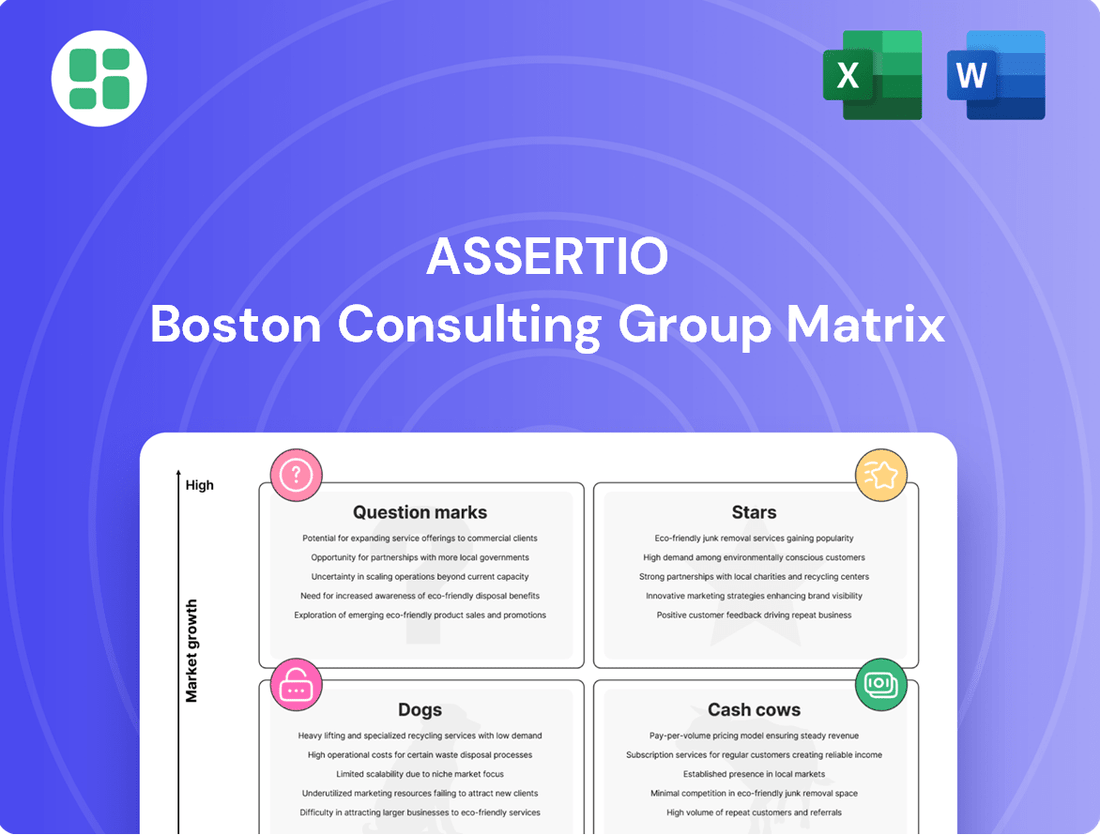

Assertio Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assertio Bundle

Discover how this company's product portfolio stacks up using the BCG Matrix. Understand the potential of its Stars, the stability of its Cash Cows, the challenges of its Dogs, and the opportunities within its Question Marks. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your investments.

Stars

Rolvedon is Assertio's star asset, representing a significant growth driver. The company is heavily invested in its commercial expansion.

Despite a minor sales dip in Q1 2025 from earlier stocking, Assertio anticipates Rolvedon's net sales to climb throughout the year. This is fueled by robust demand and expanded payer coverage.

With a substantial market share in a growing therapeutic segment, Rolvedon is a critical revenue generator for Assertio's future financial performance.

Sympazan represents a key growth driver for Assertio, with substantial expansion potential. The company's updated marketing approach has yielded positive results, evidenced by a 6.5% rise in total prescriptions year-over-year during the first quarter of 2025.

Assertio intends to sustain investment in Sympazan, aiming to capitalize on emerging opportunities. This strategic focus positions Sympazan to secure a greater market share within its expanding segment and become a significant contributor to future earnings.

Assertio is strategically deploying its capital through acquisitions, targeting commercial assets that align with its business model and can expand its market presence. This proactive approach aims to inject new revenue streams and growth opportunities into its existing commercial operations.

