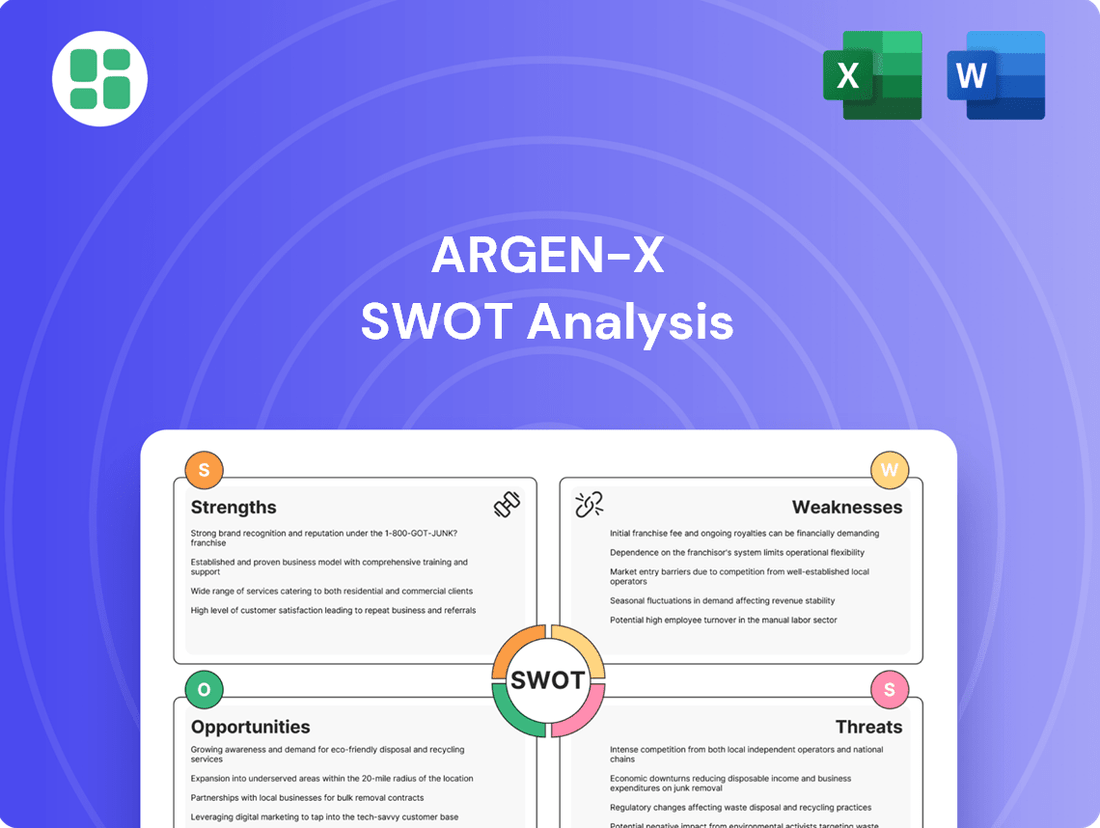

arGEN-X SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

arGEN-X Bundle

arGEN-X boasts a strong pipeline and innovative technology, but faces intense competition and regulatory hurdles. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind arGEN-X’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Argenx's proprietary SIMPLE Antibody™ Platform is a significant strength, enabling the development of highly effective and fully human therapeutic antibodies. This unique platform, derived from the llama immune system, facilitates the creation of antibodies with substantial human sequence homology. This characteristic enhances the likelihood of successful drug development by yielding superior drug candidates and potentially minimizing the need for complex engineering modifications.

VYVGART's commercial success is a significant strength, with Q1 2025 product net sales reaching an impressive $790 million, a 99% increase compared to the previous year. This robust growth highlights strong market adoption and effective commercialization strategies.

The drug's expanding global patient base, exceeding 10,000 patients across various indications in 2024, underscores its therapeutic value and broad applicability. This widespread patient reach is a key indicator of its market penetration and potential for future expansion.

The introduction of the VYVGART Hytrulo pre-filled syringe (PFS) formulation in the U.S. and Germany further bolsters its commercial performance. This user-friendly delivery method enhances patient convenience, which is anticipated to be a significant driver for continued sales growth and market share gains.

argenx boasts a robust pipeline featuring multiple promising drug candidates targeting severe autoimmune diseases. By 2025, the company is set to initiate 10 registrational and 10 proof-of-concept studies for key assets like efgartigimod and empasiprubart, with substantial data expected in 2025 and 2026. This broad development strategy diversifies risk and presents numerous avenues for future revenue generation.

