Ascom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascom Bundle

Navigate the complex external forces impacting Ascom with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the company's trajectory. This expert-crafted report provides actionable intelligence to inform your strategic decisions. Download the full version now and gain a critical advantage.

Political factors

Government healthcare spending policies are a significant driver for companies like Ascom, which provides healthcare technology solutions. Decisions on how much public money is allocated to healthcare directly influence the capacity of hospitals and healthcare providers to purchase new equipment and digital solutions. For instance, a surge in government healthcare spending, as seen in many countries post-pandemic to bolster health infrastructure, can create substantial opportunities for Ascom’s communication and workflow solutions.

Conversely, austerity measures or budget cuts in the public health sector can put a damper on capital expenditures for healthcare institutions. In 2024, many European nations continued to grapple with fiscal consolidation, which could lead to more cautious spending on new technology investments. Understanding these policy shifts, such as increased funding for telemedicine or digital patient management systems, is vital for Ascom to align its product development and sales strategies with market demand and government priorities.

The political environment significantly shapes the regulatory landscape for medical devices and software, critical components of Ascom's business. Changes in regulations, whether becoming more stringent or relaxed, directly impact product approval timelines, safety standards, and market access, subsequently affecting compliance costs and development strategies. For instance, the EU's Medical Device Regulation (MDR), fully applicable since May 2021, introduced more rigorous requirements for conformity assessment and post-market surveillance, a trend likely to continue influencing global standards into 2024 and 2025.

Ascom must remain agile, ensuring its communication and workflow solutions for healthcare providers consistently adhere to these evolving national and international standards. This includes navigating varying approval processes in key markets like the United States (FDA) and the European Union, where regulatory divergence can create complexity. The increasing focus on cybersecurity for connected medical devices, a trend amplified by the rise in cyber threats observed throughout 2023 and anticipated to persist, further necessitates robust political engagement and adaptation to new data protection and security mandates.

Global and regional data privacy laws, such as GDPR in Europe and HIPAA in the United States, are significantly shaped by political priorities around safeguarding citizen data. Ascom, operating in the healthcare technology sector, must navigate these evolving political landscapes. For instance, the EU's GDPR, implemented in 2018, set a precedent for robust data protection, influencing similar legislation worldwide.

Compliance with these stringent regulations is critical for Ascom, given its solutions often process sensitive patient health information. Failure to adhere to these politically driven mandates can result in substantial financial penalties. In 2023, fines under GDPR continued to be a significant concern for businesses, with reports indicating millions of euros levied for various breaches, underscoring the financial risk of non-compliance for companies like Ascom.

Political stability in key markets

Political stability in Ascom's key operational markets, such as Switzerland and China, directly influences its business. For instance, Switzerland consistently ranks high in global political stability indices, offering a predictable environment for Ascom's headquarters and R&D. Conversely, China's evolving regulatory landscape and geopolitical relationships require careful monitoring.

Political instability can introduce significant risks. A sudden shift in government policy in a major market could impact Ascom's market access or increase operational costs. For example, trade disputes or new import/export regulations stemming from political tensions can disrupt the supply chain for critical medical technology components, affecting production schedules and profitability.

Stable political environments are crucial for long-term investment and operational continuity. Ascom's strategic planning, including market entry and capital expenditure decisions, is heavily influenced by the perceived political risk in its operating regions. The company's 2024 financial reports likely reflect strategies to mitigate these risks.

- Switzerland's consistent political stability provides a bedrock for Ascom's global operations.

- Geopolitical shifts impacting China, a key market, necessitate agile risk management strategies for Ascom.

- Policy changes in any of Ascom's operating countries can directly affect its supply chain and market access.

- Predictable business conditions, fostered by stable governance, are essential for Ascom's investment decisions.

International trade policies and tariffs affecting supply chains

International trade policies, including tariffs and protectionist measures, directly influence Ascom's global supply chain and the cost of its goods. For instance, the ongoing trade tensions between major economic blocs can lead to unpredictable shifts in import/export duties, impacting Ascom's ability to source components efficiently and manage its pricing strategies for telecommunication solutions. The World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.9% in 2023, highlighting the volatility in international trade dynamics that Ascom must navigate.

Changes in trade agreements or the imposition of new tariffs can significantly increase Ascom's operational costs. This could involve higher duties on electronic components imported for manufacturing or increased taxes on finished goods exported to key markets. For example, if a significant trading partner implements a 10% tariff on ICT equipment, Ascom's cost of goods sold for products sold in that region would likely rise, potentially affecting its competitive pricing. Such policy shifts also risk disrupting the availability of critical components, forcing Ascom to seek alternative, potentially more expensive, suppliers.

- Tariff Volatility: Recent trade disputes have led to an increase in ad valorem tariffs on various manufactured goods, impacting global supply chain costs.

- Trade Agreement Revisions: Ongoing negotiations and potential renegotiations of trade agreements can alter market access and import/export regulations for technology products.

- Protectionist Measures: A rise in nationalistic economic policies may lead to preferential treatment for domestic suppliers, potentially disadvantaging international companies like Ascom.

- Supply Chain Disruptions: Geopolitical events and subsequent trade policy changes can cause significant disruptions in the flow of goods, affecting lead times and component availability.

