Argonaut Gold PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Uncover the critical political, economic, and technological forces shaping Argonaut Gold's trajectory. Our PESTLE analysis provides a deep dive into these external factors, offering actionable intelligence for strategic planning. Equip yourself with the insights needed to navigate the evolving mining landscape. Download the full PESTLE analysis now and gain a competitive edge.

Political factors

The political stability across Canada, the United States, and Mexico, where Argonaut Gold operates, is a significant factor. For instance, Mexico has seen shifts in its mining policy, with the current administration's focus on national resources potentially influencing regulatory frameworks. In 2023, Mexico's mining sector contributed approximately 2.4% to its GDP, highlighting the importance of stable policies for companies like Argonaut.

The mining industry is heavily influenced by government regulations and the ease of obtaining permits. For Argonaut Gold, navigating the complex web of mining permits, licenses, and environmental assessments across its operating regions, including Mexico and Canada, is a critical political factor. Delays or stricter enforcement of these regulations can significantly impact project timelines and operational costs, directly affecting the company's ability to develop new projects or expand existing ones.

Trade policies and international agreements between Canada, the US, and Mexico significantly shape Argonaut Gold's operational landscape. For instance, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, continues to govern trade relations, impacting the flow of essential mining equipment and materials. In 2023, Canada's exports to the US, a key market for many Canadian companies, reached an estimated C$674.6 billion, highlighting the importance of these cross-border flows for sectors like mining.

Any imposition of tariffs or shifts in cross-border investment regulations could directly affect Argonaut Gold's operational costs and the economic viability of its North American assets. For example, changes in import duties on specialized mining machinery or fluctuations in currency exchange rates tied to trade stability can create cost pressures. The mining sector's reliance on international supply chains means that protectionist measures in any of the USMCA countries could disrupt operations and impact profitability.

Taxation and Fiscal Regimes

Changes in corporate tax rates, mining-specific taxes, or royalty structures by governments directly impact Argonaut Gold's financial performance. For instance, if Mexico, where Argonaut has significant operations, were to increase its corporate tax rate or introduce new mining royalties, it could directly reduce the company's net earnings. During periods of high gold prices, governments often look to increase their revenue share, potentially affecting Argonaut's cash flow available for reinvestment.

For example, in 2023, Mexico's overall corporate tax rate remained at 30%. However, the mining sector is subject to specific royalty payments based on revenue. While specific changes to these royalties affecting Argonaut Gold in late 2024 or early 2025 are not yet widely publicized, any adjustments could significantly alter the company's profitability. Governments may also implement environmental taxes or levies that mining companies must bear.

- Corporate Tax Rate: Mexico's general corporate tax rate stood at 30% in 2023, a key figure for Argonaut's overall tax burden.

- Mining Royalties: The specific royalty structure for mining operations in Mexico, which is revenue-based, directly influences Argonaut's operational costs and profitability.

- Fiscal Policy Shifts: Potential government decisions to increase tax burdens on mining companies, especially during commodity booms, pose a risk to Argonaut's net income and reinvestment capacity.

- New Levies: The introduction of new environmental or sector-specific taxes could add further costs for Argonaut Gold in its operating jurisdictions.

Geopolitical Risks and Regional Stability

Geopolitical risks, particularly concerning regional stability in Mexico where Argonaut Gold has significant operations, remain a key political factor. Tensions or local political instability can directly impact mining activities. For instance, social unrest or security concerns in areas like Durango or Sinaloa, where the company holds concessions, could lead to operational disruptions.

Unexpected policy shifts at the state or municipal level in Mexico present another risk. These changes might affect permitting, environmental regulations, or taxation, thereby impacting supply chains and community relations. Such factors can disrupt operations and affect the company's assets and personnel.

- Mexico's Political Landscape: In 2024, Mexico's federal elections could introduce policy shifts affecting the mining sector.

- Regional Security Concerns: Ongoing security challenges in certain Mexican states where Argonaut operates necessitate robust risk management strategies.

- Local Governance: Changes in state or municipal leadership can lead to unpredictable regulatory environments for mining companies.

Government policies regarding resource nationalism and environmental protection are critical. Mexico's approach to foreign investment in mining, for example, can directly influence Argonaut Gold's expansion plans. In 2023, Mexico's mining sector accounted for about 2.4% of its GDP, underscoring the government's interest in its stability and growth.

Changes in mining regulations, permitting processes, and enforcement of environmental standards across Canada and Mexico significantly impact operational timelines and costs. Delays in obtaining or renewing permits can stall projects, as seen with the complex regulatory environment mining companies navigate. In 2023, the average time to secure mining permits in some Canadian provinces could extend over several months.

Trade agreements like the USMCA influence the cross-border movement of mining equipment and materials, affecting supply chain efficiency. In 2023, Canada's exports to the US were substantial, highlighting the importance of these trade relationships for sectors reliant on imports and exports.