First-Mover Advantage in Key Indications

arGEN-X's VYVGART holds a significant first-mover advantage in key indications. It was the first FcRn blocker approved globally for generalized myasthenia gravis (gMG) and subsequently for chronic inflammatory demyelinating polyneuropathy (CIDP) in the U.S. This latter approval was particularly noteworthy, representing the first new treatment option for CIDP in over 30 years, a substantial unmet need.

This pioneering market entry allows arGEN-X to establish a strong foothold and build brand recognition before competitors emerge. The company's early presence in these specific therapeutic areas translates to a considerable competitive edge, enabling them to capture market share and solidify their position as a leader in FcRn inhibition therapy.

- First Approval: VYVGART was the inaugural FcRn blocker approved for gMG globally.

- CIDP Breakthrough: It also secured the first approval for CIDP in the U.S., ending a 30+ year treatment gap.

- Market Entrenchment: This early market entry creates a significant barrier to entry for potential rivals.

Solid Financial Position and Path to Profitability

Argenx has achieved a significant milestone by reporting an operating profit of $139 million and a net profit of $169 million in the first quarter of 2025. This marks a clear transition towards sustainable profitability for the company.

The company's robust financial health is further underscored by its substantial cash reserves. Ending Q1 2025 with $3.6 billion in cash provides argenx with considerable financial flexibility. This allows for strategic investments in its innovation pipeline and the ability to seize promising commercial and clinical opportunities.

- Operating Profit (Q1 2025): $139 million

- Net Profit (Q1 2025): $169 million

- Cash Balance (End of Q1 2025): $3.6 billion

Argenx's proprietary SIMPLE Antibody™ Platform is a significant strength, enabling the development of highly effective and fully human therapeutic antibodies with substantial human sequence homology, minimizing complex engineering.

VYVGART's commercial success is a major asset, with Q1 2025 net sales reaching $790 million, a 99% year-over-year increase, demonstrating strong market adoption and effective commercialization.

The drug's expanding patient base, exceeding 10,000 patients in 2024, and the user-friendly VYVGART Hytrulo formulation enhance its therapeutic value and market penetration.

Argenx boasts a robust pipeline with multiple drug candidates targeting severe autoimmune diseases, with 10 registrational and 10 proof-of-concept studies planned for key assets by 2025.

VYVGART's first-mover advantage as the first FcRn blocker approved for generalized myasthenia gravis (gMG) globally and for chronic inflammatory demyelinating polyneuropathy (CIDP) in the U.S. establishes a strong market position.

The company achieved a significant financial milestone with an operating profit of $139 million and a net profit of $169 million in Q1 2025, transitioning towards sustainable profitability.

Substantial cash reserves of $3.6 billion at the end of Q1 2025 provide argenx with considerable financial flexibility for strategic investments and seizing opportunities.

| Metric | Q1 2025 | Year-over-Year Change |

| VYVGART Net Sales | $790 million | 99% increase |

| Operating Profit | $139 million | N/A |

| Net Profit | $169 million | N/A |

| Cash Balance | $3.6 billion | N/A |

What is included in the product

Delivers a strategic overview of arGEN-X’s internal and external business factors, highlighting its strong pipeline and market opportunities while also addressing potential competitive threats and operational challenges.

Provides a clear, actionable framework for identifying and leveraging arGEN-X's competitive advantages and mitigating potential threats.

Weaknesses

Argenx's financial health is currently very dependent on VYVGART. In the first quarter of 2024, VYVGART generated $307 million in net sales, highlighting its importance. This reliance means that any challenges faced by VYVGART, such as new competitors or unexpected regulatory hurdles, could significantly affect argenx's overall financial results.

arGEN-X anticipates its combined research and development (R&D) and selling, general, and administrative (SG&A) expenses to reach roughly $2.5 billion in 2025. These significant investments are crucial for advancing its drug pipeline and expanding commercial operations.

However, such high operational costs can strain profitability and cash reserves, particularly if clinical trials face setbacks or commercialization targets are not met. This financial pressure necessitates careful management and a strong focus on successful product launches to offset the substantial outlays.

argenx has faced significant hurdles in its clinical development, notably the discontinuation of efgartigimod for ANCA-associated vasculitis (AAV), pemphigus vulgaris/foliaceus, and bullous pemphigoid. These setbacks underscore the substantial risks inherent in bringing new therapies to market.

The mixed results observed in the development of efgartigimod for immune thrombocytopenia (ITP) further illustrate these challenges. Such clinical trial failures can result in considerable wasted investment and a contraction of the potential future applications for their drug candidates.

