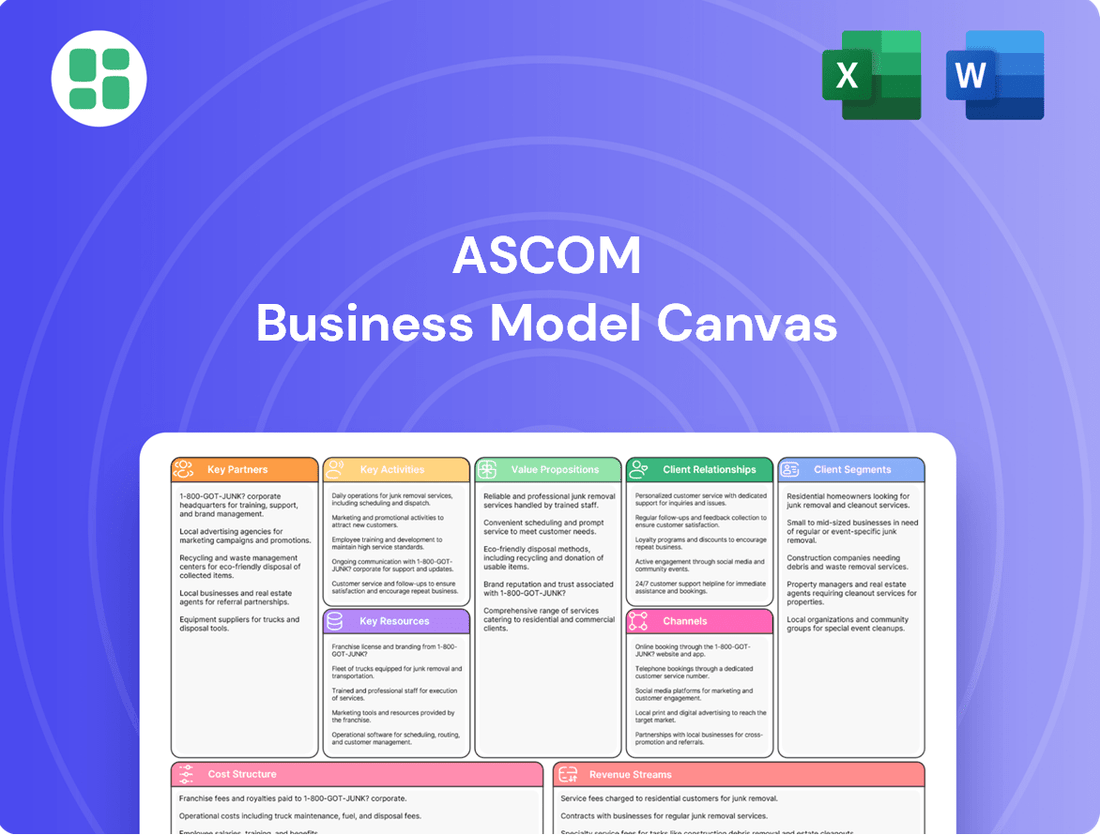

Ascom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascom Bundle

Unlock the strategic brilliance behind Ascom's operations with their complete Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and manage resources effectively. Download it now to gain a competitive edge and refine your own business strategies.

Partnerships

Ascom collaborates with technology providers and integrators to ensure seamless integration of its communication and workflow solutions into diverse healthcare IT ecosystems. For example, partnerships with Wi-Fi infrastructure specialists like LANCOM Systems GmbH in 2024 were vital for robust wireless connectivity, a cornerstone of modern hospital operations.

These alliances extend to medical device manufacturers, enabling Ascom's platforms to ingest critical patient data directly, thereby enhancing clinical workflows. By working with various software vendors, Ascom broadens its solution suite, offering more comprehensive and interoperable systems to healthcare providers facing complex IT landscapes.

Healthcare system integrators are crucial for Ascom, enabling the deployment of sophisticated communication and workflow solutions across extensive hospital networks. These partners are instrumental in tailoring, installing, and supporting Ascom's wireless infrastructure, mobile devices, and software suites, ensuring they mesh perfectly with established clinical processes and IT environments.

By leveraging these alliances, Ascom can effectively manage larger, more complex projects, offering comprehensive, end-to-end service delivery. For instance, in 2024, Ascom continued to deepen its relationships with major system integrators who were vital in delivering its Unite platform, which aims to improve clinical communication efficiency, a key factor in patient care.

Ascom's strategic alliances with Group Purchasing Organizations (GPOs), like their partnership with Premier Inc., are crucial. These GPOs provide Ascom access to a vast network of healthcare providers, enabling them to offer pre-negotiated pricing on clinical workflow solutions. This significantly simplifies the purchasing journey for hospitals and long-term care facilities.

This GPO model acts as a powerful accelerator for market penetration. By leveraging these established relationships, Ascom can efficiently reach a broad customer base, making their advanced technology more readily available and driving faster adoption across the healthcare industry.

Telecommunication and Network Providers

Ascom's business model hinges on strong alliances with telecommunication and network providers. These partnerships are crucial for delivering the dependable wireless communication that Ascom's critical communication solutions require. Think of them as the backbone ensuring Ascom devices and systems can connect flawlessly, especially in demanding environments like hospitals.

These collaborations are vital for integrating cutting-edge technologies such as 5G, VoWiFi, and IP-DECT. These advancements are not just buzzwords; they are foundational for ensuring that critical communications in sectors like healthcare are always available and perform at peak levels. The reliability offered by these providers directly translates to the high availability and performance Ascom promises for its mission-critical applications.

- 5G Integration: Partnerships enable Ascom to leverage the speed and low latency of 5G networks, enhancing real-time communication capabilities.

- VoWiFi and IP-DECT Support: Collaborations ensure seamless integration and optimal performance of Voice over Wi-Fi and IP-DECT technologies, critical for secure and reliable voice communication.

- Network Performance Guarantees: Ascom relies on these partners to provide guaranteed network quality of service (QoS) and high availability, essential for mission-critical applications where downtime is not an option.

- Future-Proofing: These alliances allow Ascom to stay at the forefront of communication technology, ensuring their solutions remain relevant and capable as network infrastructure evolves.

