Argonaut Gold Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Argonaut Gold navigates a competitive landscape shaped by the bargaining power of its suppliers and the intense rivalry among existing gold producers. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Argonaut Gold’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of large-scale mining equipment, specialized drilling technology, and processing plant components can wield considerable influence. This is largely because these critical pieces of machinery are often expensive, proprietary, and have few readily available substitutes. For instance, major manufacturers of haul trucks or sophisticated mineral processing equipment can dictate terms given the capital investment required to acquire their technology.

Energy and fuel providers wield significant bargaining power over mining companies like Argonaut Gold. Mining is incredibly energy-hungry, relying on vast amounts of fuel for equipment and electricity for ore processing. In 2024, global energy prices remained volatile, directly impacting operational costs for miners. For instance, Brent crude oil prices, a key indicator, saw fluctuations throughout the year, impacting diesel costs which are critical for heavy machinery.

The availability of experienced mining engineers, geologists, and skilled mine operators can be a constraint for Argonaut Gold, especially in competitive labor markets or regions where specific expertise is scarce. For instance, in 2024, the global mining sector continued to face a shortage of specialized talent, driving up wages and recruitment costs.

Furthermore, specialized services crucial for mining operations, such as environmental consulting, advanced geological surveys, and comprehensive safety training, often originate from a limited number of qualified providers. This concentration of expertise significantly bolsters their bargaining power, allowing them to command higher fees and dictate terms in their contracts with companies like Argonaut Gold.

Chemical and Consumable Suppliers

For heap leach operations, the bargaining power of chemical and consumable suppliers, particularly those providing essential reagents like cyanide, can be significant. The concentration within this supply chain and stringent regulatory hurdles for transportation and usage can restrict the number of viable options for companies like Argonaut Gold. This often translates to suppliers having more leverage in dictating prices and contractual terms.

- Concentrated Supply Chain: The market for critical mining chemicals is often dominated by a few key global producers, limiting competition and increasing supplier influence.

- Regulatory Burden: Strict regulations on the handling, storage, and transport of chemicals such as cyanide create barriers to entry for new suppliers and can increase costs for existing ones, further consolidating power.

- Essential Nature of Reagents: Heap leaching relies heavily on specific chemicals for mineral extraction; any disruption or price hike from these suppliers directly impacts operational costs and profitability.

Infrastructure and Logistics Providers

Infrastructure and logistics providers hold significant bargaining power, especially in regions where reliable transportation networks and port facilities are scarce or concentrated among a few entities. This scarcity can allow these providers to dictate terms and pricing, directly impacting Argonaut Gold's operational costs and efficiency in moving essential equipment, supplies, and its finished gold product. For instance, in 2024, the global supply chain disruptions highlighted how critical even basic logistics are; a report by S&P Global indicated that freight costs for certain routes saw increases of up to 30% year-over-year due to capacity constraints.

The bargaining power of these infrastructure and logistics providers is amplified when Argonaut Gold operates in remote areas with limited alternative transportation options. In such scenarios, these providers essentially become gatekeepers, and their pricing and service availability can materially affect Argonaut's ability to maintain consistent production and meet delivery schedules. Companies like Argonaut Gold must carefully assess the concentration of power within the logistics sector in their operating regions to mitigate potential cost overruns and operational bottlenecks.

Key considerations regarding infrastructure and logistics providers include:

- Dependence on Limited Providers: In areas with few logistics companies, Argonaut Gold faces higher supplier power.

- Infrastructure Development Costs: The cost and availability of essential infrastructure like roads and ports can be a significant factor.

- Contractual Negotiations: The ability to negotiate favorable terms with logistics partners is crucial for cost management.

- Impact on Supply Chain Reliability: Disruptions from logistics providers can halt operations.

Suppliers of critical mining inputs, from specialized machinery to essential chemicals like cyanide, hold considerable sway over Argonaut Gold. This power stems from the high capital costs associated with their products, proprietary technology, and often limited competition. For example, in 2024, the global shortage of certain rare earth elements used in advanced mining equipment continued to drive up prices for manufacturers, a cost that can be passed on to buyers like Argonaut.

