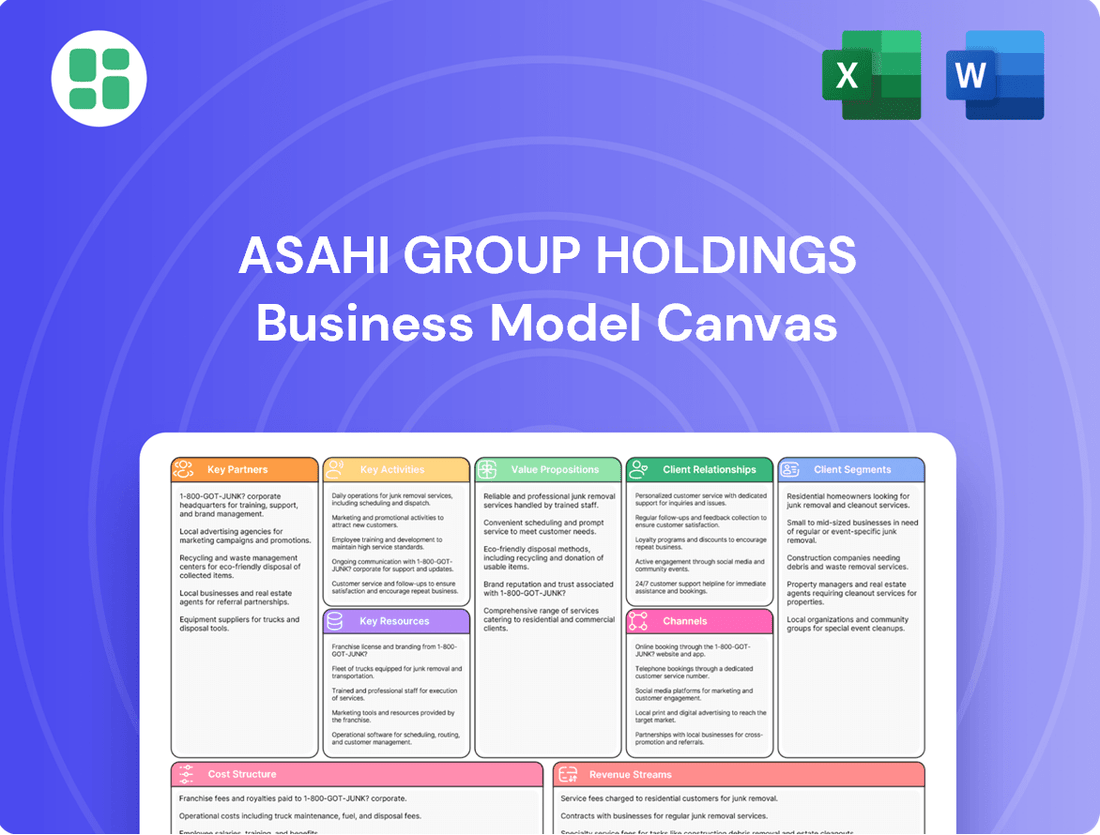

Asahi Group Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Group Holdings Bundle

Unlock the strategic blueprint behind Asahi Group Holdings's diverse business. This comprehensive Business Model Canvas reveals how they leverage their brand, distribution, and innovation to dominate the beverage and food industries. Discover their customer relationships, revenue streams, and key resources.

Ready to dissect Asahi Group Holdings's winning formula? Our full Business Model Canvas provides a detailed, actionable breakdown of their value proposition, key activities, and cost structure. Download it now to gain critical insights for your own strategic planning.

Partnerships

Asahi Group Holdings cultivates strong ties with its raw material suppliers, including those providing hops, barley, and other vital ingredients for its extensive beverage and food portfolio. These partnerships are fundamental to ensuring the consistent quality and reliability of its supply chain, a critical factor for its large-scale manufacturing operations.

The company also collaborates with agricultural partners and providers of packaging materials, aiming to meet ambitious sustainability targets. For instance, Asahi is committed to achieving 100% sustainable packaging by 2025, underscoring the strategic importance of these supplier relationships in achieving its environmental objectives.

Asahi Group Holdings relies heavily on a robust network of distribution and logistics partners to ensure its diverse beverage and food products reach consumers across more than 50 countries. These collaborations are fundamental to their global reach, facilitating efficient warehousing and timely delivery to a wide array of sales channels, from major retail chains to local restaurants and bars.

In 2024, the beverage industry, in particular, saw continued emphasis on supply chain resilience and speed-to-market. Asahi's strategic partnerships in this area are crucial for navigating complex international shipping regulations and maintaining product freshness, directly impacting their ability to meet fluctuating consumer demand and capitalize on market opportunities worldwide.

Asahi Group Holdings cultivates vital partnerships with a wide array of retailers, including supermarkets and convenience stores, alongside on-premise channels like hotels, restaurants, and bars (HORECA). These collaborations are absolutely crucial for securing prominent product placement and ensuring visibility, offering direct pathways to consumers across both Japan and international markets.

These strategic alliances are the backbone of Asahi's sales volume and market share growth for its extensive product range, which prominently features its flagship Asahi Super Dry beer. For instance, in 2023, Asahi Beverages Australia reported strong growth, partly attributed to its robust distribution network within the Australian retail and hospitality sectors.

Technology and Innovation Partners

Asahi Group Holdings actively partners with technology firms and emerging startups to fuel innovation across its operations. This includes advancements in sustainable packaging solutions, optimizing production efficiency, and pioneering new product development. For instance, its Sustainability Growth Platform, initiated in November 2024, actively seeks external collaborators to develop novel environmental solutions and achieve net-zero targets.

These strategic alliances significantly bolster Asahi's research and development capabilities. They are crucial in supporting the company's dedication to promoting healthier lifestyles and demonstrating strong environmental stewardship. Such collaborations are key to staying ahead in a rapidly evolving market.