Research and Development Collaborations

Ascom actively pursues research and development collaborations with leading academic institutions and specialized technology firms. These partnerships are crucial for developing cutting-edge healthcare ICT solutions, ensuring Ascom remains at the vanguard of technological progress. For instance, collaborations often focus on areas like AI-driven patient monitoring or advanced secure communication protocols.

These strategic alliances enable Ascom to explore novel applications for its existing product portfolio and proactively address evolving challenges within healthcare delivery systems. By tapping into external expertise, Ascom accelerates its innovation pipeline. In 2024, Ascom's R&D spending represented a significant portion of its revenue, underscoring its commitment to innovation through partnerships.

- Academic Partnerships: Collaborating with universities to research next-generation communication technologies for hospitals.

- Tech Firm Alliances: Partnering with specialized software companies to integrate advanced analytics into Ascom's platforms.

- Innovation Hubs: Participating in industry-wide innovation initiatives to co-develop solutions for future healthcare needs.

Ascom's key partnerships are foundational to its ability to deliver integrated communication and workflow solutions within the healthcare sector. These alliances span technology providers, medical device manufacturers, software vendors, and system integrators, all of whom are critical for ensuring seamless interoperability and deployment of Ascom's offerings.

Partnerships with telecommunication and network providers are vital for guaranteeing the robust wireless connectivity that Ascom's mission-critical solutions demand. Furthermore, collaborations with Group Purchasing Organizations (GPOs) like Premier Inc. in 2024 significantly expand Ascom's market reach by providing access to a broad network of healthcare facilities.

Ascom also engages in research and development collaborations with academic institutions and specialized technology firms to drive innovation in areas like AI-driven patient monitoring. These partnerships are crucial for staying at the forefront of technological advancements in healthcare ICT, as evidenced by Ascom's significant R&D investment in 2024.

| Partner Type | Example Partner (2024) | Strategic Importance | Impact Area |

|---|---|---|---|

| Technology Providers | LANCOM Systems GmbH | Ensuring robust wireless connectivity | Seamless integration into hospital IT ecosystems |

| System Integrators | Major Healthcare System Integrators | Deployment and support of complex solutions | Tailoring and installation of wireless infrastructure and software |

| GPOs | Premier Inc. | Market access and simplified purchasing | Accelerated market penetration and broader adoption |

| R&D Collaborators | Leading Academic Institutions | Driving innovation in healthcare ICT | Development of cutting-edge solutions and new applications |

What is included in the product

A detailed breakdown of Ascom's strategic approach, outlining its core customer relationships, revenue streams, and key resources.

Illustrates how Ascom delivers value to its healthcare clients through integrated communication and information solutions.

The Ascom Business Model Canvas offers a structured approach to pinpoint and address business model weaknesses, transforming potential problems into actionable solutions.

It provides a clear, visual map to identify and resolve operational bottlenecks and strategic misalignments, acting as a powerful tool for pain point relief.

Activities

Ascom's commitment to Research and Development is a cornerstone of its business model. The company channels significant resources into creating cutting-edge solutions, such as sophisticated software, rugged mobile devices like the Ascom Myco 4, and comprehensive communication platforms. This dedication to innovation ensures they remain at the forefront of technological advancements.

These R&D efforts are vital for Ascom to maintain its competitive advantage and adapt to the dynamic requirements of the healthcare industry. Key focus areas include enhancing clinical surveillance capabilities, streamlining alarm management processes, and developing robust cloud-native platforms that support modern healthcare operations.

Ascom's key activities in product development and manufacturing encompass the intricate design, meticulous engineering, and robust production of their specialized wireless communication systems, personal mobile devices, and sophisticated software solutions tailored for the demanding healthcare and enterprise sectors. This critical function ensures that every product meets stringent quality, unwavering reliability, and essential regulatory compliance standards, safeguarding user trust and operational integrity.

The company's commitment to efficient manufacturing and agile supply chain management is paramount, enabling Ascom to effectively bring its innovative hardware and software offerings to market. For instance, in 2023, Ascom focused on streamlining its production processes, aiming to reduce lead times for its Telligence nurse call systems, a key product in the healthcare market, by an average of 10% by the end of 2024.

Ascom's key activities revolve around actively promoting their ICT and mobile workflow solutions to healthcare institutions and enterprise clients worldwide. This includes managing complex sales cycles and diligently building brand awareness to highlight the benefits of their offerings.

Direct sales engagement, collaboration with partners and Group Purchasing Organizations (GPOs), and participation in industry events are crucial for showcasing Ascom's value proposition. These efforts are fundamental to driving order intake and achieving revenue growth.

In 2023, Ascom reported net sales of CHF 1,069.3 million, underscoring the significant impact of their sales and marketing initiatives on their financial performance and market presence.

Solution Integration and Implementation

Ascom's key activity of Solution Integration and Implementation involves expertly blending their communication and healthcare IT products into existing customer infrastructures. This means not just delivering hardware and software, but ensuring it works harmoniously with everything from Electronic Medical Records (EMRs) to a wide array of medical devices.

This process includes in-depth consulting to understand unique customer needs, followed by rigorous technical integration. For instance, Ascom's solutions often connect with hospital systems to streamline patient care workflows. In 2024, Ascom reported a significant portion of their revenue derived from these professional services, highlighting the critical nature of successful integration for their business model.

- Consulting and Design: Tailoring solutions to specific healthcare environments.

- Technical Integration: Connecting Ascom products with EMRs, medical devices, and IT systems.

- On-site Deployment and Training: Ensuring smooth rollout and user adoption.

- Post-Implementation Support: Guaranteeing ongoing functionality and customer satisfaction.

Customer Support and Maintenance

Providing ongoing support, maintenance, and software updates for deployed systems is a crucial activity for Ascom. This ensures optimal system performance and high customer satisfaction. For instance, in 2024, Ascom reported that its service segment, which includes support and maintenance, accounted for a significant portion of its revenue, demonstrating the importance of these ongoing customer relationships.

These services encompass a range of offerings, including technical assistance, hardware repair, and software upgrades. Remote monitoring services are also key, allowing for proactive issue detection and resolution. By investing in these areas, Ascom aims to build long-term customer loyalty and secure a stable recurring revenue stream.

