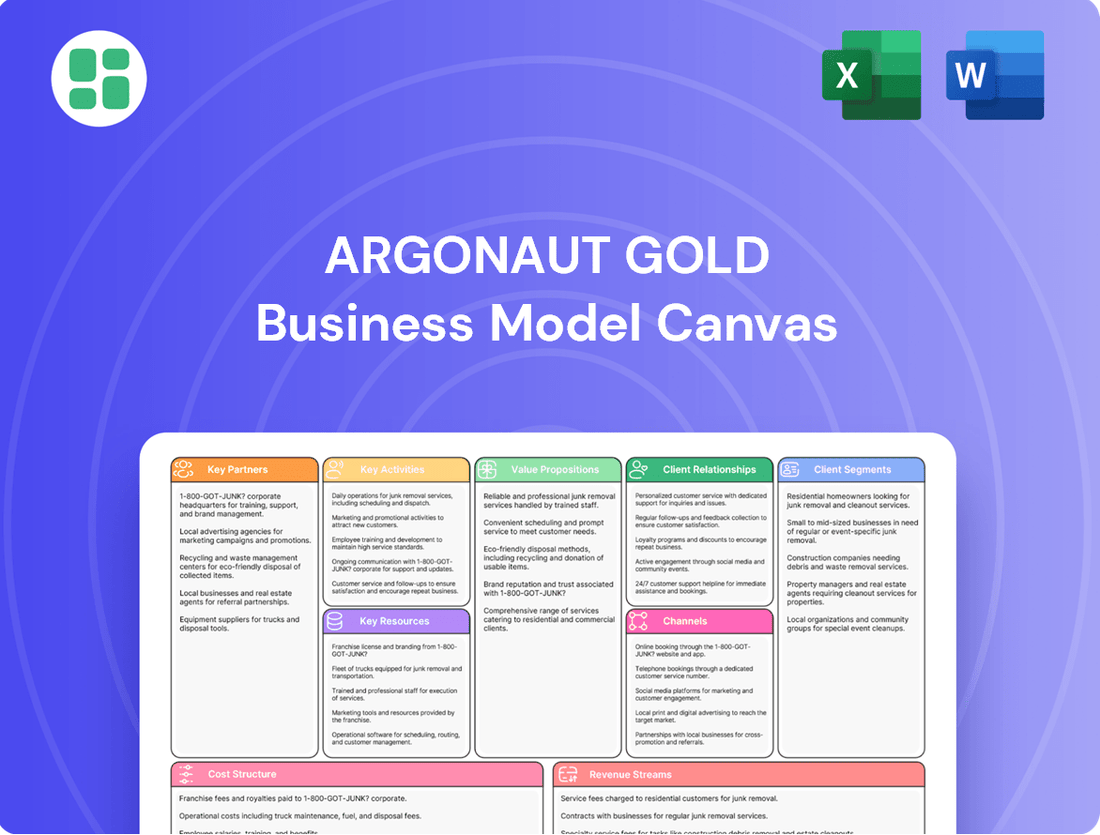

Argonaut Gold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argonaut Gold Bundle

Unlock the strategic blueprint behind Argonaut Gold’s operations with our comprehensive Business Model Canvas. This in-depth analysis reveals how they effectively manage key resources, cultivate vital partnerships, and deliver value to their target markets. Discover the core drivers of their success and gain actionable insights for your own ventures.

Partnerships

Argonaut Gold relies on mining contractors for specialized services, especially during critical development stages. For instance, the Magino mine project saw significant engagement with these partners to ensure efficient material handling and meet initial production targets.

These collaborations are vital for Argonaut Gold's operational efficiency, allowing them to leverage external expertise and equipment. This approach is particularly beneficial for managing the complexities and demands of bringing new mines online, such as the ramp-up at Magino.

Argonaut Gold's operations rely heavily on its relationships with key equipment suppliers. These partnerships are crucial for securing essential mining machinery, like shovels and mobile fleets, which are fundamental to both ongoing operations and future expansions.

The timely delivery and ongoing maintenance support provided by these suppliers directly influence Argonaut Gold's ability to meet production targets and maintain operational efficiency throughout its mining sites.

Argonaut Gold's key partnerships with financial institutions and lenders were critical for its operational and strategic growth. These relationships enabled the company to secure substantial financing packages, which were vital for funding ongoing operations, managing debt obligations, and supporting significant capital expenditures, particularly in 2024.

In 2024, Argonaut Gold actively worked on finalizing debt refinancing agreements. This strategic move aimed to enhance the company's financial flexibility and optimize its capital structure, ensuring a more robust liquidity position to navigate market dynamics and pursue future development opportunities.

Local Communities and Indigenous Groups

Argonaut Gold actively cultivates strong relationships with local communities and Indigenous groups, recognizing them as essential partners for a sustainable social license to operate. These collaborations are fundamental to implementing responsible mining practices and ensuring mutual benefit.

These partnerships are crucial for gaining and maintaining community support, which directly impacts operational continuity and project development. By addressing environmental and social considerations proactively, Argonaut Gold fosters trust and minimizes potential conflicts.

- Community Engagement: In 2024, Argonaut Gold continued its commitment to community development, investing in local infrastructure and social programs. For instance, at its San Agustin mine, initiatives focused on education and healthcare received significant support.

