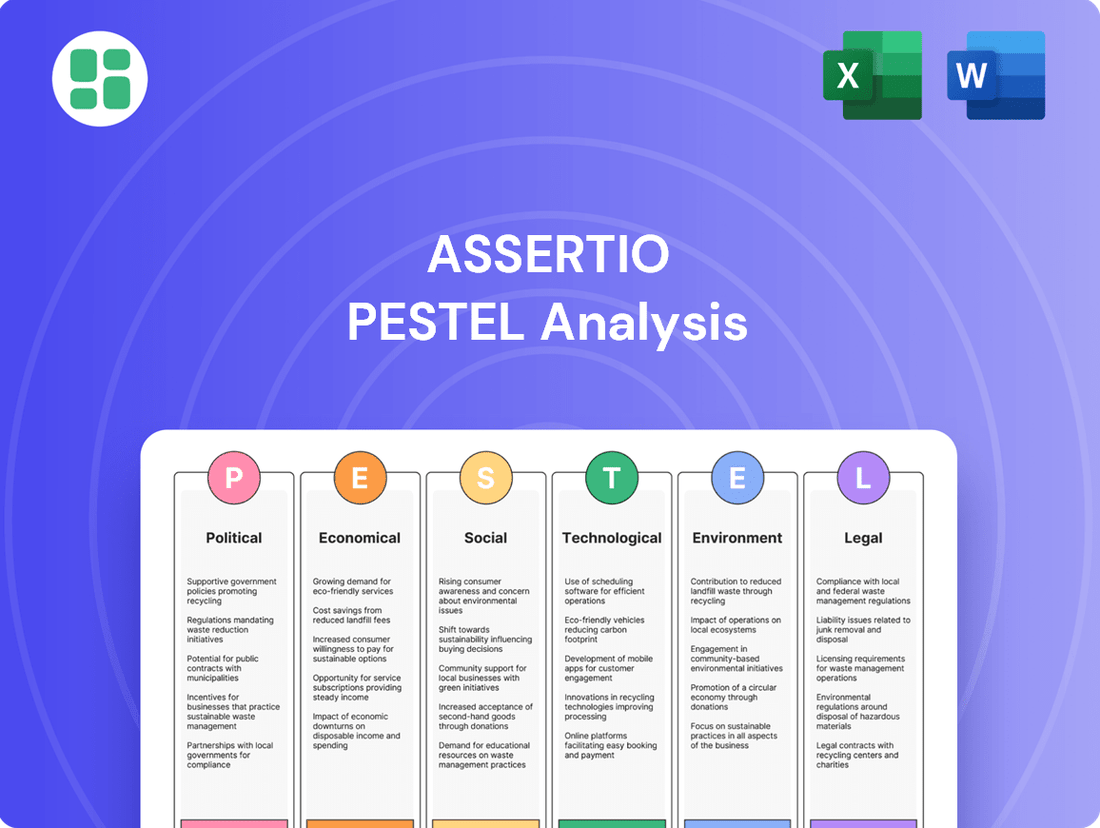

This Assertio PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Assertio's pain management market.

Economic factors

National healthcare expenditures are on a steady upward trajectory, consistently outpacing Gross Domestic Product (GDP) growth. For instance, U.S. healthcare spending reached an estimated $4.5 trillion in 2023, projected to climb further in 2024 and 2025. This expansion signals a growing market for Assertio's pharmaceutical offerings, especially its specialty drugs.

However, this increased spending also heightens the scrutiny and cost-containment efforts from payers and employers. Assertio's strategic focus on high-cost specialty drugs, particularly those addressing neurology and pain management, places it squarely within a segment that is experiencing substantial growth in expenditure, presenting a dual-edged sword of opportunity and challenge.

The global specialty pharmaceutical market is on a significant upward trajectory, projected to reach approximately $400 billion by 2025, a substantial increase from recent years. This growth is primarily fueled by innovations in biologics and precision medicine tailored for complex and rare diseases.