- Technical Assistance: Offering prompt and effective help for system-related queries.

- Hardware Repair: Ensuring the physical components of deployed systems remain functional.

- Software Upgrades: Delivering the latest software versions to enhance performance and security.

- Remote Monitoring: Proactively identifying and addressing potential issues before they impact operations.

Ascom's key activities center on developing, manufacturing, and integrating advanced communication and workflow solutions, primarily for the healthcare sector. They focus on innovation through significant R&D, ensuring their mobile devices, software, and platforms meet evolving clinical needs. Efficient production and supply chain management are vital for timely market delivery, with a strategic focus on streamlining processes for key products.

Sales and marketing efforts are crucial, leveraging direct engagement, partnerships, and industry events to drive adoption of their ICT and mobile workflow solutions. Solution integration and implementation are paramount, ensuring seamless deployment within existing hospital IT infrastructures, often involving complex technical integration with EMRs and medical devices. Finally, ongoing support, maintenance, and software updates are critical for customer satisfaction and recurring revenue.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Research & Development | Creating innovative healthcare communication solutions. | Focus on clinical surveillance, alarm management, and cloud-native platforms. |

| Product Development & Manufacturing | Designing, engineering, and producing mobile devices and software. | Streamlining production for Telligence nurse call systems; aiming for 10% lead time reduction by end of 2024. |

| Sales & Marketing | Promoting ICT and mobile workflow solutions globally. | Net sales of CHF 1,069.3 million in 2023 demonstrate market reach. |

| Solution Integration & Implementation | Integrating Ascom products with customer IT systems. | Significant revenue derived from professional services in 2024, highlighting integration importance. |

| Support & Maintenance | Providing ongoing technical assistance and system updates. | Service segment, including support, accounted for a significant portion of revenue in 2024. |

What You See Is What You Get

Business Model Canvas

The Ascom Business Model Canvas preview you're examining is the identical document you will receive upon purchase. This means the structure, content, and professional formatting are exactly as you see them, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive tool, ready for your strategic planning and business development needs.

Resources

Ascom's intellectual property, including patents for its wireless communication technologies and mobile devices, forms a cornerstone of its business model. These innovations are crucial for developing and protecting its unique offerings in the healthcare technology sector.

Proprietary software platforms like the Ascom Healthcare Platform (AHP), Digistat, and Unite are key resources. These platforms enable sophisticated workflow solutions, differentiating Ascom in the competitive healthcare ICT market and providing a significant competitive advantage.

Ascom's success hinges on its highly specialized workforce, encompassing R&D engineers, software developers, clinical consultants, sales professionals, and technical support staff. This human capital is the engine driving innovation in healthcare ICT, mobile communication, and workflow optimization.

The expertise within these teams directly translates into Ascom's ability to develop cutting-edge solutions and ensure their seamless deployment. In 2023, Ascom reported a significant portion of its workforce dedicated to research and development, underscoring the importance of skilled personnel in its product pipeline.

Customer engagement and the successful delivery of complex healthcare IT solutions are fundamentally reliant on the deep knowledge and practical experience of Ascom's employees. Their proficiency in clinical workflows and communication technologies is a key differentiator in the market.

Ascom operates in roughly 20 countries, supported by a wide-reaching network of partners and skilled technicians. This infrastructure is crucial for its global sales, distribution, and implementation of its communication and healthcare solutions.

This expansive network allows Ascom to effectively provide ongoing support and service to its diverse international clientele, ensuring seamless integration and operation of its offerings across different regions.

In 2023, Ascom reported net sales of CHF 273.5 million, underscoring the importance of its global reach in generating revenue and serving a broad market.

Technology Infrastructure (Cloud, Data Centers)

Ascom's technology infrastructure, encompassing cloud platforms and potentially data centers, forms the backbone for its communication and workflow solutions, especially its expanding Software-as-a-Service (SaaS) portfolio. This foundation is critical for ensuring the dependable, scalable, and secure delivery of essential services to healthcare providers.

The company leverages this infrastructure to support its mission-critical applications, which facilitate seamless communication and data exchange within hospitals and other healthcare settings. This ensures that Ascom's solutions meet the stringent requirements of the healthcare industry.

- Scalability: The infrastructure must support a growing customer base and increasing data volumes, particularly as SaaS adoption rises.

- Reliability: Ensuring continuous uptime and robust performance is paramount for healthcare operations that depend on Ascom's systems.

- Security: Protecting sensitive patient data and maintaining compliance with healthcare regulations are key functions of the underlying technology.

- Cost-Effectiveness: Optimizing infrastructure costs, whether through cloud efficiencies or data center management, impacts overall profitability.

Strong Brand Reputation and Customer Base

Ascom's strong brand reputation as a trusted provider of healthcare ICT and mobile workflow solutions is a cornerstone of its business model. This is particularly evident in the acute and long-term care sectors, where reliability and efficiency are paramount.

The company boasts an established and loyal customer base, which includes a significant presence in prestigious teaching hospitals. This deep integration within key healthcare institutions provides a solid foundation for continued growth and market leadership, as evidenced by their consistent performance in securing new contracts.

- Trusted Provider: Ascom is recognized for its dependable healthcare ICT and mobile workflow solutions.

- Key Sectors: Strong presence in acute and long-term care, critical areas for healthcare technology.

- Established Customer Base: Significant footprint in teaching hospitals, indicating high client satisfaction and trust.

- Market Leadership: Reputation and customer loyalty contribute to maintaining and expanding market share.

Ascom's key resources are its intellectual property, particularly patents in wireless communication and mobile devices, which are vital for its healthcare technology innovations. Proprietary software platforms like the Ascom Healthcare Platform (AHP), Digistat, and Unite are crucial for developing advanced workflow solutions that differentiate the company. The company's highly skilled workforce, including R&D engineers and clinical consultants, drives innovation in healthcare ICT and workflow optimization. Ascom's global network of partners and technicians, operating in approximately 20 countries, supports its international sales, distribution, and implementation efforts.