The energy sector, a major cost driver for mining, also demonstrates significant supplier bargaining power. Mining operations are energy-intensive, relying heavily on fuel for heavy machinery and electricity for processing. In 2024, global energy market volatility, influenced by geopolitical events, directly impacted fuel costs. For instance, diesel prices, crucial for Argonaut's fleet, remained a significant operational expense, with fluctuations directly affecting profitability.

Furthermore, skilled labor and specialized services represent another area where suppliers can exert influence. The mining industry faces ongoing challenges in securing experienced geologists, engineers, and skilled operators, particularly in niche areas. In 2024, the demand for these professionals remained high, leading to increased recruitment costs and wage pressures for companies like Argonaut Gold, especially in competitive mining regions.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Argonaut Gold (2024 Context) |

|---|---|---|

| Mining Equipment Manufacturers | High capital investment, proprietary technology, limited substitutes | Potential for higher equipment purchase/lease costs; reliance on specific maintenance providers. |

| Energy & Fuel Providers | Volatile global energy prices, essential for operations | Direct impact on operational costs (diesel, electricity); risk of price hikes affecting profitability. |

| Specialized Labor & Services | Shortage of skilled professionals, high demand in competitive markets | Increased recruitment and wage costs; potential delays due to talent scarcity. |

| Chemical & Consumable Suppliers (e.g., Cyanide) | Concentrated supply chain, regulatory burdens, essential for processing | Price sensitivity for reagents; risk of supply disruptions impacting production. |

| Infrastructure & Logistics Providers | Limited providers in remote areas, reliance on transportation networks | Potential for higher freight and logistics costs; impact on supply chain reliability and delivery schedules. |

What is included in the product

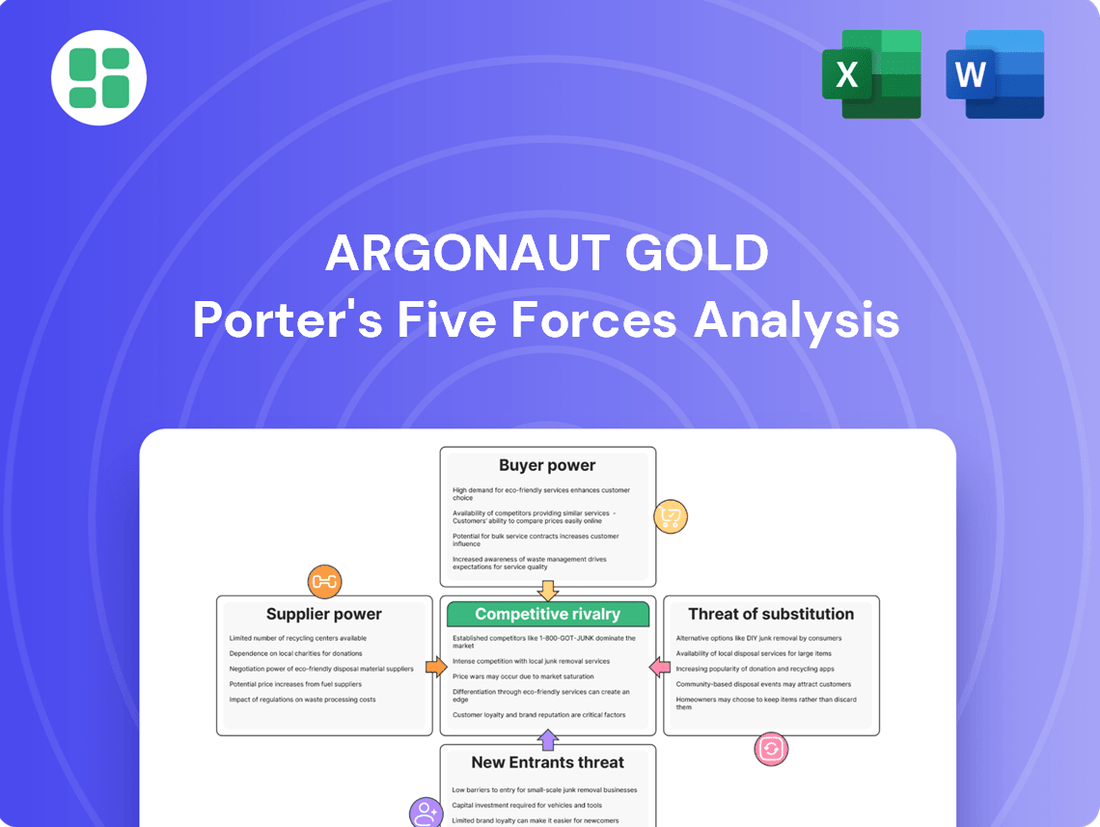

This analysis dissects the competitive landscape for Argonaut Gold, examining the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes, and their collective impact on Argonaut Gold's profitability.

