Argonaut Gold SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Argonaut Gold's strengths lie in its established production assets and experienced management team, but it faces challenges with operational efficiencies and project development timelines. Understanding these internal dynamics is crucial for navigating the volatile gold market.

Want the full story behind Argonaut Gold's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Argonaut Gold boasts a significant operational footprint across North America, with key assets like the Magino mine in Ontario, Canada, and the Florida Canyon mine in Nevada, USA. This concentration in stable mining jurisdictions significantly mitigates geopolitical risks, a crucial advantage in the global mining sector.

Operating in established mining regions grants Argonaut Gold access to a readily available pool of skilled labor and robust infrastructure. Furthermore, the predictable regulatory environments in Canada and the USA streamline operations and reduce uncertainty, fostering a more efficient and reliable business model.

Argonaut Gold’s strategic focus on efficient open-pit, heap leach operations is a significant strength. This method typically offers lower operating costs compared to underground mining, directly contributing to stronger cash flow and profitability, particularly when gold prices are volatile.

For instance, the company’s Florida Canyon mine achieved its highest production in 19 years, demonstrating the effectiveness and potential of this operational model. This efficiency is key to Argonaut’s ability to navigate market fluctuations and maintain a competitive edge.

Argonaut Gold’s dedication to sustainable mining is a significant strength, highlighted in its 2022 ESG Report. This commitment extends to concrete actions like managing climate change risks and addressing modern slavery, alongside conducting greenhouse gas inventories and adhering to international mine closure standards.

This focus on responsible operations can bolster Argonaut Gold's public image, making it more attractive to investors prioritizing environmental, social, and governance (ESG) factors. Furthermore, a strong sustainability record may simplify and expedite the often-complex permitting processes for new projects.

Strategic Acquisition by Alamos Gold (Magino Mine)

The strategic acquisition of Argonaut Gold's Magino mine by Alamos Gold in July 2024 represents a major strength. This move places the Magino asset with a financially robust operator, significantly enhancing its prospects and de-risking its development. Alamos Gold's established financial capacity provides a solid foundation for Magino's operations and future expansion.

The integration of Magino with Alamos's nearby Island Gold mine is a key benefit. This synergy is projected to create one of Canada's largest and lowest-cost gold mining operations. For instance, Alamos Gold anticipates that the combined operations will benefit from significant operational efficiencies and economies of scale.

- Enhanced Financial Backing: Alamos Gold's stronger balance sheet provides crucial capital for Magino's ramp-up and ongoing operations.

- Synergistic Operations: Combining Magino with Island Gold is expected to unlock significant cost savings and operational efficiencies.

- De-risked Development: Ownership by a larger, experienced producer like Alamos Gold reduces the execution risk associated with Magino's production ramp-up.

- Scale Advantage: The combined entity is poised to become a major player in the Canadian gold mining landscape, offering greater market influence.

Development-Stage Project Portfolio

Argonaut Gold's strength lies in its development-stage project portfolio, offering significant potential for future growth and resource expansion beyond its current producing assets. This pipeline is crucial for replenishing reserves and ensuring long-term operational viability.

While Argonaut is spinning out some Mexican assets, the strategic focus remains on developing projects in North America. This concentration allows for organic growth and a more streamlined approach to expanding its production capacity.

- Development Pipeline: Argonaut Gold's portfolio includes several key development projects, such as the Magino project in Ontario, Canada, which is expected to commence production in 2024.

- Resource Expansion: The company actively works on expanding resources at its existing and new projects, aiming to increase the overall gold reserves and extend the mine life of its operations.

- Organic Growth Focus: By prioritizing the development of its North American assets, Argonaut aims to achieve sustainable, organic growth, reducing reliance on external acquisitions and strengthening its internal development capabilities.

