Asahi Group Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Group Holdings Bundle

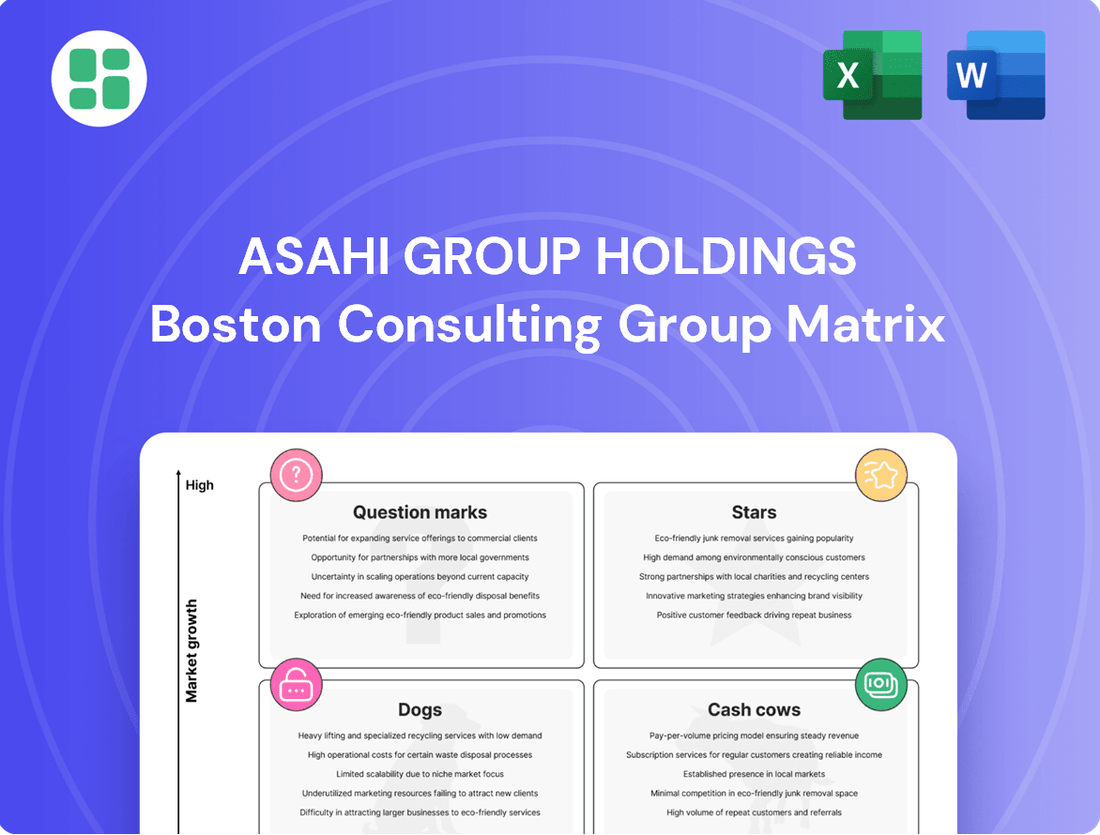

Curious about Asahi Group Holdings' strategic product positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up—identifying potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed investment decisions and optimize your strategy for Asahi's future success.

Stars

Asahi Super Dry is a cornerstone of Asahi Group Holdings' international strategy, demonstrating robust growth in key global markets. Its international sales volume saw a significant +14% year-on-year increase in Q3 2024, and a remarkable +27% year-on-year rise outside Japan in the first half of 2024, underscoring its strong performance in expanding regions like Asia, Europe, South Korea, and the UK.

Strategic marketing initiatives, including its sponsorship of the Rugby World Cup, have been instrumental in elevating Asahi Super Dry's global brand recognition and driving sales momentum. These efforts contribute to its position as a star product within the company's portfolio, capitalizing on growing consumer demand and market penetration.

Asahi's premium beer category in Europe is a significant growth engine, bolstered by a strategic focus on premiumization. This segment experienced robust performance, with premium and non-alcohol beer offerings driving increased profits and higher average selling prices.