Instantly visualize Argonaut Gold's competitive landscape with a dynamic Porter's Five Forces analysis, allowing for rapid identification of key strategic pressures.

Customers Bargaining Power

Argonaut Gold operates in a global commodity market for raw gold, meaning prices are set by broad international forces like supply, demand, and macroeconomic trends, not by individual customer negotiations. In 2024, gold prices have shown volatility, influenced by central bank policies and inflation expectations, underscoring the market-driven nature of pricing.

Consequently, Argonaut Gold's customers, such as refineries and bullion dealers, possess minimal bargaining power. They are obligated to accept the prevailing market price for gold, as there are no viable alternatives for large-scale procurement outside this established global pricing mechanism.

Gold, being a commodity, is largely a homogeneous product, meaning Argonaut Gold's output is interchangeable with that of its competitors. This lack of differentiation limits buyers' ability to demand specific features or quality advantages, thereby reducing their bargaining power.

While Argonaut Gold sells its output to a select few industrial buyers like smelters and refiners, the true market for gold is incredibly broad. Consumers purchasing jewelry, investors buying bullion, and various industrial applications create a vast end-user base. This diffusion of demand means no single industrial buyer can significantly dictate prices for Argonaut Gold.

Low Switching Costs for Buyers

For entities like refiners or bullion dealers, shifting from one gold supplier to another presents very little in terms of costs or hassle. This is primarily because as long as the gold meets the established purity benchmarks, the process is straightforward. In 2023, the global gold refining industry processed approximately 3,500 tonnes of gold, underscoring the scale of transactions where such low switching costs are prevalent.

This inherent ease of substitution significantly diminishes the bargaining leverage that individual direct customers might otherwise wield. When buyers can easily move between suppliers without incurring substantial expenses, their power to negotiate better terms or prices is naturally curtailed. For instance, a large refiner might source gold from multiple mines, and if one supplier increases prices, they can readily shift their business elsewhere, keeping supplier pricing competitive.

- Low Switching Costs: Refiners and bullion dealers face minimal costs when changing gold suppliers.

- Purity Standards: The primary requirement for switching is meeting established gold purity specifications.

- Reduced Buyer Power: This ease of substitution limits the bargaining power of individual customers.

- Supplier Competition: Buyers can easily shift business, fostering competition among gold suppliers.

Standardized Contracts and Terms

The bargaining power of customers for Argonaut Gold is significantly influenced by the standardized nature of gold sales. Raw gold transactions typically follow international market terms and conditions, often pegged to spot prices or widely recognized benchmarks. This uniformity limits individual customers' ability to dictate unique contractual demands or negotiate terms outside the established market agreements.

This standardization directly curtails the bargaining power of customers. For instance, in 2024, the London Bullion Market Association (LBMA) Gold Price, a key benchmark, averaged around $2,300 per troy ounce, reflecting a globally accepted pricing mechanism. Customers purchasing gold from producers like Argonaut Gold are generally bound by these prevailing market rates and standard contractual clauses, leaving minimal scope for personalized negotiation.

- Standardized Market Terms: Gold sales adhere to international benchmarks, limiting customer negotiation.

- Price Benchmarks: Spot prices and established benchmarks, like the LBMA Gold Price, dictate transaction terms.

- Limited Contractual Flexibility: Customers cannot easily impose unique demands or negotiate beyond market agreements.

- Reduced Customer Leverage: The lack of customization in contracts weakens the overall bargaining power of individual buyers.

