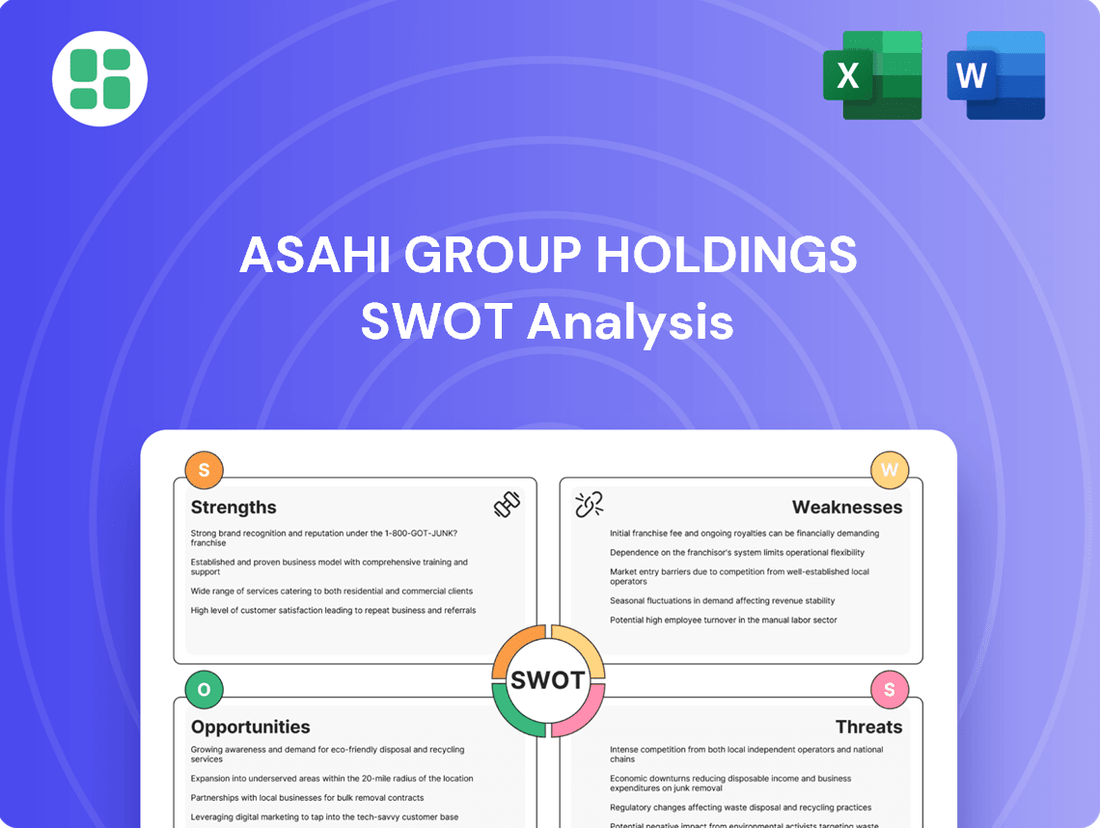

Asahi Group Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Group Holdings Bundle

Asahi Group Holdings boasts strong brand recognition and a diverse product portfolio, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Asahi's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Asahi Group Holdings possesses a robust global brand portfolio, anchored by its flagship Asahi Super Dry. This collection also features highly regarded international names such as Peroni Nastro Azzurro, Pilsner Urquell, and Kozel, all of which are significant drivers of the company's international revenue streams.

The strategic emphasis on premiumizing these established brands strengthens Asahi's market standing and broadens its appeal to a wide array of consumer tastes worldwide. For example, Peroni Nastro Azzurro has seen consistent growth in premium beer segments across key European markets.

Asahi Group Holdings boasts a robust international presence, strategically expanding into vital markets across North America, Europe, and the Asia-Pacific region. This global reach is further solidified by recent acquisitions, such as Octopi Brewing in the United States, which bolsters local production capabilities and deepens market penetration. The company's diversified revenue streams, stemming from this broad international footprint, effectively mitigate risks associated with over-reliance on any single geographic market.