Argonaut Gold benefits from operating in stable jurisdictions like Canada and the USA, which offer predictable regulatory environments and access to skilled labor. This geographical focus minimizes geopolitical risks and streamlines operations. The company’s efficient open-pit, heap leach mining strategy, as demonstrated by Florida Canyon’s 19-year production high, contributes to lower operating costs and improved profitability.

The strategic sale of the Magino mine to Alamos Gold in July 2024 is a significant strength, providing enhanced financial backing and de-risking its development. Alamos Gold’s integration of Magino with its Island Gold mine is projected to create substantial operational efficiencies and economies of scale, positioning the combined entity as a major Canadian gold producer. This partnership ensures Magino's development is supported by a financially robust operator with proven expertise.

Argonaut Gold's portfolio includes promising development-stage projects, such as the Magino project, which was expected to commence production in 2024. This pipeline is crucial for future growth and resource expansion, ensuring long-term operational viability. The company's focus on developing North American assets supports sustainable, organic growth and strengthens its internal development capabilities.

What is included in the product

Delivers a strategic overview of Argonaut Gold’s internal and external business factors, highlighting its operational strengths, market opportunities, and potential threats.

Offers a clear, actionable SWOT analysis for Argonaut Gold, pinpointing areas for improvement and leveraging strengths to overcome operational challenges.

Weaknesses

The ramp-up at Argonaut Gold's Magino mine faced significant hurdles in early 2024, with mining rates, mill throughput, and gold grades falling short of initial projections. This slower-than-anticipated progress directly impacted the company's operational efficiency.

Operational challenges, including insufficient loader availability and substantial unplanned downtime at the mill, severely hampered production during the first quarter of 2024. These issues contributed to a net loss and necessitated impairment charges, highlighting the financial strain caused by the operational setbacks.

Argonaut Gold's financial position prior to the Alamos Gold transaction was a significant concern, marked by substantial net debt. As of March 31, 2024, the company reported a net debt of $186.5 million, highlighting a considerable leverage burden.

Further compounding these issues was a working capital deficit of $179.0 million as of the same date. This deficit indicated that Argonaut Gold's short-term liabilities exceeded its readily available assets, creating immediate liquidity challenges.

The company's financial strain was evident in its need to implement various initiatives to cover near-term liquidity needs. Moreover, Argonaut Gold faced difficulties in complying with its financial covenants, which necessitated obtaining waivers from its lenders, underscoring the precariousness of its financial health.

Argonaut Gold is facing elevated operating expenses, exceeding initial 2024 projections. These include higher labor, grade control, drill and blast costs, and increased diesel prices, all contributing to a tougher cost environment.

Sustaining capital expenditures are also a significant factor. The completion of the tailings management facility at Magino and the ongoing construction of a third heap leach pad at Florida Canyon are necessary investments that, while crucial for future operations, are currently driving up unit costs.

Dilution Issues and Lower Grades at Magino

Argonaut Gold is facing challenges at its Magino mine, particularly with selectively extracting high-grade gold. This difficulty has led to increased dilution, meaning more waste rock is being processed alongside the ore. Consequently, the average grade of material sent to the mill is running about 5% to 10% lower than initially projected in the technical report for the upcoming two to three years.

This lower-than-expected grade directly impacts the mine's immediate gold production and, by extension, its revenue generation. For instance, if the technical report projected an average grade of 1.5 grams per tonne (g/t) and actual grades are 10% lower, the mill is receiving closer to 1.35 g/t. This shortfall can affect profitability and cash flow in the short to medium term.

- Dilution Challenges: Difficulty in selectively mining high-grade zones at Magino.

- Grade Reduction: Average mill grade is 5%-10% lower than technical report projections.

- Timeframe: This grade reduction is expected to persist for the next 2-3 years.

- Financial Impact: Potential negative effect on immediate gold output and revenue.