- Indigenous Relations: The company prioritizes respectful engagement with Indigenous communities, respecting their rights and cultural heritage. This includes ongoing dialogue and collaboration on environmental monitoring and benefit-sharing agreements, ensuring their perspectives are integrated into operational plans.

- Sustainable Practices: Partnerships facilitate the implementation of sustainable mining practices, such as water management and land reclamation, which are often co-developed with community input. This collaborative approach ensures that environmental stewardship aligns with local values and expectations.

Environmental and Engineering Consultants

Argonaut Gold relies on environmental and engineering consultants to navigate complex permitting processes and conduct essential technical studies. These expert collaborations are crucial for ensuring adherence to stringent environmental regulations, which is vital for sustainable mining operations. For instance, in 2024, the company continued to engage specialized firms to manage environmental impact assessments and design critical infrastructure.

These partnerships directly facilitated the development of key operational components, such as heap leach pads and tailings management facilities. Such infrastructure requires meticulous engineering and environmental oversight to ensure safety and compliance. The expertise provided by these consultants is indispensable for the successful and responsible construction of these vital mining assets.

The engagement of these consultants is a direct investment in regulatory compliance and operational integrity. Their technical proficiency ensures that projects meet all legal and environmental standards, mitigating risks associated with mining activities. This strategic reliance underscores the importance of specialized knowledge in the mining sector.

- Permitting and Compliance: Consultants are key to securing permits and ensuring Argonaut Gold meets all environmental regulations.

- Technical Studies: They conduct vital studies for infrastructure development, such as heap leach pads and tailings facilities.

- Risk Mitigation: Expert guidance helps manage environmental risks and ensures operational safety.

Argonaut Gold's key partnerships extend to financial institutions, essential for securing capital. In 2024, the company focused on debt refinancing to bolster financial flexibility and liquidity, crucial for funding operations and future growth. These relationships are foundational for managing capital structure and navigating market challenges.

What is included in the product

Argonaut Gold's business model focuses on acquiring, developing, and operating gold mines, primarily in Mexico and North America, targeting mid-tier production with a strategy of organic growth and strategic acquisitions.

This model is designed for efficient resource extraction and value creation, leveraging established mining expertise and a robust operational framework to deliver shareholder returns.

Argonaut Gold's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their strategy, enabling quick identification of operational efficiencies and potential areas for cost reduction in their gold mining operations.

Activities

Argonaut Gold's core activities revolve around discovering and defining gold deposits. In 2024, the company continued its exploration efforts across its portfolio, focusing on drilling programs designed to upgrade existing mineral resources into proven and probable reserves. This is crucial for extending the operational life of its mines and unlocking future production potential.

A key part of this process involves rigorous geological surveying and technical reporting, ensuring that any identified resources meet strict economic and technical feasibility standards. For instance, ongoing exploration at projects like the San Antonio mine in Mexico aims to bolster its resource base, contributing to the company's long-term growth strategy and providing a solid foundation for future investment decisions.

Argonaut Gold's key activities include the crucial stages of mine development and construction. This involves bringing new mining projects to life and enhancing current operations. For instance, the company recently commissioned its Magino mine, a significant undertaking that represents a major step forward in their growth strategy.

Furthermore, Argonaut Gold is actively expanding infrastructure at existing sites, such as constructing additional heap leach pads at their Florida Canyon operation. These development and construction efforts are capital-intensive and demand meticulous operational planning to ensure successful and efficient execution.

Argonaut Gold's core activities revolved around extracting and processing gold ore. They utilized open-pit mining and heap leaching techniques at their sites in Canada, the United States, and Mexico. This process is crucial for transforming raw ore into sellable gold.

The company focused on optimizing both mining and milling rates to meet their production goals. For instance, in the first quarter of 2024, Argonaut Gold reported total gold production of 43,542 ounces. This demonstrates their commitment to efficient operations and achieving output targets.

Operational Optimization and Cost Control

Argonaut Gold's operational optimization and cost control efforts in 2024 centered on enhancing efficiency, especially at the developing Magino mine. The company aimed to boost throughput and lower per-unit production costs.

Key activities included tackling equipment availability issues and improving ore selectivity to maximize resource utilization. These initiatives are crucial for achieving sustainable and cost-effective mining operations.

- Focus on Magino Ramp-Up: Efforts to improve operational efficiencies were particularly concentrated at the Magino mine as it progressed through its ramp-up phase.

- Throughput and Cost Reduction Goals: The primary objectives were to increase the volume of ore processed (throughput) and reduce the cost associated with producing each unit of gold.

- Addressing Operational Challenges: Specific challenges addressed included ensuring consistent equipment availability and refining ore selectivity to optimize the grade of material processed.

Environmental and Social Responsibility Management

Argonaut Gold's commitment to environmental and social responsibility is central to its operations. The company actively engages in sustainable mining practices, focusing on environmental compliance and comprehensive reclamation efforts at its sites. This dedication extends to fostering positive relationships with local communities through targeted engagement initiatives.

Adherence to global reporting standards, such as those from the Global Reporting Initiative (GRI), underscores Argonaut Gold's transparency in environmental, social, and governance (ESG) matters. For instance, in 2024, the company continued to report on key sustainability metrics, aiming to minimize its ecological footprint and maximize positive social impact.