Asahi Group Holdings boasts a robust and diverse product portfolio that extends well beyond its foundational beer segment. This includes a significant presence in soft drinks, various food products, and premium spirits, notably Nikka Whisky. This broad offering helps to cushion the company against fluctuations in any single market segment.

The company is actively pursuing growth in what are termed Beer Adjacent Categories, specifically focusing on low-alcohol and non-alcoholic beverages. This strategic pivot aligns with evolving consumer preferences and market trends, tapping into a rapidly expanding sector. For instance, in 2024, the global non-alcoholic beverage market was projected to reach over $1.3 trillion, with low-alcohol options also showing strong upward momentum.

This diversification is a key strength, effectively mitigating risks tied to potential shifts in alcohol consumption patterns. By expanding into these growing categories, Asahi Group Holdings not only strengthens its market position but also unlocks new and substantial revenue streams, enhancing overall business resilience.

Commitment to Sustainability and ESG

Asahi Group Holdings shows a strong dedication to environmental, social, and governance (ESG) principles, setting ambitious goals like reaching net-zero greenhouse gas emissions by 2040. This commitment is backed by concrete actions, such as aiming for 100% renewable electricity at key production facilities by 2025. The company is also actively investing in sustainable packaging, a move that not only appeals to eco-conscious consumers but also solidifies Asahi's reputation in an increasingly sustainability-focused market.

These ESG initiatives are crucial for Asahi's long-term success. By aligning with global sustainability trends, the company is better positioned to attract investors and customers who prioritize responsible business practices. For instance, the push for renewable energy aligns with the growing demand for green supply chains, a trend that is expected to accelerate through 2025 and beyond.

- Net-Zero Target: Asahi aims for net-zero greenhouse gas emissions by 2040.

- Renewable Energy: The company plans to use 100% renewable electricity in major production sites by 2025.

- Sustainable Packaging: Significant investments are being made in developing and implementing sustainable packaging solutions.

- Brand Enhancement: These efforts are designed to boost brand reputation and attract environmentally aware consumers.

Robust Financial Performance and Strategic Pricing

Asahi Group Holdings has shown impressive financial strength, with consistent revenue and core operating profit growth even amidst economic headwinds. This resilience is largely attributed to their strategic pricing power and a strong emphasis on premium product offerings, which have resonated well with consumers.

The company's financial health is further bolstered by significant strides in improving cash flow and actively reducing its net debt. For instance, as of the first half of 2024, Asahi reported a notable decrease in its net interest-bearing debt, showcasing effective financial stewardship.

- Consistent Revenue Growth: Asahi has maintained upward revenue trends, demonstrating market penetration and demand for its portfolio.

- Enhanced Profitability: Strategic pricing and a focus on higher-margin products have led to improved core operating profit.

- Debt Reduction: Proactive management of its balance sheet has resulted in a lower net debt position, strengthening financial flexibility.

- Investment Capacity: The solid financial footing enables continued investment in brand development and key strategic growth areas.

Asahi Group Holdings benefits from a powerful and globally recognized brand portfolio, headlined by Asahi Super Dry. This includes premium international brands like Peroni Nastro Azzurro and Pilsner Urquell, which are key contributors to its international sales. The company's strategy of elevating these established brands enhances its market position and broadens its consumer appeal worldwide.

The company's financial performance is a notable strength, marked by consistent revenue and operating profit growth, even when facing economic challenges. This resilience stems from its effective pricing strategies and a strong focus on premium products, which have been well-received by consumers. Asahi has also made significant progress in improving its cash flow and reducing its net debt, as evidenced by a notable decrease in net interest-bearing debt in the first half of 2024, demonstrating sound financial management.

