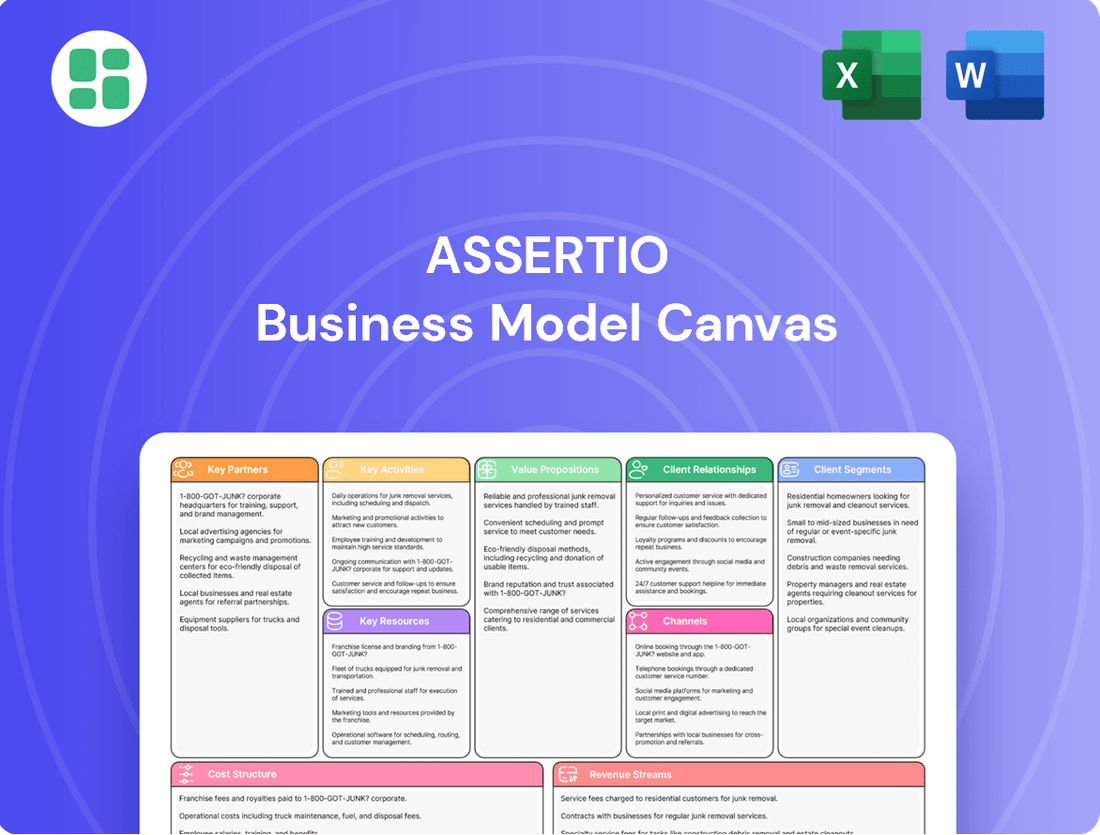

Assertio Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assertio Bundle

Unlock the complete strategic blueprint behind Assertio's business model. This detailed Business Model Canvas reveals exactly how they create value, reach customers, and generate revenue in the competitive pharmaceutical market. Perfect for anyone looking to understand their success drivers.

Dive into the core of Assertio's operations with our comprehensive Business Model Canvas. It breaks down their customer relationships, key resources, and cost structures, offering invaluable insights for strategic planning. Download the full version to see how the pieces fit together.

Want to benchmark your own strategies against a successful company? The full Assertio Business Model Canvas provides a detailed, section-by-section analysis of their entire business. Get actionable insights for your own growth and innovation.

Partnerships

Assertio heavily depends on third-party manufacturers to produce its specialized pharmaceutical products, ensuring a steady and high-quality supply chain for its neurology, hospital, and pain management drugs.

These crucial partnerships allow Assertio to effectively manage production expenses and maintain consistent product availability, which is vital for meeting market demand and patient needs.

For instance, in 2024, Assertio continued to leverage these manufacturing relationships to support its diverse product portfolio, aiming for operational efficiency and supply chain resilience.

Assertio Holdings, Inc. actively pursues collaborations with research institutions and smaller biotechnology companies to fuel its pipeline. These partnerships are crucial for accessing innovative therapeutic candidates, complementing their core strategy of acquiring and commercializing differentiated products. For instance, a 2023 collaboration with a university research lab focused on novel pain management compounds aimed to bolster Assertio's organic growth by identifying early-stage assets.

Assertio's growth hinges on acquiring and licensing new products. In 2024, the company continued to actively seek opportunities to broaden its therapeutic reach beyond its core areas of neurology, hospital, and pain management, aiming for differentiated offerings.

Building and maintaining robust relationships with potential acquisition targets and licensing partners is paramount. These connections are vital for identifying promising assets and securing advantageous terms, a strategy that has historically fueled Assertio's expansion.

Distribution and Logistics Providers

Assertio relies on a network of distribution and logistics providers to ensure its specialty pharmaceutical products reach patients. These partners are critical for navigating the intricate pharmaceutical supply chain, which demands strict temperature control and adherence to regulatory standards. For instance, in 2024, Assertio continued to leverage established third-party logistics (3PL) providers to manage warehousing and transportation.

The efficiency of these partnerships directly impacts product availability and patient outcomes. Reliable delivery ensures that healthcare providers have the necessary medications when and where they are needed. This operational excellence is a cornerstone of Assertio's commitment to patient care.

Key aspects of these partnerships include:

- Cold Chain Management: Ensuring temperature-sensitive medications are maintained within specific ranges throughout transit.

- Inventory Control: Accurate tracking and management of stock levels to prevent shortages or excess.