Divestiture of Mexican and US Assets (SpinCo)

The divestiture of key Mexican and US assets, including Florida Canyon, El Castillo Complex, La Colorada, and Cerro del Gallo, into a new entity called SpinCo as part of the Alamos transaction, significantly alters Argonaut Gold's operational footprint. This move, while streamlining Alamos's portfolio, leaves the original Argonaut entity with a potentially reduced operational base.

This strategic shift means Argonaut, or the newly formed SpinCo, will operate with a more concentrated portfolio. For instance, as of late 2024, the combined production from these divested assets contributed a substantial portion of the previous operational output, and their absence will necessitate a recalibration of future production targets and growth strategies for the remaining or spun-out entity.

The loss of these producing and development assets could impact the financial flexibility and market perception of the entity retaining these assets. Investors will need to assess the quality and potential of the remaining assets to compensate for the loss of these previously significant contributors.

- Reduced Operational Scale: The spin-off of US and Mexican assets into SpinCo concentrates the operational base, potentially limiting economies of scale for the remaining entity.

- Portfolio Concentration Risk: The remaining assets will carry a higher proportion of the company's operational risk, requiring careful management and development.

- Impact on Future Growth: The loss of these producing and development assets may necessitate a more aggressive exploration and development strategy for the remaining assets to maintain growth momentum.

Argonaut Gold's operational performance in early 2024 was significantly hampered by lower-than-expected mining rates, mill throughput, and gold grades at its Magino mine. This resulted in operational inefficiencies and a net loss for the quarter, further exacerbated by impairment charges and substantial unplanned downtime, particularly at the mill. The company also grappled with elevated operating expenses, including higher labor, grade control, drill and blast costs, and increased diesel prices, impacting its cost structure. Furthermore, sustaining capital expenditures for critical infrastructure like the Magino tailings management facility and the Florida Canyon heap leach pad are currently driving up unit costs.

The company's financial health in the lead-up to the Alamos Gold transaction was precarious, characterized by a net debt of $186.5 million as of March 31, 2024, and a working capital deficit of $179.0 million. These figures underscore significant liquidity challenges and a high leverage burden. Argonaut Gold's ability to meet financial covenants was strained, necessitating waivers from lenders, signaling a fragile financial position.

The divestiture of key Mexican and US assets, including Florida Canyon, El Castillo Complex, La Colorada, and Cerro del Gallo, into a new entity, SpinCo, as part of the Alamos transaction, has substantially reduced Argonaut Gold's operational scale and concentrated its portfolio. This strategic move means the remaining entity will operate with a more focused asset base, potentially impacting economies of scale and requiring a more aggressive strategy for the remaining assets to maintain growth momentum.

| Weakness | Description | Impact |

| Operational Ramp-Up Challenges | Lower mining rates, mill throughput, and gold grades at Magino mine in early 2024; insufficient loader availability and unplanned mill downtime. | Reduced operational efficiency, net loss, impairment charges, and financial strain. |

| Elevated Operating Expenses | Higher labor, grade control, drill and blast costs, and increased diesel prices exceeding 2024 projections. | Tougher cost environment, potentially impacting profitability. |

| Financial Leverage and Liquidity | Net debt of $186.5 million and working capital deficit of $179.0 million as of March 31, 2024. | Significant liquidity challenges and precarious financial health, requiring lender waivers for covenant compliance. |

| Portfolio Concentration | Divestiture of Mexican and US assets into SpinCo reduces operational scale and concentrates risk. | Potential loss of economies of scale and increased reliance on remaining assets for growth. |

