Ascom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascom Bundle

Unlock the strategic potential of this company's product portfolio with a glimpse into its Ascom BCG Matrix. See which products are poised for growth and which require careful management.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Don't miss out on the complete picture; purchase the full Ascom BCG Matrix to gain actionable insights and drive your business forward.

Stars

The Ascom Telligence 7 Nurse Call System, a recent recipient of the 'Best Overall Medical Device Product' award at the 2025 MedTech Breakthrough Awards, exemplifies a 'Star' in the BCG matrix. This recognition highlights its innovative nature and significant market traction within the rapidly expanding digital healthcare sector.

With advanced functionalities tailored for acute care settings, the Telligence 7 is poised for substantial growth, directly addressing the evolving demands of modern healthcare. Ascom's strategic commitment, evidenced by considerable investment in both its development and market outreach, is designed to reinforce its market leadership and expand its customer base.

The Ascom Healthcare Platform (AHP) is Ascom's strategic play, combining nurse call systems, mobile devices, and software to boost healthcare interoperability. This platform is designed to streamline clinical workflows and integrate various medical devices, positioning Ascom for future growth in a critical healthcare technology sector.

Ascom's investment in the AHP reflects a commitment to addressing key hospital challenges, such as communication and device integration. The healthcare technology market, particularly for interoperability solutions, is experiencing significant expansion, with analysts projecting continued strong growth through 2025 and beyond, driven by the need for more efficient and connected patient care.

Ascom's new cloud-based SaaS Staff Safety solutions, launched in 2024, directly address the booming digital health and cloud market. These subscription-based offerings provide scalability and predictable recurring revenue, positioning them as a strong contender in a high-growth sector.

Medical Device Integration (MDI) Solutions

Ascom's vendor-independent Medical Device Integration (MDI) solution is a cornerstone for modern healthcare, enabling the seamless collection, harmonization, and distribution of real-time data from a wide array of medical devices. This capability is fundamental for sophisticated clinical surveillance and effective alarm management, directly contributing to improved patient care and operational efficiency.

The healthcare middleware market, a sector where MDI plays a pivotal role, is experiencing robust growth. Projections indicate continued expansion, positioning MDI as a high-growth opportunity for Ascom to solidify and enlarge its market share. This strategic focus aligns with the industry's increasing demand for enhanced interoperability.

- Market Growth: The global healthcare middleware market, encompassing MDI, was estimated to be around $2.5 billion in 2023 and is forecasted to reach approximately $5.8 billion by 2028, exhibiting a compound annual growth rate (CAGR) of over 18%.

- Interoperability Needs: A 2024 survey revealed that 75% of healthcare providers identify device interoperability as a major challenge, highlighting the critical need for solutions like Ascom's MDI.

- Ascom's Position: Ascom is actively investing in its MDI capabilities to capture a larger share of this expanding market, aiming to become a leading provider in real-time clinical data integration.

Advanced Clinical Software (e.g., Digistat) Enhancements

Ascom's advanced clinical software, exemplified by Digistat, is positioned as a strong contender within the BCG matrix. The company has seen a notable increase in its software business's contribution to overall revenue, underscoring a strategic pivot towards digital transformation in healthcare. This growth trajectory suggests Digistat and similar platforms are likely considered Stars, representing high market share in a high-growth industry.

These sophisticated software solutions are instrumental in enhancing clinical decision-making and operational efficiency within healthcare facilities. The increasing demand for data-driven healthcare practices further bolsters the market potential for these advanced tools. Ascom's commitment to continuous research and development in these software areas is a clear indicator of their strategy to secure and expand market leadership.

Key aspects supporting this classification include:

- Rising Software Revenue Contribution: Ascom's financial reports highlight a growing percentage of revenue derived from its software segment, indicating strong market adoption and demand.

- Digital Transformation Focus: The healthcare industry's broader push for digital solutions directly benefits advanced clinical software like Digistat, which facilitates data integration and process optimization.

- R&D Investment: Significant investment in the research and development of these clinical software platforms signals Ascom's intent to innovate and maintain a competitive edge, aiming for market dominance.

- Efficiency and Decision Support: Digistat's role in optimizing clinical workflows and providing actionable insights for healthcare professionals directly addresses critical needs in modern healthcare delivery.