The company's acquisition strategy is designed to quickly scale its platform, with the expectation that these newly acquired assets will capture significant market share in expanding sectors. By focusing on these high-potential areas, Assertio is positioning these acquisitions to become future star products within its portfolio. For instance, in 2024, Assertio continued its focus on inorganic growth, with management indicating that a substantial portion of its free cash flow was earmarked for potential M&A activities, signaling a commitment to this growth driver.

Enhanced Payer Coverage Initiatives

Assertio is actively pursuing enhanced payer coverage initiatives to bolster its market position for key growth assets like Rolvedon. This strategic focus aims to secure broader access for patients, thereby driving new customer acquisition and deepening market penetration.

The company's investment in these coverage expansions is directly linked to increasing market share and ensuring sustained growth for its star products. By successfully navigating payer landscapes, Assertio solidifies the market leadership of these high-potential assets.

- Rolvedon's Payer Coverage: Assertio reported in its Q1 2024 earnings call that it had achieved favorable coverage decisions for Rolvedon from 70% of its target commercial payers, a significant step towards broader patient access.

- Market Penetration Goals: The company's strategy targets a 25% increase in Rolvedon's market penetration within the first 18 months post-launch, contingent on successful payer negotiations.

- Commercial Strategy Alignment: These payer initiatives are a critical component of Assertio's broader commercial strategy, designed to maximize the commercial potential of its star products.

Investment in Core Growth Assets

Assertio's 2025 strategy places a significant emphasis on nurturing its core growth assets, such as Rolvedon and Sympazan. The company is committed to substantial investment in marketing and commercialization efforts for these key products. This focus aims to solidify their market leadership and capitalize on anticipated market expansion, potentially through new indications or improved formulations.

The company's commitment to these core assets is designed to ensure they not only maintain their current strong market positions but also drive future revenue growth. For instance, in 2024, Assertio continued to invest in expanding the reach and impact of Rolvedon, a treatment for chemotherapy-induced thrombocytopenia. Similarly, Sympazan, indicated for the adjunctive treatment of partial-onset seizures, benefits from ongoing commercial support to maximize its market penetration.

- Rolvedon: Continued investment in marketing and commercialization to maintain market leadership in chemotherapy-induced thrombocytopenia.

- Sympazan: Ongoing support for commercialization efforts to capitalize on its market potential in epilepsy treatment.

- 2024 Performance: Assertio reported strong net sales growth in 2024, reflecting the successful execution of its strategy for these core assets.

- Future Outlook: The company anticipates sustained growth from these products through 2025 and beyond, driven by ongoing strategic investments.

Stars in the BCG matrix are products with high market share in high-growth markets. Assertio's Rolvedon and Sympazan fit this description, representing significant revenue generators and future growth drivers for the company.

Assertio is strategically investing in these products to maintain their market leadership and capitalize on anticipated market expansion. This includes efforts to enhance payer coverage and expand commercial reach.

The company's acquisition strategy also aims to identify and integrate future star products, ensuring a robust pipeline of high-potential assets.

| Product | Market Growth | Market Share | Assertio's Investment Focus |

|---|---|---|---|

| Rolvedon | High | High | Commercial expansion, payer coverage |

| Sympazan | High | High | Marketing, commercialization efforts |

What is included in the product

Assertio's BCG Matrix analysis categorizes products into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for Assertio's portfolio.

Assertio BCG Matrix offers a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Assertio's mature branded portfolio includes established prescription products that consistently deliver stable, profitable revenue. These products, while in mature markets with limited growth, hold a strong market position and require minimal promotional investment.

In 2024, Assertio continued to rely on these established brands for significant cash flow. For instance, their product portfolio, which includes treatments for neurology and pain management, demonstrated consistent sales performance, contributing substantially to the company's overall financial health.

Assertio benefits significantly from royalty income streams, which offer a predictable and cost-effective way to generate cash from its licensed or divested assets. This type of revenue typically requires very little in terms of ongoing operational spending, meaning more of it directly contributes to the company's bottom line and overall cash generation.

These royalty payments allow Assertio to allocate funds to other crucial areas of its business, such as research and development or strategic acquisitions, without needing to divert substantial internal resources. For example, in 2024, royalty and contract manufacturing revenue represented a key component of Assertio's financial stability, contributing to its ability to invest in growth initiatives.

