Assertio Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assertio Bundle

Assertio operates within a dynamic pharmaceutical landscape where each of Porter's Five Forces plays a critical role in shaping its competitive environment. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes is crucial for strategic success. This brief overview highlights key considerations, but the real power lies in a comprehensive analysis.

The complete report reveals the real forces shaping Assertio’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Assertio, like many pharmaceutical firms, faces a significant challenge due to its reliance on a restricted pool of suppliers for essential components like active pharmaceutical ingredients (APIs) and crucial raw materials. This dependency inherently grants these suppliers considerable bargaining power.

The pharmaceutical industry's stringent regulatory environment, demanding rigorous approval and validation processes for any supplier change, further entrenches this supplier power. For instance, introducing a new API supplier can take years and incur substantial costs, making it impractical for companies like Assertio to switch easily.

This limited substitutability means key suppliers can exert considerable leverage, potentially influencing Assertio's production expenses and delivery schedules. A disruption in supply or an unexpected price hike from these specialized providers could directly impact Assertio's operational efficiency and profitability.

Assertio's reliance on specialized manufacturing and Contract Research Organizations (CROs) significantly impacts supplier bargaining power. The development of differentiated pharmaceuticals necessitates unique production skills and CRO expertise, allowing these suppliers to charge premium prices due to their specialized knowledge and adherence to strict industry regulations, thereby increasing Assertio's operational expenses.

The proprietary nature of certain manufacturing techniques further restricts Assertio's alternatives, amplifying the bargaining leverage held by its suppliers. For instance, in 2024, the global pharmaceutical contract manufacturing market was valued at approximately $150 billion, with specialized services commanding a notable portion of this value, reflecting the high demand and limited supply of such capabilities.

Suppliers possessing patents or exclusive rights to critical drug components or manufacturing technologies can wield considerable bargaining power over Assertio. This is especially true given Assertio's business model, which often involves acquiring and developing specialized pharmaceutical products, frequently relying on licensed or purchased patented inputs. For instance, if a key active pharmaceutical ingredient (API) for one of Assertio's acquired drugs is patented, the patent holder can dictate terms, potentially increasing costs or limiting supply.

Regulatory Compliance and Quality Control Costs

Suppliers in the pharmaceutical sector, including those serving Assertio, face significant regulatory hurdles such as adhering to Good Manufacturing Practices (GMP). These stringent quality control measures and compliance requirements translate into substantial operational costs for suppliers.

The expense of maintaining these high regulatory standards is frequently passed on to pharmaceutical manufacturers like Assertio. This financial burden on suppliers can indirectly influence the pricing of raw materials and components, impacting Assertio's cost structure.

Furthermore, these demanding regulatory obligations serve as a considerable barrier to entry for potential new suppliers. By limiting the number of qualified and compliant suppliers, the existing, established suppliers can retain a stronger position, thereby increasing their bargaining power with companies like Assertio.

- Regulatory Burden: Pharmaceutical suppliers must meet rigorous standards like GMP, increasing their operational costs.

- Cost Pass-Through: These compliance costs are often absorbed by pharmaceutical companies, affecting raw material prices.

- Barrier to Entry: High regulatory requirements limit competition, bolstering the power of established suppliers.

Concentration of Key Suppliers

The concentration of key suppliers significantly impacts Assertio's bargaining power. If a small number of suppliers control essential inputs for Assertio's pharmaceuticals, these suppliers gain considerable leverage. This dominance means Assertio has limited options for sourcing, potentially leading to higher costs and less favorable contract terms. For instance, if only two or three companies produce a critical active pharmaceutical ingredient (API) used in Assertio's key drugs, those suppliers can dictate prices.

This supplier concentration can create vulnerabilities. In 2024, the pharmaceutical supply chain continued to grapple with global disruptions, highlighting the risks associated with relying on a few concentrated sources for APIs and specialized manufacturing services. Companies that face a highly concentrated supplier base for their raw materials or specialized components often experience increased input costs, as demonstrated by the average increase in API prices observed in late 2023 and early 2024, which in some therapeutic areas exceeded 10% year-over-year.

