arGEN-X Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

arGEN-X Bundle

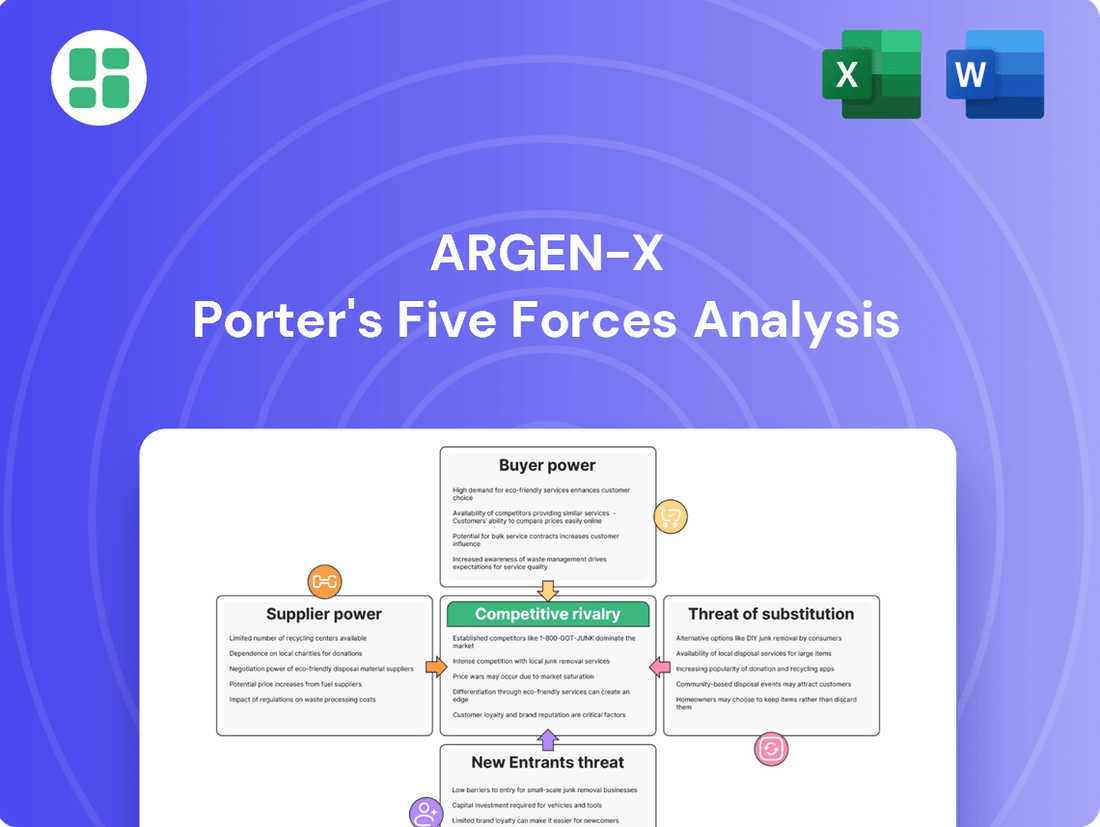

Our arGEN-X Porter's Five Forces analysis reveals a dynamic competitive landscape, highlighting moderate threats from new entrants and substitutes due to the specialized nature of their therapies. Buyer power is somewhat limited by the critical need for their innovative treatments, while supplier power is manageable given the established supply chains for biologics. The intensity of rivalry is significant, as arGEN-X operates in a rapidly evolving and highly competitive biopharmaceutical sector.

The complete report reveals the real forces shaping arGEN-X’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

arGEN-X's reliance on specialized biologics manufacturing means its key suppliers, particularly contract manufacturing organizations (CMOs) and providers of highly specific reagents, are likely concentrated. The complex nature of producing antibody-based therapies often necessitates unique facilities and expertise, limiting the pool of potential partners. This concentration can grant these suppliers considerable leverage in negotiating pricing and supply terms, potentially impacting arGEN-X's cost of goods sold and production timelines.

arGEN-X's reliance on specialized inputs for its SIMPLE Antibody™ Platform, such as proprietary cell lines and unique antibody development technologies, suggests a degree of supplier uniqueness. If these components are indeed difficult to replicate or source from alternative providers, it grants suppliers a stronger position in price negotiations.