The company is actively investing in expanding its premium beer footprint across Europe. This expansion is supported by consistent demand for premium products and successful price adjustments, which have contributed to the category's strong financial results.

The non-alcohol and low-alcohol beverage category is a key growth area for Asahi Group Holdings, with a stated ambition to achieve 50% of its beverage sales from these products by 2040. This strategic focus is supported by global rollouts of brands such as Peroni Nastro Azzurro 0.0% and Asahi Super Dry 0.0%, utilizing advanced technologies to replicate authentic beer flavors.

This segment is experiencing robust expansion, fueled by a growing consumer preference for healthier options and the potential for higher profit margins compared to traditional soft drinks. Asahi's investment in this area reflects a forward-looking approach to market trends and evolving consumer demands.

Ready-to-Drink (RTD) Alcohol Beverages

Asahi Group Holdings is making substantial investments in the Ready-to-Drink (RTD) alcohol beverage sector, especially within its home market of Japan. This strategic focus is driven by the category's robust growth trajectory and the success of Asahi's innovative offerings, such as Mirai no Lemon Sour, which are enhancing brand appeal and profitability.

The company identifies Beer Adjacent Categories (BAC), which prominently feature RTDs, as a critical pillar of its future growth strategy. This segment is demonstrating impressive momentum, with Asahi reporting a +12% year-on-year increase in overall BAC sales volume during the first quarter of 2025.

- Strategic Investment in RTDs: Asahi is actively channeling resources into the RTD alcohol beverage market, recognizing its significant growth potential, particularly in Japan.

- Product Innovation Driving Earnings: The introduction of differentiated products like Mirai no Lemon Sour is contributing to higher earnings and strengthening Asahi's market position.

- BAC as a Growth Engine: Asahi views Beer Adjacent Categories, including RTDs, as a key driver for future expansion, highlighting the category's strategic importance.

- Strong Volume Growth: In Q1 2025, Asahi's total BAC sales volume experienced a healthy +12% growth compared to the same period in the previous year, underscoring the category's dynamism.

Other Global Brands (e.g., Peroni Nastro Azzurro, Kozel)

Asahi Group Holdings strategically leverages brands like Peroni Nastro Azzurro and Kozel to build its international premium portfolio, complementing the flagship Asahi Super Dry.

Peroni Nastro Azzurro demonstrated robust performance, achieving a 3% sales volume increase in the first quarter of 2025. This growth was significantly bolstered by its global collaboration with Scuderia Ferrari HP, enhancing its premium market presence.

While these brands may not exhibit the same hyper-growth as Super Dry, their expansion is a key component of Asahi's global strategy, focusing on cultivating and growing premium segments across various international markets.

- Brand Expansion: Peroni Nastro Azzurro and Kozel are integral to Asahi's international growth strategy for high-value brands.

- Sales Performance: Peroni Nastro Azzurro recorded a 3% sales volume increase in Q1 2025.

- Strategic Partnerships: Global collaborations, such as Peroni's with Scuderia Ferrari HP, drive brand visibility and premium positioning.

- Market Focus: These brands are actively developed within growing premium segments worldwide, contributing to Asahi's diversified global offering.

Asahi Super Dry is a clear star in Asahi Group Holdings' portfolio, showing impressive international growth. Its sales volume outside Japan rose by a significant 27% year-on-year in the first half of 2024, highlighting its strong performance in key markets like Asia and Europe.

The brand's global recognition has been boosted by strategic marketing, including its Rugby World Cup sponsorship, further solidifying its star status. This upward trajectory is expected to continue as Asahi focuses on expanding its premium beer offerings and leveraging successful price adjustments.

| Product | Category | Growth Driver | Key Metric | Status |

|---|---|---|---|---|

| Asahi Super Dry | Beer | International Expansion, Sponsorships | +27% YoY International Sales (H1 2024) | Star |

| Peroni Nastro Azzurro | Premium Beer | Global Partnerships, Premiumization | +3% Sales Volume (Q1 2025) | Star/Cash Cow |

| Mirai no Lemon Sour | RTD | Product Innovation | +12% YoY BAC Sales Volume (Q1 2025) | Star |

| Kozel | Beer | International Premium Portfolio | Market Penetration | Star/Cash Cow |

What is included in the product

Asahi Group Holdings' BCG Matrix offers a strategic overview of its business units, highlighting which to invest in, hold, or divest based on market growth and share.