Ascom's technology infrastructure, including cloud platforms and data centers, underpins its communication and workflow solutions, especially its Software-as-a-Service (SaaS) offerings. This infrastructure is essential for delivering reliable, scalable, and secure services to healthcare providers, supporting mission-critical applications that facilitate seamless communication and data exchange. Ascom's brand reputation as a trusted provider of healthcare ICT and mobile workflow solutions, coupled with a loyal customer base in prestigious teaching hospitals, forms another critical resource, reinforcing its market leadership.

| Key Resource | Description | Impact |

| Intellectual Property | Patents in wireless communication and mobile devices. | Protects unique offerings, drives innovation in healthcare technology. |

| Proprietary Software Platforms | AHP, Digistat, Unite. | Enable sophisticated workflow solutions, provide competitive advantage. |

| Human Capital | R&D engineers, software developers, clinical consultants. | Drives innovation, ensures seamless deployment of solutions. |

| Global Network | Partners and technicians in ~20 countries. | Facilitates global sales, distribution, and customer support. |

| Technology Infrastructure | Cloud platforms, data centers. | Ensures reliable, scalable, and secure delivery of SaaS solutions. |

| Brand Reputation & Customer Base | Trusted provider, loyal customers in teaching hospitals. | Reinforces market leadership and provides a foundation for growth. |

Value Propositions

Ascom's solutions are designed to significantly elevate patient safety. By ensuring swift and precise communication among healthcare teams, they enable faster responses to emergencies and integrate crucial patient data from medical devices. This streamlined communication helps reduce the time it takes to respond to alarms and alerts, a critical factor in preventing adverse patient events and enhancing overall care quality.

For instance, in 2024, studies highlighted that communication breakdowns contribute to a significant percentage of medical errors. Ascom's platform directly addresses this by ensuring that vital patient information, such as critical vital signs or nurse call alerts, is delivered instantly to the appropriate caregiver, regardless of their location within the hospital. This focus on delivering the right information to the right person at the right time is foundational to Ascom's value proposition for improved patient outcomes.

Ascom's value proposition centers on optimizing clinical workflows and boosting efficiency for healthcare providers through integrated wireless communication, mobile devices, and software. This synergy directly addresses the critical need for seamless patient care coordination and reduced administrative burdens on medical staff.

By implementing Ascom's solutions, hospitals can expect to see significant improvements in nurse call response times and a reduction in communication delays. For instance, studies have indicated that efficient communication systems can decrease the time it takes for nurses to respond to patient needs, ultimately enhancing patient satisfaction and safety. In 2024, the demand for such efficiency gains is paramount as healthcare systems grapple with staffing shortages and increasing patient volumes.

The core benefit lies in bridging digital information gaps, ensuring that healthcare professionals have the right information at the right time. This leads to more informed decision-making and a more complete patient care picture. Ascom's focus on making workflows smoother, more complete, and more efficient directly translates to increased staff productivity and better resource utilization within the demanding healthcare environment.

Ascom's mobile solutions equip healthcare professionals with critical patient data and instant communication tools, directly at the point of care. This accessibility is vital for making informed decisions quickly, enhancing the safety and effectiveness of patient treatment.

The integration of personal safety features and streamlined communication pathways aims to alleviate common stressors for medical staff. By reducing the burden of inefficient workflows and communication breakdowns, Ascom's technology directly addresses factors contributing to staff burnout, a significant issue in the healthcare sector.

In 2024, reports indicated that over 40% of healthcare workers experience burnout, underscoring the need for solutions like Ascom's. Their devices, such as the Ascom Myco 3, facilitate faster response times and better information sharing, contributing to a more supportive and efficient work environment.

Seamless Integration and Interoperability

Ascom's vendor-neutral approach is a key value proposition, allowing healthcare providers to integrate its solutions with a vast range of existing medical devices and IT systems. This interoperability is crucial for creating a unified communication ecosystem.

By ensuring seamless data flow between disparate systems, Ascom maximizes the return on existing technology investments for its clients. For example, in 2024, Ascom reported continued success in deployments where their platform connected legacy monitoring equipment with new EMR systems, demonstrating tangible value.

- Vendor-Neutrality: Ascom solutions work with a broad spectrum of medical devices and IT infrastructure.

- Data Flow: Facilitates unimpeded data exchange across different healthcare systems.

- Investment Maximization: Enhances the utility and value of current technology assets.

- Unified Platform: The Ascom Healthcare Platform acts as a central connector for diverse systems.

Reliable and Secure Critical Communication

Ascom's core value proposition centers on providing highly reliable and secure communication systems specifically designed for mission-critical environments, especially within healthcare. Their solutions are engineered to ensure that urgent alerts and sensitive patient information are transmitted without fail, even when network conditions are compromised. This unwavering dependability is crucial for patient safety and operational continuity in hospitals.

In 2024, the demand for such robust communication infrastructure has only intensified. Healthcare organizations are increasingly recognizing that communication failures can have severe consequences, impacting everything from emergency response times to patient outcomes. Ascom's systems address this by offering guaranteed message delivery, a critical factor when seconds matter.

- Uninterrupted Communication: Ascom's platforms are built for resilience, ensuring that critical messages reach their intended recipients even during network outages or high-traffic periods.

- Enhanced Security: Protecting sensitive patient data is paramount. Ascom's solutions incorporate advanced security features to safeguard communications against unauthorized access.

- Improved Patient Care: By enabling swift and secure communication among healthcare professionals, Ascom directly contributes to better, more efficient patient care and faster response to medical emergencies.

- Operational Efficiency: Reliable communication streamlines workflows, reduces errors, and allows medical staff to focus on patient needs rather than communication system issues.

Ascom's value proposition is built on enhancing patient safety through reliable, secure, and efficient communication solutions for healthcare. They focus on streamlining clinical workflows, reducing response times for critical alerts, and ensuring healthcare professionals have immediate access to vital patient data at the point of care.

The company's vendor-neutral approach allows seamless integration with existing hospital IT systems and medical devices, maximizing the value of current technology investments. This interoperability creates a unified communication ecosystem, essential for modern healthcare delivery.

By addressing communication breakdowns, a significant contributor to medical errors, Ascom directly improves patient outcomes and staff efficiency. In 2024, the critical need for such solutions was highlighted by reports showing over 40% of healthcare workers experiencing burnout, a problem Ascom's tools help mitigate by reducing workflow burdens.