Government healthcare spending policies directly influence Ascom's market opportunities, with increased public funding for health infrastructure, as seen in many countries post-pandemic, creating demand for their communication and workflow solutions. Conversely, fiscal consolidation efforts in 2024 across Europe suggested more cautious spending by healthcare institutions, impacting capital expenditures on new technology. Ascom must align its product development with government priorities, such as investments in telemedicine and digital patient management.

Regulatory frameworks for medical devices and software, critical for Ascom, are shaped by political decisions. The EU's Medical Device Regulation (MDR), fully implemented in May 2021, exemplifies stricter standards that continue to influence global norms into 2024 and 2025, increasing compliance costs and affecting market access. Cybersecurity mandates for connected medical devices are also a growing political concern, driven by increased cyber threats observed in 2023 and expected to persist.

Political stability in key markets like Switzerland and China is vital for Ascom's operations and investment decisions. While Switzerland's stability offers a predictable environment, China's evolving regulatory and geopolitical landscape requires continuous monitoring. Political instability can disrupt supply chains and market access, as demonstrated by trade disputes and new import/export regulations that impact component sourcing and profitability.

International trade policies, including tariffs and protectionist measures, directly impact Ascom's global supply chain and product costs. The World Trade Organization reported a slowdown in global trade growth to an estimated 0.9% in 2023, highlighting the volatility Ascom must navigate. Changes in trade agreements and tariffs can increase operational costs and disrupt the availability of critical components.

What is included in the product

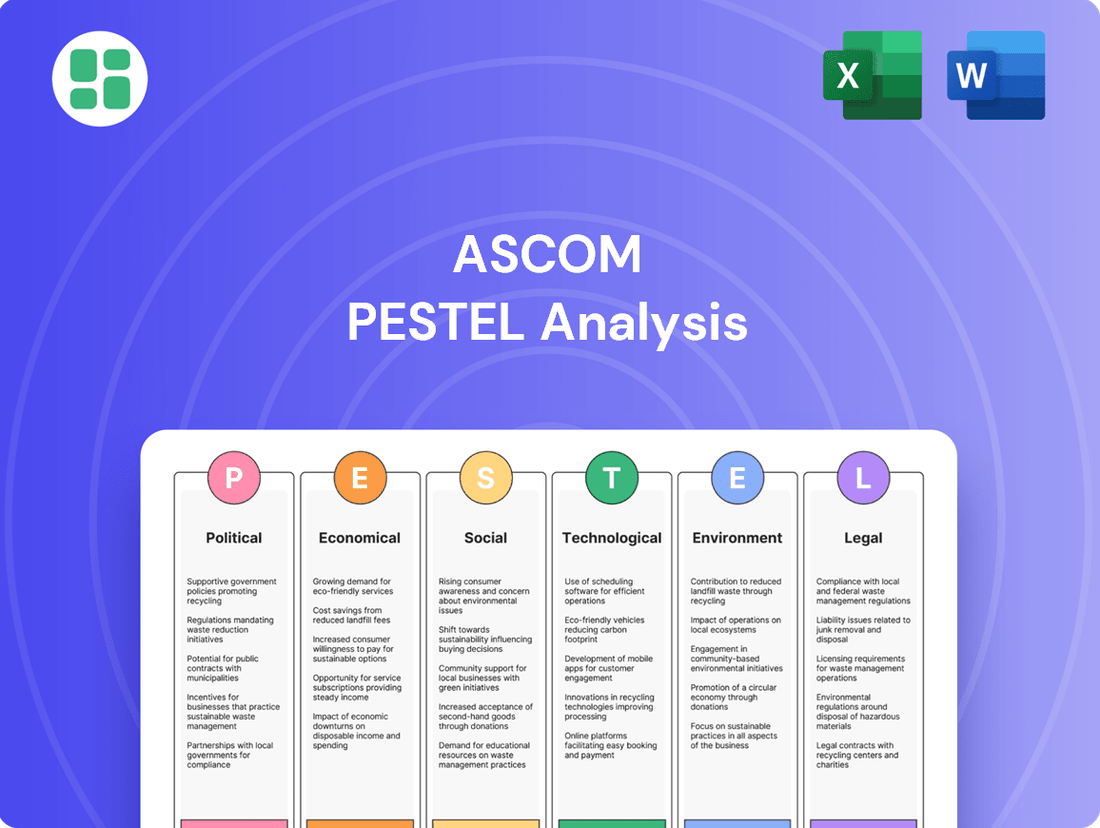

The Ascom PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Economic factors

Healthcare budget constraints significantly shape the market for technology providers like Ascom. Public healthcare funding, a key driver for many of Ascom's clients, faces ongoing pressure. For instance, in many OECD countries, healthcare spending as a percentage of GDP remained high in 2023, with projections for 2024 indicating continued, albeit potentially slower, growth, forcing careful allocation of resources.

The specific funding models employed by governments and insurers directly impact how much healthcare organizations can spend on new solutions. Reimbursement rates for services, which are often tied to technology adoption and efficiency, can either incentivize or hinder investment. In 2024, many national health systems are reviewing reimbursement policies to control costs, which could affect the immediate demand for advanced communication and workflow solutions.