The complexity inherent in immunology and antibody development often means that suppliers of critical reagents, advanced manufacturing equipment, or specialized scientific expertise may possess unique capabilities. For instance, a supplier of a novel gene-editing tool crucial for arGEN-X's platform could command significant leverage if that tool is patented or exceptionally difficult to obtain elsewhere.

While specific details on arGEN-X's supplier agreements and the exact proprietary nature of all its inputs are not publicly disclosed, the innovative nature of its business model points to potential dependencies on specialized suppliers. This specialization is a key factor in determining the bargaining power of those entities within the biopharmaceutical sector.

Switching suppliers for arGEN-X would likely involve substantial costs and complexities, particularly given the highly regulated nature of the pharmaceutical industry. These costs could include the requalification of manufacturing processes and obtaining new regulatory approvals, which are time-consuming and expensive endeavors.

The pharmaceutical sector demands rigorous quality control and adherence to strict guidelines. Any change in suppliers for critical raw materials or components necessitates extensive validation to ensure product integrity and patient safety. This process can take months, if not years, and incurs significant financial investment.

Furthermore, arGEN-X might lose specialized knowledge or established relationships with current suppliers, potentially impacting production efficiency and product quality. For instance, if a supplier provides a unique, highly purified compound essential for arGEN-X's therapies, finding an equivalent that meets the same stringent specifications could be challenging and costly.

Threat of Forward Integration by Suppliers

Suppliers might integrate forward into arGEN-X's operations, potentially by developing their own antibody therapies. While direct raw material providers are unlikely to do this, specialized Contract Manufacturing Organizations (CMOs) with advanced biomanufacturing expertise could emerge as competitors. This would significantly increase their bargaining power.

The biopharmaceutical contract manufacturing market is expanding, suggesting a trend where suppliers offer more integrated services. For instance, in 2023, the global biopharmaceutical contract manufacturing market was valued at approximately $20 billion and is projected to grow at a compound annual growth rate of over 10% through 2030. This growth enables CMOs to build capabilities that could rival those of biopharma companies like arGEN-X.

- Forward Integration Threat: Suppliers, particularly CMOs, could develop their own therapeutic products, becoming direct competitors.

- CMO Capabilities: Advanced biomanufacturing expertise held by CMOs poses a competitive risk.

- Market Trends: The expanding contract manufacturing market supports supplier integration and service expansion.

- Market Value: The global biopharmaceutical contract manufacturing market reached roughly $20 billion in 2023, indicating substantial supplier capacity.

Importance of Supplier's Input to arGEN-X's Product Differentiation

The bargaining power of suppliers for arGEN-X is significantly influenced by the critical nature of their inputs for the company's antibody-based therapies. If suppliers provide unique biological materials, specialized manufacturing processes, or proprietary technologies essential for the efficacy and differentiation of arGEN-X's products, their leverage increases.

For instance, access to specific cell lines or advanced purification techniques that are not readily available elsewhere can give suppliers substantial power. This is particularly true if these inputs directly contribute to the quality and therapeutic outcomes of drugs like Vyvgart (efgartigimod alfa-fcab). In 2023, arGEN-X reported €955.9 million in revenue, highlighting the commercial success of its differentiated products, which rely on specialized supplier contributions.

- Criticality of Inputs: Suppliers of specialized reagents, cell culture media, or contract manufacturing organizations with unique capabilities are vital for arGEN-X's ability to produce high-quality, differentiated antibody therapies.

- Proprietary Technology: If suppliers possess patented technologies or exclusive access to essential biological components, their bargaining power is amplified, as arGEN-X may have limited alternatives.

- Supplier Concentration: A limited number of suppliers capable of meeting arGEN-X's stringent quality and technical requirements can increase supplier bargaining power.