The Asahi Group Holdings BCG Matrix provides a clear, one-page overview, relieving the pain of scattered business unit performance data.

Cash Cows

Asahi Super Dry continues to dominate the Japanese beer market, holding its position as the nation's best-selling beer. This iconic brand is a cornerstone of Asahi Group Holdings, generating substantial revenue and profit for the company. Its impressive market share, hovering around 38% of the Japanese beer sector, guarantees a steady stream of cash for the group.

Despite the maturity of the domestic beer market, Asahi Super Dry's profitability remains robust. Recent tax revisions in Japan have favorably shifted consumer demand back towards the beer category, further bolstering sales. Coupled with strategic pricing initiatives, these factors ensure Asahi Super Dry remains a reliable cash cow for Asahi Group Holdings.

Asahi Group Holdings' established Japanese soft drinks portfolio, featuring iconic brands like Mitsuya, Wilkinson, Calpis, Wonda, and Juroku-cha, represents a classic Cash Cow. These brands command a substantial share in Japan's mature yet stable beverage market.

The consistent and reliable cash flow generated by these long-standing products requires minimal promotional investment, thanks to their deeply entrenched consumer loyalty. In 2023, Asahi's domestic soft drink business, a significant portion of which comprises these established brands, continued to be a bedrock of the company's profitability, contributing steadily to overall earnings.

The Japanese domestic beer-type beverage market, excluding premium and non-alcoholic options, is a mature segment where Asahi Group Holdings holds a commanding presence. Despite a general downward trend in overall beer consumption in Japan, Asahi's significant market share, bolstered by effective pricing strategies, consistently generates stable cash flow for the company.

In 2023, Asahi Group Holdings reported net sales of ¥2,489.9 billion, with its Japanese segment contributing substantially to this figure. The company's ability to maintain profitability within this mature market is partly attributed to its successful push for premiumization, encouraging consumers to opt for higher-value products within the beer category.

Select Food Products (e.g., Mintia, Amano Foods)

Asahi Group Holdings' food segment, featuring brands like Mintia and Amano Foods, represents a significant Cash Cow. These products consistently generate stable revenue, reflecting their strong market positions.

- Mintia's robust growth: Mintia mints experienced a notable 23% sales increase in 2023, with projections indicating continued expansion through 2024.

- Amano Foods' steady contribution: Amano Foods, particularly its popular miso soup, provides reliable income streams within its mature market.

- Low investment requirement: These established food brands operate in saturated markets, necessitating minimal new investment to maintain their cash-generating capabilities.

- Mature market stability: The mature nature of the markets for these products ensures consistent and predictable cash flow for Asahi Group Holdings.

Traditional Spirits and Wine in Japan

Asahi Group Holdings' traditional spirits and wine segment in Japan operates as a cash cow. While not experiencing rapid growth, these categories benefit from a stable, loyal customer base within a mature market. This stability ensures consistent profitability, allowing Asahi to leverage these established brands for reliable cash generation.

The segment contributes significantly to Asahi's diversified revenue. For instance, in 2024, the Japanese alcoholic beverage market, including traditional spirits and wine, maintained a steady demand. This consistent performance means these products require minimal reinvestment for expansion, freeing up capital for other strategic initiatives within the group.

- Stable Demand: The Japanese market for traditional spirits like shochu and sake, as well as domestic wines, exhibits predictable consumer behavior.

- Mature Market Dynamics: Growth in these segments is typically incremental, driven by brand loyalty rather than disruptive innovation.