- Environmental Compliance: Adhering to stringent regulations and internal standards to mitigate environmental risks.

- Reclamation Efforts: Implementing progressive reclamation plans to restore mined land to its natural state.

- Community Engagement: Building and maintaining strong relationships with local stakeholders through dialogue and support programs.

- ESG Reporting: Transparently disclosing performance on environmental, social, and governance issues, aligning with GRI standards.

Argonaut Gold's key activities encompass the entire mining lifecycle, from initial exploration and resource definition to mine development, construction, and ongoing production. The company prioritizes efficient extraction and processing of gold ore, employing techniques like open-pit mining and heap leaching. Operational optimization and cost control are paramount, with a strong focus on enhancing throughput and reducing per-unit production costs, particularly evident in the ramp-up of the Magino mine.

Furthermore, Argonaut Gold is committed to environmental stewardship and social responsibility, engaging in sustainable practices, reclamation efforts, and community engagement. Transparency in ESG matters is maintained through adherence to global reporting standards.

| Key Activity | Description | 2024 Focus/Data |

| Exploration & Resource Definition | Discovering and defining gold deposits; upgrading resources to reserves. | Continued drilling programs; focus on San Antonio mine resource base. |

| Mine Development & Construction | Bringing new projects to life and enhancing existing operations. | Commissioning of Magino mine; expansion of infrastructure at Florida Canyon. |

| Extraction & Processing | Extracting and processing gold ore using open-pit mining and heap leaching. | Achieved 43,542 ounces of gold production in Q1 2024; optimizing mining and milling rates. |

| Operational Optimization & Cost Control | Enhancing efficiency, increasing throughput, and lowering per-unit costs. | Focus on Magino ramp-up, addressing equipment availability, and improving ore selectivity. |

| Environmental & Social Responsibility | Sustainable mining practices, environmental compliance, reclamation, and community engagement. | Adherence to GRI standards for ESG reporting; minimizing ecological footprint. |

Full Version Awaits

Business Model Canvas

The Argonaut Gold Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no discrepancies. You'll gain immediate access to this comprehensive and professionally prepared business model, ready for your immediate use and analysis.

Resources

Argonaut Gold's most critical resource is its diverse portfolio of gold mineral reserves and resources, primarily located in North America. These assets, including the significant Magino mine in Canada and its Florida Canyon and Mexican operations, form the bedrock of the company's long-term production capacity and future growth potential.

As of the first quarter of 2024, Argonaut Gold reported proven and probable mineral reserves of approximately 2.1 million ounces of gold. This highlights the tangible resource base that underpins its operational strategy and financial projections.

Argonaut Gold's mining and processing infrastructure, a cornerstone of its operations, includes essential physical assets like mining equipment and processing plants. Notably, the Magino mill represents a significant processing facility, complemented by heap leach operations across its various sites.

The company's commitment to maintaining and upgrading this vital infrastructure is paramount for ensuring uninterrupted production and operational efficiency. For example, in 2024, Argonaut Gold continued to invest in its facilities to optimize output and manage costs effectively.

Argonaut Gold's success hinges on its specialized human resource base. This includes geologists, mining engineers, metallurgists, and experienced mine operators crucial for exploration, development, and efficient mine operations. In 2024, the company continued to invest in its team, recognizing that skilled personnel are fundamental to unlocking the value of its mineral assets.

The management team provides the strategic direction, guiding exploration efforts, operational improvements, and capital allocation. Their expertise is vital for navigating the complexities of the mining industry, ensuring the company remains competitive and profitable. This leadership is key to achieving operational excellence and sustainable growth.

Financial Capital and Liquidity

Argonaut Gold's financial capital and liquidity are critical for its mining operations. Access to funds, whether through cash on hand, revolving credit lines, or the ability to issue debt or equity, directly fuels day-to-day activities, significant capital investments in new projects and equipment, and the repayment of existing loans. Strong financial health is essential for moving projects from exploration to production.

For example, as of the first quarter of 2024, Argonaut Gold reported cash and cash equivalents of approximately $70.1 million. The company also had access to a $150 million revolving credit facility, providing substantial liquidity. This financial foundation is key to managing operational costs and pursuing strategic growth initiatives.

- Cash Reserves: $70.1 million in cash and cash equivalents as of Q1 2024, supporting immediate operational needs.

- Credit Facilities: Access to a $150 million revolving credit facility, offering flexibility for short-term funding requirements and capital expenditures.

- Debt Management: Ability to service and potentially refinance existing debt obligations, crucial for maintaining financial stability and investor confidence.

- Capital Investment Funding: Securing funds for ongoing exploration, mine development, and equipment upgrades, which are vital for long-term production and profitability.

Mining Permits and Licenses

Argonaut Gold's ability to operate hinges on its possession of crucial mining permits, environmental licenses, and necessary regulatory approvals. These non-tangible assets are the bedrock, allowing the company to legally undertake exploration, development, and production activities across its various projects.

As of late 2024, Argonaut Gold maintained a portfolio of active permits and licenses across its Mexican and North American operations. For instance, its San Antonio mine in Mexico held all essential permits for its current operational phase, with ongoing efforts to secure extensions and approvals for planned expansions. Similarly, the Florida Canyon mine in Nevada had its operating permits renewed and was progressing through the environmental review process for potential leach pad expansions.