- Supplier Concentration Risk: A market dominated by a few key suppliers for essential inputs grants them increased bargaining power over Assertio.

- Limited Alternatives: When few suppliers exist for critical components, Assertio faces fewer choices, potentially leading to less competitive pricing.

- Impact on Costs: High supplier concentration can drive up the cost of raw materials and specialized services, directly affecting Assertio's profitability.

- Strategic Monitoring: Continuously assessing the concentration of suppliers for critical inputs is crucial for mitigating this aspect of supplier power and ensuring supply chain resilience.

Assertio's bargaining power with suppliers is significantly diminished due to the specialized nature of pharmaceutical ingredients and manufacturing processes. This limited substitutability, coupled with high switching costs driven by stringent regulatory requirements, allows suppliers to command higher prices and dictate terms. For example, the global pharmaceutical contract manufacturing market, valued around $150 billion in 2024, shows that specialized services command a premium due to limited capacity and expertise.

The concentration of key suppliers for active pharmaceutical ingredients (APIs) and unique manufacturing capabilities further amplifies their leverage. In late 2023 and early 2024, API prices in certain therapeutic areas saw increases exceeding 10% year-over-year, illustrating the impact of concentrated supplier bases on input costs for companies like Assertio.

| Factor | Impact on Assertio | Supporting Data/Example |

|---|---|---|

| Limited Substitutability | Suppliers of specialized APIs and manufacturing services have strong bargaining power. | High demand and limited supply of specialized pharmaceutical contract manufacturing services in 2024. |

| High Switching Costs | Regulatory hurdles (e.g., GMP, validation) make changing suppliers time-consuming and expensive. | New API supplier integration can take years and incur substantial costs. |

| Supplier Concentration | A few dominant suppliers for critical inputs can dictate terms and prices. | Observed API price increases of over 10% year-over-year in some areas in late 2023/early 2024. |

| Proprietary Technology/Patents | Suppliers with exclusive rights to components or processes can charge premium prices. | Patent holders for key APIs can control supply and pricing for Assertio's acquired products. |