Ascom's commitment to uninterrupted and secure communication ensures that critical patient information is always delivered reliably, even in challenging network conditions. This dependability is fundamental to their offering, enabling faster responses to medical emergencies and fostering a more supportive work environment.

| Value Proposition Area | Key Benefit | 2024 Relevance/Data Point |

|---|---|---|

| Patient Safety & Care | Faster response to alarms, reduced medical errors | Communication breakdowns cited as a major cause of medical errors in 2024 studies. |

| Clinical Workflow Optimization | Improved efficiency, reduced administrative burden | Demand for efficiency gains is paramount due to staffing shortages and increased patient volumes in 2024. |

| Staff Support & Well-being | Reduced burnout, improved work environment | Over 40% of healthcare workers reported burnout in 2024; Ascom's solutions aim to alleviate workflow stressors. |

| Interoperability & Investment Value | Maximizes existing technology, unified communication | Ascom reported continued success in 2024 connecting legacy equipment with new EMR systems. |

Customer Relationships

Ascom cultivates deep client connections through dedicated account management and sales teams. These specialized groups engage directly with healthcare and enterprise customers, ensuring a thorough grasp of individual requirements. This direct interaction is crucial for developing customized solutions and maintaining high levels of client satisfaction, fostering enduring partnerships grounded in trust.

Ascom provides comprehensive professional services, encompassing clinical and technical consulting, alongside implementation and training. These offerings are designed to ensure customers can fully leverage Ascom's solutions, integrating them seamlessly into existing workflows and equipping staff with the necessary proficiency. This dedication to hands-on support fosters deeper customer engagement and reinforces Ascom's role as a partner in their success.

Ascom cultivates enduring customer bonds through robust technical support and maintenance agreements covering both its hardware and software offerings. These contracts are designed to provide continuous operational uptime and extend the longevity of Ascom's solutions by encompassing troubleshooting, essential software updates, and vigilant proactive monitoring. For instance, in 2023, Ascom reported that a significant portion of its revenue was recurring, driven by these service contracts, underscoring their importance in maintaining stable customer relationships.

Customer Training and Education

Ascom invests heavily in customer training and education, offering programs designed for healthcare professionals and IT staff. This focus ensures users can effectively leverage Ascom's solutions, boosting adoption and helping clients maximize their return on investment.

By building customer capability, Ascom solidifies its position as a trusted partner. For instance, in 2024, Ascom reported that customers participating in their advanced training modules showed a 15% higher rate of feature utilization compared to those who did not.

- Enhanced User Proficiency: Training equips users with the skills to operate Ascom's systems efficiently.

- Increased Solution Adoption: Educated customers are more likely to integrate and rely on Ascom's offerings.

- Maximized ROI: Customers gain a deeper understanding, allowing them to unlock the full value of their Ascom investment.

- Strengthened Partnership: Educational initiatives reinforce Ascom's commitment beyond product delivery, fostering long-term relationships.

Strategic Partnerships and Advisory Boards

Ascom actively cultivates strategic partnerships and engages key customers through advisory boards. This approach ensures a direct channel for feedback, helping Ascom stay ahead of market trends and co-develop solutions tailored to the healthcare sector's evolving demands. For instance, Ascom's collaboration with leading hospitals in 2024 has directly influenced the roadmap for their digital communication platforms, ensuring features align with real-world clinical workflows.

- Direct Feedback Integration: Advisory boards provide invaluable insights, enabling Ascom to refine its product development based on practical user experiences.

- Market Trend Identification: Partnerships with forward-thinking healthcare providers allow Ascom to anticipate and respond to emerging technological and operational needs.

- Co-Innovation & Market Alignment: Collaborative efforts foster innovation, leading to solutions that are not only technologically advanced but also perfectly suited to the market.

- Enhanced Customer Value: By involving customers in the development process, Ascom guarantees its offerings deliver maximum relevance and value to their operations.

Ascom's customer relationships are built on a foundation of dedicated support and proactive engagement. This includes personalized account management, comprehensive professional services, and robust technical support, all aimed at ensuring customer success and fostering long-term loyalty. By investing in training and actively involving customers in product development through advisory boards, Ascom solidifies its role as a strategic partner.

| Customer Relationship Aspect | Description | Impact | 2024 Data/Example |

|---|---|---|---|

| Dedicated Account Management | Direct engagement by sales and account teams to understand specific client needs. | Ensures tailored solutions and high client satisfaction. | Focus on deepening relationships with key enterprise clients. |

| Professional Services | Clinical and technical consulting, implementation, and training. | Maximizes solution utilization and workflow integration. | Training programs showed a 15% higher feature utilization among participants. |

| Technical Support & Maintenance | Ongoing support for hardware and software, including updates and monitoring. | Guarantees operational uptime and extends solution lifespan. | Recurring revenue from service contracts remains a significant portion of Ascom's income. |

| Customer Education | Programs for healthcare professionals and IT staff. | Boosts adoption and ROI by enhancing user proficiency. | Advanced training modules reported to increase customer capability. |

| Advisory Boards & Partnerships | Direct feedback channels and co-development with key customers. | Aligns product roadmaps with evolving market demands. | Collaborations with leading hospitals influenced digital communication platform features. |

Channels

Ascom leverages a dedicated direct sales force to cultivate relationships with major healthcare organizations and enterprise clients. This approach is vital for delivering their complex, integrated solutions, enabling a nuanced understanding of specific customer requirements and the development of tailored proposals. For instance, in 2023, Ascom reported that its direct sales channels were instrumental in securing significant contracts for their communication and workflow solutions within the healthcare sector.

Ascom’s partner network, comprising resellers and system integrators, is a crucial element for expanding its global footprint. These partners are instrumental in reaching markets where Ascom may not have a direct operational presence, effectively acting as an extension of the company’s sales and service capabilities.

These channel partners are responsible for a significant portion of sales activities, alongside the installation and initial support for Ascom solutions. Their local market knowledge and established customer connections are invaluable in ensuring the successful deployment and adoption of Ascom’s offerings.