- Permit Portfolio: Holds a comprehensive set of operating, environmental, and exploration permits for key assets like San Antonio and Florida Canyon.

- Regulatory Compliance: Adheres to strict environmental and governmental regulations, ensuring continued legal operation.

- Expansion Approvals: Actively seeks and obtains necessary permits for future growth and development initiatives, such as leach pad expansions.

Intellectual property, including geological data, exploration results, and proprietary mining techniques, represents a significant intangible asset for Argonaut Gold. This knowledge base drives efficient resource discovery and extraction. The company's ongoing investment in geological research and development in 2024 aimed to refine exploration models and improve operational efficiencies.

The company's brand reputation and established relationships with stakeholders, including investors, local communities, and government bodies, are crucial for its social license to operate and for attracting future investment. Maintaining strong community ties and a positive public image are key priorities for Argonaut Gold.

Argonaut Gold's technological capabilities, encompassing advanced geological modeling software and efficient mining equipment, are vital for optimizing resource extraction and minimizing operational costs. Investments in technology, such as upgrades to processing equipment at its Florida Canyon mine, underscore its commitment to leveraging innovation.

Value Propositions

Argonaut Gold’s consistent gold production was a core value proposition, assuring investors of a steady output from its strategically located North American mines. This reliability was built on a diverse asset base, minimizing single-mine risk and providing a stable foundation for operations.

The company actively worked to meet and exceed its annual gold equivalent ounce production targets. For instance, in 2023, Argonaut Gold reported production of 227,507 gold equivalent ounces, demonstrating its commitment to consistent output and growth within its operational capabilities.

Argonaut Gold's commitment to operational efficiency and cost management was a cornerstone of its business model. The company actively pursued disciplined capital allocation, with a keen focus on controlling expenditures to bolster cash flow generation.

A key element of this strategy involved optimizing unit costs at its active mining sites. For instance, in 2024, Argonaut Gold reported a significant reduction in its all-in sustaining costs (AISC) at its San Agustin mine, bringing it down by 8% compared to the previous year, demonstrating tangible progress in cost control.

Argonaut Gold’s business model highlights significant growth potential stemming from the ramp-up of its flagship Magino mine. This development is crucial for future revenue streams and operational expansion.

The company is actively engaged in exploration programs designed to bolster its mineral reserve base. In 2024, Argonaut reported a significant increase in its measured and indicated gold reserves at Magino, reaching approximately 2.8 million ounces. This expansion directly translates to long-term upside for stakeholders, underpinning the company’s growth narrative.

Responsible and Sustainable Mining

Argonaut Gold’s commitment to responsible and sustainable mining practices offers significant value by proactively addressing environmental and social impacts, thereby reducing operational risks. This focus builds trust and strong relationships with local communities, which is crucial for long-term operational continuity. In 2024, Argonaut continued to invest in environmental stewardship programs, aiming to minimize their footprint and adhere to evolving regulatory standards, a key differentiator for socially conscious investors.

This dedication also enhances the company's appeal to a growing segment of investors who prioritize Environmental, Social, and Governance (ESG) criteria. By demonstrating a tangible commitment to sustainability, Argonaut Gold can attract capital from funds and individuals seeking to align their investments with ethical principles. This strategic approach not only safeguards the company's reputation but also potentially lowers the cost of capital.

- Risk Mitigation: Lowering the likelihood of costly environmental fines or community opposition.

- Community Relations: Fostering goodwill and social license to operate.

- Investor Attraction: Appealing to the expanding ESG investment market.

- Brand Reputation: Building a positive image as a responsible corporate citizen.

Value Creation for Shareholders

Argonaut Gold focused on delivering shareholder value through reliable gold production and enhancing operational efficiency. The company's strategy included pursuing growth opportunities and maintaining a robust financial standing, underscored by significant corporate actions.

Strategic moves, such as the acquisition of Alamos Gold's Mexican assets in 2023, were designed to bolster the company's portfolio and long-term profitability. This transaction, valued at approximately $342 million, aimed to create a more focused and potentially higher-performing entity.

- Consistent Production: Targeting stable output from its existing mining operations.

- Operational Improvements: Implementing measures to boost efficiency and reduce costs.

- Strategic Growth: Pursuing acquisitions and development projects to expand its resource base.

- Financial Strength: Maintaining a healthy balance sheet to support operations and growth.

Argonaut Gold’s value proposition centers on delivering consistent gold production from its North American assets, supported by a commitment to operational efficiency and cost management. The company is also focused on growth through strategic development projects like Magino and active exploration programs to expand its mineral reserves.

Furthermore, Argonaut Gold emphasizes responsible mining practices, which enhances its appeal to ESG-focused investors and strengthens community relations, thereby mitigating operational risks.

The company aims to create shareholder value through reliable production, operational improvements, strategic growth initiatives, and maintaining financial strength, as demonstrated by its acquisition of Alamos Gold's Mexican assets in 2023 for approximately $342 million.

| Value Proposition | Key Aspect | Supporting Data/Action |

|---|---|---|

| Consistent Gold Production | Reliable output from North American mines | 2023 production: 227,507 gold equivalent ounces |

| Operational Efficiency & Cost Management | Disciplined capital allocation, cost control | 2024: San Agustin AISC reduced by 8% |

| Growth Potential | Magino mine ramp-up, exploration programs | Magino reserves: ~2.8 million ounces (2024) |

| Sustainability & ESG Focus | Responsible mining, community relations | Continued investment in environmental programs (2024) |

| Shareholder Value | Strategic acquisitions, financial strength | Acquired Alamos Gold's Mexican assets (2023) for ~$342M |

Customer Relationships

Argonaut Gold fostered transparent investor relations by consistently providing regular financial reports and timely news releases. This commitment to open communication, including detailed investor presentations and direct engagement with financial analysts, ensured stakeholders remained well-informed about the company's performance and strategic direction.

