Asahi Group Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asahi Group Holdings Bundle

Asahi Group Holdings masterfully crafts its product portfolio, from iconic beers to health-conscious beverages, ensuring broad appeal. Their pricing strategies balance premium perception with accessibility, while their distribution network ensures widespread availability across diverse markets.

Want to understand the intricate promotional campaigns and the strategic placement that drives Asahi's global success? Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering all 4Ps. Ideal for business professionals, students, and consultants seeking strategic insights.

Product

Asahi Group Holdings boasts a diverse beverage portfolio, anchored by its iconic Asahi Super Dry beer. This core offering is complemented by an expanding range of low-alcohol and alcohol-free alternatives, reflecting evolving consumer trends. The company also strengthens its alcoholic segment with premium spirits like Nikka Whisky, appealing to a discerning market.

Beyond its alcoholic beverages, Asahi strategically extends its reach into the non-alcoholic sector with popular soft drinks such as Mitsuya and Wilkinson. This dual focus on both alcoholic and non-alcoholic categories, alongside a presence in food products, enables Asahi to capture a broad spectrum of consumer tastes and market demands. For instance, in the first half of 2024, Asahi reported robust growth in its Japan business, driven by strong performance across its beer and soft drink segments.

Asahi Group Holdings actively pursues a premiumization strategy, a cornerstone of its product approach. This involves elevating its brand portfolio globally and locally by concentrating on high-value offerings and boosting the perceived quality of existing brands to support premium pricing. For instance, Asahi's Super Dry brand has consistently been positioned as a premium lager, a strategy that has contributed to its strong performance in international markets.

Asahi Group Holdings is making significant strides in the low and non-alcoholic beverage market, a segment experiencing robust growth driven by health-conscious consumers. The company's commitment to innovation is evident in its expanded product portfolio, featuring items like Asahi Dry Crystal and Asahi Super Dry 0.0%, catering to a growing demand for healthier lifestyle choices.

This strategic focus on health and wellness is not just about product development; it's a key part of Asahi's strategy to attract new consumer groups and tap into high-potential emerging markets. By introducing options such as Asahi Zero and Mirai no Lemon Sour, alongside the new standard-priced beer, Asahi The Vitalist, the company is actively positioning itself to capture market share in these evolving categories.

Commitment to Sustainable Packaging

Asahi Group Holdings is deeply committed to sustainability, making eco-friendly packaging a core product strategy. Their ambitious goal is to transition to 100% sustainable packaging materials by 2025, a move that resonates with growing consumer demand for environmentally responsible products.

This product-focused initiative is crucial for Asahi's market positioning, directly addressing global environmental concerns and enhancing brand appeal among eco-conscious demographics. It’s a tangible demonstration of their dedication to corporate social responsibility.

- 100% Sustainable Packaging Goal: Aiming for full implementation by 2025.

- Consumer Appeal: Directly targets environmentally aware consumers.

- Brand Enhancement: Reinforces Asahi's commitment to sustainable development.

- Market Alignment: Responds to global trends favoring eco-friendly practices.

Global Brand Consistency and Design

Asahi Super Dry's global brand consistency is being reinforced through a significant packaging redesign. This initiative, launched across Asia and EMEA in Q3 2024 and slated for the U.S. in 2025, aims to establish a unified, premium, and distinctive brand image worldwide. The modernized design system is flexible, allowing for seamless integration of new products and special editions while maintaining cohesive brand recognition.

This strategic refresh is crucial for Asahi Group Holdings, especially as the global beverage market continues to evolve. In 2024, the premium beer segment saw continued growth, with brands emphasizing sophisticated branding and quality perception. Asahi Super Dry's investment in design consistency directly supports its premium positioning, targeting consumers who value both taste and brand experience.

The flexible design system is a key component, enabling Asahi to adapt to market trends and introduce innovations without diluting its core brand identity. This approach is particularly important in 2024/2025, a period marked by increased demand for limited-edition offerings and product line extensions in the beverage industry. The redesign ensures that whether a consumer encounters Asahi Super Dry in Tokyo, London, or New York, the brand's premium essence remains unmistakable.

- Global Launch Phases: Asia & EMEA (Q3 2024), U.S. (2025).

- Design Objectives: Unified, premium, and distinctive global brand image.

- System Flexibility: Accommodates new products and special editions.

- Market Context: Reinforces premium positioning amidst evolving consumer preferences in 2024/2025.

Asahi Group Holdings offers a diverse product range, from its flagship Asahi Super Dry beer to premium spirits like Nikka Whisky, and non-alcoholic options such as Mitsuya. This broad portfolio caters to varied consumer preferences and market segments, as evidenced by strong performance in both beer and soft drinks in the first half of 2024.