Competition in FcRn Inhibitor Space

The FcRn inhibitor market is heating up, with several major players like Johnson & Johnson with Nipocalimab, Sanofi developing SAR445088, UCB marketing Rystiggo, and Immunovant advancing Batoclimab. This crowded field, targeting various autoimmune diseases, presents a significant challenge for arGEN-X.

This intensified competition could translate into considerable pricing pressure as companies vie for market share. Furthermore, it raises concerns about potential market share erosion for arGEN-X's own pipeline candidates and could complicate efforts to secure approvals for new indications.

- Increased Competition: Key competitors include Johnson & Johnson (Nipocalimab), Sanofi (SAR445088), UCB (Rystiggo), and Immunovant (Batoclimab).

- Potential Market Impact: Growing competition may lead to pricing pressures and challenges in market penetration.

- Indication Expansion Hurdles: Gaining new indications could become more difficult due to the presence of multiple FcRn inhibitors in development.

Regulatory and Reimbursement Hurdles

Even with successful drug approvals, arGEN-X navigates a complex web of regulatory and reimbursement challenges. These hurdles vary significantly by country, impacting how quickly and widely their therapies can reach patients. For instance, the ongoing discussions around drug pricing in major markets like the United States and Europe continue to put pressure on pharmaceutical companies, arGEN-X included, to justify their value propositions.

The intricate and often differing regulatory pathways in various regions demand substantial resources and strategic adaptation. Furthermore, securing favorable reimbursement terms is critical for market penetration and commercial success. arGEN-X's ability to effectively manage these negotiations directly influences the accessibility and uptake of its innovative treatments, potentially affecting revenue streams and market share in the competitive biotech landscape of 2024 and 2025.

- Navigating diverse regulatory frameworks: arGEN-X must adapt to distinct approval processes in markets like the US, EU, and Japan.

- Intense pricing and reimbursement negotiations: Ongoing pressure on drug pricing globally impacts the commercial viability of arGEN-X's therapies.

- Impact on market access: Successful negotiation of reimbursement is crucial for patient access and arGEN-X's market penetration strategy.

- Geographic variability in hurdles: The complexity of regulatory and reimbursement landscapes differs significantly across key international markets.

argenx's significant dependence on VYVGART presents a key weakness. In Q1 2024, VYVGART sales reached $307 million, underscoring its critical role but also highlighting the financial risk if this single product faces market challenges or increased competition.

The company's substantial R&D and SG&A expenses, projected around $2.5 billion for 2025, create financial strain. These high costs are necessary for pipeline advancement but can impact profitability and cash reserves, especially if clinical trials encounter delays or commercialization targets are missed.

Clinical development setbacks, such as the discontinuation of efgartigimod for certain indications and mixed results in ITP trials, represent significant risks. These failures translate into wasted investment and a reduced scope for future applications of their drug candidates.

The FcRn inhibitor market is becoming increasingly crowded, with major players like Johnson & Johnson, Sanofi, UCB, and Immunovant actively developing competing therapies. This intense competition could lead to pricing pressures and difficulties in securing market share for arGEN-X's pipeline candidates.

Same Document Delivered

arGEN-X SWOT Analysis

This is the actual arGEN-X SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

The preview below is taken directly from the full arGEN-X SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing strategic advantages and potential challenges.

This preview reflects the real arGEN-X SWOT analysis document you'll receive—professional, structured, and ready to use for strategic planning.

Opportunities

Argenx has a significant opportunity to broaden VYVGART's approved uses beyond generalized myasthenia gravis (gMG) and chronic inflammatory demyelinating polyneuropathy (CIDP). The company is actively exploring efgartigimod's potential in more than 15 autoimmune conditions. This includes ongoing Phase 3 studies in myositis, thyroid eye disease (TED), and Sjögren's disease, which could open up substantial new market segments for the drug.

arGEN-X is actively pursuing global commercial expansion for VYVGART, targeting key markets such as Europe, Japan, and China with ongoing launches and regulatory approvals. This strategic push aims to significantly broaden its market penetration beyond existing territories.

The upcoming introduction of a pre-filled syringe and a potential autoinjector for VYVGART is poised to enhance patient convenience. This innovation is expected to drive increased adoption rates and potentially enable earlier treatment initiation for patients, thereby capturing new patient segments.

Beyond the established success of efgartigimod, argenx is strategically advancing a robust pipeline. Promising candidates like empasiprubart, a C2 inhibitor, and ARGX-119, a MuSK agonist, are targeting significant unmet medical needs. These developments are crucial for argenx's long-term growth trajectory.