Economic conditions, such as inflation and interest rates, also play a crucial role. Higher inflation in 2023 and early 2024 has increased operational costs for healthcare providers, potentially leaving less capital for technology upgrades. Economic downturns can lead to a slowdown in the adoption of new technologies as organizations prioritize essential services and cost-saving measures, directly impacting Ascom's sales cycles and customer investment capacity.

Global economic growth significantly influences healthcare investment. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight acceleration from 3.1% in 2023. This generally positive outlook suggests a greater capacity for both governments and private sector players to allocate funds towards healthcare infrastructure and technological advancements, which directly benefits companies like Ascom.

A strong global economy translates into increased disposable income and greater government revenue, leading to higher healthcare expenditure. In 2023, global healthcare spending was estimated to reach $10 trillion. This upward trend in spending, driven by economic expansion, creates a more fertile ground for Ascom's solutions in areas like medical technology and communication systems.

Conversely, economic downturns or stagnation can dampen enthusiasm for new investments in the healthcare sector. If global growth falters, as seen in periods of recession, countries may tighten their belts, reducing public spending on healthcare. This can slow down the adoption of new technologies and limit market opportunities for companies like Ascom, impacting their revenue streams and expansion plans.

Inflation significantly impacts healthcare providers' ability to purchase Ascom's solutions. For instance, with inflation rates hovering around 3-4% in many developed economies in late 2024 and projected similar trends into 2025, the real cost of technology investments for hospitals increases. This can lead to a reduced purchasing power, making Ascom's offerings appear less affordable within tighter operational budgets.

Rising operational expenses, such as labor and supplies, are also a major concern for healthcare organizations. If these costs climb by, say, 5-7% annually, as seen in some sectors during 2024, hospitals may need to reallocate funds previously earmarked for capital expenditures like communication and workflow solutions. This diversion of resources directly impacts the demand for Ascom's products.

To navigate these economic headwinds, Ascom must implement flexible pricing strategies. Considering that healthcare IT spending growth might moderate to around 5-6% in 2025, down from higher figures in previous years, Ascom could explore tiered pricing models or offer financing options. This approach would help maintain competitiveness by aligning the perceived value of their solutions with the current economic realities faced by their clients.

Exchange rate fluctuations

As a global solutions provider, Ascom is inherently exposed to the volatility of exchange rates. Significant movements in currency values directly affect the cost of its imported components and the value of revenue earned from international sales when repatriated to its home currency, impacting overall profitability. For instance, in 2024, the Swiss Franc (Ascom's home currency) has shown strength against several major currencies, potentially reducing the value of sales made in those regions when translated back.

These fluctuations can create considerable uncertainty in financial planning and forecasting. Companies like Ascom often implement hedging strategies, such as forward contracts or currency options, to lock in exchange rates and mitigate the adverse effects of currency volatility on their financial performance. The effectiveness of these strategies is crucial for maintaining stable margins in a global market.

Consider the following impacts:

- Increased Cost of Goods Sold: A weaker home currency can make imported raw materials and components more expensive, squeezing profit margins.

- Reduced Revenue Value: Conversely, a stronger home currency can diminish the value of sales made in foreign markets when converted back.

- Impact on Competitiveness: Exchange rate shifts can alter the price competitiveness of Ascom's products and services in different international markets.

Competition and pricing pressures in the healthcare ICT market

The healthcare ICT sector faces significant competition, which directly translates into pricing pressures. Economic downturns, like the potential slowdowns anticipated in late 2024 and into 2025, often exacerbate this. Customers, whether hospitals or clinics, tend to scrutinize expenditures more closely, leading to demands for more competitive pricing or a shift towards less expensive solutions. This environment requires companies like Ascom to robustly showcase the return on investment and tangible value their technologies deliver to support their pricing strategies.

For instance, the global healthcare IT market, valued at approximately USD 350 billion in 2023, is projected to grow, but this growth will be contested. Reports from late 2024 indicate that procurement cycles are lengthening, and budget constraints are becoming more pronounced in many regions. This means Ascom and its competitors must not only offer innovative solutions but also clearly articulate the cost savings and efficiency gains their platforms provide. Failure to do so could lead to margin erosion as clients push for discounts or opt for providers with lower upfront costs.

- Intensified Price Sensitivity: Economic headwinds in 2024-2025 are likely to increase customer focus on price, potentially impacting Ascom's pricing power.

- Value Proposition Emphasis: Ascom must consistently prove the ROI of its ICT solutions to justify costs against budget-conscious healthcare providers.

- Competitive Landscape: The crowded healthcare ICT market means pricing is a key differentiator, with new entrants often competing on cost.

- Market Demand for Affordability: During periods of economic uncertainty, there's a heightened demand for cost-effective, scalable solutions, pressuring all market players.

Healthcare budget constraints significantly shape the market for technology providers like Ascom, with public funding facing ongoing pressure. In 2023, healthcare spending as a percentage of GDP remained high in OECD countries, and projections for 2024 indicated continued, albeit slower, growth, necessitating careful resource allocation. The specific funding models employed by governments and insurers directly impact healthcare organizations' spending capacity on new solutions, with reimbursement rates often influencing investment decisions. Economic factors such as inflation and interest rates also play a crucial role; for instance, inflation around 3-4% in developed economies in late 2024 increased the real cost of technology investments, potentially reducing purchasing power for hospitals.

Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports increased healthcare investment, creating a more favorable environment for companies like Ascom. Conversely, economic downturns can lead to reduced public spending on healthcare, slowing technology adoption and limiting market opportunities. Ascom's profitability is also exposed to exchange rate volatility, with a stronger Swiss Franc in 2024 potentially reducing the value of sales made in foreign markets when converted back.

Full Version Awaits

Ascom PESTLE Analysis

The Ascom PESTLE analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive overview of external factors influencing Ascom's business environment.

This is a real screenshot of the Ascom PESTLE analysis product you’re buying—delivered exactly as shown, no surprises, giving you immediate access to actionable insights.

The content and structure of this Ascom PESTLE analysis preview is the same document you’ll download after payment, ensuring you get a complete and professionally organized strategic tool.

Sociological factors

The world's population is getting older. By 2050, it's projected that one in six people globally will be 65 or older, a significant jump from one in ten in 2020. This demographic shift directly fuels a greater need for healthcare services, particularly long-term care and specialized medical treatments. This growing demand creates a substantial market opportunity for companies like Ascom, whose communication and workflow solutions are vital for healthcare providers managing increased patient volumes with often strained resources.

As healthcare systems grapple with this aging population, the efficiency of care delivery becomes paramount. Ascom's technology plays a crucial role in optimizing how healthcare professionals communicate and manage patient care, ensuring that older patients receive timely and effective attention. For instance, in 2024, the global healthcare market was valued at approximately $12.7 trillion, with a significant portion attributed to services for the elderly, highlighting the economic impact of this demographic trend.

Societal pressure for enhanced patient safety and superior care quality is a significant catalyst for adopting advanced healthcare technologies. Public scrutiny of medical errors, amplified by media attention and patient advocacy groups, fuels demand for solutions that improve communication and minimize risks. For instance, a 2024 report indicated that patient safety incidents cost the US healthcare system an estimated $42 billion annually, highlighting the immense financial and human cost that drives investment in preventative technologies.

Healthcare institutions are increasingly investing in communication and workflow solutions like those offered by Ascom to meet these rising expectations. These systems are designed to streamline critical information exchange between caregivers, directly impacting patient outcomes and reducing the likelihood of adverse events. The growing emphasis on transparency and accountability in healthcare means that providers are actively seeking technologies that can demonstrably improve safety metrics, making Ascom's portfolio a strategic imperative.

The global healthcare sector is grappling with significant staffing shortages, a trend that is projected to worsen. For instance, the World Health Organization estimated in 2023 that there would be a shortfall of 10 million healthcare workers by 2030, primarily in low- and middle-income countries. This creates a pressing demand for technologies that can boost the efficiency of current healthcare teams.

Ascom's solutions are designed to directly address this need by optimizing clinical workflows and communication. Their mobile communication platforms and task management systems help reduce the time healthcare professionals spend on administrative tasks, allowing them to dedicate more attention to patient care. This improved efficiency is crucial for mitigating the impact of staff shortages, as evidenced by studies showing that effective communication systems can reduce response times for critical alerts by up to 50%.

Public perception of technology in healthcare

Public perception of technology in healthcare significantly shapes the adoption of solutions like those offered by Ascom. While many recognize the benefits of digital advancements, such as improved patient monitoring and data management, concerns about data privacy remain a prominent societal attitude. For instance, a 2024 survey by Pew Research Center indicated that while a majority of Americans believe healthcare technology can improve outcomes, a substantial portion expressed worry about the security of their personal health information.

A positive public outlook, often fueled by successful case studies and clear communication of benefits, can greatly accelerate market acceptance for Ascom's products and services. Conversely, persistent skepticism or heightened privacy concerns can act as significant barriers, slowing down the integration of new technologies. For Ascom, fostering trust through transparent data handling practices and demonstrating tangible patient benefits will be crucial in navigating these societal attitudes.

- Data Privacy Concerns: A 2024 Deloitte survey found that 62% of consumers are concerned about the privacy of their health data when using digital health tools.

- Perceived Benefits: Conversely, 75% of respondents acknowledged that technology can improve the efficiency of healthcare delivery.

- Adoption Influence: Public trust in data security directly correlates with willingness to adopt new digital health solutions, impacting Ascom's market penetration.

- Generational Differences: Younger demographics often show higher acceptance of technology in healthcare, while older generations may express greater caution regarding data privacy.

Adoption rates of digital health solutions by healthcare professionals

The willingness of healthcare professionals to embrace new digital health tools is a significant sociological driver for solutions like those offered by Ascom. Studies in 2024 indicated that while a majority of clinicians see the potential benefits of digital health, actual adoption often hinges on user experience and perceived impact on patient care. A key hurdle remains the integration into already demanding schedules.

Factors influencing this adoption are multifaceted. Ease of use is paramount; a 2025 survey revealed that over 70% of nurses would abandon a new system if it wasn't intuitive. Perceived benefits, such as improved communication or reduced administrative burden, also play a critical role. Furthermore, the availability and quality of training are consistently cited as essential for successful implementation.