Government fiscal policies, including corporate tax rates and mining royalties, directly affect Argonaut Gold's profitability. Mexico's corporate tax rate was 30% in 2023, and any adjustments to mining royalties could alter the company's net earnings and reinvestment capacity.

| Political Factor | Impact on Argonaut Gold | Relevant Data/Context (2023-2024) |

| Resource Nationalism | Influences foreign investment and operational concessions. | Mexico's mining sector contributed ~2.4% to GDP in 2023. |

| Regulatory Environment | Affects project timelines, permitting, and operational costs. | Permit acquisition in Canada can take several months. |

| Trade Policies (USMCA) | Impacts supply chains for equipment and materials. | Canada's exports to the US were significant in 2023. |

| Fiscal Policies (Taxes/Royalties) | Directly affects profitability and cash flow. | Mexico's corporate tax rate was 30% in 2023. |

What is included in the product

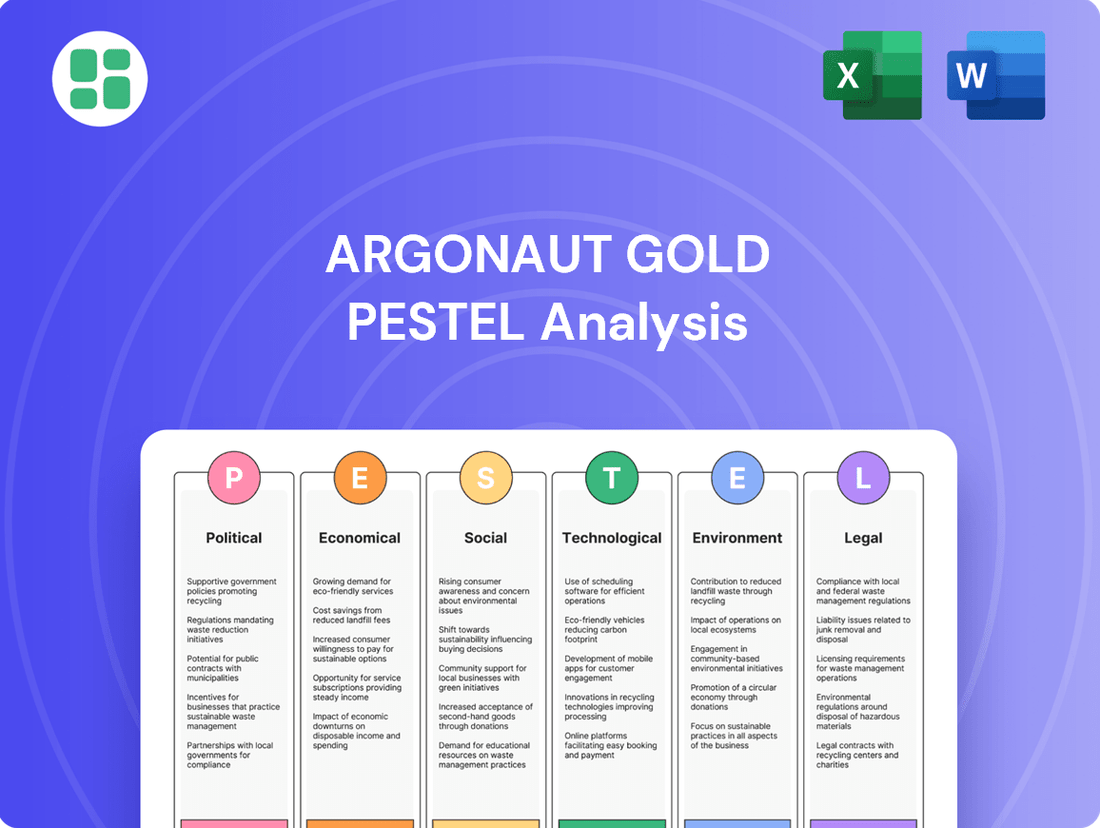

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Argonaut Gold, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces present both challenges and opportunities for the company's strategic planning and operational success.

Provides a concise version of Argonaut Gold's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, effectively relieving the pain point of time-consuming data synthesis.

Economic factors

Gold prices are the bedrock of Argonaut Gold's financial performance. Fluctuations in the market price directly dictate how much revenue the company can generate and, consequently, its profitability. This is a critical factor for any mining operation, especially one focused on a single commodity.

Global economic forces heavily sway gold prices. Think about inflation, interest rates, the strength of currencies like the US dollar, and even major global events or political instability. These macroeconomic indicators create a dynamic environment that can cause gold prices to move up or down, directly impacting Argonaut Gold's financial well-being. For instance, as of early 2024, persistent inflation concerns in major economies have often supported gold prices, but anticipated interest rate cuts by central banks could introduce volatility.

A significant downturn in gold prices poses a direct threat to Argonaut Gold's operational viability. If the market price falls too low, previously profitable lower-grade ore deposits might become uneconomical to extract. This could lead to a reduction in the company's estimated gold reserves and potentially impact its ability to meet production targets, a crucial metric for investors.