- Profit Generation: These established products consistently generate profits with lower marketing and development costs compared to high-growth categories.

- Diversified Revenue: The segment provides a reliable income stream that complements Asahi's other business units.

Asahi Group Holdings' portfolio of established Japanese alcoholic beverages, encompassing traditional spirits and wines, functions as a classic cash cow. These offerings benefit from a loyal consumer base and operate within a mature market, ensuring consistent profitability with minimal need for significant reinvestment. This segment, including brands like Nikka Whisky and various domestic wines, provides a stable and predictable revenue stream that underpins the company's overall financial health.

| Category | Market Position | Contribution to Asahi Group | Key Characteristics |

|---|---|---|---|

| Japanese Spirits (e.g., Nikka Whisky) | Strong, established presence | Consistent, reliable revenue generation | Mature market, high brand loyalty, low growth potential |

| Japanese Wines | Steady demand | Stable income stream | Mature market, reliance on brand reputation, predictable sales |

What You’re Viewing Is Included

Asahi Group Holdings BCG Matrix

The Asahi Group Holdings BCG Matrix preview you are viewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use document for your business planning.

Dogs

In Oceania, specifically Australia and New Zealand, Asahi Group Holdings faces a tough market. Declining sales volumes and profits have been a persistent issue for their alcoholic beverages. While price adjustments have boosted revenue, higher operating costs and reduced beer sales have eaten into overall profitability, falling short of projections.

Within this challenging landscape, certain local brands in Oceania are identified as Dogs. These brands possess a low market share and are struggling to gain traction against stronger competitors, making them candidates for divestment or significant strategic review.

Some of Asahi Group Holdings' older or traditional products might be struggling as consumer tastes shift towards healthier, more premium, or sustainable options. These offerings, which haven't kept pace with market changes, could see their market share shrink and growth stagnate.

Products in this category likely produce very little cash and consume valuable resources, making them prime candidates for either being sold off or undergoing a major strategic review. While not explicitly identified, this segment would encompass products that do not fit with Asahi's broader strategy to focus on premium and health-aware products.

Niche or unsuccessful acquisitions within Asahi Group Holdings' portfolio would be categorized as Dogs in the BCG Matrix. These are typically smaller brands or ventures that Asahi has acquired but which have struggled to gain significant market traction or achieve their projected growth. For instance, if Asahi acquired a niche craft brewery in a saturated market that failed to capture a meaningful share, it would likely be a Dog.

These acquisitions often find themselves with a low market share in markets that are either growing very slowly or are intensely competitive. They consume valuable resources and management attention without a clear or achievable path to profitability or market leadership. Asahi Group Holdings has been active in mergers and acquisitions, and it's a common occurrence for some of these smaller integrations to not meet initial expectations, placing them in the Dog quadrant.

Products in Highly Saturated or Declining Niche Markets

Within Asahi Group Holdings' vast beverage and food offerings, certain products might be found in highly specific, saturated niches where market expansion is either nonexistent or shrinking. In these areas, Asahi may hold a comparatively small market share.

These underperforming products typically hover around the break-even point, yielding negligible profits and presenting minimal prospects for future growth. Their continued existence incurs operational expenses without generating substantial returns, marking them as potential candidates for divestment or discontinuation.

- Market Saturation: For example, a specific flavored water brand might be in a segment where numerous competitors offer similar products, leading to price pressures and limited consumer demand for new entrants or existing players with small market shares.

- Stagnant Growth: In 2024, the global market for certain traditional carbonated soft drinks, a category Asahi participates in, saw growth rates of less than 1%, indicating a mature and largely stagnant demand.

- Low Profitability: Products in these niches often struggle to achieve economies of scale, resulting in thinner profit margins. For instance, a niche regional beer might have production costs that outweigh its sales volume, leading to minimal profit contribution to the overall group.

- Rationalization Potential: Asahi's strategy often involves portfolio optimization. Products that consistently fail to gain traction in saturated markets, like a specific type of canned coffee that hasn't resonated with younger demographics in a competitive landscape, become prime candidates for review and potential exit to reallocate resources to more promising ventures.