Argonaut Gold prioritizes building and maintaining strong, positive relationships with the local communities surrounding its mine sites. This proactive community engagement is fundamental to securing and retaining its social license to operate. For instance, in 2024, the company continued its commitment to addressing community concerns through regular dialogue and transparent communication channels.

The company's dedication to local development is evident through its ongoing investments. In 2024, Argonaut Gold allocated significant resources towards community development initiatives, focusing on areas such as education, infrastructure, and local employment opportunities. These efforts aim to create shared value and foster long-term sustainability for both the company and the communities.

Argonaut Gold actively cultivates relationships with government entities and regulatory bodies to ensure strict adherence to mining laws, environmental standards, and permitting processes. This proactive engagement is crucial for maintaining operational continuity and advancing project development timelines. For instance, in 2024, the company continued its focus on environmental stewardship, with expenditures on environmental programs and reclamation efforts being a key aspect of its operational budget.

Strategic Supplier and Contractor Partnerships

Argonaut Gold's strategic supplier and contractor partnerships are crucial for ensuring the consistent and timely delivery of essential services and equipment. These collaborations directly influence operational efficiency and the adherence to project timelines, which is vital in the mining sector. For instance, in 2024, the company continued to leverage long-term agreements with key mining contractors and equipment suppliers to maintain operational continuity and manage costs effectively.

- Long-Term Agreements: Argonaut Gold prioritizes establishing enduring relationships with its suppliers and contractors, often through multi-year contracts. This fosters stability and predictability in its supply chain.

- Operational Efficiency Impact: The reliability of these partnerships directly impacts the company's ability to maintain consistent production levels and meet operational targets. Delays from suppliers can significantly disrupt mining schedules.

- Cost Management: Strategic partnerships allow for better negotiation of terms and pricing, contributing to Argonaut Gold's overall cost management efforts in its mining operations.

- Equipment and Service Reliability: Access to dependable equipment and specialized services from trusted partners is fundamental to safe and productive mining activities.

Employee Relations and Talent Retention

Argonaut Gold prioritizes its workforce by fostering strong employee relations. This involves ensuring fair labor practices, maintaining safe working conditions, and providing avenues for professional development. These efforts are crucial for attracting and retaining the skilled talent necessary to thrive in the competitive mining sector.

In 2024, Argonaut Gold's commitment to its employees is reflected in its focus on safety initiatives and training programs. For instance, the company's safety performance is a key metric, with ongoing efforts to reduce incident rates across all operations. Investing in employee growth not only enhances operational efficiency but also builds loyalty and reduces costly turnover.

- Talent Attraction: Competitive compensation and benefits packages are designed to draw in experienced mining professionals.

- Retention Strategies: Emphasis on career progression, ongoing training, and a positive work environment helps keep valuable employees.

- Safety Culture: Implementing robust safety protocols and providing comprehensive safety training is paramount to employee well-being and operational continuity.

- Community Engagement: Building positive relationships with local communities often extends to creating employment opportunities for residents, fostering goodwill and a stable workforce.

Argonaut Gold's approach to customer relationships centers on its investors and the communities where it operates. Transparent communication with investors, including regular financial updates and presentations, is key to maintaining trust and support for its mining ventures.

The company actively cultivates strong ties with local communities, recognizing that a positive social license to operate is vital. In 2024, this involved continued dialogue and investment in local development projects, such as infrastructure and employment, to foster mutual benefit and long-term sustainability.

Furthermore, Argonaut Gold emphasizes building reliable partnerships with suppliers and contractors, securing essential services and equipment through long-term agreements. These relationships are critical for operational efficiency and cost management, ensuring the smooth execution of mining activities.

| Relationship Type | Key Focus | 2024 Actions/Data |

|---|---|---|

| Investors | Transparency, Financial Reporting | Regular financial reports, investor presentations, direct analyst engagement. |

| Local Communities | Social License, Development | Community dialogue, investment in education, infrastructure, local employment. |

| Suppliers & Contractors | Reliability, Efficiency | Long-term agreements for services and equipment, cost management. |

| Employees | Safety, Development | Safety initiatives, training programs, fair labor practices. |

Channels

Argonaut Gold's primary stock exchange channel is the Toronto Stock Exchange (TSX), where its shares are listed. This listing provides a crucial avenue for investors to buy and sell the company's securities, ensuring market liquidity and enabling public valuation of the company. As of July 2025, Argonaut Gold's TSX listing continues to be a cornerstone of its investor relations strategy, facilitating capital raising and shareholder engagement.

The company website acts as a primary communication channel, offering investors and stakeholders access to critical information like news releases, quarterly financial reports, and detailed technical studies. In 2024, Argonaut Gold's website likely provided access to their latest operational updates and financial performance data, crucial for understanding their ongoing projects and market position.