Inflationary pressures are a significant concern for Argonaut Gold, directly impacting operational costs. For instance, rising diesel prices, a key input for open-pit mining equipment, and increasing electricity costs for processing can substantially elevate expenses. In 2024, global inflation rates remained a persistent challenge, with energy prices showing volatility.

These escalating costs for essential materials like chemicals used in leaching and steel for infrastructure place further strain on Argonaut's budget. Managing these cost escalations is paramount for maintaining profitability, particularly for their heap leach operations, which are inherently sensitive to fluctuations in energy and material prices.

Currency exchange rate volatility presents a significant economic factor for Argonaut Gold. As a Canadian company with operations spanning Canada, the United States, and Mexico, fluctuations in the Canadian dollar (CAD), US dollar (USD), and Mexican peso (MXN) directly impact its reported financial performance.

For instance, a stronger CAD relative to the USD could reduce the value of USD-denominated gold sales when translated back into Canadian dollars, potentially lowering reported revenues. Conversely, movements in the MXN can significantly affect the cost of local operations in Mexico, influencing profitability.

During 2024, the CAD experienced periods of strengthening against the USD, which could have presented headwinds for Argonaut Gold's revenue reporting. Similarly, the MXN's performance against the CAD and USD throughout the year would have directly influenced the local cost structure in Mexico, a key operational region for the company.

Access to Capital and Financing Costs

Access to capital and the cost of financing are paramount for Argonaut Gold's growth. In 2024, global interest rates have remained elevated, with many central banks maintaining a hawkish stance to combat inflation. For instance, the US Federal Reserve kept its benchmark interest rate in the 5.25%-5.50% range through early 2024, impacting borrowing costs for companies like Argonaut Gold. This environment can make securing debt financing more expensive and potentially limit equity issuance if market conditions are unfavorable.

The ability to secure funding for exploration, project development, and operational expansions is directly tied to these economic factors. Higher interest rates increase the cost of debt servicing, potentially reducing profitability and cash flow available for reinvestment. If credit markets tighten, it could become more difficult for Argonaut Gold to obtain the necessary capital for its strategic initiatives, including debt refinancing, thereby impacting its capacity for growth.

- Increased Borrowing Costs: Higher interest rates directly translate to more expensive debt, affecting Argonaut Gold's debt servicing obligations.

- Tighter Credit Markets: A more restrictive lending environment can reduce the availability of new loans and make it harder to refinance existing debt.

- Impact on Growth: Difficulty in securing capital can hinder exploration activities, project development timelines, and the execution of expansion plans.

- Equity Market Volatility: Unfavorable equity market conditions could make raising capital through share issuance less attractive or feasible.

Global Economic Growth and Demand

Global economic growth significantly impacts demand for gold, influencing both industrial use and investor sentiment. While a robust economy can boost consumer spending on gold jewelry and electronics, it may also lessen the appeal of gold as a safe-haven asset.

Conversely, economic slowdowns or recessions often drive investment demand for gold as a hedge against inflation and market volatility. For instance, the IMF projected global growth to moderate to 2.9% in 2024, down from 3.0% in 2023, signaling a potentially more cautious investment environment that could favor gold.

- Global Growth Projections: The International Monetary Fund (IMF) forecast global economic growth at 2.9% for 2024, a slight decrease from 3.0% in 2023, indicating a potentially subdued demand environment.

- Inflationary Pressures: Persistent inflation in various economies can increase gold's attractiveness as an inflation hedge, potentially offsetting reduced consumer demand.

- Investor Sentiment: Geopolitical uncertainties and market volatility, often amplified during economic downturns, typically bolster investor interest in gold as a perceived safe-haven asset.

Gold prices are the primary driver of Argonaut Gold's revenue. As of early 2024, gold prices have shown resilience, often trading above $2,000 per ounce, supported by persistent inflation concerns and geopolitical uncertainties. However, anticipated interest rate cuts by central banks in 2024 could introduce volatility, impacting the company's financial performance.

Operational costs for Argonaut Gold are significantly influenced by inflation, particularly for energy and materials. For instance, diesel prices, a key input for mining equipment, and chemicals for processing have seen upward pressure throughout 2024. This directly impacts the profitability of their heap leach operations.

Currency fluctuations, especially between the Canadian Dollar (CAD), US Dollar (USD), and Mexican Peso (MXN), affect Argonaut Gold's reported earnings and operational costs. In 2024, the CAD experienced periods of strengthening against the USD, potentially reducing the value of USD-denominated sales when converted to CAD.