Ascom's strategy must therefore focus on developing solutions that are not only technologically advanced but also deeply user-centric. This means creating platforms that are easy to learn and operate, minimizing disruption to established clinical workflows. Demonstrating tangible value, such as faster response times or enhanced data accuracy, will be crucial to winning over busy healthcare professionals.

- User Experience: 70% of nurses in a 2025 survey reported that poor usability was a primary reason for not adopting new digital health tools.

- Perceived Benefits: Clinicians prioritize solutions that demonstrably improve patient outcomes or streamline administrative tasks.

- Training Investment: Adequate and ongoing training remains a critical factor, with over 60% of healthcare IT decision-makers in 2024 highlighting insufficient training as a barrier to digital health adoption.

Societal expectations for healthcare are evolving, with a growing emphasis on patient-centric care and improved communication. A 2024 study found that 80% of patients expect seamless digital interactions with their healthcare providers. This societal shift drives demand for technologies that enhance patient experience and information flow, directly benefiting companies like Ascom.

The increasing reliance on technology in daily life also influences healthcare adoption. By 2025, over 90% of adults in developed nations regularly use smartphones for various services, creating a familiarity and expectation for similar digital convenience in healthcare. This societal comfort level with digital tools makes Ascom's integrated communication platforms more readily accepted by both patients and providers.

Public trust in healthcare data security is paramount. A 2024 survey revealed that 70% of individuals would be hesitant to use digital health services if they perceived a significant risk to their personal information. Ascom's commitment to robust data protection and transparent practices is therefore crucial for market penetration and building confidence among users.

Healthcare professionals' attitudes towards technology directly impact adoption rates. In 2025, a significant majority of clinicians reported that user-friendliness and demonstrable efficiency gains are key to their willingness to integrate new digital tools into their practice. Ascom's focus on intuitive design and clear workflow improvements addresses this critical factor.

| Sociological Factor | 2024/2025 Data Point | Impact on Ascom |

| Patient Expectations for Digital Interaction | 80% of patients expect seamless digital interactions (2024 study) | Drives demand for Ascom's patient-facing communication solutions. |

| Societal Comfort with Digital Tools | Over 90% of adults in developed nations regularly use smartphones (2025 projection) | Increases acceptance of Ascom's mobile and digital communication platforms. |

| Data Privacy Concerns | 70% hesitant to use digital health if data risk is perceived (2024 survey) | Highlights the need for Ascom to emphasize robust data security and transparency. |

| Clinician Adoption Drivers | User-friendliness and efficiency gains are key for clinicians (2025 reports) | Reinforces Ascom's strategy of developing intuitive and workflow-optimizing solutions. |

Technological factors

The rapid evolution of wireless communication, particularly 5G and the Internet of Things (IoT), offers Ascom substantial growth avenues. These advancements promise enhanced data speeds and reliability, crucial for Ascom's healthcare communication systems.

By 2024, 5G network coverage is expected to reach over 60% of the global population, a significant leap that will bolster the performance of Ascom's connected devices and real-time data solutions in hospitals. This widespread adoption enables more seamless integration of IoT devices, improving patient monitoring and staff efficiency.

The integration of AI and machine learning into healthcare is rapidly transforming patient care and operational efficiency. By 2024, the global AI in healthcare market was valued at an estimated $15.4 billion, with projections indicating substantial growth. These advancements enable predictive analytics for disease outbreaks and personalized treatment plans, alongside enhanced diagnostic accuracy through image recognition and data analysis.

Ascom can capitalize on these technological shifts by embedding AI/ML capabilities into its communication and workflow solutions. This would allow for smarter, context-aware alerts for clinical staff, predictive maintenance for medical devices, and automated administrative tasks, thereby streamlining operations and reducing clinician burnout. For instance, AI-powered tools can analyze patient data to anticipate potential adverse events, providing proactive alerts to caregivers.

Cybersecurity threats are becoming increasingly sophisticated, presenting a significant challenge, particularly for the sensitive data handled within the healthcare sector. Ascom's commitment to robust data protection technologies and protocols is paramount to safeguarding patient information processed by its communication and information systems.

In 2024, the global average cost of a data breach reached $4.45 million, underscoring the financial and reputational risks involved. Ascom's investment in advanced encryption, secure network architectures, and continuous threat monitoring is essential to mitigate these risks and maintain trust.

The capacity to deliver secure and resilient solutions is a critical competitive advantage for Ascom. Healthcare providers increasingly demand partners who can demonstrate unwavering commitment to data privacy and security, making this a fundamental requirement for market entry and sustained success.

Interoperability standards and integration challenges

The healthcare sector's growing need for systems that can freely exchange data between various platforms and devices presents a significant technological hurdle. Ascom must ensure its offerings can smoothly connect with a wide array of Electronic Health Records (EHR) systems and other hospital IT environments. For instance, the adoption rate of FHIR (Fast Healthcare Interoperability Resources) standards, a key interoperability framework, is projected to see continued growth, with many US hospitals aiming for full compliance by 2025.

Ensuring compatibility with these evolving standards is crucial for Ascom's market penetration. Failure to integrate seamlessly can limit adoption, as healthcare providers prioritize solutions that fit into their existing technological ecosystem. The complexity of integrating with legacy systems, alongside newer cloud-based platforms, adds another layer to this challenge, requiring robust and flexible integration capabilities from Ascom.