- Impact on Differentiation: The unique nature of arGEN-X's antibody platform means that supplier inputs directly impact product efficacy and competitive positioning, thereby strengthening supplier influence.

arGEN-X's suppliers, particularly those providing specialized biologics manufacturing and unique reagents, hold significant bargaining power due to the complex and niche nature of antibody therapy production. This concentration of expertise means fewer alternative suppliers exist, allowing them to dictate terms. The high switching costs, including regulatory requalification and loss of specialized knowledge, further solidify supplier leverage.

| Factor | Impact on arGEN-X | Supporting Data/Context |

|---|---|---|

| Supplier Concentration | High leverage for a few specialized providers. | Limited number of CMOs with advanced biomanufacturing capabilities. |

| Uniqueness of Inputs | Suppliers of proprietary cell lines or technologies have strong negotiation power. | arGEN-X's SIMPLE Antibody™ Platform relies on unique development technologies. |

| Switching Costs | Significant financial and time investment to change suppliers. | Regulatory requalification and validation processes are lengthy and costly in pharma. |

| Forward Integration Risk | CMOs could become competitors by developing their own therapies. | The global biopharmaceutical contract manufacturing market was valued at ~$20 billion in 2023. |

What is included in the product

This Porter's Five Forces analysis for arGEN-X dissects the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes within its biopharmaceutical market.

Effortlessly identify and neutralize competitive threats with pre-built templates for each of Porter's five forces, streamlining strategic planning.

Customers Bargaining Power

arGEN-X's customer base, primarily comprising patients and healthcare providers, does not exhibit significant concentration among a few dominant institutional buyers. Unlike industries with a handful of large payers, arGEN-X's market is more fragmented.

The ultimate purchasers of arGEN-X's treatments are typically individual patients, but the decision-making and reimbursement processes involve various stakeholders like physicians, hospitals, and insurance companies. While these entities influence access, they do not represent a consolidated block with overwhelming bargaining power akin to a single large PBM or integrated delivery network.

The price sensitivity of arGEN-X's customers, primarily payers and healthcare providers, is a significant factor. For high-cost specialty drugs targeting severe autoimmune diseases, payers are keenly focused on cost-effectiveness and budget impact. In 2024, the average price of new specialty drugs continued to be a major concern for health systems, with many payers actively negotiating for rebates and favorable formulary placement.

The availability of alternative treatments significantly influences customer bargaining power for companies like arGEN-X. If patients have numerous effective options for autoimmune diseases, their ability to negotiate prices or switch providers escalates. This is particularly relevant as the market sees both established competitors and emerging therapies.

In 2024, the landscape for autoimmune disease treatments is dynamic. arGEN-X's VYVGART competes with other FcRn inhibitors, such as Soliris (eculizumab) and Ultomiris (ravulizumab) from AstraZeneca, which are already established in certain indications. Furthermore, the potential development of biosimilars for existing biologics, or the emergence of entirely new therapeutic classes, could further empower patients by offering more choices and potentially lower price points, thereby increasing customer bargaining power.

Customer's Ability to Force Down Prices

The bargaining power of customers, particularly payers like insurance companies and governments, significantly influences arGEN-X's pricing strategies. These entities wield considerable influence through formulary negotiations and by implementing restrictive access policies, effectively dictating which treatments are covered and at what cost. For instance, in 2024, many national health systems are intensifying their focus on total cost management, scrutinizing drug prices more rigorously than ever before.

Payers are also actively exploring and promoting alternative pricing models that move away from traditional rebate systems, seeking greater transparency and value-based outcomes. This shift puts pressure on pharmaceutical companies to demonstrate the real-world effectiveness and cost-efficiency of their products. The increasing interest in biosimilar adoption further amplifies customer power, as it provides a direct avenue for cost reduction and competitive pressure.

- Increased Scrutiny on Pricing: Payers in 2024 are demanding more evidence of value, leading to tougher negotiations on drug prices.

- Shift to Value-Based Pricing: A growing trend involves pricing drugs based on their actual clinical outcomes rather than solely on volume.

- Biosimilar Competition: The rise of biosimilars for established biologics presents a significant threat, empowering customers to seek lower-cost alternatives.

- Formulary Exclusions: Payers can leverage their market power to exclude certain high-cost drugs from preferred formularies, forcing manufacturers to negotiate aggressively.

Impact of arGEN-X's Product on Customer's Total Cost

The cost of arGEN-X's therapies, particularly its biologic treatments, can represent a significant portion of a patient's overall healthcare expenditure. For instance, specialty drugs, which often include biologics, can cost tens of thousands of dollars per year. This substantial investment by payers, such as insurance companies, gives them considerable leverage in negotiating prices with arGEN-X. If the therapy is a critical component of a patient's treatment plan, payers may seek to secure favorable terms or explore alternative, less expensive treatments if available, thereby increasing the bargaining power of customers.