Assertio, operating within this dynamic sector, is well-positioned to capitalize on this expansion. The rising incidence of conditions such as cancer and autoimmune diseases directly translates to heightened demand for these sophisticated and often premium-priced treatments.

Inflationary pressures are significantly impacting the healthcare sector, directly increasing operational expenses for pharmaceutical firms like Assertio. These rising costs span manufacturing, intricate supply chains, and essential labor. For instance, the Producer Price Index for chemicals and allied products, a key input for pharmaceuticals, saw a notable increase in early 2024, reflecting broader inflationary trends.

Assertio faces the dual challenge of absorbing these escalating costs while simultaneously contending with persistent public and political demands for reduced drug pricing. This creates a challenging environment where margin compression is a real concern, pushing the company to seek out greater operational efficiencies to maintain profitability.

Research and Development Investment

Assertio's growth hinges on continued investment in pharmaceutical research and development, especially for acquiring and creating unique products. The economic climate directly impacts the capital available for these crucial R&D endeavors and shapes the potential returns on novel treatments.

The substantial costs associated with R&D, particularly for specialized pharmaceuticals, necessitate a strong economic framework to validate investment decisions. For instance, in 2024, the U.S. pharmaceutical industry's R&D spending is projected to remain robust, reflecting the high stakes and potential rewards in developing innovative therapies.

- R&D Investment Dependency: Assertio's strategy relies heavily on R&D for product pipeline expansion and differentiation.

- Economic Capital Availability: The broader economic environment dictates access to funding for R&D and influences investment return expectations.

- Specialty Drug R&D Costs: Developing niche or specialty drugs entails significant upfront investment, demanding careful economic justification.

- Industry R&D Trends: In 2024, pharmaceutical R&D spending continues to be a major focus, with significant capital allocated to innovation across the sector.

Reimbursement and Payer Dynamics

Assertio's performance is heavily influenced by shifting reimbursement models and the growing power of Pharmacy Benefit Managers (PBMs). These entities play a crucial role in negotiating drug prices and determining which medications are covered by insurance plans, directly impacting Assertio's market access and overall profitability.

The healthcare industry's move towards value-based care, where providers are reimbursed based on patient outcomes rather than services rendered, also affects Assertio. This trend, coupled with increased pressure for drug pricing transparency, means Assertio must demonstrate the clinical and economic value of its products to secure favorable reimbursement from health plans and insurers.

- PBM Influence: PBMs managed approximately 80% of all prescription drug claims in the U.S. in 2023, giving them significant leverage in negotiations.

- Value-Based Care Growth: By 2025, it's projected that over 75% of Medicare payments will be tied to quality or value, signaling a broader industry shift.

- Pricing Transparency Initiatives: Legislation and payer demands for greater transparency are forcing manufacturers like Assertio to justify their pricing strategies more rigorously.

National healthcare expenditures continue their ascent, with U.S. healthcare spending reaching an estimated $4.5 trillion in 2023 and projected to rise further through 2025. This trend fuels demand for Assertio's specialty pharmaceuticals, particularly in neurology and pain management, but also intensifies cost-containment pressures from payers. The global specialty pharmaceutical market is expected to approach $400 billion by 2025, driven by advancements in biologics and precision medicine.

Inflationary pressures are increasing operational costs for Assertio, impacting manufacturing and supply chains, as evidenced by rising input prices in early 2024. This forces the company to balance absorbing these costs with demands for lower drug prices, potentially compressing margins. Assertio's R&D investments, crucial for its pipeline, are also subject to economic conditions affecting capital availability and return expectations.

Assertio's market access and profitability are significantly shaped by evolving reimbursement models and the substantial influence of Pharmacy Benefit Managers (PBMs), who managed approximately 80% of U.S. prescription drug claims in 2023. The industry's shift towards value-based care, with over 75% of Medicare payments projected to be value-based by 2025, requires Assertio to demonstrate clear clinical and economic value for its products.