What is included in the product

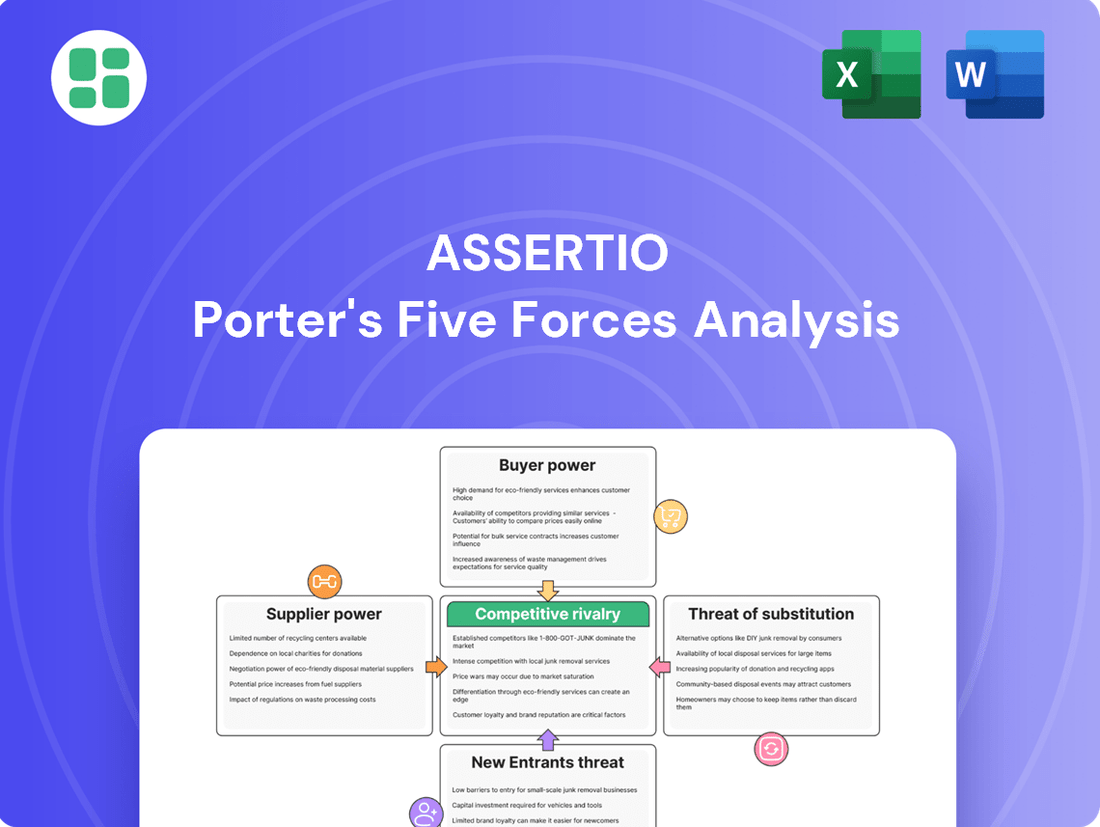

Assertio's Porter's Five Forces analysis dissects the competitive intensity within its specialty pharmaceutical market, examining threats from new entrants, substitutes, buyer and supplier power, and the rivalry among existing competitors.

Visually map competitive intensity and identify key threats with an intuitive spider chart, simplifying complex market dynamics.

Customers Bargaining Power

Assertio's customer base, including specialists in neurology, pain management, and hospital settings, faces a healthcare environment characterized by significant consolidation. Large health systems, major insurance providers, and powerful Pharmacy Benefit Managers (PBMs) wield considerable influence. For instance, in 2024, the top 10 PBMs managed prescriptions for over 200 million Americans, giving them substantial leverage in negotiating drug prices and formulary access.

This consolidation translates into increased bargaining power for these payers. They can demand substantial discounts and rebates from pharmaceutical companies like Assertio, or dictate favorable formulary placement, directly impacting Assertio's net revenue and market access for its products in key therapeutic areas.

Customers in the specialty pharmaceutical market, like those served by Assertio, are acutely aware of price due to the high cost of treatments and mounting healthcare expenses. For instance, the average annual cost of specialty drugs can easily exceed $30,000, making even small price increases impactful for patients and payers.

Reimbursement policies from major players such as Medicare, Medicaid, and large private insurers exert considerable influence over Assertio's pricing power. These entities often negotiate aggressively, and their formulary decisions can dictate market access, forcing Assertio to align pricing with what is deemed affordable or risk limited patient uptake.

This heightened price sensitivity compels Assertio to be highly competitive. In 2024, many pharmaceutical companies faced increased scrutiny on drug pricing, with some payers implementing stricter utilization management or demanding rebates to offset costs, directly impacting Assertio's ability to command premium pricing.

The availability of generics and biosimilars significantly influences customer bargaining power for Assertio. For instance, Indocin, an Assertio product, has already encountered generic competition. This trend is expected to continue as patents for other Assertio products expire, offering consumers more affordable alternatives and pressuring Assertio’s pricing.

Physician and Specialist Influence

Physicians and specialists, particularly in fields like neurology and pain management, hold significant sway over Assertio's product demand, even if hospitals or pharmacies are the direct buyers. Their prescribing habits are often driven by factors such as proven clinical effectiveness, desired patient outcomes, and personal familiarity with specific Assertio brands.

This physician preference can make them less sensitive to price for Assertio's highly differentiated products. For example, if a specialist believes a particular Assertio medication offers a unique benefit for a specific patient condition, they are more likely to prescribe it regardless of minor price differences. This was evident in 2024, where specialty drug pricing continued to be a focal point, yet physician loyalty to effective treatments remained a key driver.

