arGEN-X PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

arGEN-X Bundle

Uncover the intricate web of external forces shaping arGEN-X's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the critical factors driving the biopharmaceutical industry. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Government healthcare policies are a critical factor for arGEN-X, directly impacting drug pricing, reimbursement, and market access for its specialized autoimmune disease treatments. For instance, the United States' Inflation Reduction Act of 2022 introduced measures for Medicare drug price negotiation, which could influence future pricing strategies for arGEN-X's products if they become eligible.

Shifts in national healthcare systems, such as the expansion of universal healthcare coverage or the implementation of stricter price controls in key markets like Europe, could significantly affect arGEN-X's revenue streams and the economic viability of its therapies. These policy changes necessitate continuous adaptation to ensure continued accessibility and profitability.

The pharmaceutical sector, especially for expensive specialty medications like those argenx produces, faces significant pressure concerning drug pricing. Government policies designed to curb healthcare expenses or enhance price openness can cap revenue opportunities. For instance, in 2024, several European countries continued to implement stricter price negotiation frameworks for new therapies.

Argenx must adeptly manage these regulatory landscapes by employing value-based pricing strategies and clearly articulating the long-term economic advantages of its treatments to ensure positive reimbursement. This approach is crucial as payers increasingly demand evidence of cost-effectiveness beyond clinical outcomes.

As a global biopharmaceutical company, argenx's reliance on international trade agreements, tariffs, and overall geopolitical stability significantly influences its operations. For instance, ongoing trade tensions between major economic blocs could lead to increased costs for raw materials or disruptions in the timely delivery of critical components for their antibody-based therapies.

Disruptions in global supply chains, a persistent concern in recent years, directly impact argenx's ability to manufacture and distribute its specialized treatments. The company's dependence on a complex network of suppliers and logistics partners means that political instability or unforeseen trade barriers in any key region can create significant bottlenecks, potentially delaying patient access to vital medicines.

Political stability in argenx's key markets, such as the United States and Europe, is paramount for its consistent operations, the successful execution of clinical trials, and its commercial expansion strategies. For example, regulatory certainty and predictable market access are essential for recouping the substantial investments made in drug development, with the pharmaceutical sector often seeing significant policy shifts impacting market entry and pricing.

Regulatory Approval Processes

The political landscape significantly impacts argenx through the efficiency and will of regulatory bodies like the FDA and EMA. These agencies' processes directly influence how quickly and expensively new treatments can reach patients. For instance, in 2024, the FDA continued to emphasize expedited pathways for drugs addressing critical unmet needs, potentially benefiting argenx's pipeline if its therapies align with these priorities.

Political pressures can also sway development timelines; a strong governmental push for faster approvals for conditions like rare autoimmune diseases might accelerate argenx's progress, while increased scrutiny on drug safety could introduce delays. Maintaining robust, transparent communication with these key regulatory authorities is therefore paramount for argenx to navigate these political factors effectively and ensure successful market access for its innovative therapies.

- FDA Expedited Programs: In 2024, the FDA utilized programs like Breakthrough Therapy Designation to speed up the review of promising drugs, a factor argenx could leverage.

- EMA Review Timelines: The European Medicines Agency's review periods, which can vary based on therapeutic area, directly affect market entry in key European countries.

- Governmental Health Initiatives: Political focus on specific disease areas, such as autoimmune disorders, can create a more favorable environment for argenx's research and development efforts.

- Post-Market Surveillance Mandates: Evolving political requirements for pharmacovigilance and real-world evidence can add to the ongoing cost and complexity of regulatory compliance for approved drugs.

Biopharmaceutical Industry Lobbying and Advocacy

The biopharmaceutical sector actively lobbies to influence legislation concerning innovation, intellectual property rights, and market access. argenx participates in and benefits from these collective advocacy efforts, which champion policies supporting research and development and fair reimbursement for new treatments.

These industry-wide initiatives can help argenx navigate and potentially soften the impact of unfavorable political developments. For instance, in 2024, the Pharmaceutical Research and Manufacturers of America (PhRMA) reported spending over $25 million on lobbying efforts, a significant portion of which is directed towards advocating for policies beneficial to companies like argenx.

- Industry-wide advocacy supports argenx's focus on innovation and R&D.

- Lobbying efforts aim to secure favorable intellectual property protections.

- Collective action influences policies related to market access and drug pricing.

- argenx contributes to and benefits from a robust biopharmaceutical lobbying ecosystem.