- Technology Partnerships: Collaborations with tech companies for R&D, focusing on sustainable packaging and production efficiency.

- Startup Engagement: Working with startups to drive innovation in new product development and environmental solutions.

- Sustainability Growth Platform: Launched in November 2024, this initiative invites external partners to co-create net-zero solutions.

- R&D Enhancement: These partnerships directly improve Asahi's innovation pipeline and support its commitment to sustainability.

Joint Ventures and Strategic Alliances

Asahi Group Holdings actively engages in joint ventures and strategic alliances to broaden its reach and product offerings in targeted markets and beverage categories. For instance, in 2024, Asahi continued to explore and solidify partnerships to navigate the nuanced landscape of local consumer preferences and regulatory environments, particularly in emerging markets.

These collaborations are instrumental in accessing new customer bases and bolstering Asahi's competitive edge by pooling resources and specialized knowledge. This approach proved particularly effective in 2024 as Asahi focused on expanding its premium beer portfolio and entering new geographic territories, leveraging the local market insights of its partners.

- Market Expansion: Asahi's joint ventures, such as those in Southeast Asia, have facilitated entry into rapidly growing beverage markets, allowing them to tap into local distribution networks.

- Product Diversification: Strategic alliances enable Asahi to introduce or co-develop products that cater to specific regional tastes, complementing their existing global brands.

- Resource Optimization: By sharing the costs and risks associated with market entry and product development, these partnerships enhance capital efficiency and accelerate growth.

- Competitive Advantage: Access to partners' established brands, distribution channels, and consumer insights in 2024 provided Asahi with a significant advantage over competitors operating independently.

Asahi Group Holdings actively collaborates with technology firms and startups to drive innovation, particularly in areas like sustainable packaging and production efficiency. Its Sustainability Growth Platform, launched in November 2024, actively seeks external partners to co-create net-zero solutions, underscoring a commitment to environmental stewardship and R&D enhancement.

What is included in the product

This Business Model Canvas provides a comprehensive overview of Asahi Group Holdings' strategy, detailing their customer segments, value propositions, and key activities across their diverse beverage and food businesses.

It offers a structured analysis of their revenue streams, cost structure, and competitive advantages, making it ideal for strategic planning and stakeholder communication.

Asahi Group Holdings' Business Model Canvas offers a pain point reliever by condensing complex strategies into a digestible format for quick review.

It saves hours of formatting and structuring, making it ideal for comparing multiple companies or models side-by-side.

Activities

Asahi Group Holdings' manufacturing and production is a cornerstone of its operations, focusing on the large-scale creation of alcoholic beverages, soft drinks, and food products. This involves intricate processes like brewing beer, crafting a diverse range of non-alcoholic drinks, and expertly processing various food items. Adherence to rigorous quality control is paramount across all its global facilities to ensure product excellence.

In 2024, Asahi continued to emphasize operational efficiency in its production lines. The company operates numerous breweries and bottling plants worldwide, with significant investments directed towards modernizing equipment and optimizing supply chains to meet escalating consumer demand. For instance, their commitment to advanced brewing technology aims to enhance both the quality and volume of their flagship beer products.

Asahi Group Holdings places significant emphasis on Research and Development (R&D) and Innovation as a core activity. This involves continuous investment to create novel products, enhance current offerings, and pioneer advancements in categories such as low-alcohol and alcohol-free beverages, plant-based alternatives, and environmentally friendly packaging solutions.

For 2024, Asahi earmarked an investment of ¥30 billion for R&D, underscoring its commitment to leading the beverage sector with forward-thinking products. This strategic focus on innovation is crucial for the company to effectively respond to shifting consumer preferences and to sustain its competitive advantage in the dynamic market.

Asahi Group Holdings invests heavily in marketing and branding, focusing on global flagship brands like Asahi Super Dry. Their strategy includes significant advertising spend and high-profile sponsorships, such as their involvement with the Rugby World Cup, to cultivate a premium image and boost global recognition.

These initiatives are designed to elevate brand value and drive premiumization, which is key to capturing a larger share of diverse global markets. For instance, Asahi Super Dry's sales in Japan reached approximately ¥300 billion in 2023, showcasing the effectiveness of their branding efforts in a core market.

Supply Chain Management and Logistics

Asahi Group Holdings actively manages a complex global supply chain, encompassing everything from sourcing raw materials like barley and hops to delivering finished beverages to consumers worldwide. This vital activity includes strategic procurement, meticulous inventory management, and the continuous optimization of logistics to ensure operational efficiency, cost control, and punctual product availability. The company's commitment to this area is underscored by the establishment of Asahi Global Procurement Pte. Ltd. (AGPRO) in January 2024, signaling a strategic move to integrate and streamline its global procurement operations.

Key activities within Asahi's supply chain management and logistics include:

- Global Sourcing and Procurement: Securing high-quality raw materials from diverse international suppliers, with AGPRO playing a central role in consolidating and optimizing these efforts.

- Inventory Optimization: Implementing sophisticated inventory management systems to balance stock levels, minimize waste, and ensure product availability across its vast distribution network.

- Logistics and Distribution Network Management: Efficiently managing transportation, warehousing, and last-mile delivery to meet consumer demand and maintain product freshness and quality.

- Supplier Relationship Management: Building and maintaining strong relationships with key suppliers to ensure consistent supply, quality, and competitive pricing, crucial for cost-effective operations.

Sales and Distribution

Asahi Group Holdings actively engages in direct sales initiatives and meticulously manages its vast distribution networks to ensure its products reach consumers globally. This encompasses robust sales force management and nurturing strong relationships with channel partners, all aimed at optimizing product availability across diverse retail and on-premise establishments.

In 2024, Asahi's sales and distribution efforts are critical for driving revenue and expanding market share. For instance, the company's focus on direct-to-consumer channels and enhancing its wholesale partnerships continues to be a cornerstone of its growth strategy.