Asahi's commitment to ESG principles is a significant advantage, with clear targets for reducing its environmental impact, such as achieving net-zero emissions by 2040 and using 100% renewable electricity at major production sites by 2025. These efforts, combined with investments in sustainable packaging, not only resonate with environmentally conscious consumers but also strengthen Asahi's corporate reputation in a market increasingly focused on sustainability.

| Key Strength | Description | Supporting Data/Example |

| Brand Portfolio | Strong global brands, including premium international offerings. | Asahi Super Dry, Peroni Nastro Azzurro, Pilsner Urquell. |

| Financial Performance | Consistent revenue and profit growth, debt reduction. | Notable decrease in net interest-bearing debt (H1 2024). |

| ESG Commitment | Ambitious environmental targets and sustainable practices. | Net-zero emissions by 2040; 100% renewable electricity by 2025 for key sites. |

What is included in the product

Delivers a strategic overview of Asahi Group Holdings’s internal and external business factors, highlighting its strong brand portfolio and market position alongside potential challenges in diversification and evolving consumer preferences.

Offers a clear, actionable framework to navigate Asahi Group Holdings' market challenges and capitalize on growth opportunities.

Weaknesses

While Asahi Group Holdings has seen global sales growth, its Oceania segment, encompassing Australia and New Zealand, has unfortunately faced declining operating profits. This downturn is largely due to a tougher market environment and higher expenses, impacting the company's bottom line in that specific area.

The primary drivers behind this regional profitability dip include a noticeable decrease in beer sales volumes and a significant increase in the cost of essential raw materials. These factors combined have put pressure on margins, making it harder for Asahi to maintain its profitability in Oceania.

For example, in the first half of 2024, Asahi’s Oceania segment reported a decline in operating profit, a trend that contrasts with the group’s overall positive sales performance. This regional weakness can indeed act as a drag on the consolidated financial results of the entire Asahi Group Holdings.

Asahi Group Holdings' significant reliance on its traditional beer segment presents a notable weakness. Despite diversification efforts, a substantial portion of its revenue, approximately 70% as of the latest available data from fiscal year 2023, is still generated from beer sales.

This dependence exposes Asahi to challenges in mature markets like Japan, where beer consumption has seen a gradual decline, with volumes shrinking by an estimated 1-2% annually over the past few years. Consumer preferences are also evolving, with a growing interest in alternative beverages and a general trend towards healthier lifestyles.

Consequently, Asahi must continually innovate within its core beer offerings and explore new growth avenues to offset potential volume erosion and maintain its competitive edge in these key regions.

Asahi Group Holdings operates in a fiercely competitive global beverage arena, where giants like AB InBev and Heineken, along with major soft drink players, exert significant influence. This intense rivalry, further amplified by the growing consumer preference for craft beers and distinct local brands, presents a constant challenge.

The pressure from these competitors can easily trigger price wars, eroding profit margins and making it considerably more difficult for Asahi to gain or maintain market share. For instance, in 2023, the global beer market saw intense promotional activities from major players, impacting pricing strategies across the board.

Operational Complexity of Diverse Portfolio

Asahi Group Holdings faces significant operational hurdles due to its extensive and varied product range, spanning alcoholic and non-alcoholic beverages, alongside pharmaceuticals, across many global markets. This diversification, while a strength, creates inherent complexity in managing supply chains, distribution networks, and manufacturing processes efficiently. For instance, navigating differing regulatory environments and consumer preferences in markets like Japan, Australia, and Europe demands tailored operational strategies, which can strain resources and increase overhead.

The sheer breadth of Asahi's operations can lead to inefficiencies. Coordinating a vast array of SKUs (Stock Keeping Units) and ensuring timely delivery across different geographies presents ongoing logistical challenges. In 2023, the company continued to invest in supply chain optimization, aiming to mitigate these complexities. However, the inherent nature of such a diverse portfolio means that streamlining these operations remains a constant, critical focus for maintaining profitability and market responsiveness.

Key areas of operational complexity include:

- Supply Chain Management: Coordinating raw material sourcing, production, and distribution for a wide array of products across international borders.

- Logistical Coordination: Managing diverse transportation needs and warehousing for perishable and non-perishable goods in various regulatory landscapes.