Access to capital remains a critical economic factor, with global interest rates staying elevated in early 2024, impacting borrowing costs. The US Federal Reserve's benchmark rate, for example, remained in the 5.25%-5.50% range, making debt financing more expensive and potentially limiting growth initiatives.

| Economic Factor | 2024 Impact on Argonaut Gold | Data/Trend (Early 2024) |

|---|---|---|

| Gold Prices | Directly impacts revenue and profitability. | Trading above $2,000/oz, supported by inflation and geopolitics. Potential volatility from anticipated rate cuts. |

| Inflation | Increases operational costs (energy, materials). | Persistent inflationary pressures affecting diesel, chemicals, and electricity costs. |

| Currency Exchange Rates | Affects reported revenue and local operating costs. | CAD strengthening against USD potentially reducing USD sales value in CAD terms. MXN impacts Mexican operating costs. |

| Interest Rates / Access to Capital | Influences borrowing costs and ability to fund growth. | Elevated rates (e.g., US Fed 5.25%-5.50%) increase debt servicing costs. |

What You See Is What You Get

Argonaut Gold PESTLE Analysis

The preview shown here is the exact Argonaut Gold PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Argonaut Gold's operations and strategic decisions.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing deep insights into the external landscape Argonaut Gold navigates.

Sociological factors

Argonaut Gold's ability to maintain a social license to operate hinges on fostering robust community relations. This involves actively addressing local concerns regarding land use, water rights, and environmental impacts like noise and dust, which can otherwise escalate into operational disruptions or project delays.

In 2023, for instance, community engagement initiatives were a key focus, with the company reporting ongoing dialogue with stakeholders near its Mexican operations to mitigate potential conflicts and ensure mutual benefit.

The availability of skilled mining professionals is a significant factor for Argonaut Gold. For instance, in 2024, the global mining industry faced a notable shortage of experienced geologists and engineers, with some reports indicating a deficit of up to 20% in certain specialized roles. This scarcity directly impacts operational efficiency and project timelines.

Maintaining positive labor relations is equally vital. In 2024, several mining companies experienced increased wage demands due to inflation, with average labor costs rising by an estimated 5-7% in key mining regions. Any industrial disputes or strikes could significantly disrupt Argonaut Gold's production schedules and increase operational expenses.

Argonaut Gold's success hinges on its capacity to attract and retain a skilled workforce. By investing in training and development programs, the company can mitigate the impact of labor shortages and foster a stable, productive workforce, thereby ensuring smoother operations and better cost management in 2024 and beyond.

Adherence to stringent health and safety standards is paramount for mining operations like Argonaut Gold, directly impacting employee well-being and operational continuity. For instance, in 2023, the mining industry globally saw a continued focus on reducing lost-time injury frequency rates (LTIFR), with many companies aiming for LTIFR below 1.0, a benchmark Argonaut Gold would also strive to meet.

Any safety incidents can have severe repercussions, including significant reputational damage, hefty regulatory fines, and increased insurance premiums. In 2024, regulatory bodies are expected to maintain or even increase scrutiny on safety compliance, potentially leading to substantial penalties for non-adherence.

Furthermore, a strong safety culture is intrinsically linked to workforce morale and productivity. Companies that prioritize safety often experience lower employee turnover and higher engagement, contributing to more efficient and sustainable mining practices.

Indigenous Rights and Engagement

Argonaut Gold's operations, particularly in North America, necessitate deep engagement with Indigenous communities. Respecting their inherent rights, including traditional land use and the preservation of cultural heritage, is paramount for project sustainability. For instance, in 2023, Argonaut Gold reported ongoing dialogue and collaboration with several First Nations groups in Canada, aiming to establish mutually beneficial relationships.

Successful partnerships hinge on transparent communication and the establishment of fair benefit-sharing agreements. These agreements not only mitigate potential conflicts but also contribute to the long-term social license to operate. In 2024, the company is focusing on refining its community engagement strategies, with a stated goal of increasing local employment and procurement opportunities in its project areas.

- Community Investment: In 2023, Argonaut Gold invested over $2 million in community development initiatives, with a significant portion directed towards Indigenous communities in proximity to its Canadian operations.

- Local Employment: The company aims to increase Indigenous employment in its workforce by 15% by the end of 2025, building on existing programs.

- Cultural Heritage Protection: Protocols are in place to identify and protect culturally significant sites, with ongoing training for site personnel in 2024.

- Benefit Sharing: Discussions are underway for new benefit-sharing agreements in 2024, building on existing frameworks to ensure continued economic participation for Indigenous partners.

Public Perception of Mining

Public sentiment towards mining significantly shapes regulatory landscapes and investment decisions. Concerns over environmental degradation and social disruption can lead to stricter oversight and impact capital availability. For instance, in 2024, several jurisdictions saw increased public pressure leading to moratoriums on new mining projects due to environmental impact assessments.

Argonaut Gold's proactive approach to sustainability is crucial for navigating these perceptions. By emphasizing responsible extraction and community engagement, the company aims to foster trust. This focus is increasingly important as socially responsible investing (SRI) gained momentum, with global SRI assets projected to reach $50 trillion by 2025, according to various financial reports.

- Environmental Stewardship: Public scrutiny of mining's footprint, including water usage and land reclamation, is intense. Companies demonstrating strong environmental management, like Argonaut Gold's efforts in water conservation at its El Castillo mine, can mitigate negative perceptions.