The company emphasizes premiumization, elevating brands like Asahi Super Dry to a premium lager status globally, which has boosted its international market performance. Furthermore, Asahi is actively expanding its presence in the growing low and non-alcoholic beverage market with offerings like Asahi Super Dry 0.0%, aligning with health-conscious consumer trends and targeting new demographics.

A key product strategy is a commitment to sustainability, with a goal to achieve 100% sustainable packaging by 2025. This initiative directly appeals to environmentally conscious consumers and strengthens Asahi's brand image. Additionally, a global packaging redesign for Asahi Super Dry, rolling out in Asia and EMEA in Q3 2024 and the U.S. in 2025, aims to create a unified, premium global brand identity.

| Product Category | Key Brands | 2024/2025 Focus |

|---|---|---|

| Beer | Asahi Super Dry, Asahi Dry Crystal | Premiumization, Global Brand Consistency, Non-Alcoholic Variants |

| Spirits | Nikka Whisky | Premium Segment Growth |

| Soft Drinks | Mitsuya, Wilkinson | Growth in Non-Alcoholic Sector |

| Packaging | All Products | 100% Sustainable Packaging by 2025 |

What is included in the product

This analysis provides a concise overview of Asahi Group Holdings' marketing mix, examining their diverse product portfolio, strategic pricing across various markets, extensive distribution networks, and multi-faceted promotional activities to understand their competitive positioning.

This Asahi Group Holdings 4P's analysis acts as a pain point reliever by providing a clear, concise overview of their marketing strategy, allowing stakeholders to quickly identify and address potential challenges in product, price, place, and promotion.

It simplifies complex marketing decisions, offering a readily understandable framework for leadership to align on key initiatives and overcome common marketing hurdles.

Place

Asahi Group Holdings boasts an extensive global market presence, operating in over 50 countries as of its latest reports. This broad international footprint is fundamental to effectively distributing its wide array of products, which includes popular alcoholic beverages, refreshing soft drinks, and various food items. The company's strategic focus remains on strengthening its position and expanding its reach within key global markets, aiming to capitalize on diverse consumer demands.

In April 2025, Asahi Group Holdings undertook a significant restructuring of its regional headquarters, consolidating four existing hubs into three. This strategic realignment saw the integration of its Oceania and Southeast Asia operations into a unified Asia Pacific (APAC) regional headquarters.

This move is designed to streamline operations, fostering greater agility and accelerating Asahi's global brand expansion efforts. The optimization of its distribution networks and market management strategies is a key driver behind this decision.

Asahi Group Holdings is strengthening its local production and distribution to better meet regional demands. A key move was acquiring Octopi Brewing in the U.S. in January 2024, enabling local production of Asahi Super Dry. This strategic acquisition aims to reduce lead times and better cater to the American market.

The company operates an extensive network of over 50 manufacturing and distribution centers throughout Australia and New Zealand. This robust infrastructure ensures efficient product availability and accessibility for consumers across these key markets.

Targeted Market Expansion Initiatives

Asahi Group Holdings is strategically expanding its global reach, aiming for a 15% annual increase in international sales by 2026. Key target regions include North America, Europe, and the Asia-Pacific. This ambitious growth is supported by efforts to bolster existing international sales channels for popular brands such as Nikka Whisky.

The company is also innovating with new business models to capture market share. A prime example is the 'WATER BASE' app-linked vending system being piloted in Japan, which aims to enhance consumer engagement and sales efficiency.

- Global Sales Growth Target: 15% annually by 2026.

- Key Expansion Markets: North America, Europe, Asia-Pacific.

- Brand Focus: Strengthening international channels for Nikka Whisky.

- Innovative Models: Exploring 'WATER BASE' app-linked vending in Japan.

Optimizing Supply Chain and Logistics

Asahi Group Holdings is actively refining its supply chain and logistics to boost efficiency and resilience. A key development is the establishment of Asahi Global Procurement (AGPRO) in February 2024, a strategic move designed to centralize global procurement activities and strengthen risk mitigation across its operations. This initiative is expected to yield significant cost savings and improve sourcing strategies.

The company is also undergoing a physical network optimization. Older distribution centers are being systematically retired, with their functions being absorbed by either upgraded existing facilities or newly established ones. This consolidation aims to enhance overall logistical flow and maximize the utilization of its brewery capacities, ensuring that production and distribution remain synchronized with market demand.

- Global Procurement: AGPRO, launched February 2024, centralizes sourcing to drive cost efficiencies and manage supply chain risks more effectively.