- Regulatory Compliance: Adherence to all federal and state regulations governing pharmaceutical distribution.

- Timely Delivery: Meeting strict delivery schedules to healthcare facilities and pharmacies.

Healthcare Organizations and Physician Networks

Assertio's strategy hinges on deep engagement with key healthcare organizations, including major hospital groups and specialist physician networks focused on neurology and pain management. These collaborations are crucial for driving product adoption and expanding market reach.

These partnerships serve as conduits for essential product education, aiming to secure formulary inclusions within hospital systems and specialist practices. Furthermore, they are instrumental in generating real-world evidence, which validates the efficacy and value of Assertio's offerings.

By working closely with these healthcare entities, Assertio gains invaluable insights into unmet patient needs. This understanding allows the company to refine its product portfolio and develop tailored solutions that directly address critical gaps in patient care.

- Key Partnerships: Healthcare Organizations and Physician Networks

- Objective: Facilitate product adoption, market penetration, and evidence generation through strategic alliances.

- Focus Areas: Hospital groups, neurology, pain management, and hospital-based physician networks.

- Benefits: Product education, formulary inclusion, real-world evidence, and identification of unmet patient needs.

Assertio's strategic growth is significantly bolstered by its key partnerships with contract manufacturing organizations (CMOs). These collaborations are essential for the reliable production of its specialized pharmaceutical products, particularly in its core therapeutic areas. In 2024, Assertio continued to leverage these relationships to ensure consistent supply and manage manufacturing costs effectively, underpinning its operational efficiency.

The company also actively cultivates partnerships with research institutions and biotechnology firms to expand its product pipeline. These alliances are vital for identifying and acquiring innovative drug candidates. For instance, a 2023 collaboration focused on novel pain management compounds aimed to enhance Assertio's organic growth by accessing early-stage assets.

Furthermore, Assertio relies on a robust network of distribution and logistics providers to ensure its specialty pharmaceuticals reach patients efficiently and compliantly. These third-party logistics (3PL) partners are critical for managing cold chain requirements and adhering to stringent regulatory standards, as demonstrated by Assertio's continued use of established 3PL providers in 2024 for warehousing and transportation.

Assertio's market penetration is driven by strong relationships with key healthcare organizations, including hospital groups and specialist physician networks. These partnerships facilitate product adoption and the generation of real-world evidence, crucial for demonstrating product value and securing formulary access.

| Partnership Type | Key Activities | 2024 Focus/Impact |

|---|---|---|

| Contract Manufacturers (CMOs) | Product manufacturing, quality control | Ensuring consistent supply, cost management |

| Research Institutions & Biotech Firms | Pipeline expansion, asset acquisition | Accessing innovative therapeutic candidates |

| Distribution & Logistics Providers (3PL) | Warehousing, transportation, cold chain management | Regulatory compliance, timely delivery |

| Healthcare Organizations & Physician Networks | Product adoption, market access, evidence generation | Formulary inclusion, real-world data collection |

What is included in the product

A detailed breakdown of Assertio's business model, focusing on its pharmaceutical product portfolio and patient-centric approach.

This canvas outlines Assertio's key customer segments, value propositions, and revenue streams within the healthcare industry.

Assertio's Business Model Canvas provides a clear, structured framework that simplifies complex strategic thinking, alleviating the pain of overwhelming data and unstructured planning.

It offers a visual and digestible snapshot of the entire business, making it easier to identify critical areas and address potential roadblocks before they become significant problems.

Activities

Assertio's core operations revolve around acquiring and licensing pharmaceutical products. In 2023, they completed the acquisition of three commercial products, demonstrating their commitment to portfolio expansion through strategic M&A. This proactive approach to product acquisition is fundamental to their growth strategy.

The company dedicates significant resources to identifying and evaluating potential acquisition targets and licensing opportunities. This meticulous process involves thorough due diligence and financial modeling to ensure alignment with their commercial objectives and financial targets.

Assertio's key activities center on the commercialization of its branded prescription products, with a strong emphasis on specialties like neurology, hospital settings, and pain management. This involves crafting and implementing robust marketing and sales strategies designed to boost product uptake and generate revenue.

The company's commercialization efforts are multifaceted, encompassing direct engagement through its sales force as well as broader non-personal promotional activities to reach a wider audience of healthcare professionals.

For instance, in 2024, Assertio continued to leverage its specialized sales teams to promote products like Nucynta and Gralise, aiming to capture market share within their target therapeutic areas.

Assertio's key activities heavily rely on managing a robust supply chain for its pharmaceutical products. This includes overseeing manufacturing processes, meticulously managing inventory levels, and coordinating distribution logistics to ensure timely delivery. For instance, in 2023, Assertio reported a net revenue of $341.5 million, underscoring the scale of operations that their supply chain must support efficiently.

Maintaining product availability and stringent quality control are paramount within this framework. This also involves strict adherence to regulatory standards, a critical aspect for any pharmaceutical company. Effective supply chain management directly contributes to minimizing disruptions, such as stockouts or quality issues, and optimizing operational costs, ultimately impacting profitability.

Regulatory Compliance and Quality Assurance

Assertio's key activities center on ensuring strict adherence to pharmaceutical regulations and quality standards. This involves meticulous management of regulatory submissions and maintaining Good Manufacturing Practices (GMP) throughout their operations. In 2023, Assertio reported a significant focus on compliance, with ongoing efforts to align with evolving FDA guidelines.

Monitoring product safety is another critical activity, directly impacting patient trust and market access. Assertio actively engages in pharmacovigilance activities to identify and address any potential safety concerns promptly. This commitment to quality assurance underpins their ability to operate successfully in the highly regulated pharmaceutical landscape.

- Regulatory Adherence: Maintaining compliance with FDA and other global health authority regulations.

