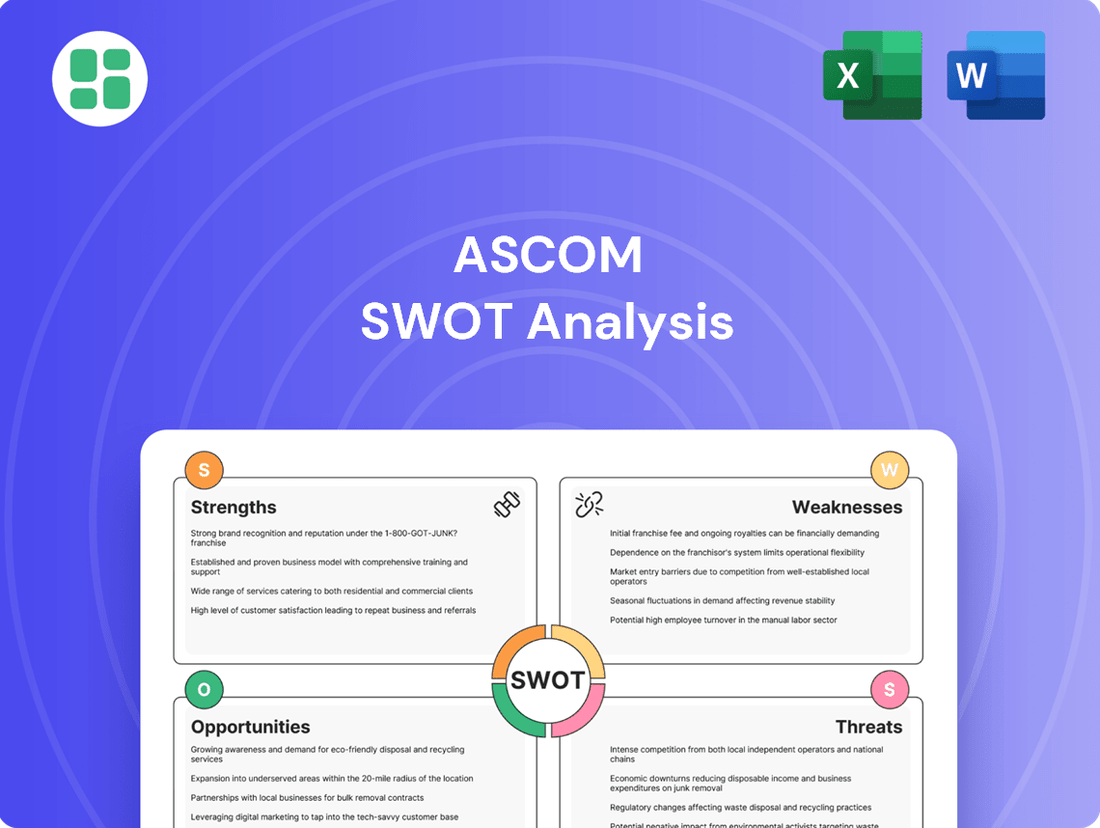

Ascom SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascom Bundle

Ascom's strengths lie in its established reputation and innovative communication solutions, but it faces challenges from intense market competition and evolving technological landscapes. Understanding these dynamics is crucial for strategic planning.

Unlock the full picture of Ascom's market position with our comprehensive SWOT analysis. This in-depth report provides actionable insights, financial context, and strategic takeaways, making it an indispensable tool for investors, analysts, and business leaders.

Strengths

Ascom's dedicated focus on healthcare ICT and mobile workflow solutions is a significant strength. This specialization allows them to cultivate deep expertise, enabling the development of highly tailored solutions that address the intricate demands of the healthcare industry, thereby solidifying their market standing.

Their offerings are designed to streamline operational processes and equip healthcare professionals with the tools needed to provide safer, more efficient patient care. This value proposition is particularly impactful in a sector where precision and effectiveness are paramount, as demonstrated by their continued innovation in areas like nurse call systems and secure communication platforms.

Ascom boasts a comprehensive product and service portfolio, encompassing wireless communication systems, personal mobile devices like the GCF MCS-certified 5G Myco 4, and specialized software such as Digistat and Unite. This breadth of offerings, including nurse call systems and professional services, enables them to deliver integrated, end-to-end solutions tailored to diverse healthcare requirements.