Argonaut Gold's customers, primarily industrial buyers like refineries and bullion dealers, have very low bargaining power. This is due to the highly standardized nature of gold as a commodity and the global pricing mechanisms that dictate its value. In 2024, gold prices have been influenced by global economic factors, with the LBMA Gold Price benchmark remaining a key determinant for transactions, averaging approximately $2,300 per troy ounce for much of the year.

The lack of product differentiation means Argonaut Gold's output is interchangeable with that of competitors, and customers face minimal switching costs. The global gold refining market, processing thousands of tonnes annually, operates on these established purity standards, further limiting any individual buyer's ability to negotiate preferential terms. This environment ensures that Argonaut Gold is not significantly constrained by customer demands for price concessions or unique contract conditions.

| Factor | Impact on Argonaut Gold's Customer Bargaining Power | Supporting Data/Context (2023-2024) |

|---|---|---|

| Commodity Nature | Low | Gold is a homogeneous product, interchangeable across suppliers. |

| Global Pricing | Low | Prices set by broad market forces, not individual negotiations. LBMA Gold Price averaged ~$2,300/oz in 2024. |

| Switching Costs | Low | Minimal costs for refineries to switch suppliers if purity standards are met. Global refining volume ~3,500 tonnes in 2023. |

| Customer Concentration | Low | While Argonaut sells to few industrial buyers, the overall gold market is vast, preventing any single buyer from dictating terms. |

What You See Is What You Get

Argonaut Gold Porter's Five Forces Analysis

This preview showcases the complete Argonaut Gold Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the gold mining industry. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes. This comprehensive analysis is ready for your immediate use, no further editing or placeholders required.

Rivalry Among Competitors

The global gold mining sector is quite crowded, with a mix of very large, established companies and smaller, emerging ones. For instance, in 2024, major players like Barrick Gold and Newmont Corporation operate on a massive scale, while companies such as Argonaut Gold fit into the mid-tier category. This means there are many companies competing for the same valuable gold deposits and investor attention, particularly in regions like North America.

The gold mining industry's growth trajectory is intrinsically linked to global gold prices and overarching demand. When gold prices experience stagnation or a downturn, the competitive landscape within the industry becomes notably more intense. This heightened rivalry forces companies to aggressively pursue cost-reduction measures or engage in strategic acquisitions to preserve profitability and market share.

Gold, being a commodity, offers little room for product differentiation. This means companies like Argonaut Gold face intense rivalry primarily based on cost efficiency and production scale. In 2023, the average all-in sustaining cost for gold producers hovered around $1,200 to $1,300 per ounce, highlighting the critical importance of cost control in maintaining profitability when gold prices fluctuate.

The competitive landscape is thus shaped by operational excellence and the ability to manage costs effectively, rather than unique product features. While direct price wars are uncommon, the pressure to be a low-cost producer is constant, influencing strategic decisions regarding exploration, development, and operational improvements to remain competitive in the global gold market.

High Fixed Costs and Exit Barriers

The gold mining sector is characterized by exceptionally high fixed costs. These costs stem from the massive upfront capital required for exploration, mine development, and the construction of essential infrastructure like processing plants and transportation networks. For instance, developing a new gold mine can easily cost hundreds of millions, even billions, of dollars. This significant investment creates a high hurdle for new entrants and locks existing players into substantial financial commitments.

These high fixed costs, combined with the long operational life of mining assets, erect formidable exit barriers. Once a company has invested heavily in a mine, it is compelled to continue operations to recoup its investment, even if market conditions become unfavorable. This necessity to maintain production, regardless of short-term price fluctuations, intensifies competitive rivalry as companies strive to cover their ongoing operational expenses and debt servicing. In 2024, many gold producers continued to operate mines with higher production costs to meet financial obligations.

- High Capital Intensity: Gold mining requires substantial upfront investment, often exceeding $1 billion for a single large-scale mine development.

- Long Asset Lifespans: Mines are long-term assets, meaning capital is tied up for decades, discouraging quick exits.

- Operational Necessity: Companies must continue mining to recover initial investments, even in periods of lower gold prices, thereby sustaining competitive pressure.

- Infrastructure Commitment: Significant investment in processing facilities and infrastructure creates sunk costs that further elevate exit barriers.