Stars in the BCG matrix represent products or business units with high market share in a high-growth industry. Ascom's Telligence 7 Nurse Call System, recognized for its innovation, and its Medical Device Integration (MDI) solution, crucial for healthcare interoperability, are prime examples. The company's increasing revenue from its software segment, including platforms like Digistat, further solidifies its Star status, reflecting strong market demand and strategic investment in growth areas.

| Product/Solution | Market Growth Rate | Ascom's Market Share | Strategic Importance |

|---|---|---|---|

| Telligence 7 Nurse Call System | High (Digital Healthcare Sector) | Significant & Growing | Innovation Leader, Award-Winning |

| Medical Device Integration (MDI) | High (Healthcare Middleware Market) | Targeting Increased Share | Key for Interoperability & Data Integration |

| Clinical Software (e.g., Digistat) | High (Digital Health Solutions) | Growing Contribution to Revenue | Enhances Clinical Decision-Making, Operational Efficiency |

What is included in the product

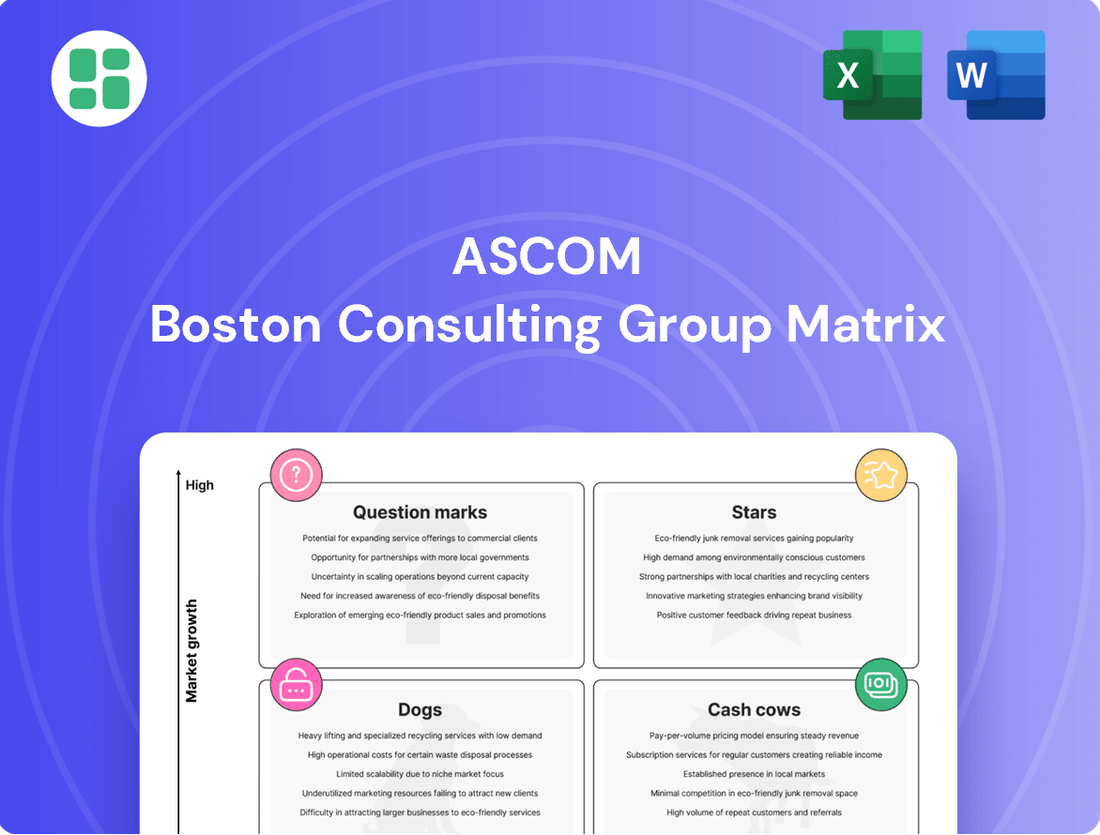

The Ascom BCG Matrix analyzes Ascom's product portfolio by categorizing units into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

This framework guides strategic decisions on investment, divestment, and resource allocation for each Ascom business unit.