- Network Modernization: Phasing out older distribution centers and consolidating operations into modernized or new facilities to improve logistical performance.

- Capacity Utilization: Optimizing the distribution network directly supports better utilization of brewery production capacities.

- Efficiency Gains: These combined efforts are projected to lead to a more streamlined and cost-effective supply chain, supporting Asahi's overall profitability.

Asahi Group Holdings leverages its extensive global network, operating in over 50 countries, to ensure widespread product availability. The company's strategic restructuring in April 2025, consolidating regional headquarters, further enhances its ability to manage diverse market needs efficiently. By acquiring Octopi Brewing in the U.S. in January 2024, Asahi is bolstering local production capabilities to better serve key markets like North America, a crucial region for its projected 15% annual international sales growth by 2026.

| Market Presence | Key Initiatives | Impact |

| Over 50 countries globally | Regional HQ consolidation (April 2025) | Streamlined operations, accelerated global expansion |

| U.S. market focus | Octopi Brewing acquisition (Jan 2024) | Enabled local production of Asahi Super Dry, reduced lead times |

| Targeted growth regions | North America, Europe, Asia-Pacific | Aiming for 15% annual international sales growth by 2026 |

What You See Is What You Get

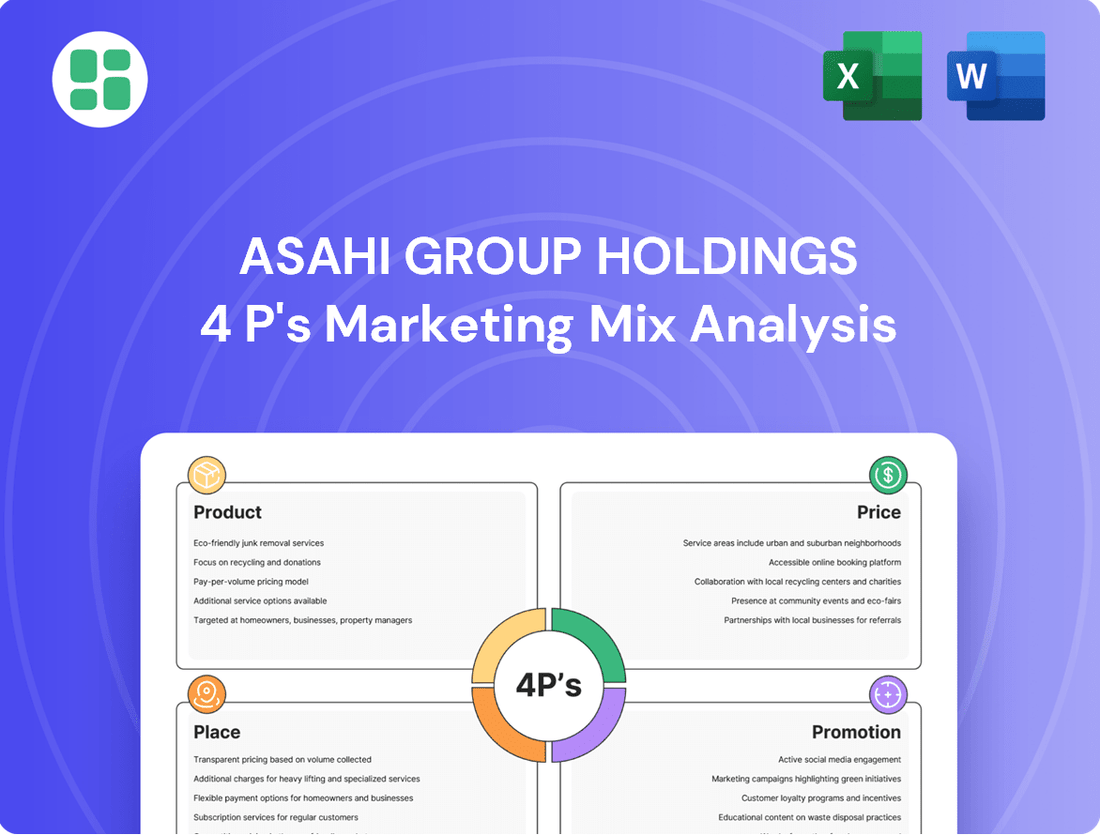

Asahi Group Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises regarding Asahi Group Holdings' 4P's Marketing Mix Analysis. This comprehensive analysis details their Product strategies, pricing tactics, distribution channels, and promotional efforts. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use for your business insights.

Promotion

Asahi Group Holdings focuses its promotion on elevating brands like Asahi Super Dry to a super premium global status. This strategy leverages a consistent worldwide marketing approach, highlighting the beer's distinct flavor and Japanese origins to stand out in crowded markets and boost overall brand equity.