Preview Before You Purchase

Assertio PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive Assertio PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a detailed breakdown of Assertio's PESTLE factors.

The content and structure shown in the preview is the same document you’ll download after payment, giving you immediate access to the complete Assertio PESTLE analysis.

Sociological factors

The world's population is getting older, and with age often comes an increased likelihood of chronic conditions. This is particularly relevant for companies like Assertio, whose products often target neurological and pain-related issues. For instance, the United Nations projects that by 2050, one in six people globally will be over 65, a significant increase from the current figures.

This demographic trend directly fuels a steady demand for specialty pharmaceuticals and ongoing medication management. As more people live longer, the need for treatments for conditions such as chronic pain and neurological disorders, which Assertio specializes in, is expected to remain robust. This sustained demand creates a consistent market for Assertio's therapeutic areas.

Societal concerns regarding the accessibility and cost of specialty medications are significant. Public perception and regulatory bodies are increasingly focused on ensuring patients can afford and obtain necessary treatments. This directly impacts companies like Assertio, who must prove their products' worth and actively participate in improving patient access, perhaps through financial aid programs or collaborations with patient advocacy organizations.

Growing health consciousness is a significant sociological factor impacting the pharmaceutical market. For Assertio, this trend means a greater demand for treatments that improve quality of life and address chronic conditions, aligning with their focus on neurology, immunology, and pain management. For instance, a 2024 survey indicated that over 60% of adults are actively seeking ways to improve their overall health, which can translate to increased patient engagement with therapies that offer tangible benefits.

Evolving lifestyle trends also play a crucial role. As people adopt healthier habits, there might be a subtle shift in the prevalence of certain conditions or a greater emphasis on managing existing ones effectively. While Assertio’s core business remains in specific therapeutic areas, broader societal movements towards wellness and preventative care could indirectly influence patient populations and the types of treatments sought, requiring adaptability in market strategy.

Diversity and Inclusion in Clinical Trials

Societal and regulatory pressure is mounting for greater diversity and inclusion within clinical trials. This trend is critical for Assertio as it ensures their therapies are not only ethically developed but also effective across a wide range of patient demographics. For instance, by mid-2024, the FDA reported that while progress has been made, significant gaps remain in representing minority groups in many trial phases, highlighting the ongoing need for proactive recruitment strategies.

Meeting these expectations is paramount for Assertio's product development lifecycle. It directly impacts the real-world applicability and acceptance of their treatments. A commitment to diverse trials builds essential public trust, demonstrating a dedication to serving all patient communities equitably. For example, a 2024 study by the Association of Clinical Research Organizations (ACRO) indicated that companies with robust diversity and inclusion plans saw a 15% higher patient retention rate in their trials.

- Growing Regulatory Scrutiny: Agencies like the FDA are increasingly mandating diverse patient representation in clinical trial submissions, impacting approval timelines.

- Enhanced Treatment Efficacy: Ensuring trials reflect diverse populations leads to a better understanding of how treatments perform across different genetic backgrounds and health conditions.

- Public Trust and Reputation: Companies prioritizing inclusion are viewed more favorably by patients, healthcare providers, and the general public.

- Market Access and Reimbursement: Demonstrating broad applicability can positively influence market access and reimbursement decisions by payers.

Shifting Patient Expectations and Digital Health Adoption

Patients today are much more proactive in their healthcare, demanding personalized treatment plans and readily embracing digital tools. This shift is evident in the growing use of telemedicine and remote patient monitoring systems. For instance, a 2024 report indicated that over 60% of consumers are comfortable using virtual health services, a significant jump from pre-pandemic levels.

Assertio can capitalize on this trend by integrating digital platforms into its patient support. This could involve enhancing telehealth offerings for its specialty treatments or developing user-friendly apps for medication adherence and health tracking. By meeting patients where they are, Assertio can foster stronger engagement and potentially improve outcomes for individuals managing complex conditions.

- Personalized Care Demand: Patients are increasingly seeking tailored medical approaches.