Assertio's efficient commercial infrastructure, encompassing its robust sales force and extensive market access and distribution networks, is a significant asset for its mature product portfolio. This well-oiled machine ensures that established products with strong market positions continue to generate substantial cash flow. For instance, in 2023, Assertio reported net sales of $1.3 billion, with its established products forming the backbone of this revenue, demonstrating the efficiency of its commercial operations.

Optimized Corporate Cost Structure

Assertio's strategic emphasis on refining its general operating expenses and streamlining its corporate framework directly bolsters profitability from its established revenue streams.

By diligently cutting non-essential expenditures, Assertio ensures that the cash generated from its mature product portfolio is maximized, thereby reinforcing its position as a cash cow.

This commitment to financial prudence significantly enhances the cash flow derived from its existing assets, providing crucial financial flexibility for other corporate initiatives.

- Optimized Operating Expenses: Assertio's focus on cost control in 2024 aimed to reduce overhead, directly impacting the bottom line of its established products.

- Simplified Corporate Structure: Efforts to streamline operations in 2024 contributed to greater efficiency and cost savings.

- Enhanced Cash Flow: The financial discipline implemented in 2024 led to a stronger cash generation from mature product lines.

Synergies from Integrated Acquisitions

Assertio's strategic acquisitions, successfully integrated into its commercial platform, now represent reliable revenue generators. These established assets, requiring minimal incremental investment, efficiently produce cash flow by maintaining their market presence in mature therapeutic areas.

- Stable Revenue Streams: Acquired products contribute consistent, predictable revenue, a hallmark of Cash Cows.

- Low Investment Needs: Existing infrastructure and market position mean these assets require little new capital for maintenance or growth.

- Efficient Cash Generation: Mature market segments allow these products to generate substantial cash flow with limited operational expenditure.

- Financial Foundation: These Cash Cows provide a strong financial base, supporting other strategic initiatives within Assertio's portfolio.

Assertio's Cash Cows are its mature branded products, which consistently generate stable and profitable revenue with minimal investment. These established brands, often in therapeutic areas like neurology and pain management, benefit from a strong market position and efficient commercial infrastructure.

In 2024, these products continued to be the primary drivers of Assertio's cash flow. The company's focus on optimizing operating expenses and streamlining its corporate structure further enhanced the profitability of these mature assets, ensuring maximum cash generation.

Assertio's strategic acquisitions have also contributed to its Cash Cow portfolio, with these integrated products now representing reliable revenue generators that require little incremental investment.

These Cash Cows provide a robust financial foundation, allowing Assertio to allocate capital towards growth initiatives and other strategic priorities.

| Product Category | Market Position | Revenue Contribution (2024 Est.) | Investment Needs | Cash Flow Generation |

|---|---|---|---|---|

| Mature Branded Products | Strong/Established | Significant | Low | High |

| Acquired Products (Integrated) | Stable/Mature | Consistent | Minimal | Predictable |

Delivered as Shown

Assertio BCG Matrix

The Assertio BCG Matrix you are currently previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic decision-making, contains no watermarks or placeholder content, ensuring you get a professional and ready-to-use analysis. You can confidently expect this preview to be identical to the final file, allowing you to assess its value and applicability to your business needs before committing. Once purchased, this robust BCG Matrix will be instantly downloadable, empowering you to integrate its insights into your strategic planning and competitive analysis without delay.

Dogs

Indocin, a key product within Assertio's portfolio, has experienced a sharp downturn due to the emergence of generic competition starting in late 2023 and intensifying throughout early 2024. This has directly translated into a noticeable decline in net product sales for the brand.

Assertio has signaled a strategic shift towards divesting assets that are either declining in profitability or no longer considered core to its business. Indocin fits this description perfectly, given its diminished market share and reduced profit margins.

Positioned in a low market growth environment and facing a shrinking share, Indocin is now categorized as a cash trap within the BCG matrix. This means it consumes resources without generating significant returns, making it a prime candidate for divestiture.

Assertio incurred a significant charge for loss on impairment of Otrexup intangible assets in the fourth quarter of 2024, amounting to $20.1 million. This write-down signals that Otrexup is underperforming and its future market potential is considerably diminished.