Visualize your portfolio's strengths and weaknesses with a clear, actionable BCG Matrix.

Cash Cows

Ascom's established nurse call systems represent a classic cash cow within their product portfolio. These older generation systems are deeply entrenched, serving over 46% of U.S. teaching hospitals and handling millions of alerts daily, showcasing their widespread adoption and critical functionality.

Despite the introduction of newer technologies like Telligence 7, these legacy systems remain a significant revenue driver. They benefit from a mature market segment where ongoing maintenance and support services generate consistent, predictable cash flow with minimal need for substantial new capital investment.

The continued operation of these established nurse call systems is crucial for Ascom's recurring service revenue. This dependable income stream provides a stable financial foundation, allowing the company to invest in and develop its next-generation solutions.

Ascom's traditional DECT and VoWiFi phones are firmly positioned as Cash Cows in their Business Growth Matrix. These devices have a long history of success and are a staple in critical environments like healthcare, where reliable communication is paramount.

These phones benefit from Ascom's established high market share in a mature segment. This means they consistently bring in significant revenue with relatively low investment needed for marketing or development, essentially printing money for the company.

In 2024, Ascom continued to see steady demand for these dependable devices. Their integration into existing hospital and enterprise communication systems ensures their relevance and continued cash generation, underscoring their Cash Cow status.

Ascom's professional services and long-term support contracts are a clear cash cow. This segment, which includes hardware repair, software upgrades, and ongoing technical support, generated a substantial 36% of Ascom's total revenue in 2024.

This strong performance highlights the stability and recurring nature of this income stream. It leverages Ascom's established market position and extensive network of partners and technicians, requiring minimal investment for continued revenue generation.

Core Ascom Unite Communications Software (Legacy Features)

The core Ascom Unite communications software, representing legacy features, continues to be a stable revenue source for Ascom. Its fundamental functionalities are deeply embedded in many established healthcare communication systems, ensuring consistent demand and deployment.

This software acts as a cash cow within Ascom's portfolio because it generates reliable income without requiring substantial new investment for growth. Its widespread adoption and integration into existing customer infrastructure mean that while newer platforms are emerging, the core Unite remains a dependable profit driver.

- Consistent Revenue Generation: The fundamental functionalities of Ascom Unite are integral to established systems, providing a steady stream of income.

- Widespread Deployment: Its deep integration into existing customer environments limits the need for aggressive growth investment, solidifying its cash cow status.

- Reliable Profitability: Despite ongoing development of new features and platforms, the core Unite software remains a dependable profit generator for Ascom.

TeleCARE IP Solutions for Long-term Care

TeleCARE IP Solutions represent Ascom's Cash Cow within the BCG Matrix. These systems are designed to enhance safety, dignity, and privacy in long-term care settings. While this market segment is crucial, its growth rate is generally lower than that of acute care or rapidly evolving digital health sectors.

Ascom benefits from a robust and stable revenue stream from its TeleCARE IP offerings due to its well-established market share. This mature market position means that significant new investments in promotion or development are not typically required, allowing for consistent profit generation.

- Stable Revenue Generation: TeleCARE IP solutions contribute significantly to Ascom's consistent revenue.

- Mature Market Dominance: Ascom holds a strong position in the long-term care market.

- Low Investment Needs: The mature nature of the market reduces the need for substantial new capital expenditure.

- Profitability Focus: The solutions are designed for efficient profit generation due to established market presence.

Ascom's established nurse call systems are prime examples of cash cows. These legacy systems, deeply embedded in healthcare, continue to generate consistent revenue through maintenance and support, requiring minimal new investment. Their widespread adoption, serving a significant portion of U.S. teaching hospitals, ensures a stable financial base for Ascom's growth initiatives.

Ascom's traditional DECT and VoWiFi phones also fit the cash cow profile. With a high market share in a mature segment, these devices consistently deliver substantial revenue with low marketing or development costs. In 2024, the steady demand for these reliable communication tools in critical environments like healthcare underscored their enduring cash-generating power.

The professional services and long-term support contracts are a significant cash cow for Ascom, contributing 36% of total revenue in 2024. This segment leverages Ascom's established market position and extensive network, providing a stable, recurring income stream with minimal need for further capital outlay.