- Integration of Acquisitions: Assimilating new businesses and product lines acquired in recent years, such as the significant acquisition of the Australian beer business, adds layers of operational integration challenges.

- Cost Control: Maintaining cost-effectiveness across a broad operational footprint, especially when dealing with diverse production standards and labor costs.

Vulnerability to Economic Downturns

Asahi Group Holdings, like many consumer staples companies, faces a significant vulnerability to economic downturns. Global economic uncertainties and persistent inflationary pressures, as observed in early 2025 financial reports, directly impact consumer purchasing power. This can lead to a noticeable reduction in spending on non-essential goods, such as Asahi's premium beverage offerings, thereby affecting sales volumes and overall profitability. The company must remain agile in its pricing and cost management to navigate these challenging economic periods effectively.

Asahi's significant reliance on its traditional beer segment, accounting for approximately 70% of revenue in fiscal year 2023, makes it vulnerable to shifts in consumer preferences and mature market declines. This dependence is particularly pronounced in Japan, where beer consumption has been steadily decreasing by an estimated 1-2% annually, alongside a growing consumer interest in healthier options and alternative beverages.

The company faces intense competition from global beverage giants like AB InBev and Heineken, as well as a rise in craft beer and local brands, which can lead to price wars and pressure on profit margins. For instance, aggressive promotional activities were noted across the global beer market in 2023, impacting pricing strategies.

Asahi's diverse product portfolio and global operations, spanning beverages and pharmaceuticals across numerous markets, create significant operational complexities. Managing varied supply chains, distribution networks, and differing regulatory environments, as seen in Japan, Australia, and Europe, strains resources and increases overhead costs. In 2023, continued investment in supply chain optimization was necessary to address these inherent complexities.

The company is also susceptible to economic downturns and inflationary pressures, which reduce consumer purchasing power for non-essential premium products. This was evident in early 2025 financial reports, highlighting the need for agile pricing and cost management during challenging economic periods.

Same Document Delivered

Asahi Group Holdings SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global shift towards healthier lifestyles and reduced alcohol intake is a prime opportunity for Asahi's low- and non-alcoholic beverage portfolio. This burgeoning market segment is experiencing robust expansion, enabling Asahi to capitalize on its established brewing and soft drink capabilities to secure greater market penetration.

Asahi is strategically allocating resources to bolster and broaden its offerings in these categories, directly addressing the dynamic preferences of today's consumers. For instance, in 2023, the global market for non-alcoholic beverages was valued at over $1.1 trillion and is projected to grow at a compound annual growth rate of 5.5% through 2030, presenting a substantial runway for Asahi's innovation.

Asahi Group Holdings is actively pursuing expansion in emerging markets, particularly across Africa, Asia, and South America, via strategic mergers and acquisitions. These regions present a significant opportunity for sales growth and market share gains, driven by increasing disposable incomes and expanding populations. For instance, in 2024, many African nations are experiencing robust GDP growth, with projections for continued upward trends, offering fertile ground for beverage consumption.

Asahi Group Holdings has a significant opportunity to boost its financial performance by doubling down on its premium product strategy. This means continuing to develop and promote high-end beers, spirits, and other beverages that appeal to consumers seeking superior quality and unique experiences. For instance, in 2023, the global premium spirits market alone was valued at over $100 billion, indicating a substantial appetite for such offerings.

Strategic Acquisitions and Partnerships

Asahi Group Holdings actively pursues strategic acquisitions and partnerships to fuel growth and expand its market reach. A prime example is its acquisition of Octopi Brewing in the United States, which facilitated a swift entry into the U.S. craft beer market. Furthermore, its distribution agreement with Coca-Cola in Japan significantly bolsters its beverage distribution network.

These strategic moves provide Asahi with:

- Access to new technologies and production facilities, enhancing operational efficiency.

- Established market channels, accelerating penetration into new or existing markets.

- Opportunities to leverage complementary strengths, such as Coca-Cola's extensive distribution in Japan.

- A pathway to diversify its product portfolio and strengthen its competitive position.