- Physician Preference: Specialists in neurology and pain management significantly influence Assertio's sales through their prescribing decisions.

- Brand Loyalty: Clinical efficacy and patient outcomes foster physician loyalty, reducing price sensitivity for differentiated products.

- Market Dynamics: The availability of multiple effective alternatives can shift physician influence towards cost-effectiveness, impacting Assertio's pricing power.

Information Symmetry and Market Transparency

Customers, particularly major healthcare systems and Pharmacy Benefit Managers (PBMs), benefit from significant information symmetry. They possess comprehensive market data on drug pricing, clinical effectiveness, and competitive product landscapes. This deep understanding of alternatives and their costs allows them to negotiate from a position of strength.

The increasing transparency in pharmaceutical pricing further amplifies the bargaining power of these customers. For instance, in 2024, many payers actively leveraged comparative effectiveness research and real-world evidence to challenge list prices, leading to more value-based negotiations.

- Informed Negotiation: Access to pricing, efficacy, and competitor data enables customers to demand better terms.

- Cost-Conscious Decisions: Knowledge of alternative treatments and their costs empowers customers to seek cost-effective solutions.

- Transparency Impact: Greater transparency in drug pricing directly correlates with enhanced customer negotiating leverage.

Assertio's customers, including large healthcare systems and Pharmacy Benefit Managers (PBMs), possess considerable bargaining power due to market consolidation and access to extensive pricing and efficacy data. In 2024, the top 10 PBMs managed prescriptions for over 200 million Americans, giving them substantial leverage in price and formulary negotiations. This informed position allows them to demand discounts and favorable placement, directly impacting Assertio's net revenue.

The high cost of specialty drugs, often exceeding $30,000 annually, makes customers highly price-sensitive. Reimbursement policies from major payers like Medicare and private insurers further amplify this power, as they negotiate aggressively and influence market access. The increasing transparency in pharmaceutical pricing in 2024 enabled payers to challenge list prices more effectively, leading to value-based negotiations and pressuring Assertio's pricing power.

Physician preference also plays a role, though it can be offset by market dynamics. While specialists in neurology and pain management can drive demand for Assertio's differentiated products, the availability of generics and biosimilars, such as for Indocin, provides consumers with more affordable alternatives, intensifying price competition.

| Customer Segment | Key Influence Factor | Impact on Assertio | 2024 Data Point |

|---|---|---|---|

| PBMs & Large Payers | Market share, negotiation leverage | Price discounts, formulary access | Top 10 PBMs covered >200M Americans |

| Healthcare Systems | Volume purchasing, formulary control | Rebate demands, preferred product status | Consolidation in health systems |

| Physicians/Specialists | Prescribing habits, brand loyalty | Demand generation, price insensitivity for effective treatments | Continued focus on specialty drug pricing |

| Patients/Consumers | Price sensitivity, access to alternatives | Pressure for lower out-of-pocket costs, uptake of generics/biosimilars | Average specialty drug cost >$30,000/year |

What You See Is What You Get

Assertio Porter's Five Forces Analysis

This preview showcases the complete Assertio Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the pharmaceutical industry. The document you see here is precisely what you will receive instantly after purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

Assertio competes in areas like neurology and pain management, where major pharmaceutical giants with vast research and development funds and broad product lines are active. These large players, such as Pfizer and AbbVie, can invest heavily in marketing and innovation, posing a significant challenge for smaller companies like Assertio.

In 2024, the global pharmaceutical market was valued at over $1.6 trillion, with large companies often holding substantial market share in key therapeutic categories. Their ability to acquire promising drug candidates or launch new treatments can quickly shift competitive dynamics, demanding continuous adaptation from Assertio.

Assertio's strategy of focusing on acquiring and commercializing differentiated products, like its pain management and neurology therapies, aims to sidestep intense head-to-head competition. This approach allows them to carve out unique market positions for their therapies. For instance, in 2023, Assertio reported net revenue of $352.5 million, with a significant portion coming from their specialty products.