- Social License to Operate: Gaining and maintaining community support is vital. Argonaut Gold's investment in local infrastructure and employment initiatives addresses this, as exemplified by its community development programs in Durango, Mexico.

- Investor Confidence: A positive public image attracts socially conscious investors. In 2024, ESG (Environmental, Social, and Governance) factors were increasingly integrated into investment analysis, influencing capital allocation towards mining companies with robust sustainability credentials.

- Regulatory Environment: Negative public perception can translate into more stringent regulations. Argonaut Gold's commitment to transparency and adherence to evolving environmental standards helps preemptively address potential regulatory hurdles.

Sociological factors significantly influence Argonaut Gold's operations, primarily through community relations and labor dynamics. Maintaining a social license to operate requires proactive engagement with local communities, addressing concerns about land use and environmental impacts, as seen in ongoing dialogues near its Mexican operations in 2023.

The availability of skilled labor is a critical challenge, with a global mining industry shortage of experienced geologists and engineers noted in 2024, potentially impacting efficiency. Furthermore, positive labor relations are essential, with rising inflation in 2024 leading to increased wage demands, making industrial disputes a significant risk to production schedules and costs.

Argonaut Gold's commitment to health and safety is paramount, aiming to reduce lost-time injury frequency rates, a key metric in 2023. A strong safety culture not only ensures employee well-being but also boosts morale and productivity, contributing to sustainable operations.

Engagement with Indigenous communities is vital for project sustainability, requiring respect for rights and cultural heritage, as demonstrated by collaborative efforts with First Nations in Canada in 2023. Transparent communication and fair benefit-sharing agreements are key to mitigating conflicts and securing a long-term social license, with a focus on increasing local employment and procurement opportunities in 2024.

| Sociological Factor | Impact on Argonaut Gold | 2023-2025 Data/Trends |

|---|---|---|

| Community Relations | Social license to operate, operational continuity | Ongoing dialogue with stakeholders near Mexican operations (2023); $2M+ invested in community development (2023). |

| Labor Availability & Relations | Operational efficiency, project timelines, cost management | Global mining industry skilled labor shortage (2024); 5-7% average labor cost increase in key mining regions (2024). |

| Health & Safety Standards | Employee well-being, operational continuity, reputation | Focus on reducing LTIFR (benchmark <1.0); increased regulatory scrutiny on safety compliance (2024). |

| Indigenous Community Engagement | Project sustainability, social license, conflict mitigation | Collaboration with First Nations in Canada (2023); aim to increase Indigenous employment by 15% by end of 2025. |

| Public Sentiment & SRI | Regulatory landscape, investment decisions, capital availability | Increased public pressure leading to mining moratoriums (2024); global SRI assets projected to reach $50T by 2025. |

Technological factors

Argonaut Gold is actively embracing technological advancements to boost its mining operations. The company's focus on implementing autonomous haulage systems and remote-controlled equipment at its open-pit mines is designed to streamline processes and improve safety. For instance, by adopting these technologies, Argonaut aims to achieve greater efficiency in material movement and reduce the risks associated with human intervention in hazardous environments.

Technological advancements in geological surveying and geophysical imaging are crucial for Argonaut Gold's exploration efforts. Innovations like advanced seismic imaging and drone-based magnetic surveys allow for more precise identification of potential gold deposits, reducing the cost and time associated with traditional methods. For instance, the successful application of AI-driven data analysis in identifying anomalies in geological datasets could significantly improve the accuracy of exploration targeting.

Drilling techniques are also evolving, offering greater precision and efficiency in accessing identified resources. Enhanced directional drilling and automated drilling systems can lower operational costs and improve the success rate of resource delineation. This technological edge directly impacts Argonaut Gold's ability to expand its reserves, as seen in projects where improved drilling technology has unlocked previously uneconomical gold ounces, contributing to future production growth.

Argonaut Gold's reliance on heap leach operations makes advancements in processing technology paramount. Innovations in leach pad design, for instance, can significantly improve solution-ore contact, boosting recovery. In 2023, Argonaut reported that its San Agustin project, a heap leach operation, continued to advance, highlighting the company's commitment to this technology.

Optimizing reagent use, such as cyanide consumption, directly impacts operational costs and environmental safety. By employing more efficient leaching agents or improving their application, Argonaut can lower expenses and reduce its environmental impact. The company's focus on improving recovery rates from lower-grade ores is also a key technological driver, making previously uneconomical deposits viable.

Data Analytics and Artificial Intelligence

Data analytics and artificial intelligence are becoming increasingly crucial for mining operations like Argonaut Gold. Leveraging these technologies can lead to significant improvements in efficiency and decision-making. For instance, predictive maintenance, powered by AI, can anticipate equipment failures, minimizing costly downtime. In 2024, the mining industry saw increased investment in AI for operational efficiency, with some companies reporting up to a 15% reduction in maintenance costs through predictive analytics.