Asahi Group Holdings strategically utilizes major sporting events, like its sponsorship of the Rugby World Cup through 2029, to boost global brand visibility. This partnership ensures exposure across match venues, fan zones, and broadcast media, effectively reaching a broad international consumer base.

Asahi Group Holdings excels with innovative product-specific campaigns, a key element in their marketing mix. For instance, Asahi Super Dry's limited-edition Model Kit designed cans and packaging for Lunar New Year celebrations in the Asia-Pacific region in 2024 exemplifies this strategy. These campaigns highlight product distinctiveness and foster consumer engagement through artistic collaborations and culturally resonant themes.

Digital Transformation and Customer Engagement

Asahi Group Holdings is actively pursuing digital transformation to foster deeper customer engagement, aiming to elevate the consumer experience. This strategic focus is projected to drive a significant 30% increase in online sales by the close of 2025, underscoring a commitment to digital channels.

The company is integrating robust feedback mechanisms to refine its product offerings, ensuring they align with evolving consumer preferences. This customer-centric approach is key to Asahi's strategy for enhancing brand loyalty and market responsiveness in the digital age.

Asahi is exploring new digital platforms to facilitate direct interaction with consumers. This initiative is designed to build stronger relationships and gather valuable insights, which will inform future product development and marketing efforts.

- Digital Sales Target: Aiming for a 30% growth in online sales by 2025.

- Customer Feedback Integration: Utilizing consumer input to tailor product development.

- New Digital Platforms: Exploring avenues for direct consumer interaction and engagement.

Emphasis on Smart Drinking and Health & Wellness Trends

Asahi Group Holdings actively promotes 'Smart Drinking' through various campaigns, encouraging responsible alcohol consumption and spotlighting the appeal of low-to-no alcohol alternatives. This strategic focus aligns with a broader shift in consumer behavior towards mindful choices.

The company's commitment to health and wellness is evident in its product development and marketing efforts. Campaigns for offerings like Asahi Zero and their range of sugar-free beverages directly address the increasing consumer demand for healthier options, communicating clear product benefits and resonating with evolving lifestyle priorities.

- Smart Drinking Initiatives: Asahi promotes responsible consumption and low-to-no alcohol options.

- Health & Wellness Focus: Campaigns highlight benefits of products like Asahi Zero and sugar-free beverages.

- Consumer Alignment: These efforts cater to growing consumer priorities for healthier lifestyles.

Asahi Group Holdings' promotion strategy centers on building a premium global image for brands like Asahi Super Dry, utilizing consistent worldwide marketing and sponsorships, such as the Rugby World Cup through 2029, to enhance visibility. They also employ innovative, product-specific campaigns, like limited-edition Lunar New Year cans in 2024, to engage consumers. Furthermore, Asahi is investing in digital transformation, aiming for a 30% online sales increase by 2025, and promoting 'Smart Drinking' and healthier options like Asahi Zero to align with evolving consumer preferences.

| Promotion Area | Key Initiatives | Target/Impact |

|---|---|---|

| Global Brand Building | Super premium positioning for Asahi Super Dry | Consistent worldwide marketing |

| Sponsorships | Rugby World Cup (through 2029) | Broad international consumer reach |

| Product-Specific Campaigns | Lunar New Year limited editions (2024) | Consumer engagement, product distinctiveness |

| Digital Transformation | Online sales growth | Projected 30% increase by 2025 |

| Health & Wellness | 'Smart Drinking', Asahi Zero, sugar-free options | Alignment with consumer demand for healthier choices |

Price

Asahi Group Holdings employs a premiumization-driven pricing strategy, consistently increasing unit sales prices across its beverage and food product lines. This approach targets consumers willing to pay more for superior quality and distinctive brand experiences, as evidenced by their focus on premium segments in markets like Japan and Europe.

For instance, in fiscal year 2023, Asahi's core spirits and RTD (Ready-to-Drink) segments in Japan saw continued strength, supported by pricing power that outpaced volume growth. This strategy allows Asahi to capture greater value, reflecting the enhanced perceived worth of its premium offerings like Asahi Super Dry.

Asahi Group Holdings exhibits remarkable dynamic pricing strategies, adjusting prices across diverse markets to align with local demand and economic shifts. This adaptability is crucial for maintaining profitability, especially when facing varied market conditions.

In 2024, Asahi has shown agility by implementing price revisions in key markets like Japan and Europe. These adjustments have successfully led to an increase in average unit sales prices, bolstering revenue streams even in the face of challenging economic headwinds.