- Sales Force Management: Asahi invests in training and empowering its sales teams to effectively promote and sell its beverage and food products.

- Distribution Network Optimization: The company continuously refines its logistics and supply chain to ensure timely and efficient delivery to all sales points.

- Channel Partner Relationships: Asahi cultivates strong partnerships with retailers, distributors, and hospitality venues to maximize product visibility and accessibility.

- Market Penetration: Effective sales and distribution are key to Asahi's success in both mature markets and its strategic expansion into emerging economies.

Asahi Group Holdings' key activities center around its robust manufacturing and production capabilities, focusing on creating a diverse portfolio of alcoholic and non-alcoholic beverages, alongside food products. This is supported by significant investments in research and development to drive innovation in product creation and packaging. The company also places a strong emphasis on marketing and branding to elevate its global flagship brands and expand market reach.

These core activities are underpinned by a sophisticated global supply chain management system, ensuring efficient sourcing of raw materials and timely delivery of finished goods. Furthermore, Asahi actively manages its sales and distribution networks, cultivating strong relationships with partners to maximize product availability and drive revenue growth. In 2024, Asahi Group Holdings continued to invest in modernizing its production facilities and optimizing its supply chain to meet growing consumer demand, with a particular focus on advanced brewing technologies.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Manufacturing & Production | Large-scale creation of alcoholic beverages, soft drinks, and food products with rigorous quality control. | Modernizing equipment and optimizing supply chains; investment in advanced brewing technology. |

| R&D and Innovation | Developing novel products, enhancing existing offerings, and pioneering new categories. | ¥30 billion earmarked for R&D to address shifting consumer preferences and maintain competitive advantage. |

| Marketing & Branding | Promoting global flagship brands through advertising and sponsorships to build premium image and recognition. | Focus on elevating brand value and driving premiumization; Asahi Super Dry sales in Japan reached ~¥300 billion in 2023. |

| Supply Chain Management | Sourcing raw materials, inventory management, and logistics for global product delivery. | Establishment of Asahi Global Procurement Pte. Ltd. (AGPRO) in January 2024 to streamline global procurement. |

| Sales & Distribution | Managing sales force and distribution networks to ensure product availability and drive revenue. | Emphasis on direct-to-consumer channels and enhancing wholesale partnerships for market share expansion. |

Full Version Awaits

Business Model Canvas

The Asahi Group Holdings Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable. You'll gain full access to this comprehensive analysis, allowing you to immediately leverage its insights for strategic planning and understanding Asahi Group's core business operations.

Resources

Asahi Group Holdings' strong brand portfolio, featuring globally recognized names like Asahi Super Dry, Peroni Nastro Azzurro, and Kozel, represents a cornerstone of its business model. These brands, along with a diverse array of soft drinks and food products, are meticulously protected by significant intellectual property, encompassing proprietary recipes, advanced brewing techniques, and registered trademarks.

The inherent strength and consumer recognition of these brands are instrumental in fostering unwavering customer loyalty and enabling Asahi to command premium pricing in competitive markets. For instance, Asahi Super Dry consistently ranks among the top-selling beers globally, contributing significantly to the group's revenue and market presence.

Asahi Group Holdings leverages a robust network of advanced manufacturing facilities and cutting-edge technology, crucial for its large-scale beverage production. These modern plants, including breweries and bottling facilities, are outfitted with sophisticated machinery that ensures both efficiency and the high quality consumers expect. For instance, in 2023, Asahi invested significantly in upgrading its Japanese breweries to enhance automation and reduce environmental impact, a testament to their commitment to operational excellence.

These technologically advanced facilities are not just about scale; they are enablers of innovation. Asahi utilizes them to implement novel production processes, from developing new beverage formulations to integrating sustainable practices like water recycling and energy-efficient brewing. This continuous investment, exemplified by the ongoing modernization of its European operations throughout 2024, allows Asahi to maintain a competitive edge and respond effectively to evolving market demands and sustainability goals.

Asahi Group Holdings leverages its extensive global distribution network as a core resource. This includes a vast array of warehouses, sophisticated logistics infrastructure, and deeply entrenched relationships with distributors worldwide. This robust physical and relational framework is critical for the efficient movement and delivery of Asahi's diverse product portfolio across international markets.

This vital infrastructure underpins Asahi's significant international market presence and is a cornerstone of its ongoing global expansion strategies. For instance, in 2024, Asahi continued to invest in optimizing its supply chain, aiming to reduce delivery times and enhance product availability in key growth regions, thereby solidifying its competitive edge.

Skilled Human Capital

Asahi Group Holdings relies heavily on its skilled human capital, a diverse workforce with deep expertise across brewing, food science, marketing, sales, and intricate supply chain management. This collective knowledge is fundamental to driving the company's innovation pipeline, ensuring smooth operational efficiency, and effectively executing market strategies.

The company's commitment to strengthening its global capabilities is evident in its proactive approach to talent acquisition, actively recruiting experienced professionals from outside the organization. Simultaneously, Asahi invests in robust internal development programs to cultivate and retain its existing talent pool.

- Expertise in Brewing and Food Science: Asahi's technical teams possess specialized knowledge crucial for product development and quality control in the beverage and food sectors.

- Marketing and Sales Acumen: A skilled sales and marketing force is essential for brand building, market penetration, and driving consumer demand across diverse international markets.

- Supply Chain Management Proficiency: Efficient management of a complex global supply chain, from sourcing raw materials to final product distribution, is a key operational strength.

- Talent Development Initiatives: Asahi's focus on continuous learning and career progression for its employees ensures a motivated and highly capable workforce, supporting long-term growth and adaptation.

Financial Capital and Market Access

Asahi Group Holdings' robust financial capital, underscored by substantial annual sales, fuels its operational capacity and strategic ventures. In fiscal year 2023, Asahi reported net sales of approximately ¥2.5 trillion, demonstrating a strong revenue stream that supports its extensive business activities.