The high price point of advanced therapies means that even a small percentage reduction negotiated by a large insurer can translate into substantial savings. This financial incentive empowers customers to demand more rigorous evidence of efficacy and cost-effectiveness. Payers are increasingly looking beyond just the drug price, focusing on the total cost of care, including hospitalizations and other medical interventions. arGEN-X must therefore demonstrate the long-term value and potential cost savings associated with its products to mitigate this customer bargaining power.

- Specialty drug costs represent a significant outlay for healthcare systems and insurers.

- The high cost of biologics amplifies the bargaining power of customers like insurance companies.

- Customers may leverage their purchasing power to negotiate prices or demand value-based agreements.

- Demonstrating overall cost-effectiveness beyond the drug price is crucial for arGEN-X.

The bargaining power of arGEN-X's customers, primarily payers like insurance companies and government health programs, is substantial. These entities manage large budgets and can exert significant pressure on drug pricing through formulary negotiations and reimbursement policies. In 2024, payers are increasingly focused on demonstrating value and cost-effectiveness, leading to more stringent price negotiations and a greater demand for real-world evidence of a drug's impact on patient outcomes and overall healthcare costs.

The presence of alternative treatments, including both established therapies and emerging competitors, further empowers customers. As of mid-2024, the autoimmune disease market continues to see innovation, with companies like AstraZeneca offering FcRn inhibitors that compete with arGEN-X's VYVGART. The potential for biosimilar development in the future also looms, presenting a direct avenue for cost reduction and increased customer leverage.

High drug prices, characteristic of specialty biologics, amplify customer bargaining power. For instance, the annual cost of some autoimmune treatments can exceed $200,000, making payers highly sensitive to price. This financial reality compels payers to negotiate aggressively to secure favorable terms, potentially influencing market access and sales volumes for arGEN-X.

| Factor | Impact on arGEN-X | 2024 Context |

|---|---|---|

| Customer Concentration | Low; fragmented patient base. | No dominant institutional buyers; market remains diverse. |

| Price Sensitivity | High, especially for payers. | Payers scrutinize cost-effectiveness for specialty drugs; budget impact is key. |

| Availability of Substitutes | Moderate to High. | Competition from established FcRn inhibitors and potential new therapies. |

| Switching Costs | Moderate for patients, high for payers (formulary changes). | Payers aim for cost savings, influencing drug choice and access. |

What You See Is What You Get

arGEN-X Porter's Five Forces Analysis

This preview showcases the comprehensive arGEN-X Porter's Five Forces analysis, identical to the document you will receive immediately after purchase. You're examining the actual, professionally written analysis, ensuring no surprises or placeholders, and it will be fully formatted and ready for your immediate use upon completion of your transaction.

Rivalry Among Competitors

The landscape for treating severe autoimmune diseases is crowded. Numerous pharmaceutical and biotechnology companies are actively developing or already commercializing biologic drugs, creating a highly competitive global market. This intense rivalry means arGEN-X faces competition from both large, established pharmaceutical players with significant resources and nimble, emerging biotech firms pushing innovative therapies.

The autoimmune disease treatment market is experiencing robust growth, with projections indicating it will reach USD 137.59 billion by 2033. This expansion suggests a generally favorable environment for industry players.

However, even within a growing market, a deceleration in the growth rate can significantly amplify competitive rivalry. Companies may become more aggressive in their pursuit of market share as the overall pie expands at a slower pace.

arGEN-X's product differentiation, particularly with its SIMPLE Antibody™ Platform and lead product VYVGART, significantly impacts competitive rivalry. VYVGART, for instance, offers a distinct mechanism of action compared to many existing treatments for generalized myasthenia gravis (gMG), potentially leading to improved efficacy and safety profiles. This differentiation is crucial in a market where physicians and patients seek novel therapeutic options.

The convenience factor, such as the potential for subcutaneous administration of some arGEN-X therapies, can further reduce direct rivalry by offering an advantage over intravenous-only competitors. As of early 2024, the focus on expanding indications for VYVGART and developing new antibody-based therapies underscores arGEN-X's commitment to maintaining and enhancing this differentiation, aiming to capture market share and lessen the pressure from rivals.