These advanced tools also enable better resource modeling and grade control. By analyzing vast datasets from exploration and operational activities, Argonaut Gold can optimize extraction processes, ensuring higher yields and more efficient use of resources. Studies in 2024 indicated that AI-driven grade optimization in mining can lead to a 5-10% increase in overall resource recovery.

- Predictive Maintenance: AI algorithms analyze sensor data to forecast equipment failures, reducing unplanned downtime.

- Process Optimization: Data analytics identifies bottlenecks and inefficiencies in extraction and processing, leading to cost savings.

- Resource Modeling: Advanced analytics improve the accuracy of ore body estimations and grade control, maximizing resource utilization.

- Enhanced Decision-Making: Real-time data insights empower management to make more informed operational and strategic choices.

Environmental Monitoring and Remediation Technologies

New technologies for real-time environmental monitoring, water treatment, and land reclamation are becoming increasingly vital for responsible mining operations. These advancements allow companies like Argonaut Gold to proactively manage their ecological footprint.

Implementing advanced solutions helps Argonaut Gold meet stringent regulatory compliance requirements, a critical factor in today's mining landscape. For instance, advancements in drone-based sensor technology can provide continuous data on air and water quality, offering immediate insights into potential environmental issues. In 2024, the mining sector saw significant investment in AI-powered predictive analytics for environmental risk assessment, aiming to prevent incidents before they occur.

These technologies also enable Argonaut Gold to minimize its environmental impact, demonstrating a commitment to sustainable practices. Innovations in water treatment, such as advanced membrane filtration systems, can significantly reduce the volume of wastewater requiring disposal. Furthermore, the development of bio-remediation techniques offers more effective land reclamation methods, restoring mined areas to a more natural state.

- Real-time Monitoring: Deployment of IoT sensors for continuous tracking of water quality, air emissions, and ground stability.

- Water Treatment: Adoption of advanced filtration and ion exchange technologies to purify process water and reduce discharge volumes.

- Land Reclamation: Utilization of specialized vegetation and soil amendments to accelerate the restoration of disturbed land.

- Regulatory Compliance: Leveraging technology to ensure adherence to evolving environmental standards and reporting requirements.

Technological advancements are reshaping Argonaut Gold's operational efficiency and exploration success. The company is integrating autonomous haulage systems and remote-controlled equipment to enhance safety and streamline material movement in its open-pit mines. Innovations in geological surveying, such as drone-based magnetic surveys, are improving the precision and reducing the cost of identifying new gold deposits.

Furthermore, developments in drilling techniques, including enhanced directional and automated drilling, are lowering operational costs and improving the accuracy of resource delineation, directly impacting Argonaut's ability to expand its reserves. In 2024, the mining industry saw increased investment in AI for operational efficiency, with some companies reporting up to a 15% reduction in maintenance costs through predictive analytics.

AI and data analytics are critical for Argonaut Gold, enabling predictive maintenance to minimize downtime and optimizing resource modeling for higher yields. Studies in 2024 indicated that AI-driven grade optimization can lead to a 5-10% increase in overall resource recovery.

Argonaut Gold is also adopting new technologies for real-time environmental monitoring and water treatment to manage its ecological footprint and ensure regulatory compliance. For instance, advancements in drone-based sensor technology provide continuous data on air and water quality, offering immediate insights into potential environmental issues.

Legal factors

Argonaut Gold must meticulously adhere to a complex web of national, state/provincial, and local mining laws and regulations. These legal frameworks dictate everything from mineral rights and land tenure to stringent operational safety standards and detailed production reporting requirements. For instance, in Mexico, where Argonaut Gold has significant operations, compliance with the General Law of National Mining and its associated regulations is paramount, impacting areas like environmental protection and community engagement.

Failure to comply with these mining laws can lead to severe consequences, including substantial financial penalties, the revocation of operating licenses, and even outright operational shutdowns, directly impacting revenue and investor confidence. In 2023, the mining sector globally faced increased scrutiny on environmental, social, and governance (ESG) factors, with regulatory bodies imposing stricter compliance measures, a trend expected to continue through 2024 and 2025.

Environmental Protection Legislation is a critical factor for Argonaut Gold. The company operates under stringent laws covering emissions, waste management like tailings facilities, water discharge, and biodiversity. For instance, in 2024, Mexico, where Argonaut has significant operations, continued to emphasize environmental compliance, with potential for increased scrutiny on water usage and waste disposal practices in the mining sector.

Adherence to these evolving regulations is non-negotiable. Argonaut Gold must allocate capital for necessary upgrades and maintain robust ongoing monitoring systems. Failure to comply can lead to substantial fines and significant reputational damage, impacting investor confidence and operational continuity. The company's 2024 sustainability reports highlighted investments in environmental management systems to meet these demands.

Argonaut Gold must meticulously adhere to labor and employment laws, covering everything from minimum wage requirements and safe working conditions to employee union rights and occupational health and safety standards. Failure to comply can result in costly legal battles, disruptive labor strikes, and substantial financial penalties, directly affecting operational continuity and employee morale.