This financial strength directly translates into significant capital efficiency, enabling substantial investments in research and development, crucial for innovation in the beverage and food sectors. It also underpins Asahi's ability to pursue strategic acquisitions, expanding its market reach and product portfolio.

Furthermore, Asahi's access to capital markets is a vital component of its business model. This access allows the company to secure the necessary funding for ongoing growth initiatives, extensive brand-building campaigns, and critical sustainability efforts, ensuring long-term viability and competitive advantage.

- Financial Strength: Asahi's ¥2.5 trillion in net sales for FY2023 highlights its significant financial resources.

- Investment Capacity: This capital enables consistent investment in R&D and strategic acquisitions.

- Market Access: Access to capital markets facilitates funding for growth, brand development, and sustainability.

Asahi Group Holdings' key resources are its powerful brands, advanced manufacturing capabilities, extensive global distribution network, skilled workforce, and robust financial capital. These elements collectively enable the company to produce high-quality beverages and food products, reach consumers worldwide, and drive innovation and growth in a competitive market.

| Key Resource | Description | Impact/Example |

| Brand Portfolio | Globally recognized brands like Asahi Super Dry, Peroni, Kozel. | Drives customer loyalty and premium pricing; Asahi Super Dry is a top global seller. |

| Manufacturing Facilities | Advanced breweries and bottling plants with sophisticated machinery. | Ensures efficiency and quality; 2023 upgrades in Japan focused on automation and sustainability. |

| Distribution Network | Vast warehouses, logistics infrastructure, and distributor relationships. | Facilitates global market presence and expansion; 2024 supply chain optimization targets reduced delivery times. |

| Human Capital | Skilled workforce in brewing, food science, marketing, sales, and supply chain. | Drives innovation and operational efficiency; proactive talent acquisition and development initiatives. |

| Financial Capital | Substantial sales and access to capital markets. | Supports operations, R&D, acquisitions, and brand building; FY2023 net sales approx. ¥2.5 trillion. |

Value Propositions

Asahi Group Holdings is renowned for its premium quality beverages and food products, a cornerstone of its value proposition. Asahi Super Dry beer, for instance, is celebrated globally for its exceptionally crisp and dry taste, setting it apart in a crowded market.

This dedication to superior quality and unique flavor profiles directly targets consumers who actively seek out high-end, differentiated experiences. This focus on premiumization across their entire product range fosters strong brand loyalty and supports strategic pricing strategies that reflect the elevated value offered.

In 2023, Asahi Holdings saw its net sales reach approximately 2.5 trillion Japanese Yen, with a significant portion attributed to its premium beer offerings, underscoring the financial success of its quality-driven approach.

Asahi Group Holdings boasts a diverse product portfolio, encompassing alcoholic beverages, non-alcoholic drinks, and food items. This broad offering allows them to cater to a wide range of consumer preferences and various occasions, from casual gatherings to special events.

The company's strategic expansion into low-alcohol and alcohol-free options reflects an adaptation to evolving lifestyle trends and a commitment to inclusivity. Asahi has set a target for non and low-alcohol beverages to represent 20% of their sales composition ratio by 2030, demonstrating a clear focus on this growing market segment.

Asahi Group Holdings is doubling down on health and wellness, a move that’s clearly resonating with consumers. Their portfolio is expanding to include more low-alcohol and alcohol-free beverages, alongside a growing range of plant-based food options. This strategic pivot directly addresses the global surge in demand for healthier lifestyle choices and a more mindful approach to alcohol consumption.

This commitment isn't just about following trends; it's a core part of their business strategy. For instance, Asahi's sales in the health and wellness beverage sector saw a significant uplift in 2024, driven by the popularity of their non-alcoholic beer and functional drinks. This demonstrates their investment in innovation and their ability to adapt to evolving consumer preferences.

Sustainability and Environmental Responsibility

Asahi Group Holdings champions sustainability, aiming for net-zero greenhouse gas emissions by 2040 and 100% sustainable packaging by 2025. This commitment attracts consumers and stakeholders who prioritize environmental responsibility.

Their environmental stewardship includes concrete actions like reducing greenhouse gas emissions and promoting responsible water usage, demonstrating a tangible contribution to a healthier planet.

- Net-Zero Emissions Goal: Targeting net-zero GHG emissions by 2040.

- Sustainable Packaging: Aiming for 100% sustainable packaging by 2025.

- Resource Management: Focusing on reducing greenhouse gas emissions and responsible water usage.

Global Availability and Consistent Experience

Asahi Group Holdings leverages its global availability to offer a consistent brand experience worldwide. Flagship brands like Asahi Super Dry are accessible in numerous international markets, building consumer familiarity and trust. This widespread distribution is a key factor in strengthening its competitive standing on the global stage.

The company's commitment to consistent product quality across its international operations is a significant value proposition. Consumers can expect the same taste and quality from Asahi products, whether they are in Japan, Europe, or North America. For instance, Asahi Super Dry maintained strong performance in key international markets throughout 2024, contributing to its global brand equity.

- Global Brand Recognition: Asahi Super Dry is a prime example of a globally recognized brand that consumers can find in over 100 countries.

- Consistent Quality Assurance: The company implements rigorous quality control measures to ensure product consistency across all production facilities worldwide.

- Enhanced Market Penetration: Widespread availability facilitates deeper penetration into diverse international markets, driving sales volume and brand loyalty.

Asahi Group Holdings delivers premium quality beverages and food, exemplified by the crisp, dry taste of Asahi Super Dry, appealing to consumers seeking differentiated, high-end experiences. This focus on premiumization drives brand loyalty and supports premium pricing, as seen in their 2023 net sales of approximately 2.5 trillion Yen.

The company offers a diverse portfolio, including alcoholic, non-alcoholic, and food items, catering to varied preferences and occasions. Asahi is strategically expanding into low-alcohol and alcohol-free options, targeting these segments to represent 20% of sales by 2030, adapting to evolving lifestyle trends.