The company actively navigates less favorable market environments, such as in Oceania, by employing flexible pricing tactics. This strategic approach ensures Asahi can sustain its market presence and profitability despite external pressures, demonstrating a keen understanding of regional market dynamics.

Asahi Group Holdings demonstrates robust cost management and procurement optimization, crucial for navigating economic headwinds. The establishment of AGPRO in February 2024, a global procurement company, signifies a strategic move towards centralized sourcing. This initiative is designed to enhance supply chain efficiency and reduce operational costs, directly impacting their ability to maintain competitive pricing in the market.

This proactive approach to cost discipline is particularly vital given the persistent inflationary pressures on variable costs. By optimizing its global procurement, Asahi aims to absorb some of these rising expenses, mitigating the need for sole reliance on price adjustments. For instance, in the fiscal year ending December 31, 2023, Asahi reported a consolidated net sales of ¥2,453.7 billion, underscoring the scale at which these cost-saving measures can yield significant benefits.

Value-Based Pricing for New and High-Margin Products

Asahi Group Holdings employs value-based pricing for its new and high-margin products, especially within the burgeoning beer-adjacent categories. This strategy ensures that the price reflects the premium quality and unique selling propositions of items like alcohol-taste beverages and ready-to-drink (RTD) alcohol beverages. For instance, in 2024, Asahi's focus on RTDs saw significant growth, with the company aiming to capitalize on consumer demand for convenience and novel flavor profiles, which inherently command higher margins than traditional beer.

Products like Asahi THE BITTER-IST and Mirai no Lemon Sour exemplify this approach. They are strategically priced not just to attract consumers but also to build brand loyalty and insulate Asahi from direct price competition. This allows the company to maintain healthy profit margins even as it expands its market presence. In 2023, the Japanese RTD market alone was valued at over ¥500 billion, with premium segments showing particularly strong growth, a trend Asahi is actively leveraging.

- Premium Positioning: New launches in categories like RTDs are priced to reflect their higher perceived value and profit potential.

- Market Share Capture: Products like Asahi THE BITTER-IST are introduced at price points that encourage trial and adoption while signaling quality.

- Margin Insulation: By focusing on unique value propositions, Asahi aims to reduce sensitivity to price-based competition, preserving profitability.

- Category Growth: Asahi's strategy aligns with the robust growth observed in Japan's RTD market, which experienced a double-digit increase in consumption in recent years.

Strategic Pricing in Response to Tax Revisions

Asahi Group Holdings actively monitors and responds to external economic shifts, particularly tax revisions, when setting prices. For instance, anticipating the October 2026 beer tax reduction in Japan, Asahi strategically launched 'Asahi The Vitalist.' This move demonstrates a proactive pricing strategy designed to capitalize on anticipated changes in consumer purchasing power and market dynamics.

This forward-thinking approach allows Asahi to:

- Capture early demand by introducing products before tax benefits fully materialize.

- Optimize product positioning to align with evolving consumer affordability.

- Mitigate potential negative impacts of tax changes on sales volume.

- Reinforce market leadership through agile and informed pricing decisions.

Asahi Group Holdings employs a premium pricing strategy, focusing on value and quality to justify higher unit sales prices, particularly in markets like Japan and Europe. This is evident in their 2023 performance where pricing power outpaced volume growth in core spirits and RTD segments.

The company's dynamic pricing adapts to local demand and economic conditions, as seen with price revisions in Japan and Europe during 2024, which boosted average unit sales prices. Conversely, flexible tactics are used in markets like Oceania to maintain profitability amidst external pressures.

Asahi's value-based pricing for new products, such as in the growing RTD category, ensures prices reflect premium quality and unique selling points, aiming to build brand loyalty and insulate from price competition.

The company also strategically anticipates tax changes, like the upcoming Japanese beer tax reduction, by launching new products to capture early demand and optimize positioning.

| Market Segment | 2023 Performance Highlight | 2024 Pricing Strategy |

|---|---|---|

| Japan (Spirits & RTD) | Pricing power outpaced volume growth. | Continued price revisions to increase average unit sales price. |

| Europe | Focus on premium segments. | Price adjustments to align with local demand and economic shifts. |

| Oceania | Navigating less favorable environments. | Flexible pricing tactics to sustain market presence and profitability. |

| New Product Launches (e.g., RTDs) | Capitalizing on demand for convenience and novel profiles. | Value-based pricing reflecting premium quality and higher profit potential. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis for Asahi Group Holdings is meticulously constructed using a blend of official financial disclosures, including annual reports and investor presentations, alongside insights from their corporate website and recent press releases. This ensures a comprehensive understanding of their product portfolio, pricing strategies, distribution networks, and promotional activities.