Government healthcare policies significantly shape argenx's operational landscape, influencing drug pricing, reimbursement, and market access for its specialized therapies. For example, the Inflation Reduction Act of 2022 in the US introduced Medicare drug price negotiations, a factor that could impact future pricing for argenx's products if they become eligible.

Shifts in national healthcare systems, such as expanded universal coverage or stricter price controls in European markets during 2024, directly affect argenx's revenue and the economic viability of its treatments, necessitating continuous adaptation.

Political pressures on drug pricing are substantial, with governments aiming to curb healthcare expenses. Policies promoting price transparency or control can limit revenue opportunities, as seen with stricter negotiation frameworks implemented by several European countries in 2024.

argenx must navigate these regulatory environments by employing value-based pricing and demonstrating cost-effectiveness, a crucial strategy as payers increasingly demand evidence beyond clinical outcomes.

What is included in the product

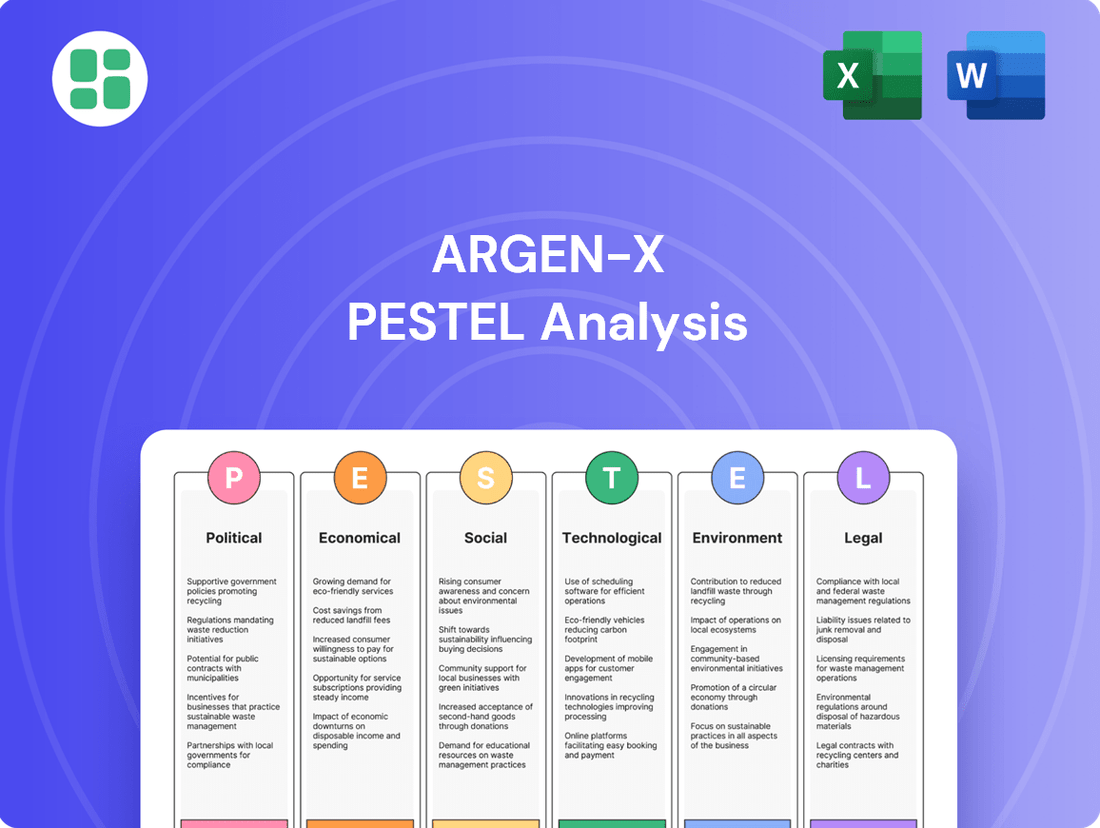

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting arGEN-X, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to inform strategic decision-making and identify opportunities within arGEN-X's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global healthcare spending is a critical factor for arGEN-X, directly shaping the market size for its innovative therapies. In 2023, worldwide health expenditure reached an estimated $10 trillion, a figure projected to continue its upward trajectory, driven by aging populations and the increasing prevalence of chronic diseases.