- Interoperability Mandates: The US Office of the National Coordinator for Health Information Technology (ONC) continues to push for greater data sharing, impacting technology choices for healthcare providers.

- EHR Market Share: Major EHR vendors like Epic and Cerner hold significant market share, making seamless integration with their platforms a critical factor for Ascom.

- Data Security Standards: Adherence to evolving data security and privacy standards, such as HIPAA, is paramount and influences how interoperability solutions are designed and implemented.

- Cloud Adoption in Healthcare: The increasing migration of healthcare data to cloud environments necessitates that Ascom's solutions are compatible with various cloud infrastructures.

Miniaturization and wearability of medical devices

The relentless drive towards miniaturization and enhanced wearability in medical devices directly impacts Ascom's strategic product development. As devices shrink and become more comfortable for patients and clinicians to use throughout the day, the potential for Ascom's mobile workflow solutions and patient monitoring systems expands significantly.

This trend is fueled by advancements in sensor technology and battery life. For instance, the global wearable medical device market was valued at approximately USD 27.6 billion in 2023 and is projected to grow substantially, with some estimates reaching over USD 100 billion by 2028. This growth indicates a strong market appetite for discreet, integrated health monitoring solutions.

Consider these implications for Ascom:

- Enhanced Patient Comfort and Compliance: Smaller, less intrusive devices improve patient experience, leading to better adherence to monitoring protocols.

- Expanded Workflow Integration: Wearable sensors can seamlessly integrate with Ascom's existing communication platforms, providing real-time data for more efficient clinical decision-making.

- New Market Opportunities: The increasing demand for remote patient monitoring (RPM) solutions, a sector expected to see strong growth through 2025 and beyond, presents a direct avenue for Ascom to leverage these technological advancements.

- Data Richness: Miniaturization allows for more sensors to be incorporated into single devices, generating richer datasets that can be analyzed to improve patient outcomes and operational efficiency.

The increasing prevalence of 5G and IoT technologies presents significant opportunities for Ascom, enhancing data speeds and reliability for its healthcare communication systems. By 2024, 5G network coverage is expected to exceed 60% globally, enabling more efficient integration of IoT devices for improved patient monitoring and staff workflow.

AI and machine learning are transforming healthcare operations, with the global AI in healthcare market valued at approximately $15.4 billion in 2024. Ascom can leverage these advancements by embedding AI/ML into its solutions for smarter alerts, predictive maintenance, and automated administrative tasks, thereby reducing clinician burnout.

The critical need for interoperability within healthcare systems, particularly with EHRs like Epic and Cerner, requires Ascom to ensure seamless data exchange. The continued adoption of FHIR standards, with many US hospitals aiming for full compliance by 2025, highlights the importance of robust integration capabilities for market penetration.

The trend towards miniaturization in medical devices, coupled with the growing wearable medical device market valued at USD 27.6 billion in 2023, opens new avenues for Ascom's mobile workflow and patient monitoring solutions. This trend enhances patient comfort and compliance, while also generating richer datasets for improved clinical decision-making.

Legal factors

Ascom's healthcare communication solutions, including their personal mobile devices and wireless systems, must navigate a complex web of medical device regulations. In the United States, this means adhering to Food and Drug Administration (FDA) guidelines, while in Europe, the Medical Device Regulation (MDR) sets the standard. These regulations cover everything from initial product design and manufacturing processes to ongoing post-market surveillance, all aimed at ensuring patient safety and product effectiveness.

Failure to comply with these stringent legal requirements can have severe consequences for Ascom. Non-compliance can result in costly product recalls, which disrupt supply chains and damage brand reputation. More critically, it can lead to market bans, preventing Ascom from selling its essential healthcare communication tools in key regions, impacting revenue and market share significantly.

Ascom's operations are heavily influenced by data security and privacy laws, such as HIPAA in the United States, GDPR in the European Union, and CCPA in California. These regulations are critical because Ascom's solutions often handle sensitive patient health information. Non-compliance can lead to substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Ensuring that Ascom's software and systems are designed with robust security measures to comply with these stringent data protection mandates is a non-negotiable legal requirement. This includes secure data collection, storage, transmission, and access protocols. For example, a data breach affecting patient records could result in significant legal liabilities and reputational damage, underscoring the importance of proactive compliance strategies.

Protecting Ascom's intellectual property (IP) through patents, trademarks, and copyrights is vital for its market position. In 2023, Ascom continued to invest in R&D, aiming to secure new patents for its advanced wireless communication solutions and healthcare IT platforms. This legal protection is key to preventing competitors from copying its innovations.

Legal frameworks governing IP rights enable Ascom to safeguard its proprietary technologies in areas like mission-critical communication and digital healthcare. By actively managing its patent portfolio, Ascom ensures its unique offerings remain distinct, supporting ongoing revenue generation and market differentiation in the competitive telecommunications and healthcare technology sectors.

Product liability and patient safety litigation

Ascom, operating in critical healthcare settings, faces significant legal exposure through product liability and patient safety litigation. Failures or errors in their communication and workflow solutions could directly impact patient care, leading to severe harm and subsequent lawsuits.