These next-generation assets represent potential future revenue drivers, aiming to diversify argenx's product offerings. Successfully bringing these candidates to market could solidify the company's position in autoimmune and rare disease therapeutics, potentially expanding its market share significantly in the coming years.

Strategic Partnerships and Immunology Innovation Program (IIP)

argenx’s Immunology Innovation Program (IIP) and its collaborations with academic institutions are crucial for its growth. These partnerships act as a constant wellspring of new antibody-based treatments and advancements in immunology, ensuring a robust and innovative pipeline.

By teaming up with external experts, argenx can tap into specialized knowledge and broaden its research scope without incurring the full cost and time of in-house development. This strategy is designed to create ongoing value and maintain a competitive edge in the biopharmaceutical landscape.

- Pipeline Expansion: The IIP facilitates the efficient expansion of argenx's drug development pipeline by identifying and advancing promising early-stage research.

- Leveraging External Expertise: Collaborations allow argenx to access cutting-edge scientific insights and technologies from leading academic researchers.

- Cost-Effective Innovation: Partnering reduces R&D overhead, enabling argenx to pursue a wider range of therapeutic targets more economically.

- Repeat Value Creation: The program is structured to foster ongoing discoveries, leading to sustained value generation through new product candidates.

Leveraging Data and Real-World Evidence

The ongoing collection of real-world data and evidence, particularly from the increasing use of VYVGART in generalized Myasthenia Gravis (gMG) and Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), presents a significant opportunity for arGEN-X. This data is crucial for reinforcing VYVGART's established clinical profile and encouraging wider market acceptance. For instance, by mid-2024, real-world studies are expected to further illustrate VYVGART's efficacy and safety in diverse patient populations, potentially leading to enhanced reimbursement negotiations.

Furthermore, this wealth of real-world evidence can directly inform the strategic development of new indications for VYVGART. By analyzing patient outcomes and treatment patterns, arGEN-X can identify and pursue novel therapeutic areas where VYVGART's mechanism of action could prove beneficial. This data-driven approach strengthens the scientific rationale for expanding VYVGART's label, a key driver for long-term revenue growth.

The ability to leverage real-world data also bolsters arGEN-X's market access and reimbursement strategies. By providing robust evidence of VYVGART's value proposition, including its impact on patient quality of life and healthcare resource utilization, the company can negotiate more favorable terms with payers. This is particularly important in 2024 and 2025 as healthcare systems increasingly demand demonstrable value from new therapies.

- Real-World Data Collection: Continued accumulation of real-world evidence from VYVGART's expanding use in gMG and CIDP.

- Clinical Profile Solidification: Using this data to further confirm and strengthen VYVGART's established clinical efficacy and safety.

- New Indication Development: Informing the identification and pursuit of new therapeutic areas for VYVGART based on real-world patient outcomes.

- Market Access & Reimbursement: Strengthening arguments for market access and favorable reimbursement by demonstrating VYVGART's value proposition through real-world evidence.

Argenx has a significant opportunity to expand VYVGART's approved uses beyond its current indications, with ongoing Phase 3 studies in myositis, thyroid eye disease, and Sjögren's disease. This expansion into over 15 autoimmune conditions could unlock substantial new market segments. Furthermore, the company is actively pursuing global commercial expansion, targeting key markets like Europe, Japan, and China, which will broaden its market penetration significantly. The upcoming introduction of a pre-filled syringe and potential autoinjector for VYVGART is expected to boost patient convenience and adoption rates, potentially capturing new patient segments.

The company's robust pipeline, including empasiprubart and ARGX-119, represents crucial future revenue drivers and diversification opportunities. Argenx's Immunology Innovation Program (IIP) and academic collaborations are vital for continuous innovation and pipeline growth, allowing access to specialized knowledge and cost-effective R&D. The ongoing collection of real-world data for VYVGART is critical for reinforcing its clinical profile, driving wider market acceptance, and informing the development of new indications, thereby strengthening market access and reimbursement negotiations through demonstrated value.

Threats

The landscape for autoimmune diseases like gMG and CIDP is heating up. Several major pharmaceutical players are bringing new FcRn inhibitors and other innovative treatments to market, or they're in the final stages of testing. This surge in competition means argenx could face challenges in capturing and holding onto market share, potentially leading to downward pressure on prices and a slower adoption rate for their existing therapies.

The possibility of clinical trials not yielding the desired results is a persistent threat, as demonstrated by past setbacks with some of efgartigimod's development paths. Such failures can significantly derail a company's pipeline and financial projections.