Asahi Group Holdings is committed to health and wellness, increasing its range of low-alcohol, alcohol-free beverages, and plant-based foods. This aligns with the global demand for healthier choices, with significant sales uplift in the health and wellness beverage sector in 2024.

Sustainability is a core value, with Asahi targeting net-zero greenhouse gas emissions by 2040 and 100% sustainable packaging by 2025, attracting environmentally conscious consumers and stakeholders.

Customer Relationships

Asahi cultivates deep brand loyalty by consistently delivering high-quality beverages and employing marketing strategies that resonate with consumer lifestyles. For example, their Super Dry brand has maintained a strong presence and appeal through continuous innovation and effective advertising campaigns, contributing to a significant share in key markets.

Beyond product excellence, Asahi actively engages with communities through various initiatives, including responsible drinking campaigns and local sponsorships. This commitment not only enhances their brand image but also builds trust and fosters a sense of belonging among consumers, strengthening customer relationships.

Asahi Group Holdings actively connects with consumers through its digital channels and participation in major events. In 2024, the company continued to leverage social media and online platforms to foster direct engagement, a strategy bolstered by their digital transformation initiatives. This approach allows for real-time feedback collection and the promotion of new offerings, strengthening consumer relationships.

Their involvement in significant events, such as sponsoring the Rugby World Cup, provides a unique avenue for consumer interaction. These sponsorships, like the successful activation around the 2023 tournament, help Asahi understand evolving consumer tastes and build brand loyalty. This direct interaction is crucial for Asahi's ongoing efforts to refine its product portfolio and marketing strategies.

Asahi cultivates robust B2B partnerships with its retail and on-premise clients, leveraging dedicated sales teams and collaborative marketing to ensure optimal product placement and inventory management. This focus is vital for securing prominent shelf space and tap access in a highly competitive beverage market.

Customer Service and Support

Asahi Group Holdings prioritizes customer service to handle inquiries, concerns, and feedback, aiming for a positive post-purchase experience. This dedication to support resolves issues swiftly, bolstering customer satisfaction and trust.

Effective customer service is crucial for maintaining Asahi's strong reputation in the competitive beverage and food industry. For instance, in 2024, Asahi's customer support channels likely handled millions of interactions, with a focus on quick resolution times to foster loyalty.

- Customer Inquiry Management: Asahi's service teams address a wide range of customer questions, from product information to distribution inquiries.

- Issue Resolution: Promptly addressing and resolving customer complaints or concerns is a key aspect of their support strategy.

- Feedback Collection: Gathering customer feedback through various channels helps Asahi identify areas for improvement in products and services.

- Reputation Enhancement: Consistently positive customer service interactions contribute significantly to Asahi's brand image and market standing.

Responsible Drinking Initiatives

Asahi Group Holdings actively champions responsible drinking through a multifaceted approach, including partnerships with organizations focused on alcohol awareness and the development of consumer education campaigns. This commitment underscores their dedication to consumer well-being and aligns with global public health objectives.

These proactive measures not only foster trust and enhance Asahi's reputation as a responsible corporate citizen but also contribute to a sustainable operating environment by mitigating potential societal impacts associated with alcohol consumption. For instance, in 2024, Asahi continued its support for initiatives aimed at preventing drunk driving and promoting moderate consumption, reflecting a consistent investment in these crucial areas.

- Consumer Education: Asahi implements campaigns to educate consumers on the risks of excessive alcohol consumption and provides resources for seeking help.

- Partnerships: The company collaborates with industry associations and public health bodies to advance responsible drinking standards and practices.

- Product Innovation: Asahi explores and promotes lower-alcohol or alcohol-free alternatives to cater to diverse consumer preferences and promote healthier choices.

- Industry Standards: Asahi actively participates in setting and adhering to industry-wide guidelines for responsible alcohol marketing and sales.

Asahi Group Holdings fosters strong customer relationships through a blend of quality products, community engagement, and digital interaction. Their commitment extends to robust B2B partnerships and exceptional customer service, all while championing responsible consumption. This holistic approach solidifies brand loyalty and market presence.

Channels

Asahi Group Holdings heavily relies on its extensive network of retail stores, including supermarkets, hypermarkets, and convenience stores, as a primary distribution channel. This widespread presence ensures their diverse range of beverages and food products are readily available to consumers for everyday purchases and at-home consumption, driving high-volume sales across numerous markets.

In 2024, Asahi's commitment to this channel is evident in its continued investment in market penetration. For instance, in Japan, Asahi holds a significant market share in the beer and non-alcoholic beverage sectors, with its products ubiquitously found in over 10,000 convenience stores and a vast majority of supermarkets, facilitating impulse buys and planned shopping trips.

Asahi Group Holdings deeply relies on on-premise outlets such as bars, restaurants, and hotels, often referred to collectively as the HORECA channel. This segment is vital for showcasing brands like Asahi Super Dry, fostering social drinking occasions, and delivering premium consumer experiences.

In 2024, the HORECA channel continued to be a cornerstone for Asahi's sales strategy, particularly in key markets like Japan and Australia. These outlets serve as critical touchpoints for brand building and driving trial, especially for new product introductions and premium offerings.

Strategic collaborations with hotel groups and restaurant chains in 2024 were instrumental in securing prominent placement and promotional activities. These partnerships not only boost sales volume but also enhance brand perception and consumer engagement within environments that value quality and experience.

Asahi Group Holdings is strategically enhancing its presence on e-commerce platforms and through online retailers, recognizing the significant shift in consumer purchasing behavior towards digital channels. This expansion is crucial for meeting the growing demand for convenient online shopping experiences.

This digital push allows Asahi to offer direct-to-consumer sales in various markets, thereby expanding its customer reach and adapting to contemporary retail trends. For instance, the company has set a target of achieving 15% of its bicycle business sales through e-commerce by February 2026, underscoring a broader commitment to digital sales growth across its portfolio.