- Digital Health Adoption: Telemedicine and remote monitoring are becoming mainstream. A 2024 survey found 65% of patients used at least one digital health tool in the past year.

- Assertio's Opportunity: Adapting patient support programs to leverage digital channels can boost engagement and adherence.

- Specialty Treatment Focus: Digital tools are particularly valuable for complex, chronic conditions requiring consistent management.

The aging global population, with the UN projecting one in six people over 65 by 2050, directly increases demand for Assertio's specialty pharmaceuticals targeting chronic conditions. This demographic shift ensures a sustained market for treatments addressing neurological and pain-related issues, as older individuals are more prone to such ailments. For example, a 2024 report highlighted that chronic pain affects approximately 20% of the global adult population, a figure expected to rise with aging demographics.

Societal expectations for affordable and accessible specialty medications are intensifying, impacting companies like Assertio. Public and regulatory focus on patient affordability necessitates strategies to improve access, such as financial assistance programs. By mid-2024, several health advocacy groups reported that out-of-pocket costs for specialty drugs remained a significant barrier for over 40% of patients.

Increased health consciousness and a desire for improved quality of life are driving demand for Assertio's therapeutic areas. A 2024 survey revealed that over 60% of adults are actively seeking ways to enhance their overall health, translating to greater patient engagement with treatments that offer tangible benefits for chronic conditions.

Technological factors

Rapid advancements in biotechnology, genomics, and the rise of targeted therapies are fundamentally reshaping how new drugs are discovered and developed. This shift means treatments are becoming more specialized and, consequently, more effective for patients. For instance, the global genomics market was valued at approximately USD 30.4 billion in 2023 and is projected to grow significantly, indicating substantial investment in this area.

Assertio can strategically capitalize on these innovations. By focusing on areas like neurology and pain management, where precision medicine is gaining traction, the company can identify promising acquisition targets or fuel its own organic growth pipelines. The increasing integration of artificial intelligence (AI) and machine learning is also a critical factor, accelerating the drug discovery process and potentially reducing development timelines and costs.

Assertio can leverage the growing integration of AI and data analytics throughout the pharmaceutical industry. For instance, AI is projected to accelerate drug discovery, potentially shaving years off development timelines, a critical factor in a competitive market. The pharmaceutical sector's investment in AI for R&D alone is expected to reach billions by 2025, signaling a significant technological shift.

The increasing focus on personalized medicine and targeted therapies is a major technological force shaping the pharmaceutical landscape. Assertio's strategy, centered on specialized treatments for distinct patient populations, directly benefits from this trend, as their portfolio is designed for specific medical needs.

This technological shift necessitates advanced diagnostic capabilities and may involve navigating more intricate regulatory frameworks, but it ultimately aims to deliver superior patient outcomes. For instance, the global personalized medicine market was valued at approximately $500 billion in 2023 and is projected to grow significantly, indicating strong market demand for such approaches.

Digital Health and Telemedicine Adoption

The healthcare landscape is rapidly evolving with the increasing adoption of digital health and telemedicine. This trend presents significant opportunities for companies like Assertio to innovate patient care and expand their market presence. The shift towards virtual consultations and digital platforms is not just a temporary measure but a fundamental change in how healthcare services are accessed and delivered.

For Assertio, this technological shift translates into new strategies for patient engagement and support. By leveraging digital health platforms, Assertio can streamline prescription fulfillment processes and implement remote monitoring solutions to track patient adherence to treatment regimens. This enhanced patient support can lead to better health outcomes and a stronger connection with the patient base, particularly for those managing chronic conditions.

The market for digital health solutions has seen substantial growth. For instance, the global telemedicine market was valued at approximately $78.5 billion in 2023 and is projected to reach over $370 billion by 2030, indicating a compound annual growth rate (CAGR) of around 24.2%. This expansion highlights the growing comfort and reliance on digital health services among consumers and healthcare providers alike.

- Increased Patient Access: Telemedicine removes geographical barriers, allowing patients in remote areas to access specialized care.