Access to Reserves and Exploration Success

Competition is intense for securing new, high-quality gold reserves and achieving exploration success. Companies actively vie for attractive land packages, necessary exploration permits, and the skilled geologists needed to find and delineate new gold deposits, which are vital for sustained growth and operational longevity.

The race to acquire promising exploration ground means that costs for land acquisition and permitting can escalate rapidly. In 2024, junior exploration companies, in particular, faced significant challenges in securing capital for these early-stage activities, often relying on partnerships or joint ventures with larger, more established miners.

- Land Acquisition Costs: Increased competition drives up the cost of acquiring prospective exploration land.

- Permitting Challenges: Navigating complex and often lengthy permitting processes adds to the cost and timeline of exploration.

- Geological Talent: The demand for experienced geologists and exploration teams remains high, leading to competitive compensation packages.

- Exploration Budgets: Major gold producers, like Barrick Gold, allocated substantial budgets to exploration in 2024, with figures often in the hundreds of millions of dollars, underscoring the scale of investment required.

Competitive rivalry in the gold mining sector, including for companies like Argonaut Gold, is fierce due to the commodity nature of gold and high fixed costs. Differentiation is minimal, so companies compete primarily on cost efficiency and production scale. This pressure intensifies when gold prices are stable or declining, forcing aggressive cost-cutting or consolidation.

The industry is populated by a wide range of players, from global giants to smaller explorers, all vying for prime deposits and market share, particularly in regions like North America. In 2024, the average all-in sustaining cost for gold producers remained a critical benchmark, often between $1,200 and $1,300 per ounce, underscoring the constant need for operational excellence to maintain profitability amidst price volatility.

| Metric | 2023 Average (Approx.) | Significance for Rivalry |

|---|---|---|

| All-in Sustaining Cost (per oz) | $1,200 - $1,300 | Drives focus on cost efficiency; lower costs offer competitive advantage. |

| Exploration Budgets (Major Producers) | Hundreds of Millions USD | Intensifies competition for new reserves and geological talent. |

| New Mine Development Cost | $100 Million - $1 Billion+ | Creates high barriers to entry and exit, locking companies into operations. |

SSubstitutes Threaten

For investors looking for a safe place to put their money or something to hold its value, other precious metals such as silver, platinum, and palladium can be good alternatives to gold. These metals often track gold prices, though typically with higher volatility. For instance, in early 2024, gold prices surged past $2,300 per ounce, while silver hovered around $25-$30 per ounce, and platinum and palladium traded significantly lower, highlighting their potential as more accessible substitutes for some investors.

In the world of jewelry, consumers have a wide array of choices beyond gold. Platinum, known for its durability and hypoallergenic properties, and silver, a more affordable yet still precious option, directly compete with gold. Furthermore, diamonds and other gemstones offer distinct aesthetic appeal and perceived value, drawing consumer spending away from gold jewelry. This broadens the competitive landscape, meaning demand for gold can be influenced by the desirability and pricing of these other luxury goods.

Investors have a vast universe of financial assets beyond gold, such as stocks, bonds, and real estate, all vying for capital. In 2024, for example, global equity markets saw significant inflows, with the MSCI World Index gaining over 20% by mid-year, demonstrating how readily capital can shift away from traditional safe havens like gold when risk appetite increases.

The attractiveness of these substitutes is heavily influenced by macroeconomic factors. For instance, rising interest rates, as seen with the US Federal Reserve's policy tightening in recent years, make interest-bearing assets like government bonds more appealing, potentially drawing investment away from non-yielding assets such as gold. In early 2024, benchmark 10-year US Treasury yields hovered around 4.5%, offering a competitive return profile.

The rise of cryptocurrencies like Bitcoin as a potential digital store of value poses a growing threat of substitution for traditional assets, including gold. Bitcoin's market capitalization reached over $1 trillion in early 2024, demonstrating significant investor interest and a growing perception of it as an alternative to gold for wealth preservation.

While cryptocurrencies remain volatile, their increasing adoption and accessibility could divert investment flows that might otherwise be directed towards gold. This emerging asset class offers a decentralized alternative, appealing to investors seeking diversification beyond traditional financial systems.