International Distributors and Export Networks

Asahi Group Holdings leverages a comprehensive network of international distributors and export channels to extend its product reach beyond its core markets. These partners are crucial for managing local operations, including sales, marketing, and logistics, facilitating Asahi's efficient entry into varied global markets. This strategic reliance on external networks is fundamental to its ongoing global growth ambitions.

In 2024, Asahi's international sales continued to be a significant driver of its overall revenue, underscoring the importance of these distribution partnerships. For instance, its presence in key Asian markets, such as Vietnam through its subsidiary Vinamilk, showcases the success of localized distribution strategies. The company actively seeks to expand its footprint in North America and Europe, relying on established distributors to navigate these complex retail landscapes.

- Global Market Penetration: Asahi's international distributors are key to accessing and succeeding in diverse geographical markets.

- Operational Efficiency: These partners handle local logistics and sales, allowing Asahi to focus on production and brand development.

- Strategic Partnerships: The company's global expansion is heavily dependent on the strength and effectiveness of its export network.

- Revenue Contribution: International sales, facilitated by these channels, represent a vital component of Asahi's financial performance.

Vending Machines and Automated Retail

Vending machines and automated retail are a cornerstone of Asahi Group Holdings' distribution strategy in specific markets, notably Japan. This channel offers consumers unparalleled convenience, ensuring products are readily available in bustling urban centers and high-traffic locations.

This pervasive availability is crucial for maintaining brand presence and capturing impulse purchases. In 2023, Japan's vending machine market was estimated to be worth over ¥5 trillion, with beverages representing a significant portion.

- Convenience: Vending machines provide 24/7 access to beverages and snacks, catering to busy lifestyles.

- Market Penetration: In Japan, there are approximately 2.4 million vending machines, ensuring widespread product visibility.

- Sales Contribution: This channel is a vital contributor to soft drink sales, particularly for brands like Asahi's popular lines.

Asahi Group Holdings utilizes a multi-faceted approach to channels, balancing traditional retail with burgeoning digital avenues and specialized outlets. This ensures broad consumer access and caters to diverse purchasing preferences.

In 2024, the company's retail presence in Japan remained robust, with Asahi products consistently stocked in over 10,000 convenience stores and a majority of supermarkets, facilitating both planned and impulse purchases.

The HORECA sector, including bars and restaurants, continued to be a key channel in 2024 for brand building and premium product placement, particularly for brands like Asahi Super Dry.

Asahi's e-commerce expansion is a strategic priority, aiming to capture a larger share of online sales, with a specific target of 15% of its bicycle business sales through e-commerce by February 2026.

International distributors played a crucial role in 2024, driving revenue growth in markets like Vietnam and supporting expansion efforts in North America and Europe.

Vending machines in Japan, a market estimated to be worth over ¥5 trillion in 2023, continue to be a vital channel for Asahi, offering convenience and widespread product visibility with approximately 2.4 million machines nationwide.

| Channel Type | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Retail Stores (Supermarkets, Convenience) | High volume, everyday purchases, impulse buys | Ubiquitous presence in over 10,000 Japanese convenience stores |

| HORECA (Hotels, Restaurants, Cafes) | Brand showcasing, premium experience, social occasions | Cornerstone for brand building and new product trials in key markets |

| E-commerce & Online Retail | Convenience, expanded reach, direct-to-consumer | Target of 15% of bicycle business sales via e-commerce by Feb 2026 |

| International Distributors | Global market access, local operations management | Significant driver of overall revenue in 2024, supporting expansion |

| Vending Machines | 24/7 access, high-traffic locations, convenience | Vital in Japan's ¥5 trillion vending machine market (2023 est.) |

Customer Segments

Asahi Group Holdings' mass market consumer segment for adult beverages encompasses a wide range of adults who enjoy alcoholic drinks, especially beer, for everyday enjoyment and special occasions. This segment represents a significant portion of the beverage market, driven by consistent demand and diverse consumption patterns.

The company actively engages this broad demographic by offering both mainstream and premium beer options. Asahi Super Dry, a flagship brand, is a prime example of their strategy to capture widespread appeal and foster repeat purchases among these consumers. In 2023, the global beer market was valued at approximately $745.7 billion, with Asia Pacific being a key growth region.

Asahi Group Holdings is increasingly focusing on health-conscious consumers, a segment that is rapidly expanding. This demographic actively seeks out healthier beverage and food choices, including low-alcohol, alcohol-free, and plant-based options. For instance, Asahi's commitment is evident in its development of products like their "Style Balance" line, which offers non-alcoholic flavored drinks designed for mindful consumption.

Asahi Group Holdings caters to a vast and diverse customer base within its Food and Soft Drink Consumers segment. This includes families seeking refreshing beverages and convenient snacks like Mintia, as well as parents purchasing baby food. In 2024, Asahi's soft drink business, particularly in Japan, continued to see strong demand, with brands like Mitsuya Cider and Wilkinson Tansan maintaining significant market share.

International Markets and Diverse Cultures

Asahi Group Holdings actively engages with consumers across a broad international landscape, encompassing Europe, Oceania, and Southeast Asia, among other significant regions. This strategic global reach is fundamental to their expansion and diversification efforts.

The company demonstrates a keen understanding of local nuances, tailoring its product portfolio and marketing campaigns to resonate with diverse cultural preferences and consumer tastes. This adaptability is key to success in varied markets.

In 2024, Asahi’s international operations continued to be a substantial contributor to its overall revenue. For instance, their European segment, particularly with brands acquired through SABMiller, consistently shows robust performance, reflecting successful integration and market penetration.

- Global Reach: Asahi's presence spans Europe, Oceania, and Southeast Asia, catering to a wide array of international consumers.

- Cultural Adaptation: Product and marketing strategies are localized to align with diverse cultural tastes and preferences.

- Growth Driver: The international market segment is vital for Asahi's ongoing growth and diversification strategy.