In 2024, the mining sector, like others, faces increasing scrutiny on fair labor practices. For instance, the U.S. Bureau of Labor Statistics reported that in 2023, the mining, quarrying, and oil and gas extraction industry had a total recordable case rate of 2.9 per 100 full-time workers, highlighting the importance of robust occupational health and safety compliance. This underscores the critical need for Argonaut Gold to maintain rigorous safety protocols and fair employment terms to avoid regulatory action and reputational damage.

Corporate Governance and Securities Regulations

As a publicly traded entity, Argonaut Gold operates under strict corporate governance and securities regulations in Canada, where it is listed on the Toronto Stock Exchange (TSX). This necessitates transparent financial reporting, robust investor relations practices, and diligent board oversight to maintain accountability and foster investor trust. For instance, companies listed on the TSX are subject to continuous disclosure obligations, requiring timely reporting of material information. In 2023, the TSX saw a significant number of new listings and follow-on offerings, underscoring the active regulatory environment for public companies.

These regulations extend to ensuring fair trading practices and protecting shareholder rights. Argonaut Gold's adherence to these frameworks is crucial for its reputation and ability to access capital markets. The company's compliance efforts are regularly reviewed by regulatory bodies like the Ontario Securities Commission (OSC). The OSC, for example, actively enforces rules around insider trading and misleading disclosures, aiming to preserve market integrity.

- Continuous Disclosure Obligations: Argonaut Gold must promptly disclose material information affecting its share price, as mandated by Canadian securities laws.

- Board Oversight and Accountability: The company's board of directors is responsible for overseeing management and ensuring compliance with governance standards, a critical element for investor confidence.

- Investor Relations: Maintaining open and transparent communication with shareholders and the investment community is a regulatory requirement and a key component of corporate governance.

- Compliance with Securities Laws: Adherence to regulations set by bodies like the OSC is fundamental to Argonaut Gold's legal standing and operational legitimacy.

International Trade and Investment Laws

International trade and investment laws significantly shape Argonaut Gold's global footprint. Treaties governing cross-border commerce and foreign direct investment directly influence its operational strategies, particularly concerning potential acquisitions or asset sales in different jurisdictions. Compliance with these legal structures is paramount for maintaining smooth international business operations and safeguarding its assets located overseas.

For instance, the World Trade Organization (WTO) agreements and bilateral investment treaties (BITs) provide frameworks for trade and investment protections. In 2023, global foreign direct investment (FDI) flows reached an estimated $1.9 trillion, highlighting the importance of understanding and adhering to these international legal norms for companies like Argonaut Gold operating in multiple countries.

- Trade Agreements: Adherence to WTO rules and regional trade pacts impacts import/export duties and market access for Argonaut Gold's products and equipment.

- Investment Treaties: Bilateral Investment Treaties offer legal protections against expropriation and ensure fair treatment for foreign investors, crucial for Argonaut Gold's asset security.

- Dispute Resolution: International arbitration mechanisms, such as those under the International Chamber of Commerce (ICC), provide avenues for resolving cross-border legal disputes.

- Regulatory Compliance: Navigating diverse international legal systems requires robust compliance frameworks to avoid penalties and ensure operational continuity.

Argonaut Gold's operations are fundamentally shaped by mining and environmental legislation, demanding strict adherence to regulations concerning mineral rights, safety, and ecological impact. For example, in 2024, Mexico's environmental agencies continued to enforce stringent rules on water usage and waste management, impacting mining operations. Failure to comply can lead to significant fines and operational disruptions, as seen with increased regulatory scrutiny on ESG factors globally in 2023 and continuing into 2024.

Labor laws and corporate governance regulations are also critical. In 2023, the mining sector's recordable case rate highlighted the importance of occupational health and safety, a key area for Argonaut Gold's compliance. As a TSX-listed entity, the company must maintain transparent financial reporting and robust board oversight, with bodies like the OSC actively enforcing rules to ensure market integrity.

International trade and investment laws govern Argonaut Gold's global activities, with treaties influencing cross-border operations and asset protection. Global foreign direct investment (FDI) reached approximately $1.9 trillion in 2023, underscoring the need for companies like Argonaut to navigate diverse international legal frameworks effectively.

Environmental factors

Climate change poses significant physical risks to Argonaut Gold's operations. Shifts in precipitation patterns and increased frequency of extreme weather events, like droughts or floods, directly impact water availability, a critical resource for their heap leach mining processes. For instance, in 2023, many mining regions experienced prolonged dry spells, potentially affecting water reserves for operations in Mexico and Canada.

Adapting to these evolving environmental conditions is crucial for maintaining operational continuity and water security. Argonaut Gold must proactively assess its exposure to climate-related hazards and implement strategies to mitigate these impacts. This includes investing in water management technologies and exploring alternative water sources to build resilience against future climate volatility.

Water is absolutely vital for mining, and its availability, especially in dry areas where Argonaut Gold operates, is a major environmental consideration. The company must navigate potential scarcity and ensure water quality is maintained.