Digital Transformation and Innovation

Asahi Group Holdings can capitalize on digital transformation by investing in R&D for innovative product formulations and digital customer engagement. This includes developing health-conscious and plant-based beverages, a growing market segment. For example, the global plant-based food and beverage market was valued at over $29 billion in 2023 and is projected to grow substantially in the coming years, offering Asahi a significant opportunity.

Enhancing online sales channels and leveraging data analytics will be crucial. By improving e-commerce capabilities and understanding consumer behavior through digital platforms, Asahi can offer more personalized product experiences. This digital-first approach can lead to greater operational efficiency and deeper consumer insights, driving sales and brand loyalty.

- Focus on health-conscious and plant-based product innovation.

- Invest in digital platforms to enhance customer experience and sales channels.

- Utilize data analytics for personalized product offerings and deeper consumer insights.

- Drive operational efficiency through digital transformation initiatives.

Asahi's expanding portfolio of low- and non-alcoholic beverages presents a significant growth avenue, aligning with global health trends. The company's strategic investments in emerging markets, particularly in regions like Africa and South America, offer substantial sales and market share expansion opportunities. Furthermore, a continued focus on premium products taps into a lucrative global market segment valued in the billions.

| Opportunity Area | Market Trend/Driver | Asahi's Strategic Response | 2023/2024 Data Point |

|---|---|---|---|

| Low/Non-Alcoholic Beverages | Growing health consciousness | Portfolio expansion and innovation | Global non-alcoholic beverage market > $1.1 trillion (2023) |

| Emerging Markets Expansion | Increasing disposable incomes | Strategic M&A and market penetration | Many African nations projected for continued GDP growth (2024) |

| Premium Product Strategy | Consumer demand for quality/experience | Development and promotion of high-end offerings | Global premium spirits market > $100 billion (2023) |

| Digital Transformation | E-commerce growth, data analytics | Investment in online sales and personalized experiences | Global plant-based food & beverage market > $29 billion (2023) |

Threats

Asahi faces formidable competition in the beverage sector, with global powerhouses and a growing wave of craft and local players vying for market share. This intense rivalry often translates into price wars and escalating marketing costs, squeezing profitability. For instance, in 2023, the global non-alcoholic beverage market was valued at over $1.2 trillion, a highly contested space.

The pressure to innovate and stand out is relentless. Asahi must consistently invest in new product development and effective branding to maintain its position against competitors who are also rapidly expanding their portfolios and marketing reach, particularly in emerging markets where growth is most dynamic.

A significant global trend towards healthier lifestyles, including reduced alcohol consumption and a rise in demand for low-sugar or natural products, directly threatens Asahi's core alcoholic beverage sales. This shift necessitates continuous adaptation of their product offerings to match evolving consumer tastes, preventing potential market share decline.

Asahi Group Holdings faces a significant threat from escalating raw material, energy, and logistics expenses. These rising input costs directly squeeze profit margins, as evidenced by several of their recent financial reports indicating increased cost of goods sold in certain markets. For instance, in the first half of 2024, the beverage industry globally experienced an average increase of 5-7% in key ingredient costs, impacting companies like Asahi.

Furthermore, the increasing cost of labor across various operational segments presents another challenge. Effectively managing these upward cost pressures through optimized procurement strategies and judicious price adjustments will be paramount for Asahi to sustain its profitability in the coming periods.

Regulatory Changes and Excise Taxes

Asahi Group Holdings operates in a highly regulated industry where shifts in government policies can significantly impact its business. For instance, changes in excise taxes on alcoholic beverages, as seen in various markets, can directly affect pricing and consumer demand, potentially reducing sales volumes and profitability. In 2023, Japan, a key market for Asahi, saw discussions around tax reforms that could influence the pricing of certain alcoholic products.

Furthermore, evolving advertising restrictions and new health-related regulations, such as those concerning alcohol consumption or labeling, pose another threat. Stricter rules in markets like Australia or Europe can limit marketing strategies and increase compliance costs. Navigating these diverse and often changing regulatory landscapes across its global operations adds considerable complexity and expense for Asahi.