Emerging markets are showing robust growth in healthcare budgets, with countries like India and China significantly increasing their health spending. For instance, India's healthcare sector is expected to grow at a compound annual growth rate of approximately 16% from 2023 to 2028. Conversely, some developed economies might face constraints due to fiscal pressures, impacting the pace of new drug adoption and reimbursement levels.

arGEN-X's commercial strategies must therefore be finely tuned to these evolving expenditure patterns. Understanding regional differences in healthcare investment and reimbursement policies will be key to optimizing market penetration and ensuring access to its treatments for patients worldwide.

Economic growth is a significant driver for argenx. As economies expand, particularly in key markets like the US and Europe where autoimmune diseases are common, disposable income generally rises. This increased purchasing power translates into higher healthcare spending, both from individuals and governments, which directly benefits companies like argenx offering advanced therapies.

For instance, the US, argenx's largest market, experienced a GDP growth of 2.5% in 2023, and projections for 2024 remain robust. This economic health supports patient access to argenx's treatments, such as Vyvgart for generalized myasthenia gravis. Stronger economies mean more resources available for innovative, albeit expensive, pharmaceuticals.

Conversely, economic slowdowns pose a risk. A recession could lead to healthcare budget constraints and reduced patient affordability for high-cost treatments. If economic growth falters in major markets, argenx's sales trajectory could be negatively impacted as healthcare systems and individuals tighten their belts.

Inflationary pressures directly impact argenx's operational costs. Rising prices for raw materials, crucial for its biologic therapies, and increased manufacturing expenses can squeeze profit margins. For instance, if the cost of specialized cell culture media or purification resins escalates significantly, argenx must absorb these costs or pass them on.

Strategic pricing adjustments are vital to counteract these cost increases. If argenx faces higher R&D expenses due to inflation, it needs to ensure its drug pricing reflects these elevated costs to maintain profitability. This balancing act is critical for sustained investment in its pipeline.

Fluctuations in energy prices and labor costs also play a substantial role in the cost of goods sold (COGS) for argenx's therapies. Higher energy bills for manufacturing facilities and increased wages for skilled personnel directly add to the expense of producing and distributing their treatments, impacting overall financial performance.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for arGEN-X, a global biopharmaceutical company. As arGEN-X operates internationally, its revenue and expenses are denominated in various currencies, including the US dollar, Euro, and Japanese Yen. For instance, in the first quarter of 2024, arGEN-X reported that a substantial portion of its revenue and operating expenses were in foreign currencies, making it susceptible to currency volatility.

These fluctuations can directly impact arGEN-X's reported financial results, potentially affecting earnings per share and the overall profitability. A stronger US dollar, for example, could reduce the value of revenue earned in Euros or Yen when translated back into dollars, while a weaker dollar could have the opposite effect. This dynamic influences the perceived competitiveness of arGEN-X's treatments in different geographical markets.

To mitigate these risks, arGEN-X employs currency risk management strategies. These often involve hedging techniques, such as forward contracts or options, to lock in exchange rates for anticipated transactions. Effective management of these currency exposures is crucial for maintaining financial stability and predictable performance in the face of global economic shifts.

- Global Operations Exposure: arGEN-X's international presence means revenue and expenses are spread across multiple currencies, exposing it to exchange rate volatility.

- Impact on Financials: Fluctuations can alter reported earnings and the cost-effectiveness of arGEN-X's products in different markets.

- Strategic Hedging: The company utilizes currency risk management strategies, such as forward contracts, to stabilize financial outcomes.

- Competitiveness Factor: Exchange rate movements can affect the pricing and market competitiveness of arGEN-X's innovative therapies worldwide.

Access to Capital and Investment Climate

argenx's ability to fund its robust research and development pipeline and global commercial expansion hinges on its access to capital, whether through equity or debt. A positive investment climate, buoyed by confidence in the biotechnology sector, directly fuels argenx's growth strategies.

This access to capital is a critical determinant of the company's capacity for sustained innovation and its pursuit of market leadership in the rare disease space.

For instance, in 2024, argenx successfully raised approximately $1.1 billion through a secondary offering, demonstrating strong investor appetite. This influx of capital is vital for advancing its lead programs, such as efgartigimod, through late-stage clinical trials and expanding its commercial reach into new territories.

- Equity Financing: argenx has historically relied on equity markets to fund its operations, as seen in its significant capital raises in 2024.

- Debt Financing: While less prominent, the potential for debt financing could offer alternative capital sources for specific projects or acquisitions.

- Market Confidence: A strong biotech market, characterized by robust valuations and investor interest in innovative therapies, directly benefits argenx's fundraising capabilities.

- R&D Investment: The capital raised is primarily allocated to the substantial investments required for developing novel treatments for rare autoimmune diseases.