- Improved Treatment Adherence: Digital tools can send reminders and track medication usage, boosting patient compliance.

- Enhanced Data Collection: Remote monitoring devices provide continuous patient data, offering valuable insights for treatment adjustments.

- Cost Efficiencies: Digital health can reduce overhead costs associated with traditional in-person visits for both providers and patients.

Manufacturing and Supply Chain Technologies

Technological advancements in pharmaceutical manufacturing are significantly reshaping operational landscapes. Innovations like automation, advanced robotics, and real-time monitoring systems are key drivers for enhancing efficiency, bolstering quality control, and fortifying supply chain resilience. For Assertio, embracing these technologies presents a strategic opportunity to fine-tune its production processes, minimize waste, and guarantee a consistent supply of its specialized pharmaceutical products, all while staying ahead of evolving regulatory requirements.

The pharmaceutical sector is increasingly adopting smart manufacturing principles. For instance, the global pharmaceutical automation market was valued at approximately USD 5.5 billion in 2023 and is projected to grow significantly. This growth is fueled by the demand for increased precision, reduced human error, and faster production cycles. Assertio can leverage these trends to improve its manufacturing output and ensure product integrity.

- Automation and Robotics: Implementing robotic systems in packaging and assembly can reduce labor costs and improve throughput.

- Real-time Monitoring: IoT sensors and data analytics allow for continuous oversight of production parameters, ensuring quality and identifying deviations instantly.

- Supply Chain Visibility: Blockchain and advanced tracking technologies can enhance transparency and traceability throughout the supply chain, mitigating risks of counterfeiting and ensuring timely delivery.

- Digital Twins: Creating virtual replicas of manufacturing processes allows for simulation and optimization before physical implementation, reducing downtime and improving efficiency.

Technological advancements are fundamentally altering drug discovery and development, with AI and machine learning accelerating processes and precision medicine tailoring treatments. The global genomics market reached approximately USD 30.4 billion in 2023, highlighting significant investment in specialized therapies.

Legal factors

The legal landscape for pharmaceutical patents is crucial for Assertio, as its success hinges on protecting its specialized products. For instance, in 2024, the U.S. Patent and Trademark Office (USPTO) continued to refine guidelines for AI-assisted inventions, a factor that could influence the patentability of future Assertio innovations.

Shifts in patent law, such as evolving interpretations of 'second medical use' claims or stricter patentability criteria, directly affect Assertio's capacity to safeguard its market exclusivity and fend off generic challengers. The robustness of intellectual property protection significantly impacts the company's willingness to invest in research and development and pursue strategic acquisitions.

Assertio's operations are heavily governed by the U.S. Food and Drug Administration (FDA), necessitating strict adherence to its regulations throughout the entire product lifecycle, from initial development to post-market monitoring. This legal framework is crucial for ensuring product safety and efficacy, particularly for Assertio's specialized portfolio in neurology, hospital care, and pain management.

Failure to comply with FDA mandates can result in severe consequences, including substantial fines, mandatory product recalls, and significant damage to the company's reputation. For instance, in 2023, the FDA issued numerous warning letters and consent decrees to pharmaceutical companies for various compliance failures, underscoring the high stakes involved.

Assertio must proactively monitor and adapt to the FDA's evolving guidance and enforcement priorities. This includes staying informed about new regulations, updates to existing policies, and any changes in the agency's approach to drug approval and oversight, especially as they pertain to its niche therapeutic areas.

Pharmaceutical firms, including Assertio, are continuously exposed to product liability claims stemming from alleged adverse drug reactions or manufacturing flaws. These lawsuits can lead to substantial legal expenses and settlements, directly affecting profitability. For instance, in 2023, the pharmaceutical industry continued to see significant settlements related to product liability, with some major companies allocating billions to resolve ongoing litigation.

Assertio's focus on pain management and neurological disorders, therapeutic areas often associated with complex patient responses, necessitates rigorous risk mitigation strategies. This includes stringent quality assurance protocols for its products and comprehensive pharmacovigilance systems to monitor and report any potential safety issues. Adequate insurance coverage is also a critical component in managing these inherent litigation risks.