Ascom's strength lies in its Healthcare Platform (AHP), a vendor-neutral solution designed for effortless integration with diverse healthcare systems and medical devices. This interoperability is key in today's complex healthcare settings, facilitating smooth data flow and ultimately boosting patient care.

The company is actively pursuing platform convergence and rolling out new cloud-based offerings, aiming to significantly improve operational efficiency for its clients. This strategic direction is supported by Ascom's 2024 financial performance, which showed a continued focus on its platform strategy, contributing to revenue growth in key segments.

Commitment to Innovation and R&D

Ascom's dedication to innovation is a significant strength, fueled by consistent investment in Research & Development. This commitment is demonstrated through the successful launch of products like the Ascom Myco 4 smartphone, a key device for healthcare communication. The company is also actively developing next-generation Nurse Call systems, showcasing a forward-looking approach to enhancing critical healthcare infrastructure.

These R&D efforts are strategically focused on expanding Ascom's capabilities in crucial areas. They are enhancing their offerings to include advanced medical device integration, robust alarm management solutions, seamless clinical collaboration tools, and the integration of augmented intelligence. This multi-faceted approach positions Ascom to capitalize on future market opportunities and meet the evolving demands of the digital healthcare landscape.

- Investment in R&D: Ascom consistently allocates resources to research and development to foster innovation.

- Product Development: The company has successfully developed and launched key products like the Ascom Myco 4 smartphone.

- Future Offerings: Ascom is actively developing next-generation Nurse Call systems and enhancing capabilities in medical device integration and alarm management.

- Strategic Focus: Investments target augmented intelligence and clinical collaboration, aligning with future market trends.

Solid Order Backlog and Financial Stability

Ascom's financial strength is underscored by its substantial order backlog. Despite market headwinds in 2024, the company ended the year with CHF 301.5 million in orders, a clear indicator of robust future revenue streams expected to materialize in 2025. This backlog provides a degree of revenue visibility and operational stability.

Furthermore, Ascom exhibits strong financial health, characterized by a net cash position and a healthy equity ratio. This financial resilience is crucial, enabling the company to weather economic fluctuations and pursue strategic investments without undue financial strain. It positions Ascom favorably for continued operational execution and potential growth initiatives.

- Solid Order Pipeline: CHF 301.5 million order backlog at the end of 2024.

- Financial Resilience: Maintained a net cash position and healthy equity ratio.

- Future Revenue Visibility: Backlog provides a strong foundation for 2025 revenue.

Ascom's strategic focus on healthcare ICT and mobile workflow solutions is a core strength, allowing for specialized development and deep market understanding. Their commitment to enhancing patient care through streamlined operations and advanced tools, such as their GCF MCS-certified 5G Myco 4 device, directly addresses critical needs within the healthcare sector.

The company's comprehensive portfolio, including wireless systems, personal mobile devices, and software like Digistat and Unite, enables integrated, end-to-end solutions. A key differentiator is the Healthcare Platform (AHP), a vendor-neutral solution promoting interoperability with diverse healthcare systems and devices, facilitating seamless data flow.

Ascom's financial stability is evident in its robust order backlog, which stood at CHF 301.5 million at the close of 2024, providing significant revenue visibility for 2025. This, coupled with a net cash position and a healthy equity ratio, demonstrates strong financial resilience, enabling continued investment in innovation and strategic growth.

| Metric | Value (End of 2024) | Significance |

|---|---|---|

| Order Backlog | CHF 301.5 million | Indicates strong future revenue streams and operational stability. |

| Net Cash Position | Positive | Demonstrates financial resilience and ability to invest. |

| Equity Ratio | Healthy | Underpins financial stability and capacity to manage economic fluctuations. |

What is included in the product

Maps out Ascom’s market strengths, operational gaps, and risks.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Ascom's net revenue saw a downturn in 2024, a clear signal of the tough market conditions and hesitant customer spending they encountered. This challenging environment directly impacted their sales performance.

The company reported a 1.6% decrease in net revenue when calculated at constant currencies, and a more significant 3.6% drop at actual currencies compared to 2023. These figures underscore the headwinds Ascom faced in its revenue generation during the year.

Ascom's profitability took a hit in 2024, with its EBITDA falling to CHF 21.3 million. This also meant a decrease in the EBITDA margin, which landed at 7.4%, down from 10.1% in 2023.

This financial dip was largely due to a combination of lower revenue and increased spending on research and development, as well as marketing and sales efforts. These factors combined to impact the company's overall financial performance.