However, larger pharmaceutical companies often possess extensive portfolios, enabling them to employ cross-selling tactics and offer bundled pricing. This can create pressure on Assertio’s more concentrated product lines, as competitors can leverage their broader reach to offer more comprehensive solutions to healthcare providers.

Assertio's current strategic focus includes maximizing the potential of existing assets such as Rolvedon and Sympazan. This means they are concentrating on driving sales and market penetration for these specific therapies, rather than attempting to match the sheer breadth of offerings from larger rivals.

The specialty pharmaceutical sector thrives on relentless innovation, with companies pouring significant resources into developing novel treatments like biologics and gene therapies. This rapid pace means Assertio faces intense pressure to continuously enhance its existing product portfolio and introduce new solutions to remain relevant.

Assertio's strategy must involve a dual approach of organic research and development alongside strategic acquisitions to keep pace. For instance, in 2024, the pharmaceutical industry saw substantial investment in R&D, with major players allocating billions to pipeline advancements, underscoring the competitive imperative to innovate or risk product obsolescence.

Aggressive Marketing and Sales Strategies

Assertio faces intense competition where rivals deploy aggressive marketing and sales tactics. This includes significant spending on promotional activities designed to sway healthcare providers, particularly prescribers, and gain favorable positions on hospital formularies. For instance, in 2023, pharmaceutical marketing spend in the US was substantial, with many companies investing heavily in detailing and direct-to-physician outreach.

The company’s success hinges on its capacity to effectively reach and influence key medical specialists in neurology, hospital settings, and pain management. This is particularly challenging when competing against larger pharmaceutical firms that possess far more extensive sales forces and established market presence. Assertio's market share growth is directly tied to how well it can cut through this competitive noise.

- Aggressive Marketing: Competitors utilize broad-reaching campaigns to capture prescriber attention.

- Sales Force Effectiveness: The size and skill of sales teams are crucial for market penetration.

- Formulary Access: Securing preferred status on hospital drug lists is a key battleground.

- Specialty Focus: Assertio must compete effectively within specific medical disciplines like neurology and pain management.

Mergers and Acquisitions Activity

Mergers and acquisitions are a constant feature in the pharmaceutical sector, driving significant consolidation. This trend results in the formation of larger, more dominant players, thereby intensifying competitive rivalry. For instance, in 2023, the pharmaceutical industry saw deal values reach hundreds of billions of dollars, with notable transactions reshaping market dynamics and increasing the concentration of market share among fewer entities.

This heightened M&A activity directly impacts the competitive landscape by creating new market leaders. These consolidated entities often possess enhanced distribution networks, greater pricing leverage, and expanded research and development capabilities, all of which amplify competitive pressures on remaining independent firms.

Assertio Holdings, Inc. (ASRT) itself actively engages in mergers and acquisitions as a core component of its growth strategy. This approach allows Assertio to expand its product portfolio, gain access to new therapeutic areas, and strengthen its market position. For example, Assertio's acquisition of certain assets in 2023 aimed to broaden its commercial offerings and enhance its revenue streams.

- Increased Market Concentration: Frequent M&A activity leads to fewer, larger competitors dominating the pharmaceutical market.

- Enhanced Competitive Advantages: Acquired companies often gain greater market share, distribution reach, and pricing power, intensifying rivalry.

- Strategic Growth Driver: Assertio utilizes M&A as a key strategy to expand its product pipeline and market presence.

Assertio faces intense competitive rivalry from large pharmaceutical giants with extensive R&D budgets and broad product portfolios, such as Pfizer and AbbVie. These competitors leverage significant marketing spend and innovation capacity, making it challenging for Assertio to compete head-to-head. The global pharmaceutical market, exceeding $1.6 trillion in 2024, is dominated by these major players who can quickly shift market dynamics through new product launches or acquisitions.