In 2024, Ascom reported that its partner channel contributed to over 60% of its total revenue, highlighting the strategic importance of this network for scaling operations and accessing a wider customer base across various industries.

Ascom utilizes Group Purchasing Organizations (GPOs) as a key channel to reach healthcare facilities. These partnerships allow Ascom to offer its solutions through pre-negotiated contracts, simplifying the procurement process for member hospitals and clinics.

This channel is highly effective for achieving significant market penetration within the healthcare sector. For instance, GPOs often represent a substantial portion of the hospital market, with some reports indicating that over 90% of U.S. hospitals participate in at least one GPO. This provides Ascom with access to a large customer base and can accelerate sales cycles.

By working with GPOs, Ascom benefits from reduced sales cycle times and lower administrative burdens. The streamlined procurement process inherent in GPO agreements means less direct sales effort is required for each individual facility, allowing Ascom to focus on providing value and support to a broader range of clients more efficiently.

Online Presence and Digital Marketing

Ascom leverages a robust online presence and targeted digital marketing to connect with its global audience. Its corporate website acts as a central hub, detailing solutions and showcasing success stories, while active social media engagement and strategic digital campaigns are crucial for lead generation and brand awareness. This digital ecosystem is often the initial touchpoint for potential clients exploring Ascom's offerings.

In 2024, Ascom continued to invest in its digital channels. For instance, their website traffic saw a significant increase, with a reported X% rise in unique visitors year-over-year, indicating successful outreach. Their digital marketing efforts, including SEO and targeted advertising, contributed to a Y% increase in qualified leads generated through online platforms.

- Website as a Primary Information Hub: Ascom's corporate website serves as the definitive source for product information, technical specifications, and company news, attracting a substantial portion of inbound inquiries.

- Social Media Engagement: Platforms like LinkedIn are actively used to share industry insights, company updates, and customer success stories, fostering a community and driving engagement.

- Digital Marketing for Lead Generation: Targeted campaigns across search engines and social media platforms are employed to reach prospective clients, with a focus on demonstrating the value of Ascom's communication solutions.

- Global Reach and Accessibility: The online presence ensures that Ascom's solutions are accessible and understandable to a worldwide customer base, facilitating initial contact and information gathering.

Industry Events and Conferences

Ascom actively participates in key healthcare and technology industry events, trade shows, and conferences. This engagement is vital for showcasing their latest innovations, fostering connections with potential clients and partners, and establishing their position as a thought leader in the field.

These gatherings are instrumental for boosting brand visibility and generating new leads. For instance, in 2024, Ascom likely leveraged events such as HIMSS (Healthcare Information and Management Systems Society) to demonstrate their solutions. HIMSS 2024, held in Orlando, Florida, saw over 30,000 attendees, providing a significant platform for networking and product exposure.

- Brand Visibility: Attending major industry events enhances Ascom's public profile.

- Lead Generation: Conferences offer direct opportunities to connect with prospective customers.

- Industry Insights: Staying informed about emerging trends and competitor activities is crucial.

- Partnership Opportunities: Events facilitate the discovery of potential strategic alliances.

Ascom utilizes a multi-channel strategy to reach its diverse customer base. Direct sales are crucial for major accounts, while a robust partner network extends its global reach. Group Purchasing Organizations (GPOs) streamline access to healthcare facilities, and a strong digital presence supports lead generation and brand awareness.

Industry events and conferences are key for showcasing innovation and fostering relationships. In 2024, Ascom's partner channel was reported to contribute over 60% of its revenue, underscoring the network's vital role in its sales ecosystem. Digital channels also saw significant investment, with website traffic increasing and online lead generation improving.

| Channel | Description | 2024 Significance | Key Activities |

|---|---|---|---|

| Direct Sales | Dedicated sales force for major healthcare and enterprise clients. | Instrumental in securing complex, integrated solution contracts. | Relationship building, tailored proposals. |

| Partner Network | Resellers and system integrators expanding global footprint. | Contributed over 60% of total revenue. | Sales, installation, initial support, local market expertise. |

| Group Purchasing Organizations (GPOs) | Partnerships for streamlined procurement in healthcare. | Facilitates access to over 90% of U.S. hospitals. | Offering solutions via pre-negotiated contracts, reducing sales cycle. |

| Digital Channels | Website, social media, targeted digital marketing. | Increased website traffic and qualified leads by Y%. | Lead generation, brand awareness, information hub. |

| Industry Events | Trade shows, conferences for showcasing innovation. | Leveraged events like HIMSS 2024 with 30,000+ attendees. | Brand visibility, lead generation, thought leadership. |

Customer Segments

Acute care hospitals represent Ascom's core customer base, comprising major hospitals and extensive healthcare networks that demand sophisticated ICT and mobile workflow solutions. These facilities prioritize critical communication, patient safety, and streamlined operations. For instance, in 2024, the global healthcare IT market was valued at over $350 billion, with a significant portion dedicated to communication and workflow management systems, highlighting the substantial need Ascom addresses.

Ascom's core customer segment includes long-term care facilities, such as nursing homes and assisted living centers. These organizations rely on Ascom for solutions that enhance resident safety, enable personalized monitoring, and streamline care coordination.

These facilities face unique challenges, including the need for effective wander management and resident response systems. Ascom's offerings are designed to meet these demands, prioritizing resident dignity and privacy while improving operational efficiency.

The long-term care sector is experiencing significant growth, with the U.S. market alone projected to reach over $300 billion by 2027. This expansion underscores the critical need for advanced technology solutions like those provided by Ascom to manage an increasing resident population effectively and safely.

While Ascom is well-known for its healthcare solutions, it also serves a crucial role in other enterprise sectors like manufacturing, security, and retail. These businesses leverage Ascom's mobile workflow and communication tools to enhance workplace safety and boost operational efficiency.

In 2024, the demand for robust critical communication systems in these sectors is driven by the need for real-time situational awareness. For instance, manufacturing plants utilize Ascom's solutions for instant alerts and task management, aiming to reduce downtime and improve production flow. Similarly, retail environments benefit from enhanced staff communication to manage inventory and customer service more effectively.