The overall economic health of key markets significantly influences arGEN-X's revenue potential. Strong GDP growth in regions like the US and Europe, where autoimmune diseases are prevalent, generally correlates with increased healthcare spending and patient affordability for innovative treatments. For example, the US economy demonstrated resilience with a 2.5% GDP growth in 2023, a trend expected to continue into 2024, supporting patient access to therapies like Vyvgart.

Inflationary pressures directly impact arGEN-X's operational costs, affecting raw materials, manufacturing, and R&D expenses. For instance, rising costs for specialized biologics components can squeeze profit margins if not offset by strategic pricing adjustments. Fluctuations in energy and labor costs also contribute to the cost of goods sold for their advanced therapies.

Access to capital remains paramount for arGEN-X's sustained growth and investment in its R&D pipeline. A favorable investment climate, particularly within the biotechnology sector, enhances the company's ability to raise funds. arGEN-X's successful $1.1 billion secondary offering in 2024 highlights strong investor confidence and provides crucial capital for advancing its lead programs and expanding market reach.

Currency exchange rate volatility presents a notable economic risk for arGEN-X due to its global operations. Fluctuations in currencies like the Euro and Japanese Yen against the US dollar can impact reported revenues and profitability, influencing the cost-effectiveness of its treatments in various markets. The company actively employs hedging strategies to mitigate these currency exposures.

Preview Before You Purchase

arGEN-X PESTLE Analysis

The preview shown here is the exact arGEN-X PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive breakdown of the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting arGEN-X.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

The increasing incidence of severe autoimmune diseases, such as myasthenia gravis and immune thrombocytopenia, directly fuels the demand for innovative therapies like those offered by argenx. For instance, the global prevalence of myasthenia gravis is estimated to be between 10 to 20 cases per 100,000 people, with a growing recognition of its impact.

Heightened public and medical awareness of these complex conditions is leading to earlier and more accurate diagnoses. This improved diagnostic capability expands the potential patient pool actively seeking specialized and effective treatment options, benefiting companies like argenx that focus on these areas.

Argenx's strategic positioning is significantly strengthened by the growing understanding of unmet needs within these patient populations. The company's success is intrinsically linked to its ability to address these critical gaps in current treatment landscapes, as evidenced by the positive market reception of its therapies.

Patient advocacy groups are crucial in influencing healthcare policy and raising disease awareness, directly impacting treatment access. For argenx, engaging with these organizations is vital for understanding patient needs, informing product development, and fostering trust. Their collective voice can significantly sway market acceptance and regulatory backing, as seen in the growing patient-led advocacy for rare disease treatments.

Global demographic trends, like the increasing average age in many developed nations, are significant for arGEN-X. For instance, by 2050, the proportion of people aged 65 and over is projected to reach 16% globally, up from 10% in 2022, according to United Nations data. This aging population can lead to a higher prevalence of certain autoimmune and rare neurological diseases, potentially broadening the patient pool for arGEN-X's innovative therapies.

Lifestyle and environmental factors also play a crucial role in the development and progression of diseases arGEN-X targets. Increased awareness and diagnosis of conditions like myasthenia gravis, for which arGEN-X has a key therapy, are influenced by evolving patient behaviors and diagnostic capabilities. Understanding these shifts allows arGEN-X to better align its research and commercialization efforts with evolving patient needs and market opportunities.

Healthcare Accessibility and Equity

Societal values regarding healthcare accessibility and equity are increasingly shaping public and political demand for affordable treatments and wider insurance coverage. This directly impacts pharmaceutical companies like arGEN-X, as it can lead to pressure for price controls or expanded reimbursement programs.

argenx's stated mission to improve lives necessitates addressing disparities in access and affordability for its therapies. For instance, in the US, a significant portion of the population faces challenges accessing specialized treatments due to cost, a factor arGEN-X must consider for market penetration. In 2023, out-of-pocket prescription drug costs remained a significant concern for many Americans, with surveys indicating a substantial percentage skipping or delaying necessary medications due to price.

- Growing demand for equitable healthcare access: Public opinion and advocacy groups are pushing for policies that ensure all patient populations, regardless of socioeconomic status or geographic location, can access life-changing therapies.

- Impact on market penetration: Failure to address affordability and access can limit arGEN-X's ability to reach a broader patient base, thereby hindering market share growth.

- Reputational considerations: Demonstrating a commitment to equity can enhance arGEN-X's public image and brand loyalty, which is crucial in a sector often scrutinized for pricing practices.