Financial news wires and media are crucial for Argonaut Gold's communication strategy. In 2024, companies heavily rely on these channels to distribute press releases, ensuring timely updates on operational progress, exploration results, and financial performance reach a wide audience of investors and stakeholders. This broad dissemination is vital for maintaining market awareness and investor confidence.

Investor Presentations and Conferences

Argonaut Gold actively engages with the financial community via investor presentations and industry conferences. These interactions are crucial for disseminating company strategy and performance updates directly to stakeholders.

In 2024, Argonaut Gold participated in key mining conferences, providing opportunities for one-on-one meetings with institutional investors and financial analysts. This direct engagement facilitates clear communication regarding the company's operational progress and future outlook.

- Direct Communication: Facilitates in-depth discussions on strategic initiatives and financial performance.

- Investor Relations: Builds and maintains relationships with institutional investors and analysts.

- Market Visibility: Enhances the company's profile within the mining investment community.

- Feedback Loop: Provides valuable insights from the investment community regarding strategy and operations.

Regulatory Filings (SEDAR+)

Regulatory filings, such as the Annual Information Form (AIF) and Management Discussion and Analysis (MD&A), submitted to platforms like SEDAR+ are critical for transparency and compliance. These documents offer legally mandated disclosures, providing stakeholders with detailed insights into a company's operations, financial performance, and strategic direction. For Argonaut Gold, these filings are essential for communicating with investors, analysts, and the broader financial community.

These filings serve as a cornerstone for informed decision-making. For instance, in their 2023 filings, Argonaut Gold provided detailed operational updates and financial results, allowing stakeholders to assess the company's progress and future prospects. The MD&A, in particular, offers management's perspective on the company's performance, risks, and opportunities.

- SEDAR+ is the official platform for regulatory filings in Canada.

- Key documents include the Annual Information Form (AIF) and Management Discussion and Analysis (MD&A).

- These filings provide legally mandated disclosures for all stakeholders.

- Argonaut Gold utilizes SEDAR+ to communicate its operational and financial performance.

Argonaut Gold's digital presence, including its website and social media platforms, serves as a direct channel for disseminating information to a broad audience. In 2024, these platforms were essential for sharing operational updates, exploration results, and financial performance, ensuring stakeholders remained informed. The company's engagement on platforms like Twitter and LinkedIn also fosters community and provides real-time updates.

Argonaut Gold utilizes financial news services and press releases to reach a wide investor base. These channels are critical for timely announcements regarding production, exploration success, and corporate developments. In 2024, consistent communication through these outlets helped maintain market awareness and investor confidence.

The company's participation in investor conferences and roadshows provides direct engagement opportunities. These events allow for in-depth discussions with analysts and institutional investors, offering valuable insights into operational progress and strategic direction. Such interactions are vital for building and maintaining strong investor relationships.

Regulatory filings, particularly on SEDAR+, are fundamental for transparency and compliance. Documents like the Annual Information Form and Management Discussion and Analysis provide comprehensive data on Argonaut Gold's performance and outlook. These filings are crucial for stakeholders seeking detailed, legally mandated information about the company's operations and financial health.

Customer Segments

Institutional investors, such as large investment funds and pension funds, represent a crucial customer segment for Argonaut Gold. These entities typically allocate substantial capital, aiming for long-term growth and stability within the precious metals market. In 2024, the global institutional investor market continued to show significant interest in commodities, with gold often serving as a hedge against inflation and geopolitical uncertainty.

Retail investors, individuals looking to grow their wealth, were a key segment for Argonaut Gold. They typically bought shares through their brokerage accounts, aiming for capital gains or exposure to the gold market. These investors often based their decisions on information readily available to the public and the advice of financial analysts.

Financial analysts and portfolio managers are crucial for Argonaut Gold. These professionals, often from investment banks and research firms, meticulously analyze the company's operational efficiency, reserve reports, and financial statements. Their in-depth research and stock recommendations directly influence investor sentiment and capital allocation, making their informed opinions vital for Argonaut Gold's market valuation and access to funding.

Debt Providers and Lenders

Debt Providers and Lenders are crucial for Argonaut Gold, primarily consisting of banks and other financial institutions. These entities supply the necessary debt financing, credit facilities, and loans to fuel the company's capital-intensive projects and ongoing operations. The strength of these relationships hinges on Argonaut Gold's demonstrated creditworthiness and the perceived viability of its mining projects.

For instance, in 2024, Argonaut Gold continued to manage its debt obligations, which are essential for funding exploration, development, and operational expenditures. The company's ability to secure and service this debt directly impacts its capacity to expand its asset base and maintain production levels. Financial institutions assess factors like proven reserves, production forecasts, and management's track record when extending credit.

- Banks and Financial Institutions: Key providers of capital through various loan agreements and credit lines.

- Relationship Basis: Founded on Argonaut Gold's creditworthiness, project economics, and collateral.

- Impact on Operations: Debt financing enables capital expenditures for mine development, equipment acquisition, and working capital needs.

- Risk Mitigation: Lenders typically require covenants and reporting to monitor the company's financial health and project progress.

Governmental Bodies and Regulators

Governmental bodies and regulators are critical stakeholders for Argonaut Gold, influencing operational permits, environmental compliance, and taxation. Their approval is non-negotiable for exploration, development, and production activities. In 2024, the mining sector globally faced increased scrutiny on environmental, social, and governance (ESG) factors, necessitating robust engagement with these entities.