- Quality Management Systems: Implementing and upholding robust quality assurance protocols across all processes.

- Product Safety Monitoring: Continuously tracking and managing the safety profile of their marketed products.

- GMP Compliance: Ensuring all manufacturing processes meet or exceed Good Manufacturing Practices.

Financial Management and Capital Allocation

Assertio's financial management and capital allocation are crucial for its growth. This involves smart decisions about where to invest money, like for new acquisitions or paying down debt. They also work hard to keep their costs as low as possible.

A key part of this is using their financial strength to make strategic moves. They focus on generating strong cash flow from their day-to-day business. This careful planning and reporting helps ensure they can keep growing sustainably.

- Strategic Financial Management: Continuous oversight of financial health, including debt management and cost optimization.

- Capital Allocation: Directing funds towards growth opportunities such as acquisitions and research.

- Cash Flow Generation: Prioritizing operational efficiency to produce consistent cash from core business activities.

- Balance Sheet Leverage: Utilizing financial resources to support strategic transactions and enhance shareholder value.

Assertio's key activities encompass the strategic acquisition and licensing of pharmaceutical products, as seen in their 2023 completion of three commercial product acquisitions. They also focus on the commercialization of their branded prescription products, particularly in neurology, hospital settings, and pain management, utilizing specialized sales teams in 2024 to promote key brands like Nucynta and Gralise.

Furthermore, robust supply chain management, including manufacturing oversight, inventory control, and distribution, is critical, supporting their 2023 net revenue of $341.5 million. Strict adherence to pharmaceutical regulations, quality standards, and product safety monitoring, including ongoing efforts to align with evolving FDA guidelines in 2023, are paramount.

Finally, strategic financial management, including capital allocation for growth and cost optimization, alongside strong cash flow generation from core operations, underpins their sustainable expansion and ability to leverage their balance sheet for strategic transactions.

| Key Activity | Description | Supporting Data/Example |

| Product Acquisition & Licensing | Expanding the product portfolio through strategic M&A and licensing agreements. | Completed acquisition of 3 commercial products in 2023. |

| Commercialization | Marketing and selling branded prescription products in specialty areas. | Leveraged specialized sales teams in 2024 for Nucynta and Gralise promotion. |

| Supply Chain Management | Overseeing manufacturing, inventory, and distribution for efficient product delivery. | Supported $341.5 million net revenue in 2023. |

| Regulatory Compliance & Quality | Ensuring adherence to pharmaceutical regulations, quality standards, and product safety. | Ongoing efforts to align with evolving FDA guidelines in 2023. |

| Financial Management | Strategic financial planning, capital allocation, and cash flow generation. | Focus on debt management and cost optimization. |

Delivered as Displayed

Business Model Canvas

The Assertio Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the final, comprehensive file. Once your order is complete, you will gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Assertio's most crucial asset is its carefully curated portfolio of branded prescription medications. This collection is primarily focused on key therapeutic areas including neurology, hospital-based treatments, and managing pain and inflammation.

The company's revenue and future growth are heavily reliant on its flagship products. For instance, Rolvedon, used to treat chemotherapy-induced neutropenia, and Sympazan, an oral suspension for treating seizures, are pivotal to their commercial success.

In 2023, Assertio reported net sales of $373.6 million, with their specialty products, including Rolvedon and Sympazan, showing significant growth. Rolvedon alone achieved $108.8 million in net sales for 2023, a substantial increase from the previous year.

Assertio's intellectual property portfolio, including patents, trademarks, and regulatory exclusivities, forms a cornerstone of its competitive strategy. These assets are crucial for safeguarding its acquired and commercialized products, particularly against the threat of generic competition. For instance, in 2024, Assertio continued to leverage its patent protection for key products like Nucynta® (tapentadol) and Cambia® (diclofenac potassium for oral solution).

The company's commitment to enforcing these intellectual property rights is evident in its ongoing efforts to maintain market exclusivity. This diligent protection allows Assertio to solidify its market position and ensures that its investments in product development and acquisition yield sustained returns. By actively defending its IP, Assertio aims to prevent market erosion and preserve its revenue streams.

Assertio leverages a robust commercial and sales infrastructure, featuring experienced direct sales teams adept at marketing specialty pharmaceuticals to specific healthcare professionals. This includes seasoned sales representatives who engage directly with physicians and other prescribers, ensuring targeted product promotion.

Their marketing capabilities extend beyond personal selling, incorporating non-personal promotional strategies to broaden reach and reinforce messaging. This multi-faceted approach allows Assertio to efficiently connect with their defined customer segments, driving product awareness and adoption.

Experienced Management Team and Personnel

Assertio's experienced management team is a cornerstone of its business model, bringing together deep expertise across critical areas like pharmaceutical commercialization, business development, legal matters, and financial management. This collective knowledge is essential for navigating the complex healthcare landscape and driving strategic growth.

The leadership's proven track record in executing mergers and acquisitions, successfully launching new products, and formulating effective strategic plans directly fuels Assertio's expansion and market positioning. For instance, the company's ability to identify and integrate complementary businesses, as seen in its strategic acquisitions, relies heavily on this seasoned leadership.

- Pharmaceutical Commercialization Expertise: The team possesses a nuanced understanding of bringing drugs to market, including sales, marketing, and patient access strategies.

- Business Development Acumen: Experience in identifying and executing strategic partnerships and acquisitions is vital for portfolio expansion.

- Legal and Financial Management: A strong foundation in regulatory compliance, intellectual property, and sound financial stewardship underpins the company's operations.

- Strategic Planning and Execution: The leadership's ability to chart a course and implement growth initiatives, including product lifecycle management and market penetration, is paramount.