- Increased excise taxes in key markets like Japan or Australia could directly reduce Asahi's net sales and profit margins on affected products.

- Stricter advertising and marketing regulations in regions such as the EU or North America might limit Asahi's ability to reach consumers and build brand loyalty.

- New health regulations, like mandatory calorie labeling or restrictions on alcohol content, could necessitate product reformulation or packaging changes, incurring additional costs.

- Compliance costs associated with adhering to varying regulations across numerous countries represent a significant operational challenge and expense.

Global Economic Instability and Geopolitical Risks

Macroeconomic uncertainties, including persistent inflationary pressures observed throughout 2024 and projected into 2025, can significantly erode consumer purchasing power. This, coupled with ongoing geopolitical tensions, creates a volatile operating environment for Asahi Group Holdings.

These global instabilities directly threaten to disrupt Asahi's intricate global supply chains, leading to increased operational costs and potential product shortages. Furthermore, heightened geopolitical risks can stifle international trade agreements and deter foreign investment, impacting Asahi's expansion strategies and overall financial performance.

The resulting volatility in currency exchange rates, particularly impacting major markets where Asahi operates, can negatively affect reported earnings and the cost of imported raw materials. Reduced consumer spending, a direct consequence of economic uncertainty and inflation, poses a substantial risk to Asahi's revenue streams across its diverse beverage and food segments.

- Inflationary pressures: Global inflation rates remained elevated in many regions through 2024, with projections suggesting continued, albeit potentially moderating, price increases into 2025, impacting consumer budgets.

- Supply chain disruptions: Geopolitical events in 2024 continued to cause bottlenecks and increased shipping costs, affecting the timely delivery of ingredients and finished goods for multinational corporations like Asahi.

- Currency volatility: Major currency pairs experienced significant fluctuations in 2024, presenting challenges for companies with international sales and sourcing, such as Asahi's operations across Asia, Europe, and North America.

Asahi faces intense competition from global beverage giants and a surge of local craft brands, leading to price wars and increased marketing expenditure. The global non-alcoholic beverage market, valued at over $1.2 trillion in 2023, exemplifies this highly contested landscape, forcing Asahi to continuously innovate and invest in new products to maintain market share.

Shifting consumer preferences towards healthier options, including reduced alcohol intake and demand for low-sugar products, pose a direct threat to Asahi's core alcoholic beverage business. Adapting its product portfolio to align with these evolving tastes is crucial to prevent market share erosion.

Rising costs for raw materials, energy, and logistics are squeezing Asahi's profit margins, as seen in increased cost of goods sold reports. For instance, key ingredient costs in the beverage industry saw an average increase of 5-7% globally in the first half of 2024, impacting companies like Asahi.

Government regulations, such as increased excise taxes on alcoholic beverages and stricter advertising rules, can directly impact sales volumes and profitability. Changes in Japan's tax policies in 2023, for example, could influence pricing and demand for Asahi's products.

Macroeconomic instability, characterized by persistent inflation in 2024 and 2025, alongside geopolitical tensions, disrupts supply chains and reduces consumer spending power. Currency volatility also affects Asahi's international earnings and import costs.

| Threat Category | Specific Impact on Asahi | 2024/2025 Data Point |

| Competition | Price wars, increased marketing costs | Global non-alcoholic beverage market valued >$1.2 trillion (2023) |

| Consumer Trends | Decline in traditional alcoholic beverage sales | Growing demand for low-alcohol and non-alcoholic options globally |

| Cost Inflation | Reduced profit margins due to higher input costs | 5-7% average increase in key beverage ingredient costs (H1 2024) |

| Regulatory Changes | Impact on pricing, sales, and marketing strategies | Discussions on tax reforms affecting alcoholic beverages in Japan (2023) |

| Macroeconomic Instability | Supply chain disruptions, reduced consumer spending, currency volatility | Elevated inflation rates persisting through 2024, impacting purchasing power |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Asahi Group Holdings' official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded strategic overview.