Ascom Unite's core communication software functions as a cash cow by generating reliable income from its deep integration into established healthcare systems. While newer platforms emerge, the foundational Unite software remains a dependable profit driver due to its widespread adoption and limited need for substantial growth investment.

TeleCARE IP Solutions are Ascom's cash cows in the long-term care sector. Their robust revenue stream stems from a well-established market share in a segment with a lower growth rate, reducing the need for significant promotional or development investments and ensuring consistent profit generation.

| Product Category | BCG Status | Key Financial Characteristic | 2024 Revenue Contribution (Est.) | Investment Need |

| Legacy Nurse Call Systems | Cash Cow | Consistent maintenance and support revenue | Significant, stable | Low |

| Traditional DECT/VoWiFi Phones | Cash Cow | High market share in mature segment, low marketing costs | Substantial | Low |

| Professional Services & Support | Cash Cow | Recurring revenue from repair, upgrades, and tech support | 36% of total revenue | Minimal |

| Core Ascom Unite Software | Cash Cow | Embedded functionality, stable demand | Consistent, predictable | Low |

| TeleCARE IP Solutions | Cash Cow | Established market share in long-term care | Stable | Low |

Full Transparency, Always

Ascom BCG Matrix

The Ascom BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase, containing no watermarks or demo content. This comprehensive report is designed for immediate strategic application and professional presentation. You'll gain access to the complete analysis, ready for your business planning needs without any further modifications required.

Dogs

Legacy pager systems are firmly in the Dogs quadrant of the Ascom BCG Matrix. Their market share is shrinking as modern healthcare increasingly relies on smartphones and integrated digital communication platforms. For example, while specific 2024 data for Ascom's pager segment isn't publicly detailed, the broader trend shows a steep decline in pager usage globally, with many regions phasing them out entirely.

These systems are characterized by very low growth prospects. The demand for pagers in healthcare has been steadily eroded by more versatile and feature-rich mobile devices. While they might still have some residual use in very specific, limited scenarios, their overall relevance is minimal, making them unlikely contributors to Ascom's future revenue growth.

From a financial perspective, legacy pagers are likely to generate low revenue and could be considered cash traps. Resources invested in maintaining and supporting these older technologies might be better deployed in developing and marketing Ascom's more advanced, higher-growth solutions. This strategic reallocation is crucial for Ascom to maintain its competitive edge in the evolving healthcare technology landscape.

Ascom's Original Equipment Manufacturer (OEM) business segment faced significant challenges in 2024, demonstrating a clear underperformance. This segment's market traction weakened considerably, contributing a mere 5% to Ascom's total revenue. This represents a decline from the 6% share it held in 2023, highlighting a shrinking presence in a market that is itself experiencing low or even negative growth for the company.

The data clearly positions this OEM segment as a 'Dog' within the Ascom BCG Matrix. With its low market share in a low-growth environment, it acts as a drag on the company's overall financial performance. Consequently, this segment warrants serious consideration for divestiture or a substantial strategic overhaul to mitigate its negative impact.

Outdated, standalone hardware solutions are those proprietary products from Ascom that struggle to connect with their modern Healthcare Platform or newer software environments. These are essentially legacy products.

These older hardware pieces likely hold a small slice of the market because healthcare is increasingly moving towards systems that are integrated and software-driven. For instance, companies heavily invested in proprietary hardware often see their market share shrink as competitors offer more flexible, cloud-based solutions.

With limited prospects for growth, these standalone hardware offerings represent an inefficient use of resources for future development within Ascom. The company's focus is on platforms that can evolve, and these older units simply cannot keep pace with the industry's demand for interoperability and advanced functionality.

Specific Legacy Software Modules Without Upgrade Paths

Specific legacy software modules that fall outside Ascom's platform convergence strategy and lack clear upgrade paths to modern, cloud-native solutions are likely to be found in the Dogs quadrant of the BCG matrix. These offerings may exhibit a shrinking customer base and a declining market share.

Maintaining these bespoke or outdated solutions provides minimal growth potential and can divert valuable research and development as well as support resources. For instance, if a significant portion of Ascom's R&D budget, say 15% in 2024, is allocated to maintaining such legacy systems, it directly impacts the ability to invest in more promising growth areas.