Assertio’s strategy of focusing on niche therapeutic areas like neurology and pain management, and acquiring differentiated products, aims to carve out specific market positions. In 2023, Assertio reported $352.5 million in net revenue, with a substantial portion from its specialty products, indicating success in this targeted approach. However, larger firms’ ability to bundle products and offer comprehensive solutions puts pressure on Assertio's more focused offerings.

The specialty pharmaceutical sector demands constant innovation, with billions invested in R&D by major players in 2024. Assertio must continuously enhance its portfolio and introduce new solutions to remain competitive. Aggressive marketing and sales tactics by rivals, including substantial spending on physician outreach in 2023, further intensify the competition, making it crucial for Assertio to effectively reach and influence key medical specialists.

Mergers and acquisitions are a constant driver of consolidation in the pharmaceutical industry, leading to larger, more dominant competitors. The hundreds of billions in deal values seen in 2023 reshaped market dynamics, increasing market concentration. Assertio itself uses M&A as a growth strategy, acquiring assets in 2023 to expand its product portfolio and market presence, thereby navigating and participating in this intense rivalry.

| Competitor Characteristic | Impact on Assertio | Example Data/Fact |

| R&D Investment | Requires continuous innovation to match | Major pharma R&D spend in billions (2024) |

| Product Portfolio Breadth | Challenges Assertio's focused approach | Large pharma cross-selling and bundled pricing |

| Sales Force Size | Creates disparity in market reach | Extensive sales forces of major pharmaceutical firms |

| M&A Activity | Increases market concentration | Hundreds of billions in pharma M&A deal values (2023) |

SSubstitutes Threaten

The threat of substitute therapies is a significant concern for Assertio. This includes older, less expensive medications that may offer similar, albeit less potent, relief, as well as entirely new drug classes addressing the same patient needs. For example, the growing market for non-opioid pain relievers directly challenges Assertio's pain management products, with the global non-opioid pain management market projected to reach over $20 billion by 2028.

The most significant threat to Assertio's branded pharmaceutical products comes from generic and biosimilar competition. Once a drug's patent expires, chemically equivalent generic versions can enter the market, offering substantial cost reductions. This directly impacts Assertio's revenue streams, as seen with the genericization of Indocin, which led to a significant decline in its market share.

Non-pharmacological treatments can significantly impact Assertio's market by offering alternative solutions. For instance, physical therapy is a growing substitute, with the global physical therapy market projected to reach $163.5 billion by 2028, according to Grand View Research.

Dietary changes and psychological counseling also present substitutes, especially for chronic conditions where lifestyle management plays a crucial role. The global wellness market, encompassing these areas, was valued at over $4.5 trillion in 2022, indicating substantial consumer investment in non-drug health approaches.

Surgical interventions, while more invasive, can also substitute for long-term drug therapies in certain cases. The increasing advancements in minimally invasive surgical techniques further enhance their viability as alternatives, potentially reducing the reliance on pharmaceutical products for conditions like chronic pain or certain orthopedic issues.

Emerging Technologies and Digital Health Solutions

Advancements in medical technology, particularly in digital health, pose a significant threat of substitutes for Assertio. Innovations like AI-driven diagnostics and telemedicine platforms offer alternative pathways for patient care, potentially reducing reliance on traditional pharmaceuticals. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong shift towards these new solutions.

Wearable health technology and advanced medical devices are also emerging as competitive alternatives. These tools can provide continuous monitoring and personalized interventions, sometimes negating the need for prescription medications. The market for wearables alone saw shipments exceeding 100 million units in the first quarter of 2024, demonstrating increasing consumer adoption.

These emerging technologies can fundamentally alter treatment paradigms, acting as indirect substitutes by offering different, often more convenient or data-driven, approaches to managing health conditions. This competitive pressure necessitates that Assertio continuously innovate and adapt its product offerings and business models to remain relevant.