What You See Is What You Get

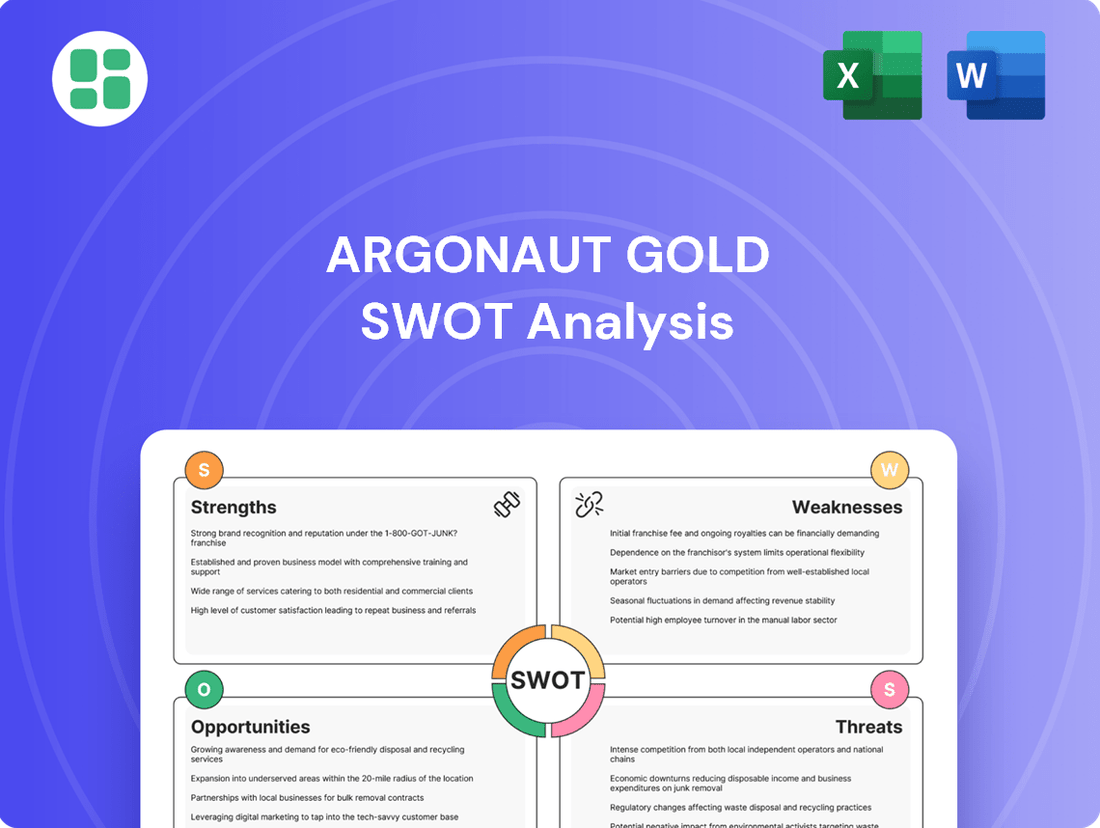

Argonaut Gold SWOT Analysis

This is the actual Argonaut Gold SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights into the company's strategic position.

The preview below is taken directly from the full SWOT report you'll get, offering a clear snapshot of Argonaut Gold's Strengths, Weaknesses, Opportunities, and Threats.

Purchase unlocks the entire in-depth version, providing a complete and actionable understanding of Argonaut Gold's competitive landscape and future potential.

Opportunities

The Magino mine presents a compelling opportunity for Argonaut Gold, with significant potential for production optimization and expansion. Following initial ramp-up challenges, the company is focused on increasing daily mining rates and mill throughput in the latter half of 2024. This strategic push aims to unlock greater operational efficiency and output from the asset.

Looking ahead, the medium-term vision involves expanding the reserve base and further increasing mill throughput. The target is to elevate annual production to a range of 200,000 to 250,000 ounces. This ambitious expansion plan is now being actively pursued by Alamos Gold, highlighting the recognized value and future potential of the Magino operation.

Argonaut Gold is actively pursuing exploration to boost its mineral reserves, with significant efforts focused on projects like Magino and Florida Canyon. These drilling programs are designed to uncover and define new resources, directly contributing to the company's future production capacity.

The company has set a target for 2024 to invest in reserve development, aiming to add between 500,000 and 1 million ounces to its estimated mineral reserves. This strategic investment in exploration is crucial for extending the operational life of its mines and strengthening its long-term production outlook.