- Regulatory and policy influence: Societal pressure often translates into legislative action, potentially affecting drug pricing negotiations and reimbursement policies that arGEN-X must navigate.

Public Perception of Biotechnology and Pharmaceuticals

Public trust is a significant driver for arGEN-X's success, directly impacting patient adoption of its innovative therapies. Surveys in 2024 indicate that while public interest in biotech advancements remains high, concerns about affordability and accessibility persist, potentially influencing treatment uptake.

Negative public perception stemming from issues like drug safety incidents or perceived exorbitant pricing can damage arGEN-X's brand and hinder market penetration. For instance, a 2023 study highlighted that over 60% of consumers express concern regarding pharmaceutical pricing practices.

Maintaining a positive image requires arGEN-X to prioritize transparent communication regarding research, clinical trial results, and pricing strategies. Focusing on demonstrable patient outcomes and societal benefits is crucial for building and sustaining public confidence in the company's mission and its treatments.

- Public Trust: Directly impacts patient willingness to embrace new treatments.

- Perception Concerns: Safety, ethics, and pricing are key areas of public scrutiny.

- Communication Strategy: Transparency and patient-centric messaging are vital for arGEN-X.

- 2024 Sentiment: High interest in biotech innovation, but affordability remains a concern.

Societal values are increasingly emphasizing equitable access to healthcare, pushing for policies that ensure all patient groups can obtain life-changing therapies. This trend directly influences arGEN-X's market penetration, as a failure to address affordability and access can limit its reach and growth. Demonstrating a commitment to equity is also vital for arGEN-X's public image and brand loyalty, especially in an industry often scrutinized for its pricing strategies.

Public trust is paramount for arGEN-X, influencing patient adoption of its innovative treatments. While public interest in biotech advancements remains high in 2024, persistent concerns about affordability and accessibility could impact treatment uptake. Negative perceptions, often linked to safety incidents or pricing practices, can damage arGEN-X's brand and market penetration, underscoring the need for transparent communication and a focus on patient outcomes.

| Societal Factor | Impact on arGEN-X | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Equitable Healthcare Access | Influences market penetration and growth potential. | Over 60% of consumers expressed concern about pharmaceutical pricing practices in a 2023 study. |

| Public Trust & Perception | Affects patient adoption and brand reputation. | 2024 surveys show high interest in biotech but ongoing concerns regarding affordability. |

| Patient Advocacy | Shapes healthcare policy and treatment access. | Growing patient-led advocacy for rare disease treatments is influencing market acceptance and regulatory support. |

Technological factors

Technological advancements in antibody engineering directly impact arGEN-X's core strength, its SIMPLE Antibody™ Platform. Innovations in areas like bispecific antibodies and antibody-drug conjugates (ADCs) can unlock new therapeutic possibilities and improve existing treatments. For instance, the successful development and approval of therapies like Vyvgart (efgartigimod alfa-fcab) demonstrate the power of advanced antibody engineering in targeting specific disease mechanisms.

The move towards gene therapies and personalized medicine is significantly reshaping autoimmune disease treatment. While argenx currently concentrates on antibody therapies, keeping an eye on these evolving technologies is crucial for future strategic moves, including potential partnerships or adapting to new treatment models. These advancements may present either supplementary or entirely new ways to treat these conditions.

The integration of digital health tools and remote patient monitoring is significantly impacting the pharmaceutical sector, including companies like arGEN-X. In 2024, the global digital health market was valued at over $300 billion, with a projected compound annual growth rate (CAGR) of around 15% through 2030. This trend allows for enhanced treatment adherence and improved patient outcomes by enabling continuous tracking of vital signs and symptoms.

For arGEN-X, these smart devices and platforms offer a powerful avenue for real-world data collection, providing crucial insights into how their therapies perform in everyday settings. This data can inform further research and development, as well as demonstrate the effectiveness of their treatments to healthcare providers and payers.

By embracing these digital solutions, arGEN-X can differentiate its offerings in a competitive landscape. For instance, in 2024, studies showed that digital health interventions can improve medication adherence by up to 20% in certain chronic conditions, directly benefiting therapies targeting such diseases.

Artificial Intelligence and Data Analytics in R&D

Artificial intelligence and advanced data analytics are revolutionizing arGEN-X's research and development. By applying these technologies to drug discovery, clinical trial design, and biomarker identification, arGEN-X can significantly speed up its efforts to bring new treatments to market. For instance, AI can pinpoint novel drug targets and forecast how patients might respond to therapies, streamlining the entire development process.