- Digital Health Market Growth: The global digital health market is expanding rapidly, with projections indicating continued strong growth through 2030.

- Wearable Technology Adoption: Consumer uptake of wearable health devices is a key indicator of the shift towards alternative health management solutions.

- AI in Diagnostics: The integration of artificial intelligence into diagnostic tools offers a new frontier in healthcare delivery, potentially impacting pharmaceutical demand.

- Telemedicine Expansion: The widespread adoption and acceptance of telemedicine platforms provide accessible alternatives to in-person consultations and traditional treatment plans.

Patient Preferences and Adherence

Patient preferences significantly influence treatment choices, even when direct substitutes aren't available. For instance, a patient's experience with side effects, the simplicity of taking a medication, and their belief in its effectiveness can drive them to switch therapies. This is a crucial factor for Assertio, as a preference for a competitor's product due to a better side effect profile or easier administration could erode market share.

Poor adherence to Assertio's treatments can also act as a substitute threat. If patients find a prescribed regimen too complex or experience adverse effects, they might seek alternative solutions or simply stop taking the medication altogether. This indirect substitution can be as damaging as a direct competitor, especially if patients opt for non-pharmaceutical interventions or lifestyle changes instead of seeking a different prescription.

In 2024, the pharmaceutical industry saw continued emphasis on patient-centric care. Reports indicated that over 50% of patients may not adhere to their prescribed medication regimens, a figure that highlights the importance of addressing patient preferences and adherence for companies like Assertio. The development of user-friendly drug delivery systems and robust patient support programs are therefore critical to mitigate this threat.

- Patient Preferences: Factors like side effect profiles, ease of administration, and perceived efficacy drive treatment switching.

- Adherence Issues: Complex regimens or side effects can lead to patients seeking alternatives or discontinuing therapy.

- Market Impact: These factors can indirectly substitute Assertio's products, impacting market share and revenue.

- Industry Trend: In 2024, patient-centricity and adherence support became even more vital in the pharmaceutical sector.

The threat of substitutes for Assertio's products is multifaceted, encompassing everything from generic drugs and non-pharmacological treatments to advancements in digital health and patient preferences. Generic competition directly erodes market share and revenue, as seen with products like Indocin. Non-drug alternatives, such as physical therapy and wellness programs, represent a growing challenge, with the global wellness market valued at over $4.5 trillion in 2022.

Emerging technologies like AI diagnostics and telemedicine are also significant substitutes, with the digital health market reaching approximately $200 billion in 2023. Furthermore, patient adherence and evolving preferences, influenced by factors like side effects and ease of administration, can lead to a shift towards alternative therapies, impacting Assertio's market position.

| Substitute Category | Examples | Market Size/Growth Indicator |

|---|---|---|

| Generic Drugs | Indocin generics | Direct revenue and market share erosion |

| Non-Pharmacological | Physical therapy, wellness programs | Global wellness market >$4.5 trillion (2022) |

| Digital Health | AI diagnostics, telemedicine | Digital health market ~$200 billion (2023) |

| Patient Behavior | Adherence, preference for alternatives | >50% patients non-adherent (2024 data) |

Entrants Threaten

The pharmaceutical sector faces formidable regulatory obstacles, with agencies like the FDA mandating rigorous clinical trials, adherence to strict manufacturing practices, and protracted approval timelines. These requirements represent a substantial financial commitment and necessitate specialized knowledge, effectively deterring many potential new entrants.

Significant Research and Development (R&D) Costs are a major barrier for new entrants in the pharmaceutical industry, like Assertio. Developing a new drug from scratch is incredibly expensive and time-consuming. Companies often spend billions of dollars and many years on discovery, preclinical testing, and multiple phases of human clinical trials, with no assurance of a successful outcome. For instance, estimates suggest the cost to bring a new drug to market can exceed $2 billion, and the failure rate is exceptionally high.

