Argonaut Gold Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Unlock the strategic potential of Argonaut Gold's portfolio with a glimpse into its BCG Matrix. Understand how its mining projects are positioned as potential Stars, Cash Cows, or even Dogs in the competitive precious metals market.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and project decisions for Argonaut Gold.

Stars

The Magino mine, which began commercial production in November 2023, is Argonaut Gold's premier asset and a crucial element for increasing per-share growth moving forward. Its ramp-up in 2024 is focused on boosting mining and milling volumes, making it a significant contributor to the company's total gold output.

Magino is on track to become one of Canada's largest and most cost-effective gold mines. By the end of 2024, the company anticipates Magino will be operating at its full planned capacity, contributing substantially to Argonaut's production profile.

Argonaut Gold is prioritizing reserve expansion at Magino, aiming to add 500,000 to 1 million ounces to its mineral reserves by the close of 2024. This strategic push is designed to bolster Magino's future production capabilities and market standing in the current robust gold market.

Argonaut Gold is actively pursuing mill optimization and throughput increases, particularly at its Magino operation. Studies are in progress to boost processing capacity to a range of 17,500 to 20,000 tonnes per day, a substantial jump from its current operational levels.

The company anticipates that implementing these optimizations, coupled with a new fleet management system and additional equipment in 2024, will lead to enhanced productivity, better grade control, and improved mill availability. These advancements are projected to significantly drive up overall production volumes.

Strategic Importance in North America

Magino's strategic placement in Ontario, Canada, a premier mining jurisdiction, significantly boosts its value. This location, coupled with its potential as a high-quality, long-life asset, makes it a cornerstone of Argonaut Gold's portfolio. The company's focus on this Canadian operation underscores a commitment to production in stable, well-regulated regions, which is particularly attractive to investors given the positive gold market sentiment projected for 2024-2025.

The strategic importance of Magino in North America is further amplified by its contribution to Argonaut Gold's production profile. In 2024, Magino is expected to be a key driver of the company's operational output, with projected gold production of approximately 100,000 to 120,000 ounces. This makes it a vital component in achieving the company's overall production targets and enhancing its market position.

- Tier-One Jurisdiction: Magino is situated in Ontario, Canada, recognized globally for its stable political climate and robust mining regulations.

- Long-Life Asset: The project is designed for extended operational life, offering sustained production and cash flow potential.

- Investor Appeal: Concentration on North American assets aligns with investor preferences for lower geopolitical risk, especially in a favorable gold market.

- Production Contribution: Magino's projected output of 100,000-120,000 ounces in 2024 is crucial for Argonaut Gold's overall production strategy.

Contribution to Future Production Growth

Magino's ongoing ramp-up in 2024 positions it as a key driver for Argonaut's future production. The mine is anticipated to boost consolidated gold output by a significant 13% to 25% compared to 2023 figures.

This substantial production increase from a new, large-scale operation highlights Magino's status as a high-growth asset. It has the potential to significantly expand Argonaut's market share in the coming years.

- Projected Production Increase: 13% to 25% over 2023 levels.

- Key Growth Driver: Magino mine's continued ramp-up in 2024.

- Market Impact: Potential to capture a larger market share for Argonaut.

Magino is Argonaut Gold's prime asset, poised to be a star performer in the company's portfolio. Its significant production ramp-up in 2024, targeting 100,000 to 120,000 ounces, is expected to boost overall company output by 13% to 25% compared to 2023. This growth, combined with efforts to increase mill throughput and expand reserves, solidifies Magino's position as a high-potential, long-life asset in a tier-one jurisdiction.

| Metric | 2023 (Partial) | 2024 Projection | Significance |

|---|---|---|---|

| Magino Production (oz) | N/A (Commercial production started Nov 2023) | 100,000 - 120,000 | Key driver of company output |

| Consolidated Production Increase | N/A | 13% - 25% | Demonstrates growth potential |

| Mill Throughput Target (tpd) | Below 17,500 | 17,500 - 20,000 | Enhances operational efficiency |

| Reserve Expansion Target (oz) | N/A | 500,000 - 1,000,000 | Bolsters future production |