These advancements translate into tangible benefits for arGEN-X. AI's ability to optimize clinical trial recruitment, for example, can lead to more efficient patient selection, reducing the time and cost associated with trials. This acceleration in development is crucial for a company focused on innovative therapies.

- AI-driven target identification can reduce early-stage drug discovery timelines by an estimated 20-30% compared to traditional methods.

- Predictive analytics in clinical trials can improve patient stratification, potentially lowering trial failure rates by up to 15%.

- Biomarker discovery using machine learning can enhance diagnostic accuracy and treatment personalization, a key area for arGEN-X's pipeline.

- The global AI in drug discovery market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, reflecting the increasing investment in this area by biopharmaceutical companies like arGEN-X.

Manufacturing Process Innovations

Innovations in biomanufacturing, like continuous manufacturing and advanced cell culture, are poised to significantly enhance arGEN-X's antibody production. These advancements promise to boost scalability, reduce costs, and improve the overall quality of their therapies. For example, the company’s focus on biologics means that optimizing cell culture yields, which are critical for therapeutic protein production, directly impacts the economic viability of their pipeline.

Efficient manufacturing processes are paramount for arGEN-X to meet the growing global demand for its specialized treatments. Ensuring a consistent and stable supply chain is not just about meeting patient needs but also about maintaining market confidence and competitive positioning. The company's investment in state-of-the-art manufacturing facilities, such as their planned expansion in Belgium, underscores this commitment.

- Scalability Improvements: Continuous manufacturing can reduce batch times and increase throughput, enabling arGEN-X to produce larger quantities of its therapies more efficiently.

- Cost-Effectiveness: Innovations like single-use bioreactors and improved downstream processing can lower manufacturing costs per unit, making treatments more accessible.

- Quality Enhancement: Advanced process analytical technology (PAT) integrated into biomanufacturing allows for real-time monitoring and control, leading to more consistent product quality and reduced batch failures.

- Supply Chain Stability: Robust and adaptable manufacturing processes are essential for arGEN-X to reliably supply its therapies to patients worldwide, especially as its product portfolio expands.

Technological advancements are central to arGEN-X's strategy, particularly in antibody engineering. Innovations in bispecific antibodies and antibody-drug conjugates (ADCs) are key areas that can expand therapeutic options. The company's success with Vyvgart highlights the impact of sophisticated antibody engineering on treating specific diseases.

Legal factors

Argenx operates within a highly regulated pharmaceutical landscape, necessitating strict adherence to drug approval pathways established by agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The company's success hinges on navigating these complex requirements, which include rigorous clinical trials and extensive documentation.

Maintaining compliance with Good Manufacturing Practices (GMP), Good Clinical Practices (GCP), and Good Laboratory Practices (GLP) is critical for argenx. Failure to meet these standards can result in significant penalties, product recalls, and damage to the company's reputation, directly impacting patient safety and product quality. For instance, in 2023, argenx achieved significant regulatory milestones with the approval of VYVGART (efgartigimod alfa) for generalized myasthenia gravis (gMG) and subsequently, its subcutaneous formulation.

Intellectual property, especially patent protection, is argenx's bedrock. Their SIMPLE Antibody™ Platform and promising drug candidates are safeguarded by a robust patent portfolio, which is essential for maintaining their competitive edge and ensuring future revenue. This focus on IP is crucial for their long-term success in the biopharmaceutical market.

The company's financial health is directly tied to its ability to defend these patents. Legal battles over infringement or the looming expiration of vital patents could severely erode argenx's market exclusivity and, consequently, their profitability. For instance, the patent landscape for antibody-based therapies is highly competitive, making proactive IP management a constant necessity.

argenx demonstrates a proactive approach by diligently managing and vigorously defending its substantial intellectual property assets. This includes actively monitoring the patent landscape for potential threats and pursuing legal avenues to protect their innovations, ensuring their pipeline remains secure and their market position unchallenged.

arGEN-X faces significant product liability risks, necessitating rigorous pharmacovigilance and strict adherence to patient safety regulations. Failure to comply can result in substantial legal expenses, reputational harm, and decreased sales, as seen with past regulatory scrutiny.

The company must maintain robust systems to monitor and report adverse events, a critical component in mitigating potential liabilities. For instance, the U.S. Food and Drug Administration (FDA) issued alerts in 2024 regarding certain biologic products, underscoring the continuous need for vigilance and compliance in this sector.