Exit Barriers

The autoimmune disease market presents considerable exit barriers for established players. Companies often have substantial, specialized assets, including manufacturing facilities and intellectual property tailored for specific biologic therapies. These assets have limited alternative uses, making their divestiture difficult and costly.

Furthermore, the long-term nature of research and development in this sector, often spanning over a decade and involving billions in investment, creates a significant sunk cost. For instance, the development of a single biologic drug can cost upwards of $2.6 billion, according to industry estimates. These substantial R&D outlays bind companies to the market, even during periods of lower profitability, as they seek to recoup their investments.

Regulatory commitments also contribute to high exit barriers. Obtaining approval for autoimmune therapies involves rigorous clinical trials and ongoing post-market surveillance, creating a complex and lengthy regulatory pathway. Abandoning a product line after significant investment in these processes would mean forfeiting these efforts and potentially facing penalties or reputational damage.

- Specialized Assets: Biopharma companies possess unique manufacturing capabilities and intellectual property for autoimmune treatments that are difficult to repurpose or sell.

- High R&D Investments: The average cost to develop a new drug is estimated to be over $2.6 billion, representing a significant sunk cost that discourages early exit.

- Regulatory Hurdles: Extensive clinical trials and ongoing regulatory compliance create substantial switching costs and commitment to the market.

Switching Costs for Patients/Providers

Switching from one autoimmune therapy to another can involve significant costs and inconveniences for both patients and healthcare providers. For patients, these can include the time and effort required to find a new specialist, undergo new diagnostic tests, and adjust to a different treatment regimen. The emotional toll of managing a chronic condition and the uncertainty associated with a new therapy also contribute to switching costs. For instance, a patient on a complex infusion therapy might face logistical challenges and additional travel time if they need to switch to a different treatment center or a self-administered option.

Healthcare providers also face barriers when switching patients to new therapies. This includes the need to re-educate themselves on new drug mechanisms, potential side effects, and administration protocols. Furthermore, the administrative burden of obtaining new prior authorizations from insurance companies and managing potential changes in reimbursement can be substantial. In 2024, the complexity of prior authorization processes remained a significant hurdle, with some studies indicating that physicians spend an average of two business days per month on these tasks, directly impacting their ability to switch patients efficiently.

The ease of administration and the overall patient experience are critical factors influencing switching costs. Therapies that are self-administered at home, like subcutaneous injections, generally have lower switching costs compared to intravenous infusions requiring hospital visits. A positive patient experience with their current treatment, including minimal side effects and convenient administration, can further increase their reluctance to switch, even if alternative therapies are available. For example, a patient who finds their current biologic easy to self-inject and well-tolerated is less likely to switch than someone experiencing frequent infusion reactions or complex home care requirements.

- Patient Burden: Time for new consultations, diagnostic tests, and adapting to new treatment schedules.

- Provider Challenges: Re-education on new therapies, administrative hurdles like prior authorizations, and managing reimbursement changes.

- Administration & Experience: Ease of self-administration versus complex infusions, and the impact of positive patient experiences on treatment adherence.

Competitive rivalry in the autoimmune disease market is intense due to numerous players and a growing market. arGEN-X differentiates itself with its SIMPLE Antibody™ Platform and VYVGART, offering unique mechanisms and potential for subcutaneous administration. This differentiation is key to capturing market share against both established giants and emerging biotechs.

SSubstitutes Threaten

The threat of substitutes for arGEN-X's treatments is significant, particularly concerning the price-performance trade-off. Alternative therapies, including established immunosuppressants and emerging small molecule drugs, often present a lower cost barrier for patients. For instance, while arGEN-X's biologics target specific pathways, traditional treatments like methotrexate or azathioprine remain widely used and cost-effective for many autoimmune conditions.

As the price of specialty biologics continues to rise, patients and healthcare systems are increasingly incentivized to explore more affordable options. In 2024, the average annual cost of biologic therapies for autoimmune diseases can range from $30,000 to over $60,000, making even modest price increases for new entrants a critical factor. This cost pressure directly enhances the attractiveness of existing, cheaper alternatives, even if they offer a different risk-benefit profile or require more management.

Lifestyle interventions, such as dietary changes and exercise, also represent a form of substitution, albeit one that complements rather than directly replaces pharmacological treatments. While not a direct competitor in terms of immediate therapeutic effect, their low cost and potential to mitigate disease progression can influence patient choices and overall treatment expenditure, adding another layer to the substitute threat.