Ascom's revenue performance in 2024 presented a fragmented landscape, with notable underperformance in critical markets. Specifically, the UK, USA & Canada, and France & Spain regions experienced disappointing results, impacting overall growth trajectories.

These regional operational challenges directly contributed to significant management shifts. As of January 2025, new leadership was appointed in both the USA & Canada and France & Spain divisions, signaling a strategic response to address the identified weaknesses.

Impact of Increased Investments on Short-Term Profit

Ascom's strategic investments in research and development (R&D) and enterprise resource planning (ERP) systems, while crucial for future expansion, presented a short-term challenge to profitability. These increased expenditures directly impacted gross profit margins and significantly lowered the Group's overall profit in 2024. The company reported a notable decline in net profit for the year, exacerbated by higher depreciation and amortization costs. Furthermore, a non-cash one-off adjustment further weighed on their financial performance for the period.

Key financial impacts in 2024 included:

- Reduced Gross Profit: Higher R&D and ERP system costs directly compressed gross profit margins.

- Lower Group Profit: The overall profitability for the Group saw a significant reduction due to these increased investments.

- Impact of Depreciation and Amortization: Elevated depreciation and amortization expenses contributed to the decline in net profit.

- Effect of One-Off Adjustment: A non-cash, one-time adjustment negatively affected the reported net profit.

Exposure to Macro-Economic Volatility

Ascom is susceptible to fluctuations in the global economy, a factor that led to subdued market conditions and hesitant customer spending throughout 2024. This inherent vulnerability to macroeconomic shifts can disrupt project schedules, influence client investment choices, and reduce the certainty of Ascom's revenue streams.

The company's reliance on infrastructure development means it's directly impacted by economic downturns, interest rate hikes, and geopolitical instability. For instance, a slowdown in global GDP growth, projected at 2.6% for 2024 by the IMF, directly correlates with reduced capital expenditure by telecom operators, Ascom's key clients.

- Economic Sensitivity: Ascom's revenue is closely tied to the capital expenditure cycles of telecommunications operators, which are themselves sensitive to macroeconomic conditions.

- Project Delays: Macroeconomic volatility can lead to customers delaying or scaling back network infrastructure investments, impacting Ascom's order book and project execution.

- Currency Fluctuations: Operating internationally exposes Ascom to currency exchange rate risks, which can affect profitability and the cost of goods sold.

Ascom experienced a revenue decline in 2024, with net revenue down 1.6% at constant currencies and 3.6% at actual currencies compared to 2023, highlighting market challenges. Profitability also suffered, with EBITDA dropping to CHF 21.3 million and the EBITDA margin falling to 7.4% from 10.1% in 2023, driven by lower sales and increased R&D and sales expenses. Underperformance in key regions like the UK, USA & Canada, and France & Spain necessitated leadership changes in early 2025, indicating operational weaknesses that management is actively addressing.

Same Document Delivered

Ascom SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The healthcare sector's rapid digital evolution, driven by AI, IoT, and telehealth, presents a significant tailwind for Ascom. This shift creates a robust demand for solutions facilitating remote patient monitoring and real-time clinical communication, areas where Ascom's offerings are well-positioned to capitalize. For instance, the global telehealth market alone was projected to reach over $200 billion by 2027, highlighting the immense growth potential.

The healthcare industry is experiencing a significant push for interoperability, with a growing need to connect disparate IT systems and medical devices. This trend is driven by the desire for improved patient care and streamlined hospital operations. Reports from 2024 indicate that healthcare providers are increasingly investing in solutions that can integrate data from various sources, aiming to create a more unified patient record.

Ascom's vendor-neutral Healthcare Platform is well-positioned to capitalize on this opportunity. By focusing on medical device integration and data bridging, Ascom offers solutions that directly address the challenges of digital information silos. This strategic alignment allows them to meet the escalating demand for seamless data flow within hospitals, a critical factor in enhancing both clinical outcomes and operational efficiency.

Ascom's software segment demonstrated positive momentum in 2024, with the company actively pursuing a transition towards cloud-based architectures and Software as a Service (SaaS) licensing. This strategic pivot is designed to enhance Ascom's revenue mix, boost gross margins, and establish more consistent, recurring revenue streams.

By embracing SaaS, Ascom is positioning itself to capitalize on the expanding market for cloud-native healthcare solutions, a sector experiencing significant growth and demand for flexible, subscription-based software offerings.