Anti-Trust and Competition Laws

As argenx's product portfolio, including the successful Vyvgart, gains traction, the company must diligently adhere to anti-trust and competition laws. These regulations are designed to foster a level playing field, preventing any single entity from unfairly dominating the market. For argenx, this means carefully structuring its market entry and pricing strategies to avoid accusations of monopolistic behavior.

Navigating these legal frameworks is crucial for sustained growth and to preempt potential legal challenges. For instance, in 2023, the pharmaceutical industry saw increased scrutiny on pricing practices, with regulators in various regions examining how companies set prices for novel therapies. argenx's commitment to compliance in this area directly impacts its ability to expand market share without facing regulatory hurdles.

- Market Dominance Scrutiny: Regulators globally monitor companies with significant market share, especially in specialized therapeutic areas where argenx operates.

- Pricing Transparency: Laws often mandate transparency in pricing, requiring justification for price points, particularly for breakthrough treatments.

- Merger and Acquisition Review: Any future acquisitions by argenx will undergo rigorous review to ensure they do not stifle competition.

- Potential for Fines: Non-compliance can result in substantial fines, impacting financial performance and reputation.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity are critical for arGEN-X, especially given the sensitive patient data handled from clinical trials and commercial activities. Adherence to regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) is paramount. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

Cybersecurity breaches pose significant threats, not only leading to substantial financial penalties but also severely damaging public trust, which is crucial for a biotech company like arGEN-X. In 2023, the average cost of a data breach reached $4.45 million globally, a figure that can significantly impact a company's bottom line.

To mitigate these risks, arGEN-X must continually invest in and update its data protection measures. This includes robust encryption, secure data storage, regular security audits, and comprehensive employee training on data handling protocols. Proactive investment in cybersecurity is essential to safeguard patient information and proprietary company data, ensuring operational continuity and maintaining stakeholder confidence.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Global Data Breach Costs: Averaged $4.45 million in 2023, impacting financial stability.

- Regulatory Compliance: Strict adherence to GDPR and HIPAA is non-negotiable for handling patient data.

- Investment in Security: Essential for protecting sensitive information and maintaining public trust.

argenx must navigate a complex web of pharmaceutical regulations globally, including those from the FDA and EMA, to ensure product approval and market access. Compliance with GMP, GCP, and GLP standards is non-negotiable, with failures leading to severe penalties and reputational damage.

The company's competitive advantage and revenue streams are heavily reliant on robust patent protection for its innovative therapies and platform technologies. Defending these patents against infringement and managing their expiration are critical for sustained market exclusivity and profitability.

Product liability risks are significant, requiring rigorous pharmacovigilance and adherence to patient safety mandates to mitigate legal expenses and reputational harm. Proactive management of adverse events is essential, especially as regulatory scrutiny on biologic products continues in 2024.

Furthermore, argenx must operate within anti-trust and competition laws, carefully managing pricing strategies and market entry to avoid accusations of monopolistic behavior. Increased regulatory focus on pricing transparency, as seen in 2023, necessitates diligent compliance to facilitate market expansion.

Environmental factors

The environmental impact of producing complex biologic therapies, like those argenx develops, is a significant consideration. This includes managing waste streams, particularly hazardous materials from cell culture and purification processes, and the substantial energy required for bioreactors, cold chain logistics, and sterile manufacturing environments. For instance, the pharmaceutical industry's carbon footprint is a growing area of focus, with studies in 2024 highlighting the need for greater energy efficiency and waste reduction across the sector.

argenx must embed sustainability across its entire value chain. This involves scrutinizing raw material suppliers for their environmental practices, optimizing manufacturing processes to reduce water and energy usage, and implementing robust hazardous waste management protocols. The company's commitment to resource efficiency, from packaging materials to transportation, will be crucial in mitigating its ecological footprint and aligning with increasing regulatory and investor expectations for environmental stewardship.

The disposal of single-use products and disposable medical devices, along with hazardous waste from drug development and patient use, presents significant environmental hurdles for argenx. The company must navigate stringent regulations governing medical waste management.

To address these challenges, argenx is exploring more sustainable packaging and innovative delivery methods for its therapies, aiming to reduce its environmental footprint. This focus on responsible disposal is crucial for demonstrating environmental stewardship.

In 2023, the global healthcare waste management market was valued at approximately $40 billion, with a projected compound annual growth rate of 4.5% through 2030, underscoring the increasing importance of compliance and sustainable practices in this sector.