Recycled Gold Supply

The threat of substitutes for newly mined gold is significant, primarily from recycled gold. A substantial portion of the global gold supply originates from melting down existing gold items like jewelry and industrial scrap. In 2023, for instance, the World Gold Council reported that recycled gold accounted for approximately 25% of the total supply, a figure that can fluctuate based on market conditions and price incentives.

This recycled gold directly competes with primary production from mining operations. When gold prices are high, the incentive to sell old jewelry or industrial components increases, boosting the supply of recycled gold. This can put downward pressure on the price of newly mined gold, as buyers have a readily available and often cheaper alternative. For a company like Argonaut Gold, this means that even if their mining costs are competitive, the market price for their product can be influenced by the availability and cost of recycled gold.

- Recycled gold is a key substitute for newly mined gold.

- In 2023, recycled gold represented about 25% of the global gold supply.

- High gold prices incentivize more recycling, increasing supply and potentially lowering prices for primary production.

- This dynamic can impact the revenue and profitability of gold mining companies.

Industrial Material Alternatives

The threat of substitutes for gold in industrial applications, such as electronics and dentistry, is a significant consideration. While gold's unique conductivity and resistance to corrosion make it highly desirable, ongoing research into alternative materials could offer similar performance at a lower cost or with enhanced functionalities.

For instance, in electronics, palladium and silver are often explored as substitutes, though they may not perfectly replicate gold's long-term reliability. The global market for electronic components, a key industrial user of gold, was valued at approximately $2.4 trillion in 2023, highlighting the scale of potential substitution impact.

- Electronics: Palladium and silver are explored for their conductivity, though they may not match gold's corrosion resistance.

- Dentistry: While direct substitution is challenging due to biocompatibility and durability, advancements in ceramics and alloys continue.

- Catalysis: Platinum and palladium are often used in catalytic converters, offering alternatives in specific chemical processes.

- Jewelry: While not strictly industrial, the high price of gold drives innovation in alternative metals and plating techniques.

The threat of substitutes for gold is multifaceted, encompassing other precious metals, alternative investments, and even industrial materials. Investors seeking wealth preservation might turn to silver, platinum, or palladium, which often move in tandem with gold but with greater price swings. For example, in early 2024, gold prices surpassed $2,300 per ounce, while silver traded between $25-$30 per ounce, presenting a more accessible option for some.

Beyond precious metals, a wide array of financial assets, including stocks, bonds, and real estate, compete for investor capital. In 2024, strong performance in equity markets, with the MSCI World Index gaining over 20% by mid-year, demonstrated how quickly capital can shift from traditional safe havens when investor sentiment favors riskier assets.

Furthermore, the rise of digital assets like Bitcoin, which saw its market capitalization exceed $1 trillion in early 2024, presents a growing challenge as a potential store of value. While volatile, its increasing adoption signals a shift in investor perception and a diversification away from traditional assets like gold.

In industrial applications, while gold's properties are unique, alternatives like palladium and silver are explored, particularly in electronics where they offer conductivity. The global electronic components market, valued at approximately $2.4 trillion in 2023, underscores the significant potential for substitution if cost or performance advantages emerge.

| Substitute Type | Examples | Key Considerations | 2024 Market Data/Trend |

| Other Precious Metals | Silver, Platinum, Palladium | Price volatility, accessibility | Gold > $2,300/oz; Silver $25-$30/oz (early 2024) |

| Financial Assets | Stocks, Bonds, Real Estate | Risk appetite, yield potential | MSCI World Index +20% (mid-2024) |

| Digital Assets | Cryptocurrencies (e.g., Bitcoin) | Store of value perception, volatility | Bitcoin market cap > $1 trillion (early 2024) |

| Industrial Materials | Palladium, Silver, Ceramics | Conductivity, corrosion resistance, cost | Electronics market ~$2.4 trillion (2023) |

Entrants Threaten

The gold mining industry presents a formidable barrier to entry due to exceptionally high capital requirements. Establishing a gold mine, particularly an open-pit, heap leach operation, necessitates substantial upfront investment. This includes costs for exploration, acquiring mineral rights, developing essential infrastructure like roads and power, purchasing heavy-duty mining equipment, and constructing processing facilities.