- 2024 Performance: European markets, bolstered by strategic acquisitions, remained a strong performer in Asahi's international portfolio.

Business Customers (Retailers, HORECA)

Asahi Group Holdings' business customers are primarily retailers like supermarkets and convenience stores, alongside the HORECA sector encompassing hotels, restaurants, and bars. These entities purchase Asahi's diverse beverage portfolio for resale or direct customer consumption. In 2024, Asahi continued to focus on strengthening its relationships within these channels, recognizing their critical role in market penetration and brand visibility.

The company provides these business customers with specialized support designed to optimize product placement, drive sales, and ensure efficient supply chains. This includes tailored marketing campaigns, promotional activities, and robust logistics services. For instance, Asahi's efforts in 2024 aimed to enhance on-shelf availability and introduce new product variants that appeal to specific consumer demographics within these outlets.

- Retailers: Supermarkets and convenience stores represent a significant portion of Asahi's business customer base, relying on consistent supply and popular brands to meet consumer demand.

- HORECA Segment: Hotels, restaurants, and bars are key partners for on-premise consumption, where Asahi's products are featured prominently on menus and bar offerings.

- Logistics and Support: Asahi's commitment to these segments includes efficient delivery networks and dedicated sales teams offering merchandising and promotional assistance.

- Market Focus: In 2024, Asahi's strategy involved deepening engagement with these business customers to ensure product accessibility and capitalize on evolving consumer preferences in the hospitality and retail sectors.

Asahi Group Holdings' customer segments are diverse, ranging from individual consumers of alcoholic and non-alcoholic beverages to business partners in retail and hospitality.

The company targets a broad mass market for alcoholic beverages, with a particular emphasis on beer, while also catering to a growing health-conscious demographic seeking low-alcohol or non-alcoholic options.

Additionally, Asahi serves families and individuals through its food and soft drink offerings, with strong brand presence in markets like Japan.

International consumers in Europe, Oceania, and Southeast Asia are also key, with strategies adapted to local tastes.

Business customers include supermarkets, convenience stores, hotels, restaurants, and bars, all crucial for product distribution and on-premise consumption.

| Customer Segment | Key Characteristics | 2024 Focus/Data Points |

|---|---|---|

| Mass Market (Alcoholic Beverages) | Adults seeking everyday enjoyment and special occasions; brand loyalty for mainstream and premium beers. | Asahi Super Dry remains a flagship; global beer market growth continues, particularly in Asia. |

| Health-Conscious Consumers | Seeking low-alcohol, alcohol-free, and plant-based options; mindful consumption. | Growth in lines like Style Balance; increasing consumer demand for healthier choices. |

| Food and Soft Drink Consumers | Families, individuals seeking refreshing beverages and convenient snacks; includes baby food purchasers. | Strong performance of brands like Mitsuya Cider and Wilkinson Tansan in Japan. |

| International Consumers | Diverse demographics across Europe, Oceania, Southeast Asia; requires localized strategies. | European segment robust, driven by strategic acquisitions; international operations significant revenue contributor. |

| Business Customers (Retail & HORECA) | Retailers (supermarkets, convenience stores), Hospitality (hotels, restaurants, bars) purchasing for resale or direct consumption. | Focus on strengthening channel relationships, enhancing on-shelf availability, and introducing new product variants. |

Cost Structure

Asahi Group Holdings' raw material and packaging costs are substantial, driven by essential inputs like barley, hops, water, and sugar for its beverages, alongside materials for bottles, cans, and plastic packaging. For instance, in 2023, the cost of goods sold for Asahi Group Holdings was approximately 1.4 trillion Japanese Yen, reflecting the significant expenditure on these core components.

These costs are subject to market volatility; for example, global barley prices can fluctuate due to weather patterns and agricultural yields, directly impacting Asahi's procurement expenses. Furthermore, Asahi's increasing focus on environmental sustainability, including the adoption of more eco-friendly packaging solutions, can also influence the overall cost structure in this category.

Manufacturing and production expenses for Asahi Group Holdings encompass the direct costs of creating their diverse product portfolio, including beverages and food items. These operational costs involve significant outlays for labor, utilities such as electricity and water, and the ongoing maintenance of sophisticated production machinery. In 2023, Asahi Group Holdings reported that its cost of sales, which includes these manufacturing expenses, amounted to approximately ¥1,618 billion, highlighting the substantial investment in efficient production.

Asahi Group Holdings dedicates significant resources to marketing, sales, and advertising, recognizing their critical role in maintaining global brand presence and driving revenue. These expenditures encompass a wide array of activities, from large-scale advertising campaigns and strategic sponsorships to engaging promotional events and maintaining a robust sales force.

In 2023, Asahi Breweries, a key segment of Asahi Group Holdings, reported advertising and sales promotion expenses of approximately ¥117.7 billion. This substantial investment underscores the company's commitment to brand building and market penetration, essential for competing in the highly dynamic beverage industry.

Logistics and Distribution Costs

Asahi Group Holdings incurs significant expenses related to logistics and distribution, a crucial element of its cost structure. The movement of goods from production sites to various global sales points, encompassing warehousing and freight, represents a substantial investment. For instance, in fiscal year 2023, Asahi Group Holdings reported ¥1,362.1 billion in Cost of Sales, a portion of which directly relates to these logistical operations.

The company actively pursues strategic initiatives to streamline its distribution networks, aiming for greater efficiency and cost optimization. This involves managing a complex international supply chain, which inherently carries substantial operational costs.

- Warehousing: Costs associated with storing finished goods before they reach retailers or consumers.

- Freight: Expenses incurred for transporting products via various modes of transport, including sea, air, and land.

- Supply Chain Management: Investment in technology and personnel to oversee the intricate global flow of goods.

- Distribution Network Optimization: Ongoing efforts to redesign and improve the efficiency of how products reach their final destinations.