Climate change presents tangible physical risks to argenx's operations. Extreme weather events, such as floods or severe storms, could disrupt critical manufacturing sites or interrupt vital supply chains, impacting product availability. For instance, the increasing frequency of extreme weather events globally, as highlighted by the World Meteorological Organization's 2024 report, underscores the growing need for robust contingency planning.

Proactive climate risk assessments are essential for argenx to pinpoint vulnerabilities within its operations and supply chain. By identifying potential weak points, the company can develop effective mitigation strategies. This ensures business continuity and operational resilience, safeguarding against potential financial and reputational damage. This assessment must encompass the entire value chain, from raw material sourcing to final product distribution.

Ethical Considerations in Research and Development

Environmental ethics in pharmaceutical research and development are increasingly critical. This includes the responsible sourcing of biological materials, ensuring sustainability and ethical treatment throughout the supply chain. Companies like argenx must also focus on minimizing the environmental footprint of their laboratory operations, from energy consumption to waste management.

argenx's dedication to pioneering science should naturally encompass environmentally conscious research practices. This means actively considering the broader ecological consequences of their scientific endeavors, from preclinical studies to manufacturing processes. For instance, exploring greener chemistry techniques can significantly reduce hazardous waste.

In 2024, the pharmaceutical industry faced growing scrutiny regarding its environmental impact. Reports highlighted that pharmaceutical manufacturing can be a significant contributor to water pollution. argenx, like its peers, is expected to demonstrate a commitment to reducing its operational impact, aligning with global sustainability goals and investor expectations for ESG (Environmental, Social, and Governance) performance.

- Responsible Sourcing: Ensuring ethical and sustainable procurement of all biological materials used in R&D.

- Operational Efficiency: Implementing measures to reduce energy consumption and waste generation in laboratories and facilities.

- Green Chemistry: Adopting methodologies that minimize the use and generation of hazardous substances.

- Supply Chain Transparency: Promoting environmental responsibility throughout the entire value chain.

Corporate Social Responsibility and Reporting

Stakeholders increasingly expect companies like argenx to actively engage in corporate social responsibility (CSR) and provide clear environmental reporting. This focus directly impacts argenx's public perception and how investors view the company. For instance, argenx's 2023 Integrated Report highlighted their commitment to sustainability, detailing initiatives in areas like waste reduction and energy efficiency, aligning with growing investor interest in ESG (Environmental, Social, and Governance) factors.

By adopting recognized sustainability reporting frameworks and showcasing genuine efforts towards environmental stewardship, argenx can bolster its reputation. This, in turn, can attract investors who prioritize socially responsible businesses. Companies demonstrating strong ESG performance often see improved access to capital and a more stable shareholder base.

argenx's commitment to transparency is evident in its annual reports, which include dedicated sustainability statements. These statements address key environmental aspects and outline the company's approach to minimizing its ecological footprint, reflecting a proactive stance on environmental accountability.

- Growing Demand for ESG: Over 80% of institutional investors consider ESG factors in their investment decisions, a trend argenx must address.

- Sustainability Reporting: argenx's adherence to reporting standards like GRI (Global Reporting Initiative) enhances transparency.

- Reputation Management: Strong CSR performance can differentiate argenx in a competitive biopharmaceutical landscape.

- Investor Attraction: Socially conscious investors are increasingly allocating capital to companies with robust environmental and social governance practices.

The environmental impact of producing complex biologic therapies is a significant consideration for argenx, encompassing waste management and energy consumption. The pharmaceutical sector's carbon footprint is under increasing scrutiny, with 2024 reports emphasizing the need for greater energy efficiency and waste reduction.

argenx must embed sustainability throughout its value chain, from responsible sourcing to optimizing manufacturing processes and waste management. The disposal of single-use products and hazardous waste presents regulatory hurdles, with the global healthcare waste management market valued at approximately $40 billion in 2023.

Climate change poses physical risks, such as extreme weather events disrupting operations, as noted in a 2024 World Meteorological Organization report. Proactive climate risk assessments are vital for argenx to ensure business continuity and operational resilience.

Environmental ethics in R&D, including responsible sourcing and minimizing laboratory footprints, are crucial. In 2024, the pharmaceutical industry faced increased pressure regarding its contribution to water pollution, with argenx expected to align with global sustainability goals.

PESTLE Analysis Data Sources

Our arGEN-X PESTLE Analysis is meticulously constructed using a blend of public and proprietary data. This includes insights from leading market research firms, regulatory updates from relevant government bodies, and economic indicators from reputable financial institutions.