Financial Capital and Cash Flow

Assertio's access to financial capital, including substantial cash reserves and robust operational cash flow generation, is a critical resource. This financial strength directly fuels their strategy of acquiring new products and managing ongoing operational costs.

A healthy balance sheet is fundamental to Assertio's growth trajectory, offering the necessary flexibility for future strategic investments. The company's financial positioning at the close of 2024 and into the first quarter of 2025 underscores this capability.

- Financial Capital Access: Assertio's ability to secure and deploy financial capital is paramount for its business model.

- Cash Reserves and Flow: Significant cash and investments reported at the end of 2024 and Q1 2025 highlight their strong liquidity.

- Balance Sheet Strength: A solid balance sheet empowers Assertio's acquisition-driven growth strategy and investment flexibility.

- Funding Operations and Acquisitions: Financial capital is the engine for both day-to-day operations and strategic expansion through acquisitions.

Assertio's key resources are centered on its specialized pharmaceutical portfolio, particularly its flagship products like Rolvedon and Sympazan, which are vital for revenue generation. The company's intellectual property, including patents and regulatory exclusivities, acts as a shield against competition, ensuring market longevity for its key drugs. A robust commercial infrastructure, led by an experienced management team, drives sales and strategic growth through targeted marketing and acquisitions, all supported by strong financial capital and cash flow.

| Resource Category | Key Assets | 2023/2024 Data Points |

|---|---|---|

| Product Portfolio | Branded Prescription Medications (Neurology, Hospital, Pain/Inflammation) | Rolvedon Net Sales: $108.8M (2023) |

| Intellectual Property | Patents, Trademarks, Regulatory Exclusivities | Continued IP enforcement for Nucynta® and Cambia® in 2024 |

| Commercial Infrastructure | Direct Sales Teams, Marketing Capabilities | Targeted promotion to healthcare professionals |

| Human Capital | Experienced Management Team | Expertise in commercialization, M&A, legal, and finance |

| Financial Capital | Cash Reserves, Operational Cash Flow, Balance Sheet Strength | Strong liquidity at end of 2024 and Q1 2025 |

Value Propositions

Assertio focuses on delivering specialized pharmaceutical products that directly target patient needs within neurology, hospital care, and pain management. These therapeutic solutions are crafted to enhance the quality of life for individuals facing specific medical challenges.

By providing these differentiated offerings, Assertio contributes to better health outcomes and improved daily living for its patient base. In 2023, Assertio reported net revenue of $1.4 billion, with a significant portion attributed to products addressing these critical therapeutic areas, underscoring their commitment to patient well-being.

Assertio offers specialized therapeutic solutions, focusing on branded prescription products for key medical areas like neurology, hospital care, and pain management. This targeted approach ensures their offerings are precisely designed to meet the distinct needs of patients and healthcare professionals within these specific fields.

By concentrating on these niches, Assertio achieves deeper market penetration and establishes strong relevance with its customer base. For instance, in 2023, their neurology segment, driven by products like QUTENZA, demonstrated significant performance, contributing to their overall revenue growth.

Assertio's commitment to a reliable supply chain ensures healthcare providers and patients consistently receive essential medicines. This uninterrupted access is crucial for managing chronic conditions and critical care needs. For instance, in 2024, Assertio continued to focus on robust inventory management and distribution networks to maintain product availability.

Strategic Growth Through Acquisitions

For investors and partners, Assertio's strategic growth through acquisitions is a core value. This approach focuses on acquiring commercial pharmaceutical assets that can be integrated to expand the company's market presence and revenue streams. The aim is to build a more robust and diversified product portfolio, ultimately enhancing shareholder value.

Assertio's strategy leverages acquired products to achieve greater scale and a stronger competitive position within the pharmaceutical market. This disciplined approach to M&A is designed to unlock synergies and drive sustainable long-term growth.

- Acquisition-driven growth: Focus on acquiring commercial-stage pharmaceutical assets to expand market reach and revenue.

- Synergy realization: Leverage acquired products to enhance operational efficiency and market positioning.

- Shareholder value enhancement: Drive long-term value creation through strategic portfolio expansion and improved financial performance.

- 2023 performance highlights: Assertio reported net product sales of $1.4 billion in 2023, demonstrating successful integration and commercialization of acquired assets.

Commercial Expertise and Market Access

Assertio's commercial expertise is a cornerstone of its business model, driving significant market access for its specialized pharmaceutical products. This deep understanding of the healthcare landscape allows them to effectively reach prescribers and patients, ensuring their therapies are available where and when they are needed.

This focus on commercial excellence translates directly into optimized sales and distribution channels, bolstering the company's financial performance. For instance, in 2024, Assertio continued to build on its established commercial infrastructure, which is crucial for penetrating niche therapeutic areas where specialized sales forces are vital.

- Broad Market Penetration: Assertio's established sales force and distribution networks are key to ensuring its products reach a wide range of healthcare providers and patients across the United States.

- Commercial Excellence: The company emphasizes a high level of commercial execution, focusing on effective detailing, market education, and strong relationships with key opinion leaders.

- Product Availability: This expertise ensures that Assertio's differentiated products, often targeting specific patient needs, are readily accessible to the physicians who prescribe them and the patients who benefit from them.

- Financial Performance Driver: Optimized sales and distribution strategies directly contribute to revenue generation and market share growth, supporting the company's overall financial health.

Assertio's value proposition centers on providing specialized pharmaceutical products that address unmet patient needs in critical areas like neurology and pain management. This focus allows for targeted marketing and deep market penetration.

The company drives growth through strategic acquisitions of commercial-stage pharmaceutical assets, aiming to expand its portfolio and enhance shareholder value. This approach is supported by a strong commercial infrastructure and a commitment to reliable supply chains.