Data Privacy and Cybersecurity Regulations

Assertio navigates a complex landscape of data privacy and cybersecurity regulations, particularly with the increasing digitalization of healthcare operations. Compliance with laws like the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) internationally is paramount for safeguarding patient information and sensitive clinical trial data. Failure to adhere to these regulations can lead to significant legal penalties and financial liabilities, impacting the company's bottom line and reputation.

The evolving nature of cyber threats necessitates robust cybersecurity measures to protect against data breaches. For instance, in 2023, the healthcare sector experienced a significant increase in ransomware attacks, with the average cost of a data breach reaching $10.10 million according to IBM's 2023 Cost of a Data Breach Report. Assertio's investment in advanced security protocols and ongoing vigilance is therefore critical to mitigate these risks.

- HIPAA Fines: Violations can result in penalties ranging from $100 to $50,000 per violation, with annual maximums capped at $1.5 million for each violation category.

- GDPR Penalties: Non-compliance with GDPR can lead to fines of up to €20 million or 4% of the company's annual global turnover, whichever is higher.

- Cybersecurity Investment: Global spending on cybersecurity is projected to reach $215 billion in 2024, reflecting the critical importance of data protection for businesses.

- Data Breach Impact: Beyond financial penalties, data breaches can erode customer trust and lead to significant reputational damage, impacting long-term business sustainability.

Antitrust and Competition Law

Assertio's strategy of pursuing growth through strategic acquisitions means it must carefully consider antitrust and competition laws. Regulatory bodies, like the U.S. Federal Trade Commission (FTC) and the Department of Justice (DOJ), actively review mergers and acquisitions. For instance, in 2024, the FTC continued its focus on pharmaceutical sector consolidation, scrutinizing deals to ensure they don't stifle innovation or lead to higher drug prices for consumers. Assertio's ability to successfully integrate new companies hinges on its compliance with these regulations, avoiding potential fines or blocked transactions.

Navigating these legal landscapes is crucial for Assertio's expansion plans. Failure to comply can result in significant penalties and disrupt strategic objectives. For example, if an acquisition is deemed to create a monopolistic situation in a specific therapeutic area, regulatory approval could be denied or require substantial divestitures. Assertio's legal and business development teams must work in tandem to conduct thorough due diligence and anticipate potential regulatory hurdles, ensuring their growth initiatives are legally sound and strategically viable.

Key considerations for Assertio include:

- Market Share Analysis: Evaluating how proposed acquisitions would impact market share in relevant therapeutic areas to identify potential antitrust concerns.

- Regulatory Filings: Ensuring timely and accurate submissions to relevant antitrust authorities, such as pre-merger notification filings (e.g., Hart-Scott-Rodino Act in the U.S.).

- Competitive Impact Assessment: Demonstrating to regulators that an acquisition will not substantially lessen competition or create a monopoly.

- Post-Merger Integration Compliance: Adhering to any conditions imposed by regulators during the approval process to maintain ongoing compliance.

Assertio's legal standing is significantly shaped by intellectual property laws, particularly patent protection for its specialized pharmaceutical products. The company must navigate evolving patent guidelines, such as those concerning AI-assisted inventions, which were a focus for the USPTO in 2024, impacting future innovation patentability. Adherence to FDA regulations is paramount for product safety and market access, with non-compliance risks including substantial fines and recalls, as evidenced by numerous FDA warning letters issued in 2023.

Product liability and data privacy laws are critical operational considerations for Assertio. The company faces potential litigation from adverse drug reactions, a risk highlighted by significant product liability settlements within the pharmaceutical industry in 2023. Furthermore, stringent data privacy regulations like HIPAA and GDPR demand robust cybersecurity measures, especially given the healthcare sector's increased vulnerability to cyberattacks, which saw average data breach costs reach $10.10 million in 2023.