Effective water management, like recycling water used in processing and carefully managing any wastewater discharge, is key for Argonaut Gold to meet environmental regulations and maintain good relationships with local communities. For instance, in 2023, the mining industry globally faced increasing scrutiny over water usage, with some regions experiencing significant drought impacts on operations.

Open-pit mining inherently causes substantial land disturbance, potentially impacting local ecosystems and the biodiversity they support. Argonaut Gold's approach to land use, including responsible planning and progressive reclamation, is vital for maintaining operational sustainability and meeting regulatory requirements.

Waste Management and Tailings Storage

Argonaut Gold faces significant environmental scrutiny regarding its waste management, particularly concerning tailings storage. The company must adhere to stringent global and local regulations governing the safe disposal of mining byproducts. Failure to do so can result in substantial fines and operational disruptions.

The integrity of tailings storage facilities is a critical operational and environmental risk. In 2023, the global mining industry continued to grapple with the aftermath of tailings dam failures, underscoring the need for robust engineering and monitoring. For Argonaut Gold, investing in advanced containment technologies and regular safety audits of its facilities, such as those at its San Agustin or El Castillo operations, is essential to mitigate these risks and maintain its social license to operate.

Key considerations for Argonaut Gold include:

- Regulatory Compliance: Staying abreast of evolving environmental laws, including those related to water management and land reclamation post-mining.

- Tailings Management Technology: Implementing and maintaining best practices for tailings dewatering and dry-stacking where feasible to reduce the volume and risk associated with storage.

- Environmental Monitoring: Continuous monitoring of water quality and soil conditions around mining sites to detect and address any potential contamination early.

- Stakeholder Engagement: Proactively communicating waste management strategies and performance to local communities and regulatory bodies to build trust and transparency.

Energy Consumption and Carbon Footprint

Mining, by its very nature, demands significant energy, directly impacting greenhouse gas emissions. Argonaut Gold's proactive strategies to curb energy use, embrace renewable sources, and shrink its carbon footprint are becoming critical for its environmental standing, adherence to regulations, and satisfying investor demands for sustainable practices.

For instance, in 2023, the mining industry globally continued to be a major consumer of energy, with fossil fuels still dominating the energy mix for many operations. Companies like Argonaut Gold are increasingly investing in energy efficiency projects and exploring renewable energy solutions, such as solar power at their La Colorada mine, to mitigate these impacts. This transition is not just about environmental responsibility; it's also about long-term cost savings and resilience against fluctuating energy prices.

- Energy Intensity: Mining operations are inherently energy-intensive, often relying on diesel and electricity for heavy machinery and processing.

- Carbon Footprint: This energy consumption translates directly into a substantial carbon footprint, contributing to global greenhouse gas emissions.

- Sustainability Initiatives: Argonaut Gold's focus on reducing energy consumption and transitioning to renewables is vital for meeting environmental targets and stakeholder expectations.

Argonaut Gold must manage water scarcity and quality, especially in arid regions like Mexico, where operations are located. In 2023, extreme weather events like droughts impacted water availability for many mining operations globally, highlighting the need for robust water management strategies such as recycling and exploring alternative sources.

The company faces significant scrutiny over tailings management, a critical environmental risk underscored by global incidents in 2023. Implementing advanced containment and regular safety audits at sites like San Agustin is crucial for risk mitigation and maintaining social license.

Argonaut Gold's energy consumption contributes to its carbon footprint, with operations often relying on fossil fuels. Initiatives like solar power at La Colorada, as explored in 2023, are vital for reducing emissions and meeting sustainability goals.

Land disturbance from open-pit mining requires responsible planning and reclamation efforts to protect local ecosystems and biodiversity, aligning with regulatory requirements and operational sustainability.

| Environmental Factor | Impact on Argonaut Gold | Key Considerations & Data (2023/2024) |

|---|---|---|

| Water Availability & Quality | Critical for heap leach operations; risk of scarcity due to climate change. | 2023 saw prolonged dry spells in many mining regions globally. Argonaut Gold's operations in Mexico and Canada are particularly susceptible. Focus on water recycling and alternative sources. |

| Tailings Management | Risk of dam failure; regulatory compliance is paramount. | Global mining industry faced continued scrutiny in 2023 following dam failures. Argonaut Gold's San Agustin and El Castillo operations require robust safety audits and advanced containment. |

| Energy Consumption & Emissions | High energy use contributes to carbon footprint; transition to renewables is key. | Mining remains energy-intensive, often reliant on fossil fuels. Argonaut Gold exploring solar power at La Colorada to reduce emissions and costs. |

| Land Use & Reclamation | Open-pit mining causes land disturbance; requires responsible planning. | Progressive reclamation and ecosystem protection are vital for regulatory compliance and maintaining operational sustainability. |

PESTLE Analysis Data Sources

Our Argonaut Gold PESTLE Analysis is built on a robust foundation of data from official government publications, respected financial news outlets, and leading mining industry associations. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.