Research and Development (R&D) and Innovation Investment

Asahi Group Holdings dedicates substantial resources to Research and Development (R&D) and innovation. This commitment fuels the creation of new products, enhances existing ones, and drives advancements in operational efficiency and sustainability practices. In 2024, Asahi allocated approximately ¥30 billion towards these vital R&D efforts.

These investments are not merely expenses but strategic pillars supporting Asahi's long-term growth trajectory and its ability to stay ahead in a dynamic market. By consistently pushing the boundaries of product innovation, Asahi aims to maintain and strengthen its competitive advantage.

- R&D Investment: ¥30 billion in 2024.

- Focus Areas: New product development, process improvements, sustainability.

- Strategic Importance: Crucial for long-term growth and competitive edge.

Asahi Group Holdings' cost structure is significantly influenced by its raw materials, manufacturing, and extensive marketing efforts. The company's commitment to innovation through R&D, as evidenced by a ¥30 billion allocation in 2024, also represents a key investment. Distribution and logistics are critical cost drivers, reflecting the complexity of their global operations.

| Cost Category | 2023 Data (Approx.) | Key Drivers |

|---|---|---|

| Raw Materials & Packaging | ¥1.4 trillion (Cost of Goods Sold) | Barley, hops, water, sugar, packaging materials; market volatility. |

| Manufacturing & Production | ¥1.618 trillion (Cost of Sales) | Labor, utilities, machinery maintenance. |

| Marketing, Sales & Advertising | ¥117.7 billion (Asahi Breweries segment) | Brand campaigns, sponsorships, sales force. |

| Logistics & Distribution | Portion of ¥1.362.1 trillion (Cost of Sales) | Warehousing, freight, supply chain management. |

| Research & Development | ¥30 billion (2024 Allocation) | New product development, process improvements, sustainability. |

Revenue Streams

Asahi Group Holdings' core revenue originates from selling alcoholic beverages, with beer, notably Asahi Super Dry, leading the charge. This segment also encompasses spirits and ready-to-drink (RTD) beverages, broadening their market appeal.

In 2024, Asahi Group Holdings continued to leverage its strong brand portfolio, with alcoholic beverages forming the backbone of its sales. The company's focus on premiumization strategies and expanding its global footprint for these core products remains a critical growth engine.

Asahi Group Holdings earns revenue by selling a diverse portfolio of non-alcoholic drinks, including soft drinks, bottled water, and specialized non-alcoholic adult beverages. This segment is a key growth area for the company.

The company has ambitious plans for this sector, aiming for non and low-alcohol beverages to represent 20% of its total beverage sales composition by 2030, signaling a strategic shift towards healthier and alternative options.

Asahi Group Holdings also generates revenue through its food products segment. This includes a variety of items such as popular confectionery like Mintia mints, and essential products like baby food.

In 2024, Asahi's food segment demonstrated resilience and contributed to the company's broad market presence. For instance, the confectionery business, including brands like Mintia, continues to be a significant contributor, reflecting consumer demand for convenient and enjoyable treats.

International Sales and Licensing

International sales are a cornerstone of Asahi Group Holdings' revenue, with almost half of its total income generated from markets outside of Japan. This global reach is achieved through direct sales of its beverage products and potentially through licensing its well-known brands to partners in various countries, allowing for wider distribution and brand recognition.

The company actively pursues global expansion and a strategy of premiumization to drive growth in its international revenue streams. By focusing on expanding its presence in key overseas markets and offering higher-value products, Asahi aims to capture a larger share of the international beverage market.

- International Revenue Contribution: Nearly 50% of Asahi's revenue originates from international markets.

- Global Strategy: Focus on expanding presence and premiumizing products in overseas markets.

- Revenue Channels: Includes direct sales and potential licensing agreements for its brands abroad.

New Product Introductions and Category Expansion

Asahi Group Holdings leverages new product introductions and category expansion as key revenue drivers. This strategy allows them to tap into evolving consumer preferences and capitalize on emerging market trends, particularly in the beverage sector. For instance, their focus on low-alcohol and alcohol-free options, alongside functional beverages, directly addresses growing consumer interest in health and wellness.

- New Product Success: In 2023, Asahi's strategic product launches and category expansions contributed significantly to their revenue growth.

- Category Expansion: The company actively explores and invests in burgeoning categories such as low-alcohol/alcohol-free beverages and functional drinks.

- Market Responsiveness: This approach enables Asahi to quickly adapt to and capture new consumer demands and shifting market dynamics.

- Revenue Contribution: Successful new offerings and category entries are vital for maintaining and increasing overall revenue streams.

Asahi Group Holdings' revenue streams are diversified, with alcoholic beverages, particularly beer, forming the core. This is complemented by a growing non-alcoholic beverage segment, including soft drinks and innovative adult alternatives, and a resilient food products division, featuring confectionery and baby food.

International markets are crucial, generating nearly half of Asahi's total income through direct sales and brand licensing. The company's 2024 strategy emphasizes premiumization and global expansion to bolster these international revenues.

New product introductions and category expansions, such as low-alcohol and functional beverages, are vital revenue drivers, reflecting Asahi's adaptability to evolving consumer preferences.

| Revenue Stream | Key Products/Focus | 2024 Relevance |

| Alcoholic Beverages | Beer (Asahi Super Dry), Spirits, RTDs | Core revenue, premiumization focus |

| Non-Alcoholic Beverages | Soft Drinks, Water, Low/No-Alcohol | Growth area, targeting 20% of sales by 2030 |

| Food Products | Confectionery (Mintia), Baby Food | Resilient contributor, strong brand presence |

| International Sales | Global distribution of beverages | Nearly 50% of total revenue, expansion strategy |

Business Model Canvas Data Sources

The Asahi Group Holdings Business Model Canvas is built using a combination of publicly available financial disclosures, comprehensive market research reports on the beverage and food industries, and internal strategic planning documents. These sources provide a robust foundation for understanding their operations and market position.