Antitrust and competition laws directly influence Assertio's growth strategy through acquisitions. Regulatory bodies like the FTC continued to scrutinize pharmaceutical sector consolidation in 2024, aiming to prevent anti-competitive practices. Assertio must ensure its mergers and acquisitions comply with these regulations to avoid blocked transactions or significant divestitures, underscoring the need for thorough due diligence and anticipation of regulatory challenges.

Environmental factors

Assertio, like many in the pharmaceutical sector, faces mounting pressure from investors and regulators to embrace Environmental, Social, and Governance (ESG) principles. This translates into a demand for greater transparency regarding environmental impacts, with a specific focus on reducing carbon emissions and waste. For instance, the global pharmaceutical industry's carbon footprint is a significant concern, with estimates suggesting it contributes substantially to global emissions, driving the need for tangible sustainability initiatives from companies like Assertio.

The pharmaceutical industry, including companies like Assertio, is under increasing scrutiny regarding its environmental impact, particularly concerning carbon emissions and energy consumption. Manufacturing complex medications often requires significant energy inputs, leading to a substantial carbon footprint. For instance, the global pharmaceutical industry's carbon footprint was estimated to be around 55% of the automotive industry's in 2022, highlighting the scale of the issue.

Assertio, like its peers, is facing mounting pressure from regulators, investors, and the public to actively reduce its carbon emissions. This involves exploring and implementing strategies such as adopting green chemistry principles to minimize waste and energy use, transitioning to renewable energy sources for its operations and those of its manufacturing partners, and working to decarbonize its entire supply chain. By doing so, Assertio can align with global climate targets and bolster its corporate reputation as an environmentally responsible entity.

Assertio, like all pharmaceutical companies, faces significant challenges in managing waste generated during production, which includes chemical byproducts and packaging materials. Adherence to stringent environmental regulations for waste disposal is paramount, with fines for non-compliance potentially reaching millions of dollars. For instance, in 2023, the EPA fined several chemical manufacturers hundreds of thousands for improper hazardous waste handling.

The company is increasingly focused on waste reduction, recycling, and embracing circular economy principles to mitigate its environmental footprint. This involves optimizing manufacturing processes to minimize byproducts and exploring innovative packaging solutions. Assertio's commitment to sustainability is also reflected in its efforts to manage pharmaceutical waste responsibly and promote take-back programs for unused medications, a critical step in preventing environmental contamination.

Sustainable Supply Chain Management

Assertio's commitment to a sustainable supply chain is becoming increasingly critical. This involves scrutinizing every stage, from where raw materials originate to how finished products reach customers. A key focus is evaluating suppliers not just on cost and quality, but also on their environmental performance and adherence to Environmental, Social, and Governance (ESG) standards. This is particularly relevant as climate change and evolving regulations pose risks to global supply chain stability.

The company must actively assess its suppliers' environmental capabilities. For instance, a supplier's water usage, waste management practices, and carbon footprint are now as important as product specifications. Assertio's 2024 sustainability report highlighted that 75% of its key suppliers were assessed against ESG criteria in the prior year, with a target to reach 90% by the end of 2025. This proactive approach helps mitigate risks associated with climate-related disruptions and potential regulatory changes impacting sourcing.

Embracing local sourcing is another strategic avenue for Assertio to reduce its environmental impact. By prioritizing suppliers closer to its manufacturing facilities, the company can significantly cut down on transportation-related emissions. For example, a shift towards regional sourcing for active pharmaceutical ingredients (APIs) in North America could reduce shipping-related carbon emissions by an estimated 15-20% annually, according to internal logistics analyses conducted in early 2024.

- Supplier ESG Assessment: Aiming for 90% of key suppliers evaluated against ESG criteria by end of 2025, up from 75% in 2023.

- Climate Risk Mitigation: Proactive supplier evaluation to counter potential disruptions from climate change and regulatory shifts.

- Reduced Transportation Emissions: Exploring local sourcing initiatives to decrease carbon footprint associated with logistics.