These entities ensure adherence to mining laws, safety standards, and fiscal contributions. For instance, securing and maintaining mining concessions involves meeting specific governmental requirements and often involves royalty payments and corporate income taxes, which directly impact profitability. In 2024, many jurisdictions continued to refine their mining codes, potentially altering the fiscal regimes experienced by companies like Argonaut Gold.

- Regulatory Compliance: Ensuring all exploration and mining activities meet national and local environmental, health, and safety regulations.

- Permitting and Licensing: Obtaining and maintaining necessary permits for all stages of the mining lifecycle, from exploration to closure.

- Fiscal Contributions: Fulfilling obligations related to royalties, taxes, and other government fees, which were a significant factor in mining economics in 2024.

Argonaut Gold's customer segments are diverse, encompassing institutional investors seeking stable commodity exposure, retail investors aiming for capital growth, and financial professionals who influence market perception. Additionally, debt providers are critical for financing operations, while governmental bodies set the regulatory framework.

Cost Structure

Mining and processing operating costs represent the significant expenses incurred in the daily running of Argonaut Gold's mines. These costs encompass labor, energy, consumables, equipment upkeep, and the chemicals needed for ore processing. In 2023, Argonaut Gold reported total cash costs per ounce of gold sold at $1,380, a key indicator of these operational expenditures.

Exploration and development expenditures are fundamental to Argonaut Gold's long-term growth strategy, representing the costs associated with discovering and advancing new mineral deposits. These investments are vital for replenishing reserves and ensuring future production.

In 2024, Argonaut Gold continued to invest significantly in these areas. For instance, their exploration programs focused on identifying new high-grade zones and expanding existing resources at key properties like San Antonio and Altan Ol. These efforts included extensive drilling campaigns and detailed geological studies.

The company's development expenditures in 2024 were directed towards advancing projects that showed strong economic potential, such as feasibility studies and engineering work for potential new mines or expansions. These costs are essential for de-risking projects and preparing them for construction, ultimately supporting the company's pipeline of future operations.

Capital expenditures are a significant component of Argonaut Gold's cost structure, encompassing both the upkeep of current mines and investments in future growth. In 2024, the company's capital expenditures were primarily directed towards sustaining operations, such as the ongoing development of tailings facilities and heap leach pads, which are crucial for the longevity and environmental compliance of their mining sites. These sustaining efforts ensure that existing assets continue to operate efficiently and safely.

Beyond maintenance, Argonaut Gold also allocates substantial funds to growth capital projects. A prime example is the continued investment in the construction of the Magino mine, a key project expected to significantly boost production and extend the company's operational life. These growth-oriented expenditures are vital for expanding the company's asset base and enhancing its long-term revenue potential.

General and Administrative Expenses

General and Administrative Expenses (G&A) encompass the essential overhead costs that keep Argonaut Gold running smoothly. These include everything from the salaries of corporate management and administrative staff to vital legal, accounting, and investor relations functions. These expenses are crucial for the overall governance and strategic direction of the company, ensuring it operates effectively and transparently.

For Argonaut Gold, these costs are foundational to its corporate structure. For instance, in the first quarter of 2024, the company reported G&A expenses of approximately $4.7 million. This figure reflects the investment in maintaining a robust corporate framework that supports all operational activities and stakeholder communication.

- Corporate Management: Salaries and benefits for executives and senior leadership guiding the company's strategy.

- Administrative Support: Costs associated with office staff, IT, and general operational upkeep.

- Legal and Accounting: Expenses for compliance, financial reporting, and legal counsel.

- Investor Relations: Communication and engagement efforts with shareholders and the investment community.

Environmental and Reclamation Costs

Argonaut Gold's cost structure includes significant expenses for environmental stewardship and future mine closure. These encompass ongoing compliance with environmental regulations, rigorous monitoring of operational impacts, and the crucial planning and funding for eventual mine site reclamation. These expenditures are fundamental to maintaining their social license to operate and securing necessary permits.

In 2024, such environmental and reclamation costs are a substantial component of operational budgeting. For instance, companies in the mining sector often allocate millions of dollars annually for environmental programs. These funds cover aspects like water management, biodiversity protection, and the eventual rehabilitation of land disturbed by mining activities, ensuring a responsible end-of-life plan for each site.

- Environmental Compliance: Costs associated with meeting regulatory standards for air, water, and land quality.

- Monitoring Programs: Expenses for ongoing environmental surveillance and data collection.

- Reclamation and Closure: Funds set aside for the eventual restoration of mine sites to a stable and environmentally sound condition.

- Permitting and Approvals: Costs incurred to obtain and maintain the necessary environmental permits for operations.

Argonaut Gold's cost structure is heavily influenced by its mining and processing operations, with 2023 cash costs per ounce of gold sold reported at $1,380. Exploration and development are crucial for future growth, with significant investments in 2024 targeting new zones and advancing projects like Magino. Capital expenditures in 2024 focused on sustaining operations and growth projects, including tailings facilities and the Magino mine construction.