Addressing Caregiver Shortage and Staff Safety Needs

The escalating global shortage of healthcare professionals, a persistent challenge throughout 2024 and projected to continue into 2025, creates a substantial market opening. This deficit necessitates solutions that not only improve efficiency but also prioritize the well-being of existing staff.

Ascom's mobile workflow solutions are strategically positioned to capitalize on this opportunity. Their offerings, which include personal mobile devices and integrated safety features, directly address the critical needs of healthcare facilities struggling with understaffing and the imperative to enhance staff safety.

- Addressing Staff Shortages: Ascom's technology aims to optimize communication and coordination, allowing fewer staff members to manage patient care more effectively.

- Enhancing Safety: Features like panic buttons and location tracking on personal mobile devices provide crucial safety nets for caregivers in potentially hazardous situations.

- Market Demand: Reports indicate that by 2025, the global healthcare workforce gap could reach over 10 million professionals, underscoring the urgent need for Ascom’s solutions.

Leveraging ESG and Sustainability Initiatives for Market Advantage

Ascom's dedication to ESG principles, including its targets of carbon neutrality by 2040 and net zero by 2050, presents a significant market opportunity. This commitment resonates with a growing segment of investors and consumers who prioritize sustainability. For instance, in 2023, sustainable funds saw continued inflows, with global ESG assets projected to reach $33.9 trillion by 2026, according to Bloomberg Intelligence. By embedding sustainability into its product design, emphasizing durability and repairability, Ascom can differentiate itself in the market.

This strategic focus on sustainability can translate into tangible business advantages:

- Enhanced Brand Reputation: A strong ESG profile can bolster Ascom's image as a responsible corporate citizen, attracting talent and customer loyalty.

- Investor Attraction: Socially conscious investors are increasingly allocating capital to companies with robust ESG frameworks. Ascom's clear targets align with this trend, potentially improving access to capital and lowering its cost.

- Competitive Differentiation: Integrating sustainability into core operations and product development can create a unique selling proposition, setting Ascom apart from competitors who may be slower to adopt such practices.

- Risk Mitigation: Proactive environmental and social policies can reduce regulatory and operational risks, contributing to long-term business resilience.

The increasing adoption of digital health technologies, including AI and IoT, is a significant opportunity for Ascom, as these trends drive demand for their communication and workflow solutions. The global telehealth market's projected growth, potentially exceeding $200 billion by 2027, underscores the market's expansion. Ascom's platform is well-suited to integrate disparate systems and devices, addressing the healthcare industry's growing need for interoperability, a trend highlighted by increased provider investment in data integration solutions in 2024.

Ascom's strategic shift towards cloud-based and SaaS models in 2024 is poised to capture the growing demand for flexible, recurring revenue software in healthcare. Furthermore, the persistent global shortage of healthcare professionals, projected to worsen through 2025, creates a strong market for Ascom's efficiency-enhancing mobile workflow solutions, which also prioritize staff safety. The company's commitment to ESG, with targets for carbon neutrality by 2040, aligns with investor and consumer preferences for sustainability, a market segment that saw global ESG assets reach an estimated $33.9 trillion by 2026.

| Opportunity Area | Supporting Trend/Data | Ascom's Position |

|---|---|---|

| Digital Health & Telehealth Growth | Global telehealth market projected >$200B by 2027 | Ascom's solutions facilitate remote monitoring & communication |

| Healthcare Interoperability | Increased provider investment in data integration (2024) | Vendor-neutral platform bridges data silos |

| SaaS & Cloud Adoption | Focus on recurring revenue, enhanced margins | Capitalizes on demand for flexible healthcare software |

| Healthcare Workforce Shortage | Global gap potentially >10M professionals by 2025 | Mobile workflow solutions improve efficiency & staff safety |

| ESG & Sustainability Focus | Global ESG assets projected $33.9T by 2026 | Commitment to carbon neutrality by 2040 differentiates brand |

Threats

The healthcare technology sector is a crowded space, with many companies offering comparable communication and integration tools. Ascom navigates this landscape alongside established rivals and nimble newcomers, facing constant pressure that can affect its market standing and ability to set prices.

Ascom operates within the highly regulated healthcare sector, facing significant threats from evolving compliance requirements. Regulations like the EU's Medical Device Regulation (MDR) and data privacy laws such as HIPAA and GDPR demand constant vigilance and investment to ensure adherence. Failure to comply can lead to substantial fines, damage to Ascom's reputation, and potential loss of market access.