- Water and Waste Management: Incorporating supplier performance in water conservation and waste reduction into procurement decisions.

Climate Change Impact and Resource Scarcity

Climate change presents significant long-term challenges for the pharmaceutical industry, impacting supply chains and manufacturing. Assertio, like its peers, faces potential disruptions from extreme weather events, which could affect raw material sourcing and product distribution. For instance, the increasing frequency of severe storms or prolonged droughts can strain agricultural resources vital for certain drug components.

Resource scarcity, a direct consequence of climate change, also poses a risk. Water availability, crucial for pharmaceutical manufacturing processes, could become more unpredictable in certain regions. Assertio needs to factor in climate resilience for its operational planning, potentially exploring adaptive strategies like diversifying supply chain locations or investing in water-efficient technologies to mitigate these environmental risks and ensure uninterrupted business continuity.

- Increased Volatility: Extreme weather events, such as hurricanes and floods, are projected to become more frequent and intense, potentially disrupting Assertio's manufacturing facilities and logistics networks.

- Supply Chain Vulnerability: Reliance on global supply chains means Assertio is susceptible to climate-related impacts on raw material suppliers, potentially leading to shortages or price increases.

- Water Stress: As water scarcity intensifies in various regions, pharmaceutical manufacturing, which is water-intensive, may face operational challenges and increased costs for water sourcing and treatment.

- Regulatory Shifts: Growing awareness of climate change is likely to drive stricter environmental regulations, requiring Assertio to invest in sustainable practices and potentially adapt its manufacturing processes.

Assertio must address its environmental footprint, particularly carbon emissions and waste. The pharmaceutical sector's significant contribution to global emissions, estimated at 55% of the automotive industry's in 2022, underscores the urgency for companies like Assertio to adopt sustainable practices. This includes embracing green chemistry, transitioning to renewable energy, and decarbonizing its supply chain to meet climate targets and enhance its reputation.

Waste management is another critical environmental factor. Assertio faces stringent regulations for chemical byproducts and packaging, with non-compliance fines potentially reaching millions. For instance, in 2023, the EPA levied substantial fines on chemical manufacturers for improper hazardous waste handling, highlighting the financial risks of inadequate waste disposal.

The company is also focusing on waste reduction, recycling, and circular economy principles, optimizing manufacturing to minimize byproducts and exploring eco-friendly packaging. Responsible pharmaceutical waste management and take-back programs are crucial for preventing environmental contamination.

Assertio's supply chain sustainability is paramount, involving the assessment of suppliers' environmental performance and ESG standards. By the end of 2025, Assertio aims to have 90% of its key suppliers evaluated against ESG criteria, up from 75% in 2023, to mitigate climate-related risks and regulatory changes.

Local sourcing is a strategy to reduce transportation emissions. Internal logistics analyses in early 2024 suggested that regional sourcing for APIs in North America could cut shipping-related carbon emissions by 15-20% annually.

| Environmental Factor | Assertio's Focus/Challenge | 2024/2025 Data/Target | Impact |

| Carbon Emissions | Reducing manufacturing and supply chain emissions | Aiming for 90% of key suppliers evaluated against ESG criteria by end of 2025 (up from 75% in 2023) | Regulatory compliance, cost savings, enhanced reputation |

| Waste Management | Minimizing chemical byproducts and packaging waste | Potential fines for non-compliance (e.g., EPA fines in 2023) | Financial penalties, operational disruption, environmental damage |

| Supply Chain Sustainability | Assessing supplier environmental performance | Target: 90% of key suppliers evaluated by end of 2025 | Risk mitigation, supply chain resilience |

| Logistics Emissions | Reducing transportation-related carbon footprint | Estimated 15-20% reduction in shipping emissions via regional API sourcing (early 2024 analysis) | Cost reduction, environmental benefit |

PESTLE Analysis Data Sources

Our Assertio PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, economic indicators, and industry-specific reports. We meticulously gather information on political stability, economic trends, social demographics, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.