Moreover, regulatory bodies might impose delays or reject new drug applications, even after successful trials. For instance, unexpected findings in ongoing pivotal studies for drugs like ARGX-117 could push back market entry, directly impacting anticipated revenue generation and potentially eroding investor trust.

While argenx has secured recent approvals, the long-term viability of its core products faces the eventual threat of patent expiry. This looming milestone opens the door for biosimilar competition, which could significantly erode market share and pricing power.

The introduction of biosimilars typically leads to substantial price reductions. For instance, in the US market, biosimilar entry has historically resulted in price decreases of 20-40% or more for originator biologics, directly impacting revenue streams.

This potential price erosion poses a significant challenge to argenx's revenue growth and profitability in the years following patent expiration, necessitating a proactive strategy for pipeline development and market diversification.

Pricing Pressures and Reimbursement Challenges

The high cost associated with developing and manufacturing innovative biologic therapies like those offered by argenx frequently invites intense scrutiny from payers and healthcare systems globally. This scrutiny directly translates into significant pricing pressures and difficulties in obtaining favorable reimbursement terms, which are crucial for market access and revenue generation. For instance, in 2024, many new gene therapies faced initial reimbursement hurdles, with some payers requiring extensive evidence of long-term efficacy and cost-effectiveness before agreeing to coverage, setting a precedent for similar advanced treatments.

These pricing and reimbursement challenges pose a substantial threat to argenx's financial performance. They can directly limit patient access to potentially life-changing treatments, thereby impacting the net sales of its key products, particularly as the company seeks to expand into new geographic markets or gain approval for new therapeutic indications. The ability to secure adequate reimbursement is paramount for realizing the full commercial potential of its pipeline, especially for treatments like Vyvgart (efgartigimod alfa) which represent a significant therapeutic advancement but also a substantial investment for healthcare providers.

- Pricing Pressure: Continued pressure from payers to lower the list price of biologic drugs could erode argenx's profit margins.

- Reimbursement Delays: Lengthy and complex reimbursement negotiations in key markets can delay product uptake and revenue realization.

- Market Access Restrictions: Payers may impose restrictions on patient eligibility or require step-therapy protocols, limiting broad access to argenx's therapies.

Manufacturing and Supply Chain Risks

As a global immunology company with commercialized products, arGEN-X faces significant manufacturing and supply chain risks. Complexities in producing biologics, such as Vyvgart, require stringent quality control measures and specialized facilities. Any disruption in this intricate process, from raw material sourcing to final product distribution, could severely impact product availability and patient access.

For instance, a single manufacturing batch failure or a critical supplier issue could lead to substantial product shortages. This not only affects revenue streams but also causes considerable reputational damage. arGEN-X's reliance on a global supply chain means it's vulnerable to geopolitical events, transportation delays, and regulatory changes in different regions, all of which can escalate these risks.

- Manufacturing Complexity: Biologics production is inherently complex, demanding precise environmental controls and advanced biotechnological processes to ensure product efficacy and safety.

- Supply Chain Vulnerability: arGEN-X's global operations depend on a network of suppliers for critical raw materials and components, making it susceptible to disruptions beyond its direct control.

- Quality Control Imperatives: Maintaining consistent product quality is paramount for patient trust and regulatory compliance; any lapse can result in costly recalls and market withdrawals.

- Impact of Shortages: Product shortages can lead to lost sales, damage patient relationships, and negatively affect arGEN-X's stock performance, as seen in the pharmaceutical sector during past supply chain crises.

The increasing competition from other FcRn inhibitors and novel treatments in the autoimmune disease space, particularly for gMG and CIDP, poses a significant threat to arGEN-X's market share and pricing power. This intensified competition could slow the adoption of their existing therapies and put downward pressure on revenue. Furthermore, the looming threat of patent expiry for key products necessitates continuous pipeline innovation and market expansion to mitigate the impact of future biosimilar competition, which historically leads to substantial price erosion, often in the range of 20-40% or more.

Pricing and reimbursement challenges remain a critical hurdle, with payers globally scrutinizing the high costs of biologic therapies. Delays in securing favorable reimbursement terms can restrict patient access and limit commercial potential, as observed with new gene therapies facing initial coverage hurdles in 2024. Manufacturing and supply chain complexities also present substantial risks; disruptions in the production of biologics like Vyvgart, due to issues like batch failures or supplier problems, could lead to product shortages, impacting sales and damaging reputation. The global nature of arGEN-X's operations makes it vulnerable to geopolitical events and transportation delays, further exacerbating these supply chain risks.

SWOT Analysis Data Sources

This arGEN-X SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence reports, and expert industry commentary to ensure a data-driven and strategic assessment.