The Florida Canyon mine presents a significant opportunity for Argonaut Gold, with plans for redevelopment and expansion. The construction of a third heap leach pad, slated for completion in 2024, underscores this commitment to growth.

Updated technical reports confirm the mine's substantial production potential and a favorable financial outlook, pointing towards further optimization and enhanced gold recovery rates. This asset is poised for increased efficiency and output.

Leveraging Higher Gold Prices

The current upward trajectory of gold prices presents a significant opportunity for Argonaut Gold. Higher commodity prices directly translate to increased revenue and improved profitability on their existing gold production.

This enhanced financial performance can bolster margins, making it easier to fund essential capital expenditures and strengthen the company's overall financial standing. Furthermore, elevated gold prices improve the economic viability of current and future mining projects, potentially accelerating development or expansion plans.

- Increased Revenue: With gold prices averaging around $2,300 per ounce in early 2024, Argonaut's revenue from its 2023 production of 180,789 ounces of gold would see a substantial boost compared to earlier periods.

- Improved Profitability: Higher selling prices, assuming stable or declining production costs, directly lead to wider profit margins on each ounce of gold sold.

- Enhanced Project Economics: Projects previously on the cusp of economic feasibility may become attractive investments at current gold price levels, opening new avenues for growth.

Strategic Partnerships and M&A Activity in the Sector

The acquisition of Argonaut's Magino mine by Alamos Gold for $189 million in early 2024 highlights the ongoing M&A potential in the gold mining sector. This transaction underscores how companies with quality assets in secure jurisdictions can be attractive targets, signaling a path for consolidation or new investment opportunities.

This trend suggests that Argonaut's remaining assets, potentially managed by a newly formed entity like SpinCo, could become focal points for further strategic alliances or mergers. Such moves are common as companies seek to optimize portfolios and leverage synergies in a competitive market.

- Asset Divestment: Argonaut Gold's sale of its Magino mine to Alamos Gold for $189 million in Q1 2024 exemplifies strategic asset repositioning.

- Jurisdictional Advantage: The sale reinforces the value of assets located in stable mining regions, attracting significant investor and corporate interest.

- Consolidation Potential: This M&A activity signals a broader trend of consolidation within the gold mining industry, creating opportunities for both buyers and sellers.

- SpinCo Opportunities: A potential SpinCo could leverage this environment to attract new capital or pursue its own strategic partnerships and acquisitions.

The company's strategic focus on optimizing the Magino mine, aiming for increased production to 200,000-250,000 ounces annually, presents a significant growth opportunity. Furthermore, the redevelopment and expansion of the Florida Canyon mine, including the construction of a third heap leach pad in 2024, are poised to enhance operational efficiency and output. Argonaut Gold's commitment to exploration, with a target of adding 500,000 to 1 million ounces to its reserves in 2024, directly supports long-term production capacity. The favorable gold price environment, averaging around $2,300 per ounce in early 2024, substantially boosts revenue and profitability, making projects more economically viable.

| Opportunity | Key Details | Impact |

|---|---|---|

| Magino Mine Optimization | Increase daily mining rates and mill throughput; target 200,000-250,000 oz annual production. | Enhanced operational efficiency and increased gold output. |

| Florida Canyon Redevelopment | Construction of third heap leach pad (2024); updated technical reports confirm potential. | Improved gold recovery rates and increased production capacity. |

| Exploration and Reserve Growth | Target to add 500,000-1 million oz to reserves in 2024; focus on Magino and Florida Canyon. | Strengthened long-term production outlook and extended mine life. |

| Favorable Gold Prices | Average prices around $2,300/oz in early 2024. | Increased revenue, improved profitability, and enhanced project economics. |

Threats

Continued operational challenges at the Magino mine, including lower-than-expected mill availability and grades, pose a significant threat, potentially leading to ongoing production shortfalls and elevated unit costs. This directly impacts Argonaut Gold's ability to meet its production targets.