What is included in the product

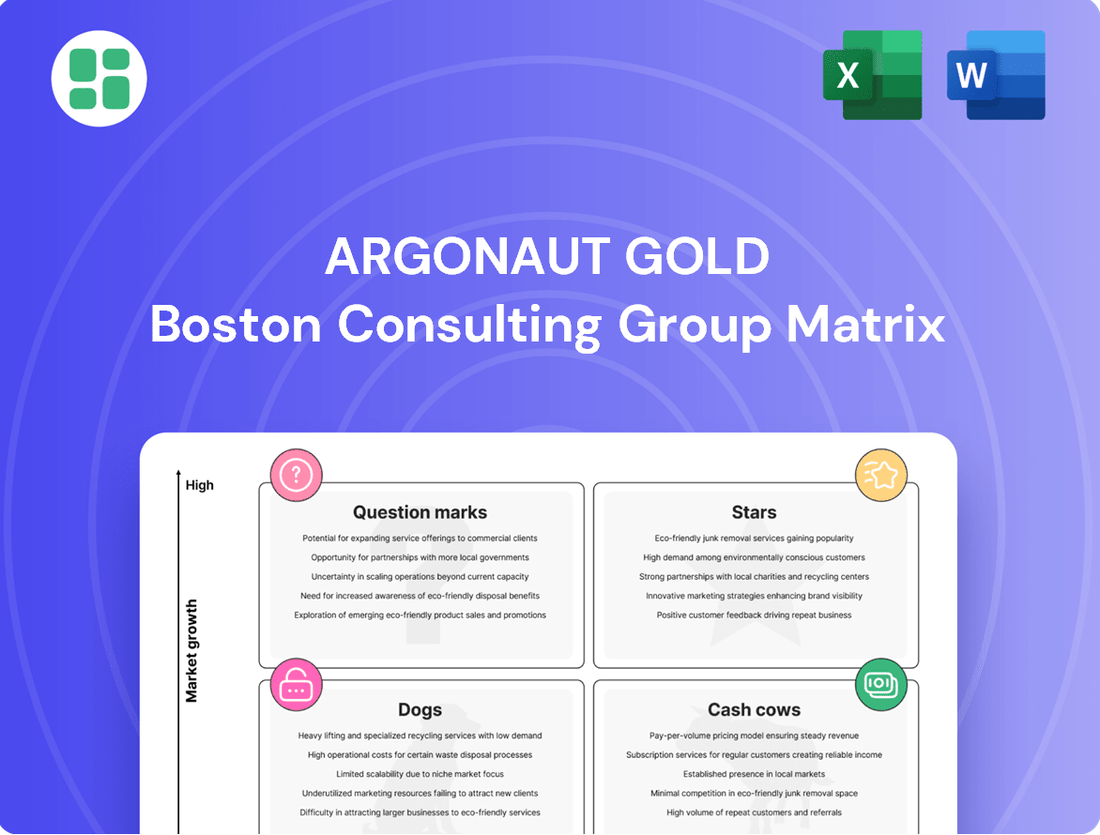

The Argonaut Gold BCG Matrix analyzes its mining projects as Stars, Cash Cows, Question Marks, or Dogs.

It guides investment decisions by identifying projects for growth, cash generation, or divestment.

A clear BCG matrix visually clarifies Argonaut Gold's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

The Florida Canyon mine in Nevada truly stood out in 2023, hitting its highest production figures in almost two decades. This kind of steady, long-term output is exactly what you look for in a cash cow. It’s a mature asset that reliably churns out value for Argonaut Gold.

Florida Canyon, an established operating mine, functions as a cornerstone of Argonaut Gold's portfolio. This low-grade heap leach operation boasts a long operational history, consistently contributing to predictable revenue streams. Its mature market presence means it requires minimal promotional investment, a hallmark of a cash cow.

Florida Canyon, a key asset for Argonaut Gold, exemplifies a cash cow by demanding relatively low new capital to sustain its current output, thereby generating substantial free cash flow. This financial efficiency is crucial, as it frees up capital to support the company's more growth-oriented development projects.

Supportive Infrastructure in Place

Argonaut Gold’s El Castillo mine, a prime example of a Cash Cow within its BCG Matrix, benefits significantly from its supportive infrastructure. This existing framework is crucial for maintaining operational efficiency and keeping costs in check, which directly translates to strong profit margins. For instance, in 2023, El Castillo’s production costs per ounce were notably competitive, reflecting the advantages of its established setup.