Ascom's reliance on digital communication systems, particularly in the sensitive healthcare sector, exposes it to significant cybersecurity risks and potential data breaches. A successful cyber-attack could compromise patient data, disrupt critical hospital operations, and severely damage Ascom's reputation.

The financial implications of a data breach can be substantial, including regulatory fines, legal costs, and the expense of remediation. For instance, the average cost of a data breach globally reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. This underscores the direct financial threat to Ascom.

Customer trust is paramount in healthcare technology. Even a limited breach, such as the internal system incident reported in March 2025, can erode confidence, leading to potential loss of business and impacting future sales opportunities. Maintaining robust security protocols is therefore essential for Ascom's continued success.

Economic Downturns and Customer Spending Caution

Continued challenging macro-economic conditions, such as persistent inflation or the risk of recessions, could prompt healthcare organizations to exercise greater caution in their spending. This economic pressure directly impacts Ascom by potentially leading to delayed projects, a reduction in technology investments, or heightened price sensitivity among its clients.

For instance, if inflation rates remain elevated throughout 2024 and into 2025, healthcare providers might prioritize essential operational expenditures over new technology acquisitions. This cautious approach could see a slowdown in the adoption of advanced communication and workflow solutions, which are core to Ascom's offerings.

- Inflationary Pressures: Elevated inflation can erode the purchasing power of healthcare budgets, forcing organizations to defer non-critical capital expenditures.

- Recessionary Fears: The specter of a recession can lead to widespread cost-cutting measures within healthcare systems, impacting demand for new technology solutions.

- Price Sensitivity: Increased economic uncertainty often translates to greater price sensitivity, potentially forcing Ascom to compete more aggressively on price, impacting margins.

- Delayed Project Timelines: Healthcare organizations facing budget constraints may push back the implementation of new IT infrastructure and communication systems, affecting Ascom's sales pipeline.

Rapid Technological Obsolescence and Need for Continuous Innovation

The healthcare technology sector is a hotbed of rapid advancement, with innovations like AI-driven diagnostics and connected IoT devices constantly reshaping patient care. Ascom faces the significant threat of its existing solutions becoming outdated quickly, necessitating substantial and ongoing investment in research and development to stay relevant.

This continuous need for innovation puts considerable pressure on Ascom's financial resources, potentially impacting its profitability and operational flexibility. For instance, the company's R&D expenses in 2023 were CHF 63.4 million, representing a notable portion of its overall spending.

- AI and IoT Integration: The increasing demand for AI-powered analytics and IoT-enabled remote patient monitoring requires Ascom to integrate these technologies into its communication platforms.

- Digital Health Platforms: Competitors are launching comprehensive digital health platforms, forcing Ascom to enhance its own offerings to compete effectively in this evolving market.

- Cybersecurity Demands: As healthcare data becomes more digitized, the threat of cyberattacks grows, requiring continuous investment in robust cybersecurity measures for Ascom's solutions.

Ascom faces intense competition from both established players and agile startups, which can pressure its market share and pricing power. Furthermore, evolving regulatory landscapes, such as the EU's MDR and data privacy laws, demand continuous investment and vigilance to avoid substantial fines and reputational damage.

Cybersecurity threats pose a significant risk, with data breaches potentially costing millions and eroding customer trust, as evidenced by the average global data breach cost reaching $4.45 million in 2024. Rapid technological advancements, particularly in AI and IoT, require substantial R&D investment to prevent Ascom's solutions from becoming obsolete.

| Threat Category | Specific Threat | Impact on Ascom | Relevant Data/Example |

|---|---|---|---|

| Competition | Intense market rivalry | Pressure on market share and pricing | Crowded healthcare technology sector |

| Regulatory Compliance | Evolving regulations (MDR, GDPR, HIPAA) | Need for constant investment, risk of fines | Failure to comply can lead to substantial fines |

| Cybersecurity | Data breaches and cyber-attacks | Financial loss, reputational damage, loss of trust | Average cost of data breach in 2024: $4.45 million |

| Technological Obsolescence | Rapid innovation in AI, IoT | Requires significant R&D investment to stay relevant | Ascom's 2023 R&D expenses: CHF 63.4 million |

| Macroeconomic Conditions | Inflation, recession fears | Reduced customer spending, price sensitivity, delayed projects | Elevated inflation may lead to deferral of capital expenditures |

SWOT Analysis Data Sources

This Ascom SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary, ensuring a data-driven and accurate strategic assessment.