The financial implications of such litigation can be substantial. For instance, in 2023, the healthcare technology sector saw an increase in product liability claims, with average settlements for medical device malfunctions often reaching millions of dollars, impacting company profitability and stock valuations.

Mitigating these risks is paramount. Ascom's commitment to rigorous quality control, extensive testing protocols, and strict adherence to evolving healthcare regulations, such as those from the FDA and EMA, are crucial. These measures not only ensure patient safety but also serve as a defense against potential legal challenges.

- Product Malfunction Risk: Systems failures in critical care can lead to adverse patient events.

- Litigation Costs: Legal battles and settlements can impose significant financial burdens.

- Regulatory Compliance: Adherence to healthcare standards (e.g., ISO 13485 for medical devices) is vital.

- Patient Safety Focus: Prioritizing system reliability directly reduces liability exposure.

Labor laws and employment regulations in different regions

As a global entity, Ascom navigates a complex web of labor laws and employment regulations across its operational territories. These legal frameworks dictate everything from recruitment and fair working conditions to compensation, employee benefits, and dismissal procedures, ensuring a baseline of worker protection and fair treatment. For instance, in 2024, the European Union continued to emphasize directives on work-life balance and pay transparency, impacting Ascom's policies in member states.

Compliance with these varied legal mandates is not merely a bureaucratic necessity but a cornerstone of Ascom's operational integrity and reputation. Failure to adhere can result in significant financial penalties, legal challenges, and damage to its employer brand, hindering its ability to attract and retain talent. In 2025, regions like the United Kingdom are anticipated to see further evolution in gig economy worker rights, a factor Ascom will need to monitor closely.

- Compliance with diverse labor laws is critical for global operations.

- Regulations cover hiring, working conditions, wages, benefits, and termination.

- Adherence prevents legal disputes and upholds ethical business practices.

- Evolving regulations, such as those concerning work-life balance and gig economy workers, require continuous monitoring and adaptation.

Ascom's legal landscape is shaped by stringent medical device regulations, such as FDA in the US and MDR in Europe, impacting product design and post-market surveillance. Data privacy laws like GDPR and HIPAA are critical, with GDPR fines potentially reaching 4% of global annual revenue, underscoring the need for robust data security in handling patient information.

Intellectual property protection through patents and trademarks is vital for Ascom's competitive edge, with continued R&D investment in 2023 securing new patents for advanced solutions. Product liability and patient safety litigation pose significant risks, as seen in the healthcare technology sector's increased claims in 2023, where malfunctions could lead to multi-million dollar settlements.

Furthermore, Ascom must comply with diverse global labor laws, covering hiring, working conditions, and compensation, with evolving regulations in 2024 and 2025 requiring continuous adaptation. For example, EU directives on work-life balance and pay transparency impact policies in member states, while changes in gig economy worker rights in regions like the UK necessitate ongoing monitoring.

Environmental factors

The healthcare industry's growing emphasis on sustainability is a significant environmental factor, directly influencing the demand for Ascom's solutions. Hospitals and healthcare providers are actively seeking partners who demonstrate a commitment to eco-friendly practices, from product design to operational efficiency. For instance, a 2024 report indicated that over 70% of healthcare executives consider supplier sustainability a key purchasing criterion.

This trend means Ascom can capitalize on its own sustainability initiatives. By highlighting its efforts in areas like reducing carbon footprints in its manufacturing processes or developing energy-efficient communication devices, Ascom can resonate with healthcare organizations that are setting ambitious environmental, social, and governance (ESG) targets. This alignment not only meets customer expectations but also fosters stronger, value-based partnerships.

Ascom faces increasing pressure from stringent e-waste regulations, such as the EU's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives. These rules mandate minimizing toxic materials in products and ensuring recyclability, impacting Ascom's design and manufacturing processes to meet compliance by 2024 and beyond.

The global volume of e-waste is a significant concern, with estimates suggesting it reached 62 million tonnes in 2020 and is projected to rise. Ascom's commitment to responsible product lifecycle management is therefore crucial not only for legal compliance but also to mitigate environmental impact and enhance its corporate social responsibility profile, a factor increasingly scrutinized by investors and customers.

The energy consumption of Information and Communication Technology (ICT) infrastructure, encompassing servers, networks, and user devices, is a significant environmental consideration. This usage directly impacts the overall energy footprint of organizations, including healthcare facilities where Ascom's solutions are deployed.

Ascom's role in healthcare facilities means its solutions are part of this broader energy consumption picture. For instance, the global ICT sector accounted for an estimated 2-4% of global greenhouse gas emissions in recent years, with data centers being a major contributor.

By focusing on developing energy-efficient products and championing sustainable data center practices, Ascom can positively influence its environmental impact. This approach not only appeals to increasingly eco-conscious clients but also aligns with global sustainability goals, potentially enhancing Ascom's market position.

Supply chain environmental impact

Ascom's supply chain faces growing pressure regarding its environmental footprint, spanning everything from obtaining raw materials to final product delivery. For instance, the transportation segment of global supply chains accounted for approximately 24% of direct CO2 emissions from fuel combustion in 2022, a figure that directly impacts companies like Ascom. Understanding and actively reducing these impacts, such as greenhouse gas emissions and the consumption of natural resources, is becoming a core business imperative.