General and Administrative Expenses (G&A) are essential for corporate governance, with Q1 2024 G&A expenses around $4.7 million. Environmental stewardship and mine closure are also significant costs, involving compliance, monitoring, and reclamation planning to ensure responsible operations and site restoration.

| Cost Category | Description | 2023 Data | 2024 Focus Areas |

| Mining & Processing | Labor, energy, consumables, equipment, chemicals | $1,380 cash cost/oz sold | Operational efficiency |

| Exploration & Development | Discovering and advancing new deposits | N/A | San Antonio, Altan Ol drilling, feasibility studies |

| Capital Expenditures (Sustaining) | Mine upkeep, tailings facilities, heap leach pads | N/A | Ongoing site maintenance and compliance |

| Capital Expenditures (Growth) | Investments in future production capacity | N/A | Magino mine construction |

| General & Administrative (G&A) | Corporate management, admin, legal, investor relations | Q1 2024: ~$4.7 million | Maintaining corporate framework, stakeholder communication |

| Environmental & Closure | Compliance, monitoring, reclamation planning | N/A | Water management, biodiversity, land restoration |

Revenue Streams

The sale of gold bullion was Argonaut Gold's primary revenue generator, directly tied to the ounces of gold produced and sold from its mines. In 2024, the company's financial performance heavily depended on the fluctuating global gold prices, which significantly impacted the revenue realized from these sales.

The sale of silver, a common by-product in gold mining operations, represented a secondary revenue stream for Argonaut Gold. This contribution, while typically smaller than gold sales, was directly influenced by both the volume of silver produced and prevailing market prices. For instance, in 2024, the company's silver sales provided a valuable, albeit supplementary, income source.

For its new mines, including the Magino project, Argonaut Gold recognizes revenue from gold ounces produced and sold during the ramp-up phase, even before the official declaration of commercial production. This approach allows for early monetization of resources.

In the first quarter of 2024, Argonaut Gold reported that Magino had produced 22,505 gold ounces. While commercial production was not yet declared, this output contributed to the company's overall financial performance, demonstrating the value generated even in the pre-commercial stage.

Cash Flow from Operations

Cash Flow from Operations is the lifeblood of Argonaut Gold's business model, reflecting the actual cash generated from its mining activities. This metric is crucial for understanding the underlying profitability and sustainability of its revenue-generating operations before considering any financing or investment decisions. A healthy operational cash flow indicates that the company's core business is performing well and can generate the necessary funds to sustain and grow.

For Argonaut Gold, the strength of its revenue streams is directly tied to its ability to efficiently extract and sell gold. The company's operational cash flow is a direct indicator of how well it manages its production costs, commodity prices, and sales volumes.

- Operational Cash Flow: For the nine months ended September 30, 2023, Argonaut Gold reported cash flow from operations of $34.2 million. This figure demonstrates the cash generated from the company's core mining activities.

- Revenue Generation: The primary revenue stream for Argonaut Gold is the sale of gold and silver. The company's ability to maintain consistent production and achieve favorable market prices for these commodities directly impacts its operational cash flow.

- Profitability Indicator: A positive and growing cash flow from operations signals the underlying profitability and financial health of Argonaut Gold's mining ventures, providing a solid foundation for future investments and debt management.

Potential Streaming and Royalty Agreements

Argonaut Gold could secure upfront capital by entering into streaming and royalty agreements, effectively selling a portion of its future production or revenue. A prime example is the Net Smelter Return (NSR) royalty on its Magino project, which Franco-Nevada acquired.

These arrangements offer a distinct revenue stream by providing immediate funding in exchange for a share of future gold or revenue. For instance, in 2023, Franco-Nevada's royalty portfolio generated $1.4 billion in revenue, highlighting the significant financial potential of such agreements for mining companies like Argonaut.

This strategy diversifies Argonaut's financing options beyond traditional debt or equity, while also allowing partners to gain exposure to the company's assets. Such deals can de-risk projects and accelerate development by providing non-dilutive capital.

- Streaming Agreements: Selling a portion of future metal production for an upfront payment.

- Royalty Agreements: Entitling a third party to a percentage of revenue or profits from a mine.

- Franco-Nevada Example: Argonaut has an NSR royalty on its Magino project with Franco-Nevada.

- Capital Infusion: These agreements provide immediate capital, aiding project development and reducing financial risk.

Beyond direct sales, Argonaut Gold also generates revenue through streaming and royalty agreements. These arrangements involve selling a portion of future metal production or revenue streams for upfront capital. For example, Franco-Nevada holds a Net Smelter Return (NSR) royalty on Argonaut's Magino project, providing a crucial funding mechanism.

These agreements offer a distinct revenue stream by providing immediate funding in exchange for a share of future gold or revenue. Such deals can de-risk projects and accelerate development by providing non-dilutive capital, diversifying financing options beyond traditional debt or equity.

| Revenue Stream | Description | Example/Note |

|---|---|---|

| Gold Sales | Primary revenue from selling mined gold bullion. | Performance tied to production volume and global gold prices. |

| Silver Sales | Secondary revenue from selling by-product silver. | Contributes supplementary income, influenced by silver prices. |

| Streaming/Royalty Agreements | Upfront capital for a share of future production/revenue. | NSR royalty on Magino project with Franco-Nevada. |

Business Model Canvas Data Sources

The Argonaut Gold Business Model Canvas is constructed using a combination of financial disclosures, operational reports, and market intelligence. This ensures each block reflects the company's current strategic positioning and resource allocation.