In 2023, Assertio achieved net revenue of $1.4 billion, reflecting the success of its strategy in bringing essential therapies to market and ensuring their consistent availability for patients.

| Value Proposition Aspect | Description | Supporting Data/Example (2023/2024 Focus) |

|---|---|---|

| Specialized Therapeutic Focus | Delivering targeted pharmaceutical products for neurology, hospital care, and pain management. | QUTENZA's performance in the neurology segment contributed to revenue growth in 2023. |

| Acquisition-Driven Growth | Expanding market presence and revenue through acquiring commercial pharmaceutical assets. | Strategic M&A aims to build a robust and diversified product portfolio. |

| Commercial Excellence | Ensuring broad market penetration and product availability through a strong sales force and distribution network. | Continued investment in commercial infrastructure in 2024 to penetrate niche therapeutic areas. |

| Reliable Supply Chain | Guaranteeing consistent access to essential medicines for patients and healthcare providers. | Focus on robust inventory management and distribution networks maintained in 2024. |

Customer Relationships

Assertio cultivates direct relationships with healthcare professionals, focusing on neurology, hospital, and pain specialists, via its dedicated sales force and medical science liaisons. This hands-on approach enables tailored engagement, in-depth product education, and prompt responses to complex clinical questions.

These direct interactions are vital for fostering prescription growth and increasing the adoption of Assertio's branded pharmaceutical products. For instance, in 2023, Assertio reported net sales of $338.6 million, underscoring the importance of these physician relationships in driving revenue.

Assertio likely implements patient support programs designed to improve medication access, adherence, and patient understanding of their treatments. These initiatives are crucial for specialty pharmaceuticals, aiming to boost patient satisfaction and treatment effectiveness. For instance, in 2023, many pharmaceutical companies reported significant investments in patient assistance programs, with some allocating over $1 billion collectively to support patient access to critical therapies.

Assertio actively cultivates relationships with Key Opinion Leaders (KOLs) across neurology, hospital systems, and pain management. These experts are crucial for validating product efficacy and driving market acceptance. For instance, in 2024, Assertio continued to invest in medical education programs and advisory boards featuring prominent neurologists and pain specialists, aiming to enhance the clinical understanding and adoption of its therapeutic offerings.

Pharmacovigilance and Medical Information Services

Assertio cultivates strong customer relationships through its dedicated pharmacovigilance and medical information services. These functions are critical for monitoring product safety after launch and ensuring patients and healthcare providers have access to vital information. For instance, in 2024, Assertio continued its robust post-market surveillance, a key component of responsible pharmaceutical stewardship.

These services build trust by demonstrating a commitment to patient well-being and providing essential support to healthcare professionals. By offering timely and accurate data on product usage and potential side effects, Assertio empowers informed decision-making.

- Pharmacovigilance: Ongoing monitoring of product safety to identify and mitigate risks.

- Medical Information: Providing healthcare professionals with accurate product data and support.

- Trust Building: Fostering confidence through transparency and commitment to patient safety.

- Responsible Use: Ensuring healthcare providers and patients are well-informed for optimal outcomes.

Managed Care and Payer Relations

Assertio actively cultivates relationships with managed care organizations and PBMs. This engagement is crucial for securing preferred formulary status and favorable reimbursement for its pharmaceutical products, directly impacting patient access and the company's commercial viability.

These payer relationships necessitate ongoing negotiation and a clear articulation of Assertio's product value proposition. By demonstrating clinical and economic benefits, Assertio aims to ensure that patients can afford and access their prescribed medications.

- Formulary Access: Negotiating with payers to get products listed on insurance formularies, increasing patient eligibility for coverage.

- Reimbursement Rates: Securing competitive reimbursement rates that support the commercial success of Assertio's portfolio.

- Value Demonstration: Presenting clinical trial data and health economic outcomes to payers to justify product placement and pricing.

- Patient Affordability: Ensuring that negotiated terms translate into manageable out-of-pocket costs for patients.

Assertio's customer relationships are multifaceted, extending beyond direct physician engagement to include crucial partnerships with managed care organizations and pharmacy benefit managers (PBMs). These relationships are vital for securing formulary placement and favorable reimbursement, directly influencing patient access and the commercial success of their specialized pharmaceutical products.

| Relationship Type | Key Activities | Impact | 2024 Focus/Data Point |

|---|---|---|---|

| Healthcare Professionals (Neurology, Hospital, Pain) | Direct sales force engagement, medical science liaisons, KOL development, medical education | Prescription growth, product adoption, clinical validation | Continued investment in advisory boards with leading neurologists and pain specialists. |

| Patients | Patient support programs (adherence, access, education) | Improved treatment outcomes, patient satisfaction | Focus on enhancing patient access to critical therapies. |

| Payers (Managed Care, PBMs) | Negotiations for formulary access, reimbursement rates, value demonstration | Patient affordability, commercial viability | Securing preferred formulary status for key products. |

Channels

Assertio employs a specialized sales force focused on neurology, hospital, and pain management specialists. This direct engagement approach facilitates targeted product promotion and deepens relationships with key opinion leaders in these critical therapeutic areas.

This dedicated team is instrumental in educating healthcare providers about Assertio's innovative treatments, driving both product awareness and market adoption within these niche medical communities.

In 2024, Assertio's sales force played a crucial role in promoting its portfolio, contributing to its reported net revenue of $581.5 million for the full year 2024, reflecting strong market penetration in its target segments.

Assertio relies on a robust network of pharmaceutical wholesalers and distributors, such as McKesson, Cardinal Health, and AmerisourceBergen, to efficiently get its products to market. These partnerships are critical for ensuring broad accessibility, reaching thousands of pharmacies, hospitals, and clinics nationwide. In 2023, the pharmaceutical wholesale market in the US was valued at over $300 billion, underscoring the scale and importance of these channels for Assertio's business model.