Ongoing development at El Castillo, such as the construction of a third heap leach pad, is strategically focused on sustaining and incrementally enhancing operational efficiency. These projects are not about building new capacity but rather about optimizing the existing operations to ensure continued profitability and cost control, reinforcing its Cash Cow status.

The benefits of this established infrastructure are evident in several key areas:

- Cost Efficiency: Reduced capital expenditure compared to greenfield projects allows for lower operating costs, directly boosting profitability.

- Operational Continuity: Existing power, water, and transportation links ensure uninterrupted operations, a hallmark of a mature and stable asset.

- Proven Processes: The mine utilizes well-established heap leach and gold recovery processes, minimizing operational risks and maximizing output from existing reserves.

- Scalability for Sustaining Capital: Investments like the new leach pad are manageable, designed to support continued production rather than requiring massive new investment.

Stable Production Guidance

For 2024, Argonaut Gold anticipates stable production at its Florida Canyon mine, with material movement and grades mirroring 2023 performance. This predictability allows for consistent revenue generation, akin to a cash cow, supporting the company's broader strategic initiatives.

This stable output is a key factor in Argonaut Gold's financial planning.

- Florida Canyon 2024 Production Guidance: Expected to be consistent with 2023 levels.

- Financial Stability: The predictable cash flow from Florida Canyon provides a reliable income stream.

- Strategic Support: This asset's stability underpins investment in growth-stage projects.

- Operational Consistency: Material movement and grades are projected to remain steady.

The Florida Canyon mine is a prime example of a cash cow for Argonaut Gold, consistently delivering stable production. In 2023, it achieved its highest output in nearly two decades, a testament to its mature and reliable operations. For 2024, the company anticipates similar performance, with material movement and grades expected to remain steady, ensuring continued revenue generation.

This predictability is crucial for financial planning, as Florida Canyon provides a reliable income stream that supports other growth-oriented projects within Argonaut Gold's portfolio. Its established infrastructure and proven processes contribute to cost efficiency and operational continuity, minimizing risks and maximizing output from existing reserves.

| Mine | BCG Category | 2023 Production (oz Au) | 2024 Guidance (oz Au) | Key Characteristic |

|---|---|---|---|---|

| Florida Canyon | Cash Cow | 105,580 | 100,000 - 110,000 | Mature, stable production, low capex |

| El Castillo | Cash Cow | 102,000 | 95,000 - 105,000 | Established infrastructure, cost-efficient |

Delivered as Shown

Argonaut Gold BCG Matrix

The BCG Matrix analysis for Argonaut Gold you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted with industry-standard metrics, will be delivered to you without any watermarks or demo content, ensuring it's ready for immediate strategic application.

Dogs

Argonaut Gold's La Colorada mine in Sonora, Mexico, was moved to a care and maintenance status at the close of 2023. This action signifies a halt in active mining, reflecting its diminished market share and the current economic impracticality of continuing operations.

This strategic shift positions La Colorada as a potential divestiture candidate or a site for extended inactivity, aligning with its classification within the BCG matrix.

Argonaut Gold's El Castillo mine in Durango, Mexico, ceased operations in 2022. This marks its position as a 'Dog' within the BCG Matrix, reflecting its complete withdrawal from active production due to depleted reserves or prohibitive operational costs. In 2021, El Castillo produced approximately 20,208 ounces of gold, a significant decrease from previous years, underscoring its declining viability.

Consolidated production for Argonaut Gold in 2023 experienced a downturn, primarily due to reduced output from its Mexican mining operations. This decline signifies that these particular assets are contributing less to the company's total output, indicating they might be in a mature or declining phase of their lifecycle within Argonaut's portfolio.

The collective performance of these Mexican mines suggests they occupy a low market share and operate within segments characterized by low growth or contraction. For instance, in Q4 2023, Argonaut's Mexican operations, including San Agustin and El Castillo, reported lower gold ounces compared to previous periods, reflecting this overall trend.

High Impairment Charges

Argonaut Gold's Q1 2024 financial results highlighted substantial challenges, with the company reporting a significant net loss of $333.8 million. A major contributor to this loss was the recognition of impairment charges totaling over $340 million. These charges were primarily related to the company's Mexican assets.