Delays in achieving nameplate capacity and projected mining rates at Magino could negatively affect cash flow and profitability. For instance, the company reported lower production in Q1 2024, partly due to these operational hurdles, underscoring the financial implications of such delays.

While gold prices have shown strength, their inherent volatility presents a persistent threat to Argonaut Gold. A significant downturn in the price of gold, a primary driver of the company's revenue, could severely impact profitability and the financial feasibility of both ongoing and planned mining operations.

For instance, if gold prices were to drop by 10% from their current levels, it could directly reduce Argonaut Gold's revenue projections for 2024 and 2025, potentially impacting its ability to service debt or fund new exploration initiatives.

Rising input costs, particularly for labor, energy such as diesel, and essential materials, present a persistent challenge to Argonaut Gold's operational cost structure. These escalating expenses directly impact the company's ability to manage its budget effectively.

Inflationary pressures are a significant threat, capable of diminishing profit margins and hindering the company's efforts to maintain efficient operations and meet its cost targets. This was evident in 2024, where higher unit costs were reported, underscoring the real-time impact of these economic conditions.

Regulatory and Permitting Risks

Mining is heavily regulated, and any hiccups in getting environmental and other permits can significantly stall or even stop operations and development. For Argonaut Gold, this is a key concern, particularly with its Mexican operations.

Specifically, the company needs to secure federal permits to access its remaining reserves in Mexico. A delay in obtaining these crucial permits could directly impact production levels and future output, creating uncertainty for the company's financial projections.

- Regulatory Hurdles: Delays in obtaining federal permits for Mexican reserves pose a significant threat to production continuity.

- Operational Impact: Failure to secure necessary permits can halt or slow down mining activities and development projects.

- Financial Ramifications: Permit delays can negatively affect projected production volumes and, consequently, Argonaut Gold's financial performance.

Integration Risks Post-Acquisition and Spin-Off

Integration risks are a significant concern for Argonaut Gold following the Magino acquisition by Alamos Gold. The successful merging of Magino's operations into Alamos's existing structure, and the subsequent performance of the spun-off entity, present potential challenges. For instance, if Alamos Gold fails to achieve the projected synergies from Magino, or if the spin-off company (SpinCo) encounters immediate liquidity or operational difficulties, it could diminish shareholder value for both companies.

Specific concerns include:

- Operational Synergies: Realizing the anticipated cost savings and operational efficiencies from integrating Magino into Alamos Gold's portfolio is not guaranteed.

- SpinCo Liquidity: The newly formed SpinCo might face initial funding gaps or struggle to secure necessary operational capital, impacting its early-stage development and production.

- Shareholder Value Dilution: Any significant integration missteps or underperformance by SpinCo could lead to a decline in the market valuation of both Argonaut Gold and Alamos Gold shares.

The ongoing operational challenges at the Magino mine, including lower-than-expected mill availability and grades, pose a significant threat, potentially leading to continued production shortfalls and elevated unit costs, directly impacting Argonaut Gold's ability to meet its 2024 and 2025 production targets.

Volatility in gold prices remains a key threat, as a substantial downturn could severely impact profitability and the financial feasibility of current and planned operations; for example, a 10% price drop could directly reduce revenue projections for 2024-2025.

Rising input costs, particularly for labor, energy, and materials, continue to challenge Argonaut Gold's cost structure, with inflationary pressures diminishing profit margins and hindering the company's ability to maintain efficient operations and meet cost targets, as evidenced by higher unit costs reported in 2024.

Regulatory hurdles, especially concerning federal permits for accessing remaining reserves in Mexico, present a significant risk to production continuity and future output, creating uncertainty for financial projections.

SWOT Analysis Data Sources

This Argonaut Gold SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary. These reliable sources ensure an accurate and insightful assessment of the company's strategic position.