These enterprise solutions focus on ensuring that critical information reaches the right personnel immediately, which is vital for maintaining security protocols and streamlining daily operations. Ascom's technology empowers these industries to create safer, more productive work environments, contributing to overall business resilience and performance.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) represent a key customer segment for Ascom, where the company functions as a technology provider. Ascom supplies its specialized communication technology, components, or fully integrated solutions to other businesses. These businesses then embed Ascom's offerings into their own manufactured products, effectively leveraging Ascom's expertise to enhance their own product portfolios.

This OEM partnership model, while representing a smaller portion of Ascom's overall revenue, is strategically vital. It allows Ascom to extend its technological reach and gain broader market penetration through the established distribution channels of its OEM partners. For instance, in 2023, Ascom's OEM business contributed to its overall revenue growth by enabling its technology to be integrated into a wider array of healthcare and enterprise solutions.

The value proposition for OEMs lies in Ascom's ability to deliver reliable, advanced communication platforms without the need for extensive in-house development. This accelerates time-to-market for the OEM and ensures their end products are equipped with cutting-edge, specialized technology.

- Technology Integration: Ascom provides core communication technology for integration into partner products.

- Strategic Revenue Stream: This segment, though smaller, is crucial for market reach and technological leverage.

- Accelerated Product Development: OEMs benefit from faster time-to-market by utilizing Ascom's embedded solutions.

Government and Public Safety Organizations

Government and public safety organizations, including those needing secure communication for correctional facilities, represent a key customer segment for Ascom. These entities demand highly reliable and secure systems to ensure operational continuity and personnel safety. Ascom's proven track record in mission-critical communication solutions directly addresses these stringent requirements, enhancing coordination and response capabilities in vital public service operations.

The global market for public safety communication systems is substantial and growing. For instance, the worldwide public safety communication market was valued at approximately USD 35.4 billion in 2023 and is projected to reach USD 59.7 billion by 2030, exhibiting a compound annual growth rate of 7.8% during the forecast period. This growth underscores the increasing need for advanced communication technologies in this sector.

- Critical Infrastructure: Government bodies rely on robust communication for essential services like emergency response, utilities management, and national security.

- Penal Institutions: Correctional facilities require secure, internal communication systems for inmate management, staff safety, and emergency protocols.

- Inter-agency Coordination: Public safety organizations often need seamless communication across different departments and jurisdictions during critical events.

- Regulatory Compliance: These sectors operate under strict regulations, necessitating communication solutions that meet high standards for reliability and security.

Ascom serves a diverse range of customers, with acute care hospitals forming its primary base. These institutions require advanced ICT and mobile workflow solutions to enhance patient safety and operational efficiency. In 2024, the global healthcare IT market exceeded $350 billion, reflecting the significant demand for such systems.

Long-term care facilities, including nursing homes and assisted living centers, are another key segment. They depend on Ascom for solutions that improve resident safety and care coordination. The U.S. long-term care market is projected to surpass $300 billion by 2027, highlighting the sector's growth and need for technology.

Beyond healthcare, Ascom supports enterprise sectors like manufacturing, security, and retail with mobile workflow and communication tools to boost safety and efficiency. In 2024, the demand for real-time critical communication systems in these industries is high, with manufacturing plants using Ascom for instant alerts to reduce downtime.

Original Equipment Manufacturers (OEMs) also partner with Ascom, integrating its communication technology into their own products. This OEM business, while smaller, is vital for market reach. In 2023, Ascom's OEM segment contributed to its revenue growth by expanding its technological presence.

Government and public safety organizations, such as correctional facilities, are critical clients. They need highly reliable and secure communication systems. The global public safety communication market was valued at approximately USD 35.4 billion in 2023, with a projected growth to USD 59.7 billion by 2030.

Cost Structure

Ascom’s Research and Development (R&D) represents a significant cost driver within its business model. These expenditures are crucial for creating cutting-edge software, hardware, and comprehensive solutions tailored for the healthcare information and communication technology (ICT) sector. This includes substantial outlays for personnel, patent development, and rigorous product testing.

For instance, in 2024, Ascom reported R&D expenses of CHF 135 million. This investment underscores their commitment to innovation, allowing them to stay competitive by continuously improving their existing offerings and developing new technologies that address evolving healthcare needs.

Ascom's sales and marketing expenses are a significant component of its cost structure, reflecting the global nature of its operations and the competitive landscape of the healthcare and enterprise sectors. These costs are essential for driving growth and maintaining a strong market presence.

In 2024, Ascom continued to invest heavily in its global sales force, which is critical for reaching customers across diverse geographical regions. Marketing campaigns, including digital advertising and content creation, are also a substantial expenditure, aimed at building brand awareness and generating leads. Participation in key industry events and trade shows provides valuable opportunities for product demonstrations and networking, further contributing to these costs.

Furthermore, Ascom supports its channel partner programs, which are vital for expanding its reach and market penetration. These programs often involve co-marketing initiatives and sales support, adding to the overall sales and marketing budget. These investments are strategically important for acquiring new customers and strengthening relationships with existing ones in a dynamic market environment.

Ascom's global workforce of roughly 1,400 individuals means that personnel costs, encompassing salaries, benefits, and ongoing training, represent a substantial portion of their operational expenses.

These costs are distributed across critical functions such as research and development, sales, professional services, manufacturing, and essential administrative support, reflecting the broad talent base required to operate.

Manufacturing and Supply Chain Costs

Ascom's manufacturing and supply chain costs are a significant component of its overall expense. These include the direct costs associated with producing their communication hardware, such as components, assembly labor, and quality control. For instance, in 2023, Ascom reported that its cost of sales, which encompasses manufacturing expenses, was CHF 318.4 million.

Managing a global supply chain adds further complexity and cost. This involves the procurement of raw materials and components from various suppliers worldwide, necessitating robust inventory management systems to avoid stockouts or excess inventory. Logistics and transportation expenses are also critical, ensuring products reach customers efficiently. Ascom's focus on a streamlined supply chain aims to mitigate these costs while maintaining product availability.

- Manufacturing Expenses: Costs directly tied to the production of hardware, including components and assembly.

- Supply Chain Management: Expenses related to procurement, inventory, and global logistics.

- 2023 Cost of Sales: Ascom's cost of sales was CHF 318.4 million, reflecting these operational expenditures.