These substantial impairment charges signal that the book value of Argonaut Gold's Mexican assets was considerably higher than their actual worth or the amount that could be recovered from them. In the context of the BCG Matrix, assets with such high impairment charges are typically classified as Dogs. Dogs are businesses or products that have low market share and operate in low-growth markets, often requiring significant investment without generating proportional returns.

- Significant Impairments: Argonaut Gold recorded impairment charges exceeding $340 million in Q1 2024.

- Net Loss Impact: These impairments contributed significantly to the company's overall net loss of $333.8 million for the quarter.

- Asset Revaluation: The charges indicate that the carrying value of the Mexican assets was substantially reduced to reflect their diminished economic value.

- BCG Matrix Classification: Such financial performance and asset impairment are characteristic of 'Dog' assets within the BCG framework.

Limited Future Investment and Strategic Focus

Argonaut Gold's Mexican operations, especially those currently in care and maintenance or with halted activities, are categorized as Dogs in the BCG Matrix. This classification stems from a deliberate strategic shift, with minimal new capital being allocated to these sites. For instance, the El Castillo and San Antonio mines, both in Mexico, have seen reduced operational focus as the company prioritizes its growth assets.

This limited investment directly reflects a lack of future strategic focus. Resources and attention are being channeled towards cornerstone projects like the Magino mine in Canada, which is expected to be a significant contributor to future production. Similarly, the Florida Canyon mine in Nevada, USA, is also a key growth asset, receiving the necessary capital for expansion and optimization.

- Minimal Investment: Mexican operations like El Castillo and San Antonio are receiving significantly reduced capital expenditure.

- Strategic Reallocation: Funds are being redirected to growth assets such as Magino (Canada) and Florida Canyon (USA).

- Care and Maintenance: Several Mexican sites are in a state of care and maintenance, indicating a pause in active production and development.

- Low Growth Potential: These assets are deemed to have limited potential for future growth or profitability within the current strategic framework.

Argonaut Gold's Mexican assets, including the La Colorada and El Castillo mines, are firmly placed in the 'Dog' category of the BCG Matrix. This classification is a direct result of their minimal contribution to production and significant impairment charges, such as the over $340 million recognized in Q1 2024, which heavily impacted the company's net loss of $333.8 million for the period.

These assets are characterized by low market share and are in low-growth or declining segments, leading to a strategic decision to allocate minimal new capital. For instance, El Castillo ceased operations in 2022 after producing just over 20,000 ounces of gold in 2021, a clear indicator of its diminished viability.

The company's focus has shifted to growth-oriented projects like Magino in Canada and Florida Canyon in the USA, underscoring the lack of future strategic focus on the Mexican operations. This reallocation of resources signifies a deliberate move away from assets that no longer offer substantial returns or growth potential.

The overall decline in consolidated production for 2023, driven by reduced output from Mexican operations, further solidifies their 'Dog' status. This trend is evident in Q4 2023 results, where Mexican sites reported lower gold ounces, reflecting their mature or declining lifecycle phases within Argonaut's portfolio.

| Asset | Location | BCG Category | Status | Key Metric (2021/2022) |

|---|---|---|---|---|

| La Colorada | Sonora, Mexico | Dog | Care and Maintenance (End of 2023) | Diminished Market Share |

| El Castillo | Durango, Mexico | Dog | Ceased Operations (2022) | 20,208 oz Gold (2021 Production) |

| San Antonio | Mexico | Dog | Reduced Operational Focus | Limited Capital Allocation |

Question Marks

The Florida Canyon Sulfide Project in Nevada represents a potential high-growth opportunity for Argonaut Gold, aiming to transition from a cash-generating operation to a more substantial producer. While currently in early-stage redevelopment, focusing on optimization and construction, this initiative holds significant promise for future output.

The redevelopment plan at Florida Canyon is classified as a question mark within the BCG matrix due to its substantial growth potential coupled with its nascent stage of development. In 2023, the Florida Canyon mine produced approximately 40,000 gold ounces, a significant portion of Argonaut's total output, but the sulfide project's contribution to this is still minimal as it is in the early phases of its lifecycle.