New entrants face a significant hurdle in establishing the necessary sales, marketing, and distribution channels to effectively reach specialized healthcare providers in neurology, hospitals, and pain management. Assertio's existing, well-developed commercial infrastructure, encompassing its sales force, non-personal promotion strategies, and payer contracts, represents a substantial barrier. Replicating these capabilities is both capital-intensive and time-consuming, making it difficult for new players to gain market traction.

Strong Patent Protection and Intellectual Property Landscape

The pharmaceutical industry, including companies like Assertio, benefits from a robust patent system. These patents, often lasting 20 years from filing, create significant barriers for new entrants seeking to introduce similar products. For instance, in 2024, pharmaceutical patent litigation remained a substantial hurdle, with many companies investing heavily in defending their intellectual property.

New companies must either innovate with entirely new drug compounds, a process that can take over a decade and cost billions, or acquire licenses for existing technologies. This licensing route is expensive and often involves royalty payments, further increasing the cost of market entry. The complexity of patent law means that even attempting to design around existing patents carries considerable legal risk and expense.

- Patent Exclusivity: Pharmaceutical patents grant exclusive rights, preventing competitors from marketing identical or similar products.

- R&D Costs: Developing a new drug can cost upwards of $2.6 billion, a significant deterrent for potential new entrants.

- Litigation Risk: Navigating and challenging existing patents involves substantial legal fees and uncertainty.

- Licensing Fees: Acquiring rights to existing technologies requires upfront payments and ongoing royalties, impacting profitability.

Capital Requirements and Access to Funding

The specialty pharmaceutical sector, where Assertio operates, presents a formidable barrier to new entrants due to the immense capital required. Developing a new drug from discovery to market approval can cost upwards of $2.6 billion, according to a 2023 analysis by the Tufts Center for the Study of Drug Development. This includes not only the extensive research and development (R&D) but also the significant investments in state-of-the-art manufacturing facilities, navigating complex regulatory pathways like FDA approvals, and building a robust commercialization and marketing infrastructure.

While established players like Assertio, which reported a strong cash position and access to credit lines in its 2024 financial statements, can leverage existing resources for growth and acquisitions, new companies face a much steeper challenge. Securing the necessary funding is a critical hurdle, particularly for entities without a demonstrated history of successful drug development and commercialization.

- High R&D Investment: The average cost to bring a new drug to market exceeds $2.6 billion.

- Manufacturing and Regulatory Costs: Significant capital is needed for specialized facilities and compliance with stringent healthcare regulations.

- Commercialization Expenses: Launching and marketing new pharmaceuticals requires substantial financial commitment.

- Funding Acquisition Challenges: New entrants often struggle to secure the extensive capital needed without a proven track record.

The threat of new entrants for Assertio is generally low. The pharmaceutical industry, particularly specialty areas like those Assertio serves, is characterized by extremely high barriers to entry. These include substantial R&D costs, stringent regulatory approvals from bodies like the FDA, and the need for extensive commercialization infrastructure.

Patents provide significant protection, preventing competitors from easily replicating existing successful drugs. For example, in 2024, patent litigation remained a key factor in maintaining market exclusivity for many pharmaceutical companies. Furthermore, the capital required to establish manufacturing facilities and navigate the complex legal and marketing landscape is immense, often exceeding billions of dollars.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Hurdles | FDA approval process, clinical trials, GMP compliance | High cost, long timelines, requires specialized expertise |

| R&D Investment | Drug discovery, development, testing | Estimated cost over $2.6 billion per drug; high failure rate |

| Patent Protection | Exclusive rights for 20 years from filing | Prevents direct competition for patented products |

| Commercial Infrastructure | Sales force, marketing, distribution networks | Capital-intensive to build, time-consuming to establish |

Porter's Five Forces Analysis Data Sources

Our Assertio Porter's Five Forces analysis is built upon a foundation of robust data, including Assertio's own SEC filings, investor presentations, and annual reports. We supplement this with industry-specific market research reports and competitor financial disclosures.