Inefficient or Obsolete Production Lines/Brands

Inefficient or obsolete production lines and brands can become a significant drag on a company like Asahi Group Holdings. These are products that might be using outdated manufacturing techniques or are entangled in inefficient supply chains. Consequently, they often come with higher operating costs and struggle to achieve healthy profit margins.

If Asahi cannot find ways to modernize these legacy operations or integrate them into more streamlined processes, these brands could end up consuming valuable resources without delivering substantial returns or contributing to the company's overarching strategic objectives. For instance, a brand with declining sales and high production costs might simply be a drain on cash flow.

Asahi's ongoing restructuring initiatives, which have been a focus in recent years, highlight the company's commitment to boosting overall efficiency. This strategic push implies that some older business segments or product lines may indeed be less optimized compared to newer, more agile ventures. In 2023, Asahi's focus on streamlining its portfolio was evident in its divestment of certain non-core assets to improve profitability and operational focus.

- Legacy Brands: Products with outdated manufacturing processes leading to high operational costs.

- Supply Chain Inefficiencies: Brands tied to non-optimized logistics and distribution networks.

- Resource Drain: Brands that consume capital without generating significant profits or strategic value.

- Restructuring Impact: Asahi's efforts to improve efficiency may lead to the phasing out of underperforming legacy operations.

Dogs within Asahi Group Holdings' portfolio represent brands or products with low market share in slow-growing or declining markets. These often include niche offerings or those that haven't adapted to evolving consumer preferences, such as certain traditional soft drinks or less popular acquired brands. In 2024, the global market for some mature beverage categories showed minimal growth, less than 1%, underscoring the challenges faced by such products.

These underperformers typically generate minimal profits and consume resources without a clear path to significant growth or market leadership. For example, a niche regional beer might have production costs that exceed its sales volume, contributing little to overall profitability. Asahi's strategic focus on premium and health-conscious products means these Dogs are prime candidates for divestment or discontinuation to reallocate capital.

The company's ongoing restructuring and portfolio optimization efforts, including asset divestments seen in 2023, signal a commitment to shedding less efficient segments. Brands tied to legacy operations with high production costs or supply chain inefficiencies are particularly vulnerable. These products often represent a resource drain, necessitating a critical review to enhance overall group performance.

Question Marks

Asahi Super Dry in the US is positioned as a question mark in the BCG matrix. While the US represents the largest and only growing developed beer market by population, North America currently contributes a mere 6% to Super Dry's international sales, highlighting a low market penetration.

The acquisition of Octopi Brewing in Wisconsin in early 2024 signifies Asahi's strategic intent to bolster local production and drive Super Dry's growth in the US. This move necessitates substantial investment to cultivate brand awareness and market share.

The US market offers high growth potential for Asahi Super Dry, yet the immediate returns on investment remain uncertain, characteristic of a question mark in the BCG framework. Asahi is investing heavily to establish a stronger foothold.

Asahi Group Holdings is channeling significant resources into new functional and health-conscious beverages, with a planned ¥30 billion investment in research and development. This strategic move aims to capitalize on the burgeoning consumer demand for wellness-oriented options, including plant-based and low-calorie choices. The company launched 15 new products in this category during 2023, signaling a strong commitment to innovation in a high-growth market.

While these new offerings are positioned in a market experiencing robust growth due to prevailing wellness trends, Asahi's current market share within this segment is relatively low. These products represent newer ventures for the company, meaning they are still in the early stages of building brand recognition and consumer loyalty. Their trajectory towards becoming Stars in the BCG matrix is contingent upon achieving rapid market adoption and substantial marketing support.

Asahi's late 2024 launch of its Sustainability Growth Platform underscores a strategic push into innovation, actively seeking startup collaborations for new impact business models and sustainable product design. This initiative targets a high-growth, future-oriented market, reflecting Asahi's ambition to pioneer in this space.