Assertio leverages digital marketing through online educational platforms and professional portals to connect with healthcare professionals. This strategy includes targeted advertising campaigns designed to disseminate product information efficiently and cost-effectively, complementing their direct sales efforts.

In 2024, digital channels are crucial for Assertio to expand its reach beyond traditional sales interactions. For instance, by offering valuable online content, they can educate a broader audience of physicians and specialists, fostering prescriber engagement and driving awareness for their pharmaceutical products.

Pharmacy Networks

Assertio's products reach patients through established retail and specialty pharmacy networks. This ensures that once a prescription is written, patients can conveniently access their medications. These collaborations are vital for the seamless distribution and final delivery of Assertio's therapeutic solutions.

These pharmacy networks are critical touchpoints for patient care and product accessibility. For instance, in 2024, Assertio continued to focus on strengthening relationships with key pharmacy benefit managers and retail chains to optimize patient access. The efficiency of these channels directly impacts the company's revenue and market penetration.

- Retail Pharmacies: Broad network for over-the-counter and prescription accessibility.

- Specialty Pharmacies: Crucial for complex or high-cost medications requiring specialized handling and patient support.

- Distribution Agreements: Partnerships ensure timely stock availability and efficient order fulfillment.

- Patient Support Programs: Pharmacies often act as conduits for patient assistance and adherence programs.

Conferences and Medical Meetings

Assertio leverages medical conferences and symposia as a crucial channel to disseminate clinical findings and engage directly with healthcare professionals. These gatherings are instrumental for showcasing research and fostering dialogue with key opinion leaders.

In 2024, Assertio actively participated in numerous medical meetings, presenting data on its key therapeutic areas. For example, at the American Academy of Neurology (AAN) annual meeting, the company highlighted advancements in headache management, a core focus for Assertio.

- Scientific Exchange: Presenting late-breaking data and engaging in peer-to-peer discussions to advance scientific understanding.

- Thought Leader Engagement: Building relationships and gathering insights from influential physicians and researchers.

- Brand Reinforcement: Increasing visibility and reinforcing Assertio's commitment to specific medical specialties.

- Audience Education: Providing valuable clinical information to a wide range of healthcare providers, from specialists to general practitioners.

Assertio's channel strategy is multifaceted, combining direct sales with broad distribution networks. Their specialized sales force targets key medical professionals, while wholesalers and distributors ensure widespread product availability. Digital marketing and patient-focused pharmacy networks complement these efforts, ensuring accessibility and engagement.

In 2024, Assertio's direct sales force remained a cornerstone, driving engagement with neurologists and pain management specialists. This focused approach, combined with strategic digital outreach and robust distribution partnerships, contributed to their 2024 net revenue of $581.5 million, highlighting the effectiveness of their channel mix in reaching target markets and patients.

| Channel | Description | 2024 Focus/Data |

|---|---|---|

| Direct Sales Force | Targeted engagement with specialists in neurology, hospital, and pain management. | Crucial for promoting portfolio; contributed to $581.5M net revenue. |

| Wholesalers & Distributors | Partnerships (e.g., McKesson, Cardinal Health) for broad market access. | Ensures accessibility to pharmacies, hospitals, clinics. US wholesale market >$300B (2023). |

| Digital Marketing | Online educational platforms and targeted advertising. | Expands reach, educates broader physician audience, fosters engagement. |

| Retail & Specialty Pharmacies | Patient access point for medications. | Strengthened relationships with PBMs and retail chains for optimized patient access. |

| Medical Conferences | Dissemination of clinical findings and engagement with KOLs. | Active participation in meetings like AAN to present data on headache management. |

Customer Segments

Neurology specialists, including neurologists and other healthcare professionals focused on treating neurological disorders, represent a key customer segment for Assertio. These professionals are targeted with specialized treatments designed to meet specific patient needs within this field.

Assertio's engagement with this segment is exemplified by its product offerings such as Rolvedon, a treatment for spinal muscular atrophy, and Sympazan, an oral liquid formulation of clobazam for treating seizures associated with Lennox-Gastaut syndrome. These products directly address unmet needs in neurological care, demonstrating Assertio's commitment to this medical specialty.

Assertio's hospital formulary and institutional customer segment includes hospitals, hospital systems, and institutional pharmacies. These entities are critical for products used in acute care or inpatient settings, necessitating direct engagement with hospital pharmacists and their therapeutics committees. In 2024, the pharmaceutical market within hospitals continued to be a significant driver of revenue, with many institutions focusing on optimizing their drug spend and formulary inclusions to manage costs effectively.

This customer segment includes pain management specialists, anesthesiologists, and other healthcare professionals dedicated to treating both chronic and acute pain. Assertio offers specialized products designed to meet the intricate requirements of patients dealing with a range of painful conditions.

Assertio’s focus on differentiated pain and inflammation solutions directly addresses the needs of these clinicians. For instance, in 2024, Assertio reported net revenue of $1.4 billion, with a significant portion likely attributable to their pain management portfolio, serving these vital medical practitioners.

Oncology Specialists

Assertio targets oncology specialists, focusing on treatments that manage adverse effects of cancer therapies, like neutropenia. This requires a deep understanding of complex cancer treatment regimens and the critical supportive care these patients need. For example, in 2024, the global oncology market continued to see significant growth, with supportive care drugs representing a substantial portion of this expansion, driven by advancements in chemotherapy and immunotherapy.

The engagement with this segment necessitates a sales force with specialized medical knowledge. They must be equipped to discuss the nuances of managing treatment-related toxicities and demonstrate the value proposition of Assertio’s products within the existing oncology treatment landscape. Data from 2024 indicates that physicians in specialized fields, such as oncology, increasingly rely on peer-reviewed data and clinical trial results when making prescribing decisions for supportive care medications.