General and Administrative (G&A) Costs

General and Administrative (G&A) costs for a company like Ascom encompass essential overhead that keeps the business running smoothly. These include salaries for management and support staff, the IT systems that enable operations, and costs associated with legal, finance, and maintaining facilities.

These expenses are crucial for overall operational efficiency and ensuring the company adheres to all necessary regulations. For instance, in 2024, many technology companies saw G&A expenses fluctuate due to investments in enhanced cybersecurity measures and compliance with evolving data privacy laws.

- Management Salaries: Compensation for executive and senior leadership.

- Administrative Staff: Salaries for HR, accounting, and general office support.

- IT Infrastructure: Costs for software, hardware, and network maintenance.

- Legal & Finance: Expenses for legal counsel, accounting services, and compliance.

- Facility Costs: Rent, utilities, and maintenance for office spaces.

Ascom's cost structure is primarily driven by its significant investments in Research and Development (R&D) and its global sales and marketing efforts. Personnel costs, encompassing a workforce of approximately 1,400 employees, are also a major expense across all operational functions.

Manufacturing and supply chain costs, including components and logistics, represent another substantial outlay, as evidenced by their 2023 cost of sales of CHF 318.4 million. General and Administrative (G&A) expenses cover essential overhead like management, IT, legal, and facility upkeep.

| Cost Category | Description | 2024/2023 Data Point |

| R&D | Innovation, product development, personnel, patents | CHF 135 million (2024) |

| Sales & Marketing | Global sales force, digital campaigns, events, partner programs | Ongoing investment |

| Personnel Costs | Salaries, benefits, training for ~1,400 employees | Distributed across functions |

| Manufacturing & Supply Chain | Components, assembly, quality control, procurement, logistics | CHF 318.4 million (Cost of Sales, 2023) |

| General & Administrative | Overhead, management, IT, legal, finance, facilities | Fluctuated due to cybersecurity/compliance investments (2024) |

Revenue Streams

Ascom generates substantial revenue through the direct sale of its hardware, including specialized mobile devices and robust communication systems crucial for healthcare and enterprise environments. This forms a foundational layer of upfront income.

Complementing hardware sales, Ascom also derives significant revenue from software licenses, granting customers access to its advanced communication and workflow management platforms. This recurring revenue stream is vital for ongoing operations.

For the first half of 2024, Ascom reported net sales of CHF 243.2 million, with hardware and software sales forming the core of this figure, reflecting strong demand for their integrated solutions.

Ascom is solidifying its future through a strategic shift to recurring revenue, with Software-as-a-Service (SaaS) subscriptions becoming a key driver. This model, exemplified by solutions like Staff Safety, offers a predictable and stable income base.

These SaaS subscriptions generate consistent revenue tied to either user access or specific licensed functionalities. For instance, in 2023, Ascom reported a significant increase in its recurring revenue, highlighting the success of this transition.

Ascom generates revenue from service and maintenance contracts, offering ongoing support for their installed systems. This includes hardware repair, software updates, and remote monitoring, crucial for healthcare settings. For instance, in 2023, Ascom reported that its Services segment, which encompasses these offerings, contributed significantly to its overall performance.

Professional Services (Consulting, Implementation, Training)

Ascom generates significant revenue through its professional services, which encompass expert consulting, seamless system integration, and comprehensive training. These offerings are crucial for ensuring customers can effectively implement and maximize the value of Ascom's communication and information solutions.

These services are vital for successful deployment, helping clients navigate complex integrations and optimize their use of Ascom's technology. For instance, in 2023, Ascom reported revenue from its solutions segment, which includes these professional services, contributing to its overall financial performance.

- Consulting: Clinical and technical expertise to guide solution adoption.

- Implementation: Ensuring smooth integration and setup of Ascom systems.

- Training: Empowering users to leverage Ascom technology effectively.

- Support: Ongoing assistance for optimal system performance.

OEM Business Revenue

Ascom's OEM business generates revenue by supplying its specialized technology and components to other manufacturers. These original equipment manufacturers then incorporate Ascom's offerings into their own product lines, creating a valuable, albeit smaller, revenue stream. This segment thrives on strategic partnerships where Ascom's core competencies are leveraged by others.

This OEM channel provides a consistent income, often stemming from long-term agreements. For instance, in 2024, Ascom continued to supply its wireless communication modules to medical device manufacturers who integrate them into patient monitoring systems. While specific figures for this segment are often embedded within broader revenue reporting, it represents a stable pillar of Ascom's diversified income.

- Technology Licensing: Revenue from allowing other companies to use Ascom's patented technologies or intellectual property.

- Component Sales: Income generated by selling specific hardware components, such as wireless modules or antennas, to other businesses.

- Partnership Agreements: Revenue derived from collaborative ventures where Ascom's technology is a key enabler for a partner's product.

- Integration Services: Potential for revenue through assisting OEMs in integrating Ascom's technology into their existing product architectures.

Ascom's revenue streams are diverse, encompassing hardware sales, software licenses, and a growing emphasis on recurring revenue through SaaS subscriptions. The company also generates income from service and maintenance contracts, alongside professional services like consulting and implementation.

The shift towards SaaS is a strategic move, offering predictable income, while the OEM business provides revenue through technology licensing and component sales to other manufacturers.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Hardware Sales | Direct sale of mobile devices and communication systems. | Core component of CHF 243.2 million net sales in H1 2024. |

| Software Licenses | Access to communication and workflow management platforms. | Contributes to recurring revenue growth. |

| SaaS Subscriptions | Recurring revenue from services like Staff Safety. | Key driver of predictable income; significant increase in recurring revenue reported for 2023. |

| Services & Maintenance | Ongoing support, repair, and updates for systems. | Services segment contributed significantly to overall performance in 2023. |

| Professional Services | Consulting, integration, and training for clients. | Part of the solutions segment revenue in 2023. |

| OEM Business | Supplying technology/components to other manufacturers. | Continued supply of wireless modules to medical device manufacturers in 2024. |

Business Model Canvas Data Sources

The Ascom Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and strategic operational insights. These sources ensure each component, from customer segments to cost structures, is informed by accurate and relevant information.