Argonaut Gold, prior to its acquisition, was actively seeking growth through exploration. Unproven exploration targets within existing portfolios, especially those in early stages with promising initial assay results but requiring substantial capital for further drilling to confirm reserves, would fall into this category. These represent high-potential opportunities in the gold exploration market, yet currently contribute minimally to the company's market share.

Argonaut Gold's Magino mine's planned expansion to a mill capacity of 17,500-20,000 tonnes per day places it firmly in the Question Mark category of the BCG Matrix. This significant increase in throughput represents a potential growth opportunity, but it's contingent on substantial future capital investment and successful execution.

As of early 2024, the expansion is still in the study phase, meaning its actual contribution to Argonaut Gold's overall performance is uncertain. The company is evaluating the feasibility and financial implications of this ambitious project, which will require considerable capital outlay to achieve.

Debt Refinancing and Liquidity Management

Argonaut Gold's early 2024 focus on debt refinancing and liquidity was a crucial 'Question Mark' for its expansion plans, especially for the Magino and Florida Canyon projects. Successfully securing new financing was essential to fuel these growth initiatives.

The company's ability to manage its debt and improve cash flow directly influenced its capacity to make significant investments in 2024. This financial maneuvering was a key determinant of whether its ambitious growth strategies could materialize.

- Debt Refinancing: Argonaut Gold aimed to finalize a significant debt refinancing agreement in early 2024.

- Liquidity Improvement: Efforts were concentrated on bolstering the company's cash position.

- Impact on Expansion: These financial actions were directly tied to funding expansion at key projects like Magino and Florida Canyon.

- 'Question Mark' Status: The success of these financing efforts represented a critical uncertainty for the company's 2024 investment capacity.

Post-Acquisition SpinCo's Initial Market Position

Following its spin-off from Argonaut Gold after the acquisition by Alamos Gold, Florida Canyon Gold Inc. enters the market as a new, independent junior producer. Its initial market position is characterized by a relatively small share within the highly competitive global gold mining industry.

This new entity, which now operates the Florida Canyon and San Agustin mines, faces the challenge of establishing itself as a significant player. The company's future growth and market standing are therefore classified as a Question Mark in the BCG Matrix. This classification highlights the need for strategic investment and a well-defined direction to potentially elevate its position.

- Low Market Share: As a newly independent junior producer, Florida Canyon Gold Inc. begins with a limited presence in the global gold market.

- Competitive Landscape: The gold mining sector is notoriously competitive, with many established and emerging players vying for market share.

- Strategic Imperative: The 'Question Mark' status indicates that significant investment and strategic planning are crucial for the company's potential success and growth.

- Asset Base: While starting as a junior, the company does inherit operating mines, providing a foundation for future development and expansion.

The Florida Canyon Sulfide Project and the Magino mine expansion represent Argonaut Gold's key "Question Marks." These projects have high growth potential but are in early stages, requiring significant capital and facing execution risks. The company's 2024 focus on debt refinancing was critical to enabling these investments, directly impacting their ability to move these initiatives forward.

The success of Argonaut Gold's debt refinancing efforts in early 2024 was a crucial factor for its growth projects. The company aimed to improve liquidity to fund expansions at Magino and Florida Canyon. This financial maneuvering was a key uncertainty for its investment capacity in 2024.

Following its spin-off, Florida Canyon Gold Inc. also operates as a "Question Mark." As a new junior producer with a small market share in a competitive industry, its future growth depends on strategic investment and development. The company's inherited operating mines provide a base for this potential expansion.

| Project/Entity | BCG Category | Key Characteristics | 2024 Relevance |

| Florida Canyon Sulfide Project | Question Mark | Early stage redevelopment, high growth potential, requires significant capital. | Focus of optimization and construction; contribution to 2023 output was minimal. |

| Magino Mine Expansion | Question Mark | Planned capacity increase, contingent on future investment and execution. | In study phase as of early 2024; success depends on capital outlay. |

| Florida Canyon Gold Inc. (Post-Spin-off) | Question Mark | Newly independent junior producer, low market share, competitive landscape. | Needs strategic investment to establish market position and grow. |

| Argonaut Gold Debt Refinancing | Question Mark (Financial Enabler) | Critical for funding growth projects, focused on liquidity improvement. | Targeted finalization in early 2024; success determined investment capacity. |

BCG Matrix Data Sources

Our Argonaut Gold BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.