While Asahi's direct market share in these emerging sustainable business models is currently minimal, the company's investment signifies a commitment to building future capabilities. These ventures, though requiring significant capital outlay and carrying inherent risks, hold the promise of substantial long-term returns and the potential to disrupt established markets.

Expansion into Emerging Markets (Africa, South America)

Asahi Group Holdings is strategically targeting emerging markets in Africa and South America for expansion, viewing them as crucial growth engines. These regions present significant opportunities driven by rising disposable incomes and expanding consumer bases. For instance, Sub-Saharan Africa's beverage market is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2028, according to recent industry analyses.

The company's approach involves actively seeking merger and acquisition (M&A) opportunities to gain a foothold. While the potential is high, Asahi's current market share in many of these diverse sub-regions is likely minimal. This necessitates considerable investment and tailored strategies to build brand presence and effectively compete against established local and international players.

- High Growth Potential: Emerging markets in Africa and South America offer expanding middle classes and increasing consumer spending on beverages.

- M&A Strategy: Asahi is pursuing acquisitions to accelerate entry and market penetration in these regions.

- Low Initial Market Share: Significant investment and strategic effort are required to establish a competitive presence.

- Economic Indicators: For example, the African beverage market is expected to see robust growth, with specific countries like Nigeria and Ethiopia showing particularly strong consumer demand trends.

Advanced Non-Alcohol Beer Development Technologies

Asahi Group Holdings is actively developing advanced non-alcohol beer technologies, aiming to replicate the authentic taste and mouthfeel of traditional beer. This strategic investment targets a rapidly expanding market where technological innovation can create significant competitive advantages.

These cutting-edge R&D efforts, while costly, position Asahi to capture a substantial share of the high-growth non-alcoholic beverage sector. The company's commitment to proprietary flavor replication technologies is a key differentiator.

Asahi's non-alcohol beer segment has already demonstrated robust growth, with global sales of low- and no-alcohol beers projected to reach $17.8 billion by 2027, according to Statista. This underscores the market potential for their advanced development initiatives.

- Flavor Replication: Focus on advanced brewing and fermentation techniques that minimize alcohol while maximizing traditional beer characteristics.

- Ingredient Innovation: Development of novel ingredients and processes to achieve authentic taste profiles without alcohol.

- Market Penetration: Leveraging proprietary technology to gain a leading position in the burgeoning non-alcoholic beer market.

- Investment Rationale: High R&D costs are justified by the potential for significant market share and premium pricing in a growing segment.

Asahi Super Dry's presence in the US market, despite its status as the largest developed beer market, currently represents a low market share for the brand. The company's acquisition of Octopi Brewing in early 2024 signals a strategic investment aimed at boosting local production and increasing brand penetration. This initiative requires substantial capital to build brand recognition and gain market share in a competitive landscape.

The company's investment in new functional and health-conscious beverages, with ¥30 billion allocated to R&D, targets a high-growth sector. While Asahi launched 15 new products in this category in 2023, its market share remains relatively low, necessitating significant marketing support and rapid consumer adoption to transition these offerings into Stars.

Asahi's strategic push into emerging markets in Africa and South America, driven by rising disposable incomes, presents significant growth opportunities. The Sub-Saharan African beverage market is projected to grow at over 5% CAGR through 2028. However, Asahi's current market share in these regions is minimal, requiring considerable investment and tailored strategies to compete effectively.

| Business Unit/Product Category | Market Growth Rate | Relative Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Asahi Super Dry (US Market) | High | Low | Question Mark | Increase market penetration through local production and brand building. |

| Functional & Health Beverages | High | Low | Question Mark | Drive innovation and market adoption through R&D and marketing. |

| Emerging Markets (Africa & South America) | High | Low | Question Mark | Expand presence via M&A and tailored market strategies. |

| Non-Alcoholic Beer Technology | High | Growing | Potential Star / Question Mark | Leverage proprietary technology to capture market share in a growing segment. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Asahi Group Holdings' financial data, industry research, and official reports to ensure reliable insights.