For instance, developing a new gold mine can easily cost hundreds of millions, and often billions, of dollars. In 2024, the average capital expenditure for bringing a new mid-tier gold mine into production is estimated to be between $500 million and $1 billion. This immense financial hurdle effectively deters most potential new entrants, leaving the market dominated by established players with access to significant funding.

The gold mining industry faces a significant barrier to entry due to the exceptionally long and complex development timelines. It can easily take a decade or more to go from discovering a gold deposit to actually producing gold commercially. This lengthy process involves extensive geological surveys, detailed feasibility studies, securing numerous permits, and then the substantial undertaking of construction.

This extended lead time makes gold mining a less appealing venture for companies or investors looking for rapid returns on their capital. For instance, many new gold projects announced in the early 2010s were still in various stages of development or early production by 2024, highlighting the protracted nature of bringing a mine online.

The gold mining sector faces substantial regulatory and environmental challenges, especially in regions like North America. These stringent rules, covering everything from environmental impact assessments to community relations, demand significant investment in compliance and specialized knowledge, effectively deterring potential new players.

For instance, obtaining the necessary permits for a new gold mine can take years and cost millions, with a high risk of denial. In 2024, the average time to secure major environmental permits for large-scale mining projects in Canada was reported to be between 4 to 7 years, a considerable hurdle for any new entrant lacking established relationships and experience.

Access to Proven Reserves and Geological Expertise

The threat of new entrants in the gold mining sector, specifically concerning access to proven reserves and geological expertise, is significantly mitigated by high barriers to entry. Successful gold mining hinges on securing economically viable deposits, a process demanding specialized geological knowledge and substantial exploration capabilities. In 2024, the cost and complexity of identifying, acquiring, and developing these reserves, coupled with the immense risk capital required, present a formidable challenge for new players entering the market.

New entrants face considerable hurdles in acquiring the necessary geological expertise and proven reserves. The industry relies heavily on sophisticated exploration techniques and a deep understanding of geological formations to locate and assess gold deposits. For instance, companies like Argonaut Gold invest heavily in geophysical surveys, drilling programs, and advanced data analysis, which require specialized talent and technology that are not easily replicated by newcomers. This inherent knowledge gap and the capital intensity of exploration activities act as a strong deterrent.

- High Capital Requirements: Exploration and mine development can cost hundreds of millions of dollars, deterring smaller, less capitalized entrants.

- Geological Expertise Gap: Identifying and proving economically viable gold reserves requires highly specialized geological and engineering skills.

- Access to Land and Permits: Securing rights to prospective land and obtaining mining permits are complex, time-consuming, and often politically influenced processes.

- Established Infrastructure: Existing mines often benefit from established infrastructure, supply chains, and experienced workforces, which new entrants must build from scratch.

Established Brand Reputation and Market Access

Established brand reputation and market access present a significant barrier to new entrants in the gold mining sector. Argonaut Gold, like other established producers, leverages existing relationships with refiners, financial institutions, and investors. For instance, in 2024, Argonaut Gold reported approximately $400 million in revenue, demonstrating its established market presence and access to capital. Newcomers would need to cultivate these crucial connections and build credibility, a difficult undertaking without a demonstrated history of successful operations and financial stability in a competitive, mature market.

The threat of new entrants in the gold mining industry is significantly low, primarily due to the immense capital requirements and lengthy development timelines. Establishing a new gold mine, from exploration to production, can easily cost hundreds of millions to over a billion dollars, a hurdle that deters many potential competitors. Furthermore, the specialized geological expertise needed to identify and secure viable reserves, along with complex regulatory and permitting processes, creates substantial barriers.

| Barrier | Estimated Cost/Time (2024) | Impact on New Entrants |

|---|---|---|

| Capital Expenditure (Mid-Tier Mine) | $500 million - $1 billion | Extremely High - Deters most new players |

| Permitting Time (Major Projects) | 4 - 7 years (Canada) | Significant - Requires established experience and relationships |

| Exploration & Reserve Acquisition | Millions to Billions (highly variable) | High - Demands specialized skills and risk capital |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Argonaut Gold is built upon a foundation of publicly available information, including Argonaut Gold's annual reports and SEC filings, alongside industry-specific data from reputable mining research firms and market intelligence platforms.