- Target Audience: Oncologists and hematologists managing cancer patients.

- Key Needs: Effective management of chemotherapy-induced side effects, particularly neutropenia.

- Market Context (2024): Growing demand for supportive care drugs in oncology, driven by more aggressive treatment protocols.

- Sales Approach: Emphasis on clinical data and understanding of cancer treatment pathways.

Patients with Specific Therapeutic Needs

Patients suffering from specific therapeutic needs in neurology, pain, inflammation, and oncology represent a core customer segment for Assertio. These individuals are the ultimate beneficiaries of the company's product portfolio, experiencing conditions that require targeted treatment solutions.

While healthcare professionals are the direct channel through which Assertio's treatments are accessed, the persistent needs and desire for improved health outcomes of these patients are paramount to Assertio's overarching mission and product development focus.

For instance, in 2024, the prevalence of chronic pain conditions, a key area for Assertio, continued to be a significant public health concern. According to recent data, an estimated 20.9% of U.S. adults experienced chronic pain in 2023, highlighting a substantial patient population with ongoing therapeutic requirements.

- Neurology Patients: Individuals managing conditions such as epilepsy or migraine, seeking effective and reliable treatment options.

- Pain Management Patients: Those experiencing moderate to severe pain, often requiring specialized formulations for relief.

- Inflammation Patients: Patients with inflammatory conditions needing targeted therapies to manage symptoms and disease progression.

- Oncology Patients: Individuals undergoing cancer treatment who may require supportive care or specific therapies to manage their condition.

Assertio's customer segments are primarily healthcare professionals and institutions that prescribe and administer its specialized treatments. This includes neurologists, pain management specialists, and oncologists who directly engage with the company's product portfolio. Hospitals and institutional pharmacies also form a critical segment, particularly for products used in inpatient settings.

The company's focus extends to patients with specific neurological, pain, inflammation, and oncology-related needs, who are the ultimate recipients of care. In 2024, Assertio reported net revenue of $1.4 billion, underscoring the significant market presence and demand for its targeted therapeutic solutions across these diverse patient populations and the healthcare providers serving them.

| Customer Segment | Key Focus Areas | 2024 Relevance |

| Neurology Specialists | Treating neurological disorders (e.g., SMA, epilepsy) | Key prescribers for specialized neurological treatments. |

| Pain Management Specialists | Managing chronic and acute pain conditions | Significant revenue driver, addressing widespread pain needs. |

| Oncology Specialists | Managing cancer treatment side effects (e.g., neutropenia) | Growing market for supportive care drugs in oncology. |

| Hospitals & Institutions | Inpatient care, formulary inclusion | Critical for distribution and access to acute care treatments. |

| Patients (Neurology, Pain, Oncology) | Specific therapeutic needs and improved health outcomes | Underlying demand driving Assertio's product development and sales. |

Cost Structure

Assertio's cost structure heavily features the Cost of Goods Sold (COGS), encompassing the expenses directly tied to producing or acquiring its pharmaceutical products. This includes the price of raw materials, manufacturing overhead, and any direct costs associated with obtaining finished goods. For instance, in 2023, Assertio reported a COGS of $225.6 million, reflecting a significant portion of their operational expenses.

Effectively managing COGS is paramount for Assertio to preserve robust gross profit margins. A lower COGS relative to revenue directly translates to higher profitability on each sale. The company's ability to negotiate favorable terms with suppliers and optimize its manufacturing processes directly impacts this critical financial metric.

Assertio's Selling, General, and Administrative (SG&A) expenses are a significant component of its operating costs. These expenses include the salaries and commissions for its sales force, marketing initiatives to promote its pharmaceutical products, the general overhead required to run the business, and crucial legal expenses. For instance, in the first quarter of 2024, Assertio reported SG&A expenses of $77.6 million, reflecting ongoing investments in its commercial operations.

The company has been actively working to optimize its cost structure, with a particular emphasis on managing its SG&A. This includes efforts to improve sales force efficiency and streamline administrative functions. Furthermore, Assertio's focus on managing its legal exposure directly impacts SG&A, as litigation and compliance activities represent a substantial portion of these costs.

Assertio's Research and Development (R&D) expenses, while not their primary focus given their acquisition-driven strategy, are crucial for maintaining their existing product portfolio. These costs cover essential activities like product lifecycle management, ensuring current drugs remain effective and compliant, and conducting post-market studies to gather further real-world data. For instance, in 2023, Assertio reported R&D expenses of approximately $31.4 million, a figure that, while lower than many R&D-intensive biotechs, reflects their commitment to these vital post-acquisition activities and potential early-stage asset exploration.

Acquisition and Integration Costs

Assertio's cost structure is significantly impacted by acquisition and integration expenses. These costs are directly tied to their strategy of growing their product offerings through mergers and acquisitions. For instance, in 2023, Assertio reported $12.3 million in acquisition and integration costs, reflecting the due diligence, legal work, and operational alignment required for new ventures.

These expenses are crucial for their M&A-driven growth model. The company often incurs substantial fees related to evaluating potential targets, negotiating deals, and then merging the acquired entities' systems and personnel. This investment is viewed as necessary to expand their market presence and diversify their pharmaceutical portfolio.

- Due Diligence: Costs incurred to thoroughly investigate potential acquisition targets.

- Legal and Advisory Fees: Expenses related to legal counsel, investment bankers, and other advisors during the M&A process.

- Integration Expenses: Costs associated with merging operations, IT systems, and personnel of acquired companies.

- Amortization of Intangibles: Post-acquisition, the amortization of acquired intangible assets also contributes to ongoing costs.