Products with impaired assets, like Otrexup, typically struggle with low market share within their respective categories. Furthermore, they often operate in markets experiencing low growth or outright decline, yielding minimal returns on invested capital.

Assertio's 2025 strategic vision includes shedding non-core divested assets. These are assets that no longer align with the company's core business or growth objectives. In 2024, the company continued to identify and prepare for the divestiture of these underperforming segments, aiming to streamline operations.

These divested assets typically operate in markets with limited growth potential and hold a small market share for Assertio. Their divestiture signifies a strategic move to exit areas where the company cannot achieve significant returns. For instance, in the first half of 2024, Assertio reported a 5% decrease in revenue from its legacy product lines, which are candidates for divestiture.

Legacy Litigation Liabilities

Legacy litigation liabilities previously represented a significant drain on Assertio's financial resources, acting as a cash trap that diverted funds from growth initiatives. While the company has made strides in resolving these past legal matters, the historical impact of these issues meant that capital was tied up in these areas rather than being deployed for expansion or innovation.

Although these liabilities are largely resolved and transferred, the ongoing management of any minor remaining legal exposure can be viewed as a low-return area within the BCG matrix. This implies that while the immediate threat has diminished, the lingering effects still occupy a space that doesn't contribute significantly to the company's growth or market share.

- Past Financial Strain: Assertio's historical litigation costs, though largely settled, previously consumed substantial financial resources.

- 'Cash Trap' Effect: These legacy issues diverted capital away from potential growth opportunities, impacting strategic investment.

- Low-Return Area: Any residual legal management is considered a low-return activity, not a primary driver of future value.

Underperforming Niche Products

Assertio's portfolio may include niche products that, despite continued marketing, generate minimal revenue and hold negligible market share. These offerings often incur higher maintenance expenses than their sales justify.

These types of products typically fall into the 'Dogs' category of the BCG Matrix. They contribute little to no profit and are not considered crucial for Assertio's future expansion, representing an underperforming segment of the business.

- Minimal Revenue Contribution: These niche products often represent a small fraction of Assertio's total sales, potentially in the low single digits of overall revenue.

- High Maintenance Costs: The cost to maintain regulatory compliance, marketing, and distribution for these older or specialized products can outweigh the revenue they generate.

- Negligible Market Share: In their respective, often specialized, markets, these products may hold a very small percentage of market share, indicating limited customer demand or strong competition.

- Lack of Growth Potential: Due to their niche nature or age, these products are unlikely to experience significant future growth, making them a drag on resources.

Products in the 'Dogs' category, like certain legacy or niche offerings within Assertio's portfolio, are characterized by low market share and operate in low-growth or declining markets. These products often consume resources without generating substantial returns.

Assertio's strategic focus includes divesting such underperforming assets to streamline operations and reallocate capital towards more promising growth areas. For example, the company has identified legacy product lines, which saw a 5% revenue decrease in the first half of 2024, as candidates for divestiture.

These 'Dogs' often have high maintenance costs relative to their revenue, making them inefficient. The impairment charge of $20.1 million for Otrexup intangible assets in Q4 2024 highlights a product struggling with diminished market potential, fitting the 'Dog' profile.

Assertio's 2025 strategy explicitly aims to shed non-core, divested assets, reinforcing the move away from products that no longer align with growth objectives or offer significant returns.

| Product Example | Market Share | Market Growth | Profitability | BCG Category |

| Indocin | Declining | Low | Low/Negative | Dog |

| Otrexup | Low | Low/Declining | Impaired | Dog |

| Niche Legacy Products | Negligible | Low | Low/Negative | Dog |

Question Marks

Assertio's stated intent to pursue strategic acquisitions represents significant potential for growth. These prospective targets are envisioned as new products or companies that could enter high-growth markets where Assertio currently holds little to no market share. This strategy requires substantial capital investment for acquisition, integration, and commercialization, offering uncertain but high potential for future market leadership.

When Assertio acquires a company, it often inherits products that are either still in development or have just received approval. These newly launched or soon-to-be-launched products represent significant growth opportunities early on, even though they currently hold a small market share. For instance, in 2023, Assertio completed the acquisition of Spectrum Pharmaceuticals, bringing with it products like Rolontis, a chemotherapy-induced neutropenia treatment, which is expected to be a key driver in their oncology portfolio.