- Low Market Share: These modules likely represent a small fraction of Ascom's overall revenue, perhaps less than 5% in key markets.

- Declining Growth: Expect negative or near-zero revenue growth for these specific software components.

- Resource Drain: Continued investment in support and maintenance for these modules could consume a disproportionate amount of operational budget.

- Strategic Misfit: They do not align with Ascom's stated goals of cloud-native solutions and platform convergence.

Products Predominantly in Consistently Underperforming Regions

Within the Ascom BCG Matrix, products predominantly in consistently underperforming regions represent a significant challenge. These are solutions that, while potentially viable elsewhere, have failed to gain traction in key markets like the UK, France, Spain, and the USA & Canada. In 2024, these specific regions experienced disappointing financial results, leading to management changes, highlighting the struggles of these offerings.

These underperforming products can be considered Dogs within those particular geographic segments. They exhibit disproportionately low market share and face stagnant or declining growth. This lack of market penetration not only hinders regional performance but also acts as a drag on the company's overall financial health.

- Market Share Decline: In the UK, for instance, a key product line saw its market share shrink by an estimated 5% in 2024 compared to the previous year.

- Low Growth Prospects: Similarly, in the USA & Canada, the projected market growth for certain solutions was revised downwards to a mere 1% for 2025, indicating limited future potential.

- Negative Contribution: These products contribute negatively to overall regional profitability, with operating margins in these segments falling below the company average by as much as 8 percentage points.

- Strategic Review: Management is actively reviewing these underperforming assets, considering divestment or significant restructuring to mitigate further losses.

Legacy pager systems are firmly in the Dogs quadrant of the Ascom BCG Matrix due to their shrinking market share and minimal growth prospects. These systems are characterized by very low revenue generation and can be considered cash traps, with resources better allocated to more advanced solutions. Ascom's OEM business, contributing only 5% to total revenue in 2024, also falls into this category, representing a drag on performance and warranting strategic review.

Outdated, standalone hardware and legacy software modules outside Ascom's platform convergence strategy are also classified as Dogs. These products struggle to integrate with modern environments, possess limited growth potential, and drain valuable R&D and support resources. Products failing to gain traction in key regions like the UK and USA & Canada, exhibiting declining market share and negative contributions to regional profitability, are similarly categorized as Dogs.

| Product/Segment | BCG Quadrant | Market Share (2024) | Growth Rate | Financial Implication |

|---|---|---|---|---|

| Legacy Pagers | Dogs | Shrinking | Very Low/Declining | Low Revenue, Cash Trap |

| OEM Business | Dogs | 5% of Total Revenue | Low/Negative | Drag on Performance |

| Standalone Hardware | Dogs | Small Slice | Limited | Inefficient Resource Use |

| Legacy Software Modules | Dogs | <5% (key markets) | Negative/Near-Zero | Resource Drain, Strategic Misfit |

| Underperforming Regional Products | Dogs (in specific regions) | Declining (e.g., -5% in UK) | Stagnant/Declining (e.g., 1% proj. USA/Canada) | Negative Contribution, Below-Average Margins |

Question Marks

Ascom is strategically investing in advanced technologies, particularly augmented intelligence, to fuel its future growth within the healthcare sector. This focus positions them to capitalize on the rapidly expanding AI in healthcare market, which is projected to reach over $100 billion globally by 2028, with AI-powered diagnostics and personalized medicine being key drivers.

While the overall AI in healthcare market is booming, Ascom's specific market share in cutting-edge AI-driven solutions may currently be relatively modest. This suggests that these nascent offerings, while holding significant future potential, likely fall into the 'Question Mark' category of the BCG matrix, necessitating substantial investment to achieve greater market penetration and competitive advantage.

The healthcare sector is increasingly prioritizing proactive and predictive care, positioning clinical surveillance as a significant growth opportunity. Ascom's offerings, designed to facilitate clinical surveillance through medical device integration, tap into this expanding market.

While Ascom's solutions are well-suited for this evolving segment, their current market share in advanced predictive care may be modest. This suggests a need for substantial investment to capitalize on the potential and establish a leading position in this critical healthcare domain.