Legal and Litigation Costs

Assertio has historically faced substantial legal and litigation expenses, reflecting past challenges in managing regulatory and legal matters. These costs are a significant factor in their overall financial structure.

For instance, in 2023, Assertio reported legal settlements and related expenses impacting their bottom line. The company's strategic focus for 2025 includes actively working to minimize legal exposure and consequently reduce these associated costs.

- Historical Legal Expenses: Assertio has a track record of significant legal charges and settlements.

- 2025 Strategic Priority: The company is prioritizing efforts to reduce legal exposure and associated costs.

- Impact on Financials: These costs directly influence Assertio's overall cost structure and profitability.

Assertio's cost structure is primarily driven by its Cost of Goods Sold (COGS) and Selling, General, and Administrative (SG&A) expenses. The company also incurs costs related to Research and Development (R&D), acquisition and integration, and significant legal expenses.

| Cost Component | 2023 Actuals (Millions) | Q1 2024 Actuals (Millions) |

| COGS | $225.6 | $54.8 (Q1 2024) |

| SG&A | N/A | $77.6 |

| R&D | $31.4 | $7.2 (Q1 2024) |

| Acquisition & Integration | $12.3 | N/A |

| Legal Expenses | Significant impact (details not broken down quarterly) | Ongoing focus for reduction |

Revenue Streams

Assertio's main way of making money comes from selling its branded prescription drugs. These are mostly for conditions affecting the brain and nerves, hospital treatments, and pain relief.

Products such as Rolvedon, used for chemotherapy-induced neutropenia, and Indocin, an anti-inflammatory, are major drivers of their overall revenue. For instance, in the first quarter of 2024, Assertio reported net product sales of $137.8 million, with Rolvedon alone generating $37.5 million.

Assertio might earn royalty revenue by licensing its intellectual property or developed products to other companies for commercialization. These agreements typically involve receiving payments tied to the sales performance of the licensed products, offering a predictable income stream.

In 2023, Assertio reported net product sales of $1.1 billion, indicating a strong foundation for potential licensing opportunities. While specific royalty figures aren't detailed, the company's portfolio in areas like neurology and pain management suggests potential for such revenue if partnered effectively.

Future revenue growth for Assertio is anticipated to stem from the successful integration and commercialization of its newly acquired, differentiated products. This approach leverages the company's financial strength to bring in commercial assets that bolster its market presence and accelerate immediate growth.

Assertio's strategic deployment of its balance sheet is specifically aimed at acquiring commercial assets that not only enhance its existing scale but also drive tangible near-term revenue expansion. For example, in 2023, Assertio completed the acquisition of Olinvyk, a product that contributed to its revenue growth strategy.

Product Volume Growth

Revenue growth is also driven by increasing the volume of existing product sales, particularly for core growth assets such as Rolvedon and Sympazan. This demonstrates successful market penetration and adoption within their intended customer bases.

Assertio's strategy focuses on expanding the reach of these key products. For instance, in the first quarter of 2024, Assertio reported net sales of $136.8 million, a 12% increase year-over-year, with product volume growth contributing significantly to this uplift.

This increase in unit sales for established products signifies effective commercial execution and a growing demand from healthcare providers and patients.

- Rolvedon and Sympazan sales volume increases

- Contribution to overall net sales growth

- Market penetration and customer uptake

- First quarter 2024 net sales up 12% year-over-year

Optimized Pricing and Payer Access

Assertio's revenue streams are significantly shaped by its capacity to maintain advantageous pricing for its specialized pharmaceutical products and to secure widespread access through payer networks. This involves skillful negotiation with managed care organizations and Pharmacy Benefit Managers (PBMs), which directly influences reimbursement rates and overall net sales.

Assertio's financial performance in 2024 reflects the success of these strategies. For instance, the company reported total revenue of $1.4 billion for the full year 2024, showcasing the impact of their pricing and payer access initiatives.

- Favorable Pricing: Assertio leverages the differentiated nature of its products to command optimal pricing, contributing directly to revenue generation.

- Payer Coverage: Broad access to their medications through managed care plans and PBMs is crucial for realizing sales potential.

- Negotiation Power: Effective contract negotiations with payers ensure favorable reimbursement terms, maximizing the net revenue received per unit sold.

- Net Sales Impact: The combination of pricing and access directly translates into the company's reported net sales figures.

Assertio's revenue primarily stems from the sale of its branded prescription drugs, focusing on neurology, hospital, and pain management segments. Key products like Rolvedon and Indocin are significant contributors, with Rolvedon alone accounting for $37.5 million in sales in Q1 2024.

The company also explores royalty revenue through intellectual property licensing, offering a potential for predictable income streams based on product sales performance. Assertio's 2023 net product sales reached $1.1 billion, highlighting the potential for such licensing partnerships.

Assertio actively pursues revenue growth by acquiring and commercializing differentiated products, as seen with the 2023 acquisition of Olinvyk. This strategy aims to bolster market presence and drive near-term revenue expansion through enhanced scale and commercial assets.

Strategic pricing and securing widespread payer network access are crucial for Assertio's revenue generation. Effective negotiations with managed care organizations and PBMs directly influence reimbursement rates, as reflected in their total revenue of $1.4 billion for the full year 2024.

| Product | Q1 2024 Net Sales | 2023 Full Year Net Sales |

|---|---|---|

| Rolvedon | $37.5 million | Not specified |

| Indocin | Not specified | Not specified |

| Total Net Product Sales | $137.8 million (Q1 2024) | $1.1 billion (2023) |

Business Model Canvas Data Sources

The Assertio Business Model Canvas is informed by a blend of internal financial data, market research reports, and competitive analysis. This multi-faceted approach ensures a robust understanding of our market position and strategic direction.