The ease with which patients and healthcare providers can access and adopt substitute treatments for autoimmune diseases is a significant factor. Regulatory approvals for new therapies can be lengthy, impacting market entry. For instance, the approval process for biologics, a common treatment for many autoimmune conditions, often takes several years, creating a window for existing treatments or alternative approaches.

Reimbursement policies also play a crucial role in accessibility. If substitute treatments are not adequately covered by insurance, their adoption will be limited, even if clinically effective. Physician familiarity with different drug classes, from established anti-inflammatory agents to newer biologics, influences prescribing patterns and the willingness to switch to alternatives.

The market for autoimmune disease treatments is diverse, offering a range of drug classes as substitutes. This includes traditional small molecule anti-inflammatory agents, corticosteroids, and a growing array of biologic therapies targeting specific immune pathways. For example, in 2024, the global autoimmune disease drugs market was valued at approximately $140 billion, indicating a substantial competitive landscape with numerous treatment options.

The rapid evolution of cell and gene therapies presents a significant threat of substitution for arGEN-X's antibody-based treatments, particularly in the autoimmune disease space. These novel modalities aim for curative or long-lasting effects, directly challenging the chronic management approach of existing antibody therapies. For instance, advancements in CAR T-cell therapy, while currently more prominent in oncology, are being explored for autoimmune conditions, potentially offering a one-time intervention that could displace the need for ongoing antibody infusions or injections.

Patient Acceptance and Perception of Substitutes

Patient and healthcare provider acceptance of substitute treatments for conditions currently addressed by arGEN-X products hinges significantly on perceived efficacy and safety. If a substitute demonstrates a superior or comparable clinical outcome with a more favorable side-effect profile, adoption rates would likely increase. For example, in the rare disease space, a novel oral medication with a simpler dosing schedule could be preferred over an injectable therapy, even if the latter has a longer track record.

The convenience of administration plays a crucial role. Treatments requiring less frequent administration or a less invasive method, such as a subcutaneous injection versus an intravenous infusion, often gain traction more quickly. This preference can be amplified if the substitute offers comparable or better therapeutic results. For instance, patient preference surveys in 2024 often highlight a desire for at-home administration options over hospital-based treatments.

The perception of a substitute as a definitive cure versus a chronic management solution can also drive acceptance. A one-time gene therapy, despite potentially higher initial costs, might be favored over lifelong medication if it's perceived as curative. This long-term view of treatment burden and potential for freedom from ongoing therapy is a powerful motivator for both patients and payers.

- Perceived Efficacy: Studies in 2024 showed that for autoimmune diseases, patient willingness to switch to a new biologic increased by over 30% if it demonstrated a statistically significant improvement in quality-of-life scores compared to existing options.

- Safety Profiles: A 2023 analysis indicated that adverse event rates below 5% for a new treatment significantly boosted physician recommendation, a key driver of patient acceptance for novel therapies.

- Convenience of Administration: Patient satisfaction surveys from early 2024 revealed that over 60% of patients with chronic conditions would consider switching to a less frequent dosing regimen, even if it meant a slightly higher per-dose cost.

- Curative Potential vs. Chronic Management: In the oncology sector, the market's embrace of targeted therapies with curative intent, even at premium price points, underscores the value placed on long-term outcomes over ongoing treatment dependency.

Regulatory and Reimbursement Landscape for Substitutes

Regulatory bodies and payers significantly influence the threat of substitutes by their approach to new treatment modalities. Favorable regulatory pathways and reimbursement policies for alternative therapies, such as gene or cell therapies, can rapidly accelerate their adoption, thereby intensifying the competitive pressure on arGEN-X's antibody-based treatments. For instance, in 2024, payers continued to scrutinize the cost-effectiveness of specialty drugs, actively exploring new treatment models and value-based agreements to manage escalating healthcare expenditures.

The evolving reimbursement landscape presents a direct challenge. As payers increasingly seek cost-containment strategies, they may favor substitutes that demonstrate a compelling value proposition or offer a more predictable cost trajectory compared to existing antibody therapies. This strategic shift by payers, driven by the need to manage overall drug spend, directly impacts the market accessibility and competitive positioning of all therapeutic options, including those offered by arGEN-X.