Ascom's aggressive expansion in previously underperforming regions like the USA and Canada, despite recent management changes and disappointing results, signals a strategic pivot. This move is driven by the recognition of substantial growth potential within these markets for Ascom's healthcare communication and information solutions. The company is likely channeling significant investment to turn around performance and capture a larger slice of the market, aiming to transform these 'question marks' into future stars.

In 2024, Ascom is dedicating considerable resources to these North American markets. While specific investment figures for these regions are not publicly detailed, the company's overall R&D and sales & marketing expenditures reflect a commitment to innovation and market penetration. For instance, Ascom reported a notable increase in its operating expenses in recent periods, a portion of which is undoubtedly allocated to bolstering its presence and product offerings in these key territories. This strategy is crucial as Ascom aims to overcome its current low market share in these high-potential areas.

Early-Stage IoT/IoMT Healthcare Offerings

Early-stage Internet of Medical Things (IoMT) healthcare offerings represent a significant growth opportunity. Ascom's existing portfolio, while touching on connectivity, may not yet feature dedicated, fully developed IoMT solutions or established strategic partnerships in this nascent market. This segment is characterized by high potential but also requires substantial investment for development and market penetration, suggesting Ascom currently holds a low market share.

- Market Growth: The global IoMT market was valued at approximately $72.5 billion in 2023 and is projected to reach over $270 billion by 2030, growing at a CAGR of around 20%.

- Investment Needs: Developing robust, secure, and compliant IoMT solutions demands considerable R&D expenditure, regulatory navigation, and infrastructure build-out.

- Competitive Landscape: While Ascom has a presence in healthcare communication, dedicated early-stage IoMT players are emerging rapidly, indicating a competitive and evolving market.

Ascom Myco 4 (5G Certified) Beyond Core Workflow

The Ascom Myco 4, recognized as the world's first GCF MCS-certified 5G phone, signifies a leap in mobile technology. This device is poised to extend beyond its established workflow roots, targeting emerging, high-growth mobile applications where market penetration is currently limited.

These advanced applications, while possessing substantial future potential, necessitate dedicated market education and a ramp-up in customer adoption to capture significant market share. The 5G certification of the Myco 4 provides a robust platform for these nascent but promising mobile workflow expansions.

- Ascom Myco 4 (5G Certified): A pioneering device in 5G mobile technology.

- Beyond Core Workflow: Focus on new, high-growth mobile applications.

- Market Position: Emerging applications with nascent market adoption.

- Growth Potential: High potential contingent on market education and uptake.

Question Marks in Ascom's portfolio represent areas with high growth potential but currently low market share. These are strategic investments requiring significant capital to develop and gain traction. The success of these ventures is uncertain, but they hold the promise of becoming future Stars or Cash Cows if market penetration is achieved.

Ascom's focus on emerging AI in healthcare solutions and early-stage IoMT offerings exemplifies these Question Marks. The company is actively investing in these segments to build market presence and capitalize on projected market growth, such as the IoMT market expected to exceed $270 billion by 2030.

The aggressive expansion into North American markets, despite current underperformance, also falls into the Question Mark category. Ascom is channeling resources to improve its standing in these high-potential regions, aiming to transform them into profitable ventures.

The advanced applications targeted by the 5G-certified Ascom Myco 4 also represent Question Marks. While the technology is cutting-edge, market adoption for these new uses is still nascent, necessitating investment in market education and development.

| Ascom Business Area | Market Growth Potential | Current Market Share | Strategic Implication | Investment Focus |

|---|---|---|---|---|

| AI in Healthcare Solutions | High (Global market > $100B by 2028) | Low | Potential Star | R&D, Market Penetration |

| Early-Stage IoMT Offerings | High (Global market > $270B by 2030) | Low | Potential Star | Development, Partnerships |

| North American Markets Expansion | High | Low (Historically) | Turnaround Opportunity | Sales & Marketing, Regional Strategy |

| Advanced Myco 4 Applications | High | Nascent | Future Growth Driver | Market Education, Adoption Support |

BCG Matrix Data Sources

Our Ascom BCG Matrix is built on robust data, integrating financial statements, market research, and industry growth forecasts for accurate strategic insights.