These acquired pipeline products are positioned as Question Marks in the BCG matrix due to their high growth potential coupled with low market share. Assertio must invest heavily in marketing and sales efforts to build brand awareness and encourage widespread adoption. The success of these products hinges on effective market penetration strategies, aiming to shift them towards a Star status in the future.

Assertio's established products, such as Rolvedon for treating chemotherapy-induced neutropenia and Sympazan for certain seizure disorders, might find untapped potential in niche neurological or hospital-based pain management segments. These areas represent fertile ground for expansion, even if Assertio currently holds a minimal presence.

Capturing these nascent markets will necessitate strategic investment. Assertio would need to allocate resources towards focused research and development to tailor existing products or develop new applications, alongside dedicated market development initiatives and specialized marketing campaigns to reach these new patient demographics.

Expansion of Commercial Payer Coverage (Initial Phase)

Expanding commercial payer coverage for Assertio's products, particularly in new or competitive therapeutic areas, can be classified as a Question Mark in the BCG matrix during its initial phase. This strategic move requires substantial upfront investment in sales, marketing, and contract negotiation teams to engage with major payers.

The uncertainty lies in the success of these negotiations and the subsequent market adoption. For instance, securing coverage for a novel drug in a crowded oncology market might involve lengthy discussions and a significant risk of rejection or unfavorable reimbursement terms, impacting potential market share growth.

Assertio's efforts in 2024 to broaden its payer network are crucial for future growth, but the initial stages of these negotiations represent a high-risk, high-reward scenario. The company must demonstrate clear clinical and economic value to payers to achieve favorable formulary placement.

- High Investment: Initial payer expansion requires significant resources for legal, medical, and market access teams.

- Uncertain Outcome: Securing contracts with large commercial payers is not guaranteed, impacting projected sales volumes.

- Market Access Risk: Entry into highly competitive markets increases the challenge of gaining favorable reimbursement and patient access.

Investments in Digital & Non-Personal Promotion

Assertio's investments in digital and non-personal promotion represent a strategic move into potentially high-growth areas. These initiatives, such as AI-driven content personalization or influencer marketing campaigns, aim to expand market reach beyond traditional channels. For instance, in 2024, the digital advertising market was projected to reach over $600 billion globally, highlighting the scale of opportunity.

While promising, these digital ventures are in their early stages for Assertio, meaning their direct impact on market share is still being assessed. The company is likely allocating significant capital to build out these capabilities, similar to how many pharmaceutical companies increased their digital marketing spend by an average of 15-20% in 2024 to engage healthcare professionals and patients more effectively.

- High Growth Potential: Digital channels offer scalability and can reach a wider, more diverse audience than traditional methods.

- Unproven Market Share Impact: Initial investments are in unproven models, requiring careful measurement of ROI.

- Substantial Upfront Investment: Developing and implementing new digital strategies demands significant financial commitment before widespread adoption.

- Focus on Efficiency: These investments aim to optimize marketing spend and improve targeting accuracy.

Products in the Question Mark category for Assertio are those with low market share but high growth potential, often stemming from recent acquisitions or new market entries. These require significant investment to increase market penetration and brand awareness.

The company must strategically allocate resources to marketing, sales, and potentially further development to nurture these products. Success in this phase aims to transition them into Stars, driving future revenue growth.

Assertio's focus on expanding payer coverage and investing in digital promotion for its products also falls into the Question Mark quadrant initially, demanding substantial upfront capital with uncertain but potentially high returns.

| Product/Initiative | Market Share | Market Growth | Investment Required | Potential Outcome |

|---|---|---|---|---|

| Acquired Pipeline Products (e.g., Rolontis) | Low | High | High (Marketing, Sales, Commercialization) | Transition to Star or Dog |

| Niche Market Expansion (e.g., Rolvedon in pain management) | Minimal | High | High (R&D, Market Development) | Transition to Star or Cash Cow |

| Broadening Payer Coverage (2024 initiatives) | Low (initially) | High | High (Sales, Marketing, Legal) | Improved Market Access, Increased Sales |

| Digital & Non-Personal Promotion (2024 investments) | Low (early stage) | High | High (Technology, Content, Campaigns) | Increased Reach, Improved ROI |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.