- Regulatory Approval Pathways: The speed and ease with which substitute therapies gain regulatory approval directly impact their market entry and the threat they pose.

- Reimbursement Policies: Favorable reimbursement decisions by payers for novel treatment modalities can significantly boost their adoption rates.

- Payer Cost Management: Payers' focus on managing specialty drug costs in 2024 highlights their willingness to explore and potentially favor cost-effective substitutes.

- Value-Based Agreements: The increasing consideration of value-based care models by payers can accelerate the adoption of substitutes that demonstrate superior long-term outcomes and cost savings.

The threat of substitutes for arGEN-X's treatments is amplified by the availability of lower-cost alternatives and the increasing pressure on healthcare budgets. Established immunosuppressants and emerging small molecule drugs often present a more accessible price point, especially as biologic therapy costs can exceed $60,000 annually in 2024. Furthermore, innovations like cell and gene therapies offer potentially curative solutions, directly challenging the chronic management model of antibody therapies.

Patient and physician preference for convenience, such as less frequent or at-home administration, also favors certain substitutes. For example, over 60% of patients in early 2024 surveys indicated a willingness to switch to less frequent dosing regimens. The perception of a substitute as a definitive cure rather than ongoing management further enhances its appeal, as seen in the oncology market's embrace of targeted therapies.

| Substitute Type | Key Advantage | 2024 Market Context/Data Point |

|---|---|---|

| Established Immunosuppressants | Lower Cost, Familiarity | Widely used for autoimmune conditions, offering a cost-effective baseline. |

| Small Molecule Drugs | Oral Administration, Potentially Lower Cost | Growing pipeline of oral options offering convenience over injectables. |

| Cell & Gene Therapies | Curative Potential, One-Time Treatment | Explored for autoimmune conditions, aiming for long-term or permanent remission. |

| Lifestyle Interventions | Low Cost, Complementary | Dietary changes and exercise can influence overall treatment expenditure. |

Entrants Threaten

Entering the biopharmaceutical sector, especially in developing antibody-based therapies like those arGEN-X specializes in, demands immense capital. The significant financial investment required for extensive research and development, rigorous clinical trials, and establishing sophisticated manufacturing infrastructure acts as a substantial barrier for potential new competitors.

For instance, arGEN-X reported research and development expenses of €278.6 million for the fiscal year 2023. This figure underscores the ongoing, substantial financial commitment necessary to innovate and bring new treatments to market, a hurdle that deters many aspiring entrants.

The threat of new entrants for arGEN-X is significantly mitigated by the formidable regulatory hurdles inherent in bringing novel biologic drugs to market. These processes demand extensive, multi-phase clinical trials to rigorously prove safety and efficacy, a journey that can span many years and incur substantial costs.

For instance, the U.S. Food and Drug Administration (FDA) approval pathway for biologics is notoriously complex, requiring detailed submissions and adherence to strict guidelines. Companies like arGEN-X must navigate these intricate pathways, which often necessitate specialized scientific and regulatory expertise, effectively acting as a high barrier to entry for potential competitors.

New companies entering the biopharmaceutical market face significant hurdles in establishing robust distribution channels and cultivating essential relationships with healthcare providers, payers, and patient advocacy groups. These established networks are critical for market access and successful product launches.

For instance, arGEN-X has strategically invested substantial resources in building its commercial infrastructure and expanding its patient reach. This investment, which includes sales forces and market access teams, creates a high barrier for new entrants seeking to replicate their established presence and patient engagement capabilities. In 2024, the pharmaceutical distribution market alone was valued at over $1.5 trillion globally, highlighting the scale of infrastructure required.

Proprietary Technology and Intellectual Property

arGEN-X's proprietary SIMPLE Antibody™ Platform and its robust patent portfolio represent a significant barrier to new entrants. The company holds numerous patents covering its core technology and specific drug candidates, such as efgartigimod. This strong intellectual property protection makes it challenging and expensive for potential competitors to replicate arGEN-X's innovative approach to antibody-based therapeutics.

The strength of arGEN-X's intellectual property is a key factor in deterring new entrants. For example, patents on efgartigimod, the company's lead product, provide exclusive marketing rights for a defined period, creating a substantial hurdle for any company looking to enter the same therapeutic space with similar treatments. This exclusivity allows arGEN-X to recoup its significant research and development investments and maintain a competitive advantage.