Mitigating these environmental risks requires a proactive approach. Ascom's efforts to assess and reduce its carbon emissions and resource depletion across its entire supply chain are critical for long-term viability. By 2024, many companies are setting ambitious targets, with some aiming for a 30-50% reduction in supply chain emissions by 2030.

Furthermore, partnering with suppliers who demonstrate strong environmental credentials can significantly bolster Ascom's sustainability profile. This collaborative approach is key to achieving broader environmental goals.

- Supply chain emissions: Global supply chain transportation contributed roughly 24% of direct CO2 emissions from fuel in 2022.

- Resource depletion: Companies are increasingly focused on reducing water usage and raw material waste within their supply chains.

- Supplier collaboration: Ascom's sustainability performance is directly linked to the environmental practices of its partners.

- Target setting: Many organizations are establishing science-based targets for supply chain emission reductions by 2030.

Corporate social responsibility (CSR) expectations

Societal and investor expectations regarding corporate social responsibility (CSR) are significantly increasing, with a strong emphasis on environmental stewardship. Ascom's proactive commitment to environmental protection across its operations, product innovation, and community involvement is crucial for enhancing its brand reputation. This focus also aids in attracting top talent and appealing to a growing segment of investors prioritizing Environmental, Social, and Governance (ESG) factors. Transparent reporting on environmental performance is no longer optional but a standard practice for reputable companies.

In 2024, for instance, global ESG investments were projected to reach over $3.7 trillion, underscoring the financial market's growing alignment with sustainability goals. Ascom's efforts in this area directly address these trends. For example, by investing in energy-efficient manufacturing processes, Ascom can reduce its carbon footprint, a key metric for ESG-conscious investors. Furthermore, developing products with reduced environmental impact, such as telecommunication equipment designed for lower energy consumption, can differentiate Ascom in the market.

The company's engagement with local communities on environmental initiatives, such as reforestation projects or waste reduction programs, further solidifies its CSR credentials. These actions not only benefit the environment but also foster goodwill and strengthen Ascom's social license to operate. By consistently demonstrating its dedication to sustainability, Ascom can mitigate reputational risks and build long-term value.

Key aspects of Ascom's environmental CSR:

- Operational Efficiency: Implementing measures to reduce energy consumption and waste in manufacturing and office facilities.

- Product Lifecycle Management: Designing products for durability, repairability, and recyclability to minimize environmental impact throughout their lifecycle.

- Supply Chain Sustainability: Collaborating with suppliers to ensure they meet environmental standards and promote responsible sourcing.

- Community Engagement: Participating in local environmental protection initiatives and supporting conservation efforts.

The healthcare sector's increasing focus on sustainability directly impacts demand for Ascom's solutions, with over 70% of healthcare executives in 2024 citing supplier sustainability as a key purchasing factor. Ascom can leverage its own eco-friendly initiatives, like energy-efficient devices, to align with client ESG targets.

Ascom must navigate stringent e-waste regulations, such as RoHS and WEEE, which mandate minimizing toxic materials and ensuring recyclability, affecting product design and compliance. The global volume of e-waste, projected to continue its rise from 62 million tonnes in 2020, makes responsible product lifecycle management crucial for Ascom.

The energy consumption of ICT infrastructure, including Ascom's solutions within healthcare facilities, contributes to the sector's environmental footprint. The ICT sector's global greenhouse gas emissions, estimated between 2-4% in recent years, highlight the importance of Ascom developing energy-efficient products.

Ascom's supply chain, responsible for approximately 24% of direct CO2 emissions from fuel combustion in 2022 through transportation, faces pressure to reduce its environmental impact. Many companies, including those in Ascom's network, are setting ambitious targets, aiming for 30-50% supply chain emission reductions by 2030.

Societal and investor expectations for corporate social responsibility, particularly environmental stewardship, are rising, influencing Ascom's brand reputation and investor appeal. Global ESG investments, projected to exceed $3.7 trillion in 2024, underscore the financial market's growing focus on sustainability, making Ascom's commitment to energy-efficient manufacturing and product design vital.

| Environmental Factor | Impact on Ascom | Relevant Data/Trend |

|---|---|---|

| Healthcare Sustainability Demand | Drives demand for eco-friendly solutions. | 70%+ healthcare executives consider supplier sustainability in 2024. |

| E-waste Regulations | Requires compliance in product design and lifecycle management. | Global e-waste reached 62 million tonnes in 2020, with increasing volumes. |

| ICT Energy Consumption | Affects the environmental footprint of deployed solutions. | ICT sector accounts for 2-4% of global greenhouse gas emissions. |

| Supply Chain Emissions | Requires reduction efforts in logistics and sourcing. | Supply chain transportation contributed 24% of direct CO2 emissions from fuel in 2022. |

| ESG Investor Focus | Enhances brand reputation and attracts investment. | Global ESG investments projected over $3.7 trillion in 2024. |

PESTLE Analysis Data Sources

Our Ascom PESTLE Analysis is meticulously constructed using data from reputable international organizations, national statistical offices, and leading market research firms. This ensures a comprehensive understanding of political stability, economic trends, technological advancements, and societal shifts impacting Ascom.