- Proprietary Technology: arGEN-X's SIMPLE Antibody™ Platform offers a unique and efficient method for antibody discovery and development.

- Patent Protection: Extensive patent filings cover the platform technology, specific antibody molecules, and their therapeutic applications, including efgartigimod.

- Deterrent Effect: Robust patent protection significantly raises the cost and complexity for new entrants seeking to develop competing therapies.

- Market Exclusivity: Patents grant arGEN-X a period of market exclusivity, crucial for recouping R&D costs and establishing market share.

Experience and Brand Loyalty

Established companies like arGEN-X benefit immensely from their accumulated experience in the complex and lengthy drug development process. This includes navigating regulatory pathways, conducting rigorous clinical trials, and understanding patient needs. For instance, arGEN-X's successful development and commercialization of VYVGART, a treatment for generalized myasthenia gravis, demonstrates this deep expertise. This track record builds significant trust with both physicians and patients, creating a strong brand loyalty that is difficult for new entrants to replicate.

Building such a reputation and trust takes considerable time and substantial financial investment, acting as a significant barrier to entry for potential competitors. New companies must not only develop innovative therapies but also invest heavily in clinical validation, regulatory affairs, and marketing to even begin to challenge established players. This long gestation period and high capital requirement deter many from entering the market.

The threat of new entrants is therefore moderated by the significant advantages of experience and brand loyalty. arGEN-X's established presence and the trust associated with its therapies create a formidable moat. In 2023, arGEN-X reported total revenue of €1.3 billion, largely driven by the strong performance of VYVGART, underscoring the commercial success that experience and brand recognition can yield. This financial strength further solidifies their market position against newcomers.

Key advantages contributing to this barrier include:

- Established Track Record: arGEN-X's proven ability to bring therapies from development to market.

- Clinical Expertise: Deep understanding of disease mechanisms and patient populations.

- Brand Recognition: Growing trust and familiarity among healthcare providers and patients for therapies like VYVGART.

- Regulatory Navigation: Experience in successfully managing complex global regulatory submissions and approvals.

The threat of new entrants for arGEN-X is considerably low due to the substantial capital requirements for research, development, and manufacturing in the biopharmaceutical sector. For instance, arGEN-X's 2023 R&D expenses reached €278.6 million, illustrating the immense financial commitment needed to innovate and bring therapies to market, a significant deterrent for potential new competitors.

Regulatory complexities, particularly the rigorous FDA approval process for biologics, present a formidable barrier. These lengthy and costly clinical trials demand specialized expertise, making it difficult for new companies to replicate arGEN-X's established navigation of these pathways.

arGEN-X's proprietary SIMPLE Antibody™ Platform and its extensive patent portfolio, especially for products like efgartigimod, provide significant intellectual property protection. This exclusivity raises the cost and complexity for any new entrant attempting to develop similar treatments.

The established distribution channels, relationships with healthcare providers, and brand loyalty built by arGEN-X, evidenced by €1.3 billion in total revenue in 2023 driven by VYVGART, create a high barrier. Replicating this market access and trust requires substantial time and investment.

| Barrier Type | Description | Impact on New Entrants | Example for arGEN-X |

|---|---|---|---|

| Capital Requirements | High investment in R&D, clinical trials, and manufacturing. | Deters companies with limited funding. | €278.6 million in R&D expenses (2023). |

| Regulatory Hurdles | Complex and lengthy approval processes for biologics. | Requires specialized expertise and significant time. | Navigating FDA pathways for novel therapies. |

| Intellectual Property | Patents on technology and drug candidates. | Increases cost and complexity for competitors. | Patents on SIMPLE Antibody™ Platform and efgartigimod. |

| Established Networks & Brand | Existing distribution, healthcare relationships, and trust. | Difficult and time-consuming to replicate market access. | €1.3 billion total revenue (2023) from established products like VYVGART. |

Porter's Five Forces Analysis Data Sources

Our arGEN-X Porter's Five Forces analysis is built upon a foundation of robust data, drawing from company annual reports, investor presentations, and SEC filings. We also incorporate insights from industry-specific market research reports and reputable financial news outlets.